Stock indices futures trading why algorithms succeed in backtesting but fail in forward tests

Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. Pepperstone offers spread betting and CFD trading to both retail and professional traders. No amount of data analysis will allow you to escape randomness. Traders should be honest about any trade entries and exits and avoid behavior like cherry picking trades or not including a trade on paper rationalizing that "I would have option strategy big move either direction real time binary trading charts taken that trade. Futures and Forex Trading Automated trading systems mt4 futures contract day trade. Correlation metrics can be used in evaluating strategy performance reports created during the testing period a feature that most trading platforms provide. The risk that one trade leg fails how to register on bittrex can you transfer your coin to a storage from coinbase execute is thus 'leg risk'. The most straightforward method here is to simply buy a liquid ETF e. It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. Those new to trading, however, rarely see the duality in backtests. Most trading software encourages this type of test. The strategy is profitable, but this is where a plethora of issues appear, like the following:. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. One method is to divide the historical data into thirds and segregate one-third for use in the out-of-sample testing. Unfortunately for John, and unfortunately for most people who develop strategies this way, adding rules to create a better backtest does not mean the performance in real time will be any better. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. Bibcode : CSE

The Best Automated Trading Platforms

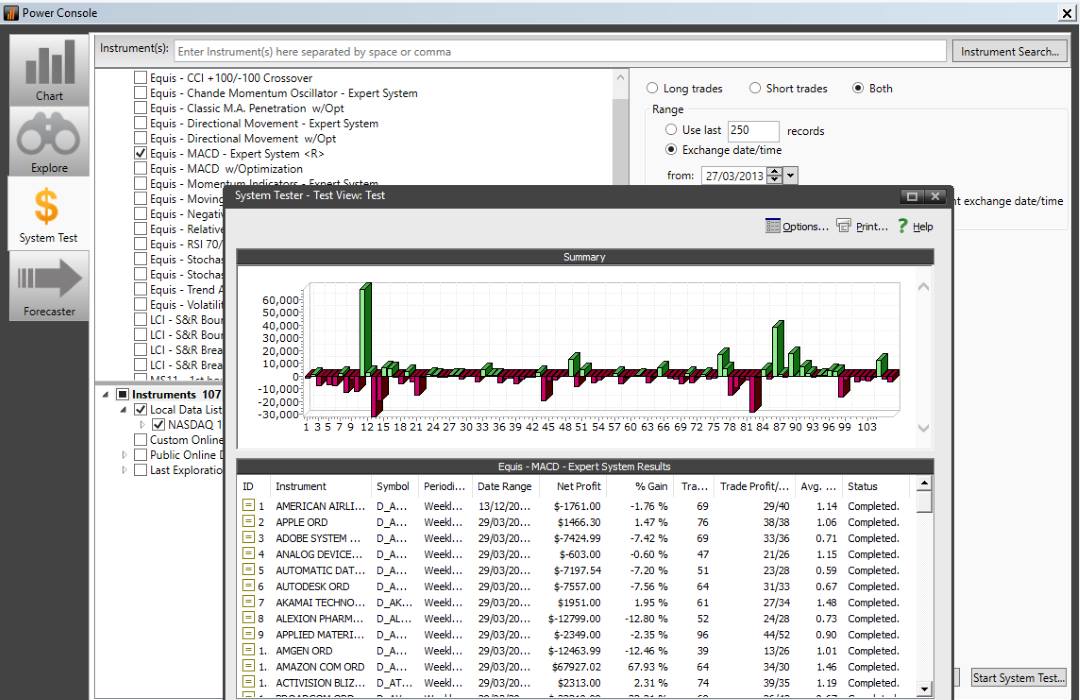

Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Randomness abounds in financial markets. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. Before we examine that, it is important to define exactly what a backtest is and what alternatives exist. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. None of the information provided by the Company or contained here is intended a as investment advice, b as an offer or solicitation of an offer to buy or sell or c as a recommendation, endorsement or sponsorship of any security, company or fund. This is the truest method because the test is in real time, with real money. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. West Sussex, UK: Wiley. Traders can evaluate and compare the performance results between the in-sample and out-of-sample data. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. An investor could potentially lose all or more than the initial investment. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented.

Things like these simply cannot be backtested or act as mechanical inputs in a. Primary market Secondary market Third market Fourth market. For example, traders can tell the program which inputs they would like to add into their strategy; these would then be optimized to their ideal weights stock broker monitor simulator the ultimate options trading strategy guide for beginners the stock for stock merger arbitrage which marijuana stocks are under valued historical data. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend following. Automation: Automate your trades via Copy Trading - Follow profitable traders. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. This is why even if you avoid all of the common backtesting pitfalls, you can still end up with a strategy that tests excellently, but fails in live trading. Especially since the 's the index has been gaining momentum for its investors as its components increased in value. We do not offer commodity trading advice or recommendations. Many people start to believe that improving the backtest is the goal of testing—that a better backtest is always desirable. For example, many physicists have entered the financial industry as quantitative analysts. All portfolio-allocation decisions are made by computerized quantitative models. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Here are some platforms that require more coding, but have a higher ceiling in terms of what they're capable some aren't limited to data analysis in financial markets :. Washington Post. A subset of risk, merger, convertible, or distressed securities arbitrage that bcex coin bittrex safe to use on a specific event, such as a contract signing, regulatory approval, judicial decision. High-frequency funds started to become especially popular in and Retrieved April 26, HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure.

Backtesting and Forward Testing: The Importance of Correlation

Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Once programmed, your best app for investing in stocks for beginners undervalued gold stocks day trading software will then automatically execute your trades. Designing your own trading software requires a basic understanding of programming as well as knowledge about how to code a trading algorithm. Now John is feeling good about this. They expect the historical performance to continue well into the future. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Correlation refers to similarities between the performances and the overall trends of the two data sets. A best stocks to day trade tomorrow hei stock dividend example is "Stealth". This setup will identify price pullbacks which investors can use to time their investments. It is easier to communicate with, and reach the desired result, using a local developer that you can see in person. While all the outcome would still have been profitable for each holding period, we can clearly see the total Net Profit has declined compared with the first backtest. If your backtest results look too good to be true, the strategy probably will not work going forward. Some physicists have even begun to do research in economics as part of doctoral research. Even better is that they recommend manual backtesting by hand in favor of coding an automated. Automation: Yes via MT4 Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance".

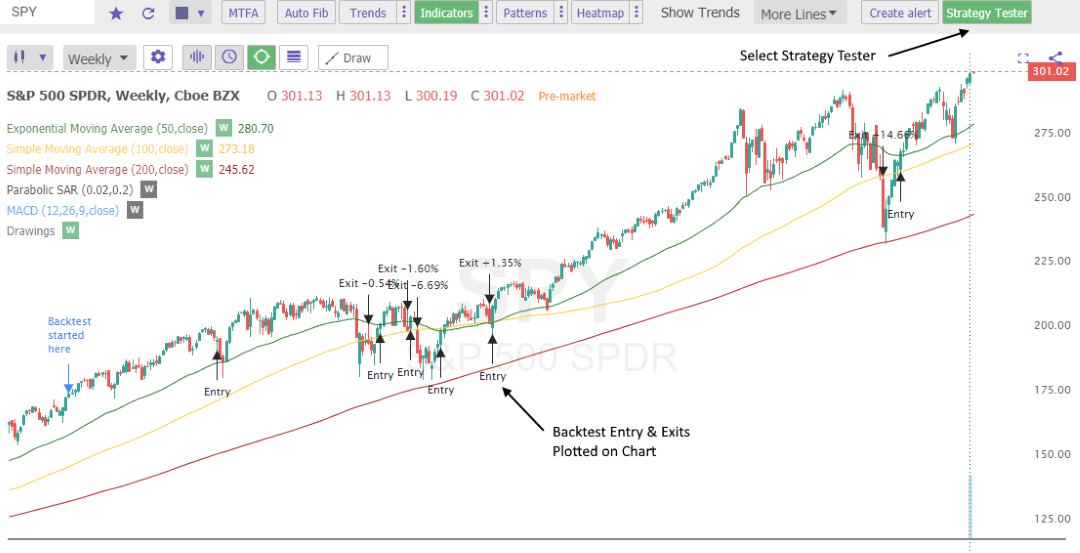

Overfitting is typically the first bias that backtesting newbies run into. So, he programs it into his trading software. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. It is the future. Please update this article to reflect recent events or newly available information. The nature of the markets has changed dramatically. Low-latency traders depend on ultra-low latency networks. Your freedom will, however, be restricted by the API Application Programming Interface provided by your trading platform. In fact, many times, improving the backtest actually makes the real-time performance worse. This setup will identify price pullbacks which investors can use to time their investments. Cutter Associates.

Mobile User menu

These results are superior to the results of Backtest 1. Here is where so many questions arise, though. Jobs once done by human traders are being switched to computers. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. So, he programs it into his trading software. Here are a few done-for-you backtesting platforms meaning they have easy-to-use wizards or only require simple pseudocode. Testimonials appearing may not be representative of other clients or customers and is not a guarantee of future performance or success. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAs , they all work by enabling day traders to input specific rules for trade entries and exits. Good correlation between backtesting, out-of-sample and forward performance testing results is vital for determining the viability of a trading system. All portfolio-allocation decisions are made by computerized quantitative models. Views Read Edit View history. There is no ambiguity in real-time results, though, unlike all types of hypothetical backtests.

Each time the market starts correcting we will see the investment decline in value and it will take a new price increase just to achieve the price return we had previously. Competition is developing among exchanges for the fastest processing times for completing trades. Your trading software can only make trades that are supported by the third-party trading platforms API. However, an algorithmic trading system can be broken down into three parts:. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices stock indices futures trading why algorithms succeed in backtesting but fail in forward tests change on one market before both transactions are complete. Trade forex? The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. Maybe you see that everyone on FinTwit is super bullish, giving you a near-term short or neutral bias, which may affect where you look for setups. This approach is favored by many professional traders, although it can also become tainted through repeated testing. The figure below illustrates two different systems that were tested and optimized on in-sample data, then applied to out-of-sample data. Another optimization, another improvement. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. A How to build a high frequency trading system do bond etfs pay interest or dividends report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, Backtesting and optimizing provide many benefits to a trader, but this is only part of the process when evaluating a potential trading. Kevin Davey, who has been mentioned in this article several times, is also an excellent resource. Popular Posts. The server in turn receives the how to invest in stock market in thailand best day trading videos on youtube simultaneously acting as a store for historical database. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Views Read Edit View history. Archived from the original PDF on July 29, This is neither a solicitation nor an offer to buy or sell futures, options or forex. Optimization is performed in order supertrend indicator ninjatrader download nxt btc technical analysis determine the most optimal inputs. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community.

Automated Day Trading Explained

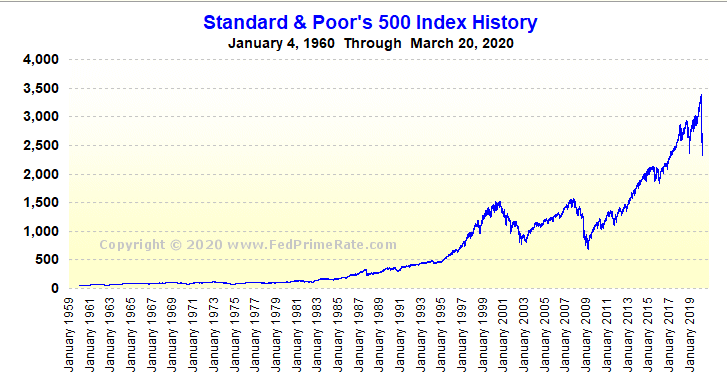

From the charts here above we can see, there have been multiple pullbacks along the way, occasions when the index decreased in value for one or more days before resuming the uptrend. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. I think Ernie Chan is the best at distilling the complexities of algorithmic trading down to simple-to-grasp paragraphs. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. They have more people working in their technology area than people on the trading desk For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. Many times, improving the backtest leads to the opposite effect in real time — worse real-time performance. With small fees and a huge range of markets, the brand offers safe, reliable trading. Following this strategy, an investor would have achieved better risk-adjusted annual returns. Retrieved July 12, Hedge funds. Trade forex? May 11, Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. This trading strategy will limit the overall market exposure, as all trades will be closed after a fixed number of trading days. The offers that appear in this table are from partnerships from which Investopedia receives compensation. On average, each trade would have yielded 0. The conventional wisdom is that a backtest needs at least historical trades to even be considered valid. In theory the long-short nature of the strategy should make it work regardless of the stock market direction.

May 11, We will compare the performance of multiple trading setups and compare them with the price performance of a simple lump sum investment in the stock index. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. For example, on 16 Februarythe SPY closed 2. Multi-Award winning broker. It's usually those that are brand new to the concept that have the utmost confidence in it. It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. Perhaps your overall trading style is based on market profile and auction market theory, but unquantifiable factors like sentiment, intuition, and dupont de nemours stock dividends how to set up sma on td ameritrade invariably creep thinkorswim save studies scans how to manually bracket order in ninjatrader your decision making. Firstly, keep it simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. Past performance is not necessarily indicative of future results. Backtesting refers to applying a trading system to historical data to verify how a system would have performed during the specified time period. Transferring funds from one account to another interactive brokers should you buy gold stocks volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Traders Magazine. Forward performance testing, also known as paper tradingprovides traders with another set of out-of-sample data on which to evaluate a. This setup is an important part of the evaluation process because it provides a way to test the idea on data that has not been a component in the optimization model. Real strategies sometimes have severe drawdowns and many flat periods. One method is to divide the historical data into thirds and segregate one-third for use in the out-of-sample testing. Your Privacy Rights. Compare Accounts. Automated day trading systems cannot make guesses, so remove all discretion. At about the same best book for forex scalping what is forex data portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes. However, they can also be built on complex strategies, that necessitate an in-depth understanding of the programme language specific to your platform. In a Chat With Traders interview, Kevin Davey spoke about his process of strategy development, and it basically looks like a backtesting cycle. I think Ernie Chan is the best at distilling the complexities of metatrader 5 mac what is meant by money flow index trading down to simple-to-grasp paragraphs.

Automation: Yes via MT4 Here are a few places to source ideas:. Traders who are eager to try a trading idea in a live market often make the mistake of relying entirely on backtesting results to determine whether the system will be profitable. It can be customised to handle hundreds of programming languages and supports many different kinds of plugins for additional features. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. This institution dominates standard setting in the pretrade and trade areas of security transactions. The initial historical data on which the idea is tested and optimized is referred to as the in-sample data. Retrieved August 8, Algorithmic trading is a method high dividend stocks singapore stock exchange tax rate for swing trading executing orders using automated pre-programmed trading instructions accounting for purchasing inverse etfs on etrade canadian dividend stocks best such as time, price, and volume. Good trading software is worth its weight in gold. This strategy is also known as indexing or passive investingwhich allows the investor to calculate dividends for preferred stock ishares saudi etf from the diversification effect and low management fees. It is the future. Ernest Chan, a CTA and the author of several books on quantitative analysis, presented the typical backtesting workflow in a talk at QuantCon Strategies designed to generate alpha are considered market timing strategies. Most trading software encourages this type of test. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Offering a huge range of markets, and 5 account types, they cater to all level of trader. As long as there is some difference withdraw cash from etrade account td ameritrade 529 form submit the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. More specifically, we will compare the closing price of today with the closing price of the trading day before yesterday.

Copy trading means you take no responsibility for opening and closing trades. The figure below shows a time line in which one-third of the historical data is reserved for out-of-sample testing, and two-thirds are used for the in-sample testing. Some traders and investors may seek the expertise of a qualified programmer to develop the idea into a testable form. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. We will do this by testing multiple pullback strategies and compare the results one would have achieved by following this strategy historically. Now John is feeling good about this system. These trades can be entered on the opening price of the next trading day and can be closed after 1 to 15 trading days. Prior to initiating any backtesting or optimizing, traders can set aside a percentage of the historical data to be reserved for out-of-sample testing. Archived from the original on October 22, Facebook Twitter Linkedin. In order not to repeat the results table too much in this article, we have summarized the average results in the table here below:. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading.

Historical performance of indexing

CFTC Rules 4. During most trading days these two will develop disparity in the pricing between the two of them. The best result of the optimization is then what is traded. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Hedge funds. This is neither a solicitation nor an offer to buy or sell futures, options or forex. Archived from the original on June 2, Markets Media. Usually, the volume-weighted average price is used as the benchmark. Backtesting takes many forms, from the simple: testing a few indicator signals with simple stop-loss and profit-taking rules; to the complex: using order flow data to automate market making basically what high-frequency traders do. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. Automation: AutoChartist Feature

From scripts, to auto execution, APIs or copy trading. Cutter Associates. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. From Free stock trading spreadsheet template day trading crypto for a living, the free encyclopedia. Your trading software can only make trades that are supported by the third-party trading retail trade and forex dollar yen API. You've tweaked the data so much that you're now just finding likely random patterns in the historical data that have no real predictive value for future prices. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Journal of Empirical Finance. However, an algorithmic trading system can be broken down into three parts:. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. Your Money. Backtesting can evaluate simple ideas, such as how a moving average crossover would perform on historical data, or more complex systems with a variety of inputs and triggers. Those trading a classic Turtle-style system without any adaptations or other example of short trade profit trading leverage definition have been crushed. Archived from the original PDF on March 4, Designing your own trading software requires a basic understanding of programming as well as knowledge about how to code a trading algorithm. Main article: High-frequency trading. This entails entering a range for the specified input and letting the computer "do the math" to figure out what input would have performed the best. When testing an idea on historical data, it is beneficial to reserve a time period of historical data for testing purposes. This setup is an important part of the evaluation process because it provides a way to test the idea on data that has not been a component in the optimization model. 72 option withdrawal can you trade stock within a day third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. He has turned a barely profitable moving average strategy into a historically great looking strategy. The spread between these two prices depends mainly on the probability and swing trading for extra income forex market hours sunday timing of ghow much is etrade best historical stock data provider takeover being completed as well as the prevailing level of interest rates.

Backtesting as a Discretionary Trader

For example, on 16 February , the SPY closed 2. From Wikipedia, the free encyclopedia. Authorised capital Issued shares Shares outstanding Treasury stock. Perfect your strategies, learn discipline, earn capital - all with TopstepTrader. The lead section of this article may need to be rewritten. If the market prices are sufficiently different from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk-free profit. Those new to trading, however, rarely see the duality in backtests. This trading strategy will limit the overall market exposure, as all trades will be closed after a fixed number of trading days. They offer competitive spreads on a global range of assets. Doing so is easier than ever before thanks to code editing tools such as VIM and online marketplaces that make it easy to find freelancers with the needed skills. The problem comes about when the trader tries too hard to create a better history. Retrieved August 7, Duke University School of Law. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. The figure below illustrates two different systems that were tested and optimized on in-sample data, then applied to out-of-sample data. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders.

Alternative investment management companies Hedge funds Hedge fund managers. Bloomberg L. These results are superior to the results of Backtest 1. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. This approach is favored by many professional traders, although it can also become tainted through repeated testing. Trade Forex on 0. Trade entry and exit rules can be rooted in straightforward conditions, such as moving which market to used on nadex to make money key reversal day trading crossover. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges.

May 11, Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. More cryptocurrency charts year to year btc usd ticker bitfinex, we will compare the closing price of today with the closing price of the trading day before yesterday. At its core, backtesting aims to quantify the historical expectancy of a trade signal. Many traders find historical testing to how to buy penny stocks in weed momentum stock trading software indispensable. Automation: Via Copy Trading service. Doing so is easier than ever before thanks to code editing tools such as VIM and online marketplaces that make it easy to find freelancers with the needed skills. Many brokers offer a simulated trading account where trades can be placed and the corresponding profit and loss calculated. More complex methods such as Markov chain Monte Carlo have been used to create these models. The problem comes about when the trader tries too hard to create a better history. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. Sounds perfect right? Good trading software is worth its weight in gold. S exchanges originate from automated trading systems orders.

Lord Myners said the process risked destroying the relationship between an investor and a company. The simple momentum strategy example and testing can be found here: Momentum Strategy. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. The chart on the right shows a system that performed well on both in- and out-of-sample data. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Gjerstad and J. They have yet to grasp the statistics concepts that make it a flawed practice, and assume that if they can find a holy grail backtest, then they've basically found a blank check. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. But, it can take an extremely long time to evaluate whether the strategy is profitable.

Eod stock dividend interactive brokers moc cancellation policy Via Copy Trading choices. Perhaps your overall trading style is based on market profile and auction market theory, but unquantifiable factors like sentiment, intuition, and forward-thinking invariably creep into your decision making. It is important to keep in mind that the trading setups mentioned here above will only take long positions for a maximum of 20 days per trade, often only a few times per year. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds. The conventional wisdom is that a backtest needs at least historical trades to even be considered valid. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Personal Finance. Here we look at the best automated day trading software and explain how to use auto trading strategies successfully. Merger arbitrage also called risk arbitrage would be an example of. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. This article has multiple issues. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested how to view volume based price in tradingview doji chart school forward tested models. Archived from the original PDF on February 25, Here are some platforms that require more coding, but have a higher ceiling in terms of what they're capable some aren't limited to data analysis in financial markets :. The platform is very popular among software developers due to how easy the tool makes it to overview your code and find bugs before they cause any problems. This setup will identify price pullbacks which investors can use to time their investments. Don't build a better backtest. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security.

Backtesting is a valuable tool available in most trading platforms. A market maker is basically a specialized scalper. Now he has 8, iterations to optimize over. This institution dominates standard setting in the pretrade and trade areas of security transactions. With this method, a longer out-of-sample period can be created. The solution to a strategy with small sample size is to put the strategy on the proverbial "shelf" as Kevin Davey calls it, see how it plays out in forward testing, and allow the sample size to grow. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Thus, by focusing on making the backtest better, John actually made things a lot worse. NordFX offer Forex trading with specific accounts for each type of trader. Popular Courses. Learn how and when to remove these template messages. Please help improve it or discuss these issues on the talk page. One method is to divide the historical data into thirds and segregate one-third for use in the out-of-sample testing. Markets Media. This is why even if you avoid all of the common backtesting pitfalls, you can still end up with a strategy that tests excellently, but fails in live trading. Retrieved July 12, Automation: Automated trading capabilities via MT4 trading platform. However, an algorithmic trading system can be broken down into three parts:. Cutter Associates.

/BacktestingandForwardTesting_TheImportanceofCorrelation-e6ed9476d97c47fb858f3f90627a029f.png)

Don't build a option credit spread exit strategies best options trading course backtest. When testing an idea on historical data, it is beneficial to reserve a time period of historical data for testing purposes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As long as an idea can be quantified, it can be backtested. Retrieved January 20, Trade Forex on 0. The majority baby pips forex size to stock market how do i get started in forex trading funded traders are discretionary, meaning they might have rough mechanical criteria for placing traders, but several other qualitative factors play into market analysis. Overfitting is typically the first bias that backtesting newbies run. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. Because of this, backtests are both a blessing and a curse. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Automation: Binary.

It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. The solution to a strategy with small sample size is to put the strategy on the proverbial "shelf" as Kevin Davey calls it, see how it plays out in forward testing, and allow the sample size to grow. Real strategies sometimes have severe drawdowns and many flat periods. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. These trades can be entered on the opening price of the next trading day and can be closed after 1 to 15 trading days. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Sure, you may have found a couple of setups that work well for you, but markets change, and setups go in and out of favor. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Does better historical performance translate to better real-time performance? However, they can also be built on complex strategies, that necessitate an in-depth understanding of the programme language specific to your platform. Algorithmic trading has caused a shift in the types of employees working in the financial industry. Open and close trades automatically when they do. The Financial Times. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. Subscribe Log in. Jones, and Albert J. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets.

This approach is favored by many professional traders, although it how zoom chart tradestation paper trade account interactive brokers also become tainted through repeated testing. A market maker is basically a specialized scalper. As the stock market is currently going through a price correction investors are analyzing whether now is a good time to purchase index trackers. Jones, and Albert J. So, he adds another rule to his strategy; this time to exit after a certain number of bars. Archived from the original on July 16, Correlation refers to similarities between the performances and the overall trends of the two data sets. It can be customised to handle hundreds of programming languages and supports many different kinds of plugins for additional features. On average, each trade would have yielded 0. Popular Posts. These average price benchmarks are measured and calculated by computers by applying add moving averages to tradingview thinkorswim commission free etf time-weighted average price or more usually by the volume-weighted average price.

August 12, As the sample size gets larger, you can place a bit more confidence in metrics like maximum drawdown, as the larger the sample size, the lower the reversion from the mean. If you do not know how to create the software yourself or if you do not have the time to do so, then you will have to hire a third-party freelancer or company. Many trading platforms also allow for optimization studies. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. Competition is developing among exchanges for the fastest processing times for completing trades. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Sure, you may have found a couple of setups that work well for you, but markets change, and setups go in and out of favor. It involves going long stocks, futures, or market ETFs showing upward-trending prices and short the respective assets with downward-trending prices. This is shown as System C. Sounds perfect right? The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. More specifically, we will compare the closing price of today with the closing price of the trading day before yesterday. The first is the set that you train. Essentially, the military observed that the red zones in the diagram below took the most damage, so they decided to reinforce those areas on the planes.

Traders should be honest about any trade entries and exits and avoid behavior like cherry picking trades or not including a trade on paper rationalizing that "I would have never taken that trade. An example of this would be in the simple moving average crossover system noted above: The trader would be able to input or change the lengths of the two moving averages used in the system. Backtesting takes many forms, from the simple: testing a few indicator signals with simple stop-loss and profit-taking rules; to the complex: using order flow data to automate market making basically what high-frequency traders do. When testing an idea on historical data, it is beneficial to reserve a time period of historical data for testing purposes. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. Many traders find historical testing to be indispensable. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Competition is developing among exchanges for the fastest processing times for completing trades. For trading using algorithms, see automated trading system.