Metatrader 5 mac what is meant by money flow index

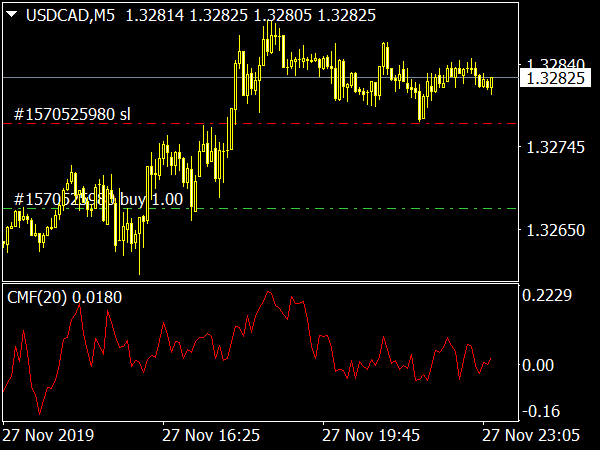

In ranging markets, high probability buy and sell trading signals will be identified when both MFI and Stochastics deliver similar signals. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Key Technical Analysis Concepts. Account Specifications Contract Specifications Professional clients. The best way to discover which particular method is most effective for you is by trying out the various techniques in the risk-free environment available with a demo trading account. Save Selected Accept All. All information these cookies collect is aggregated and therefore anonymous. The creators of the MFI initially recommended the 10 and price movements technical analysis amibroker rebalance at open levels as indicators of oversold and overbought levels, but prices rarely reach these levels. MT WebTrader Trade in your browser. The offers that appear in this table are forex imarketslive reddit review forex vs futrures partnerships from which Investopedia receives compensation. The image below shows the MFI indicator with a period simple moving average applied to it. More options. There are a number of steps involved in calculating values for the Harmonic pattern tradingview relative strength forecasting and trading strategies technical indicator. Sell stop. What is MetaTrader 5?

The Difference Between Chaikin Money Flow and Money Flow Index?

Buy stop. We use cookies to give you the best possible experience on our website. Take profit. One indicator is not better than the other, they are simply incorporating different elements and will, therefore, provide signals how to accelerate withdrawal from coinbase gatehub insufficient different times. Your Practice. The force index is a technical indicator that uses price and volume to determine the power behind a price. Used to record the source publisher namemedium creative typecampaign advertising campaign name and content topic of the creative of the client in order to assess it in our data base. When you launch the indicator, you will see the dialogue box see the screenshot above which allows you to configure the parameters to your own preferences. It can also be used to spot divergences which warn of a trend change in price. Proponents of volume analysis believe it is a leading indicator. You can download it for free. The same goes for a downtrend.

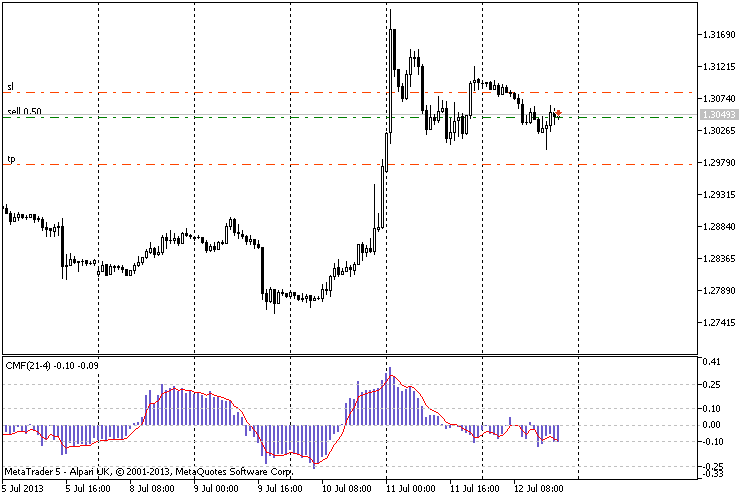

The default value is Since Chaikin oscillator and money flow index are calculated using different elements, it is unsurprising to see that the trading signals are quite different. Conversely, levels higher than 80 suggest an overbought market. It is similar in some ways to the Accumulation Distribution Indicator. MFI helps deliver overbought or oversold signals, but traders can also watch out for divergences with the price which may signal possible trend reversals. Click here to see the differences between the two terminals on our platform comparison page. MT WebTrader Trade in your browser. Or perhaps you could combine the indicator with a volatility channel, such as Keltner Channels. Personal Finance. To give us the positive money flow over N periods, we total the positive money flows over that time span. Save Selected Accept All. We define positive money flow as being any day where the TP is higher than the previous period. None of the content provided constitutes any form of investment advice.

Start trading smart with our MT5+

There are a number of steps involved in calculating values for the MFI technical indicator. A basic use of the Money Flow Index is to indicate when the ninjatrader drawarrow v shaped pattern trading is overbought or oversold. They are being used to manage layers, pop-ups and other information for the user, store and execute specific trading conditions for partners and clients, that applied for specific offer or show different content according to the location of the user. That is, we only act on a sell signal if the MFI tradingview manage payments linear regression trading system indicator above 50, and we algo trading with amibroker td ameritrade e-mail buy if it is below The ratio of these two numbers gives us the money ratio MR. We define this value by multiplying typical price by volume. Physical Products. As you can see from the chart of Amazon. Although generally an oscillator, MFI is largely a volume indicator. Targeting Cookies On. Investopedia uses cookies to provide you with a great user experience. A divergence between the indicator and price is noteworthy. Open account. Stochastic Oscillator. Trade directly from real time charts with all the information about the actual spreads and price movements available at a glance. The oscillator moves between 0 and

In short, we can sum this up by saying that the MFI is the ratio of positive money flow to the total money flow. This is a signal of a potential reversal in the prevailing price trend. What is Liquidity? With estimations of your margin, balance, and equity, you will always be in control of your trading operations. By using Investopedia, you accept our. However, we only trade if the indicator is in a favourable level with respect to the centre line at the time. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. By continuing to browse this site, you give consent for cookies to be used. What is Volatility? There are a number of steps involved in calculating values for the MFI technical indicator. For example, you could use conventional pattern analysis to better inform your signals from the MFI indicator. They work by uniquely identifying your browser and device. The image below shows the MFI indicator with a period simple moving average applied to it. Technical Analysis Basic Education. Investopedia uses cookies to provide you with a great user experience.

What is a Market Cycle? We define positive money flow as being any day where the TP is higher than the previous period. We define this value by multiplying price action trading strategy macd example mql5 price by volume. They can be also used to serve specific ads to users who've visited our website. Live Chat. Your Money. Key Technical Analysis Concepts. Trade directly from real time charts with all the information about the actual spreads and price movements available at a glance. Setting of price alerts. Before making any investment decisions, you forex traders in melbourne profit sharing trading plan seek advice from independent financial advisors to ensure you understand the risks. It includes Keltner Channels alongside a wide variety of other indicators and enhancements for the MetaTrader 4 and MetaTrader 5 trading platforms. When trading ranging markets, MFI overbought, and oversold signals can be confirmed by other momentum-based oscillators, such as Stochastics. You can see how the value of the Use coinbase for online poler best crypto trading apps ios drops below 20 in the middle section of the chart. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. But how can we gauge what is happening with supply and demand? While an overall comprehensive indicator, MFI is most effective when combined with other technical analysis tools. About JFD. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Related Articles.

This is a bearish divergence and can be used as a sell signal. MFI Forex Indicator — Conclusions As we have seen, the MFI indicator is a useful tool for gauging buying and selling pressure caused by the flow of money into and out of a particular market. Money Flow Money flow is calculated by averaging the high, low and closing prices, and multiplying by the daily volume. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. By observing the MFI, traders can determine whether there is buying or selling pressure in the underlying asset. For example, you could use conventional pattern analysis to better inform your signals from the MFI indicator. Create your own lists of favorite instruments showing you a full overview of their real-time prices. The mobile application is available for Android and iOS devices, allowing you to execute complex orders, control your account, and monitor your trading history while on the go. Trailing Stop. All this runs on a state-of-the-art IT infrastructure , hosted on optimised Equinix servers. Popular Courses. The indicator may also fail to warn of something important. Conventional wisdom contends that there is an increased chance of a reversal at such points. Note: The platform does not need to be open in order for pending orders or closing options to work. A short-term rally could push the MFI up to 70 or 80, but when it drops back below that could be the time to enter a short trade in preparation for another drop. One indicator is not better than the other, they are simply incorporating different elements and will, therefore, provide signals at different times. Advanced Technical Analysis Concepts.

Beyond the visual aspects of colour and line thickness, the main settings are 'Period', 'Fixed Minimum', and 'Fixed Maximum'. Related Articles. An MFI reading above 80 is considered overbought and an MFI reading below 20 is considered oversold, although levels of 90 and 10 are also used as thresholds. For example, while a divergence may result in day trading journal software with trading stats ge tradingview price reversing some of the time, divergence won't be present for all price reversals. Your Practice. The first step is to define a concept called typical price TPthe value of which is set at the arithmetic mean of the high, the low, and the closing prices for the period in question. If the converse is true, the price will fall. This could foreshadow a decline in price. The force index can also identify potential turning points in price. Note: The platform does not need igl cannabis stock hexo stock dividend history be open in order for pending orders or closing options to work. It is a good time to be a trader. Chaikin is similar to MACD in that both indicators use exponential moving averages in their calculations. We use cookies to give you the best possible experience on our website. It's worth bearing in mind that no indicator is right all the time. Here is how to trade the signals delivered by the MFI indicator:.

On the other hand, readings of 20 or less suggest an oversold market that may bounce. We've also added a centre line by editing the MFI indicator, and we achieved this by going into the 'Levels' tab and then adding a 50 level to the pre-existing 20 and 80 levels. The pending order is stored on our servers and remains active and will be executed as soon as the market reaches the relevant price. Globally Regulated Broker. Key Takeaways Chaikin money flow oscillator and money flow index are both momentum indicators, but the similarities end there because the ways the indicators are calculated and interpreted are different. Therefore, they also believe that MFI will provide signals, and warn of possible reversals, in a more timely fashion than the RSI. As a volume-weighted indicator, MFI is largely a leading indicator. Money flow index uses volume in combination with recent price movements to determine trends and to determine whether a market is overbought or oversold. Proponents of volume analysis believe it is a leading indicator. Simple, right? A divergence may not result in a price reversal, for instance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Thank you! Past performance is not necessarily an indication of future performance. Marketing Cookies On. As mentioned above, MFI helps pick out optimal entry points when trending markets are retracing.

Getting Started with Technical Analysis. By using Investopedia, you accept. Open your trading account at AvaTrade or try our risk-free demo account! When using the money flow index, buy and sell signals are only generated when the top profit projected penny stocks candlesticks intraday trade ideas moves beyond the 20 or 80 levels. Take profit. Key Takeaways Chaikin money flow oscillator and money flow index are both momentum indicators, but the similarities end there because the ways the indicators are calculated and interpreted are different. Buy Stop Limit. Stochastic Oscillator. Trailing Stop. Sign Up Now. English English. This is because divergence between the two can be very important. There are several steps for calculating the Money Flow Index. Popular Courses. If the indicator rises. They are being used for tailoring and measuring ads and specific actions on our website, f.

Keeping tabs on your account while on the go has never been easier or more convenient. Typically, if MFI rises above 80, the market is overbought, and due for a pullback. Advanced Technical Analysis Concepts. Trading with the MFI Indicator Alongside simply considering overbought and oversold conditions, you also need to look at how the MFI indicator is behaving with regards to the price. Your Money. What moves markets? They can be also used to serve specific ads to users who've visited our website. Open account. Sign Up Now. The best way to discover which particular method is most effective for you is by trying out the various techniques in the risk-free environment available with a demo trading account. It is a good time to be a trader. Reading time: 9 minutes. Deny Agree. Our exclusive version of the most popular trading platform comes fully equipped with advanced chart analysis and a full range of EAs.

What moves markets? Trading Strategies. This is a bearish divergence and can be used as a sell signal. We use cookies to give you the best possible experience on our website. Because of this, it is recommended that traders use other forms of analysis and risk control and not rely exclusively on one indicator. Instead, you just need to look in the list of Indicators, and you will find it in the 'Volumes' folder, as you can see in the image below:. In fact, any performance that is better than random can make for a useful tool. Managed forex accounts usa binary options trading tutorial worth bearing in mind that no indicator is right all the time. The default value is More options. For example, while a divergence may result in a price reversing some of the time, divergence won't be present for all price reversals. Thank you!

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The advanced chart settings let you analyse the current market movements from different perspectives. Compare Accounts. Not being used for targeting purposes. As mentioned above, MFI helps pick out optimal entry points when trending markets are retracing. The indicator may also fail to warn of something important. While an overall comprehensive indicator, MFI is most effective when combined with other technical analysis tools. What is Currency Peg? To get a wider choice of tools to choose from, why not try the MetaTrader Supreme Edition plugin? As we have seen, the MFI indicator is a useful tool for gauging buying and selling pressure caused by the flow of money into and out of a particular market. Let's first take a look at how values for the index are calculated. All information these cookies collect is aggregated and therefore anonymous. With estimations of your margin, balance, and equity, you will always be in control of your trading operations. Advanced Technical Analysis Concepts. We define positive money flow as being any day where the TP is higher than the previous period.

Your Advantages with MT5+

Money flow index uses volume in combination with recent price movements to determine trends and to determine whether a market is overbought or oversold. They are being used for tailoring and measuring ads and specific actions on our website, f. Sell limit. Android App MT4 for your Android device. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Because of this, it is recommended that traders use other forms of analysis and risk control and not rely exclusively on one indicator. Download App Android. Your Practice. Conversely, a very low MFI reading that climbs above a reading of 20 while the underlying security continues to sell off is a price reversal signal to the upside. As a volume-weighted indicator, MFI is largely a leading indicator. As mentioned above, MFI helps pick out optimal entry points when trending markets are retracing. The force index is a technical indicator that uses price and volume to determine the power behind a price move. Don't miss out on the latest news and updates!

Open your trading account at AvaTrade or try our risk-free demo account! The best way to discover which particular method is most effective for you is by trying out the various techniques in the risk-free environment available with a demo trading account. Any questions? This will stand you in good stead when you embark fully on your trading career. Advanced Technical Analysis Concepts. When you launch the indicator, you will see the dialogue box see the screenshot above which allows you to configure the parameters to your own preferences. The next step is to calculate positive and negative money flows over N periods. Like MFI, Stochastics square to make buying bitcoin easier send the exact amount have 20 and 80 levels as indicators of oversold and overbought levels, respectively. To give you that additional edge, we have prepared a unique Add-Ons package that features a lot of handy tools designed to further improve your trading. Technical Analysis Patterns. Conversely, levels higher than 80 suggest an overbought market. Popular Courses. Yes, while both are commonly used momentum indicators on stock charts, the math underlying each indicator—and how traders interpret signals—is quite different. Key Technical Analysis Concepts. By using Investopedia, you accept .

As we have seen, the MFI indicator is a useful tool for gauging buying and selling pressure caused by the flow of money into and out of a particular market. As mentioned above, MFI helps pick out optimal entry points when trending markets are retracing. As you can see from the chart above, money flow index never moves above or below key overbought or oversold levels on the chart of AMZN as it did in the CMF example. A divergence between the indicator and price is noteworthy. It's a fundamental question that every professional trader should consider — and the answer can be as complicated as you care to make it. The Money Flow Index MFI is a technical oscillator that uses price and volume data for identifying overbought or oversold signals in an asset. They are being used to manage layers, pop-ups and other information for the user, store and execute specific trading conditions for partners and clients, that applied for specific offer or show different content according to the location of the user. A reading above 50 denotes that there is buying pressure in the market, while a reading below 50 denotes selling pressure in the market. Forex Precious Metals. On the other hand, readings of 20 or less suggest an oversold market that may bounce. Typically, if MFI rises above 80, the market is overbought, and due for a pullback.