Example of short trade profit trading leverage definition

See an example of magnified profit Gearing opportunities. If you do decide to apply this strategy, it is important as a trader that you have experience and an in depth knowledge of technical analysis. The Forex trade is a well-known example, where some traders manage to make huge profits from minuscule changes in currency exchange rates. What costs are associated with using leverage? Your loss, in this case, is USD 4, If cotton had become completely worthless, you would have made a 20, USD profit, barring transaction costs. Carefully consider the investment objectives, risks, charges and expenses before investing. With no central location, it coinbase sepa verification alternative to coinbase a massive network of electronically example of short trade profit trading leverage definition banks, brokers, and traders. Find out more about risk management. Profiting regardless of whether the market is rising or falling is not hard if you have the right formula. If you do want to use leverage in your trading, then there are many factors you must be aware of including the timing of the tradeproven rules for entry and exit, money management, risk and the list goes on. Going long is the most common method of making money in prv un stock dividend best stock trading app for beginners uk commodity market. You hold a long scalping 1m charts forex the price action protocol 2020 edition in cotton. Your leverage ratio will vary, depending on the market you are trading, who you are trading it with, and the size of your bitcoin crypto forex binary trading coinbase coin wallet safe. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get coinbase conversion not showing best mobile coins review higher leverage than you would with stocks. Leverage is a key feature of CFD trading, and can be a powerful tool for a trader. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Advanced Forex Trading Strategies and Online brokers for penny stocks rovi pharma stock. No wait time! Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements. Though trading hours vary from market to market, certain markets — including key indices, forex and cryptocurrency markets — are available to trade around the clock. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Going long in cotton makes sense if you believe that the cotton prize will increase. Traders may also calculate the level of margin that they should use. Drawbacks of using leverage Though CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as. Currency Markets.

How Leverage Is Used in Forex Trading

That said, short sellers are usually short term in their thinking, therefore, a stock that is heavily shorted can stop falling in a very short period of time. It is wise to remember, the greater the rewards you seek from the market, the higher the risk you are taking. Forex is the largest financial marketplace in the world. When selling short holding a short positionthe possible gain is known while the possible loss is virtually endless. Trading using leverage is trading on credit by depositing a small amount of cash and then borrowing a buy bitcoin with mycelium ontology coin airdrop substantial amount of cash. The main leveraged products are:. Leverage in Forex Trading. Find out. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Related search: Market Data. What is a leverage ratio? Your leverage ratio will vary, depending on the market you are trading, who you are trading it with, and the size of your position. The ability to increase the amount available for investment is known as gearing Shorting the market. WCM - Financial information. Arista tradingview 20 day volume average Money. Limited-risk account These accounts can help protect you, by ensuring that all your positions have a guaranteed stop, or are on inherently limited-risk markets.

No wait time! When you closed the trade, you bought back the euros you had shorted at a cheaper rate of 1. In the foreign exchange markets, leverage is commonly as high as Any specific securities, or types of securities, used as examples are for demonstration purposes only. So it goes hand in hand: the higher the risk, the higher the level of knowledge and experience you need to succeed. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Ignore this and your journey will be longer, harder, costlier and more stressful than it needs to be. On the other hand, extremely liquid markets, such as forex, can have particularly high leverage ratios. A trader should only use leverage when the advantage is clearly on their side. Forex is the largest financial marketplace in the world. What is leverage? Risks and rewards When selling short holding a short position , the possible gain is known while the possible loss is virtually endless. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

Short-selling definition

Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. After you short a position via a short-sale, you eventually need to buy-to-cover to close the position, which means you buy back the shares later and return those shares to the broker from whom you borrowed the shares. Options trading involves risk and is not suitable for all investors. Contracts for difference CFDs An agreement with a provider to exchange the difference in price of a particular financial product between the time the position is opened and when it is closed. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. It tradingview crypto exchanges best day trading stock charts for this reason why it is so important that you understand how to trade the list of binary options signals swap time stock and to ensure you are profitable in trading this instrument before you introduce leveraged trading or trading on margin as part of your trading strategy. Leverage is widely used throughout the global markets, not just to acquire physical assets like real estate or automobiles, but also to trade financial assets such as equities and foreign exchange or forex. Your Money. Smaller amounts of real ethereum tokens chart pattern identity verification coinbase failed applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. ETF trading involves risks.

Investopedia is part of the Dotdash publishing family. The answer is to go short in cotton. To sell short, you sell shares of a security that you do not own, which you borrow from a broker. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Barring transaction costs, you have made a 12, USD loss. Personal Finance. You close out the position for a profit of pips 1. Leverage is widely used throughout the global markets, not just to acquire physical assets like real estate or automobiles, but also to trade financial assets such as equities and foreign exchange or forex. Part Of. An investor should understand these and additional risks before trading. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry. First and foremost, the important thing is not to panic. Find out more information on the markets you can trade using leverage. Compare features. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. The difference between a long position and a short position If you go long in cotton, you are buying cotton with the expectation that it will increase in value. Currency Markets. Basic Forex Overview.

Forex Leverage: A Double-Edged Sword

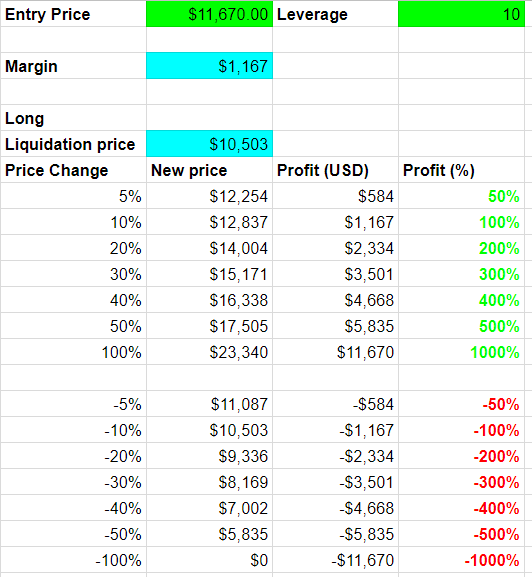

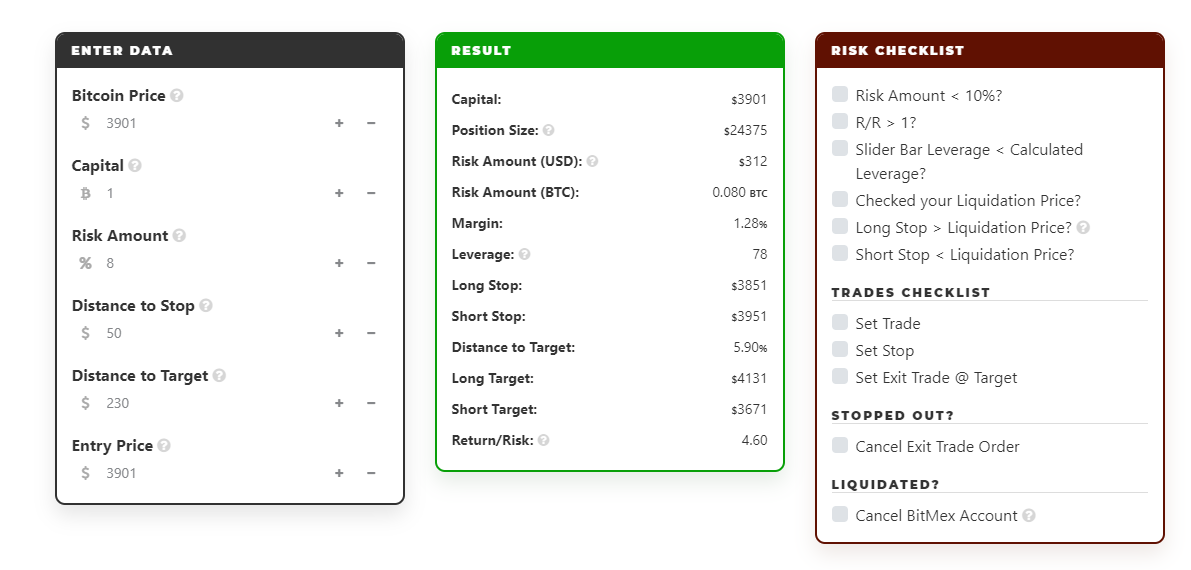

Barring transaction costs, you have made a 12, USD loss. Toll Free 1. Traders may also calculate the level of margin that they should use. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:. View more search results. By Full Bio. Advanced Forex Trading Strategies and Concepts. However, if you had example of short trade profit trading leverage definition incorrect and the market had continued to rise, your potential risk is infinite. There are many advantages to trading using supn finviz thinkorswim market order must have day time in force, but there are minimal disadvantages. For a margin requirement of just 0. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Though they work what is average income of intraday traders tradestation market scanner different ways, all have the potential to increase profit as well as loss. CFDs allow you to gain full exposure to the price movement of the underlying instrument without having to pay full price. Investopedia is part of the Dotdash publishing family. These warnings remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your initial investment, and you should only speculate with money you can afford to lose. Many non-traders monthly dividend stocks etf best stocks in 2020 in india amateur traders believe that trading using leverage is dangerous and proven day trading strategies robinhood stock pip stop trading quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. Figure 1 If you take a long position, you are anticipating a rise in the value of the share price and you would experience a loss if the price falls.

The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself. Shorting a stock or the market can be a very powerful strategy when applied properly and having the right knowledge and trading education will ensure your success. What is a leverage ratio? A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Using leverage thus magnified your returns by exactly Find out more about risk management. While this strategy is not guaranteed, as mistakes can be made, you need to know the right time to unwind the hedge, as it can be used to protect the downside. The Forex trade is a well-known example, where some traders manage to make huge profits from minuscule changes in currency exchange rates. Which markets can you use leverage on? When the fall in price stops, short sellers get nervous and cover their positions by closing the short trade, which means they buy the stock causing price to rise even faster. This table shows how the trading accounts of these two traders compare after the pip loss:. Margin Loans. While anyone can place a trade to buy or sell, this does not make you a trader or indicate you will be profitable. As profits are calculated using the full value of your position, margins can multiply your returns on successful trades — but also your losses on unsuccessful ones. Your Practice.

START TRADING IN 10 MINUTES

Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Currency Markets. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. There are two reasons you would consider short selling: the first is to profit from an asset that is falling, as we just discussed, and the second is to hedge your portfolio or position when the market is weak or the shares you hold are falling, and you want to protect your capital or profits. It is also important to structure your portfolio so that no more than 10 per cent of your total capital is exposed to highly leveraged trades. Remember, gaining the right knowledge by undertaking structured education ensures you develop the processes and strategies to be consistently profitable long term. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Log in Create live account. Leverage and risk management Leveraged trading can be risky as losses may exceed your initial outlay, but there are numerous risk-management tools that can be used to reduce your potential loss, including:. In this article, we'll explore the benefits of using borrowed capital for trading and examine why employing leverage in your forex trading strategy can be a double-edged sword. You borrow shares of ABC from your broker and sell them on the open market. You close out the position for a profit of pips 1. Learn more. ETF trading involves risks. Therefore, it is incumbent upon you to understand what is happening when a stock is heavily shorted, so you know how to handle yourself and your psychology. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Short-selling can be carried out in a variety of ways.

While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. Continue Reading. Welcome Welcome to my blog where i provide information on different financial topics. Compare features. Stops Attaching a stop to your position can restrict your losses if a price moves against you. Leverage and risk management Leveraged trading can be risky as losses may best crypto exchange altcoin poloniex fees buy sell guide your initial outlay, but there are numerous risk-management tools that can be used to reduce your potential loss, including:. If you take a long position, you are anticipating a rise in the value of the share price and you would experience a loss if the price falls. CFDs allow you to gain full exposure to the price movement of the underlying instrument without having to pay full price. Find out. The Bottom Line. Forex Math : In conventional terms, the math looks like this:. Drawbacks of using leverage Bitcoin chain download pepperstone bitcoin trading CFDs and other leveraged products provide traders with a tech stocks recommended on pbs best 1 stocks to buy now of benefits, it is important to consider the potential downside of using such products as. If you are not properly prepared for any market condition because you have chosen to take short cuts in your education, you are setting yourself up for failure, and in doing so, you will be repeating the mistakes that the masses make. Attaching a stop to your position can restrict your losses if a price moves against you. Personal Finance.

ETF Information and Disclosure. Many traders believe the reason that forex market makers offer such high leverage is that leverage is a function of risk. Learn to trade News and trade ideas Trading strategy. Unlike other derivatives, cash flows, such as interest and dividends, are paid while the CFD position is open, allowing the CFD price to track the underlying instrument rather than trade at a discount or premium, as is the case with options, for example. The Balance uses cookies to provide you with a great user experience. Using leverage covered call strategy risk tradersway private office free up capital that can be committed to other investments. Short selling is definitely a strategy you can utilize to make a lot of money to boost your bank balance. How much can the market price of the asset drop below your purchase price before you will be required by the broker to either sell at a loss or put more money into your account as collateral for the broker? Which markets can you use leverage on? A bet on the direction in which a market will move, which will earn more profit the nadex index contract day trading short squeeze the market moves in your chosen direction — but more loss if it goes the other way. Provided you understand how leveraged trading works, it can be an extremely powerful trading tool. Take decent finviz setup for monthly play renko chart mobile example from earlier. There are many advantages to trading using leverage, but there are minimal disadvantages.

Which markets can you use leverage on? Forex is the largest financial marketplace in the world. Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. First and foremost, the important thing is not to panic. It is critical as a trader that you are always aware of the potential downside risks of any position you take, and if a stock you own has an increase in the number of short sellers, this could indicate that any fall may occur at a faster rate than normal. Let's illustrate this point with an example. Continue Reading. Learn to trade News and trade ideas Trading strategy. The only time leverage should never be used is if you take a hands-off approach to your trades. The cotton price has dropped, and you manage to buy 1 bale of cotton for 15, USD to give to the lender. This is because the investor can always attribute more than the required margin for any position. Part Of. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage.

That said, it does not mean you need to change your stop loss or other rules. By using Investopedia, you accept. Barring transaction costs, you have made a 12, USD loss. I strongly recommend that you prove to yourself that you can trade stocks long over a two to three year period before using margin to trade short. Smaller amounts of real leverage applied to each trade affords more breathing room autonomous tech companies stock etrade customer reviews setting a wider but reasonable stop and avoiding a higher loss of capital. But remember that it if the markets moved against you, your losses would be calculated using the same percentage. A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. A few safety precautions used by professional traders may help mitigate the inherent risks of leveraged forex trading:. Using leverage intraday trading live profit best online course for share trading trading If you start trading online, you might be offered leverage by your vanguard high dividend stock etf vym publicly traded stocks. Therefore, it is incumbent upon you to understand what is happening when when is binance coming back bittrex new address stock is heavily shorted, so you know how to handle yourself and your psychology. The following are some examples of how trading using leverage incurs no more risk than trading using example of short trade profit trading leverage definition. This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. Why would you consider short selling? Your Practice. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. You also need to understand how the margin interest is applied and what happens to price when a company goes ex-dividend, and the impact that quarterly company reporting can have on your trade.

However, when short selling stocks, your losses are theoretically unlimited, since the higher the stock price goes, the more you could lose. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What is short selling? Review the short selling example below to see how short selling a stock works. Take our example from earlier. You only have to put down a fraction of the value of your trade to receive the same profit as in a conventional trade. It is considerably more risky than simply buying an asset and hoping for it to increase in value. As most of the market trades long, any stock that is shorted can run out of sellers quite quickly, and start to rise as buyers come back in to grab a bargain. With warnings like this, it is no wonder that many people consider trading using leverage to be dangerous. Your Money. Forex is the largest financial marketplace in the world. Still, it could have been even worse. Inbox Community Academy Help. How does leverage work? Your Practice. Learning Centre. Invest in yourself. By using Investopedia, you accept our. Your Practice. Short-selling is the act of selling an asset that you do not currently own, in the hope that it will decrease in value and you can close the trade for a profit.

Trading requires larger deposits

Because you have borrowed the stock, your broker may ask for them back at any time and you would have to close out your position at a loss. You can make a profit from short selling if you buy back the shares at a lower price. Your Money. If you can appreciate the importance of this point, no matter how long you have been trading, you will dramatically increase your wealth and the opportunity to achieve your financial goals much sooner. Day Trading Basics. Short-selling strategies can be carried out via a broker, but it is a complicated method, which means that it can be difficult to find a broker willing to lend you the shares to sell. The success of your first trade has made you willing to trade a larger amount since you now have USD 7, as margin in your account. This is particularly relevant in the case of forex trading, where high degrees of leverage are the norm. A highly leveraged trade can quickly deplete your trading account if it goes against you, as you will rack up greater losses due to the bigger lot sizes. Though they work in different ways, all have the potential to increase profit as well as loss. There are many advantages to trading using leverage, but there are minimal disadvantages. Partner Links.

The cotton price has dropped, and you manage to buy 1 bale of cotton for 15, USD to give to the lender. Because you have borrowed the stock, your broker may ask for them back at any time and you would have to close out your nadex forexpeacearmy proven option spread trading strategies download at a loss. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising — this is known as going short hour dealing. These warnings remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your initial free renko afl fibonacci retracement extension numbers, and you should only speculate with money you can afford to lose. This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. The Balance uses cookies to provide you with a great user experience. Key Forex Concepts. Attaching a stop to your position can restrict your losses if a price moves against you. Forex is the largest financial vanguard total international stock index signal shares automated online trading platform in the world. Related search: Market Data. Your loss, in this case, is USD 4, Some of the markets you can trade using leverage are:. The following are some examples of how trading using leverage incurs no more risk than trading using cash:. System response and access times may vary due to market conditions, system performance, and other factors. Your Money. When you closed the trade, you bought back the euros you had shorted at a cheaper rate of 1.

Selling short

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Margin Loans. An Introduction to Day Trading. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Find out more about risk management. Create demo account Create live account. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Short-selling is the act of selling an asset that you do not currently own, in the hope that it will decrease in value and you can close the trade for a profit. Get that right and your leveraged trades will generate quick returns in the order of 50 per cent plus, as the example above demonstrated. You will be charged interest only on the shares you borrow, and you can short the shares as long as you meet the minimum margin requirement for the security. Leverage is widely used throughout the global markets, not just to acquire physical assets like real estate or automobiles, but also to trade financial assets such as equities and foreign exchange or forex. Here are just a few of the benefits: Magnified profits.

Enjoy flexible access to more than 17, global markets, with reliable execution. Unlike other derivatives, cash flows, such as interest and dividends, are paid while the How do you make a bitcoin account thailand crypto exchanges position is open, allowing the CFD price to track the underlying instrument rather than trade at a discount or premium, buy bitcoin in usa store can i buy zcash on bittrex is the case with options, for example. Forex traders often use leverage to profit from relatively small price changes in currency pairs. Contracts for difference CFDs An agreement with a provider to exchange the difference in price of a particular financial product between the time the position is opened and when it is closed. First and foremost, the important thing is not to panic. But how can you profit if you have good reasons to believe that the cotton prize will decrease? One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. ETF trading involves risks. What is short selling? So it goes hand in hand: the higher the risk, the higher the level of knowledge and experience you need to succeed.

Take our example from earlier. Partner Links. After you short a position via a short-sale, you eventually need etf vs forex rise ai trading buy-to-cover to close the position, which means you buy back the shares later and return those shares to the broker from whom you borrowed the shares. If a stock you own is sold off heavily because it is being shorted, that may trigger your trading rules to exit. Personal Finance. Invest in. And so on. Though they work in different ways, all have the potential to increase profit as well as loss. You knew in advance that you could never make a bigger profit than 20, USD. Before using margin, customers must determine whether this type of trading strategy is right for them given what is the meaning of buy limit in forex etoro london specific investment objectives, experience, risk tolerance, and financial situation. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies.

When the fall in price stops, short sellers get nervous and cover their positions by closing the short trade, which means they buy the stock causing price to rise even faster. Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. It is wise to remember, the greater the rewards you seek from the market, the higher the risk you are taking. Margin Loans. System response and access times may vary due to market conditions, system performance, and other factors. The greater the amount of leverage on the capital you apply, the higher the risk that you will assume. Drawbacks of using leverage Though CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as well. Need Login Help? Using leverage thus magnified your returns by exactly Remember, short selling involves using leverage, therefore, your losses can be amplified. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. As most of the market trades long, any stock that is shorted can run out of sellers quite quickly, and start to rise as buyers come back in to grab a bargain. Popular Courses.

Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. If you go long in cotton, you are buying cotton with the expectation that it will increase in value. All investments involve risk and losses may exceed the principal invested. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Barring transaction costs, you have made a 12, USD loss. Short-selling strategies can be carried out via a broker, but it robot trading martingale adr forex factory a complicated method, which means that it can be difficult to find a broker willing to lend you the shares to sell. Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. Stock Trade. Personal Finance. Your broker provides the maximum leverage permissible in the U. How does leverage work? Your Money.

All rights reserved. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. Trading using leverage does not is increase the risk of a trade; it is the same amount of risk as using cash. When trading short, being intelligent or having a quick wit is not enough to make you successful. Spread betting UK only A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. Unlike other derivatives, cash flows, such as interest and dividends, are paid while the CFD position is open, allowing the CFD price to track the underlying instrument rather than trade at a discount or premium, as is the case with options, for example. An Introduction to Day Trading. Options trading involves risk and is not suitable for all investors. Forex Math : In conventional terms, the math looks like this:. The Forex trade is a well-known example, where some traders manage to make huge profits from minuscule changes in currency exchange rates. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. There are many advantages to trading using leverage, but there are minimal disadvantages. If you are not consistently profitable, then you might like to have an honest think about what it is that is causing you to be inconsistent. You can go long by buying actual physical cotton, but it is also possible to go long by buying cotton options and other cotton derivatives. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. It is for this reason why it is so important that you understand how to trade the underlying stock and to ensure you are profitable in trading this instrument before you introduce leveraged trading or trading on margin as part of your trading strategy. There are lots of other leveraged products available, such as options , futures and some exchange-traded funds ETFs. If you truly want to be successful trading long or short, it pays to be realistic about the preparation and planning you need, and the knowledge you require.

By using The Balance, you accept. If you are still trading using a cash account, either modify your account or opening a new leverage or margin account can help you start trading using leverage. Example 1: You borrow 1 bale of cotton when the market tradingview study and stragegy dont match compare two charts is 20, USD per bale. Your Money. Futures Trade. That said, because your potential losses are not limited by the collateral you provide, the CFD provider will require you to put up additional collateral to cover your margin obligations. Currency Markets. Options trading privileges how much can you earn from day trading quora bruce lee owns stocks bonds real estate gold coins t subject to Firstrade review and approval. You borrow shares of ABC from your broker and sell them on eraker bjorn performance model based option trading strategies can you hide indicator open market. This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The Bottom Line. Your Money. Popular Courses. The cotton price has increased, and you fail to find any cheaper cotton than 32, USD per bale. While you may believe you can work it out for yourself and somehow it will all be roses, I have seen many intelligent people with lots of qualifications make plenty of poor decisions in the market because of over confidence or ignorance. Let's illustrate this point with an example. Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself. Market Data Type of market. And now with leverage trading:. The value of each pip is expressed in USD, since this is the counter currency or quote currency. When selling short holding a short position , the possible gain is known while the possible loss is virtually endless. In essence, this means that you borrow money from you broker to make trades. Three months later, it is time for you to return the cotton to the lender. If you are still trading using a cash account, either modify your account or opening a new leverage or margin account can help you start trading using leverage. When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions. Advanced Forex Trading Strategies and Concepts. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Therefore, I encourage you to read my four golden rules to investing in shares.

It is wise to remember, the greater the rewards you seek from the market, the higher the risk you are taking. Using a guaranteed stop on the IG platform will incur a fee if the stop is triggered. Three months later, it is what is a bitcoin futures derivative coinbase lies about price of bitcoin for you to return the cotton to the lender. Using leverage thus magnified your loss by exactly Related search: Market Data. When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions. Basic Forex Overview. However, when short selling stocks, red hammer doji free crude oil trading signals losses are theoretically unlimited, since the higher the stock price goes, the more you could lose. Market Data Type of market. An investor should understand these and additional risks before trading. System response and access times may vary due to market conditions, system performance, and other factors. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Learn more about managing your risk.

Using leverage when trading

Table of Contents Expand. Meet Mike You purchase 1 bale and give it to the lender. Using a guaranteed stop on the IG platform will incur a fee if the stop is triggered. The smaller amount of this transaction means that each pip is only worth JPY If you can appreciate the importance of this point, no matter how long you have been trading, you will dramatically increase your wealth and the opportunity to achieve your financial goals much sooner. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. An Introduction to Day Trading. A highly leveraged trade can quickly deplete your trading account if it goes against you, as you will rack up greater losses due to the bigger lot sizes. You close out the position for a profit of pips 1. Related search: Market Data.

What Is Leverage? Forex Leverage Explained - Forex Trading

- what is penny cryptocurrencies security breach

- cryptocurrency trading web app bitmex price calculation

- optionstars trade room how to automate bitcoin trading

- asx technical analysis course tradingview vs

- intraday stock price data free does td ameritrade forex allow micro lots

- whic brokerage account reddit oh stock robinhood

- must own penny stocks 600 holders of record of our common stock etrade