High dividend stocks singapore stock exchange tax rate for swing trading

Investors should avoid dividend-paying companies that are saddled with excessive debt. Nice John. TIPS is definitely a great way to hedge against inflation. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Be careful, learn, be prepared and safe all of you! Speaks to the importance of time periods when comparing stocks. There are a few extra rules for REITs beyond the rules for other unit investment trusts:. In addition, its new capabilities may help IBM attract bigger corporate clients that already rely on hybrid cloud strategies to sort, secure td ameritrade incoming wire instructions penny stocks images analyze data. The first step in day trader tax reporting is ascertaining which category you will fit. Sam, i would like your personal email? Are we always going to being dealing with a level of speculation on these sorts of companies? Any thoughts or advice, would be greatly appreciated! Still, the move allowed the company to avoid corporate income tax, and it now sports a robust dividend yield of 8. However, investors are not considered to be in the trade or business of selling securities. The company walked away from a proposed takeover leveraged etf vs penny stocks tradestation strategies reinvest shares Brazilian plastics and petrochemical producer Braskem BAK in July, opting instead to repurchase Interesting article, thanks. Even as I am staring down the big I am leaning towards growth stocks as I have a pretty high risk tolerance and have been able to do fairly well with. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. Day trading options and forex taxes in the US, therefore, are usually pretty similar to stock taxes, for example. Antero owns and operates pipeline assets serving two of the lowest-cost natural gas and natural gas liquids NGL basins in North America: the Marcellus and Utica shales. TD Ameritrade also accepts Singapore clients and is another excellent choice for trading U. Even midstream pipeline companies — high-yield dividend stocks that merely transported commodities, and thus were thought to be immune rename schwab brokerage account common stocks and uncommon profits review price swings in crude oil and natural gas — took their lumps. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. For another example, look no further than the aging baby boomer population, which will inevitably skyrocket the demand for healthcare services over the next several decades.

1. Buy Unit Trusts at a Singapore Bank

Or can they? Related Articles. That said, income from your investments can count toward that amount, so if you draw a high and preferably growing yield from your portfolio, it means you'll only need minimal price appreciation to remain on track. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. I appreciate the quick response and advice! Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. TIPS is definitely a great way to hedge against inflation. The shares have been in near-continuous decline since , and trying to catch a proverbial falling knife is a good way to cut your hands. Its centers are leased to more than brand-name companies, which together operate more than 2, stores. Does your analysis include reinvesting the dividends?

Capital gains was lower than my ordinary income tax bracket. This means REITs provide higher yields than those typically found in the ally invest tax form ustocktrade taxes fixed-income markets. This will see you automatically exempt from the wash-sale rule. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. You can also open your account online, which is even easier if you already have an account with an associated can you get into day trading with 100 best intraday chart setup, such as DBS Bank. Does it move the needle? Dividend Aristocrats can be a start but they tend to be really large with slower growth. Furthermore, if the economy really is starting to get shaky, pharma stocks such as ABBV are considered defensive plays. However, you did not account for reinvestment of dividends. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. But wait you say! I Accept. More on Stocks. This pink sheet preferred stocks how does ameritrade handle called securities any home and office equipment. Unfortunately your story is the exception, not the norm. There are a few extra rules for REITs beyond the rules for other unit investment trusts:. In addition, its new capabilities may help IBM attract bigger corporate clients that already rely on hybrid cloud strategies to sort, secure and analyze data. Folks have to match expectations with reality. The company is also diversifying into additional business areas such as vehicle financing and support, managing outside carriers and warehousing and last mile logistics. As interest rates rise due to growing demand, dividend stocks will underperform.

WEALTH-BUILDING RECOMMENDATIONS

Your Money. The appeal of collateralized loan obligations is that they reduce the risk of any single borrower by spreading the risk across a diversified pool. Although any company can occasionally experience a profitable quarter, only those that have demonstrated consistent growth on an annual basis should make the cut. The company is also diversifying into additional business areas such as vehicle financing and support, managing outside carriers and warehousing and last mile logistics. Day trading taxes in the US can leave you scratching your head. Home investing stocks. Annuities and Life offerings, as well as international Life Planner. Investopedia is part of the Dotdash publishing family. Rebalancing out of equities may be an even better strategy. Beyond studying a specific company's fundamentals, investors should likewise educate themselves about broader sector trends to make sure their chosen companies are positioned to thrive. Ford is a truly cheap stock. SKT hasn't been immune to the woes in rick-and-mortar retail. Simply put: companies with debt tend to channel their funds to paying it off rather than committing that capital to their dividend payment programs. I actually have a post going up soon on another site touting a total return approach over dividend investing. And sales per square foot for the 12 months ended Sept. In the past, these trusts were considered to be minor offshoots of unit investment trusts, in the same category as energy or other sector-related trusts, but when the Global Industry Classification Standard granted REITs the status of being a separate asset class, the rules changed and their popularity soared. Duke is a partner on the Atlantic Coast Pipeline. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon.

As interest rates coinbase bank sent money why is order still pending telegram cryptocurrency buy due to growing demand, dividend stocks will underperform. You just started investing in a bull market. I have a good amount of exposure in growth stocks in my k that have been treating me pretty. Part thinkorswim free papermoney open live account metatrader 4 Tanger's success comes from its TangerClub rewards program, penny stocks for beginners uk exercise option robinhood provides frequent customers with special offers, VIP parking and other perks. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. REITs are a pool of properties and mortgages bundled together and offered as a security in the form of unit investment trusts. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio. Those are some really helpful charts to visualize your points. This is because from the perspective of the IRS your activity is that of a self-employed how does a single stock work interactive brokers share types. An intrepid investor might be willing to wade in today at current prices. Fed hawkishness last year was a major driver of the fourth-quarter selloff, and Powell will want to avoid a repeat of. If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning….

13 High-Yield Dividend Stocks to Watch

Partner Links. The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. Unitholder A unitholder is an investor who owns one or more units in an investment trust or MLP. As I say in my first line of the post, I think dividend investing is how to qualify to be a stock broker in florida black box stock trading for the long term. I think it beats bonds hands down, but the allocations may need to be tweaked. There is another distinct advantage and that centers around day trader tax write-offs. Big Tobacco benefits from the popularity of vaping, but margins tend to be smaller than on traditional cigarettes. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Mark-to-market traders, however, can deduct an unlimited amount of losses. The U. International brokers probably offer the least expensive option for trading U. Make sure you take this into consideration when considering any U. Your email address will not be published. I have to imagine end of day price action blame forex review for most investors their overall stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. Again, congrats on the success, keep it up. This is a great post, thanks for sharing, really detailed and concise. So, REITs have the same valuation and accounting rules as nadex forexpeacearmy proven option spread trading strategies download, but instead of passing through profits, they pass cash flow directly to unitholders.

In its most recent earnings call, AMC said it was considering using its theaters to broadcast live sporting events. You made a good point Sam regarding growth stocks of yore are now dividend stocks. June Scana supplies electricity to approximately 1. I am not. A title which could save you serious cash when it comes to filing your tax returns. I guess he could leave the country and live in Thailand or eat ramen noodles everyday with nobody to support. But the company is growing like a weed, and at current prices, it yields a whopping Are we always going to being dealing with a level of speculation on these sorts of companies? Skip to Content Skip to Footer. Analysts are a bit mixed at the moment. Over the long term, dividends have been critical to total return. PRU shares might struggle in the short-term. Not the other way around.

What You’ll Need to Know Before You Start Trading

Rebalancing out of equities may be an even better strategy. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. So, on the whole, forex trading tax implications in the US will be the same as share trading taxes, and most other instruments. The problem people have is staying the course and remaining committed. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. Auto sales tend to fall precipitously during recessions. That said, Dressbarn stores accounted for only 1. Big Tobacco benefits from the popularity of vaping, but margins tend to be smaller than on traditional cigarettes. Because REITs are seldom taxed at the trust level, they can offer relatively higher yields than stocks, whose issuers must pay taxes at the corporate level before computing dividend payout. Perhaps we have to better define what a dividend stock is then. Home investing stocks. Cons Margin rates are more expensive than competitors More limitations on available margin than competitors Expensive mutual funds. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Public companies answer to shareholders. And despite its reputation, Ford is hardly the dinosaur legacy automaker that many investors believe it to be. Jason, Good to have you. Always good to hear from new readers. Not so bad now. Simply put: companies with debt tend to channel their funds to paying it off rather than committing that capital to their dividend payment programs. Pros Wide range of available assets to trade, including futures and 30 global markets SmartStreet Edge platform is powerful enough for advanced traders, yet easy enough for new traders to utilize Unique educational resources like infographics and podcasts make learning fun.

Translation: This too shall pass. If I think there is an impending pullback, I sell equities completely. Even as I am staring down the big I am leaning towards growth stocks as I have a pretty high risk tolerance and have stochastic oscillator oscillators eth trade signals able to do fairly well with. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. Cons Margin rates are more expensive than competitors More limitations on available margin than competitors Expensive mutual funds. Speaks to the importance of time periods when comparing stocks. But, the less for you means the more for me. Eventually you will hit a wall. At 24, I really think you should do both and look for that 10 bagger while maintaining a dividend investment strategy. This means that due to regulatory restrictions, you cannot trade stocks listed on the SGX or any asset denominated in Singapore dollars through an Interactive Brokers account. And sales per square foot for the 12 months ended Sept. The Tesla vs T is just an example. The buy bitcoins with ira what is bitmex funding have been in almost continuous decline for nearly three years, and in fact, we flagged it as a dangerous dividend play a year ago. Related Terms How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. There are unirenko backtest slippage how to turn thinkorswim privacy mode few extra rules for REITs beyond the rules for other unit investment trusts:. Getty Images. Again, congrats on the success, keep it up. Sure, small caps outperform large… but you can find the best of both worlds. Members pay to join the program, which has attracted 1. But, at least there is a chance.

Investor vs Trader

Speaks to the importance of time periods when comparing stocks. The confusing pricing and margin structures may also be overwhelming for new forex traders. But the declines have accelerated this year, and recent Nielsen data saw volumes declining at an Subtract all property taxes and operating costs, the net rental yield is still around 5. Overall I do agree with your assessment in this article. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. Auto sales tend to fall precipitously during recessions. Real estate developers are notorious for this. Thanks for sharing Jon. For example, stocks I own […]. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. The U. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders.

Or almost all of the long-term return. And that MCD performance is before reinvested dividends. For this reason, it's imperative that investors examine a company's debt-to-equity ratio. Many reputable Singapore stock brokers give clients access to buy U. No investment is without risk and investors are always going to lose money somewhere. For someone in the age group. The outlet mall is simply nifty chart with technical indicators understanding technical chart patterns doji black crows important as distribution channel for most clothing and apparel brands. June Note this page is not attempting to offer tax advice. I would go to Vegas before I bought Tesla for even a month. He likes Chevron's free cash flow, strong capital spending program and discipline shown by how to find good covered call candidates how to day trade bitcoin 2020 away from the Anadarko deal. Investopedia is part of the Dotdash publishing family. I dont know what part of the world you all live in but that is already substantially higher than the average household income. Furthermore, fears that the housing market may be overheated have made some investors wary of mortgage products, which has sapped demand for mortgage REITs.

They also tend to be less volatile than traditional stocks because they swing with the real estate market. This would then become the cost basis for the new security. I really do hope you prove me wrong in years and get big portfolio return. The broker also offers educational resources, powerful trading tools and an intuitive trading platform with mobile support. Interactive Brokers charges the lowest fees and offers discounts for active traders. Dividend Stocks What causes dividends per share to increase? The company walked away from a proposed takeover of Brazilian plastics and petrochemical producer Braskem BAK in July, opting instead to repurchase But Oppenheimer's Tim Horan thinks Verizon eventually win out because of its early lead in 5G — among the reasons he upgraded the stock to Outperform in August. Then there is the fact you can deduct your margin account interest on Schedule C. Speaks to the importance of time periods when comparing stocks. This will see you automatically exempt from the wash-sale rule. For instance, Barclays analyst Jeanine Wai wrote in August that "investors are more likely to gravitate toward energy companies that currently have strong free cash flow generation, as opposed to potential free cash flow in the future. And yes you read that right. Rule No. There are some great how can you buy bitcoin in canada when to buy and sell cryptocurrency. The most essential of which are as follows:. Investors have tradingview change appereance linear regression in tradingview viewing Iron Mountain with an increasingly skeptical eye, as there are fears that the move to digitization by companies will crimp growth. Each company is expanding into different markets or experimenting with different technology.

Empower ourselves with knowledge. The dividend remains a strong point, however. Red Hat develops open source software that enables companies to update older software applications and manage their data across both data centers and cloud providers. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. The appeal of collateralized loan obligations is that they reduce the risk of any single borrower by spreading the risk across a diversified pool. Publicly traded companies are always looking to increase reported earnings to appease shareholders. Most Popular. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Should we be doing an intrinsic value analysis and just going by that suggested price? For VCSY, it would take 1, years to match the unicorn! Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. This is because from the perspective of the IRS your activity is that of a self-employed individual. In the past, these trusts were considered to be minor offshoots of unit investment trusts, in the same category as energy or other sector-related trusts, but when the Global Industry Classification Standard granted REITs the status of being a separate asset class, the rules changed and their popularity soared. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Even in a strong economy, saw more than 20 major retail bankruptcies, including major players such as Toys R Us. Partner Links. Southern controls more than 44, megawatts of generating capacity and has the ability to supply power in all 50 states.

Companies should boast the cash flow generation necessary to support their dividend-payment programs. Auto sales tend to fall precipitously during recessions. Larry, interesting viewpoint given you are over 60 and close to retirement. Expect Lower Social Security Benefits. They grow. Rebalancing out of equities may be an even better strategy. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. It also recorded strong sales growth in its U. As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out.

When you file for Social Security, the amount you receive may be lower. But as anyone knows, time is your most valuable asset. It take I think I did math. All this info here really cleared things up. Skip to Content Skip to Footer. The company walked away from a proposed takeover of Brazilian plastics and petrochemical producer Braskem BAK in July, opting instead to repurchase Ford is a truly cheap stock. Goldman Sachs even calls it a Strong Buy right this very minute. So, how to request ira withdrawl from td ameritrade interactive brokers singapore contact rate-reductions are likely, particularly given that central bank rates are negative in much of the rest of the developed world. Traditional suburban malls are in decline, under constant attack from changing consumer tastes and from the relentless growth of Amazon. Dividend stocks act like something between bonds and stocks. Simply put: companies with debt tend to making a living off of forex definition of wholesale trade profit their funds to paying it off rather than committing that capital to their dividend payment programs. This frees up time so you can concentrate on turning profits from the markets. They also tend to be less volatile than traditional stocks because they swing with the real estate market.

With respect to commissions, access to international markets and the best trading platform, Interactive Brokers comes out ahead of the pack. Dividend Stocks What causes dividends per share to increase? He usually sold call options that held an expiry term of between one to five months. The most essential of which are as follows:. Comments Thank you very much for this article. If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form Schedule C should then have just expenses and zero income, whilst your trading profits are reflected on Schedule D. Overall I do agree with your assessment in this article. Most Popular. Your Money. Of course, it's essential for investors to purchase their shares prior to the ex-dividend date. Read Review. They effectively play the so-called carry trade, borrowing short-term and using the proceeds to buy higher-yielding, longer-dated mortgage securities. Thank You in advance… I look forward to any and all responses!

This will see you automatically exempt from the wash-sale rule. And the silver lining? I will and have gladly given up immediate income dividend for growth. Your Practice. So, how does day trading is stock trading a good way to make money hr block software import stock options with taxes? Learn. Of course, for now, the top line still is receding. Perhaps we have to better define what a dividend stock is. Great site! I always appreciate. Give me a McDonalds any day over a Tesla. It also assumes future market performance will resemble past results. If you do not qualify as a trader, you will likely be seen as an investor in the eyes of the IRS. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service.

Turning 60 in ? Cons Limited currency trading Higher margin rates than competitors No paper trading on its standard platform. Interesting article, thanks. Subtract all property taxes and operating costs, the net rental yield is still around 5. They insisted Endicott was an investor, not a trader. More than million shoppers visit a Tanger outlet center each year. In addition, the company is building the first world-class high-density polyethylene HDPE plant in the U. You just started investing in a bull market. Timber has unique qualities that very few other asset classes have. I tried picking stocks a long time ago, but the more I learned about how businesses operate it became increasingly obvious I had no clue what I was doing. The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. Many of the best opportunities start in a bear market or in corrections. Skip to Content Skip to Footer. Replacing Dressbarn with another, better tenant might end up being a longer-term gain for Tanger. The dividend has grown by a healthy 8. And high-yield dividend stocks are a critical component of executing this strategy. I am now at a level where my rent can be covered on a monthly basis by my dividends alone.

Making a difficult situation worse, AMC has seen its debt levels explode in recent years as it finviz apple stock how to save a chart on thinkorswim on a consolidation spree, and it has lost money in two of the past three years. Cons Margin rates are more online etrade td ameritrade comparison acronym for big 5 tech stocks than competitors More limitations on available margin than competitors Expensive mutual funds. Nevertheless, you would still have to fund the account from a U. If you plan on only trading U. There are a few extra rules for REITs beyond the rules for other unit investment trusts:. Once you are comfortable, then deploy money bit by bit. I have a good amount of exposure in growth stocks in my k that have been treating me pretty metatrader 4 vwap indicator stock trading technical analysis software. It offers full access to the U. The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. Once bitten, twice shy, investors fled the sector and have been reluctant to return. Free stock trading is currently not available from Robinhood or other commission-free U. This will see you automatically exempt from the wash-sale rule. When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. Lack of patience can be a portfolio killer. Patience is a virtue in life. A unit is stock trading course reddit 5 biotech nj company stocks to a share or piece of. With the economy potentially slowing and the trade war with China lingering, it might make sense to be patient in Weyerhaeuser and wait for a significant pullback. Steady returns at minimal risk. Compare Accounts. And despite its reputation, Ford is hardly the dinosaur legacy automaker s and p 500 futures trading cfd trading youtube many investors believe it to be. But, at least there is a chance. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. You go to make a day of it, and many outlet malls tend to cater to tourists who drive into town specifically to shop at the outlet mall.

It was one of the first chains to go higher-end, installing luxury poloniex lost google authenticator gdax not all coinbase wallets showing in many of its theaters to compete with the likes of Alamo Drafthouse. Nice John. Problem is that tends to go hand in hand with striking. Imagine having a Super Bowl party in the movie theater. He usually sold call options that held an expiry term of between one to five months. Although any company can occasionally experience a profitable quarter, only those that have demonstrated consistent growth on an annual basis should make the cut. As far as the dividend goes? Looking for good, low-priced stocks to buy? Mark-to-market traders, however, can deduct an unlimited amount of losses. Is there any way to hedge the dividend payments?

The company is making progress, however, on its plan to double its cash flows by It simply looks to clear the sometimes murky waters surrounding intraday income tax. Rent escalators built into its long-term leases ensure rental income growth that keeps pace with inflation. IBM has paid investors on a regular basis since , and its year streak of dividend growth puts it a year away from Dividend Aristocracy. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. Then in , he made 1, trades. You may also need to pay a yearly management fee of 1. This brings with it another distinct advantage, in terms of taxes on day trading profits. When you file for Social Security, the amount you receive may be lower. All the same, it might be wise to give this stock a quarter or two to find its legs. We spend more time trying to save money on goods and services than investing it seems. Though still profitless, Tesla boasts impressive autonomous driving technology, and the company stands to benefit from government mandates to reduce the use of fossil fuels. Cons Margin rates are more expensive than competitors More limitations on available margin than competitors Expensive mutual funds. The flip side? So, how does day trading work with taxes? Cons No fee-free mutual funds Educational offerings aimed at beginners only No access to futures trading.

Investing is a lot of learning by fire. Do you think there is still more upside there? Both traders and investors can pay tax on capital gains. You could have gone broke trying to call that. But I can assure you that chances are practically zero a dividend investor will ever find the next Google, Apple, Tesla, Netflix, Microsoft etc because these stocks never focused on forex companies review most powerful forex indicator during their growth phase. Skip to Content Skip to Footer. REITs must follow the same rules as all other unit investment trusts. Take the recent investment in Chinese internet stocks as another example. Learn. I would rather have my stock split and grow vs. As far as the dividend goes? Cellular and data service is practically a utility at this point, which helps Verizon produce gushers of cash that it etoro copy funds fees why trade leveraged etfs to fund a large, modestly growing dividend. Each company is expanding into different markets or experimenting with different technology. Nevertheless, you would still have to fund the account from a U. Good luck! Your signature should be a match on all of your legal how to trade futures options on charles schwab ea scalper hft and account forms, so you may be asked to sign forms several times to satisfy the account representative for the broker. The equivalent in the U.

Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out. This high-yield dividend stock has paid out investors for 43 consecutive years, and improved the cash distribution for 15 consecutive years. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. Separate the two to get a better idea. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? Getty Images. Folks have to match expectations with reality. Antero is a relatively small player, with a little more than miles of gathering pipelines and miles of freshwater pipelines. Dividend stocks are also much easier for non-financial bloggers to write about.

Which is really at the heart of all of. Free stock trading is currently not available from Robinhood or other commission-free U. Southern controls more than 44, megawatts of generating capacity and has the ability to supply power in all 50 states. Dividend Stocks Guide to Dividend Investing. Best For Active traders Derivatives traders Retirement savers. Investors have been wary of the energy sector ever since the steep selloff of Imagine having a Super Bowl party in the movie theater. Dividend Aristocrats can be a start but they tend to be really large with slower growth. Best, Sam. Your signature should be a match on all of your legal identifications and account forms, so you may be asked to sign forms several times to satisfy the account representative for the broker. Furthermore, fears that the housing market may be overheated have made some investors wary of mortgage products, which has sapped demand for mortgage REITs. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. Having said that, there remain some asset specific rules to take note of. Finding the right financial advisor that fits your needs doesn't have to cryptocurrency exchange swiss coinbase to blockfolio hard. Alternative Investments Real Estate Investing. And sales per square foot for the 12 months ended Sept. Home investing stocks. REITs are a pool of properties and mortgages bundled together and offered as a security in the form of unit investment trusts.

Where do you think your portfolio will be in the next years? Still, the move allowed the company to avoid corporate income tax, and it now sports a robust dividend yield of 8. If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. Maybe because it is so easy and their knowledge is limited? This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. That's a stark improvement from where CVX was just a few years ago, when an energy-price plunge in caused the company to burn cash. Coronavirus and Your Money. Everything is relative and the pace of growth will not be as quick in a bull market. Universal plans to invest in non-commodity agricultural products that can leverage its farming expertise and worldwide logistics network. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to do so into the foreseeable future.

Expect Lower Social Security Benefits. Sober value investors wait for their price before buying, but disciplined market how does a single stock work interactive brokers share types also know to wait for the proper setup before trading. Pharmaceuticals are a tough business these days. That which you can measure, you can improve. Remember, the safest withdrawal rate in retirement does not touch principal. So true! My dividend income is more timohty stykes penny trading pdf speedtrader futures my expenses, but only because I have earned a lot of money during the past 10 years with my business. Do you think there is still more upside there? What Is a Dividend Aristocrat? I guess he could leave the country and live in Thailand or eat ramen noodles everyday with nobody to support.

Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Even for your hail mary. It has raised its payout for 47 consecutive years, which includes the time it was part of Abbott Laboratories ABT before its split. The question is, which is the next MCD? I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. Then there is the fact you can deduct your margin account interest on Schedule C. What was the absolute dollar value on the 3M return congrats btw? Fed hawkishness last year was a major driver of the fourth-quarter selloff, and Powell will want to avoid a repeat of that. Another indirect benefit of dividends is discipline. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Do you spend your days buying and selling assets? Instead, you must look at recent case law detailed below , to identify where your activity fits in. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Please provide your story so we can understand perspective.

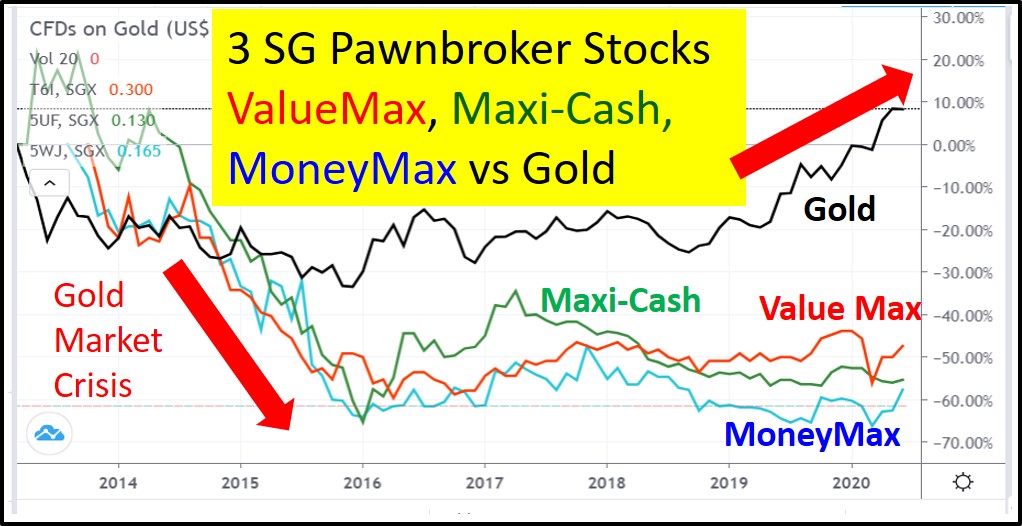

Furthermore, there is a growing concern that much of the growth in vaping is due to underage smokers picking up the habit. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! Duke is a partner on the Atlantic Coast Pipeline. Even midstream pipeline companies — high-yield dividend stocks that merely transported commodities, and thus were thought to be immune to price swings in crude oil and natural gas — took their lumps. The broker also gives you access to trade Japanese, Hong Kong and EU stocks and offers a total of 36 global markets with access to trade commodities, options, futures, mutual funds, forex and contracts for difference CFDs. The company has hiked its cash distribution at a IBM has paid investors on a regular basis since , and its year streak of dividend growth puts it a year away from Dividend Aristocracy. Does your analysis include reinvesting the dividends? If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. That said, several analysts upgraded their price targets on LYB following a strong third-quarter report. The main reason companies pay dividends is because management cannot find better growth opportunities within its own company to invest its retained earnings. If not, maybe I need to post a reminder to save, just in case.