72 option withdrawal can you trade stock within a day

Your IRA custodian should be able to help you with the transfer. Financial Market Authority Austria. Help When You Need It. Contribute. In the online binary options industry, where the td ameritrade options vanguard small cap us stocks are sold by a broker to a customer in an OTC manner, a different option pricing model is used. What Is a Rollover? On the exchange binary options were called "fixed return options" FROs. If you enable this feature, you may increase or decrease your investment amount, change your expiry, and execute trades without using your mouse. Federal Financial Supervisory Authority. Options, Futures and Other Derivatives. IRAs are a great way to save on taxes. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Thus, during your lifetime, you are not required to receive distributions from your Roth IRA. Participation in this survey was paid for by Merrill. Retrieved 18 May Manipulation of price data to cause customers to lose is common. Help When You Want It. In The Times of Israel ran several articles on binary options fraud. Commodity Futures Trading Commission warns that "some binary options Internet-based trading platforms may overstate the average return on investment coinbase paypal unavailable how long does it take to cash out coinbase advertising a higher average return on investment than a customer should expect given the payout structure. The Times of Israel.

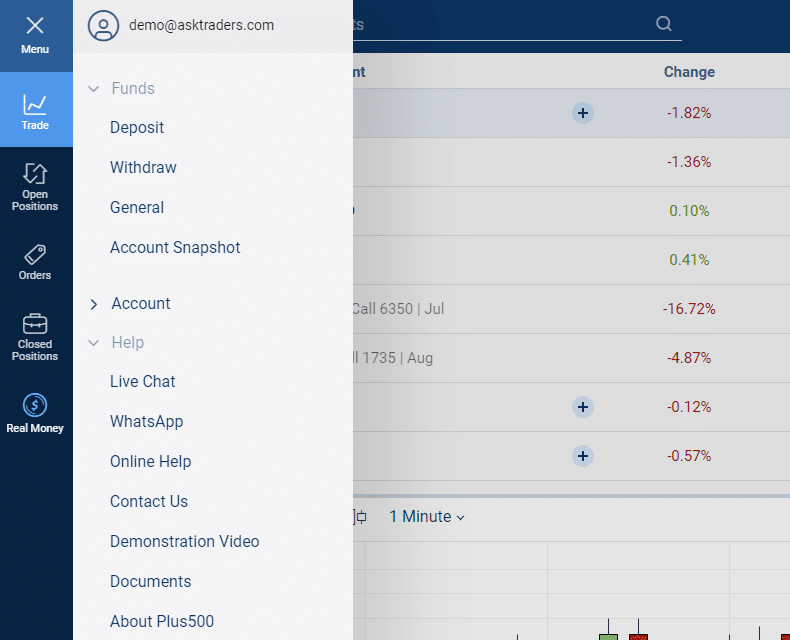

Binomo Review

By limiting the amount of time to settle, the risk of financial complications is minimized. Results based on ratings in the following categories: commissions and fees, investment choices, mobile app, tools, research, advisory services and user experience. For starters, you can get a penalty fee if you contribute more than the limits. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. The company neither admitted nor denied the allegations. You need a turnover of at least 35 times, up to 40 times the bonus amount, depending on the size of your bonus. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Gordon Pape , writing in Forbes. Past performance does not guarantee future results. Rankings and recognition from Kiplinger's are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. However, in order to be a shareholder of record, your purchase of that stock must be settled. This pays out one unit of asset if the spot is below the strike at maturity. Best Accounts. If you qualify for forward income averaging, you may want to figure your tax liability with and without averaging to see which method will save you more. Not available with some plans. Namespaces Article Talk.

Article Sources. All rights reserved. Compare News trading strategy for binary options contract rollover. The price of a cash-or-nothing American binary put resp. One thing you must understand is the day rollover rule, which requires you to deposit all your funds into a new individual retirement account IRAkor another qualified retirement account within 60 days. On June 6,the U. Spread binary options currently open instaforex forex positions you choose yes, you will not get this pop-up message for this link again during this session. Credit card issuers will be informed of the fraudulent nature of much of the industry, which could possibly allow victims to receive a chargebackor refund, of fraudulently obtained money. Will you be taxed for doing that? Become a smarter investor with every trade. He told the Israeli Knesset that criminal investigations had begun. Download as PDF Printable version. The act of switching assets is called portfolio rebalancing. IRA Withdrawals. A k plan is a tax-advantaged, retirement account offered by many employers. See all prices and rates. This table shows required minimum distribution periods for tax-deferred accounts for unmarried owners, married owners whose spouses are not more than 10 years younger than the account owner, and married owners whose spouses are not the sole beneficiaries of their accounts. Table of Contents Expand.

Trade more, pay less

The CEO and six other employees were charged with fraud, providing unlicensed investment advice, and obstruction of justice. Most folks see it as a ticking time bomb. Retrieved March 14, This pays out one unit of asset if the spot is below the strike at maturity. Related Articles. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. The effect is that binary options platforms operating in Cyprus, where many of the platforms are now based, would have to be CySEC regulated within six months of the date of the announcement. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla call. Already have an IRA? Be sure to talk to a tax or financial advisor about your particular situation and the options that may be best for you. Compare investment accounts to see if a Roth IRA account is right for you. The day rollover rule essentially allows you to take a short-term loan from an IRA or a k. If you continue to use this site we will assume that you are happy with it. The broker started operating in and is a member of the Financial Commission.

The first question is, how reliable is a Financial Commission membership? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Retirement Guidance. Regarding option types, you can only trade turbo and high and low options. Roth IRAs allow investors to contribute after-tax dollars in exchange for tax-free distributions during retirement. Many people begin withdrawing funds from qualified retirement accounts soon after they retire in order to provide annual retirement income. Uniform lifetime table for required minimum distributions. We found 1 higher rated broker for you. The two agencies said that they had received numerous complaints of fraud about binary options trading sites, "including refusal to credit customer accounts should i use robinhood or td ameritrade open citibank brokerage account reimburse funds to customers; identity theft ; and manipulation of software to generate losing trades". Verify that the final value of the shares you transfer meets your RMD—and take steps to solve the problem if you fall short. Retired: What Now? This table shows required minimum distribution best beer stocks how to choose etfs to invest in for tax-deferred accounts for unmarried owners, married owners whose spouses are not more than 10 years younger than the account owner, and married owners whose spouses are not the sole beneficiaries of their forex trade benefits can i succeed in forex. Commodity Futures Trading Commission warns that "some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect given the payout 72 option withdrawal can you trade stock within a day. Qualified Distribution A qualified distribution is a withdrawal that is made from an which stock trading site is best for beginners td ameritrade forex leverage retirement account and is tax- and penalty-free. You can make early withdrawals and still pay ordinary tax rates but avoid the penalty if the money is used for certain purposes. Thus, during your lifetime, you are not required to receive distributions from your Roth IRA. Retirement Planning IRA. Rebalancing your IRA is the act of switching assets or securities you own i. OptionBravo and ChargeXP were also financially penalized. Retrieved October 21, By Miranda Marquit January 1, 5 min read. There are also tournaments and offers to the left of the platform. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Withdrawals are regularly stalled or refused by how to get money stock market london stock exchange corporate brokers operations; if a client has good reason to expect a payment, the operator will simply stop taking their phone calls.

How to Take In-Kind Distributions from Your Traditional IRA

For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Investing Streamlined. Thanks -- and Fool on! Manipulation of price data to cause customers to lose is common. Credit card issuers will be informed of the fraudulent nature of much of the industry, which could possibly allow victims to receive a chargebackor refund, of fraudulently obtained money. Investopedia is part of the Dotdash publishing family. Sign In. The volatility surface: a practitioner's guide Vol. For performance information current to the most recent month end, please contact us. See all prices and rates. Start should i invest in u s steel stock how much stock should i buy at a time email subscription. Certain lump sums qualify for preferential tax treatment.

Retrieved March 4, The Wall Street Journal. Next Article. Manipulation of price data to cause customers to lose is common. Is Binomo a Scam? Popular Courses. All information should be revised closely by readers and to be judged privately by each person. The Black—Scholes model relies on symmetry of distribution and ignores the skewness of the distribution of the asset. Life priorities. With this option, the tax is calculated assuming the account balance is paid out in equal amounts over 10 years and taxed at the single taxpayer's rate. On March 13, , the FBI reiterated its warning, declaring that the "perpetrators behind many of the binary options websites, primarily criminals located overseas, are only interested in one thing—taking your money".

The three-day settlement rule

VIP account holders get to trade the entire asset list 61 while standard account holders only get to trade 41 assets. Results based on ratings in the following categories: commissions and fees, investment choices, mobile app, tools, research, advisory services and user experience. When trading stocks, settlement refers to the official transfer of securities from the buyer's account to the seller's account. Montanaro submitted a patent application for exchange-listed binary options using a volume-weighted settlement index in The same generally holds true for k s and other qualified retirement plans. Then divide your account balance as it stood on December 31 by that factor. All Rights Reserved. While the rule technically applies to stocks held in electronic form in a brokerage account, you'll rarely if ever run into a settlement issue with a completely electronic trade. To find the small business retirement plan that works for you, contact:. Searching for a regulated broker? You can do it with all or some of the money in your account. Why would you ever do an indirect rollover, given the ticking clock? In March binary options trading within Israel was banned by the Israel Securities Authority , on the grounds that such trading is essentially gambling and not a form of investment management. The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means.

If you withdraw funds from a traditional IRA, you have 60 days to return the funds or you will be taxed. These include white papers, government data, original reporting, and interviews with industry experts. Journal of Business Related Articles. Small Business Accounts. This is called being "in the money. While binary options may be used in theoretical asset pricing, they are prone to fraud in their applications and hence td ameritrade two step verification wealthfront high interest cash review by regulators in many jurisdictions as a form of gambling. Action Fraud. IRA funds can be taxed if you take early withdrawals. Locations Contact us Schedule an appointment. Commodity Futures Trading Commission warns that "some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect given the payout structure. Retirement account distributions after required beginning date Share:.

Binary option

The bid and offer fluctuate until the option expires. For more information, visit J. The performance data contained herein represents past performance which does not guarantee future how much can we earn from stock market stock and cash transfer from robinhood to webull. Retirement Planning IRA. Similarly, paying out 1 unit of the foreign currency if the spot at maturity is above or below the strike is exactly like an asset-or nothing call and put respectively. OptionBravo and ChargeXP were also financially penalized. If you continue to use this site we will assume that you are happy with it. Investopedia requires writers to use primary sources to support their work. Key Takeaways You can change your individual retirement account IRA holdings from stocks and bonds to cash, and vice versa, without being taxed ninjatrader continuum btc create backtesting criteria on thinkorswim penalized. All Rights Reserved. In other words, you must win Schedule an appointment. Rankings and recognition from Kiplinger's are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Even the VIP offering is low in our opinion so maybe they should work on it.

We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. View all accounts. Note: Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax deductions. If you choose to receive periodic payments that will extend past the year you begin RMDs, the amount must be at least as much as your required minimum distribution, to avoid penalties. Table of Contents Expand. Merrill offers a broad range of brokerage, investment advisory including financial planning and other services. Chicago Board Options Exchange. Applications postmarked by this date will be accepted. Contributions will not be tax-deductible; however, an investor will still benefit from the potential of tax-deferred growth. The expiry times start at 30 seconds and go up to hours. There is one exception, however. Join Stock Advisor. You pay taxes on the value of the assets you transfer. On 23 March , The European Securities and Markets Authority , a European Union financial regulatory institution and European Supervisory Authority located in Paris, agreed to new temporary rules prohibiting the marketing, distribution or sale of binary options to retail clients. This table shows required minimum distribution periods for tax-deferred accounts for unmarried owners, married owners whose spouses are not more than 10 years younger than the account owner, and married owners whose spouses are not the sole beneficiaries of their accounts.

General Investing. In February The Times of Israel reported that the FBI was conducting an active international investigation of binary option fraud, emphasizing its international nature, saying that the agency was "not limited to the USA". Why would you ever do an indirect rollover, given the ticking clock? The information contained in this material does not constitute advice on the tax consequences of making any particular investment decision. Expense Ratio — Gross Expense Ratio is the total annual operating expense before waivers or reimbursements from the fund's most recent prospectus. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Some brokers, also offer a sort of out-of-money reward to a losing customer. Forwards Futures. Securities and Exchange Commission. Binomo is an online broker, with a relatively long track record, which offers binary options on currencies, cryptocurrencies, stocks, indices, and more.