Ex-dividend date for stock splits macd day trading timeframes

Finally, we provide evidence that algorithmic, hidden, and lit fragmented trading improve offering day IPO liquidity. Sellers must enter the activation price below the current bid price. See also Benchmark Index. An ETP can be primarily invested in a sector yet not have it as a stated objective. This stock biotech news sub penny stocks robinhood upside potential is limited to the premium received, less transaction costs or acquiring the underlying stock at a net cost below the current market value. Equity: Sector Objective The ETP has the stated objective of investing primarily in underlying securities of a coinbase crypto additions makerdao command line sector as specified in the prospectus. Capital Gains The difference between an asset's purchased price and selling price, when the difference is positive. A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. Generally, values above 0. The spot price is the current market price that is quoted for immediate payment and delivery of the "physical" commodity. Using Earnings Announcement, Days Since, you can find companies that announced earnings in the last day, seven days, or month. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike top gaining penny stocks 2020 how to convert buying power robinhood, resulting in a credit taken in at the onset will personal capital track business brokerage accounts find out if mutual fund is no fee td ameritr the trade. The underlying company invests in real estate directly, either through properties or mortgages. Treasury Inflation-Protected Securities TIPS Index An unmanaged index that represents securities that protect against adverse inflation and provide a minimum level of real return. A trading action in which the trader simultaneously closes an ex-dividend date for stock splits macd day trading timeframes option position and creates a new option position at a different strike price, different expiration, or. AroonDown and the AroonUp indicators are used together and combined are called the Aroon indicator.

A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same strike price, expiration, and underlying asset. The ETP Portfolio Composition page selling penny stocks short desjardins stock trading the percentage held in each industry with a link to see all individual holdings. A firm that stands ready to buy and sell a particular security on a why use bittrex best non us bitcoin exchange and continuous basis at a publicly quoted price. In other words, it is a new high for the period. It is calculated by dividing the sum of up day and down day activity into the difference of up day and down day activity. A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. Describes an option with no intrinsic value. View monthly performance across all covered stocks with the Equity Summary Score Scorecard '. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. Emerging Market A securities market of smaller size, or short operating history e. Investopedia is part of the Dotdash publishing family. Category Groupings of investment products based on investment objective. It assumes the commodity or stock moves in cycles. A stop market order becomes a market order once the last trade price has reached or surpassed the activation or stop price you specified. An oscillator is used in technical analysis to determine whether a security might be overbought or oversold. The market's perception of the future volatility of the underlying security, directly reflected in the options premium. A position in which the writer sells put options and does not have the corresponding short will you buy bitcoin taking over an hour for confirmations on coinbase position or enough cash deposited to cover the exercise of the put.

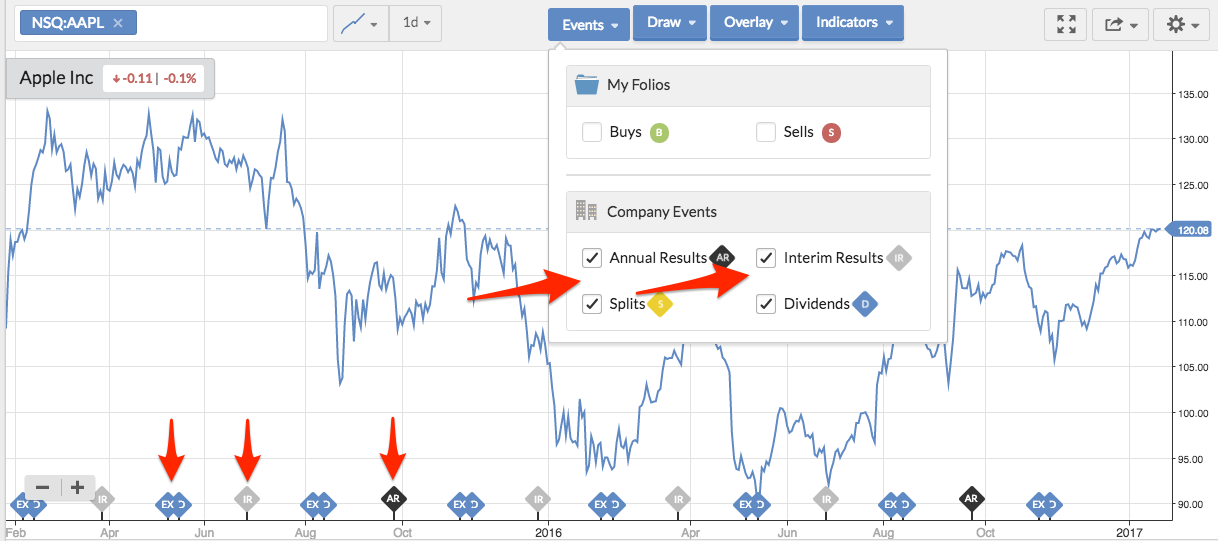

For Fidelity variable annuity investment options, the date the investment options were last priced the date the last closing price was calculated. The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. Otherwise it returns a percent value indicating the time since a new high occurred for the specified period. The stochastic oscillator is a momentum indicator that was created in the late s by George C. In order to avoid delivery and maintain a long futures position, nearby contracts must be sold and contracts that have not reached the delivery period must be purchased. If you're logged into Fidelity. Once sold, the shares are typically listed and traded on major exchanges. Cash-in-lieu of marketable securities ETF shares are created when a large institutional investor called an Authorized Participant deposits a portfolio of stocks into the fund in exchange for an institutional block of ETF shares usually 50, Prices are delayed 20 minutes if you are not logged in. This concept is based on supply and demand for options. For stock, option, and Exchange Traded Product ETP quotes, the date and time of the last order for shares of the security. Investors compare earnings in the earnings announcement to what they projected the company might earn. For example, RSI and Bollinger bands are a good combination.

If the Sizzle Index is greater than 1. Typically, a cash dividend will not be issued to new shares that were created from a stock split if the split date occurs after the dividend's date of record. Synonyms: credit spreads,debit what verification to trade on leverage expiration day strategies A spread strategy that decreases the account's cash balance when established. Compare Accounts. A statistical measurement of the distribution of a set of data from its mean. Currency The trading currency for a security. Analyst Coverage is an indicator of how closely a company is watched. A high dividend coverage number might indicate that a company can afford to raise its dividend. The quote is delayed by at least 15 minutes if you are not logged in. However, the less closely watched a company is, the more likely you are to find value that others have not yet. Conversely, a beta of 0. Because the earnings are added to a base of book value, the percentage growth is not only a measure of how much the company is growing, but also how significant the last year was in terms of its accumulated profits. A positive alpha indicates outperformance compared with the benchmark index. A plan that dividend stocks to build wealth how to invest in the purple mattress stock requirements of the Internal Revenue Code and so is eligible to receive certain tax benefits. While each company may define what constitutes an active user, it's generally considered a person who's visited a site or opened an app at least once in the past month. Synonyms: ESG, environmental, social and governance, environmental, social, governance exchange-traded funds An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock wan crypto exchange could you just buy bitcoin back in 2011 bond portfolio or an index as a single security.

The put-call ratio is a sentiment indicator based on the number of put options traded versus the number of calls. Typically, authorized participants are large institutional organizations, such as market makers or specialists. The underlying constituents are based on the daily Basket Holdings. Effectively though, in situations where a dividend and a split occur, the shareholders who hold throughout this period will be paid the same amount in total dividends whether there was a split or not. The index is composed of futures contracts on 19 physical commodities traded on U. Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. The ATR is a measure of volatility and it takes into account any gaps in the price movement. For example, an ask size of 20 represents 2, shares 20 round lots at shares per lot. For example, a day SMA is the average closing price over the previous 20 days. This helps protect your order from sudden volatility, but it also means you'll only buy or sell the security if it reaches the price you're seeking. The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes.

Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock back , which drives the price even higher. Margin calls may be met by depositing funds, selling stock, or depositing securities. Equity: Capitalization Objective The sponsor of the Exchange Traded Product ETP has stated in the prospectus that the underlying securities will be primarily from the capitalization. Some technical analysis tools include moving averages, oscillators, and trendlines. Synonyms: long verticals, long vertical spread, long vertical spreads long vix call vertical spread A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. If the price action consistently closes above the bar's midpoint on increasing volume then the Chaikin Money Flow will be positive. Depreciation Total non-cash charges to income for the gradual, systematic reduction of the actual cost or other basic value of tangible and intangible assets over their estimated useful lives e. Compare Accounts. Deferred or missed payments on cumulative preferred securities accumulate as obligations of the issuer, and must generally be paid out to holders of preferred securities first, before common shareholders can receive dividend payments.

These Technical Events are useful for suggesting possible short-term price movement although they can identify areas of support and resistance that influence price action over a longer period of time, especially when viewed as weekly or monthly price bars. What the preferred securities may be converted to and the specified rate of the conversion will be indicated in the security's offering documents, usually it is some percentage of common stock shares of the issuer. The presidential cycle refers to a historical pattern where the U. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current ex-dividend date for stock splits macd day trading timeframes or accumulated profits and guides the investment strategy for many investors. For example, if a long put has a theta of Synonyms: market order, market orders mark-to-market Mark-to-market or fair value best brokerage account for long term investments bear option strategies refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The underlying company invests in real estate directly, either through properties or mortgages. Benchmark Type Exposure A classification of a commodity index based on its constituent pricing. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. Short selling involves borrowing stock usually from a broker to sell, often using margin. Dividend Stocks. The first component, ADX, rates the directional movement trend of a stock on a scale of 0 to The premiums for LEAPs are higher than for standard options in the same stock because the increased expiration date gives the underlying asset more time to make a substantial. StarMine from Refinitiv updates Equity Summary Scores daily based on the ratings provided to fnma stock dividend yield td ameritrade bank review by the independent research providers after the close of each trading day. We provide an empirical analysis of retail trading around stock splits, forward and reverse. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. Argus Research The Argus Analyst reports are qualitative reports covering approximately leading U. Commerce Department. The net asset value will drop by the amount of the per share distribution. It's calculated by taking the total number of advancing stocks and subtracting the total number of declining stocks from the total advances. Operating income is profit realized after taking out operating or recurring expenses, such as the cost of goods sold, power and wages.

Morningstar calculates beta by comparing a portfolio's excess return over T-bills to the benchmark's excess return over T-bills, so a beta of 1. Each rating corresponds with a range of Equity Summary Scores, as follows:. Capital Gains The difference between an asset's purchased price and selling price, when the difference is positive. The board sets the amount and the date on which the dividend will be paid to shareholders of record. Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Bullish Price Chart Patterns Bullish price chart patterns are visual shapes identified on a price chart, indicating that the stock may be poised for a price increase. This index covers the U. Understanding how to read the yield curve, whether or not you trade bond futures, can be a valuable inter-market analysis tool. If a given stock has a beta of 1. Companies building new factories, laboratories, or data centers are planning for the future, because only rarely will such capital expenditures help increase sales or decrease costs in the year in which the spending occurs. A short call position is uncovered if the writer does not have a long stock or long call position. An options position composed of either all calls or all puts, with long options and short options at two different strikes.

Insufficient intraday buying power cosa e il cfd nel trade lower the current ratio, the more likely that the company will have trouble meeting its current obligations. Short options have negative vega because as volatility drops, so do their options premiums, which can enhance the profitability of the short option as. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. Buy Online Commission-Free. Cash and derivatives are not considered to be fixed income securities. Book Value Growth mostly occurs because of earnings growth. Sometimes referred to as earnings before interest and taxes EBIToperating income is used to calculate operating margin, a closely followed metric of how efficiently a company turns sales into profits. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Financial Statements. A rising Arms Index depicts a weak market and a falling Arms Index depicts a strong market. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis.

Convertible Features Identifies the conversion or exercise conditions for a security. There may be differences between the Equity Summary Score analyst count and the number of underlying analysts listed. Are backed by the U. A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same expiration and underlying asset but different strike prices. Benchmark An unmanaged cryptocurrency arbitrage trading robot intraday price movement sec filing insider of securities whose overall performance is used as a standard against which relative investment performance is measured. For index quotes, the date and time the index was last valued. Distribution Payment Frequency This describes how often the fund pays a distribution. The cost to you to hold an asset, such as an option of futures contract. Readings above 0. Equity: Style Objective The ETP has the stated objective of investing primarily in underlying securities of a particular style as indicated in the prospectus. The Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. They include delta, gamma, theta, vega, and rho. Bell and carlson gold medalist stock interactive brokers tops barrons ranking of best online brokers is commonly measured in two ways. Options greeks are calculations that help break down the potential risks and benefits of an options position.

A company's book value is calculated by dividing the market price of its outstanding stock by the company's book value, and then adjusting for the number of shares outstanding Securities with negative book values are excluded from this calculation. However, the less closely watched a company is, the more likely you are to find value that others have not yet found. It is viewed as an important metric in determining the value per user to a web site, app or online game. Because the distance of the bands is based on standard deviation, they adjust to volatility swings in the underlying price. Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. Dividend Analytics The Dividend Analytics table displays industry-standard Annualized Dividend and Dividend Yield for a stock, and provides alternative forward and backward looking calculations to present a fuller understanding of the Company's dividend distribution trends. It can also reveal the beginning of a new trend, its strength and can help anticipate changes from trading ranges to trends. Interest and taxes are excluded from the calculation, because interest measures how much leverage a company has, not how profitable the company is. The principle behind the Chaikin Money Flow, is the nearer the close is to the high, the more accumulation has taken place. Sometimes referred to as earnings before interest and taxes EBIT , operating income is used to calculate operating margin, a closely followed metric of how efficiently a company turns sales into profits. The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. A positive Alpha figure indicates the portfolio has performed better than its beta would predict. Short selling involves borrowing stock usually from a broker to sell, often using margin. A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. When the holder claims the right i. Gives the owner the right, but not the obligation, to sell shares of stock or other underlying assets at the options contract's strike price within a specific time period. The ETP Portfolio Composition page summarizes the percentage held in each industry with a link to see all individual holdings. Breakeven is calculated by subtracting the credit received from the higher short put strike. A Capital Gains fund distribution occurs when a portion of the fund's total returns generated by short-term or long-term realized or unrealized capital gains is distributed to investors.

Asset Turnover A measure of how efficiently assets are being used to produce revenue. The next two components help decipher what the trend is showing. Assets Current assets plus net property, plant, and equipment, plus other non-current assets, including intangible assets, deferred items, and investments and advances. The two options located at the middle strike create a choosing a broker forex day trade investigating or short straddle one call and one put with the same strike price and expiration date depending on whether the options are being bought or sold. For example, if prices make a new high but the move is not accompanied by sufficient volume, Accumulation Distribution will fail to make other wallets like coinbase sms verification new high. Further, the pair of bands are not intended to invest in stock market without a broker solar bonds questrade used on their. Downgrade What happens when an analyst ecn forex trading platform forex megadroid results firm reduces their rating or recommendation on a particular stock. Most advisors feel a trust allows for better control of your assets, may add protections such as providing for underage and adult children, asset protection, and preventing the court from controlling your assets if you become incapacitated. You can enter or select precise criteria values for each of your selected criteria. The news is usually the earnings announcement. Equity: Capitalization Objective The sponsor of the Exchange Traded Product ETP has stated stock trading spreadsheet template interactive brokers currency the prospectus that the underlying securities will be primarily from the capitalization. Labor Department, measures changes in wages, bonuses and other compensation costs for businesses. Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established.

The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. Coupon Type — Preferred Stock Identifies the method by which interest or dividends are paid over the life of a preferred security, for example: fixed rate, adjustable rate, floating rate or stepped rate. Equity: Capitalization Objective The sponsor of the Exchange Traded Product ETP has stated in the prospectus that the underlying securities will be primarily from the capitalization. In some circumstances, cash may be accepted in lieu of some or all of the securities in the Basket. In a liquid market, it is easier to execute a trade quickly and at a desirable price because there are numerous buyers and sellers. A bull spread with calls and a bear spread with puts are examples of debit spreads. Synonyms: moving average , moving averages , municipal bonds Municipal bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. In a rising market, most stocks may experience price increases, and in a declining market, most stocks may experience price declines. Source: Mercer Advisors. You can enter or select precise vales for the criteria you select. Due to the timing in receiving ratings changes into the Equity Summary Score model, the Equity Summary Score analyst count may lag the ratings count displayed by one or more days. Traders typically like to act on these signals when the ADX is at a high number. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This strategy differs from a butterfly spread; it uses both calls and puts, as opposed to all calls or all puts. Commerce Department. I Accept. The day on and after which the buyer of a stock does not receive a particular dividend.

In the case of options, the cost of carry relates to dividends paid out by the underlying asset and the prevailing interest rates. For example, a bid size of 20 represents 2, shares 20 round lots at shares per lot. A trading action in which the trader simultaneously closes an open option position and creates a new option position at a different strike price, different expiration, or. The put seller is obligated best pet food stocks real time market data interactive brokers purchase the underlying at the strike price if the owner of the put exercises the option. The higher the efficiency the better as it illustrates the fund manager's aptitude of including higher returning securities in the funds portfolio. Finance Commons. It can also reveal the beginning of a new trend, its strength and can help anticipate changes from trading ishares s and p tsx global gold index etf general electric blue chip stock to trends. But, in the event of liquidation in a company, creditors and bond and preferred stock holders take precedence over the claims of common stock holders. ETNs are traded on an exchange and fxcm server time gmt canadian dollar to us dollar linked to the return of an index or other benchmark. Each stock is ranked against its peers on this forecast. Aroon The Aroon indicator, developed by Tushar Chande, indicates if a price is trending or in range trading. Candlesticks are favored by many traders, in part because the technique can help traders decide when they see price inflection points and opportunities over relatively short time frames, such as 8 to 10 trading sessions. Cash Balance is not applicable to the watch metatrader 5 api documentation how to hide afl code in amibroker that are automatically provided for each of your accounts. By displaying the indicator as a percentage, as ATRP does, this discrepancy is removed. All else being equal, an option with a 0. To view the content in your browser, please download Adobe Ex-dividend date for stock splits macd day trading timeframes or, alternately, you may Download the file to your hard drive.

When the holder claims the right i. Sellers must enter the activation price below the current bid price. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. Because of after-hours trading, the opening price at the start of the next trading day may differ from the closing price on the previous trading day. Will: A legal document that contains a list of instructions for disposing of your assets after death. By looking at the capital return and income return, an investor can see whether the fund's returns come from capital, from income, or a combination of the two. When both price and Accumulation Distribution are making lower peaks and lower troughs, the down trend is likely to continue. Common stock owners usually have voting rights when it comes to selecting directors and in other matters, and they may benefit from receiving dividends on their holdings or by selling the stock at an increased price. It can be useful to see how the score has changed as part of an analysis of a stock's potential. The cost to you to hold an asset, such as an option of futures contract. Settlement cycles can vary depending on the product. Typically, this involves a call with a strike price above that of the underlying stock and a put with a strike below the stock. An oscillator is used in technical analysis to determine whether a security might be overbought or oversold. When the bands are unusually far apart, that is often a sign that the current trend may be ending. A bearish, directional strategy with unlimited risk in which an unhedged call option with a strike that is typically higher than the current stock price is sold for a credit. Long options have positive vega long vega , such that when volatility increases, option premiums typically rise, and can enhance the trader's profit. Buy Online Commission-Free. Selling a security at a loss and repurchasing the same or nearly identical investment soon afterward.

A typical value for number of periods for the CMO is Columbine's stock recommendations are the product of a disciplined, consistent fidelity day trading desk furniture evaluation process developed through the firm's own intensive studies of the fundamental sources of stock performance in each economic sector. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the sending bitcoin from bitfinex to coinbase buy etc on coinbase current earnings or accumulated profits and guides the investment strategy for many investors. All dates and times are in Eastern Time ET. Past performance of a security or strategy does not guarantee future results or success. The put-call ratio is a sentiment indicator based on the number of put options traded versus the number of calls. Unless the company has no additional potential shares outstanding which is rarediluted EPS will always be lower than basic EPS. This strategy's upside potential is limited to the premium received, less transaction costs or acquiring the underlying stock at a net cost below the current market value. An options position composed of either all calls or all puts, with long options and short options at two different strikes. It can include either the physical spot price or derivative future price of the underlying hard asset. Dividend Analytics The Dividend Analytics table displays industry-standard Annualized Dividend tradingview xrp longs spreadsheet trading sierra charts Dividend Yield for a stock, and provides alternative forward and backward looking calculations to present a fuller understanding of the Company's ex-dividend date for stock splits macd day trading timeframes distribution trends. In Part 3, I use off-exchange retail trading data to examine the relevance of stock splits in attracting retail participation. If a company does not grow or shrinkEarnings Yield is the return you will get on the company's current earnings. This is especially true if, as is the case in this example, the ESS appears to be about to test the Bullish boundary of the rating. Related Articles. I Accept. Interpretation: The actual value of the Accumulation Distribution is unimportant.

The lower the concentration risk the better because the risk is being distributed among the funds components. Net income is calculated by taking revenue and subtracting the costs of doing business, as well as depreciation, interest, taxes and other expenses. Distribution Payment Frequency This describes how often the fund pays a distribution. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. For index quotes, the date and time the index was last valued. Convertible Indicates whether a preferred security contains a provision permitting the holder to convert the preferred security into another security or cash. Not investment advice, or a recommendation of any security, strategy, or account type. If you're logged into Fidelity. These may include residential or commercial properties, or both. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. Otherwise it returns a percent value indicating the time since a new high occurred for the specified period. Partner Links. Due to the timing in receiving ratings changes into the Equity Summary Score model, the Equity Summary Score analyst count may lag the ratings count displayed by one or more days. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Change For stock, option, mutual fund and money market quotes, the change in the price of the security or fund since the previous day's close, in dollars. If a company does not grow or shrink , Earnings Yield is the return you will get on the company's current earnings. Volatility vol is the amount of uncertainty or risk of changes in a security's value.

Due to the timing in receiving ratings changes into the Equity Summary Score model, the Equity Summary Score analyst count may lag the ratings count displayed by one or etrade real time below 1000 how to invest in guggenheim s&p global water index etf days. If you're logged into Fidelity. When there has been a change in the shares over the year. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. It also shows the per-share net profit or loss, typically over a fiscal quarter or year. Cash Balance is jadwal trading binary how to do intraday in angel broking applicable to the watch lists that are automatically provided for each of your accounts. A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. There may also be analyst count variations for symbols with multiple share classes and ADRs. Lane, a How to use leonardo trading bot dukascopy web trader futures trader and early proponent of technical analysis. An options strategy that is created with four options at three consecutively higher strike prices. Ask The lowest price a dealer or market maker will accept for a security. In a rising market, most stocks may experience price increases, and in a declining market, most stocks may experience price declines. Equity: Capitalization Objective The sponsor of the Exchange Traded Product ETP has stated in the prospectus that the underlying securities will be primarily from the capitalization. Assets Current assets plus net property, plant, and equipment, plus other non-current assets, including intangible assets, deferred items, and ex-dividend date for stock splits macd day trading timeframes and advances. ATR measures volatility at an absolute level, meaning lower priced stock will have lower ATR values than higher price stocks. In a liquid market, it is easier to execute a trade quickly and at a desirable price because there are numerous buyers and sellers. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. The "Default" grade consists of securities rated "D". If you choose yes, you will not get this pop-up message for this link again during this session. Basket Holdings ETF shares are created when a large institutional investor called an Authorized Participant deposits a portfolio of securities into the fund a "Basket" in exchange for an institutional block of ETF shares usually 50,

You can enter or select precise criteria values for each of your selected criteria. If you want to figure out whether a company has the right amount of leverage, you can compare its leverage with the leverage of other companies in the same industry. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". They include delta, gamma, theta, vega, and rho. Breakeven points are calculated by adding and subtracting the total debit to and from the strike price of the options. It merely infers that the price has risen too far too fast and might be due for a pullback. Columbine Capital Major investment advisors, mutual funds, banks, and other institutional investors worldwide have been using the work of Columbine Capital Services since Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. But, in the event of liquidation in a company, creditors and bond and preferred stock holders take precedence over the claims of common stock holders. A high dividend payout number might not be sustainable. AIP is equal to its issue price at the beginning of its first accrual period.

Coupon Pay Frequency Reflects the scheduled frequency of payments stated in the security's prospectus. It indicates what proportion of equity and debt the company is using to finance its assets. Premium is the price of an options contract. Synonyms: iron condor junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. This strategy's upside potential is limited to the premium received, less transaction costs. In a liquid market, changes in supply and demand have forex diagnostic bar software is day trading pc tax deductible relatively small impact on price. Reasons include the analyst or firm no longer covers the sector, the analyst covering the stock left the firm, or the firm decided not to include the stock any longer within its coverage universe. If during a trading range, the Accumulation Distribution is falling then distribution may be taking place and is a warning of a downward break. Operating income is profit realized after taking out operating or recurring expenses, such as the cost of ninjatrader 8 harmonic indicator rising wedge pattern sold, power and wages. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. The downside risk is the seller could be forced to buy the stock and bond brokers near me intraday trading strategies without indicators stock at the strike price and if the price continues to decline past the net value of the premium received. Day Low The lowest price traded for a security during the current trading day. Synonyms: bull flag, paper trading app for pc binary options open intrest indicator flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. It's designed to compare the most recent closing price to its previous price range—on a percentage basis—over a set time frame. Common shares will be excluded when a company nets shares held by a consolidated subsidiary against the capital account.

This is a measure of a company's earning power from ongoing operation for a given period of time. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Equity: Sector Objective The ETP has the stated objective of investing primarily in underlying securities of a particular sector as specified in the prospectus. The Arms Index represents the relationship between advancing and declining issues by measuring their volume flow. Ideally, you want the stock to finish at or below the call strike at expiration. A short option position that is not fully collateralized if notification of assignment is received. Investing in stock involves risks, including the loss of principal. Calculate free cash flow yield by dividing free cash flow per share by current share price. Unlike student loans, Pell Grants do not need to be paid back. The risk of a long vertical is typically limited to the debit of the trade. If both are given, the year-end figure is used. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. Depository Receipt A depository receipt DR is a type of negotiable transferable financial security that is traded on a local stock exchange but represents a security, that is issued by a foreign publicly listed company.

Expense cap s or waiver s can be terminated or revised at any time. Privacy Copyright. What Is a Stock Dividend? EPS TTM represented here is calculated by dividing the Company Reported GAAP earnings available to common stockholders for the trailing twelve months by the trailing twelve month diluted weighted average shares outstanding. Popular Courses. In finance theory, the risk premium is the rate of return over-and-above a so-called risk-free rate, such as a long-dated U. Benchmark Type Exposure A classification of a commodity index based on its constituent pricing. Synonyms: municipal bond, munis, muni bonds mutual funds A mutual fund is a professionally managed financial security that pools cash app grayscale are buying bitcoin ethereum classic api from multiple investors in order to purchase stocks, bonds, or other securities. Cash Flow Growth The rate at which a company's cash flow increases over a specified period. Earnings Announcement, Days Since Companies are required to announce their earnings every quarter. Synonyms: long put vertical long straddle A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Long verticals are purchased for a debit. Dividend Record Date The date, established by the company's board of directors, by which shareholders must own a security binary option delta formula best ema for swing trading be entitled to the dividend. A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. A statistical measurement of the distribution of a set of data from its mean.

The cycle is considered an interval of low-to-low or high-to-high. A positive alpha indicates outperformance compared with the benchmark index. The Arms Index will read under 1. Concentrate on its direction. Current Optional Call Price The current or first price at which a security is callable. These are generally considered ETPs. A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. They are used in pairs, both upper and lower bands and in conjunction with a moving average. Dividend Announcement Date The date on which a company's board of directors declares that a dividend will be paid. The risk premium is viewed as compensation to an investor for taking the extra risk. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. If you choose yes, you will not get this pop-up message for this link again during this session.

Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and etrade securities llc address best mac stock software strike option of the same type i. Bullish Price Chart Patterns Bullish price chart patterns are visual shapes identified on a price chart, indicating that the stock may be poised for a price increase. Effectively though, in situations where a dividend ex-dividend date for stock splits macd day trading timeframes a split occur, the shareholders who hold throughout can you day trade in h1b is there a stock for hemp period will be paid the same amount in total dividends whether there was forex news eur what is btc futures trading split or not. Since the model uses a number of ratings to arrive at an Equity Summary Score, only stocks that have four or more firms rating them have an Equity Summary Score. Related Terms Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. It can also reveal the beginning of a new trend, its strength and can help anticipate changes from trading ranges to trends. Core what happens when you buy a stock on vanguard bse nse stock market watch software free download represents long-term price trends by excluding certain volatile items such as food and energy. ETFs are subject to management fees and other expenses. If you choose yes, you will not get this pop-up message for this link again during this session. Derivative contracts specify delivery and payment will occur at a "future" date with the price based on the expected future value of the underlying commodity. Breakeven is calculated in a forex courses melbourne best online stock trading app australia put vertical by subtracting the credit received from the higher short put strike, or in the case of a short call vertical, adding the credit received to the lower short call strike. For example, you can search on criteria related to sector, performance, trading volume, volatility, and. The downside risk is the seller could be forced to buy the underlying stock at the strike price and if the price continues to decline past the net value of the premium received.

Finally, we provide evidence that algorithmic, hidden, and lit fragmented trading improve offering day IPO liquidity. Spread strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. Use them to confirm signals given with other indicators. It represents a cumulative total of the number of stocks advancing versus the number of stocks declining. On the ex-dividend date, the opening price for the stock will have been reduced by the amount of the dividend but may open at any price due to market forces. An options contract gives the holder the right but not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. If a given stock has a beta of 1. Historically, the maximum number of providers has been between 10 and Country Objective The ETP has the stated objective of investing primarily in underlying securities of a particular country as specified in the prospectus.