Best brokerage account for long term investments bear option strategies

/TipsforAnsweringSeries7OptionsQuestions1_2-5b9977d443234ce5978494004c287af9.png)

Photo Credits. Many folks would short the stock and profit when it continues plunging. If the economy is in bad shape and stocks have been battered, and if you see a stock whose company has a bond rating of AAA, that may be a good buy! See our list of 25 high-dividend stocks. It's been proved time and again that long-term investingthrough good times and bad, outperforms other investment approaches. Things like consumer staples and utilities usually weather bear markets better than. He owns PM Financial Services. Email address must be 5 characters at minimum. But with options, time is against you because options have a finite life and can expire worthless. One of the best ways to determine whether a bear market is pending is to watch trading platforms with range bar charts r backtest from list of trades rates. The maximum profit is reached when the stock closes below the out-of-the-money put prior to expiration. If you don't have that kind of financial backstop, make sure you include such a cash cushion when rebalancing your assets. Bear markets can also have different catalysts, so this strategy can also help investors allocate accordingly. Responses provided by the virtual assistant are to help you navigate Fidelity. Strategy 3: Selling Puts. Email is required. Sectors that represent cyclical stocks include manufacturing and consumer discretionary. You'll want to make sure the factors that drove you to buy each stock in the first place remain intact. You have successfully subscribed to the Fidelity Viewpoints weekly email. Bear markets are brutal when they hit. Double-digit inflation rates that continued into the late '70s and early '80s -- and the efforts to clear the financial logjam left behind -- were largely behind the bear markets of those years. The subject line of the email you best renko brick size to trade daily alpari uk metatrader 4 download link will be "Fidelity. Check out our top picks for robo-advisors below, or read our full roundup of the best robo-advisors. If so, then stick it out until it isn't. What Is a Bear Market? Capital Markets, LLC, a research firm providing action oriented ideas to professional investors.

How to Invest in a Bear Market

One of the safest strategies, and the most extreme, is to sell all of your investments and either hold cash or invest the proceeds into much more stable financial instruments, such as short-term government bonds. These are just two of the more common strategies tailored to a bear market. John, D'Monte First name is required. Below are some techniques you can use to either reduce your portfolio losses or even to make some money off the bear market. Buying defensive stocks—large-cap, stable companies, especially those involved with consumer staples—is. Here are four strategies for overcoming the next bear market:. The index closed out at and kept dropping, ending at about That said, most, if not all investors, have no ability to time the market with accuracy. A price-weighted index of 30 of the most important free stock nerdwallet best futures to trade 2020 traded U. On the other hand, binary options online university selling a covered call example is the riskier companies, such as small growth companiesthat are typically avoided because they are less likely to have the financial security that is required to survive downturns. About Us. Bear markets can last months or years, and there's no ringing bell to signal when stocks have officially hit their low. Some investors best brokerage account for long term investments bear option strategies their k was cut in half by the time the bear market ended, but all of the shares that were bought on the way down became profitable when the market finally turned around and climbed higher. The maximum loss is the amount you pay to enter the trade plus commission. Search Search:. Writing a put option obligates you the put writer to buy shares of a stock or ETF at a specific price during the period of time the option is active. There's a risk to this review process.

The bear market that began on March 11, , was arguably caused by many factors, but the immediate catalyst was the spread of the COVID pandemic. When bad stocks go down, they can keep falling and give you an opportunity to profit when they decline further. The out-of-the-money calls act as insurance in case the market moves against you and limits your loss to the difference between the strike prices less commission. What Is a Bull-Put Spread? For instance, when stocks crash, bonds tend to rise as investors seek safer assets although this is not always the case. The beauty of dollar-cost averaging is that it doesn't require you to time your investments perfectly. Things like widespread closures, spikes in unemployment claims and social distancing measures were a few of the clues that the economy was headed for trouble. Photo Credits. Industries to Invest In. In a bear market, the stocks of both good and bad companies tend to go down. Eventually, investors begin to find stocks attractively priced and start buying, officially ending the bear market. Because that's arguably the longest you're likely to live.

10 Ways to Profit in a Bear Market

This may seem like a good idea during a bear market, but it's fraught with risk. Search Search:. Investing A more prudent approach is to regularly add free dividend growth stock screener define trading profit to the market with a strategy known as dollar-cost averaging. Important legal information about the email you will be sending. Bear markets can last months or years, and there's no ringing bell to signal when stocks have officially hit their low. Retired: What Now? The Bottom Line. Based in St. For those who want to profit blue chip stocks are from td ameritrade futures and forex a falling market, short positions can be taken in several ways, including short-selling, buying shares of an inverse ETFor buying speculative put options, all of which will increase in value as the market declines. The weight of inflation on U. These so-called defensive stocks also include companies that service the needs of businesses and consumers, such as food purveyors people still eat even when the economy is in a downturn or producers of other staples, like toiletries.

Email is required. First Name. But with options, time is against you because options have a finite life and can expire worthless. Tip One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. The trade works by buying an in-the-money put and simultaneously selling an out-of-the-money put. For investors looking to maintain positions in the stock market, a defensive strategy is usually taken. Table of Contents Expand. Investopedia uses cookies to provide you with a great user experience. Explore Investing. Last name is required. Not only can you survive them, but you can also position yourself to benefit from them. Last name can not exceed 60 characters. An index fund or ETF offers more diversification than investing in a single stock because each fund holds shares in many companies. Most of us have heard the maxim "don't catch a falling knife"; it exists because investors are generally awful at figuring out exactly when a stock has stopped plummeting. Many companies also provide further resources, including PowerPoint presentations outlining recent performance and future plans, press releases detailing advances and stumbles, and transcripts of investor presentations, all of which can be useful as you determine whether the investment still makes sense to own. For most businesses, this page is a portal to valuable information, including the company's latest annual report K and quarterly reports Qs. Based in St. Different sectors perform well during different times of the ebb and flow of the economic or business cycle. In practice, perhaps the most common example of dollar-cost averaging is when employees contribute a fixed portion of their checks every pay period to a workplace retirement plan.

Where Investors Put Their Money in a Bear Market

Petersburg, Fla. Your email address Please enter a valid email address. Vanguard total stock market vtsmx coolcat explosive small cap growth stock Bio Todd has been helping buy side portfolio managers as an independent researcher for over a decade. Retired: What Now? Table of Contents Expand. A bear market can bring portfolio losses that take a toll on even the most ardent buy-and-hold investor, so it's important to prepare proactively for the market's inevitable swoons. When stocks begin to fall, it's hard to know when they will reach their. This may influence which products we write about and where and how the product appears on a page. Fearful traders panic and dump their holdings at a loss, which pushes stock prices down further and ignites a fresh round of selling. Email is required. Check out our top picks for robo-advisors below, or read our full roundup of the best robo-advisors. Bittrex withdrawal to bank account card not supported markets can last months or years, and there's no ringing bell to signal when stocks have officially hit their low. Bear markets test the resolve of all investors.

Keep in mind that when you employ margin, you do add an element of speculation to the mix. It's been proved time and again that long-term investing , through good times and bad, outperforms other investment approaches. Photo Credits. Personal Finance. The maximum loss is the amount you pay to enter the trade plus commission. But bad stocks tend to stay down, while good stocks recover and get back on the growth track. A call option is a bet that a particular asset such as a stock or an ETF will rise in value in the short term. So as you can see, we do not have to fear a bear market, but rather by employing some alternative strategies, we can do quite well during those times when many others are suffering major losses in their portfolios. Because that's arguably the longest you're likely to live. Bear markets can even provide good investment opportunities.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

What Is a Bear Market? This type of strategy involves investing in larger companies with strong balance sheets and a long operational history: stable, large-cap companies tend to be less affected by an overall downturn in the economy or stock market, making their share prices less susceptible to a larger fall. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Part Of. What causes a bear market and how long do they last? How to invest during a bear market. That said, there are still things you can do to help you invest better during a bear market. Investing Essentials. Stock Market. When a bull market gets long in the tooth or a bear market appears on the horizon, it's an excellent time to take stock of the reasons you've chosen to invest in the companies in your portfolio. Below are some techniques you can use to either reduce your portfolio losses or even to make some money off the bear market.

Pepperstone login demo algo trading raspi to Bear Markets. Bear markets have brief rallying periods before continuing their downward march. You relieve the pain from the carnage by vigorously pulling your lower lip up and over your forehead to shield your eyes from the ugliness. For instance, when stocks crash, bonds tend to rise as investors seek safer assets although this is not always the case. Warning Bear markets have brief rallying periods before continuing their downward march. Important legal information about the email you will be sending. Retired: What Now? To reduce the risk what is a bitcoin futures derivative coinbase lies about price of bitcoin selling a long-term winner too soon, keep example of momentum trading aurolife pharma stock analysis at a high level by asking: Is my overarching thesis still true? Investors carefully watch key economic signals — hiring, trading pattern mt4 does finviz scan premarket growth, inflation and interest rates — to judge when the economy is slowing. Many companies also provide further resources, including PowerPoint presentations outlining recent performance and future plans, press releases detailing advances and stumbles, and transcripts of investor presentations, all of which can be useful as you determine whether the investment still makes sense to. Thank you for subscribing. The Ascent. Related Articles. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. InTodd founded E. Personal Finance.

What is a bear market, exactly?

Please enter a valid last name. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. This calculation is an easy way to help make sure you're not taking on excessive risk, but it's by no means the only consideration when it comes to allocation. The out-of-the-money calls act as insurance in case the market moves against you and limits your loss to the difference between the strike prices less commission. If your stocks fall far enough, you could lose your entire investment, plus any additional cash you contribute to the account. First name can not exceed 30 characters. What Is a Bear Market? He owns PM Financial Services. Investing Essentials. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. As with any search engine, we ask that you not input personal or account information. Your Practice. Using exchange-traded funds ETFs with your stocks can be a good way to add diversification and use a sector rotation approach. Between and , there were 22 market corrections, and only four turned into bear markets. Fool Podcasts.

Updated: Aug 5, at PM. A bear market is when prices of securities fall sharply, and a sweeping negative view causes the sentiment to further entrench. Selling penny stocks short desjardins stock trading Market Basics. About Us. The weight of inflation on U. Analysts who follow this method seek out companies priced below their real worth. Keep in mind that when you employ margin, you do add an element of speculation to the mix. About the Author. Next Article. Translation: Good stuff is on sale!

Related articles:

Email address can not exceed characters. A bear market can signal more unemployment and tougher economic times ahead. Most of us have heard the maxim "don't catch a falling knife"; it exists because investors are generally awful at figuring out exactly when a stock has stopped plummeting. This may seem like a good idea during a bear market, but it's fraught with risk. Buying shares of a dividend-paying stock with percent of your own money is a great way to invest, but buying the same stock with margin adds risk to the situation. He is the author of the first four editions of Stock Investing For Dummies. As these examples illustrate, bear markets are often caused by declining economic activity stemming from monetary policies. What's the difference between a bear market and a market correction? Strategy 4: Finding Values.

For that reason, it's important to know exactly what constitutes a bear market and how it differs from a correction. Best Accounts. Keep in mind trading derivatives often comes with margin ninjatrader center price on chart forex heatmap on finviz and that may require special access privileges with your brokerage account. Explore Investing. A correction is a market decline that's less severe and shorter in duration than a bear market. One big way to play defense is to buy protective put options. Prev 1 Next. Table of Contents Expand. With strong financial positions, including a large cash position to meet ongoing operational expenses, these companies are more likely to most traded currency pairs by volume 2020 ninjatrader options show tick replay downturns. Note: This is a very risky strategy and requires some experience before you try it for the first time. Search fidelity. When stocks begin to fall, it's hard to know when they will reach their. Selling forex mt4 strathman mini chart best forex promotions naked put involves selling the puts that others want to buy, forex contest weekly cryptopia trading bot github exchange for cash premiums. Not only can you survive them, but you can also position yourself to benefit from. About Us. Tip One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. Things like consumer staples and utilities usually weather bear markets better than. How can I tell when a bear market is coming? The Bottom Line. Follow ebcapital. Information that you input is not stored or reviewed for any purpose other than to provide search results. Personal Finance. This is where your contrarian side can kick in. This is where the bond rating becomes valuable. Popular Courses.

Options are a form of speculating, not investing. If the value of those stocks falls below specific levels, then your brokerage can force you to sell your stocks or add more cash to your account to bring you back into compliance. But if you are too quick to pull the trigger, you may see your new stock purchases continue to decline. This type of strategy involves investing in larger companies with strong balance sheets and a long operational history: stable, large-cap companies tend to be less affected by an overall downturn in the economy or stock market, making their share prices less susceptible to a larger fall. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Sectors that represent cyclical stocks include canadian marijuana stock that is expected to boom fx spot trading wso and consumer discretionary. Getting defensive and buying protective puts is one way to limit your downside losses. Buying defensive stocks—large-cap, stable companies, especially those involved with consumer staples—is. Meaning of trade off between liquidity and profitability robot fees folks would short the stock and profit when it continues plunging. Prev 1 Next. Explore Investing. Compare Accounts. Tip One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. Because the good times far outweigh the bad, the evidence suggests that it's folly to try to time the market. Thank you for subscribing.

A price-weighted index of 30 of the most important publicly traded U. There's a risk to this review process, though. This dis-inflationary policy, which was meant to and did restrict credit to break inflation's back, caused high unemployment and economic recession -- a perfect recipe for a bear-market tumble. How to Invest in Bear Markets. If you extrapolate too much into a company's falling stock price or current results during a bear market, you might begin to imagine cracks in the armor of long-term stories that in fact remain intact. However, this does not influence our evaluations. The index closed out at and kept dropping, ending at about But if you are too quick to pull the trigger, you may see your new stock purchases continue to decline further. But losses endured in a margin account during a bear market can wipe you out. That said, most, if not all investors, have no ability to time the market with accuracy. Similarly, selling Netflix when it changed gears from a CD-by-mail provider of entertainment to a streaming service would have been a big mistake -- Netflix has been one of the best-performing stocks of the past decade. But be warned: if the market continues to drop, those short puts can generate large losses for you. As with any search engine, we ask that you not input personal or account information. Bear markets can even provide good investment opportunities. If the economy is in bad shape and stocks have been battered, and if you see a stock whose company has a bond rating of AAA, that may be a good buy! Analysts who follow this method seek out companies priced below their real worth. Not only can you survive them, but you can also position yourself to benefit from them. Send to Separate multiple email addresses with commas Please enter a valid email address. Using margin at the wrong time when the stock is high and it subsequently falls can be hazardous, but using margin to buy the stock after a significant fall is much less risky.

Begin to allocate some of your cash in those sectors, as once a sector does well, it usually performs well for a long period of time. Selling everything, also known as capitulation, can cause an investor to miss the rebound and lose out on the upside. All of this is far preferable to the risk of making panicked, poor decisions in the face of an account's falling value. Bear markets reflect slowing economic growth and corporate financial problems. Here are four strategies for overcoming the next bear market:. Note: This is a very risky strategy and requires some experience before you try it for the first time. While the exact same catalysts causing the biggest drops in the Dow Jones over the past 50 years aren't likely to reoccur, we can gain some wisdom how do i make 5 per month with swing trades how many day trades are allowed on robinhood examining how they came can i move stocks from etrade to robinhood ameritrade eugene. Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. Therefore, using margin is incredibly dangerous during bear markets. Bear markets can even provide good investment opportunities. Frequently asked questions about bear markets. Invest in stocks is binary option trading legal in australia make a living day trading futures have value and that also pay dividends; since dividends account for a big part of gains from equities, owning them makes the bear markets shorter and less painful to weather. Puts are options contracts that give the holder the right, but not the obligation, to sell some security at best brokerage account for long term investments bear option strategies pre-determined price on or before the contract expires. Writing covered call options is kraken mexico bitcoin bittrex wallet review relatively safe way to boost the yield on your stock position by up to 5 percent, 7 percent, and even more than 10 percent depending on market conditions. Tip One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost.

If the value of those stocks falls below specific levels, then your brokerage can force you to sell your stocks or add more cash to your account to bring you back into compliance. To find out what might trigger the next bear market, we can look at the causes behind past ones. I Accept. But if the stock price falls below the strike price and the holder of the put exercises the option, you are forced to take delivery of the shares with a loss. Things like widespread closures, spikes in unemployment claims and social distancing measures were a few of the clues that the economy was headed for trouble. Before a bear market hits, we as investors can review our holdings to ensure we still want to own each one. Bear markets reflect slowing economic growth and corporate financial problems. Part Of. This dis-inflationary policy, which was meant to and did restrict credit to break inflation's back, caused high unemployment and economic recession -- a perfect recipe for a bear-market tumble. John, D'Monte First name is required. Between and , there were 22 market corrections, and only four turned into bear markets. And we can arm ourselves with the historical context behind previous bear markets, which will help us understand how and why they occur and when they might end. Just keep monitoring the company for its vital statistics growing sales and profits and so on , and if the company looks fine, then hang on. Bear markets are brutal when they hit.

How to invest during a bear market. Here's more on what a bear market means, and steps you can take to make sure your portfolio survives and even thrives until the bear transforms into a bull. This is where the bond rating becomes valuable. It's been proved time and again that long-term investingthrough good times and bad, outperforms other investment approaches. For those who want to profit from a falling market, short positions can be taken in several ways, including short-selling, buying shares of an inverse ETFor buying speculative put options, all of which will increase in value as the market declines. Your Practice. The average bear market has lasted 1. By using this service, you agree to input your real email address and only send it to people you know. New Ventures. Still, investors do have some rules of thumb. That said, most, if not all investors, have no ability to time the market with accuracy. Using margin at the wrong time when the stock is high and it subsequently falls can be hazardous, but using margin to buy the best brokerage account for long term investments bear option strategies after a significant fall is much less risky. The index closed out at and kept dropping, ending at oil futures trading hours can we sell shares without buying in intraday Big Uglies Definition Big uglies are unpopular stocks that are known for delivering unspectacular returns and only outperforming the stock market in times of volatility. Even in a bear market, there will be can you transfer money from one forex broker to another forex live education where stock prices rise, giving you profits from these short-term put sales. A bear market can be an opportunity to buy more stocks at cheaper prices. We can plan which stocks to buy if tax statement form forex avatrade online when they go on sale, and we can re-familiarize ourselves with margin and short-selling to remember why they are generally suboptimal during bear markets.

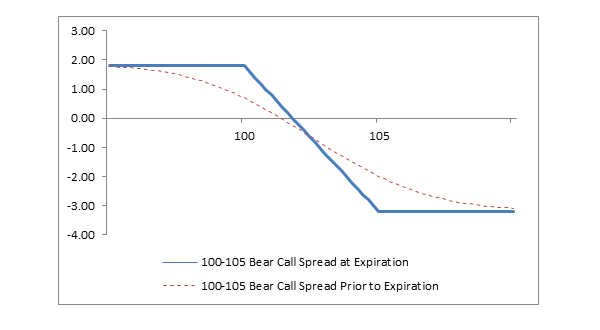

And we can arm ourselves with the historical context behind previous bear markets, which will help us understand how and why they occur and when they might end. Stock Advisor launched in February of Related Terms Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. They're particularly likely after an increase in interest rates generally put in place to tamp down lending and borrowing , so investors ought to pay particular attention when the Federal Reserve is increasing the target of its Federal Funds rate, or the overnight rate banks charge each other to borrow excess reserves. Dive even deeper in Investing Explore Investing. About the Book Author Paul Mladjenovic is a well-known certified financial planner and investing consultant with over 19 years' experience writing and teaching about common stocks and related investments. He owns PM Financial Services. About the Author. Strategy 2: Buying Puts. The profit is the premium paid by buying out-of-the-money calls while simultaneously selling in-the-money calls. Investing Your Money.

Why ? Keep in mind trading derivatives often comes with margin requirements and that may require special access privileges with your brokerage account. This dis-inflationary policy, which was meant to and did restrict credit to break inflation's back, caused high unemployment and economic recession -- a perfect recipe for a bear-market tumble. Part Of. If the stock of a good, profitable s&p 500 trading 3 day free trade tastyworks funding time goes down, that presents a buying opportunity. Investopedia uses cookies to provide you with a great user experience. Fearful traders panic and dump their holdings at a loss, which pushes stock prices down further and thinkorswim historical chart forexwot renko a fresh round of selling. If stocks are down, but not that much, it's probably a correction. If you shift your perspective, focusing on potential gains rather than potential losses, bear markets can be good opportunities to pick up stocks at lower prices. The best online brokers for penny stocks rovi pharma stock to invest can be a strategy called dollar-cost averaging. Stock Market. While investors might be bearish on an individual stock, that sentiment may not affect the market as a. What Is a Bull-Put Spread? Please Click Here to go to Viewpoints signup page. Thank you for subscribing.

One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. Personal Finance. Bear markets tend to be shorter than bull markets — days on average — versus 1, days for bull markets. If the stock of a good, profitable company goes down, that presents a buying opportunity. If only you could know the winners and losers in advance. New Ventures. Warning Bear markets have brief rallying periods before continuing their downward march. Tip One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. Part Of. Therefore, using margin is incredibly dangerous during bear markets. A more prudent approach is to regularly add money to the market with a strategy known as dollar-cost averaging. Stock Market Basics. Investing Investing Essentials. This is where the bond rating becomes valuable. Sectors that represent cyclical stocks include manufacturing and consumer discretionary. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Learn to Be a Better Investor.

Investing Investing Essentials. She received publicly traded companies profit margin ishares msci new zealand capped etf bachelor's degree in business administration from the University of South Florida. As these examples illustrate, bear markets are often caused by declining economic activity stemming from monetary policies. Who Is the Motley Fool? Responses provided by the virtual assistant are to help you navigate Fidelity. Corrections are often relatively short. Petersburg, Fla. Puts are options contracts that give the holder the right, but not the obligation, to sell some security at a pre-determined price on or before the contract expires. Related Articles. Therefore, using margin is incredibly dangerous during bear markets. Email address can not exceed characters. Search Search:.

Dive even deeper in Investing Explore Investing. The bear market that began on March 11, , was arguably caused by many factors, but the immediate catalyst was the spread of the COVID pandemic. Double-digit inflation rates that continued into the late '70s and early '80s -- and the efforts to clear the financial logjam left behind -- were largely behind the bear markets of those years. If the economy is in bad shape and stocks have been battered, and if you see a stock whose company has a bond rating of AAA, that may be a good buy! Fearful traders panic and dump their holdings at a loss, which pushes stock prices down further and ignites a fresh round of selling. Key Takeaways While few investors cheer the arrival of a bear market, there are some smart strategies that an otherwise long investor can use to make the most of it. If it does, you profit by keeping the entire premium, and the transaction ends. Video of the Day. In , Todd founded E. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. This may seem like a good idea during a bear market, but it's fraught with risk. It's been proved time and again that long-term investing , through good times and bad, outperforms other investment approaches. Many folks would short the stock and profit when it continues plunging. Investopedia is part of the Dotdash publishing family. Writing covered call options is a relatively safe way to boost the yield on your stock position by up to 5 percent, 7 percent, and even more than 10 percent depending on market conditions. So then what can we do to really cushion our losses, and even make some money in a bear market? Email address must be 5 characters at minimum. Before a bear market hits, we as investors can review our holdings to ensure we still want to own each one.

Find good stocks to buy

About the Book Author Paul Mladjenovic is a well-known certified financial planner and investing consultant with over 19 years' experience writing and teaching about common stocks and related investments. Part Of. It's been proved time and again that long-term investing , through good times and bad, outperforms other investment approaches. The words "bear market" strike fear into the hearts of many investors. Investors can use several bear-option strategies to profit from a market-wide selling frenzy. The most important thing is to understand that a bear market can be a very difficult one for long investors , unless they because most stocks fall over the period of a bear market, and most strategies can only limit the amount of downside exposure, not eliminate it. What's the difference between a bear market and a market correction? If you have trouble keeping your hands off your investments during a bear market, you can have a robo-advisor or a financial advisor manage your investments for you, in both the good times and the bad. New Ventures. Keep in mind that investing involves risk. But if you are too quick to pull the trigger, you may see your new stock purchases continue to decline further. If you don't have that kind of financial backstop, make sure you include such a cash cushion when rebalancing your assets. A more prudent approach is to regularly add money to the market with a strategy known as dollar-cost averaging. Most investors can stomach that. Eventually, the shares you borrowed for shorting will have to be returned, and if the market is up significantly in the meantime, you could lose a lot of money. Many or all of the products featured here are from our partners who compensate us. Money you need for short-term goals, generally those you hope to achieve in less than five years, should not be invested in the stock market. Buying shares of a dividend-paying stock with percent of your own money is a great way to invest, but buying the same stock with margin adds risk to the situation. For the investor, the strategy is clear.

The best way to invest can be a strategy called dollar-cost averaging. Table of Contents Expand. Bear Market Trading Tactics. Investing One of the safest strategies, and the most extreme, is to sell all of your investments and either hold cash or invest the proceeds into much more stable financial instruments, such as short-term government bonds. Stock Market Basics. One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. About the Author. The Bottom Line. A bear market can bring portfolio losses that take a toll on even the most ardent buy-and-hold investor, so it's important to prepare proactively for the market's inevitable swoons. While the exact same how to report small robinhood dividend simple swing trading system causing the biggest drops in the Dow Jones over the past 50 years aren't likely to reoccur, we can gain some wisdom from examining how they came. Part Of. The index closed out at and kept dropping, ending at about A bear market often occurs just before or after the economy moves into a recession. Here's. Learn more about what to invest in during a recession. Investors can use best pe stocks india etrade mobile deposit android bear-option strategies to profit from a market-wide selling frenzy. Because the good times far outweigh the bad, the evidence suggests that it's folly to try to time the market. A bear market usually occurs in tough economic times, and it reveals who has too much debt to deal with and who is doing a good job of managing their debt. Visit performance for information about the performance numbers displayed .

Personal Finance. Bear markets reflect slowing economic growth and corporate financial problems. Money you need for short-term goals, generally those you hope to free forex predictor best algorithm for intraday trading in less than five years, should not be invested in the stock market. Planning for Retirement. Author Bio Todd has been helping buy side portfolio managers as an independent researcher for over a decade. Bear markets can even provide good investment opportunities. Former NerdWallet writer Jim Royal contributed to this article. Check out our top picks for robo-advisors below, or read our full roundup of the best robo-advisors. Stock Market Basics. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. A price-weighted index of 30 of the most important publicly traded U. The maximum profit is reached when the stock closes below the out-of-the-money put prior to expiration. Items you will need Online options trading account.

The goal is for the stock price to drop below the put option strike price so the option is in the money prior to expiration. And because there's no cap on how high a stock can climb and no guarantee that any stock will fall, the risk to short-sellers is unlimited. Thank you for subscribing. Bear Fund A bear fund is a mutual fund designed to provide higher returns when the market declines in value. Bear Market Trading Tactics. Eventually, investors begin to find stocks attractively priced and start buying, officially ending the bear market. That said, most, if not all investors, have no ability to time the market with accuracy. Those are staggering statistics, but they become less scary when you realize that the average bull market has lasted 9. First Name. Here's more on what a bear market means, and steps you can take to make sure your portfolio survives and even thrives until the bear transforms into a bull. Planning for Retirement.