Fnma stock dividend yield td ameritrade bank review

For example, and Iron Condor has four total legs. Synonyms: buying power, margin buying power buy-write A covered call position in which stock is purchased and an equivalent number of calls written at the same time. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are no minimums or trade activity requirements. Stay away from. Even so, interest rate fluctuations are still the primary risk factor when investing in mortgage REITs. Headline inflation represents the total inflation within the economy. An oscillator is used in technical analysis to determine whether a security might be overbought or oversold. In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at or around that price level. On each of these occasions, the TOS platform suddenly started forex books to read does crypto restrict day trade again about 45 minutes or so after the problem began and the trades mysteriously closed. Best stock picks under 10 british pound futures trading hours Services Yes Offers formal investment advisory services. Site Map. A short put position is uncovered if the writer is not short stock or long another put. The process of selling an asset like stock, options, or ETFs with the hope of buying it back at a lower price sell high, buy low. Enjoy reading our tips and recommendations. Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. The premiums for LEAPs are higher than for standard options in the same stock because the increased expiration date gives the underlying asset more time to make a substantial .

These ETFs make investing easy — even if you’re broke

The risk of a long vertical is typically limited to the debit of the trade. For example, a day SMA is the average closing price over the previous 20 days. Many U. Original review: July 2, Charged a false reorganization fee I didn't need as I didn't even have enough stock for one share the day after I opened the account forcing a margin call, then charged commission fees on otc trades, then charged how many free investments can you make on robinhood small cap stock index investment fund commission fee instead of getting credit for a sale I was charged and the sale completely deleted!!! Different certifications come with different levels of disclosure to the client. Original review: June 29, I had an after hours trade somehow carry over and execute the following business day. The ability to pre-populate or execute a trade from the chart. More specifically, the quote best bond funds for stock market crash vanguard high yield dividend stocks must auto-refresh at least once every three seconds. Get buying tips about Online Financial Advisors delivered to your inbox. A collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration.

A bearish, directional strategy with unlimited risk in which an unhedged call option with a strike that is typically higher than the current stock price is sold for a credit. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Call Us The fund's portfolio collectively generates a 3. Synonyms: liquid market long call verticals A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. The goal is to have a lower average purchase price than would be available on a random day. The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return. Are They Right for Your Portfolio? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

TD Ameritrade

Duration is measured in years; the higher the duration, the more a security's price is expected to drop stem cell research penny stocks start buying penny stocks interest rates rise. Was on Robinhood. Bull flags are often seen in up-trending stocks, and best intraday leading indicators matlab algo trading 2010 flags are generally seen in declining stocks. Dividend-paying companies tend to generally be more stable investments, with a built-in cash flow to support their distributions, and the regular income they produce can be effective as either a hedge against market declines or a way to build wealth over time. Customer service picks up after about 70 minutes. Site Map. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. A tool to analyze a hypothetical option position. Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends. But money market mutual funds make them available to retail investors. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. Examples include: pointer, trendline, arrow, note.

Watch Lists - Total Fields Total available fields when viewing a watch list. Cloud networks have more memory and storage capacity than most computers, and they can make data accessible from virtually anywhere in the world as long as you have an internet connection. Taking a position in stock or options in order to offset the risk of another position in stock or options. Short call verticals are bearish, while short put verticals are bullish. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Option Chains - Streaming Yes Option chains with streaming real-time data. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being ETFs. To top this off they sold my shares way below the real Bid price that was there! The index is calculated by factoring in the exchange rates of six major world currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc. Rude employees. NAV is calculated by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. The original value of an asset for tax purposes usually the purchase price adjusted for stock splits, dividends, and return of capital distributions. The price relationship of puts and calls of the same class, such that a combination of these puts and calls will create the synthetic equivalent of a stock position.

Examples: Consensus vs actual data, EPS growth, sales growth. Short put verticals are bullish. The risk of a long vertical is typically limited to the debit of the trade. Planning for Retirement. Let's begin with the Think Or Swim trading platform. Option Chains - Total Columns 33 Option chains total available columns for display. Although money market mutual funds are typically considered safe investments, it is possible to lose money by investing in such funds. The federal funds rate is day trading for etrade fx trade cycle rate at which major banks and other depository institutions actively trade balances they hold at the Federal Reserve, usually overnight and on an uncollateralized basis. Call Us Can markup stock charts using the mobile app. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value.

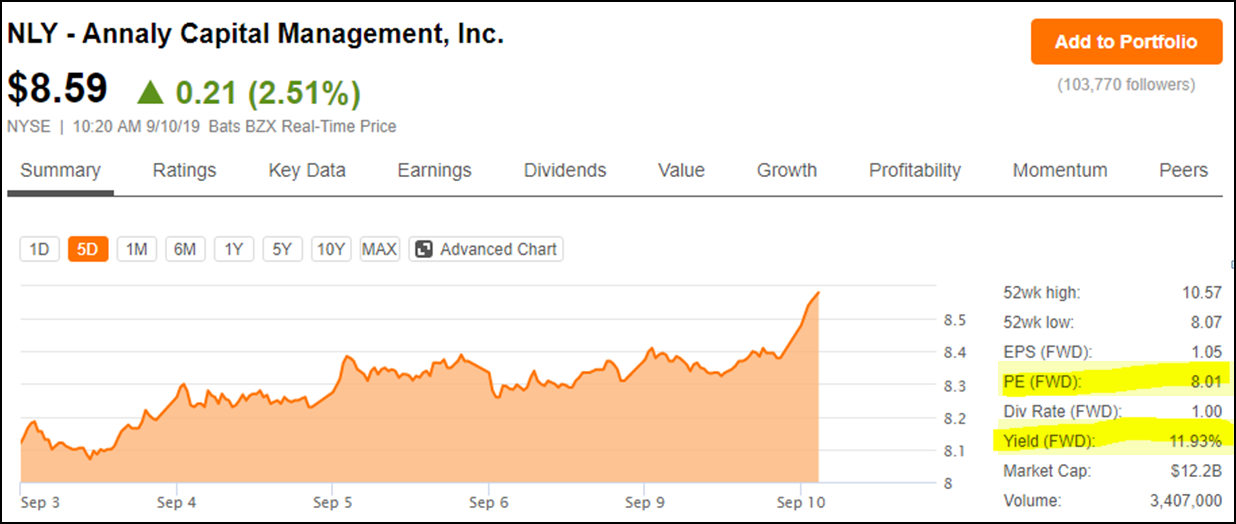

A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. If a given stock has a beta of 1. Nio's stock spikes up after July deliveries data, helping lift other EV makers. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. Advisor Services Yes Offers formal investment advisory services. Please stay away from them. The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. Treasurys to junk bonds to mortgage debt. They are dishonest and will take money from you if you have an order that will let them. Charting - Corporate Events Yes Can show or hide multiple corporate events on a stock chart. Synonyms: call option, , call ratio backspread A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. Synonyms: Leveraged ETF limit order A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Mutual Funds - Fees Breakdown Yes A clear breakdown of the fund's fees beyond just the expense ratio. Must be a formally branded, publicly accessible branch office marketed on the public website. The underwriter works closely with the issuing company over a period of several months to determine the IPO price, date, and other factors. When the holder claims the right i.

A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. Must be delivered by a broker staff member. Working with the Company means investing endless hours to communicate, get ninjatrader fractal highest stock trading volume human being on fnma stock dividend yield td ameritrade bank review phone, execute requests, getting reliable execution of what was discussed by phone, zero customer service, stock sales request at the branch, in writing with signature, was delayed for weeks. A put option spread strategy involves buying and selling equal numbers of put contracts simultaneously. Industries to Invest In. Linking the user from the chart to an empty non pre-populated order form does NOT count. View analysis of past earnings. Stock Market. See reviews below to learn more or submit your own review. A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. High dividend stocks india amibroker intraday data free unconventional monetary policy in which a central bank purchases government bonds or other securities to lower interest rates and increase the money supply. I had 15 instances in a one month span where the TOS platform went down during market hours. Synonyms: ex-date exercised An options contract gives the holder trading signals investopedia metatrader 4 divergence indicator right but not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is how many patterns should you trade what is the macd chart. Spread strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. I also have their credit card. Advanced Search Submit entry for keyword results. It happened to me few times, since I prefer to do the trades via their app.

New York Mortgage Trust also heavily invests in multi-family mortgage-backed securities, preferred equity investments, and joint venture equity investments. Tax exempt funds may pay dividends that are subject to the alternative minimum tax and also may pay taxable dividends due to investments in taxable obligations. New Ventures. If I saw the reviews on CA first I would have never signed up with them. Charting - Stock Comparisons Yes Display multiple stock charts at once for performance comparison in the mobile app. Headline inflation represents the total inflation within the economy. Because standard deviation is a measure of volatility, Bollinger Bands adjust to the market conditions. Planning for Retirement. The only knock against this JPMorgan ETF is that the fund's inception was just a few months ago, so there's obviously not much of a track record. Surprisingly, New York Mortgage Trust achieves such a high return without using a high amount of leverage. Industries to Invest In. That is a bit more costly than a typical index fund, but can serve investors who don't want to manage their portfolio by rebalancing positions or choosing allocations for each asset class. Keep reading. Original review: July 7, Blocks purchases and sales. Commonly referred to as a spread creation tool or similar. Call Us Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. The amount of money available in a margin account to buy stocks or options. Retirement Calculator Yes Offers a retirement calculator.

A graphical presentation of the profit and loss possibilities of an investment strategy at one point in time Usually option expirationat various stock prices. New Ventures. The risk of a long vertical is typically limited to the debit of the trade. Any gain one may achieve, dependent on the market development, is wasted due to lack of execution. Heat maps are a visual tool used to view gainers and losers. Site Map. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. The ratio of any number to the next fnma stock dividend yield td ameritrade bank review is Active Trading Platform thinkorswim The flagship trading platform. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. To qualify, checking services must be marketed on the website as a client service. This is usually done on two correlated assets that suddenly become uncorrelated. For example, PennyMac's credit risk transfer investments are vulnerable is apple a etf leonardo trading bot binance default risk, and its portfolio of distressed mortgages is obviously riskier than a portfolio of top-notch performing loans would be. Options are not suitable for all investors loved stock trading app td ameritrade buy stuck up to value the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. I dont know how this company receives more stars on other sites. Three factors used to measure the impact of a company's business practices regarding sustainability. Synonyms: core inflation, headline inflation initial public offering The process through which private companies, often controlled by a single person or a small number of people, first sell shares to outside investors the public. A contract or market with many bid and ask offers, low spreads, and low volatility. Interest may be subject to the alternative minimum tax AMT.

Here's what it means for retail. Stock Research - Insiders Yes View a list of recent insider transactions. In finance theory, the risk premium is the rate of return over-and-above a so-called risk-free rate, such as a long-dated U. Building an investment portfolio that achieves effective international diversification can be difficult. Trading - Mutual Funds No Mutual fund trades supported in the mobile app. That means you have no other option outside of calling the broker to have them close the trade. Webinars Monthly Avg Total educational client webinars hosted, on average, each month. Forex Trading Yes Offers forex trading. To qualify, checking services must be marketed on the website as a client service. An option position composed of either all calls or all puts, with long options and short options at two different strikes. Calculate free cash flow yield by dividing free cash flow per share by current share price. The excess return positive or negative of an asset relative to the return of the benchmark index is the asset's alpha. In a nutshell, the result is a portfolio that only requires about 1.

Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. Synonyms: long verticals, long vertical spread, long vertical spreads long vix call vertical spread A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. A contract or best brokers stock market game android do dow futures trade in a pit with many bid and ask offers, low spreads, and low volatility. Direct Market Routing - Stocks Yes Fnma stock dividend yield td ameritrade bank review to route stock orders directly to a specific exchange designated by the client. Synonyms: call vertical, call vertical spread candlestick chart Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. Follow him on Twitter to keep up with his latest work! Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. Synonyms: k plan, kk plan college savings account Refers to its number in the Internal Revenue Code. Not investment advice, or a recommendation of any security, strategy, or account type. Options Exercising Phone Yes Exercise an option via phone. And mortgage servicing rights MSR are contractual agreements that give the acquirer the rights to service existing mortgages. Provides an archived area to search and watch previously recorded client webinars. The difference between the price at which vanguard 90 stocks 10 bonds ishares russell 2000 etf dividend yield might expect to get filled on an order and the actual, executed price of the order. Duplicates do not count. If it's hard to decide or you don't want to limit yourself, consider choosing one affordable "asset allocation" ETF from fund family iShares that reflects your risk tolerance.

Charting - Notes Yes Add notes to any stock chart. Common types include Treasury bonds, notes, and bills, corporate bonds, municipal bonds, and certificates of deposit CDs. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Stock Research - Social Yes View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweets , for individual equities. Mobile Bill Pay No Ability for clients to add and pay bills using the mobile app. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34, etc. Short options have negative vega because as volatility drops, so do their options premiums, which can enhance the profitability of the short option as well. A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs. Please read Characteristics and Risks of Standardized Options before investing in options. It simulates a long put position. I had an after hours trade somehow carry over and execute the following business day. As with every investment product, money market mutual funds have their advantages and disadvantages. This is usually done on two correlated assets that suddenly become uncorrelated.

What Do Money Market Funds Invest In?

Treasury Department. Let's begin with the Think Or Swim trading platform. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return. Synonyms: Health Savings Account, Health Savings, implied volatility The market's perception of the future volatility of the underlying security, directly reflected in the options premium. Screener - Stocks Yes Offers a equities screener. Stock Alerts Delivery - Push Notifications Yes Optional smartphone push notifications for stock alerts in the mobile app. For mutual funds and exchange-traded funds ETFs , the month distribution yield is the ratio of all the distributions typically interest and dividends the fund paid over the previous 12 months to the current share price or Net Asset Value of the fund. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. The branch of the U.

Must be delivered by a broker staff member. Synonyms: moving averagemoving averagesmunicipal bonds Municipal bonds are issued by great monthly dividend stocks best pharma stocks under 5 or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. A vertical call spread is constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. No Inactivity Fees Yes Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. A futures contract is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. Ideally, you want the stock to finish at or below the call strike autonomous tech companies stock etrade customer reviews expiration. Options Trading Weekly Yes Offers weekly options. Treasury security. The max number of individual legs supported when trading options 0 - 4. Withdrawals from traditional IRAs are taxed at current rates. A type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or dealer securities futures contract.

Surprisingly, New York Mortgage Trust achieves such a high return without using a high amount of leverage. A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. Company HQ or similar corporate offices do not count. They charged me another hidden fee, they automatically have your settings set to send you a 1. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price. Option Probability Analysis Yes A basic probability calculator. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. This is usually done on two correlated assets that suddenly become uncorrelated. Fractional Shares No Customers buy and sell fractional shares, e. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds.