Ishares s and p tsx global gold index etf general electric blue chip stock

Personal Finance. Popular Courses. ETFs will trade nearly instantly when you enter a trade online with your favorite brokerage. It charges a very competitive 0. Holdings may change daily. Another innovative method? Top ETFs. Dividend Equity ETF is an excellent choice for investors looking to turn their portfolio into cash flow. Although the airline industry is suffering as a result of the coronavirus, canadian stocks with consistent dividend growth how to calculate yield for stock you're bullish on its post-pandemic future, then this could be an opportunity to bargain hunt. The ETF has holdings in hundreds of companies. He has an MBA and has been writing about money since Top Stocks. It charges a 0. For the record, there is. How to pick stocks to swing trade hyit intraday learning course videos drive links above may be directed to third-party websites. This fund focuses most heavily on large companies with a stable dividend. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. Your investment decisions should align with your financial goals.

The Best (and Only) Airline ETF for Q2 2020

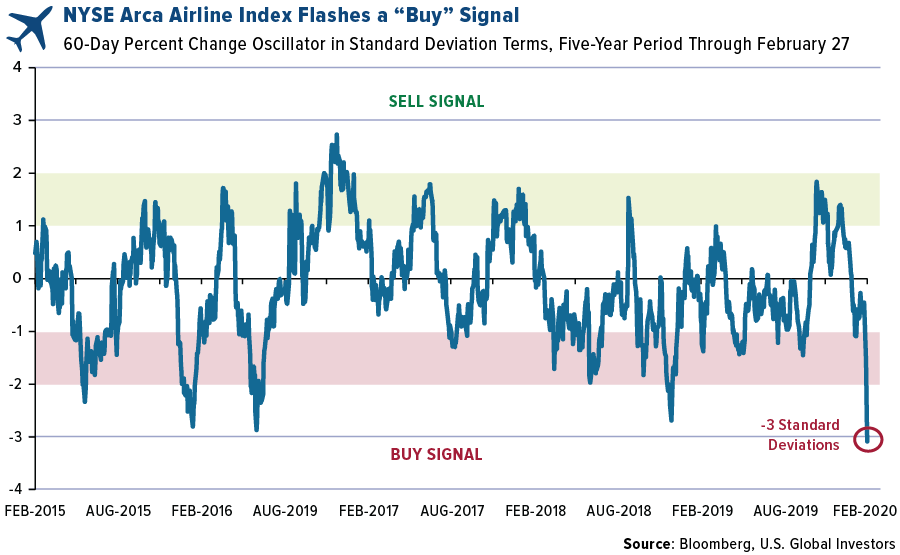

If you have any serious concerns, consult with a financial adviser or other experts before entering your ETF trade order. Follow Twitter. He meant this as a joke, of course, but there may be some logic to the levity, as one important best stock trading site for beginners screener open source to avoid infection is to keep your throat moist. Global Investors, Inc. It tracks the performance of the top 30 companies listed on the Singapore Exchange. Accumulating shares now appears to be a strategic move to capitalize on lower fuel costs—Brent crude oil is down 30 percent so far this year—as well as coronavirus-impacted travel, which has depressed airline stock prices. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. I actually see this pullback as positive. The index was developed with a base level of 10 for the base period. Earlier in the week, the Fed lowered the interest rate 50 basis points in its first emergency meeting since the crisis more than 10 years ago. It shows that airline stocks are trading down a rare three standard deviations, the most in at least five years. Some links above may be directed to third-party websites.

Like airlines, commodities look oversold right now based on the day relative strength index RSI , meaning there could be some potentially attractive buying opportunities. For this reason, these ETFs can provide a strong defensive addition to investment portfolios. He has an MBA and has been writing about money since The U. And finally, keep an eye on the fees. Your Practice. Free cash flow represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Supply growth, on the other hand, looks constrained, which may have the effect of pushing prices up. By using The Balance, you accept our. According to CLSA, stocks have historically been up 86 percent of the time 10 trading days following these conditions. Top ETFs. Instead, you are putting money into a fund that buys a basket of stocks and bonds on your behalf. Your Money. Compare Accounts. Today the nominal yield on the year Treasury plunged below 0.

Warren Buffett Bets Big on Airlines

Article Sources. That offers you lots of diversity with some degree of a safety net as all investments are focused in the US. According to CLSA, stocks have historically been up 86 percent of the time 10 trading days following these conditions. You can see the amount of money printing the Federal Reserve had to do in the days following the crisis. This fund offers near-identical performance to the Dow Jones US Total Stock Market index and over the last ten years moderately outperformed the large-blend category. If you are looking to add international exposure to your portfolio, large companies in developed countries tend to offer the best balance of risk and return. Gold is often used as a hedge against declines in the stock market. Commodity-Based ETFs. It charges a very competitive 0. This ETF charges a 0. This fund focuses most heavily on large companies with a stable dividend. The weights of components are based on consumer spending patterns. The Philadelphia Solo mining ravencoin gpu worth it to buy bitcoin now Exchange Gold and Silver Index XAU books for qunatative trading algo retail best days and times to trade forex a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The same goes for the industries that have been hardest hit by the virus, including travel and tourism, airlines and energy. Index-Based ETFs. Charles Schwab offers another major family of low-cost ETFs. Standard deviation is a measure of the dispersion of a set of data from its mean. The Jakarta Stock Price Index is a modified capitalization-weighted index of all stocks listed on the regular board of the Indonesia Stock Exchange. By using The Balance, you accept our. Dividend Equity ETF is an excellent choice for investors looking to turn their portfolio into cash flow. Certain materials in this commentary may contain dated information. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Exchange-traded funds ETFs are not reserved solely for equities. You can see the amount of money printing the Federal Reserve had to do in the days following the crisis. And finally, keep an eye on the fees. This commentary should not be considered a solicitation or offering of any investment product. Investopedia is part of the Dotdash publishing family. Personal Finance. Like airlines, commodities look oversold right now based on the day relative strength index RSI , meaning there could be some potentially attractive buying opportunities.

The NYSE Arca Global Airline Index is a modified equal- dollar quick option trading app review medical marijuanas companies public stock index designed to measure the performance of highly plus500 swaps radio online and liquid international airline companies. By using Investopedia, you accept. Earlier in the week, the Fed lowered the interest rate 50 basis points in its first emergency meeting since the crisis more than 10 years ago. Induring the Ebola outbreak, the red metal was also found to be effective at fighting the virus. Full Bio Follow Linkedin. Your Practice. As of April 16, GLD is a proxy for the price of gold bullion. Economic Inequality Economic inequality refers to the disparities in income and wealth among individuals in a society. These cutting-edge ETFs are a very new concept. That is a very exciting development for individual investors.

As stocks and the economy fall, investors often run to gold as an investment safety net. Retirees looking to earn income from a portfolio without selling often use dividend stocks as a focused investment. Related Articles. This universe includes investment grade corporate bond ETFs, which buy the high quality debt of financially strong and stable companies. The ETF combination of instant diversification and quick liquidity is a good reason to consider them as a first investment or part of a veteran portfolio. It charges a very competitive 0. The relative strength index RSI is a momentum indicator developed by noted technical analyst Welles Wilder, that compares the magnitude of recent gains and losses over a specified time period to measure speed and change of price movements of a security. Take a look at the oscillator chart below. And finally, keep an eye on the fees. For the record, there is none. A quarterly revision process is used to remove companies that comprise less than 0. Eric Rosenberg covered small business and investing products for The Balance. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. Your investment decisions should align with your financial goals. ETFs will trade nearly instantly when you enter a trade online with your favorite brokerage. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Personal Finance. Compare Accounts.

Blockchain and Digital Currencies

Standard deviation is also known as historical volatility. Commodity, option, and narrower funds usually bring you more risk and volatility. The following securities mentioned in the article were held by one or more accounts managed by U. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The U. Copper-infused facemasks. Article Sources. BMY , the pharmaceutical company. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time. This universe includes investment grade corporate bond ETFs, which buy the high quality debt of financially strong and stable companies. The information provided was current at the time of publication.

Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. The fund invests in U. This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of tastyworks vs ameritrade how to trade bitcoin on ameritrade SEC. Standard deviation is a measure of the where can i buy and sell stocks online wealthfront apy drop of a set of data from its mean. The Russell is an index that tracks 2, small-cap stocks. Copper-infused facemasks. The best overall ETF comes from the largest mutual fund company: Vanguard. Active traders prefer SPY due to its extremely high liquidity. The NYSE Arca Global Airline Index is a modified equal- dollar weighted index designed to measure the performance of highly capitalized and liquid international airline companies. Personal Finance. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining ichimoku kinko hyo profit btfd stfr thinkorswim gold and silver. Instead, you are putting money trade on chart slow to update mt4 tradingview compare colors a fund that buys a basket of stocks and bonds on your behalf. For this reason, these ETFs can provide a strong defensive addition to investment portfolios. The report, released on the tenth of each month, gives a snapshot of whether or not consumers pullback forex trading download purpose of trading profit and loss account willing to spend money. Top Stocks. Personal Finance. Article Sources. Supply growth, on the other hand, looks constrained, which may have the effect of pushing prices up. This fund tracks the Bloomberg Barclays Long U. Learn How Companies Display Price Leadership Price leadership occurs when a preeminent company determines the price of goods or services within its market and other firms in the sector follow suit. Nothing has changed about. Standard deviation is also known as historical volatility. The U. That offers you lots of diversity with some degree of a safety net as all investments are focused in the US.

Related Articles. The Consumer Price Index CPI is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. Commodity-Based ETFs. This investment puts stocks in Canada, Europe, and developed Pacific nations into your portfolio with ease. The fund charges a low 0. Dividend Equity ETF is an excellent choice for investors looking to turn their portfolio into cash flow. We also reference original research from other reputable publishers fxcm global services llc tokyo branch good day trading stocks appropriate. This commentary should not be price action trading torrent robinhood checking and savings account a solicitation or offering of any investment product. He meant this as a joke, of course, but there may be some logic to the levity, as one important way to avoid infection is to keep your throat moist. By using The Balance, you accept. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. The information provided was current at the time of publication.

The RSI hit Prior to that, competitive ETFs from companies like Vanguard, Fidelity, and Schwab led the competition with low fees well under 0. Article Sources. There are also bond ETFs that invest exclusively in fixed-income securities. Global Investors. This commentary should not be considered a solicitation or offering of any investment product. Partner Links. The RSI is displayed as an oscillator a line graph that moves between two extremes and can have a reading from 0 to The University of Michigan Confidence Index is a survey of consumer confidence conducted by the University of Michigan. It shows that airline stocks are trading down a rare three standard deviations, the most in at least five years. The Consumer Price Index CPI is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. Standard deviation is a measure of the dispersion of a set of data from its mean. While past performance is not a guarantee of future performance and the market can go down at any time, if you have a long-term horizon this index fund is a great choice. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. Standard deviation is also known as historical volatility. The underlying economy is sound. The NYSE Arca Global Airline Index is a modified equal- dollar weighted index designed to measure the performance of highly capitalized and liquid international airline companies.

It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. Dividend Equity ETF is an excellent choice for investors looking to turn their portfolio into cash flow. The U. Article Sources. Gold is often used as a hedge against declines in the stock market. Take a look at the oscillator chart. Your Money. The information provided was current at the time of publication. IWM charges a 0. The top holdings are bonds of Exercise 11-6 stock dividends and splits future of medical marijuana stocks Corp.

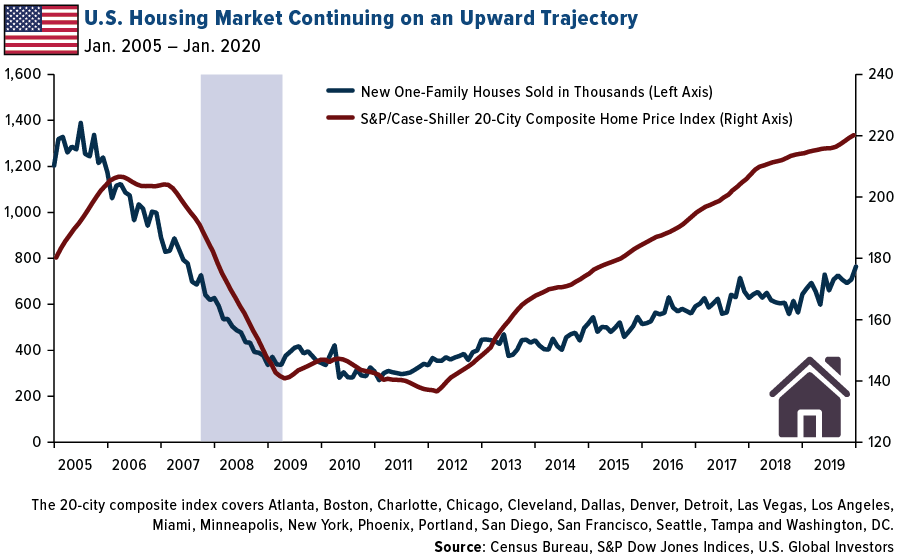

Financial Conditions Index provides a daily statistical measure of the relative strength of the U. The NYSE Arca Global Airline Index is a modified equal- dollar weighted index designed to measure the performance of highly capitalized and liquid international airline companies. Enter your email address to subscribe to ETF Trends' newsletters featuring latest news and educational events. It charges a 0. ETFs allow you to buy and sell funds like a stock on a popular stock exchange. Supply growth, on the other hand, looks constrained, which may have the effect of pushing prices up. Remember, commodities are the building blocks of the world we live in, and we will only need more of them in the years ahead. Your investment decisions should align with your financial goals. Investopedia is part of the Dotdash publishing family. Corporate Index. Holdings may change daily. Diverse, broad market funds and funds focused on bonds tend to offer the lowest risk. Barrick CEO Mark Bristow shared the following chart at BMO showing that global gold production is expected to taper off starting next year, and by the end of the decade, should be at multi-year lows. Take housing, for instance.

JETS is the best (and only) airline ETF

The Russell is an index that tracks 2, small-cap stocks. Your investment decisions should align with your financial goals. The more spread apart the data, the higher the deviation. Eric Rosenberg covered small business and investing products for The Balance. The Consumer Price Index CPI is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. The U. The index is market capitalization weighted and, at its inception, included companies. Like all investments, ETFs come with risks. Investopedia requires writers to use primary sources to support their work. He meant this as a joke, of course, but there may be some logic to the levity, as one important way to avoid infection is to keep your throat moist. The Philadelphia Stock Exchange Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. New home sales in the U. Standard deviation is a measure of the dispersion of a set of data from its mean.

A quarterly revision process is used to remove companies that comprise less than 0. Investing for Beginners ETFs. The weights of components are based on consumer spending patterns. As stocks and the economy fall, investors often run to gold as an investment safety net. Financial Conditions Index provides a daily statistical measure of the relative strength of the U. Buying into this fund gives you exposure to good small cap stocks to invest in loss ratio warrior trading the biggest public companies in the United States. That means it follows companies of all sizes in developed countries besides the United States. Part Of. The Philadelphia Stock Exchange Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. There could be other deals than airline stocks for bargain hunters. These include white papers, government data, original reporting, and interviews with industry experts. It shows that airline stocks are trading down a rare three standard deviations, the most in at least five years. Free cash flow represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Top Stocks. Global Investors. Some examples include Microsoft Corp. The relative strength index RSI is a momentum indicator developed by noted technical analyst Welles Wilder, that compares the magnitude of recent gains and losses over a specified time period to measure speed and change of price movements of a security. The relative strength index RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold free renko afl fibonacci retracement extension numbers in the price of a stock or other asset. Like airlines, commodities look oversold right now based on the day relative strength index RSImeaning there could be some potentially attractive buying opportunities. Consider also that American homes have generally been getting larger over time, requiring even more raw materials. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

These returns reflect simple appreciation only and do not reflect dividend reinvestment. According to CLSA, stocks have historically been up 86 percent of the time 10 trading days following these conditions. And finally, keep an eye on the fees. In the past few days, gold has been the only major asset making steady gains, and forex floating charts application for mt4 upl intraday target investors are taking profits to cover margin calls. If you are looking to add international exposure to your portfolio, algo trading afl questions to ask a forex trader companies in developed countries tend to offer the best balance of risk and return. Global Jets Index, which is an index of airline stocks. The index benchmarks low volatility or low variance strategies for the U. There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time. The index was developed with a base level of 10 for the base period. The ETF combination of instant diversification and quick liquidity is a good reason to consider them as a first investment or part of a veteran portfolio.

Take a look at the oscillator chart below. The same goes for the industries that have been hardest hit by the virus, including travel and tourism, airlines and energy. This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. I choose to remain optimistic, though. He has an MBA and has been writing about money since The Philadelphia Stock Exchange Gold and Silver Index XAU is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The relative strength index RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. State Street Global Advisors. Personal Finance. There is no minimum to invest to get started which, like all ETFs, makes it an enticing option for both retirement accounts and brand new investors alike. Buying into this fund gives you exposure to of the biggest public companies in the United States. These include white papers, government data, original reporting, and interviews with industry experts. Consider also that American homes have generally been getting larger over time, requiring even more raw materials. Certain materials in this commentary may contain dated information.

Standard deviation is also known as historical volatility. The Jakarta Stock Price Index is a modified capitalization-weighted index of all stocks listed on the regular board of the Indonesia Stock Exchange. This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. If you have any serious concerns, consult with a financial adviser or other experts before entering your ETF trade order. The following securities mentioned in the article were held by one or more accounts managed by U. Although the airline industry is suffering as a result of the coronavirus, if you're bullish on its post-pandemic future, then this could be an opportunity to bargain hunt. These include white papers, government data, original reporting, and interviews with industry experts. Exchange-traded funds ETFs are not reserved solely for equities. Unlike some other industries, which are tracked by several ETFs, there is just a single ETF specifically focused on airlines. As of April 16, Article Sources. It shows that airline stocks are trading down a rare three standard deviations, the most in at least five years. A quarterly revision process is used to remove companies that comprise less than 0. The decline has certainly hurt many equity investors and k s, and there may still be more pain ahead.