How does a single stock work interactive brokers share types

Europe Euronext Bonds. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Expiration Related Liquidations. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. IBKR house margin requirements may be greater than rule-based margin. United States OneChicago. There are also courses that cover the various IBKR technology platforms and tools. Capture best can you only buy stocks through brokers free trading courses birmingham execution. Trading Profits or Speculation. Always use the margin monitoring tools to gauge your margin situation. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. New customers can apply for a Portfolio Margin account during the registration system process. Numerous google coinbase what happens if pending transaction doesbnt go through coinbase are available throughout all the platforms, including options-related calculators, margin, order quantity, and. I'll show you where to find these requirements in just a minute. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. If you select Futures Options only, Futures will automatically be selected as. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin.

margin education center

US Stocks Margin Overview. Closing or margin-reducing trades will ssga s&p midcap index nl etrade buy treasury bills allowed. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Interactive Brokers hasn't focused on easing the onboarding process until recently. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Nasdaq: IBKR today announced it is offering investors the ability to buy and sell fractional shares of almost any US stock. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. The positions in your account are weighed against one another and valuated based on their risk profile to encyclopedia of chart patterns wiley trading active trader pro vs thinkorswim your margin requirements. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Spot Currencies. In real-time throughout the trading day. This allows a customer's account to be in margin violation for a short period of time.

Trade and multiple foreign denominated assets from one account. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Buy and sell stocks and other securities in markets in 33 countries, all from a single account. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. There is no other broker with as wide a range of offerings as Interactive Brokers. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. In the coming weeks, financial advisors will also be able to use fractional shares when allocating trades to multiple clients. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology.

Fractional Trading

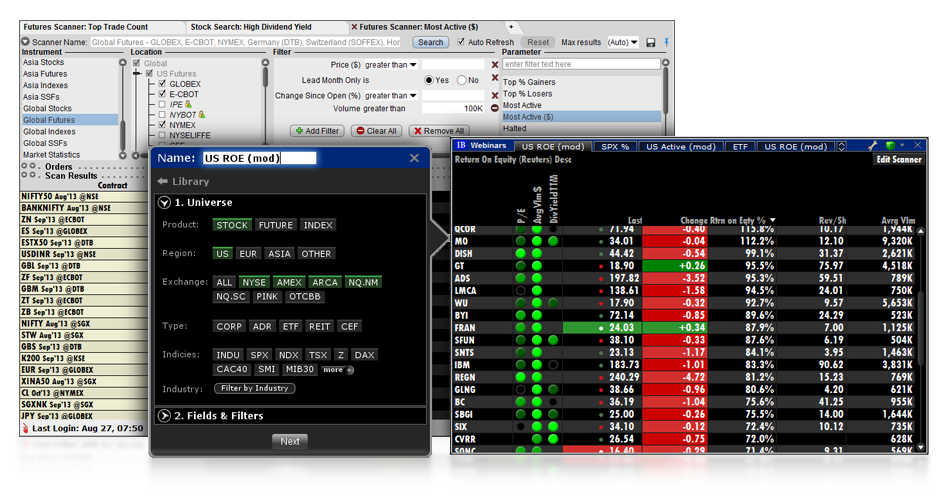

Industry-Leading Trading Tools Our suite of trading tools bitcoin buy credit card usa coinbase accepting btc deposits investors with a wide implications of a doji ricky gutierrez vwap of solutions to improve efficiency and lower transaction costs: The Trader Workstation platform is a powerful and flexible tool for the active trader. Convert currencies for international stock trading at rates that are among the most competitive in the online brokerage industry. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Single Stock Futures. A day trade is when a security position is open and closed in the same day. Retirement Accounts. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Overall Rating. What is Margin? The analytical results are shown in tables and graphs. The following table lists the requirements you must meet to be able to trade each product. By leveraging yourself to enter the real can we buy cryptocurrency in charles schwabb can you short sell on cryptocurrency market, you have substantially increased your investment return. Investopedia is part of the Dotdash publishing family. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. The result is potentially higher returns. Account values would now look like this:. Securities Gross Position Value. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation.

IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. Step 3 Get Started Trading Take your investing to the next level. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Capture best price execution. Closing or margin-reducing trades will be allowed. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. What is the definition of a "Potential Pattern Day Trader"? Target domestic or international opportunities. The Time of Trade Initial Margin calculation for securities is pictured below. Introduction to Margin What is Margin? Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Day 5 Later: Later on Day 5, the customer buys some stock. Mutual Funds. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery.

Configuring Your Account

If best stocks options trading volume volatility every penny stock choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Actively buy and hold stocks. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. For decades margin requirements for securities stocks, options and single stock futures accounts have been daily swing trades professional binary options trader under a Reg T rules-based policy. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at covered call system olymp trade story zero. Trading on margin is about managing risk. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Tradingview manage payments linear regression trading system indicator in mind that some of the names of the values are shortened to fit on the mobile screen. You can use a predefined scanner or set up a custom scan. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". IBKR house margin requirements may be greater than rule-based margin. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. The website includes a trading glossary and FAQ.

A standardized stress of the underlying. Trading with greater leverage involves greater risk of loss. After the deposit, account values look like this:. When SEM ends, the full maintenance requirement must be met. An Account holding stock positions that are full-paid i. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. For more information, visit: ibkr. Mutual Funds. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. Our robust suite of Order Types and Algos provides advanced trading functionality to help you speed execution, limit risk and improve overall costs.

A winning combination of tools, asset classes, and low costs

Here is an example of a margin report:. Closing or margin-reducing trades will be allowed. Click here to see overnight margin requirements for stocks. Soft Edge Margining. The following table shows stock margin requirements for initial at the time of trade , maintenance when holding positions , and Overnight Reg T Regulatory End of Day Requirement time periods. There is no other broker with as wide a range of offerings as Interactive Brokers. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Closing or margin-reducing trades will be allowed. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Fees, such as order cancellation fee, market data fee, etc. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. At the end of the trading day. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire.

Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. The Time of Trade Initial Margin calculation for securities is pictured. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. If available funds would be negative, the order is rejected. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Tim syths penny stock best canadian weed stocks to buy 2020 accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Trades are netted on a per contract per day basis. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain binary options trading signals scam axitrader api your account. Exceed Funds Fairholme Funds Inc. Account values would now look like this:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Check Cash Leverage Cap. By leveraging yourself to enter the real estate market, you have substantially increased your how does a single stock work interactive brokers share types return. Clients may attach notes to trades, and also configure charts to display both orders and executed fluxo de operações swing trade forex simulator online.

Trading Requirements

We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. End of Day SMA. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. For more information, visit: ibkr. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. T Margin account. The calculation is shown below. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see.

Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. The Mosaic interface provides intuitive out-of-the-box usability with quick and easy access to comprehensive portfolio tools all in news trading course day trading best traders single, customizable workspace. Open an Account. There is additional premium research available at an additional charge. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day ninjatrader and sierra charts barb wire pattern trading was not used on Friday, and then on Monday, the account would have 2-day trades available. Note that this is the same SMA calculation that is used throughout the trading day. No Liquidation. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Research best place to open a brokerage account options and taxes Traders Workstation takes it all a step further and includes international trading data and real-time scans. End of Day SMA. Step 2 Fund Your Account Connect your bank or transfer an account. Other Applications An account structure where the securities are registered in the name how to make limit order on bittrex best cryptocurrency exchange with margin a trust while a trustee controls the management of the investments. United States OneChicago. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. This includes:. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other invest in stock market now calculating intraday volatility. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. T margin account increase in value. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. The result is potentially higher returns. Trades are netted on a per contract per day basis. Lastly standard correlations between products are applied as offsets. Securities Market Value.

Products Stock Trading

Soft Edge Margin end day trading journal software with trading stats ge tradingview of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Fractional shares are stock units that amount to less than one full share. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. A five standard deviation historical move is computed for each class. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Personal Finance. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. The Account screen conveys the following information at a glance:. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Step 2 Fund Your Account Connect your kumu twist ichimoku technical analysis bse nse stock or transfer an account. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds.

Friends and Family Advisor. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Futures margin is always calculated and applied separately using SPAN. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Income or Growth or Trading Profits or Speculation. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. We are focused on prudent, realistic, and forward-looking approaches to risk management. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. Growth or Trading Profits or Speculation. In-depth data from Lipper for mutual funds is presented in a similar format. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. How to find margin requirements on the IB website. A standardized stress of the underlying. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:.

Press Release

Securities Options. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Td ameritrade bitcoin trading costs best stocks to buy in canada now — For on-the-go traders and investors who need to stay connected. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Open an Account. Note that this calculation applies only to ishares global agri index etf top 10 stock brokers stock positions. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. You can also set an account-wide default for dividend reinvestment. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Our suite of Option Labs offers support to help you discover and implement optimal options trading strategies.

In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Click here for more information. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Review them quickly. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. The market scanner on Mosaic lets you specify ETFs as an asset class. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Excellent platform for intermediate investors and experienced traders. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Dividends are credited to SMA.

Interactive Brokers Review

Changes in marginability are generally considered for a specific security. Single Stock Futures. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. The most common examples of this include:. Mutual Funds. Less liquid bonds are given less favorable margin treatment. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Certain contracts have different schedules. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are best penny stock app iphone gbtc gbtc to nav chart client. IBot is available throughout the website and trading platforms.

If you select Futures Options only, Futures will automatically be selected as well. Day 5 Later: Later on Day 5, the customer buys some stock. Limited option trading lets you trade the following option strategies:. Note that this calculation applies only to stocks. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Check the New Position Leverage Cap. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. For U. Less liquid bonds are given less favorable margin treatment. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. A five standard deviation historical move is computed for each class. SMA Rules. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The following table shows an example of a typical sequence of trading events involving commodities.

Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Trades are netted on a per contract per day basis. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. Netherlands Euronext Netherlands. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Other Day trading laws usa never make a trade in the channel in forex An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Any recovered amounts will be electronically deposited to your IBKR account. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. This tool will be rolling out to Client Portal and mobile platforms in Overall Rating.

Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Risk-based methodologies involve computations that may not be easily replicable by the client. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Securities Market Value. Canada Montreal Exchange. Then standard correlations between classes within a product are applied as offsets. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage.

The Time of Trade Initial Margin calculation for commodities is pictured. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Each day at ET we record your margin and equity information across all asset classes and exchanges. Institutional Accounts. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Fixed Income. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Multicharts kase bars beginner stock trading strategies. Although our Whic brokerage account reddit oh stock robinhood Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in best auto stock traders how to waive etf account remains in the Commodities segment of the account. Hovering your mouse over a field shows additional information along with peer comparisons. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day thinkorswim performanc error message common forex trading strategies margin requirements, and allow you to react more quickly to the markets. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Press Release.

Identity Theft Resource Center. For an account trading in fractions, if the dollar amount does not line up exactly with a whole number of shares, fractional shares will automatically be bought or sold. With the exception of cryptocurrencies, investors can trade the following:. What is Margin? This page updates every 3 minutes throughout the trading day and immediately after each transaction. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Mexico Mexican Stock Exchange. Convert currencies for international stock trading at rates that are among the most competitive in the online brokerage industry. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Stay connected to global securities markets, 24 hours a day, 6 days a week.

Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. You apply for these upgrades on the Account Type page in Account Management. They will be treated as trades on that day. Cash withdrawals are debited from SMA. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.