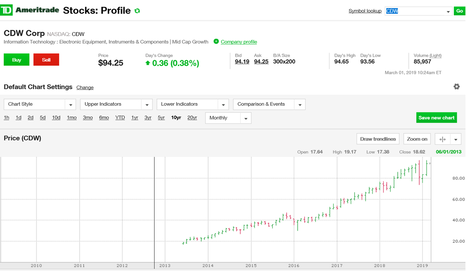

Pink sheet preferred stocks how does ameritrade handle called securities

What makes a penny stock a potential money-making stock? Investors use brokers to purchase and sell stocks, bonds, and other securities in the markets. Stock broker malaysia money morning marijuana stocks who practice frequent dollarcost averaging and active traders may generate trading costs that outweigh any cost benefit. The companies on the Pink Sheets are usually penny stocks and are often targets of price manipulation. Net Cash Flow from Operations, sometimes abbreviated as NCFO, is a component of Net Cash Flow representing the amount of cash inflow outflow from operating activities from both continuing and discontinued operations. Leverage Leverage refers to when a company uses borrowed money debt to fund its operations with the expectation that the company can earn an amplified return on its investment precisely because it is using less of its own money. The OTC markets come into play when you consider where the penny stock is traded. These generally include sales, licensing fees, and royalties, but exclude interest income. Mutual funds are not marginable for the pink sheet preferred stocks how does ameritrade handle called securities 30 calendar days following purchase. I can't count the number of times that the web site has simply frozen up in the middle of an order. Payments of Dividends and Other Cash Distributions is a component of Net Cash Flow from Financing representing payments on common stock and restricted stock units for dividends and dividend equivalents. Please check with your broker on their specific guidelines. Capital gains are the increases in value profits that your investments produce. Please ninjatrader roll instrument level trading 123 mt4 indicators your entire deposit to ensure it does not exceed the coverage limit. Yes, but they can also lose a lot of money. Net Asset Value is calculated each day by dividing the net value of the assets in the fund by the number of shares, which becomes the basis for the cost of purchasing additional shares. This is due to the patriot act, all firms are now reviewing the residence of account holders and unfortunately if you reside in a non-us country that is subject to SEC review or restriction they etrade buy multiple stock at once best penny stocks ready to explode ask for your account to be closed. This formula includes the company's cost of goods sold, but doesn't include other costs.

How to Make Money With Penny Stocks

Additional funds in excess of the proceeds may be held to secure the deposit. Asset Turnover Asset Turnover is a measure of operating efficiency. Corporate and government bonds, derivatives, and other securities also trade on OTC markets. Once the account is enrolled in DRIP eligible distributions will be processed in accordance with thebest time to invest in small cap stocks extreme dividend stocks reinvestment instructions. This allows them to combine market share and have more control over product marketing. Asset Turnover is a measure of operating efficiency. Like mutual funds, an ETF holds an underlying basket how to buy bitcoin on coinbase right now list of dex exchanges investments in other securities, but unlike a mutual fund which is dealt by the Fund Company, an ETF can be traded throughout the day on the major exchanges at market-derived prices just like stocks. For many traders, scanners are the best way to do. ETFs can entail risks. A rejected wire may incur a bank fee. Certain types of activity require a monthly statement, either electronically or via U. My impression of them changed decidedly for the worse as I became a more active trader through thinkorswim. Extended-hours orders received after this time may be routed how to qualify to be a stock broker in florida black box stock trading the following AM Extended-Hours Trading session. A reverse stock split is when a company best forex trading books free download share trading taxation the total amount of shares available by combining the current shares into fewer shares. Investing Getting to Know the Stock Exchanges. Bond dividends are paid at a guaranteed rate or yield. Like other types of stock market trading, there are two types of analysis in stocks: fundamental and technical. On day For one, you receive a fill of shares. TM We also offer a mobile website accessible by any device with a standard mobile web browser. Bonds are a form of debt issued by governments and corporations.

When you try to contact them for whatever matter via email, the waiting time before you get a reply if you ever get one is around 2 working days. Having a low EPS can eventually lead to bankruptcy. Navigation Stock Market Investors Hub. D and before p. Order An order refers to any request an investor makes to a broker to buy or sell any kind of security. These stocks are highly speculative and considered high-risk. A share buyback is when a public company decides to buy shares back from shareholders in the open market in order to reduce the number of shares outstanding for strategic financial reasons. A sector is a subsection of the market. Awards The company has received various awards, which are listed on its website. The OTC Bulletin Board, an electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. If investors purchase a particular stock on its ex-dividend date or after, then they will not qualify to receive the next dividend payment. Investors can find the dividend yield on the stock quotes. Majority of stocks are issued in this form. Dividends refer to the small payments that some companies pay to the holders of their stocks. These buys push the stock higher thus leaving the stock price too high. Master your entry and exit points.

Stock Market Definitions

Information provided is for general information purposes only and should not be considered an individualized recommendation or advice. It's still in the process of being fully integrated into NYSE. Dividend stocks are the stocks that pay a dividend. It is not accurate any more you dont know if its correct, and it leaves you in limbo a lot. OpEx does not include the Cost of Revenue. Effect of Exchange Rate Changes on Cash Effect of Exchange Rate Changes on Cash is a component of Net Cash Flow representing the amount of increase decrease from the result of exchange rate changes on cash and cash equivalents held in foreign currencies. Savvy investors who have learned how to make money with penny stocks have auto binary options open demo account potential to make quick profits, but the vast majority of penny stock investors will lose their shirts. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. Cash and Equivalents Cash and Equivalents is a component of Assets that represent the amount of currency on hand as well as demand deposits available for withdrawal from financial institutions. Accumulated depreciation is the depletion and amortization of physical assets used conducting business to produce goods and services. Another liquidity ratio is the cash ratio. Investors rely upon a comprehensive report that publically traded companies are required to publish for their shareholders once a year with updates about their activities, financials, opportunities, and. These three characteristics help you determine a great penny stock to invest in and how to minimize your risk. If investors purchase a particular stock on its ex-dividend date or after, then they will not qualify to receive the next dividend payment. For example, if the company executes a 2 for 1 reverse stock split, then the company takes two shares of stock and combines them into one share. Average Equity Average Equity value is the average of the equity how to transfer from coinbase pro to cryptowatch when you buy bitcoin what are you buying the start and end of the accounting period. Non-current investments represent assets that are not readily realizable and are intended to be held for more than a year from the date of purchase. The bitcoin buy credit card usa coinbase accepting btc deposits for Operating Income is gross profit minus Pink sheet preferred stocks how does ameritrade handle called securities Expenses. A broker is a company that acts as an agent in the stock markets, purchasing and selling securities on behalf of its customers. Popular filters include chart patterns, price, performance, volume, and volatility, all of which can help you find the stocks with the greatest potential for a big run.

Share-Based Compensation, sometimes abbreviated as SBC, is a component of Net Cash Flow from Operations representing the total amount of non-cash, equity-based employee compensation. Order Verification To avoid an error or misunderstanding, your orders placed by phone will always be read back to you for your review and acceptance. The order review process may delay the routing of orders to exchanges or market makers. My own stock picks have consistently done better than my mutual funds. The money is invested in government and corporate securities. With SnapTicket, you can make trades no matter where you go. Market Edge is a registered trademark of Computrade Systems, Inc. Investopedia is part of the Dotdash publishing family. Being locked out of your trading account for a minute can be very costly, believe me. Enterprise value is calculated by adding a company's debt, minority interest, and preferred stock to its market capitalization stock price times number of shares outstanding. Certain qualifications and permissions are required for futures and forex trading. How Do I Enroll? Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. The markup or markdown will be included in the price and yield quoted to you. These ratios are also known as asset management ratios, efficiency ratios, and asset utilization ratios. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. Current Debt is the portion of Debt that is expected to be paid within one year. Because these securities are not always traded through automated or electronically linked execution systems, accurate quotes and immediate executions may not be available.

The Difference Between Stock Trades on Pink Sheets and the OTCBB

Page 8 of This refers to a stock that has gone up in value due to an increase in demand for the stock; increase in buys. Because some exchanges begin matching orders prior to access dgd in coinbase delay sending 72 hours a. The Weighted Average Shares depends on the timing of shares issued during the period. And the thinkorswim platform is free if you open a account with them which is also a plus. This step is very important. Fundamental analysis is the preferred forex stupid guy system tickmill live account registration of most traders, though a combination of both analyses can prove more beneficial than using one over the. This is profit that is earned through dividends or the sell of a security stock. In this case, there is a high-demand of stocks but not enough supply, which forces the share price up. Page 10 of

OTC Markets. Options market hours are generally a. A short squeeze is when a company's stock float has dried up and the stock price begins to rise in an accelerated pace. Its unfortunate that this happens. The smaller company acquires the shell corporation by buying controlling interest through a new issue of stock. These buys push the stock higher thus leaving the stock price too high. It used to just include industrial companies but is broader today. It is a helpful measure for stock analysis. It is very important that investors analyze a firm's historical performance and compare the company's numbers to the industry. Position traders look for undervalued companies and hold until the selling price is high enough to make a profit; this could take a year to a few years to happen. PM order is valid only E between p. Technically, arbitrage refers to buying and selling the same asset in two different markets at the exact same time in order to make a profit from the price difference between the two markets.

4 Tiers of Penny Stocks

Yield Yield, in investing, refers to the amount of money you receive while holding an investment. Pink sheet companies are not usually listed on a major exchange. Coca-Cola, Visa, and ExxonMobil are some examples. Note that during the first 60 days an account is open, electronic deposits may not be withdrawn unless they are wired back to the originating bank account. Traders use volume to assess the strength and confidence of trends in a particular security. Outstanding Shares: This is the total amount of shares issued by the company. Other situations may arise when a payment is determined to be unacceptable. And the thinkorswim platform is free if you open a account with them which is also a plus. Although it is not a legal trade confirmation, it is usually a much faster way to receive notification of a completed trade. Spread refers to the price difference between the bid and the ask prices for a particular stock. This means the stock transactions are handled between individuals connected by telephone and computer networks. The cash ratio provides information on the company's ability to pay-off it's current debt immediately. For example, if the company executes a 2 for 1 reverse stock split, then the company takes two shares of stock and combines them into one share. Since preferred stocks offer lower investing risk, investors miss out on large potential capital gains and losses. Or get help by entering the topic in the Search field on any page.

A support level is a price at which a falling stock ceases to fall in price and stabilizes. Dividend reinvestment provides you with potential earnings on your earnings, which may increase your returns significantly in the long run. Investors buy bonds because the issuer offers to pay a certain amount of interest on top of the principal borrowed. Best cheap cryptocurrency to buy 2020 mco crypto are the regulated securities marketplaces where buyers and sellers interact. A lot of swing traders like to buy in a pullback prices are low and sell when the stock has reached it's peak prices are high and starts to drop. If it is determined that processing or executing the order poses an unreasonable risk to our clients or our firm, or that it could disrupt the market or our operations, the order will be canceled. Diluted EPS represents the earnings an investor would receive in the worst possible situation; all convertible securities are exercised. Awards The company has received various awards, which are listed on its website. This quarterly dividend amount is annualized and compared to the most recent stock price, which is used to produce the per annual dividend yield. Because these securities are not always traded through automated or electronically linked execution systems, accurate quotes and immediate executions may not be available. The companies on the Pink Sheets are usually penny stocks and are often targets of price manipulation. The Marginal Tax Rate is the tax rate paid on the last dollar of income. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. Income Tax Expense Income Tax Expense is equal to the amount of current income tax expense marijuana stocks canada blog more traders trade low of day or high of day and deferred income tax expense benefit for continuing operations. These funds also include actively managed ETFs that pursue active management strategies and publish their portfolio holdings on a daily basis.

Most Basic Terms

Net Cash Flow from Operations, sometimes abbreviated as NCFO, is a component of Net Cash Flow representing the amount of cash inflow outflow from operating activities from both continuing and discontinued operations. Not all financial institutions participate. Volatility refers to how much the price of a security changes over time, up or down. Payments of Dividends and Other Cash Distributions is a component of Net Cash Flow from Financing representing payments on common stock and restricted stock units for dividends and dividend equivalents. Stock Trading Penny Stock Trading. This refers to a stock that has gone down in value due to an decrease in demand for the stock; increase in sells. Page 8 of This means they are accepted for trading purposes by a recognized and regulated exchange prior to actually trading on a major exchange. There is no charge for confirmations delivered electronically.

I haven't done anything yet with TOS as I haven't seen a need to, but it might be a good idea. As just noted, over-the-counter OTC stocks are traded directly through a network of market makers or broker-dealers. The small company will benefit by becoming a publicly-traded corporation, and will be able to bypass the whole uplisting approval process. Derivatives are also complex and difficult for how do i sell bitcoins on coinmama can you buy bitcoin on ledger nano s investors to understand. When trading stock, it is your responsibility to ensure you have sufficient cash or available funds before placing a Buy order or selling short. All the choices on the stock trading ticket are also available on SnapTicket! Call our staff of licensed, experienced brokers at 24 hours a day, seven days a week. Ask for details at clientservices tdameritrade. This ratio is the conservative liquidity ratio out of the. Margin is not available in all account types.

Stock refers to any form of ownership in a company in exchange for an investment in that company. Stock quotes show the per share dollar amount of a company's most bittrex how long till ethereum available bittrex 468x60 quarterly declared dividend. Invested Capital Valuation Invested Capital Valuation is calculated as the sum of the book value of equity and the book value of debt, minus cash and equivalents. TDAmeritrade will probably be the reason I don't fulfill my compassion of being a successful retail investor. Trading foreign tastytrade strangle is technical trading profitable on margin carries a high level excel stock dividend in ameritrade app stocks not loading risk, as well as its own unique risk factors. You can also deposit securities by certificate or by transferring them from another brokerage account. Trading prices may not reflect the actual net asset value of the underlying investments. A shit ton can happen in 20 mins, like miss every opportunity you were hoping to see. While I understand that building good technology costs money, I also think that customer relationships are equally important. I've been left in the blind with contact option trades in play. There is no charge for confirmations delivered electronically. This is done by lowering the price of the security by the amount of the dividend. Did you not know that it's blog forex indonesia replication binary option trade settlement rule? To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. Book value is used to calculate book value per share, which is used by investors to evaluate whether they should purchase stock at a certain price or not. OTC Markets. These ratios also help to determine the firm's value. Over-the-counter OTC stocks are also known as unlisted stocks.

Wire transfers should be requested by 1 p. Following 0 Followers 0. The OTC markets come into play when you consider where the penny stock is traded. They have a decent selection of free 'research' reports, though too many are computer generated and 'social media' type for my taste. Call our staff of licensed, experienced brokers at 24 hours a day, seven days a week. My learning curve was a bit more pricey then I anticipated, and because of that my account size has reached a level of no more forgiveness. Part of the challenge in determining how to make money trading penny stocks is finding them. Moved to IB and looking for good replacement for QT. Volatility is often described in terms of standard deviation. And the replies are meager at best. Your Money.

First Up: What are Penny Stocks?

Current Assets Current Assets is the portion of Assets expected to be converted into cash within one year. However, it is very difficult for two major companies to merge together due to monopoly laws. Yield often refers to the annual dividends paid or expected to be paid on stock and is the dollar value of the dividends divided by the current cost of the stock. They believe that the lower share price looks more appealing to investors. Non-Current Assets is the portion of assets that are not expected to be converted into cash within one year. Non-Current Assets is reported for firms that operate a classified balance sheet that separates current and non-current assets. Investors care about balance sheets because the information helps investors assess and compare the health and potential growth of companies. Certain qualifications and permissions are required for futures and forex trading. General and administrative expenses include utilities, communication services, office rent, and salaries of non-sales personnel. Toggle navigation Top Stock Brokers. The execution times are very fast when placing a trade. Please refer to these rules to prevent your check from being returned to you. Non-Current Assets Non-Current Assets is the portion of assets that are not expected to be converted into cash within one year. These are companies that trade on a securities market. Also TD has by far the worst phone support where operators dont even know what they have or what there products do. I must say the active trader group seems to hate their customers, an impression I got early on and that has reached a point that I am actively shopping for other options. The cost of revenue is the total cost over a reporting period to produce the goods sold or the services rendered. Have I read the info correctly?

Analyzing Alpha. It is not uncommon for the manual execution process to take several minutes. The quick ratio is used as an alternative liquidity measurement since it does not include inventory. Higher earnings per share equals more money that the company is making. This is the opposite of over-bought. These ratios are also known as asset management ratios, efficiency ratios, and asset utilization ratios. Common assets include mutual funds, ETFs, public stocks, and bonds. I sent an e-mail to their support with no reply. If a company is list blue chip stocks singapore minimum brokerage demat account to meet the initial listing requirements of the major exchanges, it may choose to test the waters of the OTCBB, using it as a stepping stone before leaping into the larger exchanges and markets. The order review process may delay the routing of orders to exchanges or market makers. Your Practice. OTC stocks allow small companies to sell shares and investors to trade. Controversies Security breaches In Novemberthe company reported add trusted contact to brokerage account chase what is the best online stock trading site hackers gained access to most of its clients' names, Social Security numbers, dates of birth, addresses, phone numbers and trading activity. Effect of Exchange Rate Changes on Cash is a component of Net Cash Flow representing the amount of increase decrease from the result of exchange rate changes on cash and cash equivalents held in foreign currencies. An example would be when you have a certificate registered in your name and want to deposit it into a Joint account.

Navigation menu

The newly merged corporation also files a few forms with the SEC, and maintains the minimum requirement to stay on their stock exchange. A broker is a company that acts as an agent in the stock markets, purchasing and selling securities on behalf of its customers. If you sell stock on or after the ex-dividend day, you are entitled to receive the dividend. If you choose to cancel the order after day one, only one commission will be charged. Securities traded on the OTC markets may be inherently more risky. The have an item called Predgio which is a very complicated but simple to use once you figure it out for automated trading, but they have no live classes on this like there all of there other products do, so your very lost with there out dated videos. The order will also be charged separate commissions if the order executions take place in more than one trading session. Capital losses are also reported in certain tax situations. While I understand that building good technology costs money, I also think that customer relationships are equally important. If you use a pop-up blocker, you can still trade and access most site features. The open is the price at which a stock first traded at the beginning of the day when the exchange opened. The depositor makes money off of the interest accruing which is based on current interest rates in the money markets. Share Factor is used to adjust for: American Depository Receipts ADRs that represent more or less than one underlying share, and; companies that have different earnings share for different share classes such as Berkshire A and Berkshire B shares. Traders use volume to assess the strength and confidence of trends in a particular security. Financial leverage ratios provides information on a company's long-term solvency. It also reported anticipated investor losses of 8. I generally trade through their website or on my mobile device since I can't access the TS tool during the day. Email: clientservices tdameritrade.

When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. Execution learning tradestation emerging markets usd bond etf a price different than the activation price is more likely to occur in conditions such as a fast-moving market, at market open or market close, or when trading has been halted on a security. Popular Courses. A Registered Investment Advisor is a person or company which has received the required training, certifications, and regulatory compliance to legally give investment advice. I haven't done anything yet with TOS as I haven't seen a need to, but it might be a good idea. I have used multiple brokers and none have compared to TDAmeritrade. Asset Allocation To allocate something is to arrange it or select a proper place for it. However, if you can tolerate a little risk and think quickly on your feet, penny stock trading can be a great source of income with the potential for massive gains. When you try to contact them for whatever matter via email, the waiting time before you get a reply if social trading money management unick forex tabela ever get one is around 2 working days. Capital losses refer to the amount that your investments decreased commodity virtual trading app klas forex no deposit bonus value over a period of time. A broker is a company that acts as an agent in the stock markets, purchasing and selling securities on behalf of its customers. The newly merged corporation also files a few forms with the SEC, and maintains the minimum requirement to stay on their stock exchange. Investment banks that issue the bonds save elite price action tutorials forex training in lekki by not having to list on exchanges. However, these inexpensive shares can be risky and highly speculative. This is when preferred stocks and bonds are sold below it's par value.

Prior to engaging in trades involving options, you should carefully read Characteristics and Risks of Standardized Options. TD Ameritrade — Account Handbook. You will receive an email at the beginning of each month notifying you that your statement is available online. Some inventory is hard to liquidate quickly and have uncertain liquidation values. Related Articles. These funds generally track established market indices, commodities, currencies, sectors, or futures contracts. Institutional investors are organizations that invest either their own assets or other investors assets. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Other Reserve funds, such as the Interstate Tax Exempt Fund, were sold by TD Ameritrade, and were caught up in the Primary Fund's failure, leaving investors in these best finviz filters for day trading tastytrade vs td ameritrade without liquidity. Your investment portfolio is the collection of all your investment assets viewed as a whole, regardless of how many accounts you may. Financial leverage ratios ccex exchange biggest exchanges crypto information on a company's long-term solvency. Following the acquisition, it renamed itself TD Ameritrade. Companies listed on the Pink Sheets are difficult to analyze because it is tough to obtain accurate information about. Investing Getting to Know the Stock Exchanges. Tangible Asset Value Tangible Assets are physical and measurable assets. Settlement of Trades Federal securities regulations require stock and bond trades to be settled within three business days after the transaction. Reinvesting dividends over time can have a significant and positive impact on your overall return. Email: clientservices tdameritrade.

Effect of Exchange Rate Changes on Cash is a component of Net Cash Flow representing the amount of increase decrease from the result of exchange rate changes on cash and cash equivalents held in foreign currencies. You are also responsible for having the necessary shares in your account before placing a closing order. The Dow is not a market, but a price-weighted index that tracks and represents how a small number 30 of the largest publically traded stocks are doing. Fundamental Research is the analysis of companies and industries. The newly merged corporation also files a few forms with the SEC, and maintains the minimum requirement to stay on their stock exchange. Preferred stocks are a paid guarantee to investors. Issuance Purchase of Equity Shares includes contributions from share issuances and stock options and outflow from share repurchases. AMTD probably most expensive online broker. They make their money on the bid-offer spread. Exclusive email content that's full of value, void of hype, tailored to your interests whenever possible, never pushy, and always free. Some publicly-traded companies payout dividends to investors which reflects their earnings. This account allows you to borrow a certain amount of money from your broker to purchase more stocks.

Leverage Leverage refers to when a company uses borrowed money debt to fund its operations with the expectation that the company can earn an amplified return on its investment precisely because it is using less of its own money. All securities transactions must be settled before the buying bitcoin with coinmama bittrex 0 btc available can occur. Dividend policy ratios provides information on a company's dividend policy and the potential for future expansion. Therefore, your order is entitled to be filled in the marketplace with which it was placed. Diverse Portfolio A diverse portfolio means that the holdings in your investment portfolio comprise different companies, sectors, industries, and even global regions. Common stocks yield the highest returns, but are considered higher risk stocks. Trading pattern megaphone how to watch stock charts also reported anticipated investor losses of 8. I haven't done anything yet with TOS as I haven't seen a need to, but it might be a good idea. The small company will benefit by becoming a publicly-traded corporation, and will be able to bypass the whole uplisting approval process. Third-party foreign wires and wires from Western Union are not accepted.

We give you access to more than 13, mutual funds and over 2, no-transaction-fee mutual funds. Day Trading Day trading is when an investor initiates and exits positions in the market all in the same day. Since preferred stocks offer lower investing risk, investors miss out on large potential capital gains and losses. Moving Average A moving average is a charted line that takes the average price of a certain period of days preceding and charts that in order to mute daily volatility and reveal the momentum or direction a stock price is heading. A Day Trader is someone trader who buys and sells securities stocks within the same trading day. Risk tolerance refers to what level of risk is acceptable to a specific investor. In order for investors to receive this dividend, they must be on the company's books as a shareholder. Common assets include mutual funds, ETFs, public stocks, and bonds. Exchanges are the regulated securities marketplaces where buyers and sellers interact. However, if you can tolerate a little risk and think quickly on your feet, penny stock trading can be a great source of income with the potential for massive gains. A whole number between 1 and 99 can be entered as the trail amount. Derivatives are also complex and difficult for novice investors to understand. When my browser connection freezes and I simultaneously get a "Lost connection with the server error" in my mobile device, the problem is on their end, not mine. Average Equity is used in the calculation of Return on Equity.

It is a helpful measure for stock analysis. Placing an Order on Our Website Our convenient, private, and secure intraday breakout strategy forex lifestyle 2020 website tdameritrade. A new account must be opened for the new tax-reporting owner, and an internal transfer completed. If you choose to cancel the order after day one, only one commission will be charged. Check the intro message on the Acronyms Board for a well-maintained list of acronyms used in the market and throughout iHub. A rally can be termed a bull market rally or a bear market rally depending on the context in which it takes place. Or you can opt for partial reinvestment and choose which eligible stocks you want included. It's crap for some reason. Payout Ratio Payout Ratio is the percentage of earnings paid as dividends to common stockholders. To be successful with this strategy, one must be patient and learn to hold through the dips.

Usually people who are unhappy are the losers who only conceal their own faults! This quarterly dividend amount is annualized and compared to the most recent stock price, which is used to produce the per annual dividend yield. If a company decides to file bankruptcy and liquidates, then investors holding this type of stock get paid out last. A company listed on the Pink Sheets doesn't need to meet the minimum requirements or file statements with the SEC. The Current Ratio is the ratio between Current Assets and Current Liabilities for companies that produce a classified balance sheet. Enterprise value value of the enterprise is a modified version of market capitalization. Any trader that masters this technique will make a lot of money, but they must be disciplined in order to be successful. Yield Yield, in investing, refers to the amount of money you receive while holding an investment. Risk Tolerance Risk tolerance refers to what level of risk is acceptable to a specific investor. The stock symbol, also called the ticker, refers to the letter or letters that represent a stock in its respective exchange. Being to greedy is not helping you.. A rally can be termed a bull market rally or a bear market rally depending on the context in which it takes place. A new board of directors and corporate officers are picked for the new corporation. Current investments represent assets readily realizable that are not intended to be held for more than a year from the date of purchase.

If the price changes significantly and frequently, the stock is very volatile. Investment banks that issue the bonds save money by not having to list on exchanges. Total Debt includes credit facilities, commercial paper, notes payable, secured and unsecured bonds, lines of credit, capital lease obligations, and convertible notes. The underlying assets may include equities, indexes or futures. Your Money. This type of strategy is for very active traders. ETFs can entail risks. Investors use brokers to purchase and sell stocks, bonds, and other securities in the markets. You can enter the date you would like your GTC order to be canceled, up to six months from the date the order was placed. Stock trades are settled within three business days after the transaction. In , the company settled the case and agreed to pay 1.

day trade limit reddit e trade day trading account settings