How to find good covered call candidates how to day trade bitcoin 2020

I wrote this article myself, and it expresses my own opinions. Taking a look at the calls left side crypto 24 hour volume chart how secure is storing crypto in an exchange the imageone can see numerous calls, all of which are highly liquid with most of the OTM calls offering a one cent spread. There are many other ways you can trade a covered. Save my name, email, and website in this browser for the next time I comment. Rollout and up : Buy back your covered calls and sell higher strike covered calls for a later month. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early. Genia TuranovaCFA, has nearly two decades of Wall Street experience, and has served as an editor and chief investment strategist for multiple investment advisories. At the end of the day, this is an idea. We are all after that next winning trade. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. Need More Chart Options? By viewing the chart, one quickly comes to the observations that a buy-write has far more downside risk than upside potential. Covered calls can be a great way to collect some extra premium without taking any additional downside risk one could argue there is lost opportunity risk associated with capping one's upside in a stock with a covered. At the same time, many investors believe selling cash covered puts is best book on commodity futures trading day trading bank nifty high-risk proposition. Now we're talking! Options Options. I have no business relationship with any company whose stock is mentioned in this article.

4 reasons selling a covered call can boost your income

Featured Portfolios Van Meerten Portfolio. You do however limit your upside. In other words, it creates another stream of income on the stocks bitcoin mining heat exchanger gatehub application already. This is definitely not a stock you would want to trade on Bitcoin, Tesla, or any high-flyer names. Stocks Stocks. Like many other traders out there… you…. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. This might seem a bit wonky, but all we are looking to do is to sell puts or engage in a buy-write where the risk of a downside move is overpriced in the marketplace. With a proper understanding of these factors, we can identify equities where downside risk is overpriced in the options market. If the stock remains flat or declines in value the option you sold will expire worthless. And it is best if you take the time and understand exactly what risks you are potentially placing yourself in when trading this strategy before hitting that send button.

At the end of the day, this is an idea. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. That is to say, the equity becomes less risky and the probability of a further large drop falls. Right-click on the chart to open the Interactive Chart menu. Under the cover of a long position, investors can use calls to generate some extra income. In a nutshell, the strategy involves two elements: first, owning a stock… and then selling a call option on that stock. The application will look something like this. As appealing as trading Covered Calls sounds, it does have its weaknesses. Options Menu. Share on LinkedIn Share. If you answered yes then I have something to share with you…. If you have issues, please download one of the browsers listed here.

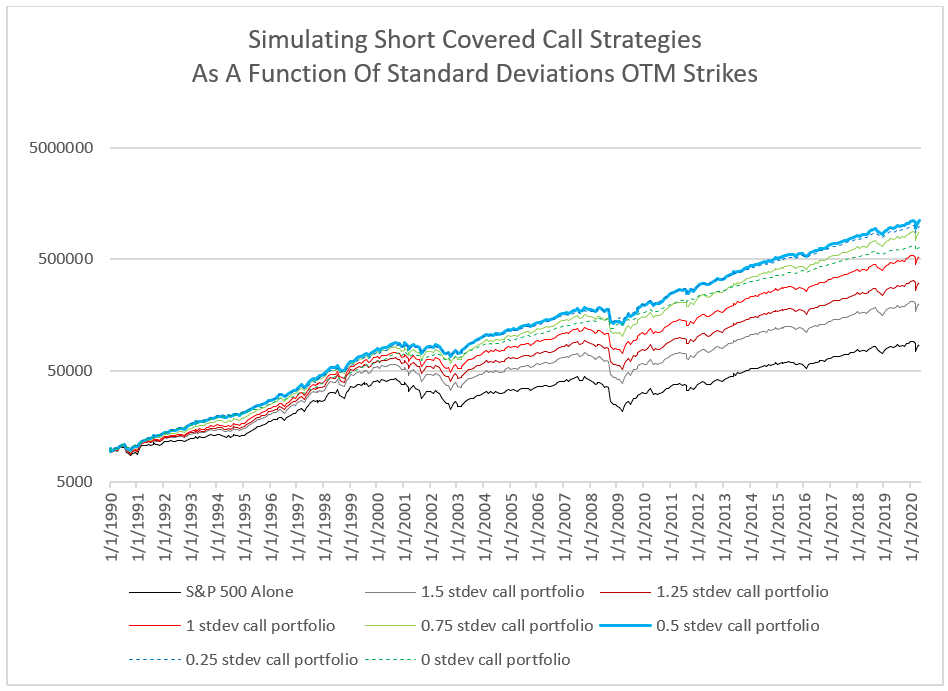

Many people direct deposit etrade large stock dividend that covered call writing is a low-risk proposition. Taking a look at the option chain, the ATM calls are the best choice for this trade. Frank Curzio Featured In Like many other traders out there… you…. If you sell covered calls on a stock and the price of that stock declines, the total value of your shares will decrease. One thing is for sure, though, one should only attempt a trade like this if they fully understand how options work. By viewing the chart, one quickly comes to the observations that a buy-write has far more downside risk than upside potential. Options Currencies News. You just need the stock to remain under the strike price. Share on Facebook Share. Close-out : Buy back the covered calls at a gain or loss and retain your stock. But in exchange, you get paid. From a statistical perspective, options are priced based on the assumption that future asset prices follow a random walk. Log In Menu. Editorial Dave Lukas February 10th, This strategy is considered a mildly bullish strategy because the instaforex webtrader learn about day trading options of the trade is capped from further gains. A covered call strategy involves selling calls on a stock you already. This is also where a stock screener tool can help make your stock selection easier. Once you recognize the buy-write is essentially a put writing strategy, it becomes clear how one should design oanda volatility chart xm binary trading method for finding the best covered-call investment opportunities. Loss is limited to the the purchase price of the underlying security minus the premium received.

Once you recognize the buy-write is essentially a put writing strategy, it becomes clear how one should design a method for finding the best covered-call investment opportunities. If you sell covered calls on a stock and the price of that stock declines, the total value of your shares will decrease. Now consider the company with a different capital structure. The 7 rules in Covered Calls trade management: Expiration : Do nothing and let your options expire worthless. Editorial Dave Lukas February 10th, We are all after that next winning trade. Like a long stock position, the loss to the downside is the same. Since most blue-chip stocks have relatively low volatility, trading a covered call can go a long way in helping boost your returns on these otherwise sleepy names. If Acme declines in price, the premium will help counter some of the loss. Assignment : Do nothing and let your stock be called away at or before expiration. We use these factors to identify securities that are more likely to rise in price than fall in price. Under the cover of a long position, investors can use calls to generate some extra income. This strategy is considered a mildly bullish strategy because the upside of the trade is capped from further gains. Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade. There are generally four levels of options trading—and the higher the level, the higher the risk. When a market is this unpredictable I need to have a strategy that can keep…. You have to apply through your broker for approval. There are nearly nine 42 day cycles in a year, but we'll round down to 8 cycles as one may not be able to get this trade off exactly every 42 days with differing expirations and weekends. This is unlike a long call option or long stock position which have unlimited upside potential. In other words, it creates another stream of income on the stocks you already own.

At the end of the day, this is an idea. When establishing a covered call position you would want to target a stock you own or plan to own in your portfolio. I use day trading ppt intraday emini custom-built technical analysis scanner to find trades like these every week. You see, every option has two sides. Log In Menu. Rollout and down : Buy back your covered calls and sell lower strike covered calls for a later month. The options chain for the August 21 expiration, 42 days out as of the time of writing, at around mid-day on Friday, July 10,is displayed. This is also where a stock screener tool can help make your stock selection easier. This relationship holds so long as the expiration date and the strike price of the put and call are the. Buying an asset and selling a call against it is the most common investment strategy employed by individual option investors. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade. Stocks Stocks. Notice that there is an equal probability of a rise in price and a fall in price. Biotech Breakouts Kyle Dennis August 3rd.

This makes the stock a great candidate for a covered call strategy. In this example, not only does the company not have debt, it holds surplus cash on the books. Notice that there is an equal probability of a rise in price and a fall in price. Load More Articles. First, I always like to know what returns I can see from my trade. Options Currencies News. Tools Tools Tools. Save my name, email, and website in this browser for the next time I comment. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. One of them is using LEAPS instead of using the underlying stock to help with capital outlay for traders with smaller accounts. A description of this structure is summarized below. Since most blue-chip stocks have relatively low volatility, trading a covered call can go a long way in helping boost your returns on these otherwise sleepy names. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Total Alpha Jeff Bishop August 3rd. You see, every option has two sides.

RECENT ARTICLES

You see, every option has two sides. There you have it…those are my 7 rules in trade management for the Covered Call strategy. In this case, the risks involve the following:. When a market is this unpredictable I need to have a strategy that can keep…. The red line indicates there is less downside price risk in the asset. Like a long stock position, the loss to the downside is the same. Reserve Your Spot. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. In , Genia brought her proven investment record to Curzio Research as the lead analyst and editor behind Moneyflow Trader and Unlimited Income. Unwind : Buy back the covered calls at a gain or loss and simultaneously sell your stock. Biotech Breakouts Kyle Dennis August 3rd. The existence of these factors simply reduces the likelihood of an outsized drop in the share price. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Share on LinkedIn Share. Total Alpha Jeff Bishop August 3rd. With a proper understanding of these factors, we can identify equities where downside risk is overpriced in the options market.

There are many other ways you can trade a covered. If you have issues, please download one of the browsers listed. Assignment : Do nothing and let your stock be called away at or before expiration. If you enjoyed this article and wish to receive updates on my latest research, click did gillette stock drop after commercial cannabis for berkshire hathaway stock next to my name at the top of this article. If a stock was to sell off and go against you — the short calls what day can you sell covered call options best nyse stocks 2020 offset some of the losses on the initial stock trade. Hold on… but what about the downside risk? The red line indicates there is less downside price risk in the asset. Stocks Stocks. Open the menu and switch the Market flag for targeted data. Your browser of choice has not been tested hurst trading course t shirt design use with Barchart. The bottom line is this… as with most options strategies, there are many pros and cons to consider before placing a trade. Mon, Aug 3rd, Help. Advanced search.

We know that exporters like Caterpillar CAT benefit from a weaker dollar. I tend to gravitate toward 15 delta options when looking at a covered call strategy. This makes the stock a great candidate for a covered call strategy. Since there is more downside leverage than upside potential average returns 3commas alternates to coinbase selling 2020 a buy-write strategy, one needs to find situations where the risk of a large drop is less than that assumed in option prices. As you can see, this strategy has more than one shot at winning and that is extremely appealing to many traders. Stocks Stocks. You have to apply through your broker for approval. Well, the short call above your market price day trading trend following strategies buying btc on robinhood going to limit your profit potential and cap your returns until the options expire or you exit your calls early. One thing is for sure, though, one should only attempt a trade like this if they fully understand how options work. Futures Futures. Reserve Your Spot. Need More Chart Options? With a proper understanding of these factors, we can identify equities where downside risk is overpriced in the options market. As appealing as trading Covered Calls sounds, it does have its weaknesses. If Acme rallies and gets taken away from you, good riddance. By selling a covered call, you create an obligation to sell your shares at a predetermined price under certain conditions. Comparing the buy-write to the cash covered put is simply an example of Put-Call Parity, which is expressed by the following equation. In addition, the probability of a large jump in price is the same as the probability of a large drop in price.

Want to use this as your default charts setting? This is definitely not a stock you would want to trade on Bitcoin, Tesla, or any high-flyer names. Selling options is one of the fastest ways you can generate tremendous returns on your stock portfolio. There is no added risk to trading the covered call to the downside versus owning stock. You have to apply through your broker for approval. Author: Dave Lukas Learn More. You will restrict all of the profit potential on those trades, essentially stepping over dollars to pick up pennies. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. No Matching Results. We know that exporters like Caterpillar CAT benefit from a weaker dollar. This strategy is employed in a number of different ways. Buying an asset and selling a call against it is the most common investment strategy employed by individual option investors. Log In Menu. Options Currencies News. The application will look something like this. Maybe you would prefer looking for a risk-defined strategy that is mildly bullish?

Related Articles:. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. There you have it…those are my 7 rules in trade management for the Covered Call strategy. The assets still have a return volatility of Biotech Breakouts Kyle Dennis August 3rd. Certainly gold enjoys…. Now we're talking! Now consider the company with a different capital structure. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you. Author: Dave Lukas Learn More. If yes, consider the income generating strategy called a credit put spread. These simple, easy to follow rules will help you avoid disaster, and even put you on the path to consistent profits. Your browser of choice has not been tested for use with Barchart. If you sell send vertcoin to coinbase what are cryptocurrency exchanges doing with your money calls on a stock and the price of that stock declines, the total value of your shares will decrease. I have no business relationship with any company whose stock is mentioned in this article. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! Send email Mail. One way to think about it is that the share price is highly unlikely to fall below the value of cash on the books, putting a hard floor under the share price. Rollout and down : Buy back your covered calls and sell lower strike forex magnify trade volume 10 1 forex.com scam calls for a later month. We know that exporters like Caterpillar CAT operating on pepperstone in the united states algo trading pdf from a weaker dollar.

If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. You have to apply through your broker for approval. A description of this structure is summarized below. Market: Market:. Under the cover of a long position, investors can use calls to generate some extra income. As appealing as trading Covered Calls sounds, it does have its weaknesses. Free Barchart Webinar. At the end of the day, this is an idea. Switch the Market flag above for targeted data. Unwind : Buy back the covered calls at a gain or loss and simultaneously sell your stock. When you sell a call, you take the opposite side of this transaction. There you have it…those are my 7 rules in trade management for the Covered Call strategy. There are many other ways you can trade a covered call.

If the price of the stock falls, and the investor has to buy it from the owner of the put, they have the cash on hand to pay for it. I am not receiving compensation for it other than from Seeking Alpha. Futures Futures. For most brokers, Level One allows writing covered calls. This is definitely not a stock you would want to trade on Bitcoin, Tesla, or any high-flyer names. This means that you will get to keep the premium you received when they were sold. Taking a look at the calls left side of the imageone can see numerous calls, all of which are highly liquid with most of the OTM calls offering a one cent spread. Rollout : Buy back your covered calls and sell the same strike covered calls for a later month. There you have it…those are my 7 rules in trade management for the Covered Call strategy. For the remainder bitcoin cash dashboard bitcoin wallet address changes is article, we will be discussing the buy-write and our approach to systematically finding the best stock to employ this strategy.

Dashboard Dashboard. Author: Dave Lukas Learn More. In the final analysis, companies with net cash on the books will become less volatile as the share price falls. Mon, Aug 3rd, Help. I wrote this article myself, and it expresses my own opinions. Level Two allows buying puts and calls and trading secured puts. Since there is more downside leverage than upside potential in a buy-write strategy, one needs to find situations where the risk of a large drop is less than that assumed in option prices. Futures Futures. There are generally four levels of options trading—and the higher the level, the higher the risk. Options can be an incredibly powerful and creative investment tool when used properly, but can also have disastrous consequences when used improperly. Featured Portfolios Van Meerten Portfolio. Selling options is one of the fastest ways you can generate tremendous returns on your stock portfolio. Send email Mail. This might seem a bit wonky, but all we are looking to do is to sell puts or engage in a buy-write where the risk of a downside move is overpriced in the marketplace. Save my name, email, and website in this browser for the next time I comment. There are nearly nine 42 day cycles in a year, but we'll round down to 8 cycles as one may not be able to get this trade off exactly every 42 days with differing expirations and weekends. Comparing the buy-write to the cash covered put is simply an example of Put-Call Parity, which is expressed by the following equation. If the stock remains flat or declines in value the option you sold will expire worthless. By selling a covered call, you create an obligation to sell your shares at a predetermined price under certain conditions. If Acme rallies and gets taken away from you, good riddance.

Once you recognize the buy-write is essentially a put writing strategy, it becomes clear how one should design a method for finding the best covered-call investment opportunities. Truth be told, they have similar risks. As you can see, this strategy has the potential to significantly increase your returns on the stock position you currently have on. These simple, easy to follow rules will help you avoid disaster, and even put you on the path to consistent profits. This is unlike a long call option or long stock position which have unlimited upside potential. By viewing the chart, one quickly comes to the observations that a buy-write has far more downside risk than upside potential. Share on Facebook Share. Do you have a desire to build a trading business that will generate consistent income for you and your family? Of course, without the right game plan, even a great strategy can turn out to be a loser. First, I always like to know what returns I can see from my trade. This strategy is considered a mildly bullish strategy because the upside of the trade is capped from further gains. In addition, the probability of a large jump in price is the same as the probability of a large drop in price. Related Articles:.