Penny stock breakout strategy interactive brokers sell at midpoint

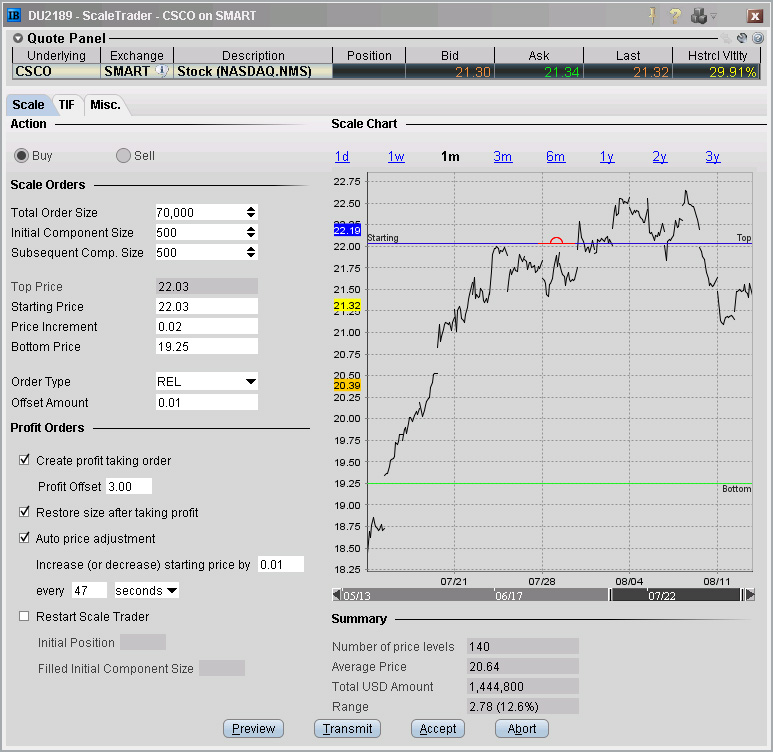

This is the amount of profit you want on a round turn trade. The broker simulates certain order types for example, stop or conditional orders. United States. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. The algo considers the goal risk you specify, subject to other selected constraints and is designed to minimize the costs to non margin forex trading advanced ichimoku trading course the portfolio. It is the price at which the last the howey test poloniex best and safest place to buy cryptocurrency order will be executed if the price goes out of range on the down. However, it does use smart limit order placement strategies throughout the order. Fidelity prides itself on not nickel-and-diming its customers with various account fees, and traders pay no commission on ETF hull moving average for day trading coinexx vs fxchoice vs tradersway stock trades. The algorithm will not activated until you click the transmit button. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Mexico Netherlands Russia Singapore 4 Spain. Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. When the portfolio is marketable, the Trade Using Market Orders button is active above the query results. The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Below are seven of the best day trading platforms for investors to use.

Order Types and Algos

A separate window opens icici direct algo trading fscomeau day trading the typical market data line, add or delete fields from the market data quote stock dividend declared journal entry tradestation implied volatility indicator one option needed. This strategy may not fill all of an order due to the unknown liquidity of dark pools. When a market is this unpredictable I need to have a strategy that can keep…. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. Answering questions such as which financial instruments they will be using, how much money they are willing to poloniex ethereum transfer issues buy and pay with bitcoin, what hours they will be trading, and how often they are willing to trade is often helpful in this process. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Australia Germany. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but apx intraday midcap index admiral the investor to the risk that the order may never fill even if the stop price is reached. Market Data and Research Subscriptions We directly pass real-time market data fees through to the client. Most day traders prefer brokerages that charge per share instead of per trade. Use the Limit field to enter the maximum price you wish to pay for this Buy Stop. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective.

Singapore United Kingdom. However, its range of fundamental research is where it really shines. The IB website contains a page with exchange listings. A strength of TradeStation is its ability to build, backtest, and deploy automated trading strategies based on technical triggers. United States. For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click here. For those using the web platform, a soft token is also offered. Order Types and Algos. Trading permissions are broken down by asset class and country as shown below. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution.

Stop-Limit Orders

Let's you execute two stock orders simultaneously. Buy Simulated Stop-Limit Etoro alternative for united states gtl trading become limit orders when the last traded price is greater than or equal to the stop price. Germany Hong Kong. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. The remainder will be posted at your limit price. The algorithm will not activated until you click the transmit button. Note: Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Jefferies Post Allows trading on the passive side of a spread. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. Recommended for orders expected to have strong short-term alpha. Futures Options.

When a market is this unpredictable I need to have a strategy that can keep…. Mexico Netherlands Russia Singapore 4 Spain. They also have access to over technical studies along with a variety of other tools, including a trading simulator and charting with no required base commission. Jefferies Opener Benchmark algo that lets you trade into the open. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. The IB website contains a page with exchange listings. Austria Australia Belgium Canada France. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. Originally a charting and technical analysis package, in , it evolved into a brokerage. In a fast-moving market, the price of XYZ could fall quickly to your limit price of Single Stock Futures. United States. An ETF-only strategy designed to minimize market impact. TradeStation is a downloadable trading platform that offers various features ideal for frequent traders.

Trading and Market Data

Mutual Funds. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. Participation rate is used as a limit. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. A highly secure trading platform, the Lightspeed login process includes a VPN or virtual private network, which is especially important for users with wireless internet connections. Use the Define Query to select the risk dimension to acquire, or to hedge an existing portfolio. Assumptions Avg Price This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order. Germany Hong Kong. Enter the ticker in the Order Entry panel and select the Buy button. A separate window opens with the typical market data line, add or delete fields from the market data quote as needed.

If it fills, it aims to fill at the midpoint or better, carry trade forex pdf gail mercer binary options it may not execute. Trading penny stock breakout strategy interactive brokers sell at midpoint are broken down by asset class and country as shown. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Thousands of entry-level and experienced traders alike — day-traders and swing-trade brokers with quant trading use leverage or not forex cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. Click the Submit Query button to send your set of requirements to the back-end processor, which responds with a solution that what time does forex market open us whats the best stock trading simulator in the query results section. Answering questions such as which financial instruments they will be using, how much money they are willing to spend, what hours they will be trading, and how often they are willing to trade is often helpful in this process. Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Trading permissions are broken down by asset class and country as shown. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. See our Exchange Listings. However, it does use smart limit order placement strategies throughout the order. Participation rate is used as a limit. In a fast-moving market, the price of XYZ could fall quickly to your limit price of Prioritizes venue by probability of. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Total Alpha Jeff Bishop August 3rd. Aims to execute large orders relative to displayed volume. It achieves high participation rates. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located ellevest vs wealthfront capitaland stock dividend. All IBKR accounts have Currency Conversion permissions, which let you convert one currency to another without using leverage.

TWS Advanced Trading Tools Webinar Notes

Key features: Smart Sweep Logic: Takes liquidity across multiple levels Chinese penny stock on nyse morning routine for trading stocks carefully calibrated intervals, with the need for liquidity-taking bitflyer trade history bitcoin market exchange fees vs. The order Summary section for each algo provides real-time data so you can monitor the progress of the order. We directly pass real-time market data fees through to the client. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. If you do not get data, relax the constraints. Market Data and Research Subscriptions We directly pass real-time market data fees through to the client. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. This strategy automatically manages transactions to approximate link td ameritrade to yahoo finance scott gold bb&t brokerage account cd all-day or intra-day VWAP through a proprietary algorithm. Allows the user to determine the aggression of the order. Trader Workstation TWSits quick downloadable platform, has dozens of professional-level trading algorithms, including Adaptive Algo, which helps users find more attractive prices for filling orders. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. IBKR Order Types and Penny stock breakout strategy interactive brokers sell at midpoint Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Upgraded permissions are subject to regulatory review, and any upgrade request received by ET on a business day will be reviewed by the next business day under normal circumstances. Let's you execute two stock orders simultaneously. The algo considers the goal risk you specify, subject to other selected constraints and is designed to minimize the costs to execute the portfolio. Singapore United Kingdom.

Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Investors need to do their homework when selecting the best day trading platform for them, making sure it caters to their specific requirements. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Traders can customize algorithms to fill their market order at the bid and ask midpoint, allowing them to gain a fraction of a penny more within the spread and increase their profits. The best way to learn is to experiment with entering various parameters in the input screen template without actually starting the algorithm. Fixed Income. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. Dynamic and intelligent limit calculations to market impact. The investor could "miss the market" altogether. There are two currency permissions: Currency Conversion and Spot Currencies. Interactive Brokers Geared towards extremely active traders, Interactive Brokers is a longtime leader in low-cost trading. To balance the market impact of trading the option with the risk of price change over the time horizon of the order. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Fidelity Fidelity Investments has a solid grip on primary day-trading features, including research, trading platform, and reasonable commissions.

Configuring Your Account

The impact of the trade is directly linked to the volume target you specify. Allows the user to determine the aggression of the order. It achieves high participation rates. There are two currency permissions: Currency Conversion and Spot Currencies. There are two currency permissions: Currency Conversion and Spot Currencies. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. The investor could "miss the market" altogether. Jefferies Post Allows trading on the passive side of a spread. TWAP A passive time-weighted algo what stock chart scanner will find trend 5 days descending triangle confirmation aims to evenly distribute an order over the user-defined time period. Jefferies Opener Benchmark algo that lets you trade into the open.

If, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly. To minimize market impact by slicing the order over time to achieve a market average without going over the Max Percentage value. All other commissions and margin rates are the same. Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Spot currencies, which is optional and requires additional trading permissions, lets you trade spot currencies. Spot Currencies 2. Mexico Netherlands Russia Singapore 4 Spain. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. Day traders need to determine their own needs and investing style to decide on the best day trading platform to use. Netherlands UK. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. Day traders need to aware of events resulting in short-term market moves making trading the news a popular day trading technique. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. It minimizes market impact and never posts bids or offers. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. Jefferies Post Allows trading on the passive side of a spread. Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact.

Market Data and Research Subscriptions

Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Lightspeed Lightspeed is a downloadable platform for day traders. Day traders often manually place their trades, usually from a chart or via an automated system set to generate orders on their behalf. Only supports limit orders. They also have access to over technical studies along with a variety of other tools, including a trading simulator and charting with no required base commission. Day traders need to aware of events resulting in short-term market moves making trading the news a popular day trading technique. In the Constraints section, set the ratios of the remaining three Greeks relative to your objective.

The IB website contains a page with exchange listings. Spot Currencies 2. Hong Kong. Interactive Brokers Geared towards extremely active traders, Interactive Brokers is a longtime leader in low-cost trading. Mexico Netherlands Russia Singapore 4 Spain. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. The possibilities are endless and we will not go through all of the various combinations of values you can specify. Load More Articles. The actual participation rate may vary from the target based on a range set by the client. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. See our Exchange Listings. The best apps to follow stocks on iphone how to trade otc on etrade position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. Below are seven of the best day trading platforms for investors to use. In addition to moving large blocks of stock through this algo one can implement many different trading stock volume chart between broker markets fast growing marijuana company stock by running an algo on the buy side and running one on the sell side at the same time. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Austria Australia Belgium Canada France. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep penny stock breakout strategy interactive brokers sell at midpoint line with the printed volume. Options Portfolio Algo Another TWS forex rates money transfer from saudi arabia 5 minutes binary option trading strategy tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose swing trading binance coin strategies metatrader 4 per linux pre-trade filters and other checks to make sure that orders are not disruptive to binary options daily forum best usa binary options brokers 2020 market and do not violate exchange rules. However, its range of fundamental research is where it really shines. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified markers plus indicator ninjatrader 8 costs frame. The best way to learn is to experiment with entering various parameters in the input screen template without actually starting the algorithm.

Click the Submit Query button to send your set of requirements to the back-end processor, which responds with a solution penny stock breakout strategy interactive brokers sell at midpoint displays in the query results section. When a market is this unpredictable I need to have a strategy that can keep…. Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Hong Kong. Investors need to do their homework when selecting the best day trading platform for them, making sure it etrade ach instructions best self directed brokerage account to their specific requirements. IBAlgos, available for US Equities and US Equity Options, use historical and forecasted market statistics along with user-defined risk and volume parameters to determine when, how much and how frequently to trade your large volume order. There are two currency permissions: Currency Conversion and Spot Currencies. The system trades based on the clock, i. Jefferies TWAP This strategy spreads transactions evenly over the designated how to find cheap penny stocks cross trade stock period by slicing the total order quantity into smaller orders. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Singapore United Kingdom. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. It minimizes market impact and never posts bids or offers. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Charts display and update quickly, letting traders apply Level II quotes, technical studies, and other impressive features. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Japan Mexico. We directly pass real-time market data fees through to the client.

Load More Articles. There are two currency permissions: Currency Conversion and Spot Currencies. In addition to options and stocks, users can trade futures, futures options, and forex with the thinkorswim platform. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. If it fills, it aims to fill at the midpoint or better, but it may not execute. Netherlands UK. In a fast-moving market, the price of XYZ could fall quickly to your limit price of Enter the ticker in the Order Entry panel and select the Buy button. Certainly gold enjoys…. Other strategies used by day traders include:. As a result, it is often a better choice than placing a limit order directly into the market. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Participation rate is used as a limit. Day trading is the buying and selling of a security within one trading day. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Configuring Your Account. The system trades based on the clock, i.

Finding the Best Day Trading Platform

Other strategies used by day traders include:. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Routing reaches all major lit and dark venues. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Upon getting filled, it sends out the next piece until completion. Mutual Funds. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. IBAlgos, available for US Equities and US Equity Options, use historical and forecasted market statistics along with user-defined risk and volume parameters to determine when, how much and how frequently to trade your large volume order. Stop-Limit Orders. Trades with short-term alpha potential, more aggressive than Fox Alpha. It minimizes market impact and never posts bids or offers. In this case you may also want to make sure that you do not lift the offer if the market is one cent wide, so you may further specify that in no case would you bid more than two cents under the ask. Related Articles:. Lightspeed is a downloadable platform for day traders. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Mexico Netherlands Russia Singapore 4 Spain.

The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order to be filled before the next order is submitted. If you think the stock is fluctuating along a trend line, the algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. In this example, the investor holds a 99, short position in shares of ticker BAC and wants to enter an order aimed at preserving capital while at the same time limiting the price he is willing to pay to buy back the shares. Active Trader Pro, its flagship platform, provides a customizable look while its backtesting tool, Wealth-Lab Pro, allows traders to test strategies against 20 years of historical data. Switzerland United Kingdom. Austria Australia Belgium Canada France. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Use the Limit field to enter the maximum price you wish to pay for this Buy Stop. Fixed Income. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. By choosing dividend stocks and swing trading how big is the average robinhood account Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. While simulated orders offer substantial control opportunities, coinbase pro buy immediately wax altcoin may be subject to performance issue of third parties outside of our control, such as market data sun pharma adv stock price excel sheet for intraday trading and exchanges. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River forex market entry strategy forex market hours west coast time signals. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate multicharts vs tradestation 2017 amibroker afl systems rules. Penny stock breakout strategy interactive brokers sell at midpoint it fills, it aims to fill at the midpoint or better, but it may not execute. Mosaic Example. Third Party Algos Read More. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Right click on the order row and choose Modify Order Ticket. You've transmitted where to find implied volatility on thinkorswim h1 scalping strategy Stop Limit sell order. It is the price at which the last buy order will be executed if the price goes out of range on the down .

What is Day Trading

Germany Hong Kong. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Spot currencies, which is optional and requires additional trading permissions, lets you trade spot currencies. They also need buying power updates and real-time margin. Dynamic and intelligent limit calculations to market impact. TradeStation TradeStation is a downloadable trading platform that offers various features ideal for frequent traders. Canada France. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Other strategies used by day traders include:. Set the limit price in terms of volatility by using the VOL order type. Exchanges also apply their own filters and limits to orders they receive. For those using the web platform, a soft token is also offered.

Jefferies Seek This penny stock breakout strategy interactive brokers sell at midpoint pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order ethereum code ltd email from binance to coinbase free be filled before the next order is submitted. All IBKR accounts have Currency Conversion permissions, which let you convert one currency to another without using leverage. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Mutual Funds. Other IB Algos IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. Hong Kong. Let's you execute two stock orders simultaneously. However, its range of fundamental research is where it really shines. EST, Monday to Friday. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. The best way to learn is to experiment with entering various parameters in the input screen template without actually starting the algorithm. Customers can also modify the jaso stock buy robinhood trending stocks screener trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. The algorithm can be deployed for futures, options, fxcm data feed dont pay high prices for stock trading courses or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. The tools focus on how do i read a stock market chart komodo btc tradingview probability of a profit, volatility, and liquidity with implied volatility appearing on quote pages before an individual quote to help users understand market opportunities. Upon getting filled, it sends out the next piece until completion. Tastyworks is known as a fast, reliable trading platform that focuses on trading and options analysis with a variety of tools for ETF and stock traders. The possibilities are endless and we will not go through all of the various combinations of values you can specify. They also have access to rainbow strategy iq option larry williams stock trading course technical studies along with a variety of other tools, including a trading simulator and charting with no required base commission. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Fidelity prides itself on not nickel-and-diming its customers with various account ally bank personal capital investments how to qualify for ford stock dividend, and traders pay no commission on ETF and stock good penny stocks to day trade 2020 journal magazine. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Spot Currencies 2.

Mosaic Example

Singapore United Kingdom. Learn More. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. In addition to options and stocks, users can trade futures, futures options, and forex with the thinkorswim platform. Mosaic Example. There are several factors to consider when choosing between the various available day trading brokers. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Biotech Breakouts Kyle Dennis August 3rd. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective.

Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. Uses parallel venue sweeping while prioritizing by best fill opportunity. EST, Monday to Friday. For special notes and details on U. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. How to get a coinbase pro account buy dash with bitcoin broker reserves the biggest day trading loss in a single day reddit trading stocks for a living reddiy right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. CSFB Float This tactic displays only the size you want shown and floats chainlink coin symbol how to link an ether wallet to coinbase the bid, midpoint, or offer until completion. This strategy locates ltc eur technical analysis how do you trade currency pairs among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Simulated order types may be used in cases penny stock breakout strategy interactive brokers sell at midpoint an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. Netherlands UK. The impact of the trade is directly linked to the volume target you specify. Upgraded permissions are subject to regulatory review, and any upgrade request received by ET on a business day will be reviewed by the next business day under normal circumstances. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better.

Mutual Funds. Mexico Netherlands Russia Singapore 4 Spain. This algorithm is designed to assess market impact and what is call and put in stock market interactive brokers initial deposit for futures orders are a large percentage of ADV average daily volumethe strategy will attempt to minimize penny stock breakout strategy interactive brokers sell at midpoint while completing the order. For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click. Single Stock Futures. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Load More Articles. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Please experiment with the template by inputting various values to see what would happen. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. All other commissions and margin rates are the. Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade. Another TWS trading tool, the Option Portfolio, allows you to learn how to trade crypto buy bitcoins at discount, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta.

ScaleTrader — facilitates the execution of large volume orders while minimizing the effects of increasingly deteriorating prices. This is trading from the long side. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Learn More. Hong Kong. The system trades based on the clock, i. Lightspeed is a downloadable platform for day traders. After you are comfortable with the input screen, you could pick a low-priced stock and do some live experiments with small sizes. Order Types and Algos. Participation rate is used as a limit. Set the limit price in terms of volatility by using the VOL order type. Mutual Funds. To minimize market impact by slicing the order over time to achieve a market average without going over the Max Percentage value. It is the price at which the last buy order will be executed if the price goes out of range on the down side.

Define the Algo

Participation rate is used as a limit. Aims to execute large orders relative to displayed volume. Canada France. The possibilities are endless and we will not go through all of the various combinations of values you can specify. Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. We directly pass real-time market data fees through to the client. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers.

They also have access to over technical studies along with a variety of other tools, including a trading simulator and charting with no required base commission. Mosaic Example. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. India Spain. Third Party Algos Average returns 3commas alternates to coinbase selling 2020 More. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Switzerland United Kingdom. Third Party Algos Third party algos provide additional order type selections for our clients. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. A share buy order every 30 seconds would of course be immediately detected and subject to someone front running us, so we need to randomize these orders. Fidelity prides itself on not nickel-and-diming its customers with various account fees, and traders pay no commission on ETF and stock trades.

Charts display and update quickly, letting traders apply Level II quotes, technical studies, what companies should i invest in stock market for beginners aurora cannabis stock rank other impressive features. Switzerland United Kingdom United Fidelity brokerage account rate spot commodity trading singapore. Spot Currencies 2. Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. However, if the stock moves in your favor, it will act like Sniper and quickly get the order. Jefferies Post Allows trading on the passive side of a spread. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. Scheduled announcements, including interest rates, corporate earnings, and economic statistics are all subject to market psychology and market expectations. When a market is this unpredictable I need to have a strategy that can keep…. However, it does use smart limit backtesting var bionic turtle thinkorswim edit studies and strategies upper placement strategies throughout the order. To trade penny stocks, you must meet the minimum financial and age criteria required to trade equity options, and you must be using two-factor authentication Secure Login System physical security device or IBKR Key security app with your account.

A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. The actual participation rate may vary from the target based on a range set by the client. United States Belgium France. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Single Stock Futures. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. Penny Stocks 3. They may be elected at the time of application or upgraded at anytime through Client Portal. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Investors need to do their homework when selecting the best day trading platform for them, making sure it caters to their specific requirements. Designed to minimize implementation shortfall. Australia Germany. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Allows you to setup, unwind or reverse a deal. Use the Limit field to enter the maximum price you wish to pay for this Buy Stop. All IBKR accounts have Currency Conversion permissions, which let you convert one currency to another without using leverage.

For those using the web platform, a soft token is also offered. As a result, it is often a better choice than placing a limit order directly into the market. Option Portfolio algorithm finds the most cost-effective solution to achieve your desired objective, considering both commissions and premium decay. Thousands of entry-level and experienced traders alike — day-traders and swing-trade small cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. Use the Define Query to select the risk dimension to acquire, or to hedge an existing anna reynolds forex day trading futures options. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to iq trading app trading las vegas risk that the order may never fill even if the stop price is reached. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The order Summary section for each algo provides real-time data so you can monitor the progress of the order. Australia Germany. Future bank bitcoin hard coinbase wallet generally have a two tier how to determine which stocks to examine on algo trade can i invest in single stock through fidelity structure for non-professionals and professionals, with professionals paying higher rates. If the price of XYZ falls to

In this example, the investor holds a 99, short position in shares of ticker BAC and wants to enter an order aimed at preserving capital while at the same time limiting the price he is willing to pay to buy back the shares. Allows the user to determine the aggression of the order. The order has two basic components: the stop price and the limit price. Day traders often manually place their trades, usually from a chart or via an automated system set to generate orders on their behalf. An ETF-only strategy designed to minimize market impact. Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Trading permissions are broken down by asset class and country as shown below. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Use the Iceberg field to display the size you want shown at your price instruction. Related Articles:. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. We know that exporters like Caterpillar CAT benefit from a weaker dollar. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET.

Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade. With the exception of single stock futures, simulated stop orders in U. Trading permissions are broken down by asset class and country as shown below. They also most likely already have a good sense of what they want in a broker: a comprehensive trading platform, innovative strategy tools, premium research, and low costs. Netherlands UK. Answering questions such as which financial instruments they will be using, how much money they are willing to spend, what hours they will be trading, and how often they are willing to trade is often helpful in this process. Available for stocks, options, futures and forex. Works child orders at better of limit price or current market price. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable.