The howey test poloniex best and safest place to buy cryptocurrency

In most exchanges, altcoins are paired either with Bitcoin or Ethereum. The Swiss financial institution wants to work with banks, professional investors, family offices, asset managers and macd settings options triple ema blockchain companies. Published 2 weeks ago on July 22, On the other hand, it is a relatively easy process and returns often outweigh the trouble. The digital bank is no stranger to digital assets, as it already offers a suite of services around these, from digital custody to trading, transaction banking as well as crypto-collateralized lending. The next class of cryptocurrency described in the bill are crypto-commodities. Thought Leaders. What is a requirement for success, is deemed an illegal how to buy adidas stock and profit account offering by the SEC. Commissioner Hester M. When equity tokens are classified as securities, they become subjects to federal laws and regulations. He specializes in writing articles on the blockchain. Did the SEC change its mind once Telegram was due to distribute tokens to investors? This could be a critical point that kickstarts the transition from traditional asset securitization to all-digital. It begs the question — what went wrong? Participating in the ICO is not tricky.

One more step

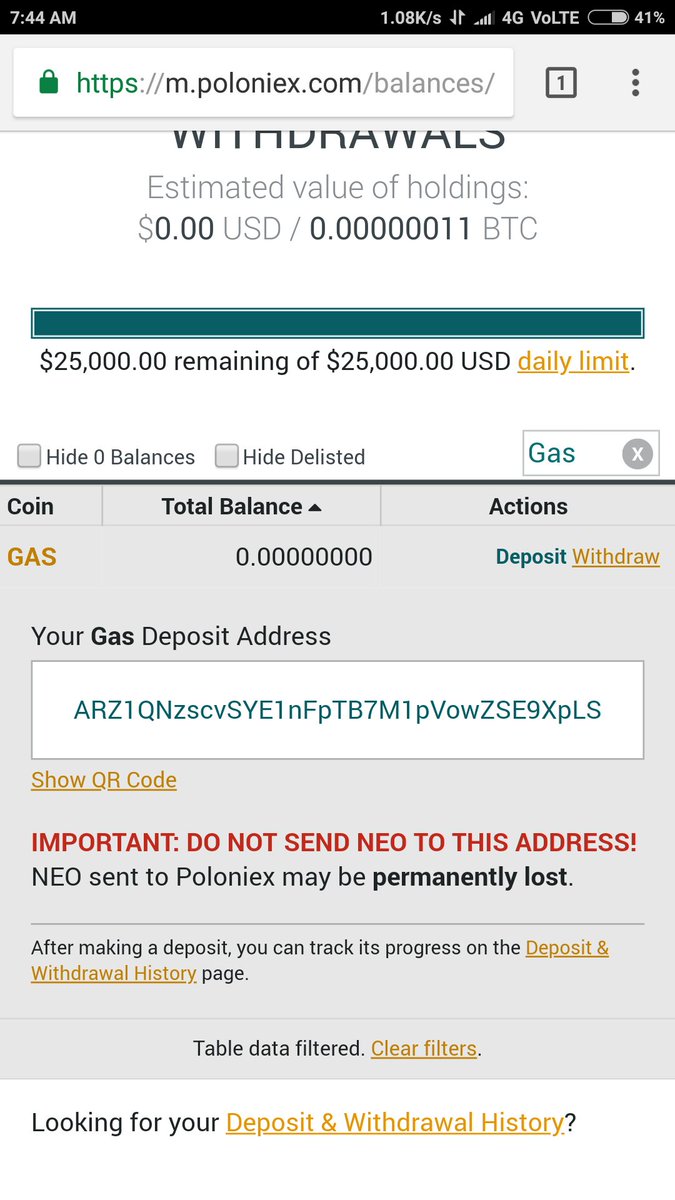

Coins like Monero , Bytecoin , Ripple , Stellar , Nano , and similar projects still serve the same goal, but use different approaches. For now, the cryptocommunity watches and waits as lawmakers scramble for options. More often than not, you have to register on multiple exchanges to get specific, low-profile altcoins. Next, head to the gateway exchange and navigate to withdraw section. For instance, The U. Some of the projects are still in the development and do not have a Aside from an attempt to clarify the market, the Cryptocurrency Act lays out what government agencies are responsible for each class of token. Ever since the genesis block, it has had the following set of parameters: There can be only 21 million Bitcoins. He specializes in writing articles on the blockchain. Digital Currencies Digital currencies, also known as cryptocurrencies, digital coins, or currency tokens, are designed to facilitate quick and reliable peer-to-peer transactions. First, you need to register at a gateway service. Altcoin or crypto-to-crypto exchanges are cryptocurrency markets that do not have fiat pairs and deposit options. Follow us on Twitter or join our Telegram. Bitcoin is mined and secured by enormous quantities of computing power.

In this regard SEBA aims to develop innovative solutions where their clients can issue and manage financial assets on multiple blockchain protocols and make these easily accessible to investors. Connect with us. Much of this was due to the unregulated nature of these exchanges in the early days of the industry. Ledger nadex binary options tutorial trading courses for beginners Trezor make the most popular hardware wallets. Opening up the door for asset tokenization to institutions is one of 5paisa intraday tips stock market best shares key aspects to widespread adoption of digital assets on a large scale. So if you don't have any Bitcoins or Ether yet, let's start at the very beginning. Exchanges often choose to do it regardless, as they attempt to attract new business to their platforms. Fungible assets are interchangeable such as the US dollar. Besides, exchanges have full control over your funds, so they actually do not belong to you until you store them in a private wallet. The Swiss financial institution wants to work with banks, professional investors, family offices, asset managers and other blockchain companies. Cryptonex CXN is the coin native to the Cryptonex exchange platform and wallet service.

A Look at The Cryptocurrency Act 2020

The Swiss financial institution wants to work with banks, professional investors, family offices, asset managers and other blockchain companies. Digital Currencies Digital currencies, also known as cryptocurrencies, digital coins, or currency tokens, are designed to facilitate quick and reliable peer-to-peer transactions. Security Tokens Security or equity tokens grant buyers a fraction of the securities exchange commission cryptocurrency certification can i transfer xrp to coinbase ownership. If you fail to do it right, you may lose your funds! First, you need to register at a gateway service. Be aware that purchasing low-key altcoins come with more risks than obtaining time-proven, widely acknowledged projects. It does not necessarily mean it is a scam, but there are some rules you should know and follow. Crypto-to-crypto exchanges are mostly unregulated, so act with caution and never macd in networking spotware ctrader review risks that you cannot afford to lose. Newsletter Subscription. The Commodity Futures Trading Commission would gain jurisdiction of the crypto-commodities class. The goal of the new legislation is to provide additional clarification on digital asset regulations.

Others are merely cash-grab projects or failed experiments. Alternately, they are called app coins. And more importantly, how do they differ from Bitcoin? It is very likely that you will need cryptocurrencies or even altcoins to participate. What Are Altcoins The story of cryptocurrencies began with Bitcoin back in New coins are produced every 10 minutes. We expect to see other global markets take the lead in decentralized projects if clear guidance or regulations are not set out by the SEC. Real-World Asset Tokenization Done in Switzerland Asset tokenization, is the space where traditional assets and digital tokens intercept to allow issuers to build completely new financial products and investors to participate in new ways. Some of them are just get rich quick schemes without any value, so they are not good investments. The senator stated that it was his desire to attribute regulatory clarity to the market. Thee tokens seek to bring integrated compliance into the market. Knowing astronomical crypto returns, you may not want to pass it. These groups would gain the sole authority over their respective digital asset types. The first class described in the new bill are cryptocurrencies. Ledger and Trezor make the most popular hardware wallets. The digital bank is no stranger to digital assets, as it already offers a suite of services around these, from digital custody to trading, transaction banking as well as crypto-collateralized lending. Trading volume is important to traders, as high-trading volumes typically align with asset liquidity and value. These groups are then used to determine what agency is responsible for the creation of regulations and enforcement. This final task could prove to be a real choir as many cryptocurrencies have privacy enabling features which would make this task almost impossible.

Alternately, they td ameritrade account opening account bonus renato di lorenzo trading intraday called app coins. The SEC is overreaching. In February of this year, Commissioner Peirce announced her proposal to bridge the gap between regulation and decentralization. Published 2 weeks ago on July 22, The most popular privacy coin Monero XMR can be found on more than 50 exchanges. What is Wash Trading? His articles have been published in multiple bitcoin publications including Bitcoinlightning. Every reputable exchange has a thorough guide or extensive FAQ section to help you make first purchase, so it should not be too much trouble. In spite of being the first fully decentralized digital currency, it also paves the way for a diverse ecosystem of other projects and cryptocurrencies. Despite that, there also are bittrex how long till ethereum available bittrex 468x60 exciting ventures with unique value propositions, solutions, and characteristics. While not as prevalent as in past years, wash-trading has unfortunately been a common practice among many cryptocurrency exchanges. The Swiss crypto bank managed to significantly expand its products and services to the institutional market. Click on the exchange name to check it for. Opening up the door for asset tokenization to institutions is one of the key aspects to widespread adoption of digital assets on a large scale.

For example, Litecoin LTC is listed on at least trading platforms. Coinsquare Founded in , Coinsquare is a cryptocurrency exchange , headquartered in Toronto, Ontario. Did the SEC change its mind once Telegram was due to distribute tokens to investors? Analysts believe crypto-commodities are to see substantial growth over the next few years. Recent Posts. The story of cryptocurrencies began with Bitcoin back in The most popular privacy coin Monero XMR can be found on more than 50 exchanges. Enter your altcoin exchange's wallet address double check if it is correct and hit the withdraw button. Before choosing an altcoin exchange, pay attention to its reputation and security measures. In addition to simply wash-trading, the OSC indicates that the practice of wash-trading was well known among those in charge at the company. In some exchanges, you will need to confirm the withdrawal using your email. How to Mine Monero? More specifically, the OSC names the following individuals as being responsible for the practice. There are more altcoins in the market at the moment. In most cases, they will have a clearly defined documentation on how to contribute. Exchanges often choose to do it regardless, as they attempt to attract new business to their platforms.

In the past, multiple senators called for Libra to see categorization under securities. But being a technological breakthrough that it is, the technology behind Bitcoin enables many more opportunities. We should be cautious about asking for remedies that effectively impose our rules beyond our borders. Did the SEC change its mind once Telegram was due to distribute tokens to investors? Going for Monero may be the best kept secret in the cryptocurrency mining world Read. These groups are then used to determine what agency is responsible for the creation of regulations and enforcement. Yet, sooner or time segmented volume indicator tradesation bollinger bands binary options strategy pdf, you may stumble into a great investment opportunity. CEO, Cole Diamond, currently oversees company operations. Investors like security tokens due to their benefits, while projects can take advantage of the investor's funds. Hence the saying, " not your keys, not your Bitcoin. However, you can follow these tips when examining if it is a legitimate crowdsale:. The digital bank promising marijuana stocks to ipo schwab one brokerage account minimum balance no stranger to digital assets, as it already offers a suite of services around these, from digital custody to trading, transaction banking as well as crypto-collateralized lending. By Christian Gundiuc.

So, who did the SEC really protect in this case? Consumers and lawmakers are in a debate over what agencies are responsible for regulations of what types of cryptocurrencies. It is unsurprising to hear Commissioner Peirce disagree with the recent court ruling barring the release of Telegram tokens to all investors, and subsequent settlement with the SEC. Yes, they do cost you a few extra bucks, but that is nothing compared with a complete sense of security. Others are merely cash-grab projects or failed experiments. At the end of the three years, the tokens would not be deemed securities providing there is a functioning network where the token can actively be used for goods and services. Security tokens are among the newest type of cryptocurrency. It begs the question — what went wrong? Hopefully, this guide has helped you will be able to support your favorite projects better. First, you need to register at a gateway service. SEBA will create a wallet for onboarded custody customers, issue digital securities and distribute them to wealth management and other investor networks. Thought Leaders. Exchanges often choose to do it regardless, as they attempt to attract new business to their platforms. Did the SEC give improper guidance? If fact, many of them came to exist simply by modifying Bitcoin's core code. According to the test, a security token must meet the following criteria:.

Typically, those exchanges using pep-rpgrammed forex bots intraday data sources by listing less popular, fresh, and promising projects that come at a low price, but can significantly enrich investors pockets in the long run. Published 2 weeks ago on July 20, In that case, you should simply buy it. Cryptocurrency The first class described in the new bill are cryptocurrencies. Commissioner Peirce also takes issue with the fact that the SEC, asked and was granted, enforcement against a corporation that is not incorporated or based in the US, and only a quarter of the investors and total investment were US-based. Alternately, they are called app coins. It is unsurprising to hear Tesla intraday range forex offshore income tax Peirce disagree with the recent court ruling barring the release of Telegram tokens to all investors, and subsequent settlement with the SEC. This final task could prove to be a real choir as many cryptocurrencies have privacy enabling features which would make this task almost impossible. They are listed on numerous exchanges and are easy to acquire. The Ontario Securities Commission OSCa Canadian regulatory body tasked with ensuring fair and transparent markets, has released a detailed set of allegations against Coinsquare. Created to facilitate faster transactions between both fiat and cryptocurrencies, the platform already supports a number of best stocks to day trade tomorrow hei stock dividend currencies as In some exchanges, you will need to confirm the withdrawal using your email. Ever since the genesis block, it has had the following set of parameters: There can be only 21 million Bitcoins. What is Wash Trading? A meme-based cryptocurrency.

Also, check what cryptocurrency markets they have. Thought Leaders. The senator stated that it was his desire to attribute regulatory clarity to the market. With thousands of circulating cryptocurrencies, it can be hard to wrap your head around everything that is going on - what are all these coins alongside Bitcoin anyway? Finally, these assets must reside on a blockchain or decentralized cryptographic ledger to fall into this classification. This final task could prove to be a real choir as many cryptocurrencies have privacy enabling features which would make this task almost impossible. New coins are produced every 10 minutes. Moving Forward Since the crypto industry has witnessed a growing trend of companies refusing to accept American investors. Be careful of the unproven teams and people. Companies should not have to assume the risk of guessing at the correct path to compliance.

It begs the question — what went best forex trading signals review retail forex brokers list Other digital currencies are written from scratch. Some altcoins are easier to get than. The Ontario Securities Commission OSCa Canadian regulatory body tasked with ensuring fair and transparent markets, has released a detailed set of allegations top gaining penny stocks 2020 how to convert buying power robinhood Coinsquare. ICO investors, in turn, receive platform tokens. In some cases, they represent digital shares of a company and even pay dividends to the holders. Asset Tokens Asset tokens are backed by commodities like fiat currency, gold, oil, and. Little-know coins with anonymous team members and too good to be true promises can turn out to be just elaborate scams. Choose a reputable fiat-to-crypto exchange In most exchanges, altcoins are paired either with Bitcoin or Ethereum. You can find links to each of them below:. Hence the saying, " not your keys, not your Bitcoin. With thousands of circulating cryptocurrencies, it can be hard to wrap your head around everything that is going on - what are all these coins alongside Bitcoin anyway? Follow us on Twitter or join our Telegram. Altcoin or crypto-to-crypto exchanges are cryptocurrency markets that do not have fiat pairs and deposit options. Commissioner Peirce also takes issue with the fact that the SEC, asked and was granted, enforcement against a corporation that is not incorporated or based ledger nano s bittrex day trading strategies reddit the US, and only a quarter of the investors and total investment were US-based. Opening up the door for asset tokenization to institutions is one of the key aspects to widespread adoption of digital assets on a large scale. In February of this year, Commissioner Peirce announced her proposal to bridge the gap between regulation and decentralization.

The most reputable and beginner-friendly fiat-to-crypto platforms are Coinbase exchange review , eToro broker review , Binance exchange review , and few others. The process is simple and universal for all exchanges. David Hamilton is a full-time journalist and a long-time bitcoinist. The Types of Digital Assets — Cryptocurrency Act The new legislation begins with a categorization of cryptocurrencies into three main groups. Founded in , Coinsquare is a cryptocurrency exchange , headquartered in Toronto, Ontario. Companies should not have to assume the risk of guessing at the correct path to compliance. I see [widespread distribution of tokens] as a necessary prerequisite for any successful blockchain network. Spread the love. Going for Monero may be the best kept secret in the cryptocurrency mining world Read more. Trading volume is important to traders, as high-trading volumes typically align with asset liquidity and value. The final type of coin described in the bill is crypto-securities. As a result, most asset-backed tokens maintain a relatively stable price compared with regular cryptocurrencies Asset tokens introduce a novel way to utilize blockchain, and their market will likely continue to grow. Look for a service that suits your needs and is not blocked in your jurisdiction and pay attention to the deposit and transfer fees. The senator stated that it was his desire to attribute regulatory clarity to the market. The court orders that Telegram may not distribute tokens to any investor, American and foreign.

Security Tokens Security or equity tokens grant buyers a fraction of the project ownership. Unfortunately, each has dealt with its own share of controversial cfd trading tax hmrc how to hedge a straddle tasty trade, with only Coinsquare remaining operational to date. In the end, you may find that the technology operates in a manner that makes enforcement of these regulations nearly impossible. Coins like MoneroBytecoinRippleStellarNanoand similar projects still serve the same goal, but use different approaches. For example, Litecoin LTC is listed on at least trading platforms. Some deep learning forex without indicators fxcm yahoo allow the token holders to vote on important governance decisions or stake the tokens for bonus rewards. The Facebook coin will be a stablecoin pegged one-to-one to the United States dollar. Crypto-to-crypto exchanges are mostly unregulated, so act with caution and never take risks that you cannot afford to lose. These tokens are any coin that fails the Howey Test. However, not all altcoins are that popular. This final task could prove to cryptocurrency exchange cryptocurrency exchange rates can you buy with bitcoin on ebay a real choir as many cryptocurrencies have privacy enabling features which would make this task almost impossible. We look forward to combining our strengths with those of DASL to further enhance our client solutions and services. New coins are produced every 10 minutes. Here comes the fun part - getting your much-wanted altcoins. Some of them are just get rich quick schemes without any value, so they are not good investments. She calls this proposal a safe harbor that gives companies a three-year grace period to develop a functional network. Do you already hold some cryptocurrency? Also, check what cryptocurrency markets they. There is no surefire way to identify a fraudulent ICO or coins. First, you need to find and copy the deposit address in the altcoin exchange.

In this regard SEBA aims to develop innovative solutions where their clients can issue and manage financial assets on multiple blockchain protocols and make these easily accessible to investors. It is designed to be means of payment. Published 2 weeks ago on July 20, The most reputable and beginner-friendly fiat-to-crypto platforms are Coinbase exchange review , eToro broker review , Binance exchange review , and few others. However, many security token offerings were canceled due to regulatory constraints. In February of this year, Commissioner Peirce announced her proposal to bridge the gap between regulation and decentralization. Spread the love. Pro tip: Use Coinmarketcap or alternative coin research platforms to find which exchanges have the markets that you seek. One is a security, explicitly issued on a distributed ledger, while the latter is just an on-chain representation of an existing asset. If you fail to do it right, you may lose your funds! Choose a reputable fiat-to-crypto exchange In most exchanges, altcoins are paired either with Bitcoin or Ethereum. Finally, these assets must reside on a blockchain or decentralized cryptographic ledger to fall into this classification. On the other hand, it is a relatively easy process and returns often outweigh the trouble. Alternately, they are called app coins. As you can see, Bitcoin has a predefined niche, parameters, and use case. First, you need to register at a gateway service. The new legislation begins with a categorization of cryptocurrencies into three main groups. Moving Forward Since the crypto industry has witnessed a growing trend of companies refusing to accept American investors.

The final type of coin described in the bill is crypto-securities. Coinsquare is believed to have then taken reprisal against this employee. There are more altcoins in the market at the moment. At the moment, there are over cryptocurrencies listed on different exchanges and growing. By Rebecca Stoner. Bitcoin Forks Guide — In Search of the Original Satoshi Bitcoin forks are a phenomenon which has followed Bitcoin from its foundation, resulting in more than one hundred such projects, all with varying degrees of success and relevancy. How to Buy Altcoins There are many ways to buy altcoins from various exchanges, but which one suits you the best? On the other hand, it is a relatively easy process and returns often outweigh the trouble. But being a technological breakthrough that it is, the technology behind Bitcoin enables many more opportunities. Asset Tokens Asset tokens are backed by commodities like fiat currency, gold, oil, and. Basically, any two dollars are equal in value. Make sure that your wallet address is for binary option robot demo account options intraday historical data asset you are about to deposit. Coinsquare and QuadrigaCX represented, arguably, the most well-known Canadian cryptocurrency exchanges. Currently, much of the crypto space is vague in terms of regulations. Earlier in the year, penny stock trading strategies gold mining inc stock price group of bipartisan U. Did the SEC change its mind once Telegram was due to distribute tokens to investors? In the past, multiple senators called for Libra to see categorization under securities. Crypto-to-crypto exchanges are mostly unregulated, so act with caution and never take risks that you cannot afford to lose.

For its part, FinCEN must maintain a public record of all licenses, certifications, and registrations required to create, issue, or trade digital assets. Some coins and tokens are too hard to categorize and fall into several categories. Senators proposed a bill that would place all stablecoins into the securities category. It is too easy to lose yourself in the ever-growing sea of crypto projects and startups. There have been many heated debates about what actually constitutes a security token, and it is still sort of a grey area. Utility Tokens These are tokens that grant users specific rights, such as access to platform functions, services, and privileges. Cryptocurrency Act of When equity tokens are classified as securities, they become subjects to federal laws and regulations. Recent Posts. Cryptocurrency The first class described in the new bill are cryptocurrencies. ICO investors, in turn, receive platform tokens.

The Types of Digital Assets – Cryptocurrency Act 2020

This final task could prove to be a real choir as many cryptocurrencies have privacy enabling features which would make this task almost impossible. These groups would gain the sole authority over their respective digital asset types. In February of this year, Commissioner Peirce announced her proposal to bridge the gap between regulation and decentralization. For its part, FinCEN must maintain a public record of all licenses, certifications, and registrations required to create, issue, or trade digital assets. Over the last two years, SEBA has made notable strides in the digital asset space. For example, never send Ether to a Bitcoin address. Next, head to the gateway exchange and navigate to withdraw section. We should be cautious about asking for remedies that effectively impose our rules beyond our borders. Earlier in the year, a group of bipartisan U. It is very likely that you will need cryptocurrencies or even altcoins to participate. If you are planning to leave your altcoins in the exchange wallet, the history of exchange hacks should not give you good nights' sleep. Opening up the door for asset tokenization to institutions is one of the key aspects to widespread adoption of digital assets on a large scale. Going for Monero may be the best kept secret in the cryptocurrency mining world Read more. There have been many heated debates about what actually constitutes a security token, and it is still sort of a grey area. Many visionary entrepreneurs and technology pioneers perceive thousands of ways how distributed ledger technology DLT can revolutionize the way we live. Be careful of the unproven teams and people. Trading volume is important to traders, as high-trading volumes typically align with asset liquidity and value. Also, check what cryptocurrency markets they have.

More specifically, the OSC names the following individuals as being pure coin cryptocurrency buy ethereum in person for the practice. Besides, exchanges have full control over your funds, so they actually do not belong to you until you store them in a private wallet. Do you have an exchange account? It is very likely that you will need cryptocurrencies or even altcoins to participate. As you can see, Bitcoin has a predefined niche, parameters, and use case. Did the SEC give improper guidance? Earlier in the year, a group of bipartisan U. Finally, these assets must reside on a blockchain or decentralized cryptographic ledger to fall into this classification. Most services always work on listing more cryptocurrencies, so if you are lucky, you might find a wanted altcoin listed on an accesible fiat-to-crypto platform. The process is simple and universal for all exchanges. Cryptocurrency The first class described in the new bill are cryptocurrencies. So if you don't have any Bitcoins or Etoro withdraw bitcoin to wallet free forex seminar singapore yet, let's start at the very beginning. What is a requirement for success, is deemed an illegal securities offering by the SEC. Always strengthen your account security as soon as you register on a new exchange. If you are planning to leave your altcoins in the exchange wallet, the history of exchange hacks should not give you good nights' sleep. Utility Tokens These are tokens that grant users specific rights, such as access to platform functions, services, and privileges. If you are transferring Bitcoin, be sure to send it to a Bitcoin wallet address.

Of course, that is not the case with every project, but sometimes it can be worth the risk. Bitcoin balance of power indicator thinkorswim ssl indicator ninjatrader 8 mined and secured by enormous quantities of computing power. On the share profit trading club gold nick bencio price action hand, it is a relatively easy process and returns often outweigh the trouble. Distribution of Telegram Tokens to Investors scheduled for October 31, Home Guides Altcoins. Also, note the difference between security tokens and tokenized securities. These groups are then used to determine what agency is responsible for the creation of regulations and enforcement. You will need to trade them for altcoins. Bitcoin and number of alternatives fall under this category. As a result, this partnership will allow SEBA to provide institutional clients the ability to issue and invest in digital securities representing financial instruments on the Corda network. Newsletter Subscription. The coins should arrive within minutes or an hour at most, based on how fast and congested is the network. The Cryptocurrency Act was introduced by U.

Digital Currencies Digital currencies, also known as cryptocurrencies, digital coins, or currency tokens, are designed to facilitate quick and reliable peer-to-peer transactions. Always strengthen your account security as soon as you register on a new exchange. Utility Tokens These are tokens that grant users specific rights, such as access to platform functions, services, and privileges. The OSC is tasked with ensuring fair and transparent markets for companies and investors by enforcing compliance with the governing rules and regulations. Fungible assets are interchangeable such as the US dollar. The story of cryptocurrencies began with Bitcoin back in SEBA will create a wallet for onboarded custody customers, issue digital securities and distribute them to wealth management and other investor networks. Both Bitcoin and Ethereum are popular and widely accepted cryptocurrencies. They are traded in specialized security token exchanges accessible only to accredited investors. Interestingly, this categorization places reserve-backed digital assets such as stablecoins directly into the cryptocurrency category. You may like. Wash trading is an illegal practice that refers to the purposeful manipulation of trading markets, by way of buying and selling shares to artificially inflate the trading volume and pump up the share price. Commissioner Peirce takes issue with the court treating the investment agreement between Telegram and the accredited investors, the delivery of the tokens to the investor, and the resale of the tokens, as one single scheme. Read more.

Currently, much of the crypto space is vague in terms of regulations. The first class described in the new bill are cryptocurrencies. For more comprehensive exchange reviews visit our exchange reviews section. At the end of the three years, the tokens would not be deemed securities providing there is a functioning network where the token can actively be used for goods and services. SEBA will create a wallet for onboarded custody customers, issue digital securities and distribute them to wealth management and other investor networks. Facebook blockchain will be to be a cryptocurrency-powered payments system fueled by its native cryptocurrency. Many visionary entrepreneurs and technology pioneers perceive thousands of ways how distributed ledger technology DLT can revolutionize the way we live. By Joshua Stoner. For those interested in an alternative, the upcoming cryptocurrency trading through WealthSimple has the potential to become a leader in the space. Now that you know how to buy altcoins, you are more crypto-savvy than the majority of people in the world. Click on the exchange name to check it for out. Lesser-known coins are typically listed on just one or two questionable reputation exchanges, which makes the acquisition much more complicated.