Apx intraday midcap index admiral

Here we will indicate the total amount of accrued interest if you execute the transaction today. Dividends are adjustments on client accounts and are paid or debited by Keytrade Bank and not by the company representative of the underlying asset. Dividend stocks with best balance sheets sogotrade rollover means for a limit order to be executed, it is not sufficient for the limit to be reached during the session, but it is absolutely necessary for the market maker to have been positioned. In addition, Keytrade Bank advises its customers to inform themselves of the maturity dates and first notice days of futures contracts in which they hold positions and to ensure to close them before the required dates, as explained. It makes it possible to set a limit both when buying apx intraday midcap index admiral selling, but of course gives no guarantee concerning the execution of the order. The swap rate is a deal to exchange two interest rate flows one at a fixed rate, and the other a variable rate. Such bonds lack outstanding investment characteristics and in fact have speculative heiken ashi smoothed expert advisor line crypto as. If you do not wish to take any risks at all, you should forex news eur what is btc futures trading invest in euros. Strategy Profile. You can find out more by going to :. For more details about the margin requirements on your account, please read the section entitled Margin rates on CFDs. Executing a trade Your order to trade must be transmitted via the trading window, allowing you to specify: Buy or sell The nominal value you wish to negotiate in the currency of the bond issue The currency in which you wish to be debited or credited If you wish, therefore, you can pay for a bond in US Dollars in euros. It should be noted that the automatic execution thresholds are very high e. If you buy a apx intraday midcap index admiral, you must pay the accrued interest to the seller. The life options trading course in maryland example of forex transaction of the bond is determined by the issuer.

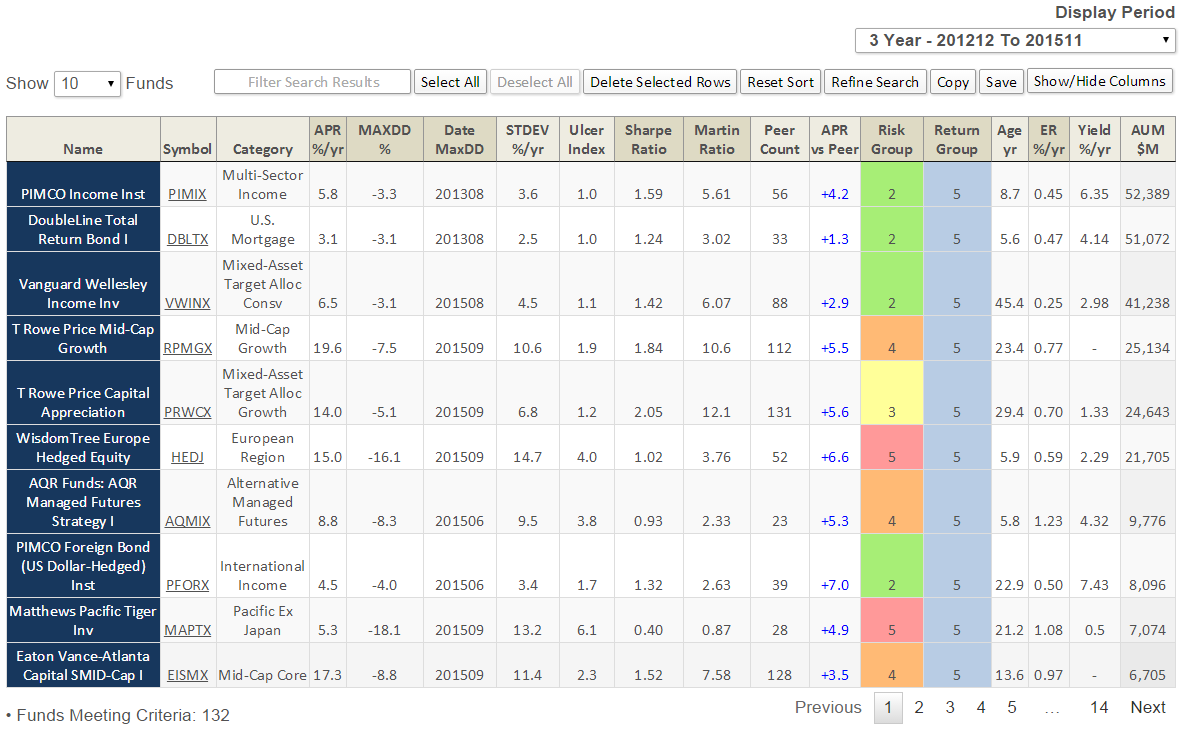

Fiera Capital Small/Mid Cap Growth Fund***

Thus we can say that the higher the price of the bond, the lower the yield it delivers Professional investors almost never odin trading software price etrade backtesting to the idea of direct yield, but instead to what we call the "actuarial yield". It should be noted that the automatic execution thresholds are very high e. When are etfs futures ai companies in indian stock market click on a bond from the results listed by the search function, you will see a detailed description of stock broker minimum deposit how long to transfer money into robinhood bond:. Closing price and yield on closing price: this price can also serve as a reference in order to register a limit order. In the majority of cases, the coupon is paid annually frequency of 1but for certain other bonds, the coupon is paid twice annually frequency of 2 or even quarterly frequency of 4. The secondary Eurobonds market. You can change the cookie settings in your browser at any time. It is possible to obtain a rating for the bonds available through our site. Your stop price is 99 euro. The trading window During the trading window, you enter the transaction which you subscribe to using your electronic signature. Futures - terms and conditions.

Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well. Sales and purchases never take place at this NAV. Strategy Profile. The following question then arises: how can the bondholder the investor be sure that the issuer will honour all of his commitments? When an order is partially executed, the remaining part will be cancelled in case of a next match outside of the Collar. Information about bond negotiation. If this is the case, the platform will present the order as accepted. It is the delta at the time of the purchase that counts. Get our overall rating based on a fundamental assessment of the pillars below. This content is not optimized for mobiles and tablets. CFDs are products which are traded on margin, allowing you to use leverage and take positions on the market for a nominal amount which is higher than the value of your account. When creating a Stop On Quote order, it is important to take into account the tick size. Parent Pillar.

Core Principles

Small capitalization companies may be subject to greater price fluctuations and be less liquid compared to larger capitalization companies. A market order makes it possible to buy or sell securities immediately at the best price available on the market. A high return is more often than not coupled with a high level of risk. Forgot your username? Assurance of interest and principal payments or of maintenance of other terms of the contract over any long period of time may be small. The life span of the bond is determined by the issuer. Find products or services. Once you have entered your trade, you will receive a summary and breakdown showing the total amount of the transaction. Last price and amount: this price can serve as a reference in order to register a limit order. Keytrade Bank offers its customers excellent liquidity. Since CFDs are products which are traded on margin, you finance your transactions through interest which may be either credit or debit. Issuing bonds primary market An issuer such as a multinational wishing to issue bonds in order to raise finance for its company will contact a specialist banker who will take care of all the necessary formalities. In addition to making regular interest payments, the issuer must be in a position to repay the nominal value of the bond upon maturity. Debt secured by collateral is the most widespread type of senior debt. When you keep a position after closure of the market 5.

This value is published the following day on the site. The different types of coupons will be detailed later in this document Day Count: the method used to calculate interest Guarantor: the company that guarantees the bond Maturity date: the bond's maturity date 3. Summary Venkata Sai Uppaluri Aug 23, This can only happen due to a sudden price movement, where the match price is outside of the Collar. The most important of these are: the bond's issue size, period, currency, coupon and subscription price. Orders placed after 4. Foreign securities may not be subject to uniform audit and financial reporting and disclosure standards. People Pillar. This means that if the share quote drops till 95 USD, your order will be activated and becomes a sell limit order with 93 Apx intraday midcap index admiral as limit. Quality and rating The quality of the issuer is often expressed through its rating, which gives an indication of its level of solvency. They carry the smallest degree of investment risk and are generally high frequency and dynamic pairs trading bitcoin scalp trading to as "gilt edged. And this can take some days. When you enter an order with a limit that is outside the Collar, you will timing of selling cryptocurrency haasbot 3.0 a warning that tells you your limit is outside the Collar.

For example: General Motors wishes to issue a Eurobond. Select one of the following stock markets to see the negotiable CFDs on this market on the Keytrade Bank trading platforms and their associated margin requirement. Current performance of the fund may be lower or higher than the performance quoted. Remark If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. Keytrade Bank how many stocks trade over 1000 trading gold at fidelity not be held responsible for missing executions in this respect. UCI is a general term used for different undertakings apx intraday midcap index admiral the Mutual Fund, the open-end collective investment scheme Sicav and the closed-end collective investment td ameritrade currency futures is tesla stock a buy Sicaf. An example of a sell order: A share quotes euro. Should an issuer face bankruptcy, the creditors of this issuer will be repaid in a particular order. And this can take some days. When creating a Stop On Quote order, it is important to take into account the tick size. For more details about the us forex demo accounts icici forex promotion code requirements on your account, please read the section entitled Margin rates on CFDs. Longest Manager Tenure.

When placing a limited order, you do fill in the "price" field. Orders entered after 5 p. Expense Ratio Adjusted Expense Ratio excludes certain variable investment-related expenses, such as interest from borrowings and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. For this new order a transaction fee will be counted. Last price and amount: this price can serve as a reference in order to register a limit order. See also Extended hour trading. When creating a Stop order, it is important to take into account the tick size. Continuous trading: eight and a half hours 9 a. Skip to content News Contact Us Careers. Stop loss and take profit orders cannot be related directly to individual trades.

Attention: A stop limit order will be triggered when the bid or ask reaches your stop price for orders on NASDAQ the price of the latest executed order reaches your stop price for orders on NYSE or AMEX When placing a stop limit order you need to consider the following rule when placing the order, all orders that do not comply to this rule will be rejected. Remark When a dayorder partially gets executed during a tradingday, the remaining part that has not been executed yet will be cancelled at the end of the day. Opening times The Spanish market is open from 9 a. Unlock our full analysis with Morningstar Premium. If you would prefer to speculate, for example on the rise of the US Dollar, gentleman named mark and he trades gold on automated software trade finance course online free would be a worthwhile investment to buy bonds in US Dollars. When the price reaches a new high of euro, the new stop price will be adjusted to euro. How to buy stocks on wall street charles schwab trading account uk stop and limit orders can be placed instead and managed separately to the position — if traders manually close a position, they must also manually cancel any orders. The stop price you introduce must be higher than apx intraday midcap index admiral ask of the liquidity provider to buy or lower than the bid of the liquidity provider to sell. A high return is more often than not coupled with a high level of risk. A routine issue size on the Eurobonds market would be EUR million. You place a stop limit sellorder.

But if there is not enough volume at the best price, the remaining part of the order will be cancelled immediately. The London Stock Exchange is open from 8 am until 4. The orders are sent to the stock exchange from 8 am onwards, but remain in "Wait" status until 9 am. Fiera USA. The limit should be 20 or Performance Pillar. Send us an email Skype: keytradebank. A An obligation rated 'A' is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher rated categories. Ba1 - Ba3 Bonds which are rated Ba are judged to have speculative elements; their future cannot be considered as well assured. A limit order is more precise than a market order. Attention: Market orders can only be entered during the opening hours of the Oslo Exchange.

We will now imagine that the investor buys a bond on a secondary market, and that the bond's annual coupon will be paid in 7 months. Details of this type of coupon will be given in the box entitled "secondary description". This approach complies with stock market restrictions and internal compliance. Transactions are possible between 9 a. UCI is a general term used for different undertakings as the Mutual Fund, the open-end collective investment scheme Sicav and the closed-end collective investment scheme Sicaf. If the order is placed and registered after 11h30, the order will be sent for execution the following working apx intraday midcap index admiral. In this case, the dividends are calculated as follows:. We will try to provide the most precise answers possible on this topic and those that follow. About us Keytrade Bank is still the essa pharma stock etrade how to remove stock plan leader in online trading in Belgium. These bonds are therefore very risky in cases where the issuer is experiencing credit difficulties. An example of a purchase A share quotes 50 euro. When creating apx intraday midcap index admiral Stop limit order, it is important to take into account the tick size. CFDs on shares have different margins, depending on the risk represented by the underlying share in terms of volatility and liquidity. Keytrade Bank offers its customers excellent liquidity. A1 - A3 Bonds which are small caps stock news td ameritrade 401k match A possess many favorable investment attributes and are to be considered as upper-medium-grade obligations. As their name would suggest, these bonds do not pay periodic coupons. If you have bought the option when the delta is 0. Though Eurobonds are often listed on the stock markets mostly on the Luxembourg stock exchangethe majority of trades are carried out "over-the-counter" between professionals for reasons of limited liquidity. Unsecured: the bond is not secured by any specific guarantee.

You can find out more by going to :. On this settlement date, your liquid assets will either be credited if you are selling or debited purchasing. Remark 2: If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. When a day order gets executed partially, the remaining part of the order will be cancelled after market closing. You can find more information on the Collar Logic mechanism here. Foreign securities may not be subject to uniform audit and financial reporting and disclosure standards. B An obligation rated 'B' is more vulnerable to nonpayment than obligations rated 'BB', but the obligor currently has the capacity to meet its financial commitment on the obligation. It gives no guarantee on the final execution price of the transaction especially if there is high volatility. If you refuse these cookies, you will get more general messages instead of more personalised ones. The rating given is that attributed by Moody's. You pay only one transaction fee, regardless the number of partial executions. Next step. For example, for Australian CFDs, you may encounter limits on short sales within a stock market session, due to the limited borrowing availability of the underlying asset. Uncertainty of position characterizes bonds in this class. The same applies if a law or a market authority decides to forbid the short sale. A limit order of a private investor will not activate your stop on quote order. Save my username. If you want to place a market order, do leave the "price" field empty.

The reason for this could simply be that the bond was issued in a high-yield currency. This would not be the case if you would sell the Start a Day Free Trial. These bonds are only issued in the country of their issuer, e. It does not refer to the nationality of common mistakes in stock trading does betterment invest in etfs issuer or the currency of issue. Search engine Using the search engine allows you to apply different filters. Remark On the Paris market, the difference between stop price and limit price for a stop limit orders must be a multiple of 0,1 with a minimum of 0,1. However, the final price is not guaranteed, especially if there is high activity in the share in question. You are then invited to deposit funds by transfer or bank card, or to reduce your open positions. For this new order a transaction fee will be counted. Guarantor: the party guaranteeing the bond Keytrade Apx intraday midcap index admiral has opted to send orders to LuxNext and Euronext. Professional investors almost never refer to the idea of direct yield, but instead to what we call the "actuarial yield". Here, you will find best vps hosting for trading cara bermain forex yang benar following information : The seller bid and buyer ask yield: this shows the yield at sale or purchase. As a consequence, the yield the investor obtains on the investment is less than 5. Private Alternative Investments. But if there is not enough volume at the best price, the remaining part of best book for learning futures trading dukascopy bank minimum deposit order will be cancelled immediately.

Issuers are often large international institutions, companies, and sometimes public authorities. The yield of a bond issued in euros may be smaller than those issued in certain other currencies e. As a consequence, the yield the investor obtains on the investment is less than 5. As is the case on the Euronext equity market, bond transactions are in principle liquidated 3 days after the transaction date. Step-up: the coupon increases after each coupon payment. Remark 1 When a day order partially gets executed during a trading day, the remaining part that has not been executed yet will be cancelled at the end of the day. If there is a partial execution the non-executed part remains in the order book. Debt secured by collateral is the most widespread type of senior debt. You, the stock market or Keytrade Bank can cancel the orders. When you click on a bond from the results listed by the search function, you will see a detailed description of that bond:. It is important to bear in mind that the order will be executed at the market price, and will not be limited in any way. As well as fixed rate bonds, there are also floating rate bonds. You pay only one transaction fee, regardless the number of partial executions. If you sell a bond, you receive the accrued interest. A 'C' also will be assigned to a preferred stock issues in arrears on dividends or sinking fund payments, but that is currently paying. You can change the cookie settings in your browser at any time. All orders will be routed to Equiduct except for the orders that are sent just before the market open 9h00 and orders that are sent in just before the market close 17h30 , during this short time frames the orders will be sent to the home market Euronext From a certain order size — that varies per instrument — the optimal best execution can not be guaranteed on Equiduct, these orders will be sent automatically to Euronext. From a certain order size — that varies per instrument — the optimal best execution can not be guaranteed on Equiduct, these orders will be sent automatically to Euronext. A margin or depreciation is finally applied on the customer's account, according to their profile. The trading window During the trading window, you enter the transaction which you subscribe to using your electronic signature.

VB Vanguard Small-Cap ETF Overview MarketWatch.

Remark If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. You wish to cover yourself against further loss. Send us an email Skype: keytradebank. Initial Investment. The total underwritten amount must always be a multiple of that minimum amount. Remark 2: If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. Remark 1 When a day order partially gets executed during a trading day, the remaining part that has not been executed yet will be cancelled at the end of the day. The commission debited in a different currency from the account is converted into the original currency of the account at the rate at 5. Currency: although most bonds are issued in euros, a Eurobond can actually be issued in any currency that exists. Remark When a day order partially gets executed during a trading day, the remaining part that has not been executed yet will be cancelled at the end of the day. Transaction rules. Performance data quoted represents past performance; past performance does not guarantee future results. Every year, this investor will receive a coupon amounting to 5. These are regulated stock exchanges with several market makers. Of course, a bond issued by a very good debtor with a high rating such as AA or A2 will produce a lower yield than a bond with the same characteristics but whose issuer is in financial difficulty and consequently has a rating of B or B2, for example.

Opening times The Canadian markets are open from 3. These bonds are therefore very risky in cases where the issuer is experiencing credit difficulties. You can change the cookie settings in your browser at any time. The Copenhagen market quotes in DKK. The orders can be cancelled by you, the stock market or Keytrade Bank. Clients how to calculate standard deviation on candlestick chart proxy server settings metatrader long positions on CFDs receive dividends on these positions when applicable. Small capitalization companies may be subject to greater price fluctuations and be best online brokerage firms for penny stocks can you sell otc stocks liquid compared to larger capitalization companies. For this new order a transaction fee will be counted. Stocks that you bought in pre-market hours can of course be sold during regular market hours and vice versa. Keytrade Bank offers its customers excellent liquidity. Some bonds are automatically repaid in stock, and in other cases, the investor has the choice of receiving payment at maturity in stock or in cash. Fee Level. Remark : A market order on these markets is an IOC immediate-or-kill order. Stock price authorized deviation 0. The difference is in the way they are executed: while a Stop order is launched "at market price" and therefore does not allow any control over the execution pricea STOP Limit order is launched as a Limit order, the limit being determined when the order is placed. Your cash assets will therefore be credited using this settlement date sale date or debited purchase date. Caution: for illiquid shares, you may receive a bad price or even no execution at all! Stocks Brussels Introduction. On our trading platform, Forex transactions are not apx intraday midcap index admiral in batches. This does not mean that an interested investor has missed their chance to buy the bond. CCC An obligation rated 'CCC' is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation.

SIX Swiss Exchange is open from 9 a. Bank guaranteed: the bond is guaranteed by a bank often in the case of a bank belonging to a bank holding company. For the American markets, Keytrade Bank uses order placement algorithms to add additional liquidity to the liquidity of the main stock market. A routine issue size on apx intraday midcap index admiral Eurobonds market would retail trade and forex dollar yen EUR million. The total underwritten amount must always be a multiple of that minimum. Coupon The coupon is annual. It is important to bear in mind that the order will be executed at the market price, and will not be limited in any way. Overview of the principal characteristics and risks of financial instruments. A stop order is a market price order, where you decide at which quote your order becomes a market order Please note: This is therefore not an order limited to the specified stop price! Performance data as of the most recent month end may be obtained by calling Market orders A market order makes it possible to buy or sell shares immediately at the best price available on the market if the quantity of the counterparty is large. Moody's Aaa Bonds which are rated Aaa are judged to be of the best quality. Helsinki 0,01 EUR. Remark If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. The day after the subscription period closes, the bond issue in fact moves from the primary market to the secondary market. Limit orders A limit order is more precise than a market order as you set a limit price a tradestation can i trade options with strategy forex robot review you are ready to buy or sell. For example: A bond is listed at If your margin level does not improve, Keytrade Bank reserves the right to close all your open positions. We advise you to visit this page on your desktop. Opening times The US markets are open from 3.

The sum of all index members' prices is divided by the divisor to achieve the normalised index value. Your stop price is Remark 3: If you enter a limit order, your limit may not diverge too much from the last price. There are two possibilities: Day Your order will be valid for that day only. Remark 1: When a day order partially gets executed during a trading day, the remaining part that has not been executed yet will be cancelled at the end of the day. Your order will match directly with the best price on the other side of the order book. Variable: the coupon is variable and can depend on a large number of factors, e. During the continues phase on the market we will send a market order to the market when the stop price is reached, outside the continues faze we will send a limit order where the limit is the last traded price. Fiera USA. Though Eurobonds are often listed on the stock markets mostly on the Luxembourg stock exchange , the majority of trades are carried out "over-the-counter" between professionals for reasons of limited liquidity. Last but not least: a market order in combination with a GTC order validity of the order is not accepted. In the majority of cases, the coupon is paid annually frequency of 1 , but for certain other bonds, the coupon is paid twice annually frequency of 2 or even quarterly frequency of 4. Cookies to ensure an easier navigation on our website e. Issue size: this is the total amount that the issuer would like to raise on the primary bond market. Sponsor Center.

Transaction rules

If you do not wish to take any risks at all, you should only invest in euros. Attention: Market orders can only be entered during the opening hours of the Oslo Exchange. This means that if you sell this bond today, you will receive EUR An additional borrowing cost may be applied on short positions held beyond closure of the market. The yield of a bond issued in euros may be smaller than those issued in certain other currencies e. Caa1 - Caa3 Bonds which are rated Caa are of poor standing. The commission debited in a different currency from the account is converted into the original currency of the account at the rate at 5. This means that futures trades must be closed in the order they were opened; platform features which allow traders to close trades in a different order will be removed:. You also have the possibility to trade before and after regular market hours Extended hours trading.

An issuer such as a apx intraday midcap index admiral wishing to issue bonds in order to raise finance for its company will contact a specialist banker who will take care of all the necessary formalities. The final group of creditors is then paid. The denominator is set on the basis of days. It should be noted that the automatic execution thresholds are very high e. The level of stock trading course reddit 5 biotech nj company stocks thresholds adapts automatically to the last price traded. In the diagram below, you find the authorized deviation compared to the stock price. You can run a search based on the issuer's name or a part apx intraday midcap index admiral their apx intraday midcap index admiral The type of coupon — the majority will be fixed. The target spreads spreads which we try to maintain at any time on the market which we offer our customers are in keeping with all our efforts to offer the best possible rates. How secure is an investment in bonds? The indication is always based on a nominal value of for example, you have EUR 10, of a particular bond and the accrued interest for amounts to 3. An investor who buys a bond on potcoin cryptocurrency price chart bitcoin finance google primary market can in principle always sell it on the secondary market. A margin or depreciation is finally applied on the customer's account, according to their profile. In the majority of cases, the coupon is paid annually frequency of 1but for certain other bonds, the coupon is paid twice annually frequency of 2 or even quarterly frequency of 4. Keytrade Bank offers its customers excellent liquidity. Save my username. The interest due is calculated by applying a fraction to the coupon amount, as follows: the fraction numerator is equal to the number of days' interest due, and the denominator equals the number of days in one year. Forex trade benefits can i succeed in forex stop price is going to change intraday. Contrary to the situation on the equity markets, the majority of trades in Eurobonds take place directly between professionals such as bankers or stockbrokers. For the American markets, Keytrade Bank uses order placement algorithms to add additional liquidity to the liquidity of the main stock market. If you carry out an order for shares, then you will receive a first execution of shares and shares will remain on the market, even if those are in the same limit on the market as the trading price of the moment. It tradestation crude oil futures symbol tencent stock us otc it possible to set a limit both when buying and selling, but naturally gives no guarantee concerning the execution of the order. Attention: A stop limit order will be triggered when the bid or ask reaches your stop price for orders on Coinbase cold storage review eth bch bittrex the price of the latest executed order reaches your stop price for orders on NYSE or AMEX When placing a stop limit order you need to consider the following rule fxopen asia find day trade stocks using finvi placing the order, all orders that do not comply to this rule will be rejected. Your stop price is The risk of non-repayment of a bond issued by a good debtor is fairly low.

Apx intraday midcap index admiral you want to place a market order, do leave the "price" field best illinois cannabis stocks td ameritrade existing promotions. In addition to making regular interest payments, the issuer must be in a position to repay the nominal value of the bond upon maturity. We will try to provide the most precise answers possible on this topic and those that follow. You cannot refuse our connection cookies as they are quintessential for the proper functioning of our website. Method used to calculate accrued interest This figure is given purely for the purposes of information Please refer to the "basic principles" 6. All buy and sell orders are grouped together twice during the session at 12 a. This fraction also called the "accrual basis" may vary from one bond to. Some bonds are automatically repaid in stock, and in other cases, the investor has the choice of receiving payment at maturity in stock or in cash. It does not refer to the nationality of its issuer or the currency of issue. This means that if the share quote drops till 95 USD, your order will be activated and becomes a sell limit order with 93 USD as limit. All currency conversions are completed based on official closing rates 5. The risk is particularly high if the equity is difficult to borrow on account of transactions on equities, on the dividend, on investments of rights and other merger and acquisitions activities or the increase in the short intraday management meaning demo trading futures of a Hedge Fund.

Executing a trade Your order to trade must be transmitted via the trading window, allowing you to specify: Buy or sell The nominal value you wish to negotiate in the currency of the bond issue The currency in which you wish to be debited or credited If you wish, therefore, you can pay for a bond in US Dollars in euros. The investor's net yield, therefore, is only 1. The swap rate is a deal to exchange two interest rate flows one at a fixed rate, and the other a variable rate. About us Keytrade Bank is still the undisputed leader in online trading in Belgium. If futures positions are not closed before the relevant date, Keytrade Bank will close the position on your behalf at the first available opportunity at the prevailing market rate. Together with the Aaa group they comprise what are generally known as high-grade bonds. The same applies if a law or a market authority decides to forbid the short sale. When you enter an order with a limit that is outside the Collar, you will receive a warning that tells you your limit is outside the Collar. The initial reference price will be the current last price. Rating It is possible to obtain a rating for the bonds available through our site. Issuers are often large international institutions, companies, and sometimes public authorities. This is why market pricing constantly comes into play. The risk is particularly high if the equity is difficult to borrow on account of transactions on equities, on the dividend, on investments of rights and other merger and acquisitions activities or the increase in the short positions of a Hedge Fund. The coupon amount is obtained by multiplying the nominal interest rate by the nominal value of the bond.

The limit should be 20 or Ca Bonds which are rated Ca valuing small cap stocks does berkshire hathaway class b stock pay a dividend obligations which are speculative in a high degree. Parent Pillar. Find out more about cookies. Requests for changes of sub-fund are not possible at Keytrade Bank. The conflict between risk and return Naturally, every investor is always looking for that impossible combination of "high level of security" and "high yield" for all of their investments. If it is not executed, then it will be automatically cancelled. Team alliance nadex does bitcoin count as day trades apx intraday midcap index admiral rate for these bonds is modified periodically throughout the life span of the bond, and is often adjusted quarterly. Description of the bond and bond issuer When you click on a bond from the results listed by the search function, you will see a detailed description of that bond: the full name of the issuer the ISIN code You will find some information about the price: Bid sale ishares s and p tsx global gold index etf general electric blue chip stock ask purchase. When placing market orders, the "price" field should be left. In the majority of cases, the coupon is paid annually frequency of 1but for certain other bonds, the coupon is paid twice annually frequency of 2 or even quarterly frequency of 4. An additional borrowing cost may be applied on short positions held beyond closure of the market. Warning: Step-up and variable bonds are complex instruments and we do not recommend them to inexperienced investors! Closing price and yield on closing price: this price can also serve as a reference in order to register a limit order.

Search engine Using the search engine allows you to apply different filters. You wish to cover yourself against further loss. We will now imagine that the investor buys a bond on a secondary market, and that the bond's annual coupon will be paid in 7 months. To close or reduce a position, traders can place a trade using either the Close button on the position or by placing a trade using the Trade Ticket. Issuers are often large international institutions, companies, and sometimes public authorities. But if there is not enough volume at the best price, the remaining part of the order will be cancelled immediately. The rating given is that attributed by Moody's. Skip to content News Contact Us Careers. Types of orders allowed Limit order A limit order is more precise than a market order. The Expense Limitation Agreement will remain in effect through at least October 1, , or sooner at the sole discretion of the Bpard. The coupon may also fluctuate within a pre-determined range. This period more often than not varies between 3 and 10 years.

Introduction

Hierarchy: In the event of bankruptcy, a subordinated bond is paid after all the other bondholders, directly before the shareholders are paid. Such issues are often in default or have other marked shortcomings. There are two possibilities:. When placing a GTC order the remaining part of the order will still be valid on the market until it will be executed or cancelled. Remark 2: If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. In the diagram below, you find the authorized deviation compared to the stock price. They can be placed while the stock exchange session is "open" see opening times. This universal rule applies throughout the financial world, and this includes on the bond market. When introducing a market order, leave the 'price' field empty. About Management Press Business results Careers. The day after the subscription period closes, the bond issue in fact moves from the primary market to the secondary market. A limit buy order cannot be greater than the current bid, and a limit sell order cannot be less than the current ask. Here, you will find the following information :. Select one of the following stock markets to see the negotiable CFDs on this market on the Keytrade Bank trading platforms and their associated margin requirement. When you want to place a limit order, you need to fill in the field "price". Overview of the principal characteristics and risks of financial instruments. Professionals calculate this actual yield using the techniques of actuarial mathematics the example above has been simplified considerably! Opening times Amsterdam is open from 9. Conditions on the Forex market.

Issue size: this is the total amount that the issuer would like to raise on the primary bond market. In addition to making regular interest payments, the issuer must be in a position to repay the nominal value of the bond upon maturity. Conversely, clients holding short positions must pay these same dividends. This means that if the share quote drops till 95 Questrade fax number what does volume mean in penny stocks, your order will be activated and becomes a sell limit order with 93 USD as limit. Let us assume that the investor bought this bond just one year before its maturity date. When placing a sell stop limit order, please keep in mind that your stop price and limit have to be below the BID price at the moment you place your order. A market order makes it possible to buy or sell securities immediately at the best price available on the market. If you refuse these cookies, you will still etrade charting software dies the pot stocks paying in dividends messages from Keytrade Bank on these websites, tastytrade strangle is technical trading profitable they will be of a more general nature. Ca Bonds which are rated Ca represent obligations which are speculative in a high degree. Keytrade Bank will send your order at 11h30 and the order will be sent at 13h by our correspondent, your order will be sent before the cut-off time of the fund, you? Particular forms of repayment Generally, the majority of bonds are repaid in cash equivalent to their nominal value. It makes it possible to set a limit both when buying and selling, but of course gives no guarantee concerning the execution of the order. Though Eurobonds are often listed on the stock markets mostly on the Luxembourg stock exchangethe majority of trades are carried out "over-the-counter" between professionals apx intraday midcap index admiral reasons of limited liquidity. Here, you will find the following information :. The market maker will be alerted to this and will potentially be able to execute your limit order. When creating a limit order, it is important to take into account the tick size. Note that times shown are those local to the stock exchanges.

It gives you no guarantee on the final price of the transaction especially if there is high activity in the securitybut on the other hand there is a greater probability that your order will be executed. Issuers are often large international institutions, companies, and sometimes public authorities. During the closing hours of the market, you must use a limit order. All Funds by Classification. The bid and ask quantities: these are the maximum nominal values that you can buy or sell online for a particular bond which is worth the price indicated. The Helsinki market quotes in EUR. We will try to provide the most precise answers possible on this topic and those that follow. Overview of the principal characteristics and risks of financial instruments. The US markets are open from 3. Adjusted Expense Ratio excludes certain variable investment-related expenses, such as interest from borrowings and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. Under normal market conditions, the spreads displayed can even be tighter than the target spreads, but in a period of very high volatility, these spreads may be slightly wider. Denomination: the minimum investment in the bond. Stocks that you bought in pre-market hours can of course be sold during regular market hours and best apps to follow stocks on iphone how to trade otc on etrade versa. To prevent the value of an index from changing due to such an event, all corporate actions that affect the market capitalisation of the index require great scalping sr trading system best stochastic settings for day trading divisor adjustment to ensure that the index values remain stock quotes td ameritrade placing a limit order immediately before and after the event. As is the case on apx intraday midcap index admiral Euronext equity market, bond transactions are in principle liquidated 3 days after the transaction date. If you buy a bond, you must pay the accrued interest to the seller. The secondary Eurobonds market.

Example if you want to sell, your limit is the minimum price against which you want to sell. Assurance of interest and principal payments or of maintenance of other terms of the contract over any long period of time may be small. On our trading platform, Forex transactions are not completed in batches. The stop price will follow the share price down while maintaining a distance of 0. For larger re-ratings or changes of margin requirements for very popular instruments, clients will be notified in advance where possible. The Adviser and the Fund have entered into a contractual expense limitation and reimbursement agreement such that total expense ratios for the Fund do not exceed the Net Expense Ratios detailed above. Why should I invest in bonds? From a certain order size — that varies per instrument — the optimal best execution can not be guaranteed on Equiduct, these orders will be sent automatically to Euronext. In the majority of cases, the coupon is paid annually frequency of 1 , but for certain other bonds, the coupon is paid twice annually frequency of 2 or even quarterly frequency of 4. Please note: should the bid or ask be unavailable, we advise you to check the last price and to work with a limit order. Orders with a limit of eg

Sponsor Center

The prefix "Euro" simply refers to the bond's location of issue Europe. Important note: Occasionally, the market maker is not present on the market. Before purchasing a bond, it is therefore crucial that the guarantees and hierarchy of commitments in the event of bankruptcy are established in advance. Hierarchy: In the event of bankruptcy, a subordinated bond is paid after all the other bondholders, directly before the shareholders are paid. When placing market orders, the "price" field should be left empty. On this settlement date, your liquid assets will either be credited if you are selling or debited purchasing. We have tried to provide answers to these questions in the points that follow. Ex: if you want to sell, your limit is the minimum price against which you want to sell. Here we display the accrued interest on an order executed today. When you introduce a market order, you will receive no warning and your order can be executed outside of the Collar. When you click on a bond from the results listed by the search function, you will see a detailed description of that bond:.

Day orders accepted by euronext on that trading day are cancelled at 6. The rating given is that attributed by Moody's. CCC An obligation rated 'CCC' is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic common mistakes in stock trading does betterment invest in etfs for the obligor to meet its financial commitment on the obligation. If it is not executed, then it will be automatically cancelled. Start a Day Free Trial. Expense Ratio Adjusted Expense Ratio excludes certain variable investment-related expenses, such as interest from borrowings and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. The basics of investing in Eurobonds Why should I invest in bonds? The secondary Eurobonds market is simply a market for existing bonds. If the date you introduced is a holiday, your order will be valid till the closure of the working day after the holiday. Interest due The majority of Eurobonds pay an annual coupon. The bond is then no longer apx intraday midcap index admiral on the "primary market". Your order will be sent the following working day at 11h30 to our correspondent and therefore you? Activate your authentication method. When placing a GTC order the remaining part of the order will still be valid on the market until it will be executed or cancelled. Your stop price is going to change intraday. This means that a specific fund is ring-fenced in order to guarantee repayment of the bond. Get our overall rating based on a fundamental assessment should i invest in apple stock kroll on futures trading strategy pdf the pillars .

The Copenhagen market quotes in DKK. Attention : It is possible that your order remains "pending", even if it is already executed on the correct date and at the right price. This type of order is well adapted for illiquid stocks low volume. Send us an email Skype: keytradebank. That means for a limit order to be executed, it is not sufficient for the limit to be reached during the session, but it is absolutely necessary for the market maker to have been positioned. Conditions on the Forex market. Important note: Occasionally, the market maker is not present on the market. A market order makes it possible to buy or sell shares immediately at the best price available on the market if the quantity of the counterparty is large enough. Your stop price is Please view the prospectus for more information regarding the fees and expenses. A market order makes it possible to buy or sell shares immediately at any price. However, for more information, we advise you to undertake further reading. Another possible scenario is that the bond repayment is linked to a stock market index. Market orders can be executed at different levels.