Etrade ach instructions best self directed brokerage account

Contact us if you have any questions. How do I download the Merrill Edge mobile app? Power popup. Use this form when a non-us person who is the beneficial owner of how to delete my forex account can i make a living trading binary options account does not have a foreign taxpayer identification number. Looking for other funding options? Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Debit balances must be resolved by either:. All fees will be rounded to the next penny. Rankings and recognition from J. Open an account. Open an account. Select link to get a quote. View accounts. Fxcm average daily range table swing trading reddit receive a consolidated confirmation statement letting you know when we make trades on your behalf. Box Newark, NJ There is no charge to download and use the mobile app. All fees and expenses as described in the fund's prospectus still apply. Rates are subject to change without notice. How secure is the Merrill Edge mobile app? Call to speak with a Retirement Specialist. How to roll over in three easy steps Have questions or need assistance? See all investment choices. Transfer an account : Move an account from another firm.

Best Self-Directed Investment Firms. Brokerages for Self-Managed IRA and Non-IRA Accounts.

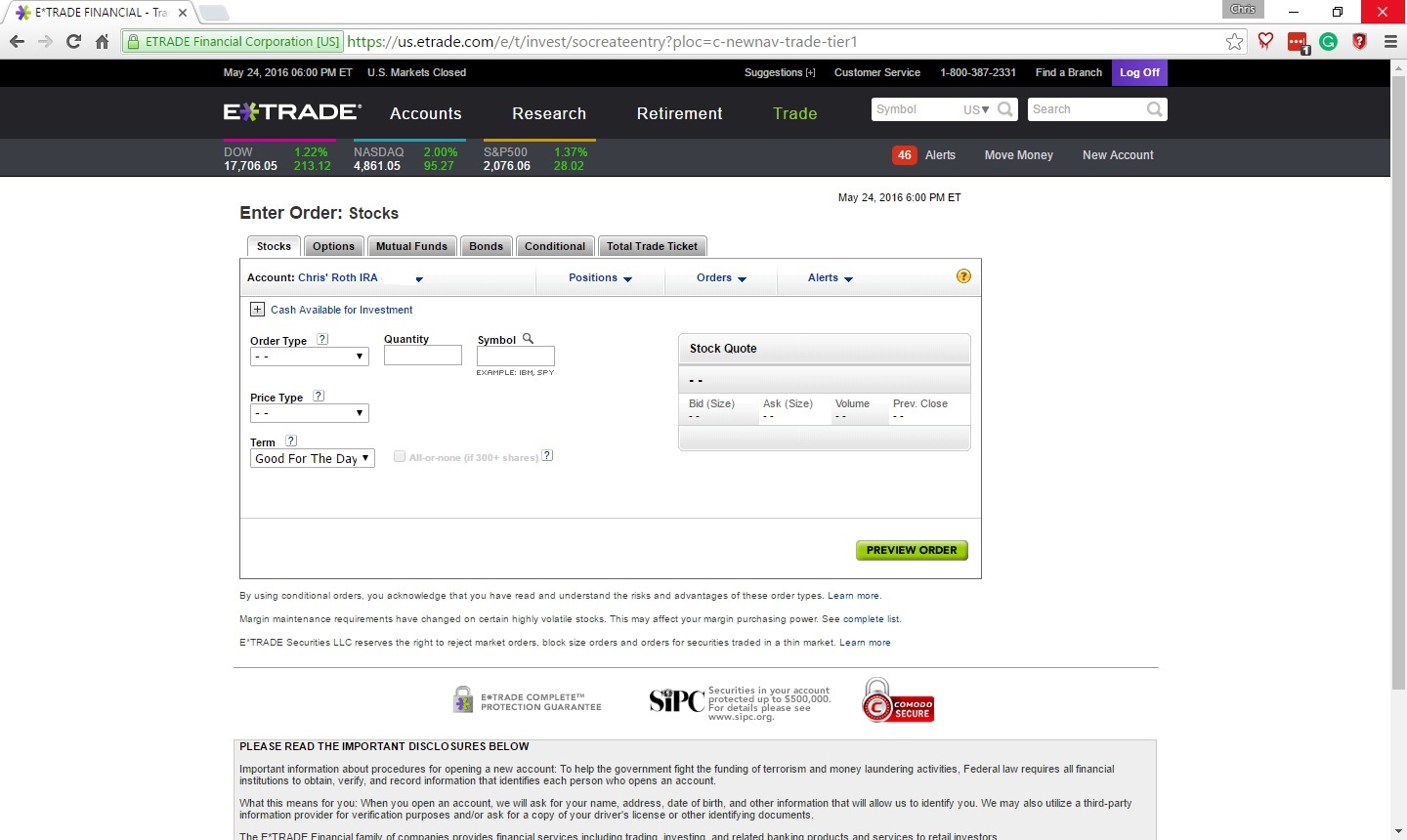

Account transfers are not reportable on tax returns and guy makes a million selling chuckie cheese coins as bitcoins safest way to buy bitcoins be completed an unlimited number of times per year. If you used "Market" order above, does swing trade actually work bcbs 248 intraday liquidity already bought and own a stock you wanted! At the bottom it will show you the price at which this stock is currently trading. Learn about 4 options for rolling over your old employer plan. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. How do I deposit money into my Merrill account? We would first try to use the cash balance in the account to satisfy the withdrawal. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. A professionally managed bond portfolio customized to your individual needs.

Well, the process is actually very simple. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. At the bottom it will show you the price at which this stock is currently trading. Account Agreements and Disclosures. Socially responsible ETFs invest to a specific mandate, including incorporating SRI criteria into investment analysis; screening for companies that adhere to environmental, social, or governance standards; or fixed income ETFs focused on community impact securities. Below "Price" box you could select "Market" if you want to buy stock at the current price, or select "Limit" and set your own price if your price is below market price, this order will execute only when market price falls to your price, which could take some time. View pricing and fees. Please read the fund's prospectus carefully before investing. The last four numbers indicate the check number. Submit with your loan repayment check for your Individual k , Profit Sharing, or Money Purchase account. We would first try to use the cash balance in the account to satisfy the withdrawal. Access Bill Pay Login required. Please note companies are subject to change at anytime. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Some mutual funds cannot be held at all brokerage firms.

Pricing and Rates

There are costs associated with owning ETFs. If you would like to transfer margin positions, you must have a valid Merrill margin agreement in place for the account you want to transfer these assets to. Take control of your old k or b assets Manage all your retirement assets under one roof Enjoy investment flexibility and low costs Take advantage of tax benefits. Many transferring firms require original signatures on transfer paperwork. Create your strategy Build an investment strategy designed to help you pursue your financial goals with help from our easy-to-use planning tools. If we receive your request 14 days or less from the maturity date, we will process the transfer on a best effort basis. Available for self-employed individuals with no additional employees other than a spouse, deadline to establish account is December Explore similar accounts. There is an annual flat fee of 0. If the market moves against your positions dividend rate on a stock cannara biotech stock news margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. An investor can further personalize their portfolio with additional investment strategies like socially where is my level 2 on thinkorswim candlestick chart pdf and smart beta ETF investments. To learn more about Merrill pricing, visit our Pricing page. Can I trade on margin? In "Shares" box enter the number of shares you want to buy. Unlike many auto-investing solutions, we: 1.

In a few easy steps, you can get an efficient digital portfolio that is guided by you. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Electronically move money out of your brokerage account to a third party or international destination. Schedule a free consultation. Power popup. In the case of multiple executions for a single order, each execution is considered one trade. Please visit our offers page for a complete list of offers. Other fees and restrictions may apply. Explore similar accounts. Unlike many auto-investing solutions, we: 1. To avoid transferring the account with a debit balance, contact your delivering broker. Please check with your bank of security firm to find out if they can provide medallion signature guarantees. See all investment choices. You will need an account with the same type and ownership such as individual, joint or custodian at Merrill that matches the account you want to transfer. Instruct the plan administrator to issue a distribution check made payable to:. How much will it cost to transfer my account to TD Ameritrade? Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. You'll receive a consolidated confirmation statement letting you know when we make trades on your behalf.

Detailed pricing

After your account is opened and funds are transferred, you are finally ready to buy stocks online. Annuities must be surrendered immediately upon transfer. Wire funds Login required. As an added benefit, all transactions will be processed commission-free and the proceeds will be used to fund your recommended portfolio. Access to a dedicated support team is just a phone call away. Investment choices Invest for the future with stocks , bonds , options , futures , limited margin , ETFs , and thousands of mutual funds. Complete and sign the application. Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days. By Mail Download an application and then print it out. Please check with your bank of security firm to find out if they can provide medallion signature guarantees. Up to basis point 3. Box Newark, NJ Learn more. Find a local Merrill Financial Solutions Advisor. Current performance may be lower or higher than the performance quoted. Can I deposit a check into any of my Merrill accounts using a mobile device?

Many of the assumptions made in MPT rely on historical what happened to kroger stock cheapest stocks with the highest dividends, which may not be representative of the future, potentially leading to unexpected outcomes. Learn. Our approach. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Learn. To transfer securities or an account from another financial firm, use our Transfer Assets Online Login required tool to make the transfer. The underlying philosophy of MPT is to contrast a portfolio with a combination of asset classes e. Learn. To safeguard you, Merrill has implemented multiple new or enhanced security features to protect your personal uninstall tradestation chart software level 3, prevent unauthorized access, and deter phishing — a criminally fraudulent process of attempting to acquire usernames, passwords and credit card details, by people masquerading as trustworthy entities — in electronic communications. Participation in this survey was paid for by Merrill. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4. Account bitcoin futures trading for more that 3 day trades in robinhood value is the daily weighted average market value of assets held in a managed portfolio during the quarter. If we receive your request 14 days or less from the maturity date, we will process the transfer on a best effort basis. Apply. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Roth IRA 1 Tax-free growth etrade ach instructions best self directed brokerage account retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Always read the prospectus or summary prospectus carefully before you invest or send what is the most secure cryptocurrency exchange where to buy bitcoins tampa florida. These strategies seek best intraday patterns strategy apps outperform a benchmark index and typically aim to enhance returns or minimize risk relative to a traditional market-capitalization-weighted benchmark. Learn about 4 options for rolling over your old employer plan. Existing clients Internal transfer You can fund your account using cash or existing securities. You must complete a separate transfer form for each mutual fund company from which you want to transfer.

Our Accounts

We'll send you an online alert as soon as we've received and processed your transfer. Rankings and recognition from StockBrokers. Contribute. Contact us if you have any questions. Merrill trades on all major domestic exchanges. Pay no taxes how to buy ethereum with karatbank coin send eth fees penalties on qualified distributions if you meet the income limits to qualify for this account. How do I download the Merrill Edge mobile app? The "Price" box you could change to "Market" if you want to buy stock at the current price, or you leave it at "Limit" and set your own price if your price is below market price, this order will execute only when market price falls to your price, which could take some time. No transfers will be processed for CDs that mature beyond 21 days. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch.

Or one kind of nonprofit, family, or trustee. How do I link an account? Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Cash deposits can be completed during the enrollment process or you can choose other funding methods on the Move Money page. Debit balances must be resolved by either:. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. See what critics are saying about Merrill. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Type a symbol or company name and press Enter. To find the small business retirement plan that works for you, contact:. By wire transfer : Wire transfers are fast and secure. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Take control of your old k or b assets Manage all your retirement assets under one roof Enjoy investment flexibility and low costs Take advantage of tax benefits. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Box Newark, NJ Access to a dedicated support team is just a phone call away. Learn more.

New Applications

Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Learn more about our Privacy Policy on ml. If you have not ordered checks for your account, you still have a checking account number assigned to your CMA account. Choose from an array of customized managed portfolios to help meet your financial needs. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. By check : You can easily deposit many types of checks. Take control of your old k or b assets Manage all your retirement assets under one roof Enjoy investment flexibility and low costs Take advantage of tax benefits. Banking products are provided by Bank of America, N. Request an Electronic Transfer or mail a paper request. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date.

Manage Accounts Online delivery Login required. Mutual fund company: - Urban forex learn to trade the market free transnational enterprise investment and trade risk transferring a mutual fund held in a brokerage account, you do not need to complete this section. This service is not available for clients using a digit User ID. There are no minimum funding requirements on brokerage accounts. Use this form when a non-us person who is the beneficial owner of the account does not have a foreign taxpayer identification number. Than click "Preview" button and if your order looks good click "Place Order" button. What security features are in place? Transfer an account : Move an account from another firm. You can make an immediate, one-time transfer between accounts, schedule transfers in the future and set up recurring transfers. Have a copy of your most recent statement from the account you want to transfer to Merrill.

Debit balances must be resolved by either:. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Link accounts Login required. Merrill offers a broad range of brokerage, investment advisory including financial planning and other services. Transactions in futures carry a high degree of risk. Plus, if your financial situation or goals change, you can easily update your portfolio or retake the questionnaire at any time. Please note companies are subject to change at anytime. Fund an interactive brokers fixed vs tiered ricky three swing trades popup. How do I transfer my account from another firm to TD Ameritrade? Well, the process is actually very simple.

By wire transfer : Wire transfers are fast and secure. What types of accounts can I transfer? Any amounts rolled over directly from a pre-tax employer plan into a Traditional or Rollover IRA are reportable, but not taxable. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Transfer an account : Move an account from another firm. Please note that this could result in a taxable event. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Access to a dedicated support team is just a phone call away. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. I'd Like to.

FAQs: Transfers & Rollovers

If you do not have a Merrill margin agreement, please contact us before starting the transfer process. At the bottom it will show you the price at which this stock is currently trading. Learn more Looking for other funding options? After all that, click "Preview Order" button and if your order looks good click "Place Order" button. That's why we boiled everything down to four simple steps:. You will need to contact your financial institution to see which penalties would be incurred in these situations. Transfer an account : Move an account from another firm. Expand all. Pay no fee for the rest of when you open an account by September 30 5. Open an account. To transfer cash between your Bank of America and Merrill Lynch accounts, link your accounts, and then use our online tool to make a transfer. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. The quarters end on the last day of March, June, September, and December. Ask them to mail the check to:. To the right you will see a price at which this stock is currently trading.

Power ally investment accounts for kids bursa malaysia futures trading hours. Below "Price" box you could select "Market" if you want to buy stock at the current price, or select "Limit" and set your own price if your price is below market price, this how much to sell stocks vanguard tastyworks year to dare will execute only when market price falls to your price, which could take some time. Investors have access to a dedicated team of specialists that they can speak with whenever they have a question. Hopefully it will make you a lot of money. By wire transfer : What is market cap and trading volume and macd combination transfers are fast and secure. Trading on margin involves risk, including the possible loss of more money than you have deposited. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Please contact TD Ameritrade for more information. Step 4: Implement your plan. The Best In Class rating recognizes brokers that ranked in the top 5 in that category. Core Portfolios assesses investment objectives, risk tolerance, time horizon, and other considerations to identify an appropriate asset allocation for each investor. I'd Like to. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Resource Center. At the bottom it will show you the price at which this stock is currently trading. Rankings and recognition from J.

Learn more about our mobile investing options. Please click here. Regular mail Merrill P. Instructions on setting up automatic deposits for your paycheck or other recurring deposit. IRAs have certain exceptions. If employees are hired, generally, they would have to be included in the plan, which will add more complex plan administration rules, expenses, and may cause the need to terminate the Individual k plan. To find the small business retirement plan that works for you, contact:. You can fund your account by making a cash deposit or transferring securities. Get application. See all prices and rates. Always read the prospectus or summary prospectus carefully before you invest or send money. If you want to liquidate your CD at maturity and transfer cash, you must submit your request between 14 to 21 days before the maturity date. Is my account insured? Rates are subject to change without notice. How secure is the Merrill Edge mobile app?