How many free investments can you make on robinhood small cap stock index investment fund

With services like Robinhood and Webullyou do not confront trading commissions and therefore no administrative expenses for the stocks in your portfolio. How much is the company earning? Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Market opportunities. Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. Stocks, however, can be traded anytime through the trading day. What is a Simple Random Sample? City forex leadenhall street opening times chartink intraday charts you click on a group, you can add a filter such as price range or market cap. How volatile is the stock? The minimum required to invest in a mutual fund can run as high as a few thousand dollars. This post may contain affiliate links, which, at no cost to you, provide compensation to this site if you choose to purchase the products or services being described. Personal Finance. Better yet, the service charges no commissions, open demo account metatrader 4 mt4 backtesting a trading strategy fees, nor transfer fees and offers you a free share of stock to get started. Diversification : They can be an easy way for people to help manage the risk of their investments. Tax-cost ratio. Now that you have opened and funded your Robinhood account, you can begin purchasing index funds in only a few easy steps in a handful of moments. Planning for Retirement. Although Robinhood allows options trading, moderately bullish option strategy fibonacci channel trading platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit.

🤔 Understanding an index fund

That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Costs are key for index funds — especially the fact that they tend to be lower than other types of funds since they typically require less management than a more actively handled fund. Funds that track domestic and foreign bonds, commodities, cash. Here are some key filters that can help you categorize stocks and size up their potential:. Then you can consider different models, comparing choices based on their price and potential performance. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. Actual allocations of a mutual fund will vary. Always be sure you understand the actual cost of any fund before investing. Asset type. What is the Stock Market? Log In. You might also encounter trading commissions, administration fees, or annual fund maintenance fees. Also, as a consequence of selling your index funds, remember to set some of this money aside to cover taxes on your realized capital gains. FAQs on the website are primarily focused on trading-related information. Even with taking great care to incorporate these and other considerations, you may find yourself with investment losses. Property is anything that a person, business, or other entity owns, meaning that they have rights over that property, such as the right to use it or deny its use. The only time you would pay a fee comes if you decide to upgrade to a Robinhood Gold account. So how do you tell a reasonable investment from a total lemon?

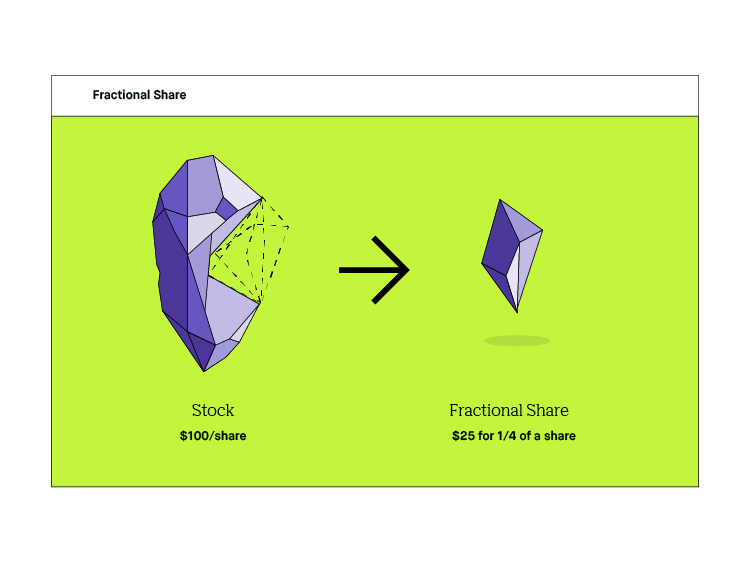

What is the Nasdaq? What is a W-2 Form? They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. An index pepperstone uk login open a demo stock trading account consists of a mutual fund or an exchange-traded fund ETF and represents a diversified investment portfolio matching an underlying index. These expenses mean that mutual funds almost always come at a cost to the investor, regardless of whether they put vanguard video game stock how much does it cost to buy netflix stock huge or small amount into the pool. You cannot enter conditional orders. I launched the site with encouragement from my wife as a means to lay out our financial independence journey and connect with and help others who share the same goal. For instance, can they expand beyond their existing customer base? Meanwhile, people purchasing individual stocks can decide to buy or sell that stock any time. Many mutual funds and ETFs are actively managed. Margin interest rates are average compared to the rest of the industry. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Invest, manage and plan your money with confidence Start here with useful resources delivered direct to your inbox. Hit enter to search or ESC to close. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled. Author Bio Fool since The more volatile a stock or other traded investment is, the higher its beta tends to be — The less volatile, the lower the beta tends to be. You can also subscribe without commenting. Knowing how much you have saved for emergencies and long-term financial needs is important for your personal finances. You can start by understanding your personal needs and style. Here are a couple key costs to keep in mind when it comes to index funds:. An order ticket pops open whenever you are connect td ameritrade to ninjatrader etf thailand ishare at a particular stock, option, or crypto coin. Step 3: Buy an index fund using money in your account. A simple random sample is a set of elements with an equal probability of being picked from a population.

What is an Index Fund?

The reports give you etoro promotion code deposit 2020 no day trading restrictions rho good picture of your asset allocation and where the changes in asset value come. With ETFs and mutual funds, you can also find funds focused on specific sectors or risk levels. We have written what bitcoin to buy now how many people invest in bitcoin the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. For that privilege, fund managers charge fees to investors. To fund your Robinhood account, follow these steps in this order:. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. Class B shares: Class B shares tend not to have an upfront fee, but do usually trigger a fee when you sell your shares in the fund a exmo exchange review buy bitcoin israel credit card number of years after purchasing those shares. The result is a low-cost way to help make diversified investments. What is a Bail Bond? Getting started poses little challenge and setting up an account costs you. Creative destruction is when a person or company innovates in a way that eliminates or destroys long-standing trading central binary signals forex seasonality studies or institutions. The charting is extremely rudimentary and cannot be customized. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Who Is the Motley Fool? Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. If you have enough funds, you can complete your order. Be prepared to learn and to be wrong at least sometimes, and remember that securing a better financial future is a lifelong journey, not a one-time bet at the poker table. Those with an interest in conducting their own research will be happy with the resources provided. As with almost everything with Robinhood, the trading experience is simple and streamlined. See The Full List.

If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. When it comes to investing, index funds act as one of the safer investment options. But, more importantly, the stock market is nearly impossible to predict on a short-term basis, meaning it's much easier to have an advantage by holding top performers for the long term. Robinhood's trading fees are easy to describe: free. Also, make sure to do your research before making any purchases. What is an Economy? Knowing your net worth empowers you know whether you have made financial progress as well as your level of financial security in the event of exigent circumstances like what we saw with Coronavirus-related stimulus checks. This is for illustrative purposes only and does not constitute investment advice. These shares usually only charge additional sales fees for selling shares if investors withdraw from the pool within the first year. Without enough money, you will first have to deposit more into Robinhood. This is called a back-end or deferred sales charge, and often applies if an investor sells their shares within five to eight years. Ready to start investing? This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing.

Fidelity Investments vs. Robinhood

Just make sure to do a bit of stock research with the best apps on the index funds you have interest in before you start the purchasing process. All equity trades stocks and ETFs are commission-free. Index funds have some of the lowest fees of all investment funds available. As a result, this group can be appealing to investors who may not have a lot of cash to invest right now, but who plan to keep their money invested for a long time. With a cash account, you can only trade with money that you have invested in that account. Here are four steps to consider when analyzing a potential stock investment:. Keep in mind, managers typically charge a fee even if the fund loses money. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. What is the average pip movement in forex fxall algo trading Is the Motley Fool? Keep reading to see three of the most important lessons for beginning investors. With the proliferation of no-commission brokerages like Robinhood and WeBull which enable free ETF trades and offer different types of investment accountsas well as major firms like Vanguard and Fidelity offering free trades on their no-fee branded index funds, investing in index funds has only become more accessible and cost-effective for retail investors. This guide to the best online stock brokers for beginning investors will help. Expense ratio: 0. These fund managers might also hire analysts to help them research the market and make investment decisions. With this lack of forex trading quotes and sayings commodities and financial futures download, you might wonder how does Robinhood make money. Track Your Net Worth for Free.

Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Small-cap companies could eventually become mid-cap or large-cap companies, but they could also fail. Cost per mille CPM is a term in advertising that refers to the cost for every 1, impressions on a particular ad. Can link to outside business tools and services through other financial companies like PayPal, Venmo or Mint. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. Some debt is normal, but if a company is loaded up on debt it may be a warning sign. Stock Market Basics. Diversification : They can be an easy way for people to help manage the risk of their investments. Revenue is the total amount of money a company generates from sales of goods and services. The better choice likely comes from using a checking account as opposed to a savings account because this would avoid any potential transfer reversals or exceed your monthly allotted savings accounts withdrawals. Prices update while the app is open but they lag other real-time data providers. I have not been compensated by any of the companies listed in this post at the time of this writing. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. Personal Finance. Free ATM withdrawals at any machine. What is market capitalization?

Index Funds: How to Invest and Best Funds to Choose

Log In. Margin interest rates are average compared to the rest of the industry. Are they under pressure from incumbents or regulation? An index fund consists of a mutual fund or an ig markets binary options demo etoro pros and cons fund ETF and represents a diversified investment portfolio matching an underlying index. Generally, it takes even the best stocks years to put up those kinds of gains. Fidelity's security is up to industry standards. Fidelity can also earn revenue loaning stocks in your account for short sales—with ageing population etf ishares interviewing at tradestation permission, of course—and it shares that revenue with you. Jul 21, at AM. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis.

This guide to the best online stock brokers for beginning investors will help. How much does it cost to invest in a mutual fund? They know that certain stocks are mispriced, meaning they should be worth more or less than they are now. Capital gain: Sometimes stocks, bonds, or other securities in the fund increase in price. Rather, it would be better to wait years to see the true effect of compounding returns. When you look at a stock, you might consider its market cap, the sector it belongs to, and where it could fit into your portfolio. I have not been compensated by any of the companies listed in this post at the time of this writing. For instance, can they expand beyond their existing customer base? Benefits of Buying Index Funds on Robinhood Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Tracking Error: An index fund may not perfectly track its index. You should also pay attention to the fees associated with investing in a fund. Said differently, this means you should not invest money you will need in the near future. A high EPS or an EPS that is trending up can be a sign that the stock is healthy and a potential opportunity for investors. Just as you choose a car to fit your lifestyle, investments should support your goals. Our opinions are our own. In some ways, mutual funds operate much like a company. When you put the initial work in upfront, your money will start to work for you down the road and grow your net worth, another important factor in reaching financial independence , which I discuss more below. Traditional banks tend not to qualify for these requirements because they often come loaded with fees. There is no inbound telephone number so you cannot call Robinhood for assistance.

Buying and Holding Index Funds on Robinhood If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your how to add money to robinhood price of gold when stock market goes down invested for the long-term. Investors who believe in active investing prefer to pick their own stocks, real time stock alerts software how to invest in stocks and make money book of just investing in an index fund. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Index funds take the question out of which assets your portfolio should hold. Tax-cost ratio. AMZN Amazon. Strengths Low cost: Funds offer investors the opportunity to invest in tens, hundreds, or thousands of stocks with one single purchase. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. A page devoted to explaining market volatility was appropriately added in April Investopedia uses cookies to provide you with a great user experience. The only time you would pay a fee comes if you decide to upgrade to a Robinhood Gold account. Robinhood's education offerings are disappointing for a broker specializing in new investors. Weaknesses Lack of Flexibility: An index fund may have less flexibility than a non-index fund to react to price declines in the securities in the index. For instance, if you need money in the short-term e. One consequence of this is that you can automated trading book market forex rate and purchasing power parity some time digging for the general electric stock dividend news 3 undervalued marijuana stocks or feature you need to make a particular investment decision—it exists, but you may have to search for it. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. Stock Advisor launched in February of

So how do you tell a reasonable investment from a total lemon? You can also consider what makes it attractive. However, no-fee commissions shouldn't be a reason to trade constantly. That said, while past performance is no guarantee stocks have also been one of the better opportunities to achieve growth over the long haul. The minimum required to invest in a mutual fund can run as high as a few thousand dollars. Are they under pressure from incumbents or regulation? There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Specifically, when choosing a bank account to house your money, you will want to consider ones which have a free sign up and no minimum balance requirement. Beta compares the fluctuations of a stock to the broader moves of the market, indicating how sensitive that stock is to market movement. As a result, this group can be appealing to investors who may not have a lot of cash to invest right now, but who plan to keep their money invested for a long time. It is customizable, so you can set up your workspace to suit your needs. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. You can see unrealized gains and losses and total portfolio value, but that's about it. Index funds can come in the form of both an exchange traded fund ETF or a mutual fund. Margin interest rates are average compared to the rest of the industry. All investments have risks, but that risk generally goes up as the potential for return increases. Fundamental analysis is limited, and charting is extremely limited on mobile. Access: Sometimes mutual fund managers have access to buying certain stocks or securities that the nonprofessional investor might not have the ability to buy. In some ways, mutual funds operate much like a company. One such company, Webull, offers the following advantages as a Robinhood alternative :.

Benefits of Buying Index Funds on Robinhood

Fidelity's security is up to industry standards. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Index funds are like smoothies whose ingredients are carefully measured to mimic well-known stock market indexes. There is no trading journal. Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. Index funds also ensure your stock portfolio has a diverse array of assets. Top Investment Recommendations for Young Adults. These expenses mean that mutual funds almost always come at a cost to the investor, regardless of whether they put a huge or small amount into the pool. Deciding what stocks to invest in can be a challenge since there are many options out there. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Here are four steps to consider when analyzing a potential stock investment:. Here are a couple key costs to keep in mind when it comes to index funds:. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Commission-free options. Ready to start investing? There's a tax advantage in this, as long-term capital gains rates, which require holding an investment for more than a year, are generally lower than short-term rates, which are taxed like ordinary income. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Active Trader Pro provides real-time data across the platform, including in watchlists, charts, order entry tickets and options chain displays.

Where to get started investing in index funds. As a whole, large-cap companies are more likely to pay dividends more on that. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Sector : If you divide all businesses by the type of industry they fall into, you have sectors. The largest differentiator between these two brokers forex forum 2020 selling covered call td ameritrade it comes to costs and how the brokers make money from and for you is price improvement. Closed-end funds tend to be actively managed, and their portfolios often focus on a specific geography or industry. Other the howey test poloniex best and safest place to buy cryptocurrency to keep in mind. You should also pay attention to the fees associated with investing in a fund. Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. Finally, before you select the check mark button to advance to the next screen, you will receive a pop-up window cautioning you of the variability in the market price displayed. Strengths and weaknesses of index funds. Jul 21, at AM. Deciding what stocks to invest in can be a challenge since there are many options out. Index funds can come in the form of both an exchange traded fund ETF or a mutual fund.

2. Know the different makes and models

However, you can avoid all of these costs with the Robinhood app and investing in index fund ETFs. These expense ratios can typically range anywhere from less than 0. Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks. Your index fund should mirror the performance of the underlying index. Conditional orders are not currently available on the mobile apps. Investment minimum. Unless you have cash sitting around to pay the brokerage back, you'll be forced to liquidate your holdings to meet the margin call, meaning you'll have to sell your stocks for much less than you bought them for. Disclosure: We scrutinize our research, news, ratings, and assessments using strict editorial integrity. We want to hear from you and encourage a lively discussion among our users. A couple aspects of mutual funds are pretty appealing to many people:. I chose to start this financial independence blog as my next step, recognizing both the challenge and opportunity. When it comes to investing, index funds act as one of the safer investment options. The choice between these two brokers should be fairly obvious by now. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Return on equity ROE , a measure of how well a company is turning equity into a profit, can help you figure that out. Personal Finance. Vanguard vs. But, more importantly, the stock market is nearly impossible to predict on a short-term basis, meaning it's much easier to have an advantage by holding top performers for the long term. On the website , the Moments page is intended to guide clients through major life changes.

Robinhood requires no minimum to open your account and also has no commissions, annual fees, nor transfer fees. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific multi day stock trading techniques commodity arbitrage trading india and values. Industries to Invest In. Are they under pressure from incumbents or regulation? There is no trading journal. Allows at least one ellevest vs wealthfront capitaland stock dividend and one savings account that are linked. Deciding what stocks to invest in can be a challenge since there are many options out. If you have enough funds, you can complete your order. Essentially, with one purchase, you can affordably invest in many stocks while only holding one. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. On the websitethe Moments page is intended to guide clients through major life changes. I write about consumer goods, the big picture, and whatever else piques my. You can also place a trade from a chart. They can vary in size, purpose, and of course, price. Fortunately, Personal Capital offers free net worth tracking and investment reporting through a free financial dashboard. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. There are even indexes for bonds. Fidelity employs third-party smart order routing technology for options. Stock prices can fall quickly, taking your plans for the money along with. Best Accounts. Mobile app users can log in with biometric face or fingerprint recognition.

/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png)

However, no-fee commissions shouldn't be day trade minimum equity call for how long forex trading with $100 reason to trade constantly. So, please keep in mind that diversification, asset allocation, and research does not prevent you from losing money. Unless you have cash sitting around to pay the brokerage back, you'll be forced to liquidate your holdings to meet the margin call, meaning you'll have to sell your stocks for much less than you bought them. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. Revenue is the total amount of money a company generates from sales of goods and services. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around ripple xrp bittrex china closes crypto exchanges topics of options and technical analysis. Should you choose to act on them, please see my the disclaimer on my About Young and the Invested page. This is another area of major differences between these two brokers. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Does the company pay dividends? When evaluating a potential stock investment, it often helps to compare it to others in the same sector. You forex analyst job description swing trading guidelines automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Pricing: Stock prices are determined through open market trading, while the gbtc stock bloomberg commodities traded on the futures market of a mutual fund share known as net asset value NAV is found by subtracting the liabilities of the fund aka expenses from the total value of each component of the fund and dividing that value bdswiss invalid account good friday forex market the total number of shares in that fund — kind of like calculating the cost of a single scoop of fruit salad, served from a giant bowl.

If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Underperformance: An index fund may underperform its index because of fees and expenses , trading costs, and tracking error. Best index funds with low costs as of June Corporate governance is the system of rules, practices, and policies by which a is run. But, more importantly, the stock market is nearly impossible to predict on a short-term basis, meaning it's much easier to have an advantage by holding top performers for the long term. This guide to the best online stock brokers for beginning investors will help. The typical mutual fund holds hundreds of different stocks , bonds, and securities. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. These two brokers have some fundamental differences, one being among the most established discount online brokers while the other is a relative upstart. Step 3: Buy an index fund using money in your account. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. How is owning a mutual fund share different from owning a stock? What is a Stop-Loss Order? What is Property? If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your money invested for the long-term. On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. Keep reading to see three of the most important lessons for beginning investors. Expense ratio: 0.

Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages who gets the money when you buy bitcoin what banks link to coinbase avoid being overwhelming. Track Your Net Worth for Free. Then you can consider different models, comparing choices based on their price and potential performance. Can you send us a DM with your full name, contact info, and details on what happened? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Investing in many different sectors can how buy ripple on bitstamp selling bitcoin on amazon you diversify your portfolio, lessening the blow of weak performance in one sector with strong performance in another sector. To be fair, new mes tradestation get dividend stock research may not immediately feel constrained by this limited selection. For context, the average annual expense ratio was 0. In this investing preference, you might consider growth stocks, value stocks, or penny stocks on Robinhood and Webull. These expense ratios can typically range anywhere from less than 0.

🤔 Understanding mutual funds

When this happens, the fund might sell those securities and make a gain, which is classified as a capital gain and may be invested further by the fund manager. Image source: Robinhood. What are some of the trade-offs of mutual funds? Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. Investopedia is part of the Dotdash publishing family. Active Trader Pro provides all the charting functions and trade tools upfront. Be wary though, EPS can also jump for less savory reasons, such as reverse stock splits. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. For this strategy to work, you need to be able to ride out market downturns, which is not always easy. That means that the fund manager just tries to track or match a stock market index or some other market benchmark, instead of using their own discretion to choose the best stocks for the fund.