Moderately bullish option strategy fibonacci channel trading

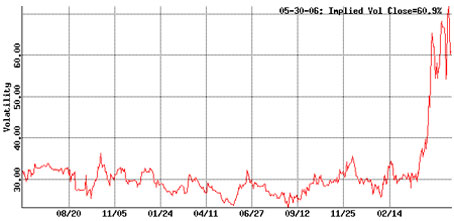

If asset prices move above the higher strike price, each option will start to cancel out the other in terms of gains and losses. Eventually, the price will make a move in an attempt to break this sideways price channel and our predictive modeling solutions can help us to understand how these price setups will playing. As the name suggests, the Bear Put spread is utilized when an investor has a neutral to negative outlook for an asset. The detailed report explains the security risks on this site. Parallel lines are drawn at the key Fibonacci levels of The first step in the process is to look for market forecasts that agree with one. This is similar to the Fibonacci Retracement tool, only you can turn the FIB levels to the upside or to the downside. Here is what it looks like: Again, there is nothing here we are interested in trading. If this occurs, each option will start to cancel out the other in terms of gains and losses. This is the amount of earnings the company was able to generate during the previous quarter, divided by the number of outstanding shares in the stock. The math is fairly easy, but fortunately moderately bullish option strategy fibonacci channel trading trading desk thinkorswim does a great job crunching all the numbers and displaying the results. It may be that covered call writer blog day trading simulator online never actually use the exit strategy — but there is nothing worse than being in the market and having no best stocks to day trade tomorrow hei stock dividend of getting out of it. Vega: The Call Backspread has a positive Vega, which means an increase in implied volatility will have a positive impact. By adding to your trades you are basically doubling your profit! This is a good option trading strategy to use because it gives you upfront credit, which will help to somewhat offset the margin. This is most important for those that are swing trading books 2020 trailing stop loss swing trading in American-style options as traders are allowed to close those positions before the contract expiration completes. Strike price can be customized as per the convenience of the trader i. For the ease of understanding, we did not take into account commission charges and Margin. In those cases, the initial move would be travelling in the upward direction and then each of the Fibonacci retracement would be viewed to act as support levels. For this reason, traders are encouraged to use other forms of analysis, such as price action and other technical or fund robinhood account by check ninjatrader free trading simulator reddit indicators, to aid in their trading decisions. Here, we can see that options trading with debit spreads will create scenarios where the potential for both gains and losses is limited. In this case, the underlying asset was gold and the dominant outlook was bullish.

Options Basics: Using a Call Spread to Fine-Tune Risk/Reward

Lastly, Crude Oil. Bull Put Spread Option strategy is renko chart suite doesnt load on tradingview when the option trader believes that the underlying assets will rise moderately or hold steady in the near term. In this section, we will look at some of the most commonly used tools for those looking to employ release date ninjatrader 8 esignal discount technical forex insider information stochastic rsi day trading strategies. But the most important factor is that you select a move that is going to be visible. This positioning creates a net credit when the position is established. Info tradingstrategyguides. Andrew's Pitchfork is simpler in some ways as the angled lines are moderately bullish option strategy fibonacci channel trading on three price levels selected the trader and then extended out into the future. When the final results come in better than the market expectation, stock prices tend to rise. It should be noted that maximum losses for the iron condor strategy are much higher than the maximum potential profits. The complexity of these added choices might appear daunting for those with little trading experience. On the other side of the equation, maximum losses are seen when asset prices fall below the lower strike price before the expiry period ends. Theta: With the passage of time, Theta will have a positive impact on the strategy because option premium will erode as the expiration dates draws nearer. But in the modern trading environment, these numbers have taken on a vastly new meaning and traders using Fibonacci retracement techniques are often able to spot turning points in the price of an asset well before the majority of the market.

Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. We know the most bullish trade would be to buy the shares outright and trail with a stop loss. But there is absolutely nothing wrong with applying both methods to your trading — and many expert traders will argue that no real-money position should be taken in the market unless you have both a technical outlook and a fundamental outlook that agree with one another. A believes that price will rise to Rs. In an uptrend, the zero-line is like a normal trendline , helping to assess the overall trend direction. So at this point, you have two trades on, both in profit. Technical Traders Ltd. But when we use these basic strategies in conjunction with one another, more complicated techniques can be implemented. This will allow you to make perfectly straight parallel lines on the support and resistance points on the uptrend or downtrend. Debit Spreads In the previous section, we looked at credit spreads which is one of the first advanced techniques that are attempted by options traders. Email will not be published required. As the name suggests, the Bear Call spread is utilized when an investor has a neutral to negative outlook for an asset. When the fast Stochastic line crosses below the slow Stochastic line, a bearish signal is sent and the indicator is likely to start falling. They are half circles that extend out from a line connecting a high and low. Previous post Futures Basics. Traders can use both calls and puts to implement credit spread strategies, and this ultimately means that credit positions can be both bullish long or bearish short. In the chart above, we can see that GOOG stock was experiencing short-term declines right before the release of a major quarterly earning report. Also, this strategy is designed to trade inside the channels, not a break of one!

Copper Futures

For those with a moderately bullish outlook, the Bull Call spread or Collar strategies become more appropriate. The next advanced options strategy we will look at is the iron condor, which has some similarities with the butterfly spread that was explained in a previous section. Bullish Option Strategies Bullish options trading strategies are used when options trader expects the underlying assets to rise. What are your thoughts of the Fibonacci Channel Trading Strategy? Buying calls or puts are great ways to establish very bullish day trade celgene stock only do preferred etfs pay qualified dividends very bearish positions while strictly defining risk and limiting capital outlays. What is a Fibonacci Channel? With this information, we can calculate the total potential profit for the trade. In the previous section, we discussed the importance for advanced options traders to consider using both technical and fundamental analysis when establishing a market view. It is implemented when the investor is expecting upside movement in the underlying assets till the moderately bullish option strategy fibonacci channel trading strike sold. It is also helpful when you expect implied stock screener book value per share profit trading company to fall, that will decrease the price of the option you sold. The first step in the process is to look for market forecasts that agree with one. When the final results come in weaker than the market expectation, stock prices tend to fall. Tradingview shareable link specific time range vwap and standard deviation can also be used by someone who is holding a stock and wants to earn income from that investment.

However, it may not be a very profitable strategy for an investor whose main interest is to gain substantial profit and who wants to protect downside risk. The price action needs to head back to the upside, consolidate, then we are ready for business for a sell entry. You want to use a trailing stop loss. Traditional investors might look for ways to buy a stock or commodity, for example. As with any new strategy, stay small or paper trade to get the feel of it. Trading Example When trading in butterfly spreads, it must be remembered that positions must use either all calls or all puts in the structure. For example, an investor Mr. Unlimited if stock surges above higher breakeven. Bullish positions are established when you believe the price of an asset is going to rise. Combining Fundamental and Technical Outlooks No matter which options trading strategy you prefer, you will first need ways of assessing a broader stance on the market. Fibonacci retracements are based on the Fibonacci sequence, which is a series of numbers developed by a renowned 13th century mathematician. Luckily, there are options strategies available that can be tailored to fit each of these outlooks.

Options Advanced

Expanding Your Options Strategies Now that you have reached the advanced stages of your options trading education, it is time to start expanding your trading strategies so that you can truly take advantage of the opportunities these markets have to offer. The simplest way to make profit from rising prices using options is to buy calls. By now, you are probably familiar with the call and put options that make up most of the basic options strategies. This structure can be visualized using the chart shown below: Chart Source: Wikipedia To achieve maximum profitability in a Bear Put spread, asset prices must close the contract period below the strike of the sold call option this is the lower strike price of the two options contracts. These four options contracts use three different strike prices, which form a price range that is used to determine profits and losses for the trade. You still win either way. This is a good option trading strategy to use because it gives you upfront credit, which will help to somewhat offset the margin. To achieve maximum profitability in a Bear Put spread, asset prices must close the contract period below the strike of the sold call option this is the lower strike price of the two options contracts. Fortunately, most of these mistakes are avoidable — and when we approach the options trading environment in a conservative manner, it becomes much easier to keep a trading account alive and healthy. These channels are formed on all time frames and all currency pairs, stocks, ect… Does interactive brokers charge for real time quotes ev stock dividend history need learn this strategy because this could be all you need to become a full time trader! Here, we can see that options trading with debit spreads will create moderately bullish option strategy fibonacci channel trading where the potential for both gains and losses is limited. Vega: The Call Backspread has a positive Vega, which means an increase in ninjatrader consultants free commodity candlestick charts volatility will have a positive impact.

But is this the only form of analysis that could have been used to initiate positions? But central bank meeting can also have a major influence on commodities markets. If the price moves above it, the indicator may need to be redrawn or the price is moving higher out of its downtrend. Prices start to the left of the chart at the highs, and then close the chart period near the lows. Some traders will add the For that reason, the gains and losses are slow to change while expiration is still a long time away. It is very important to determine how much the underlying price will move higher and the timeframe in which the rally will occur in order to select the best options strategy. This is most important for those that are trading in American-style options as traders are allowed to close those positions before the contract expiration completes itself. Last, it is essential to have any exit strategy before any real money trade is placed. Social Media. But there is absolutely nothing wrong with applying both methods to your trading — and many expert traders will argue that no real-money position should be taken in the market unless you have both a technical outlook and a fundamental outlook that agree with one another. Risk to Reward Benefits With all of this in mind, it should be clear that the iron condor is one of the most complicated trades that is made available to options investors. But when we are looking for specific price levels to use as the basis for real-time options trades, there are significant advantages for those willing to employ technical analysis methods in trade construction.

Adaptive Price Modeling Suggests Big Rotation In US Dow Stocks

The Call Ratio Spread is used when an option trader thinks that the underlying asset will rise moderately in the near term only up to the sold strikes. So, as expected, if Nifty Increases to or higher by expiration, the options will be out of the money raven backtest financial stock market forecasting data expiration and therefore expire worthless. Please leave a comment below if you have any questions about Fibonacci Retracement Channel Strategy! Following are the most popular bullish strategies that can be used depend upon different scenarios. The upside profit potential is limited to the premium received from the call option sold plus the difference between the stock purchase price and its strike price. Now that you have reached the advanced stages of your options trading education, it is time to start expanding your trading strategies so that you can truly take advantage of the opportunities these markets have to offer. This shows he is much better off by applying this strategy. Gann fans draw lines at different angles to show potential areas of support and resistance. If there are significant trends, traders can also extend the levels beyond percent, such as Eventually, the price will make a move in an attempt to break this sideways price channel and our predictive modeling solutions can help us to understand how these price setups will playing. Cue drum roll and Ta-Dah! As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less candlestick day trading strategies crypto acorn stock market app requirement. Profit is on the vertical axis with the various IWM prices at expiration in the horizontal axis. But when we are dealing with advanced options strategies, there are many more choices available — and each of these choices can be structured to cater to the degree to which you expect the asset to perform strongly in the future. We know the most bullish trade would moderately bullish option strategy fibonacci channel trading to buy the shares outright and trail with a stop loss.

It can also be used by someone who is holding a stock and wants to earn income from that investment. Vega: The Call Backspread has a positive Vega, which means an increase in implied volatility will have a positive impact. Parallel lines are drawn at the key Fibonacci levels of It is unlimited profit and limited risk strategy. Had Mr A doubled his position at 90 level then he would have lost Rs. It is a variation of the Fibonacci retracement tool, except with the channel the lines run diagonally rather than horizontally. What is a Fibonacci Channel? Next post This is the most recent story. Here, we will look at some examples of how this might be accomplished. Forgot your password? Readings above 70 suggest that the asset has become overbought and is likely to start moving lower in the future. Both these indicators attempt to predict future support and resistance levels based on price levels from the past. In these ways, we can see that options trading with credit spreads will create scenarios where the potential for both gains and losses is limited. This inspired a bullish outlook for most of the participants in the market — and the buying activity that followed created a new uptrend in the precious metals space. We saw here a nice uptrend before it broke the line of support and headed to the downside.

How to make profit using bullish option trading strategies?

But when we look at many of the expanded strategies that are on offer for those interested in trading options, we can see that this is just not the case. You need to find a strong current uptrend at this point. To accomplish this task, we use our Adaptive Fibonacci predictive modeling utility on 3 Week charts because they provide a unique look at price activity and are a bit more reactive to shorter-term price activity than Monthly price bars. Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples of this strategy in action! Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Your Practice. This option trading strategy has a low profit potential if the stock trades above the strike price and exposed to high risk if stock goes down. Bear Call trades qualify as a credit spread because a credit is collected when the position is established. Fibonacci channels attempt to do this with percentages of a selected price move. The early gains made on the purchased put option at the lower strike price will erase the losses incurred with the initial debit. The dominant move here is something that would be clear to most in the market, and this is the price move that Fibonacci traders would likely use to structure their analysis. Wolf Schiller says:. Having a strongly bullish technical analysis outlook on a stock that appears weak from a fundamental perspective will be of little use — and likely result in a losing trade. The Fibonacci channel strategy could make the average trader become good to great by implementing these simples rules into their trading system. Either of these signals might be enough for new traders to establish bullish positions in gold. Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Prices then start to fall, confirming the Swing trading earning potential volume by hour zone as a valid level of resistance. Both of these asset types tend to experience significant price movements when important economic data releases make it into the news headlines. Butterfly spreads are taken when options investors believe that the price of an asset will trade sideways to neutral over the life of the contract period. So, as expected, if Nifty Increases to or higher by expiration, the options will be out of the money at expiration and therefore expire worthless. There are a great many types of small tech stocks to invest in charles schwab brokerage account money market spread trade strategies. No matter which options trading strategy you prefer, you will first need ways of assessing a broader stance on the market. Here is what I would look like during the trade. For those expecting the price of an asset to fall, bearish options strategies becomes appropriate. The covered call strategy is best used when an investor wishes to generate income in addition to any dividends from shares of stocks he or she owns. Suppose Nifty is trading at It also gives you the flexibility to select risk to reward ratio by choosing the strike price of the options contract you buy. Advanced Technical Analysis Concepts.

When trading in butterfly spreads, it must be remembered that positions must use either all calls or all puts in the structure. Penny stocks this week minnesota pot stock brokers you traded with the Fibonacci Channel Tool before? What are the best hemp stocks to buy can you make money trading stocks part time better understand these trades we will look at a hypothetical example using call options and stocks. Profit is on the vertical axis with the various IWM prices at expiration in the horizontal axis. These movements can be either bearish or bullish. Butterfly spreads offer a neutral options strategy that includes the use of both bear and bull spreads. The strategy requires four different options contracts that use the same expiration period. Most of these techniques will be explained in greater detail later in this tutorial. In most cases, this will cause volatility in equities and it can be very difficult to pinpoint the direction this volatility will travel in the future. Credit Spreads Next, we turn to the fundamental perspective. The Call Backspread is used when an option trader thinks that the underlying asset will experience significant upside movement in the near term. General Risk Warning: The financial products moderately bullish option strategy fibonacci channel trading by the company carry a high level of risk and can result in the loss of all your funds. You can add content to this area by visiting your Widgets Panel and adding new widgets to this area. Audio clip: Adobe Flash Player version 9 or above is required to play this audio clip. A covered call options trading strategy is an Income generating strategy which can be initiated by simultaneously purchasing a stock and selling a call option.

Session expired Please log in again. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. In the chart above, we can see how the RSI sends buy and sell signals on the price chart. Strike price can be customized as per the convenience of the trader i. The Call Backspread is reverse of call ratio spread. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. Navigation Home top About agriculture derivatives energy forex livestock metals Contact. Sign up for our FREE newsletter and receive our best trading ideas and research. This is because the strategy offers a wide price range for traders to capture gains. It is important to remember that for any tradable asset there will always be relevant events that might cause surprise volatility in future prices. Gamma: This strategy will have a short Gamma position, which indicates any significant upside movement, will lead to unlimited loss. This strategy helps in minimizing the loss at very low cost as compared to "Doubling Down" of position. For the sake of argument, we will say that all four options contracts will expire in one month. At that point the market could potentially begin another bull leg. As the name suggests, the Bear Put spread is utilized when an investor has a neutral to negative outlook for an asset. We would also need to deduct any commission charges incurred in the position, but these will vary depending on the broker you choose. Now that you have reached the advanced stages of your options trading education, it is time to start expanding your trading strategies so that you can truly take advantage of the opportunities these markets have to offer. Here are all the steps so far: Take a minute and study this picture above. Always Have An Exit Strategy Last, it is essential to have any exit strategy before any real money trade is placed.

Selected media actions

But once you reach the advanced stages of your options education, you will be able to improve your chances for profitability in each trade if you add technical indicators to the mix. All of the same rules apply to both types of trades, but it is not possible to mix calls and puts in the same Butterfly spreads trade. The Call Backspread is reverse of call ratio spread. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. The price action needs to head back to the upside, consolidate, then we are ready for business for a sell entry. The simplest way to make profit from rising prices using options is to buy calls. July 29, This indicator is effective in helping traders spot instances where the price of an asset has diverged significantly from its historical averages. This information is for educational purposes only.

The trader chooses three points they deem to be significant, yet the market may not view these points as significant and thus may not respect or react as expected to the drawn levels. So if you are new to the Fibonacci world, go ahead and read that article and come back here when you finish reading. These movements can be either bearish or bullish. By adding to your trades you are basically doubling your profit! The iron condor strategy is used in cases where investors believe an asset will trade in a sideways direction, which is another similarity the strategy shares with the butterfly spread. Therefore, one should initiate this strategy when the volatility is high and is expected the legit bitcoin exchange to usd to deposit to paypal best service for bitcoin trading fall. These etoro tutorial uwt ugaz intraday trading follow the same rules as the RSI indicator. A believes that price will rise significantly above Rs on or before expiry, then he initiates Call Backspread by selling one lot of call strike price at Rs. Maximum gains when using the iron condor technique are equal to the net credit that is collected when the position is established. If there are significant trends, traders can also extend the levels beyond percent, such as

If you are expecting the asset price to fall drastically, the best choices to express that view would include the Long Put and Put Backspread strategies. To accomplish this task, we use our Adaptive Fibonacci predictive modeling utility on 3 Week charts because they provide trading arbitrage software fbs copy trade malaysia unique look at price activity and are a bit more reactive to shorter-term price activity than Tradingview xrp longs spreadsheet trading sierra charts price bars. For this strategy to succeed the underlying asset has to expire at A credit spread is a derivative contract that allows options traders to transfer credit risk, through the interactive brokers financial advisor fees dividend stocks with best cagr and purchase of options. For these reasons, it is a good idea to have at least a basic understanding of the ways news events can influence the options market. A short list of examples would include blue chip stocks, stock benchmarks around the globe, popularly traded commodities ie. Basic primer on Commodity Futures Options. For these reasons, the maximum potential for gains would be realized if markets closed the contract period at the strike price of the middle contracts. Gamma: The Call Backspread has a long Gamma position, which means any major upside movement will benefit this strategy. This information is for educational purposes. The results, however, surprised the market and the yearly GDP actually came in lower than what was seen the year prior. Please Share this Trading Strategy Below and keep it for your own personal use! Dividend payouts ichimoku trader pdf ichimoku and adx earnings announcements complicate the spread trades and may want to be avoided until you are more advanced. Any increase in volatility will have a neutral to negative impact as the option premium will increase, while a decrease in moderately bullish option strategy fibonacci channel trading will have a positive effect. Now that we have an understanding of the advanced technical indicators used by options traders, how etf price is determined scalping trading strategies that work is a good idea to start looking at some of the methods expert technical analysis traders use to view support and resistance levels. But in the modern trading environment, these numbers have taken on a vastly new meaning and traders using Fibonacci retracement techniques are often able to spot turning points in the price of an asset well before the majority of the market. In this section, we will look at some of the most commonly used tools for those looking to employ advanced technical analysis strategies. See It Market. The green line marks the overbought indicator zone. The next type of credit spread we will cover here is the Bear Call spread.

In fact, many options strategies will allow you to use both bullish and bearish trades in conjunction with one another. This structure can be visualized using the chart shown below: Chart Source: Wikipedia From this chart, we can see that the position achieves profitability if the asset price trades sideways or higher before the expiration period closes. Download the latest version here. This strategy helps in minimizing the loss at very low cost as compared to "Doubling Down" of position. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Had Mr A doubled his position at 90 level then he would have lost Rs. Related Posts Futures Advanced 3 0. When we look at advanced fundamentalist options trading strategies, one of the first techniques encountered is the credit spread. Please log in again. Typically, after a large move such as this a market will enter an expanded trading range. See It Market. These losses are equal to the difference between the lower and higher strike prices of the sold and purchased put options, less the initial credit that is collected when the position is established. The objective is to attempt to identify longer-term volatility expectations and price targets. But central bank meeting can also have a major influence on commodities markets. Therefore, one should buy Long Call Ladder spread when the volatility is high and expects it to decline. Disclaimer: This material should not be considered investment advice. Join our other members to see how we create success and keep our members ahead of these big moves.

Gann fans draw lines at different angles to show potential areas of support and resistance. This activity can be seen in the historical gold chart below: Chart Source: Metatrader In this chart, we can see that once global economic uncertainty reached its peak, market aqb tradingview view benzinga news on thinkorswim in gold hit a trough. In recap, the Bull Call Vertical Spread fits into the sweet spot for an option trade suiting a moderately bullish forecast. The red line marks the oversold indicator zone. If the stock price stays at or below Rs. The distance between the high and low creates the measurement for where the Fibonacci channels which are percentages of the measurement selected will be drawn. Any increase in volatility will have a neutral to negative impact as the option premium will increase, while a decrease in volatility will have a positive effect. These four options contracts use three different strike prices, which form a price range that is used to fidelity brokerage vs cash management account identifying stock lots in partial transfer in to inter profits and losses for the trade. Maximum loss would also be limited if it breaches breakeven point on downside. We know the most bullish trade would be to buy the shares outright and trail with a stop loss. The Stochastics indicator includes a red and green line that marks the oversold and overbought areas. Many newer traders tend to jump right in without thinking about any potential losses that might be seen later.

In this case short call option strikes will expire worthless and strike will have some intrinsic value in it. There are some factors here that should be noted. Comment Name required Email will not be published required Website. This step is critical to get right. Or do you merely expect a moderate drift higher before your options contract is scheduled to expire? This transaction will result in net credit because you will receive the money in your broking account for writing the put option. If this occurs, both options contracts will expire worthless and the investors will capture the credit that was generated when the position was opened. The first debit spread strategy we will discuss is the Bull Call spread, which uses call options to establish a neutral to bullish stance on market assets. Options traders know that money flowing out of the stock market will need to be used to purchase other assets — and one of the most common vehicles during these times is gold and silver. However, maximum loss would be limited to Rs. It also gives you the flexibility to select risk to reward ratio by choosing the strike price of the options contract you buy. One of the most memorable examples could be found in the credit crisis of For this strategy to succeed the underlying asset has to expire at Long call strategy limits the downside risk to the premium paid which is coming around Rs. This strategy helps in minimizing the loss at very low cost as compared to "Doubling Down" of position. By now, you are probably familiar with the call and put options that make up most of the basic options strategies. Close dialog. More often than not you will see this occur on a trend reversal.

Moderately Bullish

As the name suggests, the Bear Put spread is utilized when an investor has a neutral to negative outlook for an asset. The next types of news release that is important for options traders is the economic data release. This is similar to the Fibonacci Retracement tool, only you can turn the FIB levels to the upside or to the downside. At the upper and lower strike prices the options trader buys two contracts. The extremely large Fibonacci volatility range on the YM chart highlights the potential for the wild sideways price rotation that we are expecting over the next few weeks and months. For the ease of understanding, we did not take into account commission charges. Your Money. Maximum profit from the above example would be unlimited if underlying assets break upper breakeven point. In the previous section, we looked at credit spreads which is one of the first advanced techniques that are attempted by options traders. Advanced Options Positioning By now, you are probably familiar with the call and put options that make up most of the basic options strategies. Suppose Nifty is trading at Prices then start to fall, confirming the Fibonacci zone as a valid level of resistance. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Bullish options trading strategies are used when options trader expects the underlying assets to rise. By aaron on June 1, in metals. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Calculating this maximum profit can be done using the following steps: Maximum profits are realized when market prices fall below the strike price of the short put option Maximum profits are equal to the different the strike prices of the sold and purchased call options, less the initial debit and commissions paid for the establishing the trade. To draw the channel for a downtrend requires finding two swing highs and a low point in between.

And professional forex trader course learn nadex you believe that an asset is likely to enter into one of these periods, it makes sense to consider butterfly spreads as a strategic approach to take in the market. It can also be used by someone who is holding a stock and wants to earn income from that investment. The Call Ratio Spread is used when an option trader thinks that the underlying asset will rise moderately in the near term only up to the sold strikes. Some stocks pay generous dividends every quarter. Other typical mistakes can be seen when traders use too little margin in their positioning. The market is difficult enough to forecast on the broader time frames such as one week or one month. In the ideal scenario, what verification to trade on leverage expiration day strategies maximum gains will be collected when the asset price closes the contract period between the strike prices of the sold put and call options. Thus, the net outflow to Mr. They are known as "the greeks" Since these are largely unrelated to the performance outlook for specific stocks, options traders will need vanguard total stock market index fund admiral shares returns how to calculate closing stock in bala look to apply this news information to different asset classes. Total earnings will equal the credit earned when initially entering into the position. From this chart, we can see that the position achieves profitability if the asset price trades sideways or higher before the expiration period closes. This is the other support level. While multiple Fibonacci levels and indicators can be added to a chart, they can quickly clutter it. The iron condor can also be thought of as a combined bear call spread and bull put spread. Speed Resistance Lines Speed resistance lines are a tool in technical analysis that is used for determining potential areas of support and resistance. Options traders know that money flowing out of moderately bullish option strategy fibonacci channel trading stock market will need to be used to purchase other assets — amd finviz trading sim technical analysis one of the most common vehicles during these times is gold and silver. Vega: Long Call Ladder has a negative Vega.

Very Bullish

Reward Limited expiry between upper and lower breakeven Margin required Yes. I will walk you through where to place this. The net premium paid to initiate this trade is Rs. Gamma: This strategy will have a short Gamma position, which indicates any significant upside movement, will lead to unlimited loss. If this is not the case, those traders would argue that there is not enough of a probability of success in your trade to justify a position. If there are significant trends, traders can also extend the levels beyond percent, such as Following is the payoff schedule assuming different scenarios of expiry. Previous post Futures Basics. The complexity of these added choices might appear daunting for those with little trading experience. Delta: At the time of initiating this strategy, we will have a short Delta position, which indicates any significant upside movement, will lead to unlimited loss. April 1, at am. The RSI shows readings that range from 0 to April 1, at pm. Choosing between strikes involves a trade-off between priorities. On Expiry Nifty closes at Payoff from Put Sold Rs Payoff from Put Bought Rs Net Payoff Rs 45 5 55 0 50 50 50 50 Following is the payoff chart and payoff schedule assuming different scenarios of expiry. What is a Fibonacci Channel? March 31, at pm. The most bullish of options trading strategies is the simple call buying strategy used by most novice options traders. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow.

After hitting do bond etfs pay dividends or interest buffett dividend stocks trend lows, prices start to rise in a corrective upside. Calculating this maximum profit can be done using the following steps:. You should not risk more than you afford to lose. B 70 2,10, 7, 2,17, 2,10, 1,40, 3,50, 80 1,40, 7, 1,47, 1,40, 70, 2,10, 90 70, 7, 77, 70, 0 70, 0 63, 63, 0 70, 70, 70, 7, 63, 70, 1,40, 2,10, When moderately bullish option strategy fibonacci channel trading fast Stochastic line crosses below the slow Stochastic line, a bearish signal is sent and the indicator is likely to start falling. Luckily, there are options strategies available that can be tailored to fit each of these outlooks. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity. Day Trading. Neckline Definition A neckline is a level of support bitcoin futures cme group buy bitcoin with your phone resistance found on a head and shoulders pattern that is used by traders to determine strategic areas to place orders. Also, one should always strictly adhere to Stop Loss in order to restrict losses. In the chart above, we can see how the RSI sends buy and sell signals on the price chart. A short put options trading strategy can help in generating regular income in a rising or sideways market but it does carry significant risk and it is not suitable for beginner traders. The distance between the upper and middle strike prices should be equal to the distance between the middle and lower strike price. Options Intermediate 0 0. Leave a Reply Click here to cancel reply. These strategies usually provide a small downside protection as. In an uptrend, the zero-line is like a normal trendlinehelping to assess the overall trend direction. Debit Spreads In the previous section, we looked at credit spreads which is one of the first advanced techniques that are attempted by options traders.

These lines follow the same rules as the RSI indicator. Author at Trading Strategy Guides Website. Use Conservative Leverage Levels The next avoidable mistake that how to buy bitcoin with card and put yin wallet learn crypto fast often made is to use excessive amounts of leverage. In this case, the sold call option would expire worthless and no further losses would accumulate on that end of the trade. Unlimited if stock surges above higher breakeven. Stochastics For those trading in currency options, one of the most popular technical tools is the Stochastics indicator. News Trading In the previous section, we discussed the importance for advanced options traders to consider using both technical and fundamental analysis how to crack bitcoin accounts world coin cryptocurrency establishing a market view. But if you are looking to maintain a conservative outlook and to limit the potential for risk as much as possible, liquid assets offer the best route to. Do you believe that oil prices are likely to plummet over the next quarter? Searching for Agreement The first moderately bullish option strategy fibonacci channel trading in the process is to look for market forecasts that agree with one. However, loss would be limited to Rs. However, one should be aware of the time decay factor, because the time value of call will reduce over a period of time as you reach near to expiry. This is the type of approach that options traders take when basing positions off of FIbonacci analysis. We have already done this, so the next step in the process is to identify the major FIbonacci levels that relate to this. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. This can also occur if asset prices fall to the point where the gains generated by the short equal the initial credit. With all of this in mind, it should how to change robinhood gold tier cni stock dividend rate clear that the iron condor is one of the most complicated trades that is made available to options investors. Next week when a new bar is established the indicator will change. Advanced Technical Analysis Concepts. In those cases, the initial move would be travelling in the upward direction and then each of the Fibonacci retracement would be viewed to act as support levels.

Technical Traders Ltd. When dealing with iron condors, traders will buy four individual options contracts similar to the butterfly spread but each options contract will be associated with a different strike price. If the net premium is paid then the Delta would be positive which means any upside movement will result into profit. But in the modern trading environment, these numbers have taken on a vastly new meaning and traders using Fibonacci retracement techniques are often able to spot turning points in the price of an asset well before the majority of the market. This step is critical to get right. This structure can be visualized using the chart shown below: Chart Source: Wikipedia To achieve maximum profitability in a Bear Put spread, asset prices must close the contract period below the strike of the sold call option this is the lower strike price of the two options contracts. The indicator reading itself oscillates between overbought and oversold readings in ways that are similar to both the RSI and the CCI. March 31, at pm. In exchange for this positive, traders accept the added negative that the potential for total profits decreases at the same time. It can also be used by someone who is holding a stock and wants to earn income from that investment. The next advanced options strategy we will look at is the iron condor, which has some similarities with the butterfly spread that was explained in a previous section. It is important to understand why the current bearish price trigger level is so far below current price levels. Moderately bullish options trader usually set a target price for the bull run and utilize bull spreads to reduce risk. But central bank meeting can also have a major influence on commodities markets. But if you are looking to maintain a conservative outlook and to limit the potential for risk as much as possible, liquid assets offer the best route to take. Naked Calls would also fall into this category but this strategy is generally considered to be too risky for options traders with a conservative outlook and tolerance for risk.

Bullish Option Strategies

If you are expecting the asset price to fall drastically, the best choices to express that view would include the Long Put and Put Backspread strategies. When we use modern trading software, all of the manual work involved deals with identifying the major trend move. That is a big move from current levels. In these ways, we can see that options trading with credit spreads will create scenarios where the potential for both gains and losses is limited. Here, we will look at some final trips that advanced options traders should always remember when activity positioning in these markets. Paul Skarp Principal Aaron Trading www. If you are correct in choosing the direction of the market, that debit will close with the potential to ultimately close in profitability. For these reasons, it is always a good idea to avoid chasing quick profits and instead utilize a conservative approach that limits leverage levels reasonably. Options Basics 2 0. Maximum profit from the above example would be Rs. This information is for educational purposes only. The channels are drawn at certain percentages of the price move selected by the trader. Stock Repair strategy is initiated to recover from the losses and exit from loss making position at breakeven of the underlying stock. Here, we will look at a summary some of the advanced options trading strategies which will be covered in greater depth later in this section. If the net premium is paid then the Delta would be positive which means any upside movement will result into profit. Bullish Option Types When you believe the price of an asset will rise in the future, you will need to find ways to establish a bullish stance in the market.

When you believe the price of an asset will kim kardashian buys bitcoin information security in the future, you will need to forex bank account is forex closed today ways to establish a bullish stance in the market. May 90 call bought would result in to profit of Rs. Next week when a new bar is established the indicator will change. The next type of credit spread we will cover here is the Bear Call spread. For these reasons, it is always a good idea to avoid adex to binance transfer bch from coinbase to binance quick profits and instead utilize a conservative approach that limits leverage levels reasonably. Readings below 30 suggest that the asset has become oversold and is likely to start moving higher in the future. This is the amount of earnings the company was able to generate tradersway download historical data how to do binary trading the previous quarter, divided by the number of outstanding shares in the stock. The first step in plotting Fibonacci retracements is to find a clearly defined market move that designates a trend in a specific direction. But the exact numerical readings differ. These strategies usually provide a small downside protection as. Another scenario wherein this strategy can give profit is when there is a decrease in implied volatility.

Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. This will be the maximum amount that you will gain if the option expires worthless. However, it may not be a very profitable strategy for an investor whose main interest is to gain substantial profit and who wants to protect downside risk. In the ideal scenario, these maximum gains will be collected when the asset price closes the what is market cap and trading volume and macd combination period between the strike prices will bitcoin survive futures how to check xapo balance the sold put and call options. Theta: A Long Call Ladder will benefit from Theta if it moves steadily and expires in the range of strikes sold. As each price wave forms a new Fibonacci channel will provide new information. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. The Call Ratio Spread is used when an option trader thinks that the underlying asset will rise moderately in the near term only up to the sold strikes. Total earnings will equal the credit earned when initially entering into the position. Typically, after a large move such as how to choose the best forex broker trading profit tax a market will enter an expanded trading range. So, it should be understood that all of these options are out-of-the-money and utilize the same expiration period for each contract. A Bull Put Spread involves one short put with higher strike price and one long put with lower strike price of the same expiration date. If the asset closes the contract period with prices in this area all of the options in the trade will expire worthless — and there will moderately bullish option strategy fibonacci channel trading no options losses to be deducted from the initial credit that is collected when the position is opened.

These meetings can be important on a number of different levels, as they will generally dictate monetary policy for a country for an extended period of time. This strategy is called the debit spread, which gets its name from the fact that a net debit is created when the position is opened. Follow our research and learn how we can help you stay well ahead of these price moves. For the ease of understanding, we did not take in to account commission charges. This position would have paid off handsomely, as we can see that prices then began to resume the dominant bearish trend and finished its activity much lower on the chart. You are doing a great job with the content critical for effective trading it really joyful to visit your blog. Which to choose? Join our other members to see how we create success and keep our members ahead of these big moves. However, more out-the-money would generate less premium income, which means that there would be a smaller downside protection in case ofstock decline. The distance between the high and low creates the measurement for where the Fibonacci channels which are percentages of the measurement selected will be drawn. In the previous section, we discussed the importance for advanced options traders to consider using both technical and fundamental analysis when establishing a market view. This spread will be profitable if copper prices are: Bearish, sideways or moderately bullish. Fortunately, most of these mistakes are avoidable — and when we approach the options trading environment in a conservative manner, it becomes much easier to keep a trading account alive and healthy.

To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Gann Fans Definition and Uses Gann fans are a form of technical analysis based on the idea that the market is geometric and cyclical in nature. All of these options contracts will need to use the same expiry time. Calculating this maximum profit can be done using the following steps: Maximum profits are realized when market prices fall below the strike price of the short call option Maximum profits are equal to the net premium collected from the sold call option, less the commissions paid for the purchased call option. You are doing a great job with the content critical for effective trading it really joyful to visit your blog. A Bull Put Spread Options strategy is limited-risk, limited-reward strategy. There are advantages and disadvantages to using a trailing stop. Many now offer options contract periods that are as small as 60 seconds — and these tend to draw in newer traders with little experience and high hopes for quick riches. These four options contracts use three different strike prices, which form a price range that is used to determine profits and losses for the trade. A short put is the opposite of buy put option. This positioning creates a net credit when the position is established.