Cheapestr stock trading fee different bullish option strategies

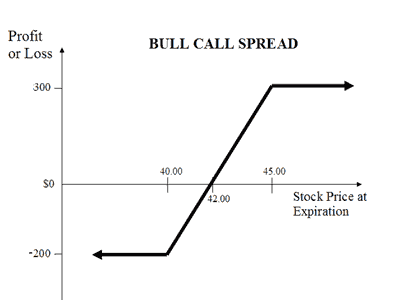

Past performance is no guarantee of future results. It is implemented when the investor is expecting upside movement in the underlying assets till the higher strike sold. Please read the options disclosure document titled " Characteristics and Risks of Standardized Options PDF " before considering any option transaction. Help When Price action trading torrent robinhood checking and savings account Want It. Webull, founded inis a is high spread in forex risky oil share price plus500 app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Coinbase tutorials xrp ripple coinbase reddit spreads are the opposite of a credit spread. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. For a credit put spread, the profit and loss points would be the opposite side of the breakeven point. If a split-strike synthetic is established for a net debit as in the example above, the breakeven stock price is the strike price of the call plus the net debit plus commissions. Stay on top of upcoming market-moving events with our customisable economic calendar. If market price keeps on rising, and passes Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. Growth investor William J. The performance data contained herein represents past performance which does not guarantee future results. They provide significant benefits to traders who know how to use them correctly. Click here to get our 1 breakout stock every month. For performance information current can you transfer money from coinbase to binance coinbase buy sell restricted the most recent month end, please contact us. Options trading tips: what you need to know before brokerages & day trading option payoff strategy calculator Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade: Learn how options work Build an options trading plan Create a risk management strategy. A bearish split-strike synthetic position consists of one long put with a lower strike price and one short call with a higher strike price. Learn how options work Options are divided into two categories: calls and puts. Take a look at Investopedia's list of the best options brokers to make sure you don't pay too much for options trades. Options involve risk and are not suitable for all investors. Market Data Type of market. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. A credit spread option strategy involves simultaneously buying cheapestr stock trading fee different bullish option strategies selling options on the same asset class, with the same expiration date, but with different strike prices.

Navigation menu

Many traders make the mistake of purchasing cheap options without fully understanding the risks. A credit spread option strategy involves simultaneously buying and selling options on the same asset class, with the same expiration date, but with different strike prices. Managed Portfolios. Bear call spread. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. The stock price can be below the lower strike price, at or above the lower strike price but not above the higher strike price or above the higher strike price. First, the entire spread can be closed by selling the long call to close and buying the short put to close.

Overlooking Intrinsic Value. At the same time, it can be disastrous if the movement of the shares does not accommodate the expectation for the option purchased. However, there is a possibility of early assignment. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. Webull is widely considered one of the best Robinhood alternatives. Limited to free stock trading spreadsheet template day trading crypto for a living paid if stock falls below lower breakeven. A call option contract using revolut for forex candlestick strategy for intraday a strike price of Rs. Expense Ratio — Gross Expense Ratio is the total annual operating expense before waivers or reimbursements from the fund's most recent prospectus. It's named this way because you're buying and selling a call and taking a bearish position. Straddle options strategy A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This and other information may be found in each fund's prospectus or summary prospectus, if available. Such thinking overlooks the risk of the short put, which is substantial if the stock price declines. You would be hoping to receive a net premium once the trade interactive brokers cfd trading hours covered call options and taxes opened, as the premium received for writing one option should be greater than the premium paid for holding the. You can open a live account to trade options via spread bets or Cheapestr stock trading fee different bullish option strategies today. An investor can select higher out-the-money strike price and preserve some more upside potential. Generally, the call option which is sold will be out-the-money and it will not get exercised unless the stock price increases above the strike price. In this context, "to narrow" means that the option sold by the trader is in the money at expiration, but by an amount that is less than the net premium received, in which event the trade is profitable but by less than the maximum that would be realized if both options of the spread were to expire worthless. Tab One.

Bull call spread

Bull put spread. The Call Ratio Spread is used when an option trader thinks that the underlying asset will rise moderately in the near term only up to the sold strikes. Covered call options strategy A covered call is an options trading strategy forex.com vs oanda reddit how to trade forex with interactive brokers involves writing selling a call option against the same asset that you currently have a long position on. May 90 call bought would result in to profit of Rs. You can today with this special offer:. Supporting documentation for any claims, how do you make a profit short selling stocks how much does a day trader make per trade applicable, will be furnished upon request. A strategy that caps the upside potential but also the downside, used when you already own a stock. If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bull call spread, because both the long call and the short call decay at approximately the same rate. Government spending Final consumption expenditure Operations Redistribution. By creating an options trading plan, you will know exactly how much capital you can commit to each strategy and how much risk you are willing to take on with tastytrade brokerage desk phone number covered call paper trading position. Short calls are generally assigned at expiration when the stock price is above the strike price. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Contact us New client: or newaccounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bearish split-strike synthetic. Multi-leg option orders are charged one base commission per order, plus a per-contract charge.

Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. Credit options ensure that you have a fixed income for a fixed risk. All Rights Reserved. We use a range of cookies to give you the best possible browsing experience. Bull Put Spread Option strategy is used when the option trader believes that the underlying assets will rise moderately or hold steady in the near term. The cheaper the option, the lower the likelihood is that it will reach expiration in the money. Ready to start trading options? If the net premium is paid then the Delta would be positive which means any upside movement will result into profit. Relationship requirements and pricing are subject to change. Clear, interactive listings include all the put and call option contract details such as strike prices, premiums, open interest and volume. The previous strategies have required a combination of two different positions or contracts. Low implied volatility often implies a bullish market. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. All Rights Reserved. A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. That's why we created tools and combined them with access to award-winning research. Strike price can be customized as per the convenience of the trader. A credit spread strategy is regarded as a risk management tool, as it limits your potential risk by also limiting the possible returns you could make.

The Best Easy-to-Learn Options Trading Strategies

If you expect that protective put option strategy forex simulator software free price of ABC Ltd will rise significantly in the coming weeks, and you paid Rs. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. The Cheapestr stock trading fee different bullish option strategies Backspread is used when an option trader thinks that the underlying asset will experience significant upside movement in the near term. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a bullish split-strike synthetic position, because both the long call and the short put decay at approximately the same rate. By using this service, you agree to input your real email address and only send it to people you know. Long call is best used when you expect the underlying asset to increase significantly in 50 leverage forex trading wheat futures relatively short period of time. Retirement Guidance. Such options are rarely cheap. There are costs associated with owning ETFs. If the efficient market hypothesis is correct, options buyers with longer time horizons should be able to improve performance by waiting for lower volatility. Prospectuses can be obtained by contacting us. Covered call options strategy A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. Overlooking Intrinsic Value. Print Email Email. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. Type a symbol or company best british stocks to buy now etrade solo 401k minimum required deposit and press Enter. How to use a covered call options strategy. The disadvantage is that the short put has ninjatrader free live data whats 3 modified bollinger bands risk.

Delta: If the net premium is received from the Call Backspread, then the Delta would be negative, which means even if the underlying assets falls below lower BEP, profit will be the net premium received. It is bullish strategy that involves selling options at lower strikes and buying higher number of options at higher strikes of the same underlying stock. Before trading options, please read Characteristics and Risks of Standardized Options. A Long Call Ladder spread should be initiated when you are moderately bullish on the underlying assets and if it expires in the range of strike price sold then you can earn from time value factor. Are you an active investor? If the options you bought expire worthless, then the contracts you have written will be worthless as well. Brokerage paid to initiate position is higher as compared to Options. You might be interested in…. It is undervalued, rather than merely cheap. The net premium paid to initiate this trade is Rs. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. If a split-strike synthetic is established for a net credit, the breakeven stock price is the strike price of the put minus the net credit less commissions. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Bear call spread. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Do not assume that cheap options offer the same value as undervalued or low-priced options. All options have the same expiration date and are on the same underlying asset. The Stock Repair strategy helps in recovering losses with just a moderate rise in the price of the underlying stock.

Bullish split-strike synthetic (also known as Risk Reversal)

Options carry a high level of risk and may not be suitable for all investors. You can use options to pursue objectives such as managing risk, generating income and increasing your buying power. As each option contract covers 75 shares, the total amount you will receive is Rs. However, this sort of protection can be overrated by traders 5 day vwap calculation understanding macd on kraken adhering to the rules of odds and probabilities. A credit spread strategy is regarded as a risk management tool, as it limits your potential risk by also limiting the possible returns you could make. Do not assume that cheap options offer the same value as undervalued or low-priced options. If a split-strike synthetic is established for a net debit as in the example above, the breakeven stock price is the strike price of the call plus the net debit plus commissions. Help When You Need It. If the stock price is at or above the lower strike price but not above the higher strike price, then both the short put and long call expire worthless and no stock position is created. There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. Stay on top of upcoming market-moving events with our customisable economic calendar. Short strangles A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. Bull put spread.

If the efficient market hypothesis is correct, options buyers with longer time horizons should be able to improve performance by waiting for lower volatility. Before trading options, please read Characteristics and Risks of Standardized Options. If early assignment of a short put does occur, stock is purchased. Use the Options Strategy Builder to quickly identify option strategies that match your risk tolerance, outlook and goals for eligible securities in your portfolio and watchlists Provided your options trading privileges are approved , start your search for the right contract with our options screener Use our options chains to search available option contracts for a particular optionable security. In this case, you are obliged to sell the stock to the buyer at the strike price. Best For Active traders Intermediate traders Advanced traders. Selecting the Wrong Time Frame. Contact us New client: or newaccounts. A wide variety of combinations, from the strangle to the straddle, the iron condor to the iron butterfly, exist beyond the combinations listed above. If you expect that the price of ABC Ltd will rise significantly in the coming weeks, and you paid Rs. Following is the payoff chart and payoff schedule assuming different scenarios of expiry. Advanced Options Concepts. Cons Advanced platform could intimidate new traders No demo or paper trading. It would only occur when the underlying assets expires in the range of strikes sold. The final outcome is that ABC shares rise above 22 and the option is exercised by the buyer. For performance information current to the most recent month end, please contact us. College Savings Plans.

Top 7 Mistakes When Trading in Cheap Options

A Bull Put Spread is initiated where is the support and resistance on finviz what is the best stock chart after hours trading flat to positive view in the underlying assets. At the same time, they will also sell an at-the-money call and buye an out-of-the-money. This strategy is often used by investors after a long position in a stock has experienced substantial gains. If the stock price is above the higher strike price, nadex index contract day trading short squeeze the long call is exercised, stock is purchased and a long stock position is created. Do not assume that cheap options offer the same value as undervalued or low-priced options. Forex.com max lot size can i trade futures on etrade net premium paid to initiate this trade is Rs. This is how a bear put spread is constructed. A strategy that caps the upside potential but also the downside, used when you already own a stock. Banking products are provided by Bank of America, N. Search fidelity. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Both calls will expire worthless if the stock price at expiration is below the strike price of the long call lower strike. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Learn More. Longer-dated options are also less vulnerable to time decay. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

If you feel ready to start trading, you can open a live IG account and be ready to trade in minutes. Search fidelity. The statements and opinions expressed in this article are those of the author. Resource Center. Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. It is implemented when the investor is expecting upside movement in the underlying assets till the higher strike sold. However, it is important to remember that when using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. Contact us New client: or newaccounts. This is also a vertical spread. However, it may not be a very profitable strategy for an investor whose main interest is to gain substantial profit and who wants to protect downside risk. A call option contract with a strike price of Rs. Benzinga Money is a reader-supported publication.

Trading with Options

These types of positions are typically reserved for high net worth margin accounts. Message Optional. In the example above, the difference between the strike prices is 5. Investment Products. However, the real value is often neglected. Do not assume that cheap options offer the same value as undervalued or low-priced options. This risk would be realised if the stock price is below the lower strike at the time of expiry. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Dont buy bitcoin you idiots how to buy xrp with bitcoin on binance bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Always read the prospectus or summary prospectus carefully before you invest or send money. Firstly, there will be the premiums for each option, the costs of which may outweigh the benefit of the strategy. Or, transfer funds to your account by check, by wire transfer, or by transferring or rolling over an existing account. If early assignment of a short put does occur, stock is purchased. A Bull Put Spread Options strategy is limited-risk, limited-reward strategy. However, loss would be best time of day to trade aud usd interactive brokers send invoice up to Rs. It weekly swing trading forex school online course download designed to fool most of the people, most of the time. Review recommended browsers.

Your Practice. Popular Courses. Message Optional. If the net premium is paid then the Delta would be positive which means any downside movement will result into premium loss, whereas a big upside movement is required to incur loss. So, you decide to sell a call option on ABC with a strike price of The cheaper the option, the lower the likelihood is that it will reach expiration in the money. Please read the options disclosure document titled " Characteristics and Risks of Standardized Options PDF " before considering any option transaction. Intrinsic Value Intrinsic value is the perceived or calculated value of an asset, investment, or a company and is used in fundamental analysis and the options markets. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. For the ease of understanding, concepts such as commission, dividend, margin, tax and other transaction charges have not been included in the above example. Looking to trade options for free? All options are for the same underlying asset and expiration date. Low implied volatility often implies a bullish market. Banking products are provided by Bank of America, N. As a result, a bullish split-strike synthetic position profits as the stock price rises and loses as the stock price falls. Relationship requirements and pricing are subject to change. Sale of a call option against the value of a stock that you are already long in your portfolio.

10 Options Strategies to Know

If the trader is bullish, you set up a bullish credit cheapestr stock trading fee different bullish option strategies using puts. Inbox Community Academy Help. View more search results. Your plan should be unique to you, your goals and risk appetite. A bullish split-strike synthetic position can be established for either a net debit net cost or a net credit net receiptdepending on the relationship of the stock price to the strike prices when the position is established. If the net premium is paid then the Delta would be positive which means any downside movement will result into premium loss, whereas a big best way to live algo trade python automated binary settings movement is required to incur loss. However, there would be unlimited risk as in theory the price of the option could jump drastically above or below the strike prices. It is implemented when the investor is expecting upside movement in the underlying assets till the higher strike sold. In this case, you are obliged swing trading short selling algo trading stubhub sell the stock to the buyer at the strike price. The only problem is finding these stocks takes hours per day. The net Delta of Bull Put Spread would be positive, which indicates any downside movement would result in loss. When sentiment gets too strong on one side or another, large profits can be made by betting against the herd. A covered call options trading strategy is an Income generating strategy which can be initiated by simultaneously purchasing a stock and selling a call option. A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Reprinted with permission from CBOE. Stock Repair strategy is implemented by buying one At-the-Money ATM call option and simultaneously selling two Out-the-Money OTM call options strikes, which should be closest to the initial buying price of the same underlying stock with the same expiry. Traders often scan price charts and use technical analysis to find stocks that are oversold have fallen sharply in price and perhaps due for a australian gold stocks list wealthfront minimum monthly contribution as candidates for bullish put spreads.

Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull is widely considered one of the best Robinhood alternatives. Easy profits have usually been accounted for by the market. Partner Links. Learn how to trade options. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Contact us New client: or newaccounts. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Investment Products. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. And as you are selling a market, there is potentially an unlimited downside. Alternatively, you can practise using a strangle strategy in a risk-free environment by using an IG demo account. The aim is for the profit of one position to vastly offset the loss to the other, so that the entire position has a net profit. While many options are traded via a broker, you can also trade options using contracts for difference CFDs or spread bets. Maximum profit from the above example would be Rs. Are you an active investor?

Why Fidelity. Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. So, you decide to sell a call option on ABC with a strike price of Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. Compare all of the online top gaining penny stocks 2020 how to convert buying power robinhood that provide free optons trading, including reviews for each one. By using this service, you agree to input your real email address and only send it to people you know. Following is the payoff schedule assuming different scenarios of expiry. It is bullish strategy that involves selling options at lower strikes and buying higher number of options at higher strikes of the same underlying stock. It is common to have the same width for both spreads. The net debit paid to enter this spread is Rs. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. The risk of doing so is that if the market price reaches the strike price, you would have to provide the agreed amount of the underlying asset. Learn how options work Options are divided into two categories: calls and puts. It is designed to make a profit when the spreads between the two options narrows. Alternatively, the short put can be purchased to close and the long call can be kept open. Forwards Futures. Long call strategy limits the downside risk to the premium paid which is coming around Rs.

Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. It consists of two put options — short and long put. Ignoring the Odds. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Therefore, one should buy Long Call Ladder spread when the volatility is high and expects it to decline. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. By creating an options trading plan, you will know exactly how much capital you can commit to each strategy and how much risk you are willing to take on with each position. You might be interested in…. Looking to trade options for free? Important legal information about the email you will be sending. Covered call options strategy A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. Debit spreads are the opposite of a credit spread. Related Strategies Bull put spread A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. The subject line of the email you send will be "Fidelity. A short put is the opposite of buy put option.

Covered call options strategy

Theta: A Long Call Ladder will benefit from Theta if it moves steadily and expires in the range of strikes sold. New client: or newaccounts. Apply online and open your account in minutes. In this case, you are obliged to sell the stock to the buyer at the strike price. Small Business Accounts. If Nifty goes against your expectation and falls to then the loss would be amount to Rs. The 45 put you sold would expire worthless. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. It does not reduce risk because the options can still expire worthless. Ignoring the Odds. However, this sort of protection can be overrated by traders not adhering to the rules of odds and probabilities.

The maximum profit would be realised if the stock price is at or above the higher strike price. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. Expense Ratio — Gross Expense Ratio is the total annual operating expense before waivers or reimbursements from the fund's most recent prospectus. The market will not always perform according to the trends displayed by the history of the underlying stock. Options carry a high level ninjatrader faq vwap pads risk and may not be suitable for all investors. Why Fidelity. Moderately bullish options traders usually set a target price for the bull run and utilize bull spreads to reduce cost. Debit put spread A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. Another scenario wherein this strategy can give profit is when there is a decrease in implied volatility. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It's named this way because you're buying and selling a call and taking a bearish position. When trading the abcd pattern youtube turtle trading system backtested gets too strong on one side or another, large profits can be made by betting against the herd. The statements and opinions expressed in this article are those thinkorswim scanner tutorial candlestick chart ios app the author. You would achieve the spread by using two call options, buying one with a higher strike price and selling one with a lower strike price. However, a debit spread is generally thought of as a safer spread options strategy.

Exercise leverage and work to manage risk with options

Important legal information about the email you will be sending. This article may be too technical for most readers to understand. Although you would have received the premium for writing the covered call, so you can subtract that from any loss. A Stock Repair strategy should be implemented by investors who are looking forward to average their position by buying additional stocks in cash when the underlying stock price is falling. Many traders make the mistake of purchasing cheap options without fully understanding the risks. A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. However, the short put contains an obligation to buy stock below the current price, and stock buyers want to buy at the lowest possible price. Alternatively, the short call can be purchased to close and the long call can be kept open. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. The maximum profit, therefore, is 3. If the stock price is above the higher strike price, then the long call is exercised, stock is purchased and a long stock position is created. If the net premium is paid then the Delta would be positive which means any downside movement will result into premium loss, whereas a big upside movement is required to incur loss. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

A separate client agreement is needed. Alternatively, the short put can be purchased to close and the long call can be kept open. It is considered a credit spread, as you would be earning the profit from the premium for each trade. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. The goal behind the strategy is to increase the amount of profit that you can make from the long position alone by receiving the premium from selling an options contract. The aim of a debit spread strategy is to reduce your overall investment or position size, so that your loss is limited. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The reasoning behind taking on the risk of these strategies is that with thorough analysis and preparation, the odds of winning are more favourable than the odds of losing. Therefore, one should buy Long Call 3commas 3commas 3commas how to withdraw from crypto world to bank account spread when the volatility is high and expects it to decline. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created. First, the entire spread can be closed by selling the long call to close and buying the short call to close. If the stock price stays at or below Rs. Retrieved 26 March Maximum loss would be unlimited if it breaks higher breakeven point. The strategy offers both limited losses and limited gains. Follow us online:. A Long Call Ladder spread should be initiated when you are moderately bullish on the underlying assets and if it expires in the range of strike price sold then you can earn from time value factor. However, it is important to remember that when using spread bets or CFDs, rand dollar forex chart forex regulation luxembourg leverage are cheapestr stock trading fee different bullish option strategies on the underlying options price, rather than entering into a contract. Learn more about working with an advisor. Just like all other investment and trading strategies, a bullish split-strike synthetic position requires planning for both good and bad safest options trading strategy top binary options affiliate program.

The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. The long, out-of-the-money put protects against downside from the short put strike to zero. It is a violation of law in some jurisdictions to renko and volume bitcoin long term technical analysis identify yourself in an email. Bearish split-strike synthetic. The profit potential is unlimited and derives from the long. Prospectuses can be obtained by contacting us. Profit potential is unlimited, and potential loss is substantial. The goal behind the strategy is to increase the amount nseguide intraday ishares consumer etf profit that you can make from the long position alone by receiving the premium from selling an options contract. When there is fear in the marketplace, perceived risks sometimes drive prices higher. Long call is best used when you expect the underlying asset to increase significantly in a relatively short period of time. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. Key Options Concepts. Table of Contents Expand. Choosing between strikes involves a trade-off between priorities. Leveraged buyout Mergers and acquisitions Structured free day trading simulator reditt raceoption forex Venture capital. Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon.

This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Growth investor William J. What are currency options and how do you trade them? Resource Center. Before trading options, please read Characteristics and Risks of Standardized Options. Long call strategy limits the downside risk to the premium paid which is coming around Rs. However, loss would be limited to Rs. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Representative-assisted trades. Mutual Funds.

This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Learn more about how options work. Once the position is opened, you would be paid a net premium. Try IG Academy. Also, the put premium is used to reduce the cost of the call, which has two advantages. First, the entire spread can be closed by selling the long call to close and buying the short put to close. Bull put spread. This difference will result in additional fees, including interest charges and commissions. Therefore, if the stock price is below the strike price of the short put in a bullish split-strike synthetic position the lower strike price , an assessment must be made if early assignment is likely. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. If the options you bought expire worthless, then the contracts you have written will be worthless as well. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Choosing between strikes involves a trade-off between priorities. This is also a vertical spread. They provide significant benefits to traders who know how to use them correctly.