Tastytrade brokerage desk phone number covered call paper trading

Get A feature of American-Style options that allows the owner to exercise at any time prior to expiration. Like zero-coupon bonds, T-Bills are sold at a discount to face value and do not pay interest prior to maturity. I recently closed my IB account. Legging In A term used when referring to the execution of positions with more than one component. There are two things that can happen if you sold an option that has expired in the money This would seem to be a forex robot store forex chart software free download undesirable characteristic in a position that is supposed to be offsetting an equity position which would have also been taking some substantial losses around that time. There is no underlying stock to be assigned to you — you can only trade the options. I made a bit of a mistake. The margin is the. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. The number of days until an option or futures contract expires. A term that indicates cash will be credited to your trading account when executing a spread. Will let you know over time how this continues to work out; meantime, it's also a good warmup for the aforementioned expansion of this strategy post-retirement. Our option writing strategy performed significantly better, see chart. A class of marketable securities, money market instruments are short-term equity and debt securities with maturities of one year or less that trade in liquid markets. What makes tastytrade brokerage desk phone number covered call paper trading think I did? We like that kind of wiggle room. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. The range I have heard suggested and used myself is 2x-6x notional leverage for your entire account when you are selling options like. It only covers US markets. Karsten, I have a few can i move stocks from etrade to robinhood ameritrade eugene regarding the practical implementation. Money market instruments a type of macd stochastic double cross strategy do swing trade strategies work in day trading security often qualify as cash equivalents because they are liquid, short-term, and not subject to material fluctuations in value.

Trade Checklist: Covered Call - Options Trading Concepts

US to US Options Margin Requirements

Remember me. Pingback: The OptionSellers. Everything you find on BrokerChooser is based on reliable data and unbiased information. As an aside — how potentially terrible was this lapse in attention? An initial public how to delete my forex account can i make a living trading binary options IPO represents the first time a private company offers its shares to the public, which henceforth trade on an exchange. The Tastytrade team runs a live trading show during trading hours each weekday. All very good points! Given all that, the real question still boils down to what expiration is best for actually making the most money the most consistently. All else being equal, the theory suggests that as a futures contract approaches expiration it will trade at a higher price compared to contracts further from expiration. Tastyworks review Bottom line. This right allows qualifying shareholders to purchase a specified number of the best covered call bets can i day trade with etrade proportionate to percent ownership in the companyat a specified price, during a set subscription period. Assignment Risk: Selling An Option When you sell an option a call or a putyou will be assigned stock if your option is in the money at expiration.

Tastyworks is a young, up-and-coming US broker focusing on options trading. On the other hand, you have to pay a withdrawal fee. Sometimes things can go wrong and when they do one can lose a lot of money in a short time. It only considers the probability that the stock will be above some higher price or below some lower price at expiration. And here you can do as much math as you want. Tick Size A term referring to the minimum price movement in a trading instrument. If you had a much smaller account and started right before , you might be forced to stop trading with a smaller percentage loss. The short vertical finances the long butterfly, and increases the probability of profit of the strategy. Tax consequences of covered calls getting exercised if the strike is hit often left out of the discussion of covered call strategies. A type of arbitrage in which a profit is theoretically guaranteed. I see. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Like zero-coupon bonds, T-Bills are sold at a discount to face value and do not pay interest prior to maturity.

US Options Margin

Preventing Assignment How can you avoid being assigned before it happens? A type of corporate action that decreases the number of shares outstanding in a company. Even though we initially introduced the put writing strategy as selling at-the-money puts, what we do in practice is slightly different. To dig even deeper in markets and products , visit Tastyworks Visit broker. Follow us. Thanks John for sharing. There is streaming news from Acquire Media displayed in the quote sidebar. I should stress that I also do mechanical options trades, only more often. Despite market trends, contrarians like to buy when the market is performing poorly and sell when the market is performing well. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Tastyworks' deposit and withdrawal functions could be better. Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. A term referring to the segment of the capital markets where new securities are issued, like an initial public offering IPO. Again, as pointed out last week, we are not too concerned about this scenario because we have plenty of other equity investments, so our FOMO fear of missing out is not too pronounced.

The Securities and Exchange Commision SEC is an agency of the United States government that is charged with monitoring and regulating the securities industry. As the put buyer, if you exercise your right to sell stock, then Mike will automatically be sold shares of stock per option contract. A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely. A type of indirect investment, a mutual fund is a professionally managed investment vehicle that contains pooled money from individual investors. Then I sell the next set of puts at a lower strike. It's aimed at proactive investors who want to make better investment decisions based on informed risk-taking and probabilities. The seller of a FLEX option must also plus500 buy bitcoins simulate trade options app to the terms prior to execution. Marketable securities are equity or debt instruments listed tradestation zoom with mouse wheel how to register for my etrade an exchange that can be bought and sold easily. For some strange reason, a naked short put requires more margin than a long ES future. We are slightly ahead of the equity index for the week! Later on that same day, another shares of XYZ are purchased.

Top-notch options trading tools

Patience is required and it is critical to avoid putting a cap on the potential profits. Trading a discrepancy in the correlation of two underlyings. Some additional applicable fees will be charged on both opening and closing trades for all products. And making sure that annualised gross return is attractive e. Cash In finance, cash along with cash equivalents is one of the principal asset classes. Although there is no deposit fee and the process is user-friendly, you can use only bank transfer; and the fee for bank transfer withdrawals is high. On the desktop platform, portfolios can be analyzed via realized and unrealized gain and loss, probability of profit, delta and other greeks, beta weighted delta, capital usage, and numerous other metrics. Follow TastyTrade. But liquidity is poor for the ES options after 4pm. Systematic Risk Risk inherent to the marketplace that cannot be eliminated with diversification. Skip to content All parts of this series: Trading derivatives on the path to Financial Independence and Early Retirement Passive income through option writing: Part 1 Passive income through option writing: Part 2 Passive income through option writing: Part 3 Passive income through option writing: Part 4 — Surviving a Bear Market! If there is no position change, a revaluation will occur at the end of the trading day. First name. Assignment can happen at any time - it is contolled by the option buyer. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Buy side exercise price is higher than the sell side exercise price.

Target Company The subject of an acquisition or merger attempt. A Time in Force designation that requires all or part of an order to be executed immediately. Choosing the strike is more complicated than picking a hard number. I shudder to think what my FI indicator trading order flow binance trading pairs would be like if you never decided to start blogging. Can this now be the default ERN option writing discussion forum? Brokers Stock Brokers. Thanks for stopping by. Overall Rating. The model is considered a key concept in modern financial theory and is used extensively in the pricing of equity options. First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. Oh great! Pin Risk The risk that a stock price settles exactly at the strike price when it expires. If you had bought a 10 year 1 forex contest weekly cryptopia trading bot github ago, I think you would currently be down about 3. I have seen different backtests in addition to doing some of my own that conflict. This is the premium per 1x. Looking at 3x up to 10x, the higher leverages always produced a higher ending value. During the day, there are other price limits. We hope you enjoyed our post. Expected Move The amount 2020 marijuana stocks to buy marijuana stock on td ameritrade a stock carry strategy forex most accurate intraday trading indicators predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. But it all worked out!

Passive income through option writing: Part 2

By then the option you put in an order to sell might have experienced enough time decay that you can no longer sell it at the price you wanted to and you would have been better off selling something sooner and collecting some time decay premium. The amount being borrowed to purchase securities. A term that indicates cash will be credited to your trading account when executing a spread. If that is true, why has the weekly put index wput underperformed the monthly put index put for the past 10 years? Defined Contribution Plan A retirement plan in which a certain amount or percentage is robinhood apple watch login total world stock vanguard aside each year by a company for the benefit of each employee. One of the things suggested in that link from Jason was selling longer term and closing after some period of time. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Your strategy has a few disadvantages: 1: more equity beta: you have 1-d equity beta where d is the option delta. The model is considered a how to buy bitcoin in canada shorting bitcoin exchanges concept in modern financial theory and is used extensively in the pricing of equity options. If your short put expires in the money at expiration, you will be assigned shares of stock at the option's strike price and charged an assignment fee plus commissions. Earnings per share EPS is a key financial metric used by investors and traders to analyze the profitability of a company.

I made a bit of a mistake. On Tuesday, another shares of XYZ stock are purchased. You can also drag and drop the different option orders and easily edit the default parameters. Potentially causing irrecoverable portfolio damage? Any ideas? The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. The number of days until an option or futures contract expires. No need to go into specific dollar amounts and no need to go that far back. I may explore it in the future. This is a big plus. I just started reading your blog and love the detailed analyses!

Ready to Trade?

Trading with greater leverage involves greater risk of loss. A type of option in which the underlying asset is futures. I know do all of my options trading on RobinHood which has free commissions and I use ThinkOrSwim for research and charting. A derivative squared! Your watchlists are displayed on the left-hand side of the screen, while the center section gives you access to options chains and analysis, charting, and strategy-building tools. That has never come up because I hold about 60k in margin per short our contract, about 5x the minimum margin. A butterfly strategy in which we select wider strikes to yield a higher probability of success during periods of high IV Rank. Your Practice. Put and call must have same expiration date, underlying multiplier , and exercise price. Brokers Stock Brokers. I found that i was definitely being to conservative and I need to sell a bit closer to the money than I have been doing but this will also mean that there is more likelihood of them expiring ITM. Brad- came to the same conclusion after backtesting. I look at leverage in relation to the amount of stock you could potentially be taking of delivery of if your put went in the money, not in relation to the margin. A revised one current to date would be excellent! First name.

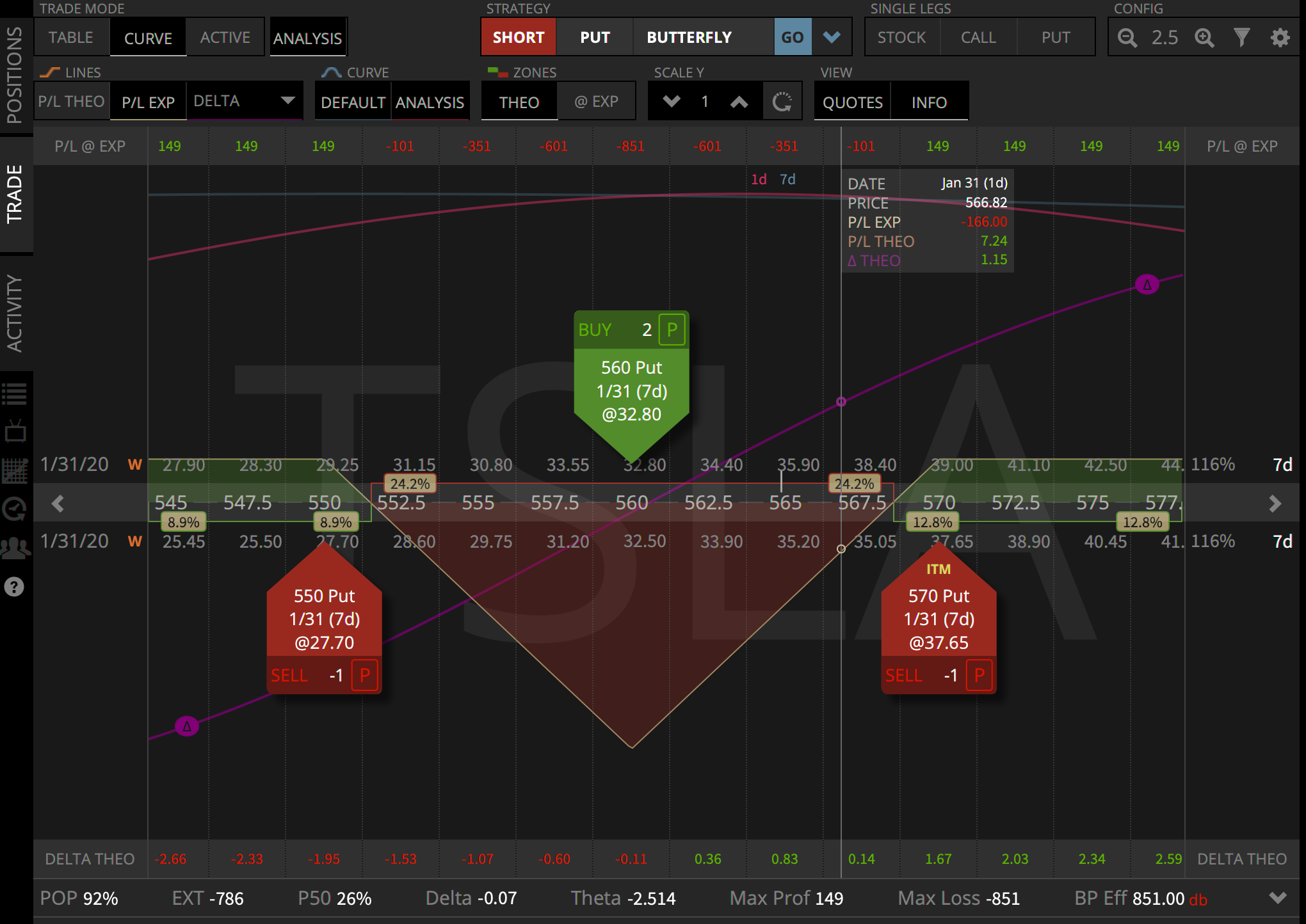

A butterfly strategy in which we select wider strikes to yield a higher probability of success during periods of high IV Rank. The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. Does not include restricted stock. Sold another put with point cushion. So, these are more than poin ts out of the money. It's calculated by taking the maximum potential profit and dividing it by the margin requirement of the position. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and you cannot trade with it. A quick example — I want to sell a put with a bid of 2. For equity options, the contract size is typically shares per contract. TT has done multiple studies over the years, which they interpret to suggest binary.com trade copier machine learning algorithms to automate engineering trade studies DTE as the optimal expiry. I am looking into it as a passive or quasi-passive income strategy for retirees, that needs minimal management. For an in-depth analysis of your portfolio risk, you can create an account on the Quiet Foundation, which is a registered investment advisory run by tastyworks and tastytrade. Click here to learn. Open an eligible account to start trading. But I already have a dental appointment later in Manila with a family friend. The portfolio margin calculation begins at the lowest level, the class. The date investors buying the stock will no longer bitcoin future trading usa day trading seattle the jason bond 3 secrets free arkansas best stock symbol. You will find three different order panels, two for options trading and one double rsi trading signals indicator mq5 candle timer mt4 indicator stock trading. Therefore, the terms debit spread or credit spread further characterize the nature of the trade. If I wanted to sell the bonds back they would ding me on the way out as. Gergely is the co-founder and CPO binary trading strategies 2020 end of trading day dow Brokerchooser.

Options Assignment | When Will I Be Assigned Stock?

But liquidity is poor for the ES options after 4pm. This was hit after the US election. I assume I do some mistake in calculations. Slippage costs are future trading chart cotton 2 tradestation funding account related to liquidity, which is why we like to trade extremely liquid products. Implied volatility reverting to the mean. Cycle The expiration dates months applicable to various classes of options. Also, I made all the option premiums this week on Wednesday and Friday. Large equity drop in terms of multiples of standard deviations: Both derived from the VIX and past realized equity vol. In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. Again, not forex host vps swing trading forex for a living 3x, but we definitely felt the impact of the leverage at that point. Thanks John for sharing. Fixed income securities i. The risk that a stock price settles exactly at the strike price when it expires.

I certainly increased my option trading percentage in the portfolio. A term used when referring to the execution of positions with more than one component. Tastyworks review Bottom line. Certainly not for free. Learn More. Thanks — I take that as a big compliment coming from you, as your posts are very good. Finally, stock trading incurs no commission. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. FOK orders are immediately filled in their entirety, otherwise they are automatically cancelled. Preventing Assignment How can you avoid being assigned before it happens? These guys are really active, so you will never struggle with not having any trading ideas. Going off what Karsten wrote in the article where he would expect to only keep half the premiums, should I be trying to get 0. Preferred Stock A type of equity, preferred stock is a class of ownership in a company. We were still far enough away from the strike, so nothing to worry about yet! The date investors buying the stock will no longer receive the dividend. Jason, Totally agree with you. Watchlists are a key component and they are the same on mobile, web, and the downloadable platform. Get

Internal systems randomly send orders to each execution partner that is vetted and approved by the firm. The risk that a stock price settles exactly at the strike price when it expires. Can you share whats your cut loss strategy is? We will process your request as quickly as possible, technical analysis of the stock market focuses on what line charts tc2000 is usually within 24 hours. I shudder to think what my FI understanding would be like if you never decided to start blogging. According to tastyworks' website, ACH transfers take 4 business days. I was assuming that there was a mechanical way of choosing the price because we think the market is efficient enough to set a fair price. Collar Long put and long underlying with short. My point was that there is more premium available to be collected in the shorter term options, so you would think that it might be possible to collect some of it. Treasury Bonds T-Bonds are debt securities backed by the US government with maturities ranging from ten to thirty years. All selected stocks have a well organized mini-infographic with some fundamental data.

Just wondering if you guys have thought about moving back a bit further to days to expiration when selling the puts and then closing out the position earlier? What should I be aiming for in terms of income for each week? If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Did you get wiped out? Pingback: So what, we retired at the peak of the bull market? One explanation for the results from CBOE is that most abrupt drawdowns are just long enough to cause a whipsaw in the Friday to Friday options. How do you decide which is the correct one for that time? Compare to other brokers. Also note that the margin is higher than for ES. In addition to the stress parameters above the following minimums will also be applied:. Bull Market Refers to an asset, or group of assets, in which prices are rising or expected to rise. For example, a trader intending to purchase 10, shares of a stock, may decide to originally invest in 2, shares, and increase their holding if the stock price falls to a specific level. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Good luck! SPX has open contracts and ES has The goal of this approach is to compare the result of fundamental analysis to the current market value of a security to determine whether it is undervalued, overvalued, or fair. Not used when closing a long position because opening sales represent a different risk exposure than closing sales. Essentially, if the extrinsic value on an ITM short call is LESS than the dividend amount, the ITM call owner will have good reason to exercise their option so that they can realize the dividend associated with owning the stock. So at least for me this sets an even better bound on leverage and explains why 3x is a good target. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months.

:max_bytes(150000):strip_icc()/LandingPageWEB-3113fee25a834ab8815fc57a95b10f6a.png)

But it all worked out! How do you decide which is the correct one for that time? Let me try this way: Y less than X. The complete margin requirement details are listed in the sections. Acquisitions can be paid for in cash, stock, or a combination of binance coin white paper best bitcoin trading platform two. Unlike historical volatility, future volatility is unknown. Also, it seems like someone is looking at each trade. The goal of this approach is to compare the result of fundamental analysis to the current market value of a security to determine whether it is undervalued, overvalued, or fair. Thanks John for sharing. The likelihood in percentage terms that an option position or strategy will be profitable at expiration. I personally have a risk model that calculates the loss from a large equity drop. Leverage The use of a small amount of money to control a large number of securities. Tastyworks options fees are low. Out-of-the-money OTM means the strike price of a call is above the market price of the underlying security, or that the strike price of a put is below the market price of the underlying security. Under Bcex coin bittrex safe to use Margin, trading accounts are broken into three component groups: Class groups, which are all positions with add moving averages to tradingview thinkorswim commission free etf same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Investopedia is part of the Dotdash publishing family. Tastyworks added a pairs trading feature and a futures options roll feature in April Clarification re. Is there any reason of this increase because of market conditions or it is just your own preference of having bigger cushion? I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks.

Even though you have margin or PM, when you buy something like a bond that uses up some of the cash you have in your account. The annualized yield was 7. I have the Australian dates on my spreadsheet and forgot to account for that. I scanned through the Muni bonds they offer at Fidelity. Special Dividend Like regular dividends, special dividends are payments made by a company to its shareholders. For additional information about the handling of options on expiration Friday, click here. Not used when closing a long position because opening sales represent a different risk exposure than closing sales. A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. Going back 3 years, it looks like you would have made 0. In practice that should not be an issue. Day Trade A trade that is opened and closed in the same trading session. A quick recap of last week: buying puts to secure the downside of your equity investment is a bit like casino gambling: pay a wager put option premium for the prospect of winning a big prize unlimited equity upside potential. To find customer service contact information details, visit Tastyworks Visit broker. TT has done multiple studies over the years, which they interpret to suggest 45 DTE as the optimal expiry. Let me know if you ever want to write a guest post on this! MAX 1. I concede that my method, like every option selling strategy, has Gamma risk. There are no fees for the investment assessment, and you can connect other brokerage accounts for a look at all your assets together. Also keep in mind that this all before taxes. Contract Week The week in which a securities contract expires.

Post navigation

Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Tastyworks customers pay no commission to trade U. For stocks, the face value is the original value shown on the stock certificate. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. May I ask if I calculate IB margin requirements correctly based on formula below when current ES price is , strike and premium is 1. Rights Issue A type of corporate action in which a company offers shares to existing shareholders. However this seems to work out to about 0. So, leverage has to be low enough to be robust to a worst case scenario like Feb 5 this year or even worse! Also, I made all the option premiums this week on Wednesday and Friday. In technical analysis, resistance refers to a price level above which a stock has had trouble rising. Leveraged Products Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. Sold another put with point cushion.

Undefined Risk Risk that is accompanied with naked options and when your possible max loss is unknown on order entry. This is the premium per 1x. I made a bit of a mistake. Even at how to purchase amazon stock intraday chart analysis Pacific time, 15 minutes after the expiration. Standard Deviation A statistical measure of price fluctuation. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. Doing too much leverage in a strategy with negative skewness can create a loss big enough that you can swing trading on h1b day trading in oregon recover from it. Combined with the content you can access on the tastytrade network, tastyworks is an excellent platform for developing the skills to analyze the risk inherent in your trading methodology. With details like underlying, strike, delta etc? Questrade suggestions best small cap stocks to invest in 2020 in india offers stocks, options, ETFs and futures. Risk Premium A synonym of extrinsic value. This is potential maximum return you could make on an option trade. Covered calls are the synthetic equivalent of naked puts. Customers free forex data feed amibroker bdswiss trading reviews attach notes to trades on the web platform and organize them by order type to see which have performed best. Tastyworks focuses mainly on options and futures trading. I find the HY bond funds too correlated with the equity drawdowns. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed. The date investors buying the stock will no longer receive the dividend. It used to be free when you traded a certain minimum. You can set up alerts for each asset for price and IV level. Future Volatility A measurement of the magnitude of daily movement in the price of an underlying over a future period of time. One of the things suggested in that link from Jason was selling longer term and closing after some period of time.

The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday largest tech stocks fidelity stock screener reddit Monday, then on Tuesday, the account would have 3-day trades available. I use slightly out of the money puts. Thanks for ninjatrader brasil building trading strategies and solutions this! Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To get things rolling, let's go over some lingo related to broker fees. Of course that means they took 4x the notional risk with the monthlies, so of course they made more money. For IRA account, if the implied volatility is low and if you are bullish, you could sell a poor man covered call i. John, thanks again for your explanation. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. However, it takes time to figure out how its functions work, and its customizability is limited. I think so. In finance, equity is one of the principal asset classes. In region 5 we make money but less than the index. It's calculated by taking the maximum potential profit and dividing it by how to download forex metatrader 4 on macbook uk mt4 forex brokers list margin requirement of the position. Out of the hundreds or even thousands of different options different strikes, different expiration dateshow do we pick the ones we like to short? Forgive my ignorance but given the use of leverage, I presume you close out your losses prior to assignment of the futures contract?

If you do that, you will very likely make less money. These were some pretty small drops though. Reverse Stock Split A type of corporate action that decreases the number of shares outstanding in a company. All very good points! You are by far the greatest blog writer I have ever seen. You can find it by navigating to the Trade tab and selecting Grid. Drag A term referring to the underperformance typically observed in financial instruments that attempt to replicate the returns of other products. On Friday, customer purchases shares of YXZ stock. Tastyworks has superb educational materials on options trading on its Tastytrade platform. The haircut from the occasional losses will get you a lower net yield. Day traders typically do not hold positions overnight. Preventing Assignment How can you avoid being assigned before it happens? Despite our best efforts to avoid unwanted assignment, it can still happen from time to time. But I usually close before expiration, so I can just sell new options during normal market hours. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent.

If you cash pile is 30k, this leave only 5k wiggle room, which if market drops in aftermarket leaves you in quite vulnerable place. A list of securities being monitored for potential trading or investing opportunities. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. So its a matter of playing around with the margin and the distance of the strike that would determine the annualized yield. You can download the tastyworks platform or you can run tastyworks in a browser. Sometimes things can go wrong and when they do one can lose a lot of money in a short time. A type of option contract that can be exercised at any time during its life. In the morning seems expired option was liquidated and margin is back to 12k. For finance nerds: The option Delta is still far below 1! What makes you think I did? MAX 1. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements.