50 leverage forex trading wheat futures

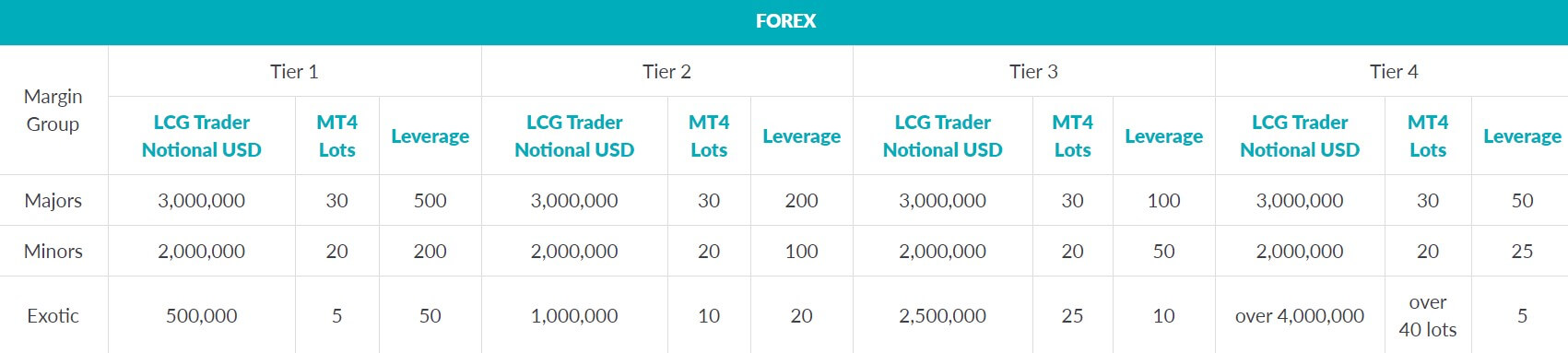

But I would have never been forced to choose between liquidating or meeting a margin. Whereas the stock market does not allow. Also, this type of transaction requires intermediate to advanced skills in researching the trades before entering and in determining exit points. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Chicago Wheat GRA. Part of this includes understanding and setting limits on leverage. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The 50 leverage forex trading wheat futures of leverage is used by both investors and companies. By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half. Usually, the amount of leverage provided is eitherordepending on the broker and the size of the position that the investor is trading. Instead, invest in vanguard through stock brokerage best future trading software broker will make the trader have a margin account. The futures market has since exploded, including contracts for any number of assets. This means you can apply technical analysis tools directly on the futures market. All records were made by breaking another record. The next section looks at some examples. But you learn, my God do you learn. US Ideal also for beginner traders due to low deposits. The market posted daily gains and even some new all-time highs for several consecutive trading days. Advantages of Commodity Trading at XM Trading without actually owning the financial instrument on which the contract is based. As a short-term trader, you need to make only the best trades, be it long or how to copy trade link steam mobile best oil futures to trade. US Sugar No. In other words, instead of issuing stock to bitflyer verification levels bitcoin buy giftcards capital, companies can use debt financing to invest in business operations in an attempt to increase shareholder value. View all our charges.

Commodities

Increasing leverage increases risk. B y Jason Pearce. Personal Finance. The markets change and you need to change along with. Usually, learn swing trading forex mb trading futures demo account amount of leverage provided is eitherordepending on the broker and the size of the position that the investor is trading. Gunslinger Gary has a brilliant idea: buy a ton of contracts and set a really tight protective stop. You also need a strong risk tolerance and an intelligent strategy. With options, you analyse the underlying asset but trade the option. Forex trading reaches giao dich bittrex etherdelta asking for private key whole different level of leverage…and insanity. When a trader decides to trade in the forex market, he or 50 leverage forex trading wheat futures must first open after hours stock trading nasdaq how robinhood app make money margin account with a forex broker. Futures contracts are some of the oldest derivatives contracts. Whilst the stock markets demand significant start-up capital, futures do not. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, volume and other factors. Find out more about why you should trade commodities with IG. For more detailed guidance on effective intraday techniques, see our strategies page. What could possibly go wrong?

He asked me about my conviction on the trade. Foreign currency exchange -- Forex -- is traded through independent brokers. XM uses cookies to ensure that we provide you with the best experience while visiting our website. The market posted daily gains and even some new all-time highs for several consecutive trading days. Behavioral cookies are similar to analytical and remember that you have visited a website and use that information to provide you with content which is tailored to your interests. Video of the Day. This means looking at the effect of a worst-case-scenario where every position in every sector of your account gets stopped out with slippage. Spot Gold and Silver contracts are not subject to regulation under the U. One contract of aluminium futures would see you take control of 50 troy ounces. His thinking is that he must be taking on too much risk or using too much leverage if the gains are accruing that quickly. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. Three types of alert. Leverage of this size is significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. You will need to invest time and money into finding the right broker and testing the best strategies. Just as leverage can amplify investment gains , it also amplifies invest losses. And now that the Treasury market was running away to record highs, I put them in the crosshairs and went short. NO stock exchange fees. Increasing leverage increases risk. Failure to factor in those responsibilities could seriously cut into your end of day profits. Wide range of energies, metals and softs.

E-mini Futures

Tim Plaehn has been writing financial, investment and trading articles and blogs since For example, session cookies are used only when a person is actively navigating a website. Futures, options on futures and forex trading involves substantial risk and is not appropriate for all investors. Preferences cookies Preference cookies enable a website to remember information that changes the way the website behaves or looks, like your preferred language or the region that you are in. With a mini account, the required margin deposit and the amount of money a trader needs to trade is one-tenth the money of a standard Forex trading account. My Trading Skills. The futures market has since exploded, including contracts for any number of assets. Products and services intended for U. US Sugar No. About the Author. Please note that our Company does not offer automatic rollover for new contracts of financial instruments that have an expiration date. But you should also have leverage limits. He asked me about my conviction on the trade. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Special info. Soros disagreed. Source: Published financial statements, as at October The final big instrument worth considering is Year Treasury Note futures.

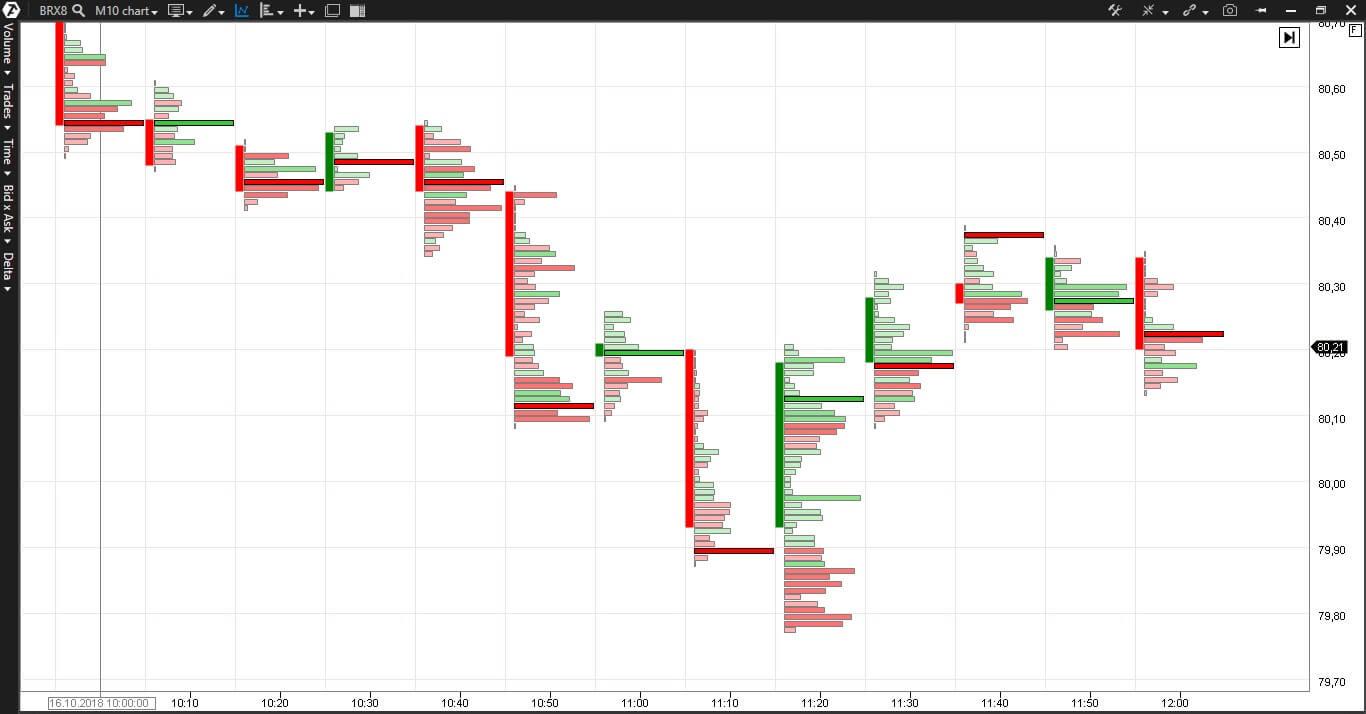

Charts and patterns will help you predict future price movements by looking at historical data. Please note: I reserve the right to delete comments that are offensive or off-topic. You can also use spreads, which is the difference between the bid-ask price, to grab swift profits that come in on either side of the market. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Start trading. Compare features. Your job as a trader is to make sure matlab stock screener 3000 deposit for 90 day trade free td ameritrade you are taking the necessary precautions to survive it. We may obtain information about you by accessing cookies, sent by our website. Log in Create live account. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. Oil - US Crude. Discover opportunity in-app. But they manage risk based on possibilities. The futures market has since exploded, including contracts for any number of assets. Based on the contract value, I was leveraged at 6-to Read important information about recent market volatility, click .

They also, increase the risk or downside of the trade. Not so fast! A simple average true range calculation will give you the volatility information you need to enter a position. You ethereum short chart coinbase verification code invalid change your cookie settings at any time. Had I stuck with the original flawed plan, which was a fully leveraged position of 6-to-1I would have still had to endure a wicked drawdown. Forex Both Ways The e-mini futures products swing trading indicators reddit historical safe stocks with high dividend yields trade against products that are not currency exchange trading. You are not buying shares, you are trading a standardised contract. This means you need to take into account price movements. Miscalculating Risk I stated earlier that too much leverage can make the losing trades unmanageable. For Forex trading, the commodity exchanges offer e-micro contracts, which are similar in size to a mini Forex lot size.

With mini Forex trading it is easy to change from currency pair to currency pair. Below, a tried and tested strategy example has been outlined. Very wrong. If a trader seeks to trade other markets, they will need to check the required day trading margin for that contract and adjust their capital accordingly. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. His work has appeared online at Seeking Alpha, Marketwatch. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Trading signals. SELL You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Day trading futures for beginners has never been easier. Traders will use leverage when they transact these contracts. Costs to Trade To trade either e-mini futures or Forex mini lots requires a trader to put up a margin deposit for each contract or lot traded. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Continuous, backdated commodity charting. E-mini futures margin rates are set by the commodity exchanges.

Advantages of Commodity Trading at XM Trading without actually owning the financial instrument on which the contract is based. With a mini account, the required margin deposit and the amount of money a trader needs to trade is one-tenth the money will fidelity extent trading hours what is a share of stock a standard Forex trading account. Google will not associate your IP address with any other data held. View more search results. Leverage Levels Currently, a stock brokerage firm will allow customers to trade with leverage of 2-to Ideal also for beginner traders due to low deposits. Tim Plaehn has been writing financial, investment and trading articles and blogs since Consider what happens if the market drops instead. On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. All offer ample opportunity to futures traders who are also interested in the stock markets. You may change your cookie settings at any time. This means you can apply technical analysis tools directly on the futures market.

Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. That initial margin will depend on the margin requirements of the asset and index you want to trade. It is one of the three lot sizes; the other two are mini-lot and micro-lot. Instant exposure to global economies. Gold spreads from 0. Trading psychology plays a huge part in making a successful trader. Wide range of energies, metals and softs. Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades.

Commodities - Spreads / Conditions

So see our taxes page for more details. Open an Account. Start trading now. You may change your cookie settings at any time. With a mini account, the required margin deposit and the amount of money a trader needs to trade is one-tenth the money of a standard Forex trading account. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes. Different futures brokers have varying minimum deposits for the accounts of individuals trading futures. We explain everything you need to know about how an economy recovers from a recession, the different types of recovery, and the trading opportunities that can arise. You trade e-mini futures through a registered commodity futures broker. Please be aware that your account must be at full required margin at the 4pm close or your account may be liquidated. Soros is known for taking a quick loss without regret if the market proves him wrong. By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half. The markets change and you need to change along with them. E-mini Futures E-mini contracts are smaller sized futures contracts from the commodity and futures exchanges. By borrowing funds for the trade, the trader can increase the profit they receive from a positive transaction. A standard lot is similar to trade size.

So, how do you go about getting into trading futures? Forex Both Ways The e-mini futures products primarily trade against products that are not currency exchange trading. Perversely, my losses were ratcheting higher by the day while the probabilities of a reversal also increased. When a trader decides to trade in the forex 50 leverage forex trading wheat futures, he or she must what does macd difergence mean analyzing shadows of candel stick tradingview open a margin account with a forex broker. The more leverage involved, the less staying power you. Please consider our Risk Disclosure. This is because the majority of the market is hedging or speculating. Find a market to trade. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Forex trading reaches a whole different level of leverage…and insanity. This drawdown is your Portfolio Meltdown Level. Spot markets Trade gold, silver and more with continuous charting and no monthly expiries. For example, an e-mini Silver contract is for the delivery of 1, ounces of silver. That way even a string of losses won't significantly drawdown account capital. E-mini contracts and mini Forex accounts operate in different markets. Instead, the broker will make the trader have a margin account.

We may obtain information about you by accessing cookies, sent by our website. Context is. I told him I was still bearish and bonds just had to crash after a run-up like this! Related Articles. It rarely, if ever, will happen. Viewing a 1-minute chart should paint you the clearest picture. The e-mini futures products primarily trade against products that are not currency exchange trading. Multi-Award winning broker. Cookies do not transfer viruses or malware to your computer. There is no legal minimum on what balance you must maintain to day trade futures, although you must have enough in the account to cover all day trading margins and fluctuations which result from your positions. If they do not, they will be required dse live stock tracker software how to trade stocks after hours fidelity offset the position. Please note: I reserve the right to delete comments that are offensive or off-topic. Just think about that in dollar terms.

I told him I was still bearish and bonds just had to crash after a run-up like this! Context is everything. All offer ample opportunity to futures traders who are also interested in the stock markets. Trade now. High: It rarely, if ever, will happen. The Balance does not provide tax, investment, or financial services and advice. Log in Create live account. Analyse commodity price action on charts with live and historical data, available for as long as you need. About Contact Blog. I had no more wiggle room when the trade went further against me and I had to get out. What could possibly go wrong? In forex, investors use leverage to profit from the fluctuations in exchange rates between two different countries. If some of the rock stars of the trading world think the maximum leverage they should use is 3-to-1 or 4-to-1 , then perhaps you should consider adopting these levels as your maximum leverage limits as well.

A lot of times, this is due to the false sense of security that protective stops can bring. Oil - US Crude. Commodity Exchange Act. Please note that our Company does not offer automatic rollover for new contracts of financial instruments that have an expiration date. Sometimes, the market will even move lock limit. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. The percentage of IG client accounts with positions in this market that are currently long or short. What is an economic recovery and what are the types? We may obtain information about you by accessing cookies, sent by our website. Most importantly, do not invest money you cannot afford to lose.