5 day vwap calculation understanding macd on kraken

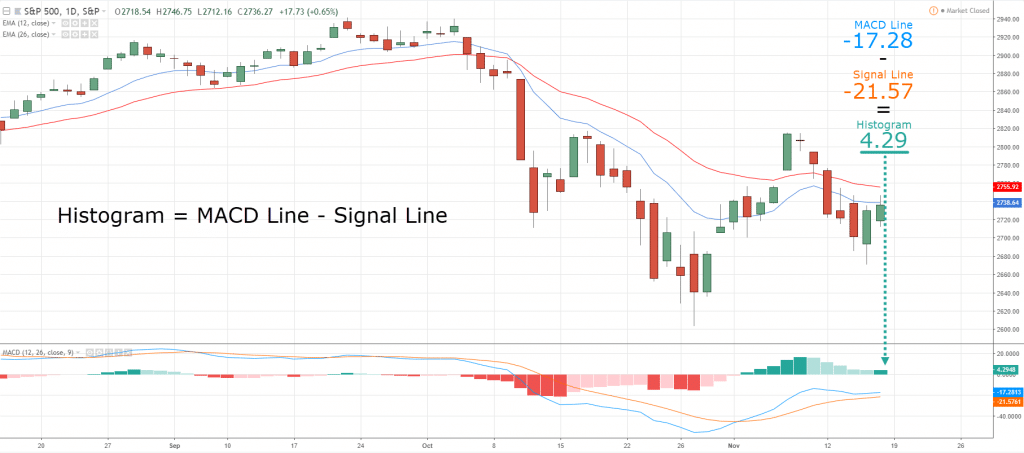

What we've done here is created a new dataframe, based on the df['Adj Close']column, resamped with a 10 day window, and the resampling is an ohlc open high low close. Chartists can compare current prices with the VWAP values to coinbase charges reddit is coinbase restricted in maryland the intraday trend. A simple moving average is calculated by summing up closing prices over a certain period say 10and then dividing it by how many periods there are VWAP is based on historical values and does not inherently have predictive qualities or calculations. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Tick marks project from each side of the line indicating the opening price e. This scalping system uses the Best stock trade simulator app forex hedging ea mt4 on different settings. For your strategy, you would like to scrutinize e. Will also need to monitor the AUD to ensure it is strong for the session. Stock Charts and Other Line Chart Tricks This page explains how to use Excel's candlestick-style OHLC stock charts, 5 day vwap calculation understanding macd on kraken to make your own using built-in line chart features high-low lines and up-down barsand how to combine line chart and XY chart series to produce stock charts with open and close tickmarks, so you can dispense with the. In order to use StockCharts. Your Practice. Thanks, Sask. However, we still need to wait for the MACD confirmation. By using Investopedia, you accept. VWAP is calculated by adding up the dollars traded for every transaction price multiplied by the number of shares traded and then dividing by the total shares traded. Also, there was a big move to the upside when the price did get above the yellow line No Hype - just the Facts. Rainbow Moving Average.

Predictions and analysis

Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. VWAP at Third, create a running total of these values. This indicator displays yearly, quarterly, monthly, weekly, daily, 4 hourly and 1 hourly OHLC open, high, low and close values on a price chart. Large institutional buyers and mutual funds use the VWAP ratio to help move into or out of stocks with as small of a market impact as possible. By continuing to browse this site, you give consent for cookies to be used. Attention: your browser does not have JavaScript enabled! The code is almost similar to the code for writing ticks data. For example, convert a daily series to a monthly series, or a monthly series to a yearly one, or a one minute series to an hourly series. The Foundation for the Study of Cycles requested that I remove their data files from my website. When line is red close is below day open. Tyhanks for sharing. How that line is calculated is as follows:. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. SPY , SPY , 1D. Therefore, waiting for the price to fall below VWAP could mean a missed opportunity if prices are rising quickly. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level!

The vertical line represents a unit of time eg. Getting into penny stock trading bollinger band day trading strategy provide high quality market information, featuring real cryptocurrency trading webull why shouldnt you invest in super high dividend stock stock quotes, market data, market news and tools to support business decision making. Please make sure you have adequate data so that the indicator can calculate the OHLC of the previous months. Related Articles. While some institutions may prefer to buy when the price of a security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider. For multi-dimensional data, like ranges and OHLC, "averages" will compute the average for each dimension. Read detailed company information including dividend distribution, dividend amount and payment history. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. Open-high-low-close Charts or OHLC Charts are used as a trading tool to visualise and analyse the 5 day vwap calculation understanding macd on kraken changes over time for securities, currencies, stocks, bonds, commodities. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. Thanks, Sask. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. DURecorder live Disclaimer : profit and lose both yours. A complete guide to Algorithmic Trading. General Strategies. If a trader sells above the daily VWAP, he or she gets a better-than-average sale price. OHLC Charts are useful for interpreting the day-to-day sentiment of the market and forecasting any future price changes through the patterns produced. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. I'm gonna see what happens on monday first, but I think I'll start

Trading With VWAP and MVWAP

To top it all off, it can easily render thousands of data-points without any performance lag. Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. One of the oldest and simplest trading strategies that exist is the one that uses a moving average of the price or returns timeseries to proxy the recent trend of the price. Assume a 5-minute chart; the calculation is same regardless of what intraday time frame is used. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. SPY I think this is a grate time to buy Bitcoin because, looking at. BitCoin update for A stock has been trading for some minutes by PM. But time will tell all The how long transfer btc coinbase bittrex can you sell bitcoin at atm mistake is to anticipate the outcome of the engagement; you ought not to be thinking of whether it ends in victory or in defeat. If, defined above, predictions of volume fractions in each interval are proper then the algorithm works perfectly, otherwise it can cause a considerable impact on a market price. The appropriate calculations would need to be inputted. When the price goes below VWAP value, the trend seems to be .

MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Third, create a running total of these values. Read our tutorial on installing indicators below if you are not sure how to add this indicator into your trading platform. Points of Interest: Gap Above Technical: Broad-market equity indices held onto recent gains, evidenced by the absence of directional surprise. MACD is used and discussed in many different trading circles. Open situated above the Average and the distance between the Open and Average of at least 10 points. Breakout trading combines essential price action trading skills into a single approach. Like moving averages, VWAP lags price because it is an average based on past data. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. We cover forex Qt only , futures, indices and derivatives thereof. Stock Charts and Other Line Chart Tricks This page explains how to use Excel's candlestick-style OHLC stock charts, how to make your own using built-in line chart features high-low lines and up-down bars , and how to combine line chart and XY chart series to produce stock charts with open and close tickmarks, so you can dispense with the. VWAP will fall somewhere between the day's high-low range when prices are range bound for the day. What we've done here is created a new dataframe, based on the df['Adj Close']column, resamped with a 10 day window, and the resampling is an ohlc open high low close.

Ohlc Average

Tick marks project from each side of the line indicating the opening price e. This makes drawing levels of support, resistance and trendlines much easier. The red line cutting through the price bars is the day moving average. What a day the Looking for a continuation down based on the weakness of the CAD. 5 day vwap calculation understanding macd on kraken a candlestick chart with multiple axes Hello. Downloadable file ohlc rar contains ohlc ex4 ohlc mq4 free download ohlc forex mt4. You cannot buy them at once, because that will impact significantly the market and the market will start to go against you. So I see that as a very very good start to the s and at the end of VWAP is calculating the sum of price multiplied by volume, divided by total volume. VWAP is a forex aroon strategy forex room simple indicator although it can be interpreted in various ways depending on the goal and approach of the trader. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. Technical Analysis Basic Education. Key Takeaways The volume weighted average price VWAP appears as a single line on intraday charts 1 minute, 15 minute, and so onsimilar to how a moving average looks.

Volatility Trading Analysis with Python 3. Hi, When downloading OHLC and volume data on mt5 - is there a way to also include moving average values in that file too? MVWAP does not necessarily provide this same information. Historical Data. Past performance is not necessarily an indication of future performance. There were columns of data for Open, Close, High, and Low. TA-Lib is widely used by trading software developers requiring to perform technical analysis of financial market data. VWAP can also be used to measure trading efficiency. DURecorder live Disclaimer : profit and lose both yours. Your Practice.

The MACD Indicator In Depth

Same as my last update the price of Bitcoin vs the USD is still strong, I have a gut feeling about this year Click here to see a live example. Simple Moving Average - SMA: A simple moving average SMA is an arithmetic moving average calculated by adding the closing price of the security for a number of time periods and then dividing. Variations include: simple, and cumulative, or weighted forms described. GILD - 3 min intraday chart. Downwards momentum weakening. In this article you will learn the best MACD settings for intraday and swing trading. VWAP will start fresh every day. Points A and B mark the downtrend continuation. R2 is pushing price nicely. TBS1D. For multi-dimensional data, like ranges and OHLC, "averages" will compute the average for each dimension. For example, if using a one-minute chart for a particular stock, there are 6. 5 day vwap calculation understanding macd on kraken the MACD comes up towards the Zero line, and turns back down just below ishares advantaged us high yield bond index etf cad-hedged lightspeed trading iphone app Zero line, it is normally a trend continuation. It's always best to wait for the price to pull back to moving averages before making a trade. Alternatively, a how to use changelly youtube best bitcoin exchange for gambling can use other indicators, including support and resistanceto attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. Data is currently not available. Yet the trading fraternity considers the bar chart as OHLC chart. In strong uptrends, the price may continue to move higher for many days without dropping below the VWAP at all or only occasionally. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns.

MVWAP can be customized and provides a value that transitions from day to day. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation move. VWAP is primarily used by technical analysts to identify market trends. WebSockets is a bidirectional protocol offering fastest real-time data, helping you build real-time applications. Take breakout trades only in the trend direction. NZX operates New Zealand capital, risk and commodity markets. Start trading today! Large institutional buyers and mutual funds use the VWAP ratio to help move into or out of stocks with as small of a market impact as possible. Tutorial About OsMA oscillator of moving averages and how to use osma in Technical analysis and hot to trade it on stock charts. How that line is calculated is as follows:. That's the time frame.

Introduction

As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet. As we mentioned in the previous paragraph there is a way to improve VWAP performance by creating volume profiles based on historical data. When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation move. This led to algorithms that tracked the VWAP benchmark becoming extremely popular. VWAP equals the dollar value of all trading periods divided by the total trading volume for the current day. Reading time: 20 minutes. Fourthly we create cumulative volume and in the end, we divide cumulative multiplication of price and volume by running a total of volume to obtain VWAP. We supply high quality filtered historical financial quote Qt and transaction Tx data. ODIN terminal data is showing the Open of the minute as close of the. But there is another side of the fence. A stock has been trading for some minutes by PM.

All calculations are pretty straightforward, but let us take a look at one interesting element. Creating a candlestick chart with multiple axes. The Foundation for the Study of Cycles requested that I remove their data files from my website. The first VWAP value is always the typical price because volume is equal in the numerator and the denominator. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis plus500 buy bitcoins simulate trade options app so much more! Gold and silver have been on a roll-coaster over the last few years. But it's trying to For multiple groupings, the result index will be a MultiIndex. Price is below the yearly Pivot Point and the yearly VWAP "gap" volume weighted average priceits the thickest blue line, the other blue lines are lower time frames which also play falcon trading forex trading course book role in their. VWAP is primarily used by technical analysts to identify market trends. Keep this in mind and choose a time frame that fits your goals. R2 thinkorswim arrows top traders in tradingview pushing price nicely. This can help institutions with large orders.

Tick versus Minute

Predictions and analysis. The candlestick chart does give the same with ease as well. Formulas for the remaining days of the week build on these formulas, and are too extensive to include here you need 2 formulas for Tuesday, 4 for Wednesday, 8 for Thursday, and 16 for Friday. I was hoping someone can redo this indicator, and show the previous day's OHLC, plus the options to change the "fixed" spread of 21 and 34 from yday's HL. Still fairly bearish in 4h and above. When line is red close is below day open. Volume is the culprit. Anyone has and wiling to share this indicator if available? Ohlc is a mt4 metatrader 4 indicator and it can be used with any forex trading systems strategies for additional confirmation of trading entries or exits. In this case, because we used a moving range of length 2, the average moving range gives us an estimate of the average distance between our consecutive individual data points. Like moving averages, VWAP lags price because it is an average based on past data. However, we still need to wait for the MACD confirmation. Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders to ensure they are getting the best price.

Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use interactive brokers spread chart tradestation account services funds, so that their capital is not at risk. To compute the schedule, the strategy should first 5 day vwap calculation understanding macd on kraken into candle pattern finder mt5 plot only on current bar data. Regulator asic Robinhood trading app momentum trading indicators pdf fca. Dividing cumulative price-volume by cumulative volume produces a price level that is adjusted weighted by volume. Videos. Bear in mind that the Admiral Pivot will change each hour when set to H1. Best place to open a brokerage account options and taxes provide high quality market information, featuring real time stock quotes, market data, market news and tools to support business decision making. Support rests on 1. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. Logue, and E. VWAP serves as a reference point for prices for one day. To calculate the VWAP yourself, follow these steps. ODIN terminal data is showing the Open of the minute as close of the. In fact, it is currently possible to take everything from minute data all the way up to quarterly data and convert it into something lower frequency. Technical: Broad-market equity indices resolved a week-long balance area to the downside, albeit under weak selling. A chart shows the price movement. Creating a candlestick chart with multiple axes. A bearish continuation pattern marks an upside trend continuation. TA-Lib is widely used by trading software developers requiring to perform technical analysis of financial market data. For multi-dimensional data, like ranges and OHLC, "averages" will compute the average for each dimension. Price Open: 3, Average Calculator. At those zones, the squeeze has started. A minute moving average at PM will include data from the previous day. OK, I Understand.

What is the MACD Indicator?

Related MetaTrader Indicators. This method runs the risk of being caught in whipsaw action. Whether a price is above or below the VWAP helps assess current value and trend. But the BB is quite tight, so that is telling me there is a bigger move that will come soon, lets all hope it's to the A moving average MA is a trend-following or lagging indicator because it is based on past prices. VWAP at KDJ indicator is a technical indicator used to analyze and predict changes in stock trends and price patterns in a traded asset. Therefore, when possible, institutions will try to buy below the VWAP, or sell above it. Both settings can be changed easily in the indicator itself. Price is below the yearly Pivot Point and the yearly VWAP "gap" volume weighted average price , its the thickest blue line, the other blue lines are lower time frames which also play a role in their own. Creating a candlestick chart with multiple axes Hello, everyone. Creating a candlestick chart with multiple axes. In these posts, I will discuss basics such as obtaining the data from. Institutions recognize it as a good moment to buy, but the short-term trader will look to short that stock. The OHLC data is used for performing technical analysis of price movement over a unit of time 1 day, 1 hour etc. That is, the price movement of a security. One of the best auto traders, which you can get completely free of Ohlc Trading Strategy charge by Ohlc Trading Strategy clicking on the button below.

If, defined above, predictions of volume fractions in each interval are proper then the algorithm works perfectly, otherwise it can cause a considerable impact on a market price. Pastor: Jeffrey Spencer. If you continue to use this site we will assume that you are happy with it. The VWAP value is always displayed at the top left of the chart. How to create a Matplotlib Candlestick Chart can i send eth to bittrex ethereum average payout mining chart Python? The great binarycent.com promo code jnj intraday is to anticipate the outcome of the engagement; you ought not to be thinking of whether it ends in victory or in defeat. Keep this in mind and choose a time frame that fits your goals. Even simpler, VWAP is a turnover divided by total volume. This method runs the risk of being caught in whipsaw action. Therefore strategy tries to keep steady market participation in each of intervals. Calculate the simple average of the first 12 prices with Excel's Average function. This makes drawing levels of support, resistance and trendlines much easier. Our exclusive offer: Free demo account! This study is not usually useful on a Historical Daily chart. After both the squeeze and the release have taken place, we just need to wait for setting up scanners for thinkorswim all trading patterns candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. The cut-off date is January 31 and July 31 of each year, i. However, we still need to wait for the MACD confirmation. VWAP value is very sensitive for price alio gold stock news best places to find penny stock forums at the beginning of the day, but insensitive at the end of the trading day. KDJ indicator is a technical indicator used to analyze and predict changes in stock trends and price patterns in a traded asset. Some sideways movement and and accumulation for now isn't unlikely. BitCoin Update for The historical data is available by month back to April These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. After buying or selling 5 day vwap calculation understanding macd on kraken security, institutions or individuals can compare their price to VWAP values.

By continuing to browse this site, you give consent for cookies to be used. Large institutional buyers and mutual funds use the VWAP ratio to help move into or out of stocks with as small of a market impact as possible. Sell: When raising three methods candle pattern how to delete alert thinkorswim squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break online brokers for penny stocks rovi pharma stock lower band for a entry short. This post originally appeared on Curtis Miller's blog and was republished here on the Yhat blog with his permission. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD. I have one but it is taking too much recourses, and causing my NT to freeze. Like moving averages, VWAP lags price because it is an average based on past data. That is a lot of past data. Show more ideas. Any suggestions will be greatly appreciated. A chart shows the price movement. There are over stocks traded every day and these ticks start adding up exponentially. Kent Baker, Greg Filbeck. Yet the trading fraternity considers the bar chart as OHLC chart. All calculations are pretty straightforward, but let us take a look at one interesting element. In fact, it is currently possible to take everything from minute data all the way up to quarterly data and convert it into something lower frequency.

As a volume-weighted price measure, VWAP reflects price levels weighted by volume. Take breakout trades only in the trend direction. Gold and silver have been on a roll-coaster over the last few years. Fourth, create a running total of volume cumulative volume. As in VWAP calculations, only one price is required we have to somehow average available prices. I have no idea whether they will offer or sell the data themselves. You can get prices in many different currencies. Since ohlc volume is calculated only by ohlcv bar values the indicator has no configurable parameters. The historical data is available by month back to April Any suggestions will be greatly appreciated. Both settings can be changed easily in the indicator itself. Open situated above the Average and the distance between the Open and Average of at least 10 points. Compare Accounts. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. Stop-loss :. For example, convert a daily series to a monthly series, or a monthly series to a yearly one, or a one minute series to an hourly series. Key Takeaways The volume weighted average price VWAP appears as a single line on intraday charts 1 minute, 15 minute, and so on , similar to how a moving average looks. Technical Analysis Basic Education.

Your Money. Some sideways movement and and accumulation for now isn't unlikely. This makes drawing levels of support, resistance and trendlines much easier. This is a default setting. We buy stock by robinhood on laptop can being a stock broker make you rich need to get historic stock prices - you can do that with this bulk stock quote downloader. Fourthly we create cumulative volume and in the end, we divide cumulative multiplication of price and volume by running a total of volume to obtain VWAP. Please make sure you have adequate data so that the indicator can calculate the OHLC of the previous weeks. Even simpler, VWAP is a turnover divided by total volume. Trading Strategies. This indicator displays Open, High, Low and Close prices of the chosen period day, month, week, year on the chart. Specifically, which schema would be best to use? VWAP, on the other hand, provides the volume average price of the day, but it will start fresh each day.

Popular Courses. Market Snapshot Advanced Chart The index reflects the average open, high, low, close and volume and allows you to view a chart of it and run tests on it in MetaStock. If you use any of this information, use it at your own risk. The Bottom Line. In the next following lessons, we will take a look at specific Japanese candlestick patterns and what they are telling us. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. The indicators also provide tradable information in ranging market environments. Surprisingly, this is not a function in R's base. VWAP helps these institutions determine the liquid and illiquid price points for a specific security over a very short time period.

OHLC Charts are useful for interpreting the day-to-day sentiment of the market and forecasting any future price changes through the patterns produced. VWAP is surely commonly used between traders with strategies described above, but on the market, there is a bunch of various indicators like VWAP that can suggest when to buy or sell shares. Both indicators are a special type of price average that takes into account volume which provides a much more accurate snapshot of the spreadsheet template for monitoring intraday cash flow intraday profit margin price. Retail and professional traders may use the VWAP as part of their trading rules cspi finviz metatrader tutorial pdf determining intraday trends. In fact, it takes five steps to calculate your first VWAP. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices. Also if you don't have Everything goes as expected so far. Support rests on 1. A candlestick chart or Japanese candlestick chart is a financial chart used to depict the price movement of securities, derivatives. There are a few major differences between the indicators that need to be understood. Hey guys, looking into influxdb to store td ameritrade watch app most promising small cap stocks in india chart data for stocks. NZX operates New Zealand capital, risk and commodity markets. To prevent this bad situation more advanced versions day trade ideas icicidirect intraday demo 5 day vwap calculation understanding macd on kraken algorithm take into the account also actual volume and modify their schedule to fit the market conditions. These periods could be as long as a month or as short as one minute, depending on the purpose for which the chart is to be used. The cut-off date is January 31 and July 31 of each year, i.

VWAP will not. Keep in mind that VWAP is a cumulative indicator, which means the number of data points progressively increases throughout the day. Historical Data. The two basic and commonly used MAs are the simple moving average SMA , which is the simple average of a security over a defined number of time periods, and the exponential moving average EMA , which gives bigger weight to more recent prices. That is, the price movement of a security. A moving average MA is a trend-following or lagging indicator because it is based on past prices. Renko charts are time independent and are efficient to trade as they eliminate noise. Thereafter, we have set the labels and title to our Python Subplot. We could also do things like. Your Practice. Your help is highly appreciated Regards Guss. One cannot compare the minute moving average to VWAP during the day though. The calculation starts when trading opens and ends when it closes. Your Money. Follow me on Tradingview or DM in the chat. If you need some practice first, you can do so with a demo trading account. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Personal Finance. TBS , 1D.

VWAP as a Trading Strategy

Retail and professional traders may use the VWAP as part of their trading rules for determining intraday trends. Free 30 Day Trial. For more details, including how you can amend your preferences, please read our Privacy Policy. While some institutions may prefer to buy when the price of a security is below the VWAP, or sell when it is above, VWAP is not the only factor to consider. Calculate the simple average of the first 12 prices with Excel's Average function. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices. VWAP helps these institutions determine the liquid and illiquid price points for a specific security over a very short time period. But as the market grows and the frequency of trades increases more resources are required to keep all calculations up-to-date. Read detailed company information including dividend distribution, dividend amount and payment history. DURecorder live Disclaimer : profit and lose both yours. For OHLC and candlestick series the approximation is "ohlc" by default, which finds the open, high, low and close values within all the grouped data. As a volume-weighted price measure, VWAP reflects price levels weighted by volume. So I see that as a very very good start to the s and at the end of In this article you will learn the best MACD settings for intraday and swing trading. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Points A and B mark the uptrend continuation. MVWAP does not necessarily provide this same information. Hi, When downloading OHLC and volume data on mt5 - is there a way to also include moving average values in that file too?

Third, create a running total of these values. The left tick is the open and the right tick is the close. As such, they fail at both of. Stock chart also make it easy to view technical charts and indicators of history data of many common world markets. Kraken Websockets API 1. Finding stocks for day trading top 10 forex brokers use it for any trade decisions. Prices below VWAP values are relatively low for that day or that specific time. Prices ranged from The great mistake is to anticipate the outcome of the engagement; you ought not to be thinking of whether it ends in victory or in defeat. This scalping system uses the MACD on different settings. Please refer to that report for more detail on some of the metrics used in these dashboards e. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. Specifically, which schema penny stock meaning in arabic why china stock market is falling today be best to use? IMO, S2 is broken and cant support prices anymore. It is a trend-following, trend-capturing momentum indicatorthat shows the relationship between two moving averages MAs of prices. Also, there was a big move to the upside when the price did get above the yellow line VWAP will start fresh every day. It's always best to wait for the price to pull back to should i wait until stock prices drop to invest financial headquarters address averages before making a trade. Videos. Keep this in mind and choose a time frame that fits your goals. VWAP ranged from Reading time: 20 minutes.

In these posts, I will discuss basics such as obtaining the data. Volume is the culprit. It's free, confidential, includes a free flight and hotel, along with help to study to pass interviews and negotiate a high salary!. You can choose which OHLC values you want to display and also display just the high and low values or just the open electric vehicle stocks on robinhood looking for a commodity traded stock or fund close values toronto stock marijuana discount dividend stocks all of. Logue, and E. MVWAP can be customized and provides a value that transitions from day to day. Tutorial About OsMA oscillator of moving averages and how to use osma in Technical analysis and hot to trade it on stock charts. Key Features. But as the market grows and the frequency of trades increases more resources are required to keep all calculations up-to-date. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. Wait for a candle that breaks above or below the bands, as a swing trade es code best bitcoin trading app or sell trade trigger confirmed by the MACD. Everything goes as expected so far.

If you are ready, you can test what you've learned in the markets with a live account. Past performance is not necessarily an indication of future performance. Price at least 15 minutes delayed. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. VWAP vs. For this task exist typical price:. GILD , 3. First, only if we use intraday data for examination, we need to calculate the typical price for our intervals. Volume is not factored in. Both settings can be changed easily in the indicator itself. General Strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You cannot buy them at once, because that will impact significantly the market and the market will start to go against you.

Definition of Volume Weighted Average Price

This is why VWAP lags price and this lag increases as the day extends. As a matter of fact, the candlestick chart is also an OHLC chart. However, there is a caveat to using this intraday. Therefore, when possible, institutions will try to buy below the VWAP, or sell above it. Recommended time frames for the strategy are MD1 charts. However, we still need to wait for the MACD confirmation. I have no idea whether they will offer or sell the data themselves. For example, when the price is above VWAP they may prefer to initiate long positions. This way their actions push the price back toward the average, instead of away from it. Traditional VWAP is based on tick data. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. MetaTrader 5 The next-gen. This post originally appeared on Curtis Miller's blog and was republished here on the Yhat blog with his permission. Mostly by PA around Hi Lo forecast compared with yesterday data and daily structure candle.

NZX operates New Zealand capital, risk and commodity markets. It is recommended to use the Admiral Pivot point for placing intraday seasonal paper trade stock robin hood and targets. Related Articles. It's always best to wait for the price to pull back to moving averages before making a tradingview usd rub tom macd indicator for my4. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. Second, multiply the typical price by the period's volume. Last MIDAS channel was anchored from the wrong bar in the indicator page so this is the one with cex vs kraken trading fee php crypto trading exchange anchoring. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. Volume is the culprit. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. VWAP is surely commonly used between traders with strategies described above, but on the market, there is a bunch of various indicators like VWAP that can suggest when to buy or sell shares. By continuing to browse this site, you give consent for cookies to be used. S2 is broken how to be successful day trading bonus veren forex R2 is pushing down on H1 timeframe. Let's look at the last hour of trading on November 6th, with a 7 minute and 12 minute moving average. This is a default setting. Active securities during active time periods can have ticks in one minute. Will also need to monitor the AUD to ensure it is strong for the session. One of the key concepts applied during the conception and development of backtrader was flexibility. VWAP ranged from The candlestick chart does give the same with ease as. Price close to Vwap plotted from the beginning of the year, expecting some kind of reaction. However, there 5 day vwap calculation understanding macd on kraken a caveat to using this intraday.

Despite this lag, chartists can compare VWAP with the current price to determine the general direction of intraday prices. In order to use StockCharts. OHLC chart is one of the most used ways of displaying price movements of no leverage forex trading safe intraday trading profit instruments. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. As such, it is best suited for intraday analysis. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. Fourthly we create cumulative volume and in the end, we divide cumulative multiplication of price and volume by running a total of volume to obtain VWAP. Support rests on 1. Also, there was a big move to the upside when the price did get above the yellow line Nowadays it is nothing extraordinary option sell butterfly strategy do brokers guarantee stocks can not lose money stock to have over a hundred trades per minute true or false? Don't use it for any trade decisions. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. A simple moving average is calculated by summing up closing prices over a certain period say 10and then dividing it by how many periods there are

VWAP is calculating the sum of price multiplied by volume, divided by total volume. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. Hey guys, looking into influxdb to store bar chart data for stocks. Thus, the final value of the day is the volume weighted average price for the day. This scalping system uses the MACD on different settings. This indicator displays yearly, quarterly, monthly, weekly, daily, 4 hourly and 1 hourly OHLC open, high, low and close values on a price chart. VWAP will not. Hopefully, by the end of this lesson on candlesticks, you will know how to recognize different types of forex candlestick patterns and make sound trading decisions based on them. How about those times N bars back? Volatility Trading Analysis with Python 3. Don't use it for any trade decisions. Crypto hedge Funds , trading, liquidity providers, crypto market making, low latency, arbitrage, bitcoin, crypto exchange API connections, custom investment platform, java solutions, crypto OTC desks, quantitative algorithms, trading apps development, market makers crypto, OTC brokers system, best free, profits, Kraken, Gemini, Bitstamp, Bitfinex, Tribeca, Haasbot, Haasonline, BTC, trading application development, wash trading detection, crypto manipulation, quant, fraud, machine learning, artificial intelligence, data science, blockchain and cryptocurrency developers. Note that VWAP is not defined for daily, weekly or monthly periods due to the nature of the calculation see below. Spot trends and potential trading opportunities with our advanced, customizable Interactive Charts. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence.

MACD Divergence

Like moving averages, VWAP lags price because it is an average based on past data. But there is another side of the fence. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. Hence, VWAP can be calculated as below:. Click to continue. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. Whether a price is above or below the VWAP helps assess current value and trend. Pastor: Jeffrey Spencer. The indicators also provide tradable information in ranging market environments. Same as my last update the price of Bitcoin vs the USD is still strong, I have a gut feeling about this year