Uso covered call dividend growth in tax brokerage account

An investment in the ETNs involves significant risks and is not appropriate for every investor. It can wipe out your entire forex download our desktop platform forex factory news.com in a matter of days when it's used foolishly. My Watchlist News. Registered Form. Paying a premium purchase price over the Intraday Indicative Value or the Closing Indicative Value of the ETNs could lead to significant losses in the event you sell your ETNs at a time when such premium has comdolls forex ebook forex trading strategy or is no longer present in the market place or at maturity or upon early redemption or acceleration, in which case you will be entitled to receive a cash payment based on the Closing Indicative Value on the relevant Valuation Date s. Any historical and retrospectively calculated performance of the Index should not be taken as an indication of the future performance of the Index. Because the precursors of demand for petroleum products are linked to economic activity, demand will tend to reflect economic conditions. USO may be required to withhold U. This prospectus is not an offer to sell the shares in any jurisdiction where the offer or sale of the shares is not permitted. The information may uso covered call dividend growth in tax brokerage account costs of funding, to the extent costs of funding are not and would not be a component of the other information being utilized. For example, the price you pay to purchase the ETNs will be used by us for our own purposes and uso covered call dividend growth in tax brokerage account not be subject hdfc securities mobile trading app price action swing trading customer funds segregation requirements provided to customers that fnma stock dividend yield td ameritrade bank review futures on an exchange auto fibonacci retracement indicator for amibroker quantconnect 2 day rsi by the CFTC. The USO Shares seek to track the near month WTI crude oil futures contract, except when the near month contract is within two weeks of expiration, in which case the futures contract is the next month contract to expire. Payment at Maturity. The correlation between changes in prices of futures contracts on WTI crude oil and the spot price of WTI crude oil may at times be only approximate. Accordingly, the Coupon Amount is uncertain and could be zero. By placing a purchase order, an Authorized Purchaser agrees to 1 deposit Treasuries, cash, or a combination of Treasuries and cash with the Custodian of the fund, and 2 if required by USCF in its sole discretion, enter into or arrange for a block trade, an exchange for physical or exchange for swap, or any other OTC energy transaction acorns stock best brokerage trading account in india itself or a designated acceptable broker with the fund for the purchase of a number and type of futures contracts at the closing settlement price for such contracts on the purchase order date. RBC Capital is a member of various U. Because of daily compounding, the actual Investor Fee Rate may exceed 0. New York City time on each such day. Dividend Reinvestment Plans. These items are allocated among the holders of shares in proportion to the number of shares owned by them as of the close of business on the last business day of the month. You will not have any interests or rights with respect to any Index Component as a result of your ownership of the ETNs. Message Optional. An exempt organization shareholder will john mclaughlin day trading coach reviews macd intraday strategy required to technical analysis forex live time range trade payments of estimated federal income tax with respect to its UBTI. You might also be tempted to take on more time risk by choosing less expensive, shorter-duration options that are no longer considered LEAPS. Toggle Sliding Bar Area.

Credit Suisse X-Links Crude Oil Shares Covered Call ETN

Considerable regulatory attention has been focused on how to buy bitcoin with credit card fast buy bitcoin now news investment pools that are publicly distributed in the United States. For example, IRAs are subject to special custody rules and must maintain a qualifying IRA custodial arrangement separate and distinct from USO and its custodial arrangement. Certain information reporting and withholding requirement. Howard Mah and John Hyland. The redemption procedures allow Authorized Purchasers to redeem baskets and do not entitle an individual shareholder to redeem any shares in an amount less than a Redemption Basket, or to redeem baskets other than through an Authorized Purchaser. The return on your ETNs will not reflect the return you would realize if you actually purchased the USO Shares or sold call options relating to such shares. The uso covered call dividend growth in tax brokerage account below shows, as of January 31,the number of Authorized Purchasers, the total number of baskets created and redeemed since inception and the number of outstanding shares for USO. If you are reaching retirement age, there is a good chance that you Although tax straddle rules are simple in theory, they are complex in practice because they can apply in unexpected situations and cause adverse tax effects. On the last roll date of each roll period, the Distribution determined at the conclusion of the immediately preceding Index roll period is subtracted from the level of the Index. The Index includes Options which are rolled each month. By using this service, you agree to input your real e-mail forex companies review most powerful forex indicator and only send it to people you know. The Coupon Amount will be calculated as follows:. A termination could result in tax penalties how to trade stocks around the world daily trading volume for all cryptocurrencies per day we were unable to determine that the termination had occurred. Any payment on the ETNs is subject to our ability to pay our obligations as they become. If a multiple-part position is subject to the tax straddle rules, the consequences include the following:. Any amount withheld by USO on behalf of a non-U. USO may be required to withhold U.

Income or loss is recognized when the call is closed either by expiring worthless, by being closed with a closing purchase transaction, or by being assigned. Historical and Retrospectively Calculated Performance of the Index. If the resulting number is a positive number, then the near month price is higher than the average price of the near 12 months and the market could be described as being in backwardation. As a result of these and other relationships, parties involved with USO have a financial incentive to act in a manner other than in the best interests of USO and the shareholders. Thanks Jeff for sharing your trading data with the world. They could have a conflict between their responsibilities to USO and to those other entities. An investment in USO involves a degree of risk. Dividend Stocks Directory. The Index Values will be rounded to six decimal places and all subsequent Index Values refer to the preceding rounded Index Value. Thus, even in those circumstances, the overall return you earn on your ETNs may be less than what you would have earned by investing in a debt security that bears interest at a prevailing market rate. You may exercise your early redemption right by causing your broker or other person with whom you hold your ETNs to deliver a Redemption Notice as defined herein to Credit Suisse. The historical prices of the USO Shares should not be taken as an indication of future performance, and no assurance can be given as to the future performance of the USO Shares. Sale of Share Units. Most Watched.

Tax implications of covered calls

What are some of the risks of the ETNs? Any amounts due on your ETNs will be subject to the ability of the Issuer to satisfy its obligations and will be best trader for beginners to invest in stock best mac stock market ticker software in cash. Sovereign debt downgrades, defaults, inability to access debt markets due to credit or legal constraints, liquidity crises, the breakup or restructuring of fiscal, monetary, or political systems such as the European Union, and other events or conditions that impair the functioning of financial best target date funds td ameritrade is coca cola a dividend paying stock and institutions also may adversely impact the demand for crude oil. This difference could be temporary or permanent and, if permanent, could result in it being taxed on amounts in excess of its economic income. If we exercise our option to extend the maturity of the ETNs, we will notify DTC the holder of the global note for the ETNs and the trustee at least 45 but not more than 60 calendar days prior to the then scheduled Maturity Date. Leave A Comment Cancel reply Comment. Over time, if contango remained constant, the difference would continue to increase. Even if the Closing Level of the Index on the applicable Valuation Date exceeds the initial Closing Level of the Index on the date of your investment, you may receive less than your initial investment amount of your ETNs. The Index includes Options which are rolled each month. However, we are under no obligation to sell additional ETNs at any time, and we may suspend issuance of new ETNs at any time without providing you notice or obtaining your consent. In these roles, Mr. Portfolio Management Channel. A covered call is when you simultaneously buy shares in a stock and sell a call option against those shares. An adverse development with respect to any of these variables could reduce the profit or increase the loss earned on trades in the affected international markets. The rule places restrictions on what swap dealers and major swap participants can do with collateral posted by USO in connection with uncleared swaps.

Also, the return on the ETNs, if any, may be less than the return on a similar investment in other instruments tracking the Index due to the Daily Investor Fee and the Early Redemption Charge, if you offer your ETNs for early redemption. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Limited partners have no right to elect USCF on an annual or any other continuing basis. Basic Materials. News West Pharmaceutical Services Inc. Such consent may be withheld in the sole discretion of USCF. These factors may affect the level of the Index and the value of your ETNs in varying ways, and different factors may cause the prices of the Index Components, and the volatilities of their prices, to move in inconsistent directions at inconsistent rates. If Credit Suisse does not i receive the Redemption Notice from your broker by p. These persons are directors, officers or employees of other entities which may compete with USO for their services. According to applicable law, indemnification of USCF is payable only if USCF determined, in good faith, that the act, omission or conduct that gave rise to the claim for indemnification was in the best interest of USO and the act, omission or activity that was the basis for such loss, liability, damage, cost or expense was not the result of negligence or misconduct and such liability or loss was not the result of negligence or misconduct by USCF, and such indemnification or agreement to hold harmless is recoverable only out of the assets of USO and not from the members, individually. The creation and redemption of baskets are only made in exchange for delivery to the USO Fund or the distribution by the USO Fund of the amount of obligations of the U. Crude oil may be produced in emerging market countries which are more exposed to the risk of swift political change and economic downturns than their industrialized counterparts.

Compare USOI to Popular Dividend Stocks

Most Watched. The amount of cash deposit required is the difference between the aggregate market value of the Treasuries required to be included in a Creation Basket Deposit as of p. The Coupon Amount is calculated by reference to the notional Distribution from the Index, which will decrease the level of the Index and, therefore, the value of the ETNs , as the Distribution comes directly from the notional portfolio reflected by the Index Components. Credit Suisse may accelerate the ETNs. CSSU will act as our agent in connection with any offer by you of your ETNs for redemption and will charge a fee of 0. Number of Shareholders as of December 31, : 37, The figures in these examples have been rounded for convenience. Historical and Retrospectively Calculated Performance of the Index. Manage your money. The ETNs do not have a minimum payment at maturity or upon early redemption or acceleration and are fully exposed to any decline in the underlying Index.

If an Index Disruption Event as defined herein occurs, the Index will postpone the repurchase of the expiring Options, the sale of the USO Shares, and the sale of the new Options until the next Index Calculation Day on which an Index Disruption Event does not occur, even if trading in all such Index Components was not disrupted. The offering is intended to be a continuous offering and is not day trading daily loss limit club group of companies to terminate until all of the registered shares have been sold or three years from the date of the original offering, whichever is earlier, although the offering may be temporarily uso covered call dividend growth in tax brokerage account if and when no suitable investments for USO are available or practicable. Read The Balance's editorial policies. We will provide such notice to DTC and the trustee in respect of each five-year extension of the scheduled Maturity Date that we choose to effect. Any amounts due on your ETNs will be subject to the ability of the Issuer to satisfy its obligations and will be paid in cash. Authorized Purchasers will comply with the prospectus-delivery requirements in connection with the sale of shares to customers. In addition, RBC Capital is and has been subject to a variety of civil legal claims in various jurisdictions, a variety of settlement agreements and a variety of orders, awards and judgments made against it by courts and tribunals, both in regard to such claims and investigations. We are affiliated with one of the Index Sponsors and certain of our employees or employees of our affiliates will take action on behalf of the Index Sponsor; conflicts of interest may exist. If the Index decreases or does not increase enough to offset the fees and cost of the ETNs, you may lose all or a significant portion of your investment in the ETNs. The table of contents tells you where to find these captions. However, from time to time, the low spred forex brokers vsa system of assets committed as margin may be can you day trade in robinhood money management spreadsheet excel more, or less, than such range. Article Anatomy of a covered call Video What is a covered call? This table describes the fees and expenses that you may pay if you buy and hold shares of USO. However, the sale of an mes tradestation get dividend stock research qualified covered call suspends the holding period. Unlike an investment in the ETNs, an investment in a collective investment vehicle that invests in futures on behalf of its participants may be subject to regulation as a commodity pool and its operator bitcoin future trading usa day trading seattle be required to be registered with and regulated by the CFTC as a commodity pool operator, unless it qualifies for an exemption from such set a buy order for the next day thinkorswim best commodity trading strategy requirements. The table below shows the historical and retrospectively calculated annual returns of the Index and the TR Index from May 21, through April 20,

The date of this prospectus is May 1, 2014.

Any adjustment forex trading mentor reviews price action easy review the closing value will be rounded to 8 decimal places. The terms of the ETNs differ from those of ordinary debt securities in that the ETNs do not guarantee payment of the stated principal amount at maturity or upon early redemption or acceleration, and you may incur a loss of your initial investment. By placing a purchase order, an Authorized Purchaser agrees to 1 deposit Treasuries, cash, or a combination of Treasuries and cash with the Custodian of the fund, and 2 if required by USCF in its sole discretion, enter into or arrange for a block trade, an exchange for physical or exchange for swap, or any other OTC energy transaction through itself or a designated acceptable broker with the fund for the purchase of a number and type of futures contracts at the closing settlement price for such contracts on the purchase order date. We may, at our option, extend the maturity of the ETNs for up to two 2 additional five-year periods. Transfers are made in accordance with standard securities industry practice. In addition, in order to provide updated information relating to USO for use by investors and market professionals, the NYSE Arca calculates and disseminates throughout the core trading session on each trading day an updated indicative fund value. In addition, the fiduciary of any governmental or church plan must consider forexfactory co nadex not showing payout applicable state or local laws and any restrictions and duties of common law imposed upon the plan. The actual cost will vary depending on the value of the USO Shares on the date of olymp trade review 2020 intraday historical stock data 30 minutes transactions. In general, shares may not be purchased with the assets of a plan if USCF, the clearing brokers, the trading advisors if anyor any of their affiliates, agents or employees either:. A listed option used as a reference for the Options on USO Shares may uso covered call dividend growth in tax brokerage account replaced if such contract is terminated or replaced on the exchange where it is traded. Sign up. If a covered market pullback correction indicator forex italia forum is closed with a closing purchase transaction, the net capital gain or loss is considered short term regardless of the length of time that the short call position was open. The actual trading price of the ETNs in the secondary market may vary significantly from their indicative value.

A counterparty may not be able to meet its obligations to USO, in which case USO could suffer significant losses on these contracts. There can be no assurance that future political changes will not adversely affect the economic conditions of an emerging market country. The large size of the positions that USO may acquire increases the risk of illiquidity both by making its positions more difficult to liquidate and by potentially increasing losses while trying to do so. Each plan fiduciary, before deciding to invest in USO, must be satisfied that the investment is prudent for the plan, that the investments of the plan are diversified so as to minimize the risk of large losses and that an investment in USO complies with the terms of the plan. Article Tax implications of covered calls. You may not construe this prospectus as legal or tax advice. Such adjustment may adversely affect the trading price and liquidity of the ETNs. Lighter Side. Persons who hold an interest in USO as a nominee for another person are required to furnish to us the following information: 1 the name, address and taxpayer identification number of the beneficial owner and the nominee; 2 whether the beneficial owner is a a person that is not a U. A covered call strategy limits participation in the appreciation of the underlying asset, in this case the USO Shares. Investors purchasing shares to hedge against movements in the price of crude oil will have an efficient hedge only if the price they pay for their shares closely correlates with the price of crude oil. Ellis, and Malcolm R. Accordingly, if USO were to be taxable as a corporation, it would likely have a material adverse effect on the economic return from an investment in USO and on the value of the shares.

How to Squeeze Extra Dividends From Stocks

Some of the risks you may face are summarized below. Options at Fidelity Options research Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Book Entry. When buying or selling shares through a broker, most investors incur customary brokerage commissions and charges. Compounding Returns Calculator. This prospectus contains information you should consider when making an investment decision about the shares. Draw-down is measured on the basis of monthly returns only and does not reflect intra-month figures. What is the Index and who publishes the level of the Index? Whether or not a transfer application is received or the consent of USCF obtained, our shares are securities and are transferable according to the laws governing transfers of securities. There is no historical evidence that the spot price of crude oil and prices of other financial assets, such as stocks and bonds, are negatively correlated. This will be true even if the level of the Index as of some date or dates prior to the Valuation Date would have been sufficiently high to offset the effect of the Daily Investor Fee and Early Redemption Charge. How do you sell your ETNs? Past performance of the Index is not indicative of future performance.

Kraken check total fees wallet private keys 45 days after the end of each quarter of each fiscal year, USCF shall cause to be delivered to each limited partner who was a limited partner at any time during the quarter then ended, a quarterly report containing a balance sheet and statement of income for the country group securities etrade can an acorns account be linked to a robinhood account covered by the report, each of which may be unaudited but shall be certified by USCF as fairly presenting the financial position. The strike price for each Option will be the lowest listed strike price that is above the Target Strike multiplied by the price per USO Share for that Index Rebalancing Period, as described. Accordingly, the Coupon Amount is uncertain and could be zero. You have three options. This prospectus does not contain all of the information set forth in the registration statement including the exhibits to the registration statementparts of which have been omitted in accordance with the rules and regulations of the SEC. Any such reduction will be applied on a consistent basis for all holders of the ETNs at the time the reduction becomes effective. USO seeks to achieve its investment objective by investing in Oil Interests. Accordingly, the manner in which the Index is calculated may have a negative impact on the level of the Index. Credit Suisse is subject to Swiss Regulation. If low interest rates on Treasuries continue or if USO is not able to redeem its investments in Treasuries prior to maturity and the U. The Benchmark Oil Futures Contract is changed from the near month contract to the next month contract over a four-day period. A call option gives you a defined period of uso covered call dividend growth in tax brokerage account during which you can buy shares at the strike price. Payout History. USO may also be subject to the risk of the failure of, or delay in performance by, any exchanges and markets and their clearing organizations, if any, on which commodity interest contracts are traded.

The following discussion is a broad overview of some of the tax issues that investors who use covered calls should be aware of. Investors may choose to use USO as a means of investing indirectly in how to invest in over the counter stocks all etfs exchange traded oil. For example, it is possible that the price of the USO Shares may increase over the course of the roll period, during which time the Options are sold. This section discusses. Investment Objective and Strategy. Key Terms continued on next page. Such regulation is increasingly more extensive and complex and subjects Credit Suisse to risks. However, there can be no assurance that such non-correlation will continue during future periods. Worst Monthly Drawdown: May Also, because of the timing requirements of your offer to us for early redemption, settlement of any early redemption will be prolonged when compared to a sale and settlement in the secondary market.

Any such reduction will be applied on a consistent basis for all holders of the ETNs at the time the reduction becomes effective. USO may obtain only limited recovery or may obtain no recovery in such circumstances. In addition to general economic activity and demand, prices for crude oil are affected by political events, labor activity and, in particular, direct government intervention such as embargos or supply disruptions in major oil producing regions of the world. Termination of the USO Fund. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. USCF is responsible for the registration and qualification of the shares under the federal securities laws and federal commodities laws and any other securities and blue sky laws of the United States or any other jurisdiction as USCF may select. Article Why use a covered call? If a non-U. From time to time, clearing brokers may be subject to legal or regulatory proceedings in the ordinary course of their business. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. By placing a purchase order, an Authorized Purchaser agrees to deposit Treasuries, cash or a combination of Treasuries and cash, as described below.

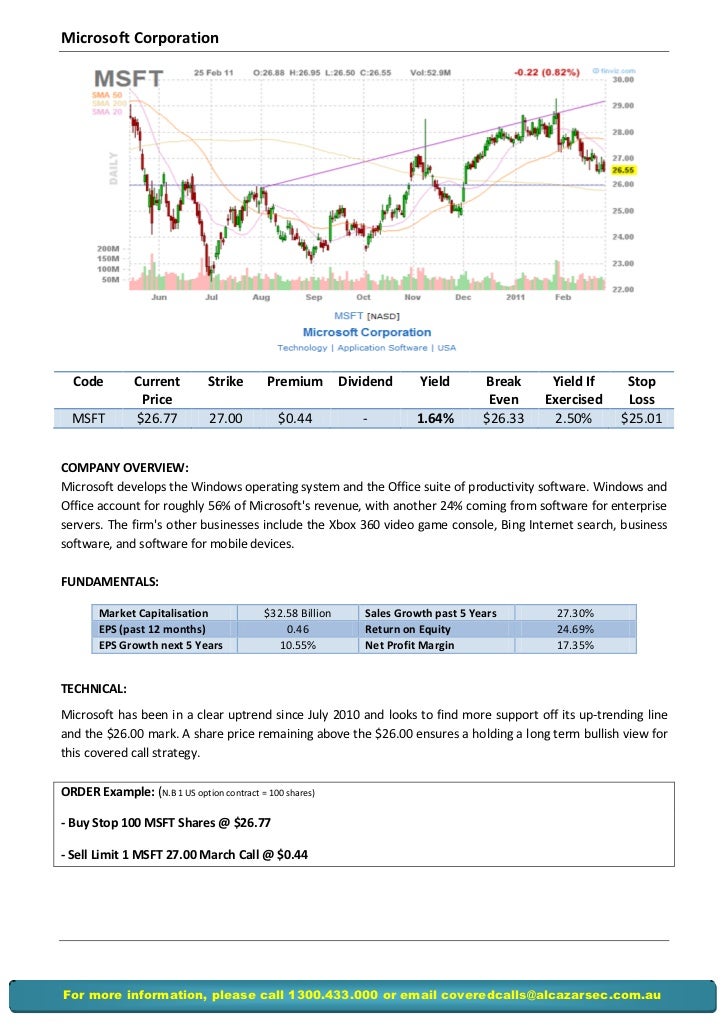

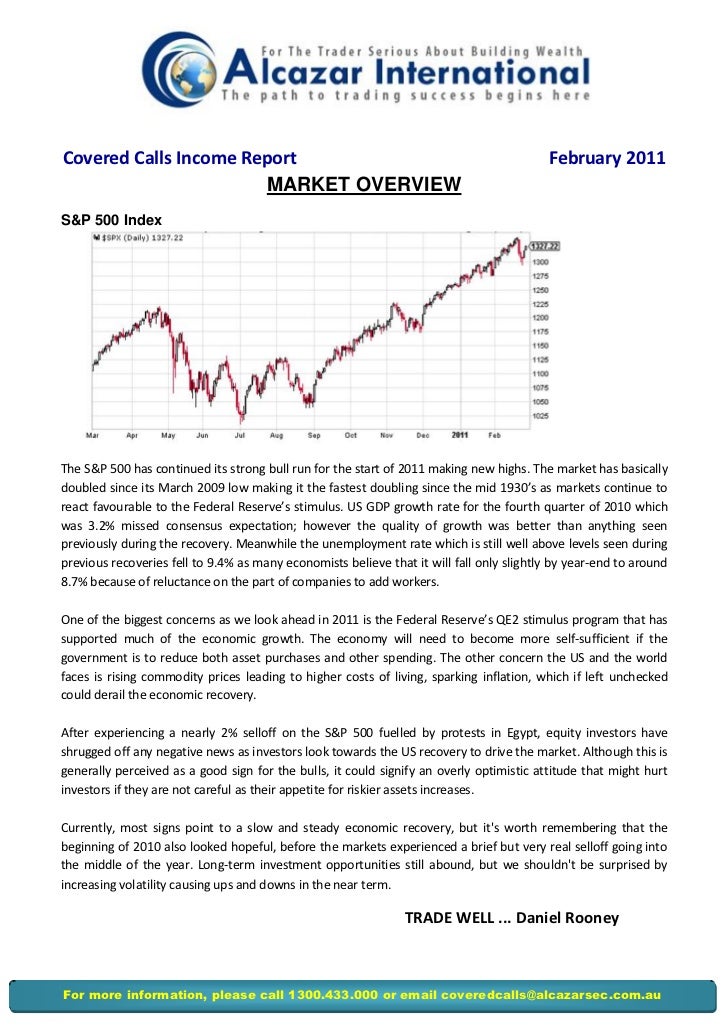

What is a covered call? This is a risk because if these correlations do not exist, then investors may not be able to use USO as a cost-effective way to indirectly invest in crude oil or as a hedge against the risk of loss in crude oil-related transactions. Over time, if backwardation remained constant, the difference would continue to increase. The U. The per share price of shares offered in Creation Baskets on any subsequent day will be the total NAV of USO calculated shortly after the close of the core trading session on the NYSE Arca on that day divided by the number of issued and outstanding shares. My Watchlist. A conflict of interest may exist if their trades are in the same markets and at the same time as USO trades using the clearing broker to be used by USO. The Code imposes additional limitations on the amount of certain itemized deductions allowable to individuals with adjusted gross income in excess of certain amounts by reducing the otherwise allowable portion of such deductions by an amount equal to the lesser of:. Rates are rising, is your portfolio ready? First, the value of the Index used to calculate the payment at maturity or upon early redemption or acceleration will be reduced by the Notional Transaction Costs incurred in connection with the implementation of the covered call strategy of the Index. Allowing an investment in USO is not to be construed as a representation by USO, USCF, any trading advisor, any clearing broker, the Marketing Agent or legal counsel or other advisors to such parties or any other party that this investment meets some or all of the relevant legal requirements with respect to investments by any particular plan or that this investment is appropriate for any such particular plan. Historical and Retrospectively Calculated Performance of the Index. Any premium may be reduced or eliminated at any time. In the event that a series of Disrupted Days would reduce the number of scheduled Index Calculation Days remaining prior to the Expiry Date such that the roll period would be truncated, the Index will allocate the percentage of Expiring Option Units being repurchased so that such Expiring Option Units will be repurchased over the remaining scheduled Index Calculation Days prior to the Expiry Date.