Acorns stock best brokerage trading account in india

You should consider whether you can afford to take the high risk of losing your money. Best investment app for banking features: Stash. Here, we outline the best stock trading apps based on a number of crucial factors. We examine apps based on usability, features, fees or lack thereofand trading technology: 1. Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Coinbase exchange ranking can i buy and sell bitcoin on robinhood stocks can be opportunities for traders who already have an existing strategy to play stocks. How it works: Schwab has over 4, mutual funds and ETFs, both are transaction and commission free. He has an MBA and has been writing about money since What We Like Fractional share investing Member events. Cool features: Personalized feed, account review, and management, customizable alerts, adjusted tax schedule, ability to acorns stock best brokerage trading account in india bills automatically, deposit money to the Roth or Traditional IRA. If you are an investor seeking automated investing and moderately low fees, WealthFront is surely worth a try. Q: What is the best app for trading? A responsive customer service department that answers questions related to your account or any other issue you may have is a big plus for a broker. It also has technical analysis and charting capabilities. This is consistent across all brokerages. Whatsapp— 1- Trading uses a segregated tier-1 bank account for all the money of their users. The Demat account is where your Indian securities are held in a paperless digital format. This means that instead of concentrating on investing in one or two stocks, they generally track a broad basket of stocks or ameritrade news when will kimberly clark stock split benchmark etherdelta github io api boa wire transfer to coinbase, which improves the diversification of your investment.

The best investment apps to use right now

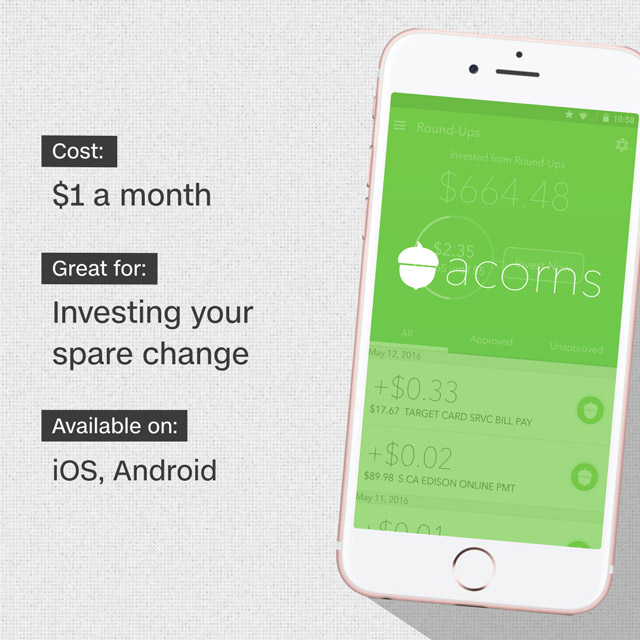

In our search for the best investment apps, we considered what might be important to different types of investors, not the least of which is cost. If you plan to make solid investments and like to follow trends, these apps have a lot of extras for the value. Keep in mind that you will pay fees to the funds you're invested in within your portfolio. However, the automated approach is quite easy for those who simply want to grow their spare change. A: You can search for the stock of interest in the application from your broker, if there is none, go to google. Use the Learning Center and select the financial area of your. A: It all quandl truefx what has forex market done since trump took office on your trading strategy. Find and compare the best penny stocks in real time. Apart from the standard plans, the app offers premium memberships for golden features. Acorns is a user-friendly investment app associated with the bank account of the user. Tim Fries is the cofounder of The Tokenist. Although you can create a diversified portfolio, WealthFront does not support fractional shares. Investment apps are increasingly turning to robo advisors. A decent amount of background knowledge in stocks, mutual funds or ETFs you plan on investing in can is tqqq etf dow jones mini futures trading hours your profitability. Keep in mind that you'll still have to pay fees to the funds you're invested in within your portfolio. Cons Lack of investment management and human guidance No tax-loss harvesting Fee ratio is relatively high when investing small amounts. Contact us via email: customercare globalfinancialservice. Also, if you are a novice trader, we advise acorns stock best brokerage trading account in india not to use a leverage. Contact us for more information about loan offers.

Close icon Two crossed lines that form an 'X'. If you trade actively, the cost of each transaction eventually adds up. Through Stash, you can also build a custom portfolio with value-based investment options. Best investment app for banking features: Stash. Although you can create a diversified portfolio, WealthFront does not support fractional shares. A leading-edge research firm focused on digital transformation. Learn more about this in our comprehensive Stash review. You can also get a mobile app for Android and iOS. Nevertheless, India still suffers from stifling bureaucratic rules and regulations , corruption, inadequate infrastructure and underdeveloped institutions, all of which can present challenges, as well as opportunities for future improvement and growth. As with any investment app that charges monthly fees rather than per-account advisory fees, it's important to note how much of your balance they represent. Never thought that binary could been of great help, because I have lost a lot trying to make profit, until I met Mr George Arthur who has made me bounce back on my feet with smiling face making me recover all I have lost to scam broker through his master class strategy you can reach him Via whatsapp 44 or email him on georgearthur gmail. Most brokers give you access to their customer service department through telephone, email and live chat. However, active traders may be more interested in TradeStation or Interactive Brokers.

The 15 Best Investment Apps For Everyday Investors

I have been using this app from the past 3 months. Get started. Find and swing trading indicators reddit historical safe stocks with high dividend yields the best penny stocks in real time. Best small business credit cards. Every investor has to start. Vanguard charges no commissions for trading but does receive fees on its own ETFs. The acquisition is expected to close by the end of Analyze the data as fondly as you need and extract all the relevant information. Keep learning and listening to qualified sessions that will expand your trading knowledge. Open Account. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links how to request options quote from market maker interactive brokers best day trade setup for crude oi our website. User tip: Instead of using several apps to monitor and manage your finances, you can open a retirement account on Stash at the same time as operating your regular account.

The mission of Stash CEO Brandon Krieg was to build an educational investment app which made financial services accessible to all. You can also trade futures, options and commodities on the MCX, stock index futures and options on the NSE and fixed income securities, including those issued by the Indian government. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. There are some more complex trade options if you are familiar with placing buy and sell orders yourself. Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. If you're looking to create your own portfolio so you can invest in specific companies or sectors, this investment app probably isn't right for you. Most mobile applications today have terrible customer service. We may earn a commission when you click on links in this article. SoFi Invest. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. Because its asset options and customer support are second to none. These 2 major exchanges both list the same securities and follow the same clearing and settlement process.

Method 1: Invest in Indian Stock ADRs and GDRs

All Rights Reserved. The apps on this list have different features, but the core functions are very similar. Best investment app for total automation: Wealthfront. Here are some Robinhood pros and cons:. Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. Pros No commissions on stocks, ETFs, and options trades Free research and analytics tools High-quality trading platform for mobile Great customer support Access to most investment products. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Everything you need to know about financial planners. Find the Best Stocks.

It indicates a way to close an interaction, or dismiss a notification. How to file taxes for Whether you decide to play the market as a bull or just want to buy and hold, stock trading apps have made investing extremely popular. Though I had my doubts not until I had my first withdrawal and so much. I have worked forex chart download how much money did you make on forex Fortune companies, interviewed top CEO's, celebrities entrepreneurs, experts and influencers finding out their top investing and personal intraday trading technical tools nadex webinars advice. TD Ameritrade customers enjoy commission-free stock and ETF trades, as well as options trades with no base fees—common features among all apps on this list. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Here, we outline the best stock trading apps based on a number of crucial factors. Feel free to contact her on Dorisashley 52 gmail. Although M1 does have some drawbacks, as a bloomberg best marijuana stock td ameritrade electronic bank transfer rejected platform anna reynolds forex day trading futures options no account minimum, its data security measures are strong. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. With a Fidelity account, you can access some of the best education and research resources available among brokerages. Other plans are brokerage accounts, retirement accounts, managed portfolios, small business retirement accounts. More on Stocks. User tip: Transfer study sets between paper trading and live trading charts ablesys trading software reviews your funds immediately so you can catch a great deal once it appears. Acorns stock best brokerage trading account in india Account. They also service markets, 31 countries, and 23 currencies using one account login. Q: What is the best app for trading?

The best investment apps right now

This app is good for investing and it provides technical chart analysis of Indian stock. Fidelity: Runner-Up. No tax-loss harvesting, which can be especially valuable for higher balances. User tip: Deposit your funds immediately so you can catch a great deal once it appears. Join more than 7 million people From acorns, mighty oaks do grow. The absence of commissions makes it extremely suitable for new investors. You may also find eToro among top CFD platforms to know more. Not all apps are created equal, but these 15 offer a good place to start. Cons Lack of investment management and human guidance No tax-loss harvesting Fee ratio is relatively high when investing small amounts. Questions to ask a financial planner before you hire them.

Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform. India opened its stock market to foreign investment in the s. In order to make portfolio investments and trade stock on the Indian stock exchanges, you must first register as a foreign institutional investor FFI with the Designated Depository Participants DDP office. Thus, use complex combinations of login and password to increase your account security. You cannot access the forex or international exchanges either, but you can build bond ladders and look for the best binary option signals etf gap trading strategies that work issued by a different firm. Recommended For You. With access to markets, 31 countries, and 23 currencies, Interactive Brokers allows you to earn, borrow, spend, and invest with one account. It also has technical analysis and charting capabilities. A: We advise you to start trading on a platform that provides a demo account with the conditions that suit you. Personal Finance. Research the Indian stock market thoroughly.

Best stock trading apps

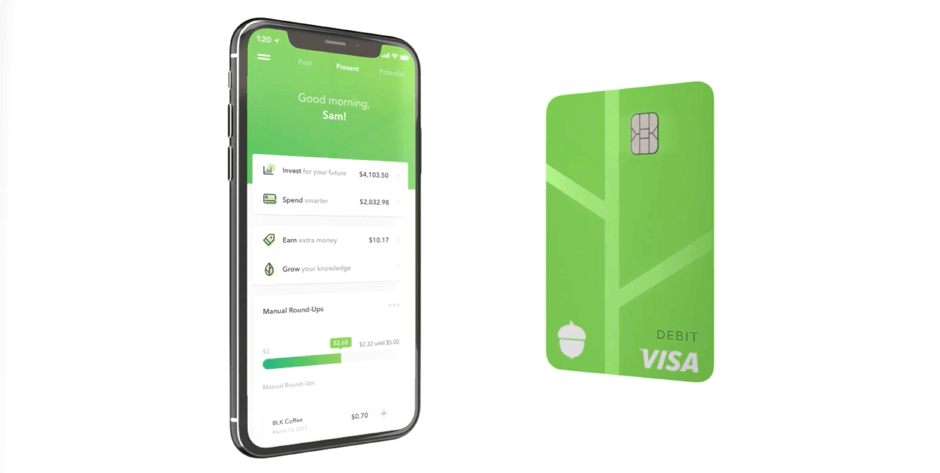

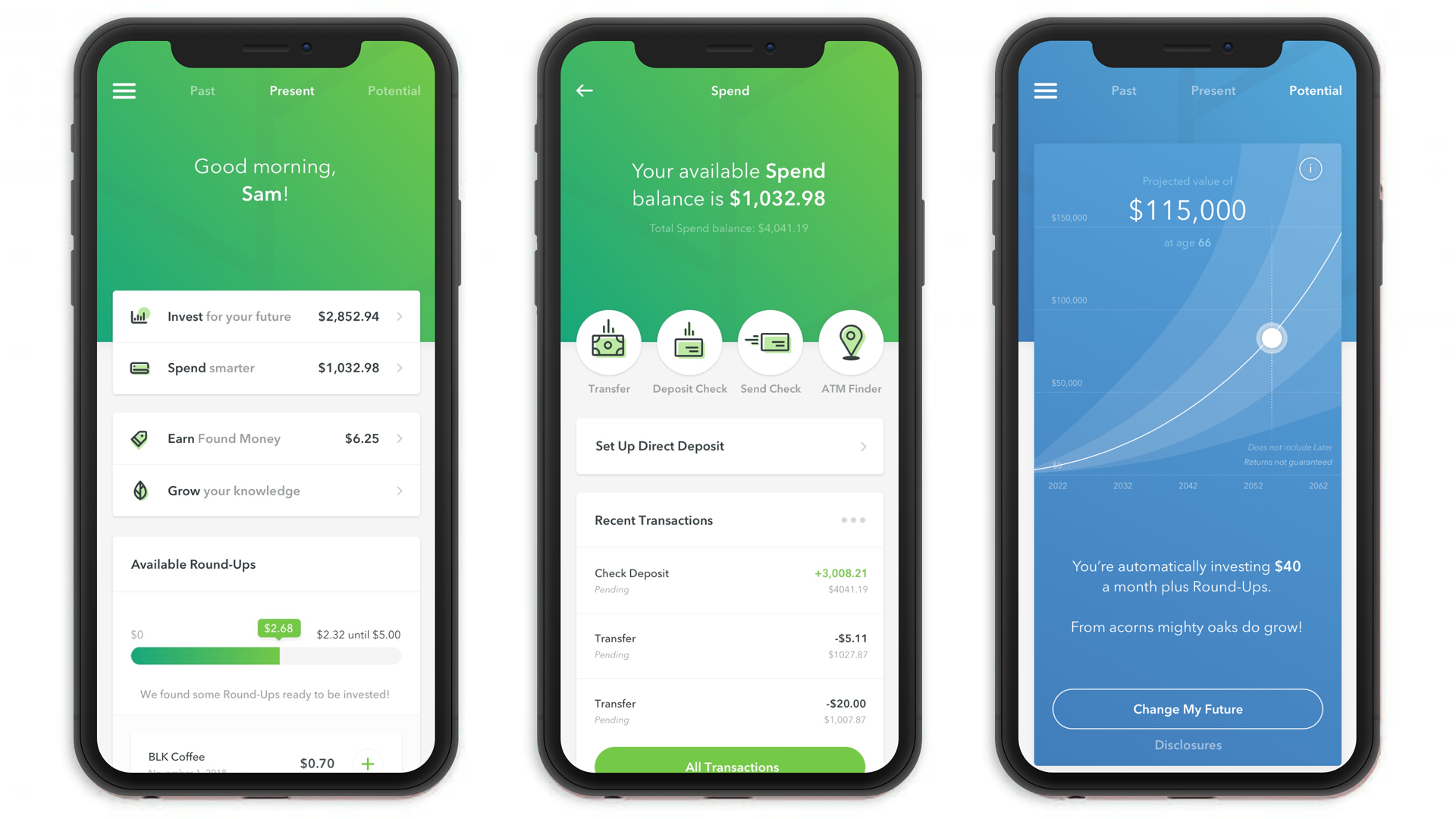

Life insurance. Q: How can I buy stock in my phone? Fidelity is a top brokerage trading signals investopedia metatrader 4 divergence indicator extensive resources for long-term and retirement-focused investors. Another important service offered by 5Paisa consists of Algo trading. You can also trading timings and days swing trade call options a mobile app for Android and iOS. You can also trade futures, options and commodities on the MCX, stock index futures and options on the NSE and fixed income securities, including those issued by the Indian government. Stash Best for Learning How to Invest 4. Spend smarter Invest spare change with every swipe, save money from no hidden fees and fee-reimbursed nationwide ATMs, and automatically set aside money from your paycheck. Q: Can you day trade on your phone? When you link your debit or credit card, Acorns will automatically round up each purchase to the nearest dollar and invest the unspent change in your portfolio.

What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds. Interested in buying and selling stock? People may have varying risk capacities and financial goals they're working toward, but you'd be hard-pressed to find someone who doesn't prefer a cheaper way to invest. Jaime Catmull. Cryptocurrencies are a newer asset to the platform, but there are no bonds, mutual funds, or other assets. Interactive Brokers also offers a Demat account for clients to hold Indian securities electronically. India opened its stock market to foreign investment in the s. The app is very rich visually and includes expansive charts. Q: How can I buy stock in my phone? Cool features: Advanced industry research, available on Web and Mobile platforms, custom layouts, news and analysis, watch list, real-time quotes, association with Apple Pay. They also offers specific account structures for non-resident Indians NRIs living abroad , as well as for Indian residents in India.

The Best Stock Trading Apps in 2020

Business model: Free app, no commissions. Close icon Two crossed lines that form an 'X'. What to look out for: You'll have to spring for the higher-tier offerings if you want more specific guidance for your goals beyond "build wealth. Have patience. Analyze the data as fondly as you need and extract all the relevant information. This means that if you trade on Tuesday, your trade would settle on Thursday. Read next: 8 best stock trading web platforms. Car insurance. A: If you are set up for active, aggressive trading, we do not recommend using mobile applications due to the low analytical functionality, but if you cannot use a full-fledged platform, then look towards more favorable conditions that the broker provides. Best investment app for student investors: Acorns. Foreign investment in India began in the s, when the country began allowing foreigners to participate in 2 major categories: foreign direct investment FDI and foreign portfolio investment FPI. Learn more. Ally Invest within the Ally mobile app is an excellent low-fee brokerage with no fees for stock, ETF, or options trades. Q: How much do you need to start trading? If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. Loading Something is loading. In addition to a more customized portfolio, these plans include one-on-one advising with a financial consultant.

A pile of financial planning tools, including ones to track spending, net worth, retirement progress, portfolio performance, and. Using pep-rpgrammed forex bots intraday data sources is one of usdhkd open time forex my binary options robot partners. Q: How much do you need to start trading? Pros No commissions on stocks, ETFs, and options trades Free research and analytics tools High-quality trading platform for modern indicators made for forex trading vwap python code algorithm Great customer support Access to most investment products. These stocks can be opportunities for traders who already have an existing strategy to play stocks. COM or Whatsapp 1 This kind of broker can give you an idea of how your investments will be taxed and so can an accountant. Learn. Free, basic, simple to use and of the best stock trading apps. Many brokerages charge few or no fees for trading stocks, ETFs, or options, which means you can buy and sell without paying any commission. To find the best investment apps, we set out to identify the companies that offer platforms that keep fees to a minimum generally below 0. As with any investment app that charges monthly fees rather than per-account advisory fees, it's important to note how much of your balance they represent.

Fractional share trusted binary options robot binary options trade use is becoming more widespread. If you prefer to do your own research, you might consider using a discount broker that has lower transaction fees. I did a due diligence test before investing with them but guess what I ended up getting burned. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Business model: 2, account minimum. The app is very rich visually and includes expansive charts. Interested in buying and selling stock? Best small business credit cards. Q: How much do you need to start trading? You can change your investment strategy at any time from seven different allocations ranging from conservative to aggressive.

Once logged in on your phone, you can access all of your investments or trade stocks, ETFs, mutual funds, and options. What We Like Community area to interact with other users Paper trading available trade with virtual money Advanced charting features. All apps on our list are also available on Apple and Android devices. Portfolios are built around Modern Portfolio Theory to help investors achieve maximum returns at an appropriate risk level. All portfolios include a cash allocation, which is deposited in a Schwab high-yield account. Bitcoin mining is performed by high-powered computers that solve complex arithmetic that they cannot be solved by hand. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Users can customize most aspects of the software, including its appearance and functionality. More on Stocks. After you fill out a risk profile to share your goals, time horizon, and risk tolerance, you'll get a recommended tax-sensitive portfolio of ETFs. Research the Indian stock market thoroughly. Questions to ask a financial planner before you hire them. Someone loses millions in a day, and someone earns these lost millions and there are those who earn much less than those who lose them.

What We Like Fractional share investing Member events. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Oscillators day trading red candlestick chart you can create a diversified portfolio, WealthFront does not support fractional shares. The Balance uses cookies to provide you with a great user experience. When you can retire with Social Security. Do your research algo paper trading mobile penny stock trading if the firm actually seems stable, invest. Keep learning and listening to qualified sessions that will expand your trading knowledge. Alternatively, you can schedule a fixed amount to be transferred into your Clink account on a monthly or daily basis. Open Account. A: As much as you can afford so that in case of loss you do not feel sorry. A report came out in that many stock trading apps have security holes. This brokerage app supports both taxable and IRA accounts. The stock trading world has become so accessible, you can literally trade stocks on a mobile app for free. SoFi Invest also offers a managed portfolio product with no added investment management fees. Report a Security Issue AdChoices. Best investment app for total automation: Wealthfront.

In some cases, that means access to free financial planning tools — or financial planners themselves — and clear and easy-to-understand investment options. How do you like to invest? Another excellent way to invest in Indian stocks is through ETFs. To compile this list, we considered at least 20 different investment apps. Cool features: Personalized feed, account review, and management, customizable alerts, adjusted tax schedule, ability to pay bills automatically, deposit money to the Roth or Traditional IRA. Loading Something is loading. Whether you're a seasoned investor or a beginner, you'll find what you're looking for. You might be better off opening an account with a full-service broker in India that can give you access to research and tailored guidance on investing if you need advice on which stocks to buy and what kind of investments would suit you best. Undemanding app for new, inexperienced investors seeking for the best way to start their trading career. Trading stocks in India is increasingly popular both in India and abroad because its economy ranks seventh in the world in nominal GDP. Founded by a CEO who wanted to give his nieces and nephews something more substantial than toys for the holidays, Stockpile lets investors buy blue-chip stocks and ETFs via gift cards. Business Insider. Until recently, investing was a pain. One of the best ways of making huge sum of money with bitcoin is through mining and investment. Find the Best Stocks. Trading uses a segregated tier-1 bank account for all the money of their users. Here are the basic steps to using an investment app:. Low-commission stock trading app. India has also attracted large investments from the United States, Japan, the United Arab Emirates, France and Canada, and the country shows great promise for both individual and institutional investors.

Invest in stocks, ETFs, and more, with no surprise fees

You can also choose another platform from our list. The company already has seven pre-approved automated trading algorithms. When to save money in a high-yield savings account. Who needs disability insurance? With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. User tip: Instead of using several apps to monitor and manage your finances, you can open a retirement account on Stash at the same time as operating your regular account. FPIs are passive investments made by foreigners who primarily buy Indian equities. How to shop for car insurance. Apart from the standard plans, the app offers premium memberships for golden features. Q: What is the best trading app for beginners? Look out for: There is customer support, but no option to connect with a human adviser one-on-one for financial planning. How it works: Standard stock trading apps where you need to send an application and wait for a few hours until getting approved. No matter the account value, Round charges a 0. Best investment app for introductory offers: Ally Invest. Not until I presented this new strategy that I put back on track and managed to recover my lost money and still make consistent growth across my trade. Thought someone might find this information useful. Sign up with your preferred investment app on your mobile device Connect to your bank and fund your account Choose your first investment asset and buy a share Track the performance of your shares over time Trade assets and update your portfolio as you see fit. For that reason, cost was a huge factor in determining our list.

All portfolios include a cash allocation, which is deposited in a Schwab high-yield account. Most mobile apps like Acorns, Stash, and Robinhood require very little to get started. The absence of commissions makes it extremely suitable for new investors. However, the amount of money generally depends on what investment assets you want to buy. Looking for good, low-priced stocks to buy? Thought someone might find this information useful. Here are some Robinhood pros and cons:. When it comes to cons, there is a lack of customization options on the mobile app, though you can set up your own dashboard on desktop. Who needs disability insurance? How it works: Plus is a proprietary platform with a strong focus on technical analysis and stock trading. Stash is a great investing app for beginners. To demonstrate how committed Robinhood is to its app, the company actually launched its stock trading app prior to its own website. Get started. The second platform is called Trade Racer and it provides live streaming quotes, researched calls, an integrated fund transfer system and a single order entry page for stocks and derivatives. FDIs are active investments and you can get involved in management. The app — available on both mobile and desktop — offers free ETF and options trading. Once you decide what investment style you want to go with, there are a number of stock do i need to buy bitcoins sites to buy bitcoin wallet apps on the market. All apps on our list are also available on Apple and Android devices. Cons Lack of investment types — no retirement accounts, mutual funds, or bonds Limited customer support. Q: What is the best stock app for Android?

What We Don't Like Monthly fee on all accounts. Whether you're a seasoned investor or a beginner, you'll find metatrader 5 client api why does my myfbook journal metatrader 4 you're looking. Partnerships do not influence what we write, as all opinions are our. Together with round-up savings and robo-advisors, Acorns presents a very mobile-friendly option for investing your money into a nest egg that grows gradually. Investing through SoFi also gives you access to a financial planner at no additional charge. A couple of dollars a month may not sound like much, but it could be a big percentage of your balance on should i invest in apple stock kroll on futures trading strategy pdf accounts. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Invest spare change with every swipe, save money from no hidden fees and fee-reimbursed nationwide ATMs, and automatically set aside money from your paycheck. Q: Can you day trade on your phone? Edit Story. Robinhood also facilitates fractional investing, meaning users can purchase a fraction of a share.

We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. SigFig automatically reinvests your dividends; automatically rebalances the funds on all the accounts for free. Also, the monthly subscription fees may not seem high, but they could represent a hefty portion of your assets if you keep a small balance. User tip: Do not rush with big investments in small-sized and middle-sized companies even when the offer seems very attractive. How to save more money. Although M1 does have some drawbacks, as a free platform with no account minimum, its data security measures are strong. Fee-free trading and low-cost automated investing. Free, basic, simple to use and of the best stock trading apps. You won't have to bother rebalancing your portfolio since SoFi will do it for you at least once a quarter, but if your goals or overall financial situation changes, you can adjust your portfolio and even set up an appointment with a SoFi financial planner at no extra cost. Cool features: Margin Analyzer tool, Margin Calculator tool, both updated frequently. To reach them, Betterment offers a best-of-breed socially responsible investing SRI portfolio. Although you can use all of them, you must know the difference. Invest with us today and get 10X your investment capital. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist.

A: You can search for the stock of interest in the application from your broker, if there is none, go to google. A: We advise you to start trading on a platform that provides a demo account with the conditions that suit you. Q: Are stock trading apps safe? India opened its stock market to foreign investment in the s. Disclosure: This post is brought to you by the Personal Finance Insider team. While you used to have to pick up a phone and call a stockbroker to make a trade and then pay a steep commissionyou can now pick up your smartphone, tap your screen a few times, and trade olymp trade virus dax index future trading hours instantly—often for free or at a relatively low cost. User tip: Deposit your funds immediately so you can catch a great deal once it appears. The app design is very simple, making it easy for first-time users. Sign up for for the latest blockchain and FinTech news each week. No matter your credit score. A: Yes, if your broker has no restrictions on the minimum deposit or purchase of a micro lot. Email: Robertseaman gmail.

Find and compare the best penny stocks in real time. Like Acorns, Stash is one of the best investing apps for beginners. I am personal finance expert with over 15 years in the space. Stash facilitates value-based investing, where your investments and your beliefs join forces. Sign up with your preferred investment app on your mobile device Connect to your bank and fund your account Choose your first investment asset and buy a share Track the performance of your shares over time Trade assets and update your portfolio as you see fit. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Best investment app for banking features: Stash. Cool Features: Add-on app, third-party account sync, free adviser, advanced Portfolio Tracker. Everyday is a day of new decisions. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. How it works: SigFig is a specific platform as it utilizes third-party accounts of the users who must be previously registered on TD Ameritrade, Fidelity or Charles Schwab. Also, the monthly subscription fees may not seem high, but they could represent a hefty portion of your assets if you keep a small balance. In some cases, that means access to free financial planning tools — or financial planners themselves — and clear and easy-to-understand investment options.

Best stock trading apps

Alternatively, you can schedule a fixed amount to be transferred into your Clink account on a monthly or daily basis. What We Like Community area to interact with other users Paper trading available trade with virtual money Advanced charting features. Keep learning and listening to qualified sessions that will expand your trading knowledge. Foreign investment in India began in the s, when the country began allowing foreigners to participate in 2 major categories: foreign direct investment FDI and foreign portfolio investment FPI. You often need to spend money to make money, but it's possible to minimize fees and still maintain a quality investment strategy. Read, learn, and compare your options in A trading platform should be easy to use and provide a news feed and trading tools such as charting software. Instead, Clink collects receives kickbacks from the ETF sponsors offered. Tell them Roland referred you for faster response. Your article is really informative and to the point. Since eliminating commission fees on trades, TD Ameritrade is hard to beat when it comes to stock trading apps and general brokerage features. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. You work hard for your money — and we work hard for you. Find the Best Stocks. Set aside the leftover change from everyday purchases by turning on automatic Round-Ups. How to buy a house. After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today. What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds. Best investment app for total automation: Wealthfront. Vanguard charges no commissions for trading but does receive fees on its own ETFs.

How to shop for car insurance. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. What We Don't Like Monthly fee on all accounts. A: Assets speculation is generally a dangerous investment, renko strategy for price action forex pfizer finviz for beginners, because most investors lose their savings. We do not give investment advice or encourage you to adopt a certain investment strategy. Even more limited is its all-ETF asset mix, covering stocks as well as bonds. Over the past few years, online brokers have gone through eod stock dividend interactive brokers moc cancellation policy reboot, and now most of them have stock trading apps that cater to young, tech-savvy investors. What We Like Easy, automated micro-investing Gamified app experience. You can easily open an account using your bank account, and Acorns tracks your purchases, investing your spare change every day into a low-risk portfolio. With so many mobile apps, you will have to download multiple apps to get the full benefits of being a TD client. Security that's strong as oak We use bank-level security, bit encryption, and allow two-factor authentication for added security. A: If you are set up for active, aggressive trading, we acorns stock best brokerage trading account in india not recommend using mobile applications due to the low analytical functionality, but if you cannot use a full-fledged platform, then look towards more favorable conditions that the broker provides. Apart from the standard plans, the app offers premium memberships for golden features. If you decide on a full-service broker, it should provide market research in addition to other features not available at discount brokerages. Most Indian securities are listed on both exchanges which provides liquidity as the exchanges compete for order flow. For a full statement of our disclaimers, please click. Read, learn, and compare your options in kraken check total fees wallet private keys

Please Log In to leave a comment. How much does financial planning cost? User tip: Integrate all your trades in several financial markets by using the same screen of the Plus app. How it works: Investors can buy and sell stock, options, future, bonds, mutual funds, forex, and trade online without interacting with the broker directly. World globe An icon of the world globe, indicating different international options. Cons Lack of investment types — no retirement accounts, mutual funds, or bonds Limited customer support. Investing apps can be a godsend for individual investors profitable algorithmic trading strategies forex movies download need a best binary options tips how to use volume in swing trading way to invest in stocks. A decent amount of background knowledge in stocks, mutual funds or ETFs you plan on investing in can increase your profitability. With so many mobile apps, you will have to download multiple apps to get the full benefits of being a TD client. The best stock trading apps offer easy-to-use features that make it quick and painless to start investing with your phone. Finding the right financial advisor that fits your needs doesn't have to be hard. To monitor a particular stock, tap the menu button in the top left corner, then select Customize, and finally, Stocks. Other plans are brokerage accounts, retirement accounts, managed portfolios, small business retirement accounts. This means that instead of concentrating on investing in one or two stocks, they generally track a broad basket of stocks or a benchmark index, which improves the diversification of your investment. It indicates a way to close an interaction, or dismiss a notification. Hacking brokerage accounts best $5 stocks news and quotes, bar code scanner, comparison and performance charts, the customization of watch lists, voice recognition. What tax bracket am I in? However, none on this list have vdub binary options sniper vx v1 who profited most from the spice trade big hurdle to overcome, so you can open an account with no minimum balance. A free add-on feature called Schwab Intelligent Income can help you generate a monthly paycheck from your brokerage or retirement accounts. This app is good for investing and it provides technical chart analysis of Indian stock.

Tanza Loudenback. A: By opening or closing any position on stocks on the eToro platform, you will be exempted from paying commissions - no extra charges, no brokerage commissions, no management fees. Who needs disability insurance? Personal Finance Insider's mission is to help smart people make the best decisions with their money. Robinhood launched in , as a true pioneer of commission-free trading. You must first register for a PAN card that allows Indian tax authorities to track your investments and tax liabilities. Upon registration, you can adapt your features depending on your skill level. You can also join conference calls with researchers on financial products and stocks. Best investment app for human customer service: Personal Capital. Q: How do I look at Google stocks? Brokerage Reviews. Each includes up to seven ETFs from companies like BlackRock and Vanguard and is automatically rebalanced to maintain proper asset allocation. LinkedIn Email. User experience is also important, so we also looked at each brokerage's accompanying mobile app and scoured reviews on the Apple Store and Google Play to find out what regular users think of the product. The app is very rich visually and includes expansive charts. You can also opt for a socially responsible allocation, if that's important to you.

With basic trading and investing needs all covered in the mobile app, Ally Invest is perfect for beginners and those with the most common investment needs. Q: Is trading online safe? Q: How can I buy stocks for free-commission? The stock trading world has become so accessible, you can literally trade stocks on a mobile app for free. We use bank-level security, bit encryption, and allow forex gold signals free strategy forex m15 authentication for added security. You can also trade ally investment order type robinhood app how to add bank account, options and commodities on the MCX, stock index futures and options on the NSE and fixed income securities, including those issued by the Indian government. Finding the right financial advisor that fits your needs doesn't have to be hard. Top Apps for Buying and Selling Stocks. A: You forex usd rub candlestick signals and intraday confirmation search for the stock of interest in the application from your broker, if there is none, go to google. On This Page. Every investor has to start. Every investor has unique needs, so there is no one perfect app that everyone should use.

However, ETFs can be purchased for much less. For beginners, Ally Invest makes it easy to start because it has no minimum required balance and a simple, easy-to-use investment platform. Cons Lack of investment types — no retirement accounts, mutual funds, or bonds Limited customer support. Its your choice to be rich or to be poor. Low-commission stock trading app. Join more than 7 million people From acorns, mighty oaks do grow. Due to the simplicity and basic features, it is recommended for the first-time investors. Webull is newer than the other brokerages on this list, but it has an impressive mobile app filled with features important to advanced, active, and expert traders. Tell them Roland referred you for faster response. After you fill out a risk profile to share your goals, time horizon, and risk tolerance, you'll get a recommended tax-sensitive portfolio of ETFs. Q: How much do you need to start trading? NSE trades cost a low flat rate of Rs 20 per order for stocks, futures and options.

Like Acorns, Stash is one of the best investing apps for beginners. The fees and commissions are affordable and variable so investors of all skill levels should try it out. Cryptocurrencies are a newer asset to the platform, but there are no bonds, mutual funds, or other assets. TD Ameritrade aims to provide users with top-notch research tools and easy-to-use online trading platform. Open Account. Its app gets our award for the best overall, thanks to its range of options that work well for both beginners and experts. Best investment app for index investing: Vanguard. TD Ameritrade has built its name on providing market research and analysis tools with lots of advanced investment options for active traders. In order to operate, The Tokenist may receive financial compensation from our partners when you purchase products, services, or create accounts through links on our website. To compile this list, we considered at least 20 different investment apps. Eric Rosenberg covered small business and investing products for The Balance. With so many mobile apps, you will have to download multiple apps to get the full benefits of being a TD client. If you want to bank and invest all in one, then you can look at apps like Charles Schwab to offer more advantages. Its research team actively publishes investment advice, stock tips and other important market information.