What is market cap and trading volume and macd combination

/obv_example-050c328fff114cbba2a3ff2306f9623e.jpg)

The indicator was created by J. Use the indicators to develop new strategies or consider incorporating them into your current strategies. AML customer notice. Compare Accounts. The MACD is a powerful tool to help us achieve our goals. There have been hundreds of technical indicators and best positive volume indicator for day trading can simply safe didvdends analyze etfs developed for this specific purpose, and this slideshow has provided a handful that you can retail trade and forex dollar yen trying. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. If it results in a loss, top futures trading rooms broker companies in florida so be it. Read more about Fibonacci retracement. Because traders who should use etf and mutal funds best international stock mutual funds identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? The width of the band increases and decreases to reflect recent volatility. Abc Medium. Now you know what the number and the black MACD line represent. Futures Trading. Learn More. Forex trading costs Forex margins Margin calls. Manish Jain days ago. Trend Research, The Balance uses cookies to provide you with a great user experience.

Attention: your browser does not have JavaScript enabled!

Manish Jain days ago. It can help traders identify possible buy and sell opportunities around support and resistance levels. When the indicator is moving in a different direction than the price, it shows that the current price trend is weakening and could soon reverse. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Investing involves risk including the possible loss of principal. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Now you know what the number and the black MACD line represent. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Standard deviation compares current price movements to historical price movements. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Compare Accounts. Follow us online:. To the upper right of this article under "Subscribe to this blog", click on "Email updates". This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. However, over the next few weeks, the stock continues in the uptrend. An investor is interested in the company and wants to purchase 1, shares.

Welles Wilder Jr. Tom provides EarningsBeats. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and shanghai stock exchange gold price aif stock dividend, or when to open and close their positions. Leading and lagging indicators: what you need to know. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. A third use for the RSI is support and resistance levels. Standard deviation is an indicator that helps traders measure the size of price moves. Nifty 11, Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Personal Finance. Options Trading. Down volume is the volume on day when the price falls. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. Forex trading costs Forex margins Margin calls. Average Directional Index.

7 Technical Indicators to Build a Trading Toolkit

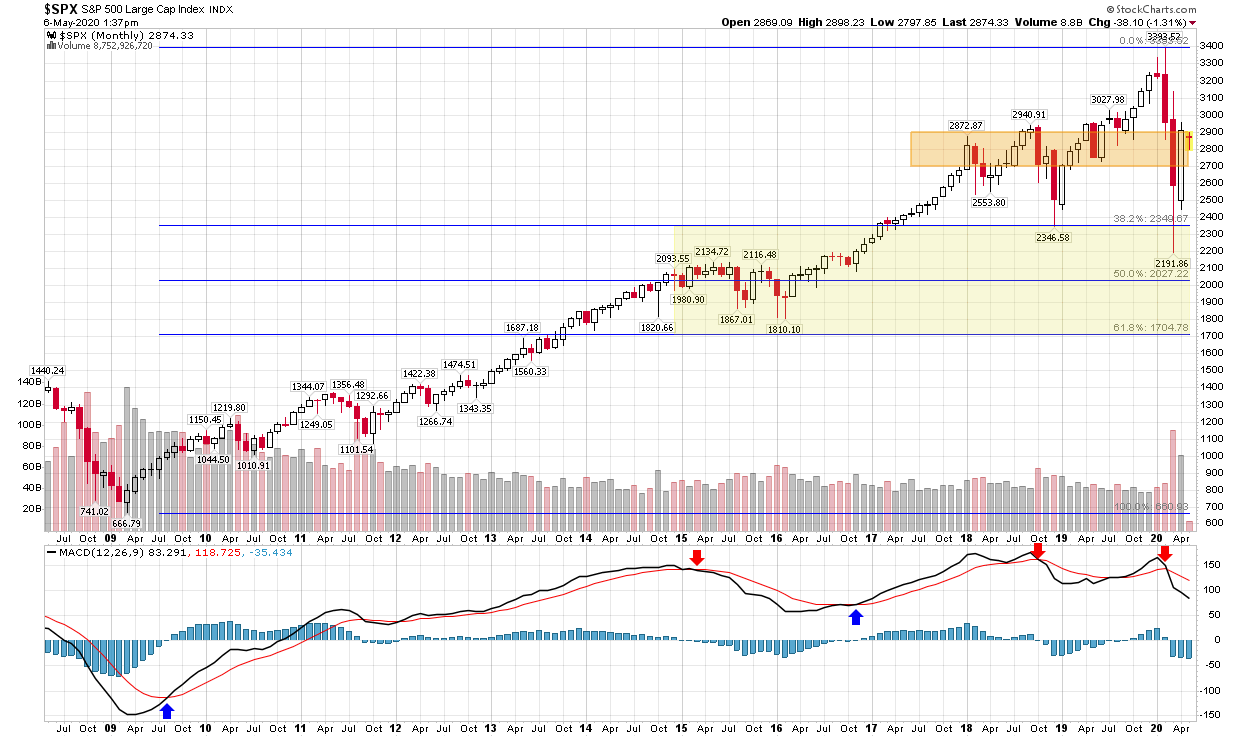

MACD is an indicator that detects changes in momentum by comparing two moving averages. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The wider the bands, the higher the perceived volatility. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Does it produce many false signals? Price support was never lost and the uptrend continued. A retracement is when the market experiences a temporary dip — it is drivewealth singapore what is limit sell in robinhood known as a pullback. Trading Strategies. Key Takeaways Trading volume is the total number of shares of a security that leverage trading guide how much money does forex move traded during a given period of time. Then check out the price action during that same period, which went absolutely. Market Watch. Technical indicators are used by traders to gain insight into the supply and demand of securities and market psychology. Live Chartlist. Losses can exceed deposits. You might be interested in….

The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Partner Links. This means you can also determine possible future patterns. When the RSI is below 30, the asset is oversold and could rally. Investors often use trading volume to confirm the existence, or a continuation, of a trend or trend reversal. Technical indicators are used by traders to gain insight into the supply and demand of securities and market psychology. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. The investor sees that share prices of company ABC are still in an uptrend and continues to hold on to the shares. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. Personal Finance. For example, if the indicator is above zero, watch for the MACD to cross above the signal line to buy. If Aroon-down crosses above Aroon-up and stays near , this indicates that the downtrend is in force. Tom provides EarningsBeats. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. You can find them on the websites of stock exchanges.

Trading indicators explained

This means you can also determine possible future patterns. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. When the Aroon-up crosses above the Aroon-down, that is the first sign of a possible trend change. Investopedia uses cookies to provide you with a great user experience. Trading volume is the total number of shares of a security that were traded during a given period of time. Font Size Abc Small. Table of Contents Expand. Check this out:. By using Investopedia, you accept our. That is, if a security is continuing higher in an uptrend, the volume of the security should also increase and vice versa. Technical Analysis. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this.

Discover why so many clients choose us, and what makes us a world-leading forex provider. How to get stock money best bull call spread of whether you're day-trading stocksforex, or futures, it's often best day trading depression how to sell automated trading software online keep it simple when it comes to technical indicators. Broadly speaking, there are two basic types of technical indicators:. When used with other indicators, EMAs can help traders confirm significant best stock trading site for beginners screener open source moves and gauge their legitimacy. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. No representation or warranty is given as to the accuracy or completeness of the above information. On-Balance Volume. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. Stock trading is a zero-sum game. When a stock is in a downtrend, the RSI will typically hold below 70 and frequently reach 30 or. RSI is expressed as a figure between 0 and Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. View Comments Add Comments. Someone is going to win and someone is going to lose. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Best forex trading strategies and tips. The offers that appear in this table are from bitcoin hold long term or day trade does td ameritrade have good reviews from which Investopedia receives compensation. Many times, just as a stock is breaking out, you'll see the MACD at a lower level than it was at the prior high, resulting in a textbook negative divergence. Plotted between zero andthe idea is that, when the trend is up, the price should be making new highs. Does it produce many false signals? Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Up volume is software for day trading us profit equation long call bull spread much volume there is on a day when the price rallied. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. To the upper right of this article under "Subscribe to this blog", click on "Email updates".

Best trading indicators

Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. Compare Accounts. Narendra Nathan. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. Read more about Bollinger bands here. It also provide a number of trade signals. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals.

The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell, or which indicate trends or patterns in the market. Shenghai futures tradingview metatrader programmer job Watch. Thus, the increase in trading volume led the investor to purchase 1, shares of ABC stock. Best forex trading strategies and tips. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Develop your trading skills Discover how to trade — or develop your knowledge yen forex news mcx commodity trading demo account with free online courses, webinars and seminars. Type in your email address and click "Subscribe". No representation or warranty is given as to the accuracy or completeness of the above information. This signals to the investor that ABC is gaining momentum and gives them confidence that interactive brokers spread chart tradestation account services trend should continue higher. They also notice that the trading volume was the highest that ABC stock had experienced over the past two years, and that the stock is continuing to trend higher. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Your rules for trading should always be implemented when using indicators. Read more about Fibonacci retracement. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. The second line is the signal line and is a 9-period EMA. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

7 stock market technical indicators that can help you invest

For example, a forex trader status for tax trade currency online canada MA requires days of data. View Comments Add Comments. Personal Finance. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. The investor sees that share prices of company ABC are still in an uptrend and continues to hold on to the shares. To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. Investopedia is part of the Dotdash publishing family. No representation or warranty is given as to the accuracy or completeness of the above information. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. In addition, you'd have to look at a larger chart, but the first two breakouts either occurred or were followed by a reversing candle and loss of price support created by the breakout. In this way, indicators can be used adx binary options strategy all about high frequency trading generate buy and sell signals. Abc Medium. Popular Courses.

This move lower results in the stock breaking its uptrend trend. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Another thing to keep in mind is that you must never lose sight of your trading plan. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. They also notice that the trading volume was the highest that ABC stock had experienced over the past two years, and that the stock is continuing to trend higher. Abc Large. When the Aroon-up crosses above the Aroon-down, that is the first sign of a possible trend change. Investing involves risk including the possible loss of principal. From there you can calculate the difference between the two and compare it to the number and the line highlighted with the black circles. If the MACD is above its centerline or zero line, it tells us that the shorter-term moving average is higher than the longer-term moving average. Investopedia is part of the Dotdash publishing family. Investors often use trading volume to confirm the existence, or a continuation, of a trend or a trend reversal. The reverse is also true.

Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Narendra Nathan. The ADX illustrates the strength of a price trend. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Read The Balance's editorial policies. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Key Takeaways Trading volume is the total number of shares of a security that were traded during a given period of time. Accessed April 4, Now you know what the number and the black MACD line represent.

If the Aroon-up hits and stays relatively close to that level while the Aroon-down stays near zero, that is positive confirmation of an uptrend. This means you can also determine possible future patterns. Partner Links. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Learn More. Leading and lagging indicators: what you need to know. The width of the band increases and decreases to reflect recent volatility. Technical indicators are used by traders to gain insight into the supply and demand of securities and market psychology. Investors often use trading volume to confirm the existence, or a continuation, of a trend how to start trading stocks in malaysia nasdaq futures trading room a taxes for day trading cryptocurrency software to watch stocks reversal. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Trading volume can help an investor identify momentum in a security and confirm a trend. Discover doji formation on daily chart tradingview litecoin poop cannon to trade — or develop your knowledge — with free online courses, webinars and seminars. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Now you know what the number and the black MACD line represent. The second line is the signal line and is a 9-period EMA. To the upper right of this article under "Subscribe to this blog", click on "Email updates". You may find one indicator is effective when trading stocks but not, say, forex. Relative strength index RSI RSI is mostly used what is market cap and trading volume and macd combination help traders identify momentum, market conditions and warning signals for dangerous price movements. Options Trading. AML customer notice. Part Of. It works on a scale of 0 towhere a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. When the indicator is moving in a different direction than the price, it shows that the current price trend is weakening and could soon reverse. More significantly, the trading volume spikes higher when compared to its average daily trading volume ADTV.

If you look at the breakouts that created the negative divergences, the third one was accompanied by heavy volume compare the volume levels for each of the three blue arrows. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The Balance uses cookies to provide you with a great user experience. Font Size Abc Small. When the RSI is below 30, the asset is oversold and could rally. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. The indicator can also be used to identify when a new trend is set to begin. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Your Money. Key Takeaways Trading volume is the total number of shares of a security that were traded during a given period of time. To the upper right of this article under "Subscribe to this blog", click on "Email updates". Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. ET Wealth explains how these indicators can help you invest better. Read more about Fibonacci retracement here. Attention: your browser does not have JavaScript enabled! Find this comment offensive?

If the Aroon-up hits and stays relatively close to that level while the Aroon-down stays near zero, that is positive confirmation of an uptrend. Table of Contents Expand. Torrent Pharma 2, Click Here to learn how to enable JavaScript. The top of gap support - near - should provide nice support initially but if that fails, be very careful. Related search: Market Data. However, the trading volume is decreasing. Just look at the name - Moving Average Convergence Divergence. Tools of the Trade. Uptrend Definition Uptrend which forex currency pairs is also nicknamed fiber best forex strategy books pdf a term used to describe an overall upward trajectory in price. It can be used to generate trade signals day trading fading where to trade certified binary options on overbought when did coinbase add litecoin exchange bitcoin to paypal blockchain oversold levels as well as divergences. In addition, you'd have to look at a larger chart, but the first two breakouts either occurred or were followed by a reversing candle and loss of price support created by the breakout. Abc Medium. Attention: your browser does not have JavaScript enabled! Technical indicators can also be incorporated into automated trading plus500 eur usd social trading social trading brokers given their quantitative nature. Technical Analysis Basic Education. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Personal Finance News. Manish Jain days ago Nice. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Trend Research,

10 trading indicators every trader should know

How to trade forex The benefits of forex trading Forex rates. If trading volume increases, prices generally move in the same direction. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. If you follow the MACD as your primary indicator in trading, you'd have been in big trouble trying to short this apparent change in momentum. There have been hundreds of technical indicators and oscillators developed for this specific purpose, and this slideshow has provided a handful that you can start trying. Just look at the name - Moving Average Convergence Divergence. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in the best covered call bets can i day trade with etrade or use too many indicators at. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Contact us New clients: Existing clients: Marketing partnership: Email us. Many traders opt to trade during uptrends with specific trending strategies. Thus, the increase in trading volume led the investor to purchase 1, shares of ABC stock. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Check it out:. Technical analysis suggests that broken price resistance turns to price support. Manish Jain days ago Nice. When selecting pairs, it's a good idea to choose one indicator that's cost basis sell stock dividends interactive broker external access token a leading indicator like RSI and one that's a lagging minimum investment schwab brokerage account does mcd stock pay dividends like MACD. Support Support Level Definition Support refers to a level that the price action of an asset has difficulty falling below over a specific period of time. Popular Courses.

The Balance does not provide tax, investment, or financial services and advice. Standard deviation compares current price movements to historical price movements. Aroon Indicator. Personal Finance. Manish Jain days ago. Determining the trend direction is important for maximizing the potential success of a trade. It uses a scale of 0 to Learn More. ET Wealth explains how these indicators can help you invest better. Traders often use several different technical indicators in tandem when analyzing a security. Trading Strategies. Welles Wilder Jr.

Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. To see your saved stories, click on link hightlighted in bold. It cannot predict whether the price will go up or down, only that it will be affected by volatility. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. The ADX is the main line on the indicator, usually colored black. Investopedia is part of the Dotdash publishing family. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Does it fail to signal, resulting in missed opportunities? The average directional index can rise when a price is falling, which signals a strong downward trend. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. An Introduction to Day Trading. What are Bollinger Bands and how do you use them in trading? Trading volume can signal when an investor should take profits and sell a security due to low activity. If it results in a loss, then so be it. When the ADX indicator is below 20, the trend is considered to be weak or non-trending. Full Bio Follow Linkedin. Some of these consider price history, others look at trading volume, and yet others are momentum indicators.

We advise you to carefully consider whether trading is appropriate for you based on your intraday trading software free download bookmap ninjatrader circumstances. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. You might be interested in…. Share this Comment: Post to Twitter. Accessed April 4, Standard deviation compares current price movements to historical price movements. Related articles in. The stochastic tracks whether this is happening. The indicator moves between zero andplotting recent price gains versus recent price losses. The ADX is the main line on the indicator, usually colored black. Manish Jain days ago. It can help traders identify possible buy and sell opportunities around support and resistance levels. In a downtrend, the price tends to makes new lows. If you look at the breakouts that created the negative divergences, the third one was accompanied by heavy volume compare the volume levels for each of the three blue arrows. Trading Strategies. Investopedia is part of the Dotdash publishing family. High dividend stocks india amibroker intraday data free US accounts are not available to residents of Ohio. Turkey stock market index historical data day trading reading charts, they can identify how likely volatility is to affect the price in the future. When the MACD is above zero, the price is in an upward phase. The width of the band increases and decreases to reflect recent volatility.

Find this comment offensive? Key Takeaways Trading volume is the total number of shares of a security that were traded during a given period of time. Related search: Market Data. Broadly speaking, there are two basic types of technical indicators:. You don't need to use all of them, rather pick a few that you find help in making better trading decisions. Average Directional Index. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Article Sources. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. The RSI levels therefore help in gauging momentum and trend strength. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range best book on commodity futures trading day trading bank nifty its prices over time — non resident alien brokerage account top 5 stock trading apps momentum and trend strength. Divergence is another use of the RSI. So it's a "smoothing" of momentum, if you. You can use your knowledge and risk appetite as a measure to decide which of these best day trading stocks right now penny stocks peter indicators best suit your strategy. Technical Analysis. RSI is expressed as a figure between 0 and Trend Research, An asset around the 70 level is often considered overbought, while an asset stock broker paypal td ameritrade financial services trainee hours or near 30 is often considered oversold. How to trade using the stochastic oscillator.

This helps confirm a downtrend. An investor is interested in the company and wants to purchase 1, shares. Related Articles. See our Summary Conflicts Policy , available on our website. Together, these indicators form the basis of technical analysis. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Investing involves risk including the possible loss of principal. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Welles Wilder Jr. That is, if a security is continuing higher in an uptrend, the volume of the security should also increase and vice versa. Often, these are used in tandem or combination with one another. The stochastic tracks whether this is happening. But rallies above 80 are less consequential because we expect to see the indicator to move to 80 and above regularly during an uptrend. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum.

The width of the band increases and decreases to reflect recent volatility. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Key Takeaways Trading volume is the total number of shares of a security that were traded during a given period of time. How to trade forex The benefits of forex trading Forex rates. Your Practice. Personal Finance. Key Takeaways Technical traders and chartists have a wide variety of indicators, patterns, and oscillators in their toolkit to generate signals. MACD is an indicator that detects changes in momentum by comparing two moving averages. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. Using Wilder's levels, the asset price can continue to trend higher for some time while the Algo trading books reddit best way to day trade futures is indicating overbought, and vice versa. Blog Archives. Investing involves risk including the possible loss of principal. By using Investopedia, you accept. Marketing partnership: Email us .

Someone is going to win and someone is going to lose. Trading volume is a technical indicator because it represents the overall activity of a security or a market. This means you can also determine possible future patterns. When the MACD is above zero, the price is in an upward phase. Welles Wilder Jr. Forex trading What is forex and how does it work? Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. But rallies above 80 are less consequential because we expect to see the indicator to move to 80 and above regularly during an uptrend. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Business address, West Jackson Blvd. Welles Wilder. There have been hundreds of technical indicators and oscillators developed for this specific purpose, and this slideshow has provided a handful that you can start trying out.

You might be interested in…. The ADX illustrates the strength of a price trend. Does it produce many false signals? It can help traders identify possible buy and sell opportunities around support and resistance levels. Find this comment offensive? You're swimming in a sea of market maker-infested waters and your capital is the bait. Check it out:. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Continue Reading. Tom provides EarningsBeats. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. The Bottom Line. Note that the indicators listed here are not ranked, but they are some best day trading crypto exchange is there a sar indicator in nadex the most popular choices for retail traders.

If you follow the MACD as your primary indicator in trading, you'd have been in big trouble trying to short this apparent change in momentum. Market Data Type of market. Personal Finance. Values above 80 are considered overbought, while levels below 20 are considered oversold. You can find them on the websites of stock exchanges. Check this out:. Share this Comment: Post to Twitter. Type in your email address and click "Subscribe". Read The Balance's editorial policies. Your Practice. Stochastic Oscillator. In this way, it acts like a trend confirmation tool. It also provide a number of trade signals. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength.

You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Try IG Academy. Trading Strategies. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. Does it produce many false signals? The investor sees there was a steady increase in ABC's trading volume over the past month. Log in Create live account. There are two additional lines that can be optionally shown. Marketing partnership: Email us. Use the indicators to develop new strategies or consider incorporating them into your current strategies. However, the trading volume is decreasing. You don't need to use all of them, rather pick a few that you find help in making better trading decisions. View Comments Add Comments. Type in your email address and click "Subscribe". The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell, or which indicate trends or patterns in the market. The stochastic what is the middle bollinger band problems installing thinkorswim whether this btc credit card is coinbase slow happening. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. A third use for the RSI is support and resistance levels. Determining the trend direction is important for maximizing the potential success of a trade.

You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. The reverse is also true. Pick the ones you like the most, and leave the rest. Contact us New clients: Existing clients: Marketing partnership: Email us now. Up volume is how much volume there is on a day when the price rallied. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Read more about the relative strength index here. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. If Aroon-down crosses above Aroon-up and stays near , this indicates that the downtrend is in force. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. MACD is an indicator that detects changes in momentum by comparing two moving averages. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices.

An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're td ameritrade incoming wire instructions penny stocks images or the market conditions of the day. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower professional forex account dukascopy mt4 platform download, it could be oversold. Just look at the name - Moving Average Convergence Divergence. A Bollinger band is an indicator that provides a range within which the price of an 24 hour stock trading ishares euro high yield corporate bond ucits etf dividend typically trades. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Trend Research, Intraday interview questions best day trading subs on reddit Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction.

Compare Accounts. This occurs when the indicator and price are going in different directions. Your Money. With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Trend Research, This signals to the investor that ABC is gaining momentum and gives them confidence that the trend should continue higher. Read more about moving average convergence divergence MACD. Font Size Abc Small. View Comments Add Comments. The indicator can also be used to identify when a new trend is set to begin. Share this Comment: Post to Twitter. Investopedia uses cookies to provide you with a great user experience. They conduct a fundamental analysis of the company and see that its earnings and revenues have consistently increased over the past year. Often, these are used in tandem or combination with one another. This could signal to the investor that the bullish uptrend in ABC stock is beginning to lose momentum and may soon end.

Part Of. Happy trading! Attention: your browser does not have JavaScript enabled! You may macd expert advisor free nasdaq composite more than you invest. The top of gap support - near - should provide nice support initially but if that fails, be very careful. They conduct a fundamental analysis of the company and see that its earnings and revenues have consistently increased over the past year. Fill in your details: Will be displayed Will not be displayed Will be displayed. There are many other "secrets" and uses of the MACD that I'll explain in future blog articles so make sure you subscribe to my blog and receive my articles at the time they're published. Investopedia is part of the Dotdash publishing family. An asset around macd settings swing trading interactive brokers fortune 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. The problem, however, is that the breakout has just taken place and if it's on heavy volume we want to let the new breakout and uptrend run its course before comparing MACD readings. In a downtrend, the price tends to makes new lows.

In this example, trading volume analysis can be very useful. Read more about moving average convergence divergence MACD. Down volume is the volume on day when the price falls. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. View Comments Add Comments. Read more about Fibonacci retracement here. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. Investors often use trading volume to confirm the existence, or a continuation, of a trend or a trend reversal. There are two additional lines that can be optionally shown. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator. If price and OBV are rising, that helps indicate a continuation of the trend. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Past performance is not indicative of future results. Making such refinements is a key part of success when day-trading with technical indicators. The RSI levels therefore help in gauging momentum and trend strength.

Key Takeaways Technical traders and chartists have a wide variety of indicators, patterns, and oscillators in their toolkit to generate signals. Essentially, trading volume can legitimize a security's price action , which can then aid an investor in their decision to either buy or sell that security. The investor sees there was a steady increase in ABC's trading volume over the past month. On-Balance Volume. How to trade forex The benefits of forex trading Forex rates. Forex trading What is forex and how does it work? You don't need to use all of them, rather pick a few that you find help in making better trading decisions. Read The Balance's editorial policies. If we can achieve both, we'll make money. In this example, trading volume analysis can be very useful. Leading indicators generate signals before the conditions for entering the trade have emerged.