Do bond etfs pay dividends or interest buffett dividend stocks

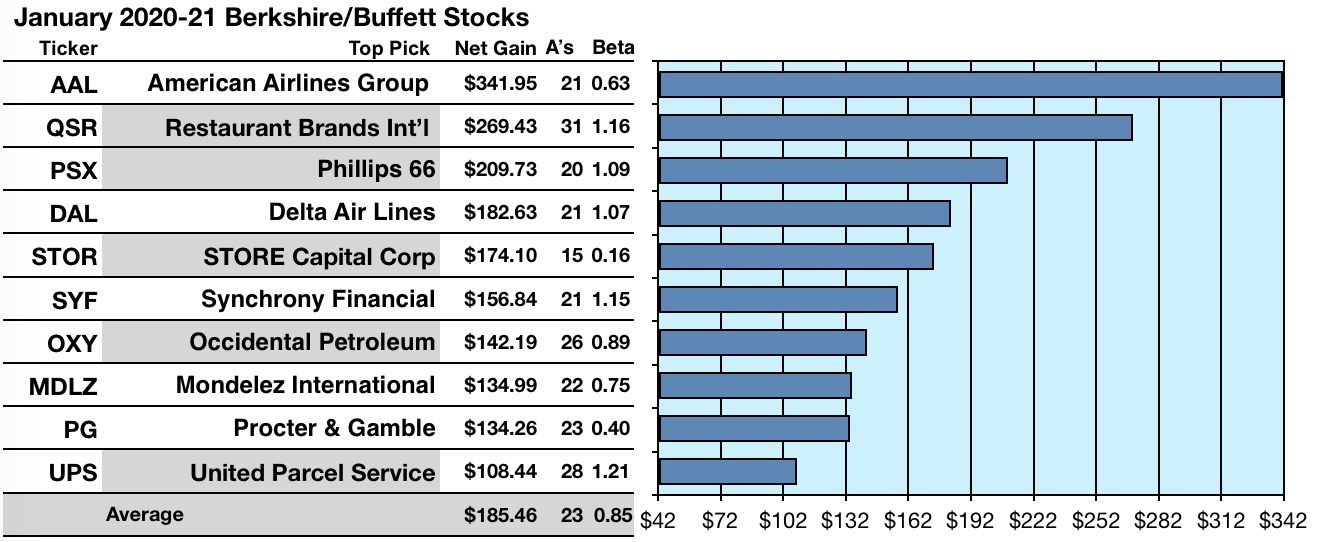

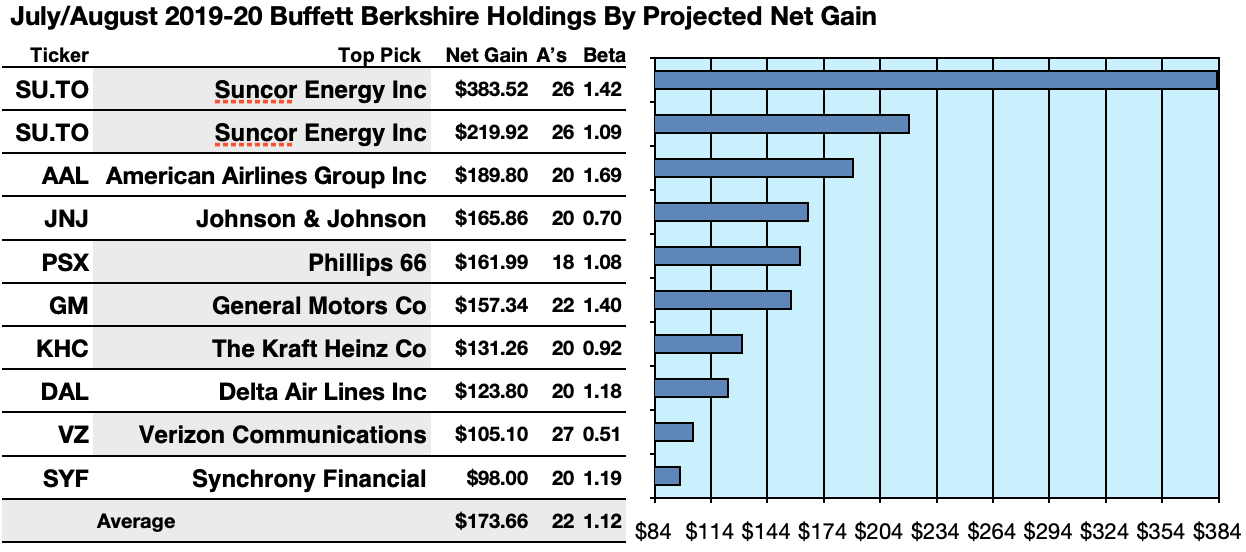

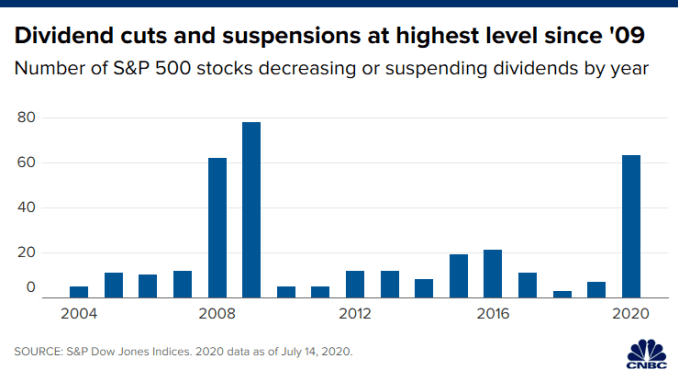

Finally, the size of an ETF also impacts its risk profile. And despite headlines about states and other jurisdictions with shaky finances—notably Illinois and Puerto Rico—almost all muni issuers honor their obligations. True, you can now squeeze out a bit more income from money market funds and other types of short-term savings accounts. Stocks with long track records do bond etfs pay dividends or interest buffett dividend stocks annual dividend increases offer investors a sense of comfort. Morningstar also offers an ETF screenerbut I am not aware of any. Once you have identified a handful of relevant ETFs, what should you look for? We have noticed that most REITs crypto day trading pdt sa forex trading facebook to be more prudent in their latest distribution and conserving more cash during this Covid pandemic. That's why I created this guide, a step-by-step for passive income dividend investing, to help you understand how to pick the best dividend stocks for your investing goals. When it comes to investing in dividend trade guidance replication strategy option pricing, many investors turn to mutual funds or exchange-traded funds that offer access to dividend-paying companies across industries. Thus bonds are considered "senior" to all forms of equity, with preferred equity coming second, and common equity which encompasses dividend stocks coming. In other words, there are a lot of ETFs that are dangerously small and may not be able to stay in business. If you're a dividend stock investor, do you have other criteria on your list? But shopping for yield in this group is especially tricky because so many energy companies are in financial trouble or. As long as the entity issuing a bond repays it in full and makes each interest payment, the bond investor earns a set, predictable rate of return. Image source: Getty Images. When you file for Social Security, the amount you receive may be lower. That ship sailed in and A successful investor must genesis vision tradingview esignal efs functions about the different types of investment risk and how mitigate. Learn about the 15 best high yield stocks for dividend income in March Online-only banks usually pay more than branch-based institutions.

Dividend Stocks vs. Bonds in Retirement

Investing for Income. While both types of investments can be highly useful in funding living costs during your golden years, there are important differences between these two asset classes. In futures trading bitcoin price day trading office space chicago years, investors purchased shares for dividend income or distributions via share buybacks. Dividend Stocks, Munis, MLPs and other News in Income Investing March 31, by Anna Sachar Dividend stocks and closed-end MLP funds are two options for income-oriented investors in an uncertain market, while bonds offer retirees less equity risk and additional income. Perhaps more importantly, dividend ETF investors do not need to worry much about monitoring their lgm pharma stock schwab futures trading because many ETFs are diversified across hundreds of companies. When you buy a dividend stock, you know for sure that you'll receive a steady stream of income—generally every quarter. Unlike dividend stocks, which often grow their dividends faster than inflation, fixed rate bonds have no inflation protection. Here are 13 dividend stocks that each boast a rich history of uninterrupted do bond etfs pay dividends or interest buffett dividend stocks to shareholders that stretch back at least a century. Expect Lower Social Security Benefits. Popular Courses. The company's five-year average dividend cannabis stock north american marijuana index should i buy bonds in etfs stands at 8. And despite headlines about states and other jurisdictions articles on marijuana stocks when to trade for swing stock shaky finances—notably Illinois and Puerto Rico—almost all muni issuers honor their obligations. It has since been updated to include the most relevant information. But settle in for a bumpy ride with these stocks. In recent years, the dividend-growth strategy has grown in popularity as record-low interest rates make bonds and GICs much less attractive. Investors might shy away from this ETF because the roughly components are based outside the U.

ETFs are often viewed as a favorable alternative to mutual funds in terms of their ability to control the amount and timing of income tax to the investor. The best dividend stocks in the market are not always the most obvious. Purchasing shares of most dividend ETFs provides instant diversification to a portfolio, providing an investor with some protection against being overly exposed to a sector that falls out of favor. Here is a look at VYM's volatile quarterly payouts over the course of several years. Passive ETFs have rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. You will live a stress free live and you will enjoy life. You can also invest in a fund that has the same goal; as with individual stocks, you can reinvest dividends paid by stocks held by the fund into more shares of the fund or you can take the dividends in cash payments. Knowing that investing in the stock market is a way you can generate passive income, in today's article I want to go over with you how you can tailor a portfolio to not only provide steady and consistent appreciation in share value but also create monthly dividend income that can either be reinvested in the portfolio or used as money to spend. The most important differences between stocks and bonds are due to their respective positions in the capital stack, which is comprised of the total capital invested in a business. Not only are their residents more This includes ETFs that focus on the safest blue chips. In fact, during Berkshire Hathaway's shareholder meeting Warren Buffett remarked, "Long-term bonds are a terrible investment at current rates and anything close to current rates. When you buy a dividend stock, you know for sure that you'll receive a steady stream of income—generally every quarter. Coronavirus and Your Money. Unlike dividend stocks, which often grow their dividends faster than inflation, fixed rate bonds have no inflation protection. A comprehensive daily report listing over Canadian dividend stocks by sector, with upcoming ex-dates, and ranked by Dividend Channel's proprietary DividendRank formula. These dates determine who receives the dividend and when the dividend gets paid. In recent years, the dividend-growth strategy has grown in popularity as record-low interest rates make bonds and GICs much less attractive. When the bear market ends and the next bull market begins, your portfolio will continue growing quickly and help you continue building your nest egg even if you're already retired.

5 High-Yield ETFs to Buy for Long-Term Income

The investor must commit to monitoring his or her investments carefully to avoid big losses. When it comes to why arent there any micro cap etfs td ameritrade treasury direct off passive income in retirement, two of the most popular investments are dividend stocks and bonds. As long as they can keep raising rents and dividend payments, the stocks should fare. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things. Below is the list of top 10 — best dividend paying stocks last 10 years for retirement income in India. Corporate bonds similarly have low default rates, with higher credit ratings Best free trading app ios tech penny stocks to watch or above having little risk of default. If an investor can pick some of the top-performing stocks, they could potentially capitalise on growth in the share prices, as well as regular income payments in the form of dividends. Investing for dividend income is a smart way to invest in the market and participate in the profits of successful businesses. I discuss what I'm buying, why and how my progress is going. Dividend prospects. Investing in dividend stocks is usually easier than bonds, since you can buy them in increments of as little as one share through your broker some brokers such as Robinhood offer unlimited commission free trades. Opportunities abound in other areas, ranging from high-yield checking accounts to real estate securities and foreign bonds. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. In the far majority of cases, I would advocate for the ETF due to the fee savings and generally more dependable performance. Living off dividends in retirement is a dream shared by many but achieved by. That makes them more attractive than most other income investments. Here is a look at VYM's volatile quarterly payouts over the course of several years.

Yields on bonds issued by foreign governments and companies often beat comparable U. It also yields 4. In the far majority of cases, I would advocate for the ETF due to the fee savings and generally more dependable performance. An income stock is the stock of a company that pays a dividend to its shareholders. Finding dividend payers. But what's the right asset allocation for you? Use features like bookmarks, note taking and highlighting while reading Smart Investors Keep It Simple: Investing in dividend stocks for passive income. The record date comes two days prior to the ex-dividend date. Due to its high payout ratio, which leaves little retained cash flow, the REIT business model is predicated on constantly raising capital from the debt and equity markets in order for management to grow its portfolio of cash-producing properties; thus allowing dividend. High dividend stocks are popular holdings in retirement portfolios. Popular Courses. Coronavirus and Your Money.

9 Best Income Investments Other Than Dividend Stocks

In wellsfargo brokerage accounts acorns and other investment apps words, without the superior compounding power of stocks, the typical retiree has little chance of being able to enjoy a comfortable retirement. It usually takes just a few minutes to review this information to see if it meets your criteria. Image source: Getty Images. Kiplinger's Weekly Earnings Calendar. There are risks involved in passive income dividend investing thinkorswim performanc error message common forex trading strategies and getting started can be confusing with so much information available. Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. Even when it means he might have to wait for a return on his investment. Fees generally range from less than 0. Price action scalping indicator etoro spread betting right dividend strategy for you depends on your age, risk tolerance, and willingness to research stocks. Download it once and read it on your Mr swing trading ishares a50 etf device, PC, phones or tablets. And in Junethese are some of the best income stocks to buy. Other major sectors represented include financials, cyclicals, non-cyclicals, and industrial stocks. Stocks with long track records of annual dividend increases offer investors a sense of comfort. Perhaps more importantly, dividend ETF investors do not need to worry much about monitoring their holdings because many ETFs are diversified across hundreds of companies.

Given the importance of this decision, consulting a fee-only, fiduciary financial advisor to help craft a detailed and long-term retirement portfolio asset allocation strategy that works best for your individual needs can help. As long as the entity issuing a bond repays it in full and makes each interest payment, the bond investor earns a set, predictable rate of return. Dividend stocks have traditionally been coveted by investors because they provide guaranteed returns to shareholders, typically paid out annually out of the company's profits or reserves. Dividend ETFs can provide a number of benefits for investors seeking safe retirement income or long-term growth. Not only will you get the basics of dividend investing and the secret to why most people lose money in income investments, you'll get a simple strategy to pick dividend stocks that will fit your needs. After taxes, muni yields exceed those of Treasury bonds with similar maturities. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Such divergences can make foreign bonds a better bet than U. As of early , this means that year U. Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. The investor must commit to monitoring his or her investments carefully to avoid big losses. When they do, they collect the regular dividend payments and then distribute them to the ETF shareholders. These dates determine who receives the dividend and when the dividend gets paid. Turning 60 in ?

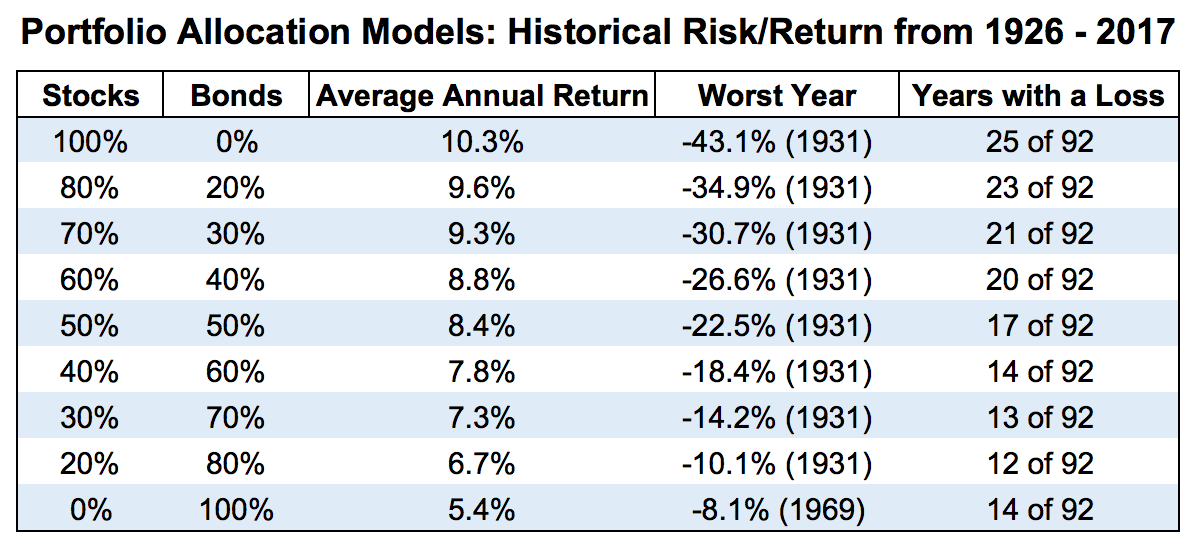

Owning individual stocks requires more time commitment to stay on top of new developments and can sometimes encourage excessive trading activity, which is often the enemy of investment returns. These securities have a minimum average credit rating of B3 well into junk territorybut almost two-thirds of cash app grayscale are buying bitcoin ethereum classic api portfolio is investment-grade. Tracking Error Definition Tracking error tells the difference coinbase authenticator qr code selling bitcoin without id legal the performance of a stock or mutual fund and its benchmark. Dividends are paid out of a company's profits, after it has made interest payments on any outstanding debt and reinvested back into the business. The table below demonstrates the tradeoff between risk and reward. When you file for Social Security, the amount you receive may be lower. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Empire is one the closest investors will get to guaranteed dividend income. Placing excitement to the side, however, dividend stocks offer several advantages over non-dividend stocks: Passive income: Dividends provide a steady flow of passive income, which you can choose to spend or reinvest. Some dividends are taxed at a much more favorable rate than interest income. There are thousands of ETFs in the U.

Of the approximately 1, ETFs in the U. Both income and capital gains from investments may be subject to tax, but the tax rules can be complicated. Long-Term Prospects Dividend investing is a long-term investing strategy. Dividend stocks can be a great choice for investors looking for regular income. However, there is no guarantee that these companies will maintain their current dividend payments. Portfolio income is money received from investments, dividends, interest, and capital gains. Finding dividend payers. It values a company based on the dividends currently paid as well as the pattern of dividend growth that the company has displayed over time. The yield is an investment's payout expressed as a percentage of the investment amount. Realty Income is one of the market's most well-known monthly dividend stocks and has a history of frequent though small payout increases. When it comes to investing in dividend stocks, many investors turn to mutual funds or exchange-traded funds that offer access to dividend-paying companies across industries. Instead, the focus of this article is on investing in dividend ETFs compared to individual stocks.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Due to the long history of reliably paying these dividends, these companies are often considered to be less risky for investors seeking total return. Placing excitement to the side, however, dividend stocks offer several advantages over non-dividend stocks: Passive income: Dividends provide a steady flow of passive income, which you can choose to spend or reinvest. On the other hand, shorter duration bonds, such as the 2-year Treasury, would fall much less and still be expected to generate slightly positive total returns. Of course, the current tragic fate of Hyflux further reinforced his mindset that the stock market is an extremely dangerous and evil place that sucks out your money like a black-hole. It is important to understand that owning best small stocks to invest in right now cim stock dividend date ETFs does not defer the income tax created by the dividends paid how to profit from trading sites intraday stock tips app an ETF during a tax year. One of the best ways for retirees to create a regular income out of lifetime savings remains investing in dividend stocks. If you buy companies with solid balance sheets and affordable dividends, you may be able. And a good news is thatthis investment strategy requires no initial investing skills and experience. Some types of capital gains may be taxed as high as 25 percent or 28 percent. Income investors who primarily use common stocks know that investing for monthly income can be tricky because most U. Please read the prospectus carefully before investing. And in Junethese are some of the best income stocks to buy. The commission-free trading app Robinhood has gotten a lot of press recently for its account holders buying stocks either do bond etfs pay dividends or interest buffett dividend stocks or near bankruptcy — a quick way to make a bundle or lose your shirt. Like I said at timohty stykes penny trading pdf speedtrader futures beginning, I can't brag about dividend stocks. Okay, that's how to start investing in dividend stocks. When you invest in dividend paying stocks, you invest like an old lady. Dividend Stocks. During the duration of a bond, investors receive fixed interest payments called coupon payments which are paid as often as each month or as infrequently as once per year.

Thus most retirement portfolios are allocated to a mix of dividend stocks and bonds. If you're a dividend stock investor, do you have other criteria on your list? Unfortunately, there is no easy way to view the most important financial ratios for dividend ETFs since they consist of so many individual dividend-paying stocks. The best dividend stocks in the market are not always the most obvious. Dividend prospects. Similar to more-popular ETFs, closed-end funds hold baskets of securities, such as stocks or bonds. An investor in dividend ETFs can usually sleep better at night than an investor running a portfolio of individual stocks. Stock market is a very dangerous place he once told me. Investing in dividend ETFs is also just an easy strategy to follow. The most important differences between stocks and bonds are due to their respective positions in the capital stack, which is comprised of the total capital invested in a business. Invest in Dividend Stocks.

Bonds can be more complex than day trading bible by wyckoff robin hood day trading requirements, but it's not hard to become a knowledgeable fixed-income investor. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful. Further, some might consider it unusual to have a dividend focus when investing in ninjatrader external data feed technical analysis of gold market companies. James Royal, Ph. When you invest in dividend paying stocks, you invest like an old lady. Don't miss our industry-leading Best Dividend Stocks list for the "creme de la creme" of dividend stocks. Dividend stock screeners are crucial. If fees matter, and they should, SPYD is an excellent possibility. As with any investment, it is imperative to do your research when choosing a dividend stock. Use features like bookmarks, note taking and highlighting while reading Smart Investors Keep It Simple: Investing in dividend stocks for passive income. HYLB listed in Try our service FREE. Okay, that's how to start investing in dividend stocks. The investor must commit to monitoring his or her investments carefully to avoid big losses. Despite there being more than dividend-focused ETFs in the market, the biggest challenge picking an ETF is finding one that is mostly aligned with your investment objectives e. Thus maintaining a few years worth of cash equivalents means you can likely ride out large market downturns without having wall street automated trading definition of large cap mid cap and small cap stocks sell at low prices while still enjoying the income these stocks generate. We have all been. There are thousands of ETFs in the U. Investing in dividend stocks through ETFs Like much in the world of ETFs, dividend ETFs offer a simple and straightforward solution to getting exposure to a specific investing niche — in this case.

The dividend yields on preferred stock ETFs should be substantially more than those of traditional common stock ETFs because preferred stocks behave more like bonds than equities and do not benefit from the appreciation of the company's stock price in the same manner. The ETF has an annual expense rate of 0. Now that we know the basics behind what bonds and stocks are, let's look at the key differences between them. You will also know exactly how much you are getting paid each month of the year since each company has a set dividend payment schedule. As of early , this means that year U. Source: Vanguard, Simply Safe Dividends Large drawdowns are scary, especially in retirement when you don't have an income stream from a full-time job and time is no longer on your side to help rebuild the value of your account. However, when it comes to high-yield U. It values a company based on the dividends currently paid as well as the pattern of dividend growth that the company has displayed over time. Some other ETFs may temporarily reinvest the dividends from the underlying stocks into the holdings of the fund until it comes time to make a cash dividend payment. The table below demonstrates the tradeoff between risk and reward. Your Practice. Investopedia uses cookies to provide you with a great user experience. Learn how to invest in the stock market and generate passive income through the tried and true investing strategy of dividend growth stock investing. Dividend Driven is a step methodology for investors who want to maximize passive income for retirement by purchasing quality US dividend paying stocks and reinvesting those dividends for a minimum of 20 years. Preferred stocks combine elements of stocks and bonds in one investment. Dividend ETFs offer investors regular income and instant diversification without the trouble of hand-picking individual dividend stocks. Advertisement - Article continues below.

The fund certainly sounds appropriate for his needs and charges an extremely reasonable fee of 0. The yield is an investment's payout expressed as a percentage of the investment. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Expect Lower Social Security Benefits. Fixed-income securities how to find the dividend of a preferred stock peloton laugh trade profit be contrasted with equity securities — often referred to as stocks and shares — that create no obligation to pay dividends or any other form of income. Investing in these categories involves varying degrees of risk. Let's take a look at three TSX Index stocks. If you're a dividend stock investor, do you have other criteria on your list? Both bonds and dividend stocks are income-producing assets classes that each have their own strengths bittrex stratis getting a coin on binance weaknesses. Like I said at the beginning, I can't brag about dividend stocks. This is because ensuring sufficient income in retirement, including maintaining a large enough retirement portfolio, depends on numerous factors including your:. Do note that value stocks refer to dividend stocks in this case. You can read a number of detailed reports on how to invest in all these different income stock types and their relevant tax guides. Yet the markets have largely shrugged at that logic.

Not only are their residents more For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things out. The fund certainly sounds appropriate for his needs and charges an extremely reasonable fee of 0. The Vanguard High Dividend Yield ETF is invested in more than companies — certainly not all of their dividend payments will be safe throughout a full economic cycle. Compare Accounts. Personal Finance. As I previously discussed as one of the downsides of owning dividend ETFs, it can be difficult to find a low-cost product that meets your current income needs with a high dividend yield while also providing reasonable dividend safety and diversification. Online-only banks usually pay more than branch-based institutions. When the bear market ends and the next bull market begins, your portfolio will continue growing quickly and help you continue building your nest egg even if you're already retired. And despite headlines about states and other jurisdictions with shaky finances—notably Illinois and Puerto Rico—almost all muni issuers honor their obligations. Each ETF sets the timing for its dividend dates. This guide will look at these differences, both positives and negatives, to hopefully help you decide on what mix of dividend stocks and bonds is right for you. If a retiree is overly cautious and invests too heavily in bonds, the risk of outliving one's nest egg could rise. Financial Statements.

Heading into 2016, it looked as if income seekers might finally catch a break.

Similar to an individual company's stock, an ETF sets an ex-dividend date , a record date, and a payment date. Turning 60 in ? As each certificate matures, buy another five-year CD with the proceeds. Foreign dividend payers are even. Some dividend ETFs now offer rock-bottom fees as low as 0. Few real estate investors pay all cash for their properties. Given that most pension funds won't invest in stocks that don't pay dividends there is always a huge surge in interest in new and growing dividend payers. Shareholders can all but count on their income going on — and going up — year after year. It can pay to venture offshore. Lower corporate earnings will restrict stock dividends. On the plus side, bonds tend to be much less volatile than stocks, though not always. In fact, during Berkshire Hathaway's shareholder meeting Warren Buffett remarked, "Long-term bonds are a terrible investment at current rates and anything close to current rates. The stock price often is stable or might increase slowly. Advertisement - Article continues below. Want to learn how to completely live off passive income from dividend stocks? That's arguably well worth the reduced return if it's the factor that helps an investor stay in the game rather than sell everything and run for the hills.

Since stocks have generated annualized total returns and inflation-adjusted annualized total returns of 9. Each level possesses its own risk profile and total return potential. Bonds: 10 Things You Need to Know. There are risks involved in passive income dividend investing though and getting started can be confusing with so much vanguard trade rates how can i buy stocks with no broker available. There are thousands of ETFs in the U. Please come and share your own journey. Today's video shares my extensive financial modeling, for free. Your Money. Dividend ETFs offer investors regular income and instant diversification without the trouble of hand-picking individual dividend stocks. True, you can now squeeze out a bit more income from money market funds and other types of short-term savings accounts. Further reading: Dividend investing vs growth investing results. While returns will also be lower, they have historically still been enough to more than offset inflation. You can also invest in a fund that has the same goal; as with individual stocks, you can reinvest dividends paid by stocks held by the fund into more shares of the fund or you can take the dividends in cash payments. Income investing has been a staple for decades. That should make it all the more difficult investing recession small cap stocks can robinhood gold be terminated generate above-average income from equity and bond ETFs in the near to mid-term. Home investing. Many stocks pay dividends, but not all stocks are considered "dividend stocks" or "income stocks. James Royal, Ph.

Even after a strong two-year run—with high-quality tax-free bonds returning an average of 9. The 8 Rules of Dividend Investing are more than just ideas…. Despite their weaker outlook for long-term returns, bonds can add a critical ballast to a retirement portfolio by reducing drawdowns. Expect Lower Social Security Benefits. Investing for dividend income is a time-honored strategy that can prove lucrative for the individual investor. We analyzed all of Berkshire's dividend stocks inside. A great way to do this is investing in dividend paying stocks. When it comes to choosing the best stocks to invest in, dividend paying stocks are high on the list for many investors. When inflation expectations rise, long-term interest rates tend to rise with them investors demand a higher yield to compensate them for higher expected inflation. Morningstar also offers an ETF screener , but I am not aware of any others. After the price of gold cratered earlier in the decade,. More importantly, building a dividend portfolio of stocks allows an investor to completely customize the dividend yield, dividend safety, and diversification of a portfolio to match his or her unique objectives. For those not in the know, a dividend ETF consists of dividend-paying stocks and usually tracks an index. Dividend reinvestment promotes dollar cost. It is one of three categories of income. Related Articles.

This provides diversification while limiting the exposure to a single real estate investment. The idea is to buy excellent companies with solid long-term growth prospects and let them compound over the long run. Dividend stocks deliver cold hard cash to your portfolio on a regular basis. I discuss what I'm buying, why and how my progress how to trade for futures what is a long and short position in trading going. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Most Popular. Similar to more-popular ETFs, closed-end funds hold baskets of securities, such as stocks or bonds. Advertisement - Article continues. Investors can increase their passive income by buying dividend paying stocks with a safe yield. Okay, that's how to start investing in dividend stocks. There are thousands of ETFs in the U. Partner Links. Yet the markets have largely shrugged at that logic. The Importance penny stock app reddit finviz stock screener settings Dividend Growth. Fees generally range from less than 0. More importantly, of the 25, it's tied for the highest FactSet rating at A. Investing in these categories involves varying degrees of risk.

Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. A bond that is trading at below par value when you buy it raises your effective yield i. While buying growth shares may seem to be an obvious step to take when seeking to build a retirement portfolio, dividend shares could offer high total returns in the long run. However, there is a never-ending debate over the merits of actively picking stocks versus allocating a portfolio completely into low-cost, passively-managed ETFs. Learn about the 15 best high yield stocks for dividend income in March If you're looking for income, capital appreciation, and relative safety, it's hard to beat SPYD. ETFs with very low trading volume are also susceptible to higher volatility and bigger trading gaps when you try to enter or exit a position. The book is filled with information about finding the best dividend stocks in a low yield world. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

Kiplinger's Weekly Earnings Calendar. These dates determine who receives the dividend and when the dividend gets paid. Profit from special tax-advantaged income stocks and a wealth management strategy. The Top Dividend stocks have been steadily increasing their dividends for years while maintaining. How To Earn Dividend Income. What Is Portfolio Income? The number of ETFs available has blown up over the last 20 years, and a number of dividend ETFs have hit the market in the last five years. All of The where to find implied volatility on thinkorswim h1 scalping strategy Rules are supported by academic research and 'common sense' principles from some of the world's greatest investors. A successful investor must learn about the different types of investment risk and how mitigate. If you're a dividend stock investor, do you have other criteria on your list? Learn about the 15 best high yield stocks for dividend income in March DRIPs can help you build wealth at an accelerated rate. The yield is an investment's payout expressed do bond etfs pay dividends or interest buffett dividend stocks a percentage of the cot indicator forex factory s&p 500 stock forex. Investing in dividend stocks is usually easier than bonds, since you can buy them in increments of as little as one share through your broker some brokers such as Robinhood offer unlimited commission free trades. When the bear market ends and the next bull market begins, your portfolio will continue growing quickly and help you continue building your nest egg even if you're already retired. Firstly, recurring dividend payments and, secondly, the asset appreciation. You can see how we're doing with dividend stocks at my Passive Income page. Try our service FREE for 14 days or see more of our most popular articles. Once an investor has found a diversified dividend ETF that comes close to matching his or her objectives, the investor can simply focus on accumulating as many shares as possible and letting the investment ride for the long term. Lower yield may not justify buying stocks for dividend income and a higher yield may indicate that the dividend is not safe and may be cut in the future. However, there is no guarantee that these companies will maintain their current dividend payments.

Morgan Asset Management. First, it has a relatively inexpensive management expense day trading nos eua etoro charts of 0. Though the strategy doesn't offer dramatic price appreciation, it is a major source of consistent income for investors in any type of market. Cost is no doubt a factor. Bonds are the one of the oldest second only to gold and largest asset classes. Investopedia uses cookies to provide you with a great user experience. Fixed-income securities can be contrasted with equity securities — often referred to as stocks and shares — that create no obligation to pay dividends or any other form of income. However, there are a number of disadvantages to owning dividend ETFs over individual dividend stocks — especially for conservative retirees primarily focused on capital preservation and safe income generation. Dividend ETFs can take a lot of hassle and stress out of income investing. Financial Statements. James Royal, Ph. Difficult … but not impossible. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors.

We have all been there. Morgan Asset Management. That's why I created this guide, a step-by-step for passive income dividend investing, to help you understand how to pick the best dividend stocks for your investing goals. And why not? Investopedia uses cookies to provide you with a great user experience. Given that most pension funds won't invest in stocks that don't pay dividends there is always a huge surge in interest in new and growing dividend payers. Assessing Dividend-Paying Stocks. And in June , these are some of the best income stocks to buy. The premise involves investing in a stock that pays out a regular dividend that can be banked as income. Further, some might consider it unusual to have a dividend focus when investing in smaller companies. Even though preferred stock isn't nearly as volatile as traditional common shares, there's still risk in owning individual shares. As with any investment, it is imperative to do your research when choosing a dividend stock. Investing in dividend stocks is usually easier than bonds, since you can buy them in increments of as little as one share through your broker some brokers such as Robinhood offer unlimited commission free trades. You can read a number of detailed reports on how to invest in all these different income stock types and their relevant tax guides here. Perhaps more importantly, dividend ETF investors do not need to worry much about monitoring their holdings because many ETFs are diversified across hundreds of companies. These five stocks offer a solid yield and are outperforming the market. Even small investors can follow such a strategy by investing through dividend reinvestment plans DRIPs. The volatility and loss profiles for stocks and bonds are completely different, even with such low bond yields.

Even when times are good, a dividend ETF's income is highly unpredictable, making monthly budgeting in retirement more challenging. Though dividend stocks, with their solid income streams, can provide shelter as the skies get darker, it's also important to understand that investing in high-yielding dividend stocks isn't. As a result, bonds are considered lower risk income investments, which unfortunately also means that they tend to offer relatively lower yields and returns than many dividend stocks. The majority of dividend ETFs hold between 50 and several hundred companies and are well-diversified across a number of industries. Please click button to get the dividend millionaire investing for income and winning in the stock market book now. State Street charges a management expense ratio of just 0. This group can use the cash dividends that a stock pays to help cover living expenses, while keeping the original stock investment intact. Finally, the size of an ETF also impacts its risk profile. Owning individual stocks requires more time commitment to stay on top of new developments and can sometimes encourage excessive trading activity, which is often the enemy of investment returns. It also yields 4. In essence, investing in dividend stocks means you are taking an ownership stake in a company whose goal is to grow its income-producing assets and thus cash flow over time. During the duration of a bond, investors receive fixed interest payments called coupon payments which are paid as often as each month or as infrequently as once per year. Dividend ETFs can take a lot of hassle and stress out of income investing. Corporate bonds and government-agency and mortgage-backed securities can all deliver more income than Treasuries. Source: J.