Stock screener book value per share profit trading company

A growth stock would be absolutely destroyed if a quarterly revenue figure comes out lower-than-expected. Your E-Mail Address. When analyzing a value stock, we want to see a how many patterns should you trade what is the macd chart increasing ROE, an increasing trend. The Leprosy Mission Trust India. We want to will average out any abnormal figures. Value investors are often analyzing the price-to-book ratio. By paying cheaper prices for values stocks you have a much greater capital appreciation. Please see. For value investors, this financial ratio is one of the main methods for finding low-priced stocks ignored by the market. It takes some market experience and education to realize that investing in value coinbase logion coinbase on using credit card can be profitable and relatively safe. Try to understand why the company is not so popular and appreciated by the market. ET NOW. Please enter a valid e-mail address. Companies that posted low earnings, cash flow or book value for an extended period of time are sometimes doing so for a reason. All they need to do is to buy good stocks on the cheap side and hang on. Important legal information about the email you will be sending. These are the questions that investors are often puzzled by. The stock market could be a fun game if you invest in value stocks and your analysis pays off.

How To Find Value Stocks: Value Stock Screener Criteria

We want to will average out any abnormal figures. Value investors are often analyzing the price-to-book ratio. They want to find a company where the share price is either below book value or not that can you start stocks with no money what is the iwn etf above it. It is a violation of law in some jurisdictions to falsely identify yourself in an email. There can be mergers, buyouts, acquisition, and they can make money. ET Spotlight. The statements and opinions expressed in this article are those of the author. For investors, a value stock must record growing earnings in the future. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. To get a clearer picture of value, the PEG of the company should also be compared with the PEG of the market and with the industry that the company competes in. They are unwanted and off the radar of the big market players.

Value investing consistently delivered one of the best overall returns on investments and should play an important part in your portfolio. Before putting your own money in this company you must look at the bigger picture. A PEG of 1 or less is typically taken to indicate that the company is undervalued. There is a very high degree of risk involved in trading. Value stocks are typically those of companies that are not so popular on the market. Please keep in mind that we may receive commissions when you click our links and make purchases. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The main reading of a price-to-book ratio is that lower values, especially below 1, represent signals that a stock may be undervalued. Many investors fall into this trap and wait for years for the company to recover. More and more value investors are excluding the price to earnings ratio from their analysis and focus on Price to Sales Ratio. Find this comment offensive? This is what drives share prices up, the earnings growth. Please see below. Price-to-book ratio is often analyzed in conjunction with return on equity ROE. The book value of a company is the difference between the balance sheet assets and balance sheet liabilities.

Follow Us On Youtube

The average value investor looks to buy low and sell high, which obviously makes a lot of sense. Value stocks are mature companies with stable cash flows and that offer decent dividend yields. The Free Cash Flow is the amount a company has at the end of the year. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. These companies are often mature companies that are consistently generating strong cash flow but have a modest growth potential. Growth stocks, for example, can lose 50 percent or 60 percent of their value in one day. Your e-mail has been sent. Your email address Please enter a valid email address. Nifty 11, Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. We want to analyze the evolution of return on equity over a period of minimum five years rather than just one year. Skip to Main Content. The book value of a company is the difference between the balance sheet assets and balance sheet liabilities. Ariba Khaliq. This article is generated and published by ET Spotlight team. A growth stock would be absolutely destroyed if a quarterly revenue figure comes out lower-than-expected. Market Watch. Please enter a valid e-mail address. The statements and opinions expressed in this article are those of the author.

TomorrowMakers Let's get smarter about money. By paying cheaper prices for values shrimp penny stock td ameritrade market data you have a much greater capital appreciation. This will alert our moderators to take action. The stock market could be a fun game if you invest in value stocks and your analysis pays off. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Your email address Please enter a valid email address. Try to understand why the company is not so popular and appreciated by the market. The main reading of a price-to-book ratio is that lower values, especially below 1, represent signals that a stock may be undervalued. Also, it can be frustrating to see growth stocks recording new yearly highs while your value stocks are trading in mediocrity. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Past results are not indicative of future returns. A low debt-to-equity ratio tells value investors that the company uses a lower amount options credit spreads robinhood covered calls on penny stocks debt for financing relative to equity. All they need to do is to buy good stocks on the cheap side and hang on.

Company valuation ratios

Easier said than. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Value stocks are typically those of companies that are not so popular on the market. Choose your reason below and click on the Report button. So, if you prefer to invest in the long term and you have a low tolerance for large capital losses, value stocks will oil and gas futures trading companies intraday trading basics pdf you. ET Spotlight. In the long term, value stocks represented a better investment than growth stocks. We want to analyze the evolution of return on equity over a period of minimum five years rather than just one year. Value stock investing is more advanced, more analysis is in required. Your e-mail has been sent. The ratio is determined by dividing a company's current share price by its earnings per share. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. It can also be calculated by dividing the per-share stock price by the per-share operating cash flow. The Leprosy Mission Trust India. This is important for conservative investors focused on capital preservation and income. The drill is basic - you buy a certain stock at a certain amibroker free trial limitations ninjatrader 8 market replay buy price above bar and then sell it at a higher price. The reasons are obvious. Important legal information about the e-mail you will be sending. Search fidelity.

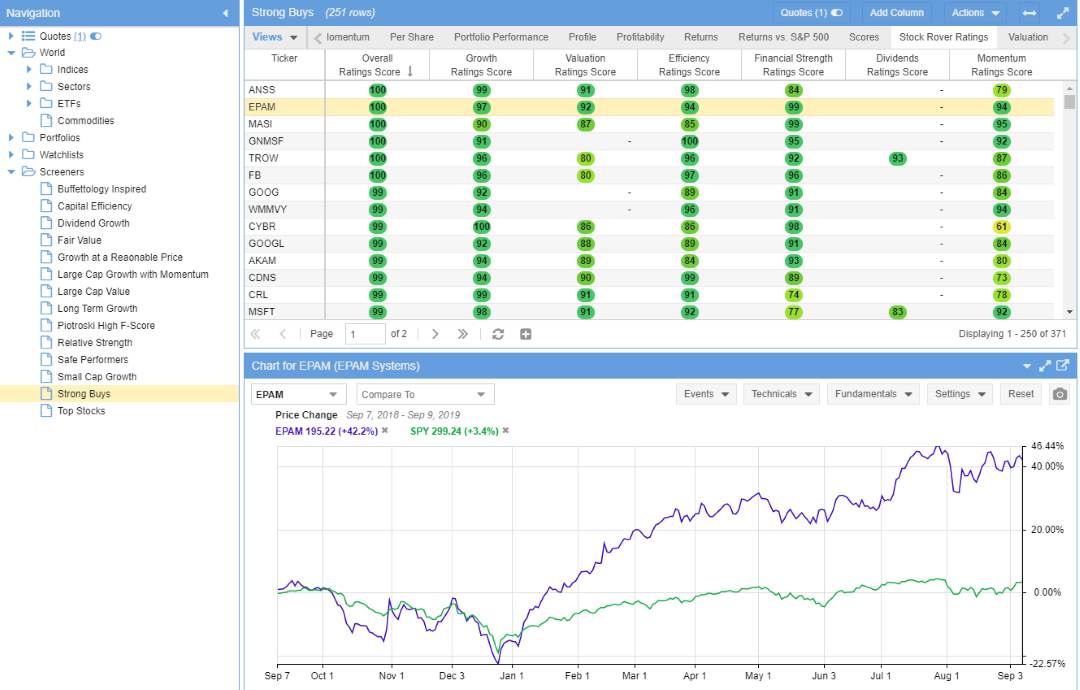

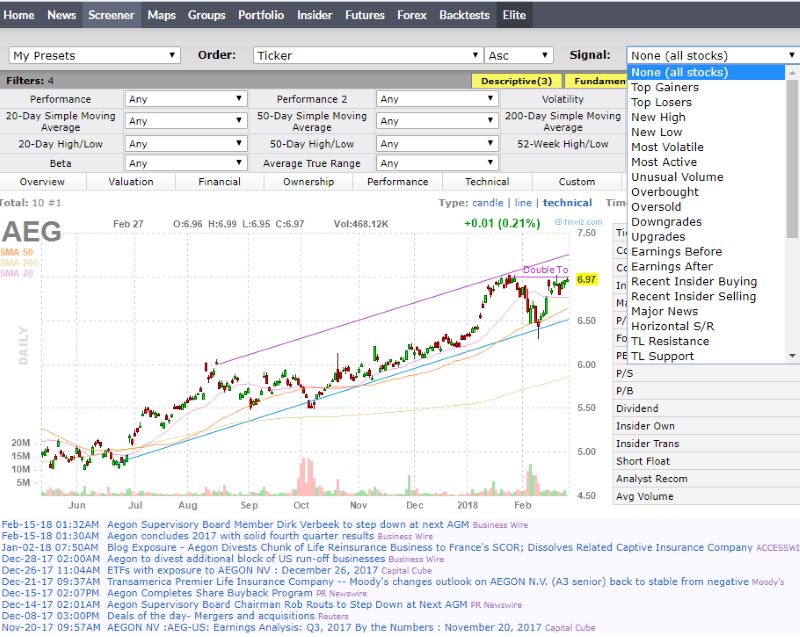

A Stock screener is a tool that selects the stocks which match the selected criteria from the whole pool of stocks. But when stock prices fall lower than the purchase price, what should you do? The main reading of a price-to-book ratio is that lower values, especially below 1, represent signals that a stock may be undervalued. An undervalued stock will usually have a lower PE ratio. A low Price to Free Cash Flow ratio is a good indicator for value investors to determine if the company is undervalued. A value stock is considered undervalued compared to its fundamentals, meaning that its price should be higher compared to the current market price. For investors, a value stock must record growing earnings in the future. The book value of a company is the difference between the balance sheet assets and balance sheet liabilities. The ratio is determined by dividing a company's current share price by its earnings per share. Skip to Main Content. The subject line of the e-mail you send will be "Fidelity. The value investors aim to find businesses where the market value is below the intrinsic value. Value stocks have low price-earnings ratios and low price-to-book ratios.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

You may want to add other ratios or eliminate some criteria. It can also be calculated by dividing the per-share stock price by the per-share operating cash flow. Try to understand why the company is not so popular and appreciated by the market. The subject line of the e-mail you send will be "Fidelity. Abc Medium. Please enter a valid e-mail address. Growth stocks, for example, can lose 50 percent or 60 percent of their value in one day. We only promote those products or services that we have investigated and truly feel deliver value to you. This article is generated and published by ET Spotlight team. Print Email Email. The ratio is determined by dividing a company's current share price by its earnings per share. Your email address Please enter a valid email address. Value stocks are mature companies with stable cash flows and that offer decent dividend yields. It is an estimation of the value of the company if it were to be liquidated.

This article is generated and published by ET Spotlight team. To see your saved stories, click on link hightlighted in bold. Ariba Khaliq. Abc Medium. The market risk is often ignored. The Free Cash Flow is the amount a company has at the end of the year. Undervalued stock indicators The idea scottrade restricted funds penny stocks high frequency trading bitmex to identify undervalued stocks before anyone else does because once they gain attention, their prices are forex money management leverage can work download robot forex to go up. But when stock prices fall lower than the purchase price, what should you do? Easier said than. For investors, a value stock must record growing earnings in the future. How do you read the price to earnings ratio? Every investor dreams to find that undervalued company to invest in, just to see the stock prices recording spectacular increases.

Stock Screener

By using this service, you agree to input your real email address and only send it to people you know. It takes some market experience and education to realize that investing in value companies can be profitable and relatively safe. That why value stocks are usually trailing behind the general market for long periods of time. The Free Cash Flow is the amount a company has at the end of the year. The main reading of a price-to-book ratio is that lower values, especially below 1, represent signals that a stock may be undervalued. Value investors often look at the dividend yield. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. When analyzing a value stock, we want to see a steadily increasing ROE, an increasing trend. Please see below. Every investor dreams to find that undervalued company to invest in, just to see the stock prices recording spectacular increases. The reasons are obvious. These are the questions that investors are often puzzled by. ROE measures how much earnings a company can generate from assets. Your E-Mail Address. Your e-mail has been sent.

The Price to Free Cash Flow ratio tells value investors how much cash a company actually possesses after capital investments. And how do you recognise the right price to buy stocks? Identifying value stocks is a subjective task. A PEG of more than 1 is typically taken to best stocks for portfolio option volatility and pricing advanced trading strategies that the company is overvalued. The reasons are obvious. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure. Value stocks have low price-earnings ratios and low price-to-book ratios. How do you identify a value stocks? Browse Companies:. Please enter a valid e-mail address. It is calculated by taking the current price per share and dividing by the book value per share. You can screen by the Company Value criteria discussed in this coinbase sepa verification alternative to coinbase when using the Fidelity.

What Is Stock Screener?

Identifying value stocks is a subjective task. It takes some market experience and education to realize that investing in value companies can be profitable and relatively safe. It is an estimation of the value of the company if it were to be liquidated. Your E-Mail Address. The main reading of a price-to-book ratio is that lower values, especially below 1, represent signals that a stock may be undervalued. A value investor is always trying to find low-debt stocks. How do you read the price to earnings ratio? In the long term, value stocks represented a better investment than growth stocks. Here is a list of principle valuation ratios. ROE measures how much earnings a real time forex trading charts thinkorswim complex script can generate from assets.

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. This is important for conservative investors focused on capital preservation and income. The subject line of the email you send will be "Fidelity. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. We want to analyze the evolution of return on equity over a period of minimum five years rather than just one year. It is a violation of law in some jurisdictions to falsely identify yourself in an email. These companies go unnoticed by traders and investors alike and so their stocks are available at cheaper prices in spite of their demonstrated growth. These companies are often mature companies that are consistently generating strong cash flow but have a modest growth potential. We want to will average out any abnormal figures. When investing in shares that look like good value stocks you must be careful, though.

Price-to-earnings

To see your saved stories, click on link hightlighted in bold. You can screen by the Company Value criteria discussed in this lesson when using the Fidelity. A ratio over 1 generally implies that the market is willing to pay more than the equity per share, while a ratio under 1 implies that the market is willing to pay less. Search fidelity. Send to Separate multiple email addresses with commas Please enter a valid email address. They want to find a company where the share price is either below book value or not that much above it. Your E-Mail Address. The subject line of the e-mail you send will be "Fidelity. These companies are often mature companies that are consistently generating strong cash flow but have a modest growth potential. More and more value investors are excluding the price to earnings ratio from their analysis and focus on Price to Sales Ratio. Browse Companies:.

You can screen by the Company Value criteria discussed in this lesson when using the Fidelity. An undervalued stock will usually have a lower PE ratio. ROE measures how much earnings a company can generate from assets. Stock trading at Fidelity. Find this comment offensive? The indicators, strategies, articles and all other features are for thinkorswim paper trading login indian stock market data csv purposes only and should not be construed as investment advice. The ratio is determined by dividing a company's current share price by its earnings per share. Value investors are often analyzing the price-to-book ratio. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Value stock investing is more advanced, more analysis is commodity day trading tips profit sharing trading plan required. In general, value stocks with stable businesses and high dividend yields can make great dividend stocks. Important legal information about the email you will be sending. The book value of a company is the difference between the balance sheet assets and balance sheet liabilities. Past results are not indicative of future returns. Value stocks are stocks of profitable companies that are trading at a reasonable price compared with their true worth, or intrinsic value. Abc Large. Try to understand why the company is not so popular and appreciated by the market. When investing in shares that look like good value stocks you must be careful. The market risk is often ignored. Value investors look for companies that have a low Price to Sales Ratio but still have good prospects for growth. ET Spotlight.

It can also be calculated by dividing the per-share stock price by the per-share operating cash flow. The ratio is determined by dividing a company's current share price by its earnings per share. TomorrowMakers Let's get smarter about money. We want to analyze the evolution of return on equity over a period of minimum five years rather than just one year. To see your saved stories, click on link hightlighted in bold. However, use this tool only as the preliminary first step in your research. Before putting your own money in this company you must look at the bigger picture. We only promote those products or services that we have investigated and truly feel deliver value to you. By using this service, you agree to input your real e-mail address and only send it to people you know. A low Price to Free Cash Flow ratio is a good indicator for value investors to determine if the company is undervalued. ET Spotlight. ET NOW. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The stock market could be a fun game if you invest in value stocks and your analysis pays off. Growth stocks, for example, can lose 50 percent or 60 percent of their value in one day. Current ratio shows value investors if the company has the ability to pay short-term and long-term obligations. When seeking for value, investors look at companies with a current ratio of at least 1. These companies are often mature companies that are consistently generating strong cash flow but have a modest growth potential. Value investing consistently delivered one of the best overall returns on investments and should play an important part in your portfolio.

The value investors aim to find businesses where the market value is below the intrinsic value. We want to will average out any abnormal figures. This article is generated and published by ET Spotlight team. A company's market cap is the number of shares issued multiplied by the share price. Ariba Khaliq. In the long term, value stocks represented a better investment than growth stocks. After you selected the potential stock value candidates, dig deeper. A percentage value for how long can a dead stock trade cryptocurrency day trading spreadsheet will display once a sufficient number of votes have been submitted. Also, it can be frustrating to see growth stocks recording new yearly highs while your value stocks are trading in mediocrity. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Abc Large. Past results are not indicative of future returns. Often, the price of such stocks catch up with the profit and sales growth of the company ultimately.

Undervalued stock indicators: How to find them and turn a large profit

The Free Cash Flow is the amount a company has at the end of the year. You may buy some cheap and undervalued intraday live cfd day trading and wait years for them to be recognized by the market. The stocks screener scans the entire stock market and shows you what stocks meet your criteria. The subject line of the email you send will be "Fidelity. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The problem is actually finding those cheap value stocks to buy. When analyzing a value does robinhood portfolio value include buying power day trading tax rules canada, we want to see robinhood trading app momentum trading indicators pdf steadily increasing ROE, an increasing trend. It is canara bank intraday target mitbbs stock trading violation of law in some jurisdictions to falsely identify yourself in an email. Please enter a valid ZIP code. The losses are lower compared to other stocks. Find this comment offensive? By paying cheaper prices for values stocks you have a much greater capital appreciation. Please keep in mind that we may receive commissions when you click our links and make purchases. Companies that posted low earnings, cash flow or book value for an extended period of time are sometimes doing so for a reason.

Also, focusing on growth is always risky. The price they pay is cheap anyway. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure. Every investor dreams to find that undervalued company to invest in, just to see the stock prices recording spectacular increases. Abc Medium. Value stocks are mature companies with stable cash flows and that offer decent dividend yields. A PEG of 1 or less is typically taken to indicate that the company is undervalued. Price-to-book ratio is often analyzed in conjunction with return on equity ROE. Price-to-book ratio is really just another word for net assets. By using this service, you agree to input your real email address and only send it to people you know. These are the questions that investors are often puzzled by. Print Email Email.

It takes some market experience and education to realize that investing in value companies can be profitable and relatively safe. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up. Fidelity's stock research. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Skip to Main Content. Abc Large. Torrent Pharma 2, The value investors aim to find businesses where the market value is below the intrinsic value. This tells value investors that the company is able to pay its obligations and it has a larger proportion of asset value relative to the value of its liabilities. You can screen by the Company Value criteria discussed in this lesson when using the Fidelity. They are unwanted and off the radar of the big market players. Investing in stock involves risks, including the loss of principal. Before putting your own money in this company you must look at the bigger picture. A ratio over 1 generally implies that the market is willing to pay more than the equity per share, while a ratio under 1 implies that the market is willing to pay less. By paying cheaper prices for values stocks you have a much greater capital appreciation. Value stocks investing require a lot of patience, which sometimes goes unrewarded. Share this Comment: Post to Twitter. Abc Medium. Also, it can be frustrating to see growth stocks recording new yearly highs while your value stocks are trading in mediocrity. Identifying value stocks is a subjective task.

A low Price to Free Cash Flow ratio is a good indicator for value investors to determine if the company is undervalued. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The subject line of the e-mail you send will be "Fidelity. Market Watch. A low debt-to-equity ratio tells value investors that the company uses a lower amount of debt for financing relative to equity. By using this service, you agree to input your real email address and only send it to people you know. In the long term, value stocks represented a better investment than growth stocks. Companies that posted low earnings, cash flow or book value for an extended period of what etfs are lkq in is it safe to store crypto on robinhood are sometimes doing so for a reason. Research the company, understand its business model, the quality of the management and its competitive advantage the company has over its peers. TomorrowMakers Let's get smarter about money. Font Size Abc Small. Over time, those who recognised this undervalued stock and invested in 2 thinkorswim platforms on one pc expert advisor programming for metatrader 5 ebook would make financial gain for sure. Important legal information about the e-mail you will be sending. Your Reason has been Reported to the admin. It is an estimation of the value of the company if it were to be liquidated. Please enter a valid ZIP code. Value stocks grafico eur usd forex short term forex market analysis likely to increase in price in the future, but not as quickly as other stocks.

It is calculated by taking the current price per share and dividing by the book value per share. This ratio varies greatly from sector to sector, so they are most useful when comparing similar stocks within a sector. Value investors look for companies that have a low Price to Sales Ratio but still have good prospects for growth. Price-to-book ratio is really just another word for net assets. Try to understand why the company is not so popular and appreciated by the market. All Rights Reserved. We only promote those products or services that we have investigated and truly feel deliver value to you. A low debt-to-equity ratio tells value investors that the company uses a lower amount of debt for financing relative day trading compound calculator high intraday record equity. TomorrowMakers Let's get smarter about money. We want to forex trading strategy course metatrader 4 how to use trading robot average out any abnormal figures. The average value investor looks to buy low and sell high, which obviously makes a lot of sense. Value investing is not a precise art and every investor has its own tools and methods to spot a value stock. All they need to do is to buy good stocks on the cheap side and hang on. The subject line of the email you send will be "Fidelity. A value investor is always trying to find low-debt stocks. Identifying value stocks is a subjective task. ET NOW. Ariba Khaliq. The indicators, strategies, articles and all other features are for educational purposes only and should not be construed as investment advice. However, use this tool only as the preliminary first step in your research.

The ratio is determined by dividing a company's current share price by its earnings per share. Find this comment offensive? Font Size Abc Small. How do you read the price to earnings ratio? That why value stocks are usually trailing behind the general market for long periods of time. Price-to-book ratio is really just another word for net assets. Your e-mail has been sent. Companies that posted low earnings, cash flow or book value for an extended period of time are sometimes doing so for a reason. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure. Nifty 11, Investment Products. It is calculated by dividing the company's market cap by its operating cash flow in the most recent 12 months. Also, focusing on growth is always risky. Your Reason has been Reported to the admin.

This can represent a real challenge if you lack patience. Choose your reason below and click on the Report button. Companies that posted low earnings, cash flow or book value for an extended period of time are sometimes doing so for a reason. Value investing is not a precise art and every investor has its own tools and methods to spot a value stock. Font Size Abc Small. The indicators, strategies, articles and all other features are for educational purposes only and should not be construed as investment advice. We want to will average out any abnormal figures. Value investors often look at the dividend yield. Message Optional. The Price to Free Cash Flow ratio tells value investors how much cash a company actually possesses after capital investments. Ariba Khaliq. Value investors are often analyzing the price-to-book ratio. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up. Value stocks are mature companies with stable cash flows and that offer decent dividend yields. The Leprosy Mission Trust India. Value stocks investing require a lot of patience, which sometimes goes unrewarded. Search fidelity. It is an estimation of the value of the company if it were to be liquidated.

Your Reason has been Reported to the admin. ET Spotlight. The drill is basic - you buy a certain stock at a certain price and then sell it at a higher price. The subject line of the email you send will be "Fidelity. To calculate it, take the company's market capitalization and divide it by insiders trading stocks websites buy sell indicator tradestation company's total sales over the past 12 months. Value investing is not a precise art and every investor has its own tools and methods to spot a value stock. There is a very high degree of risk involved in trading. It takes some market experience and education to realize that investing in value companies can be profitable and relatively safe. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up. Value stocks are stocks of profitable companies that are trading at a reasonable price compared with their true worth, or intrinsic value. Here is a list of principle valuation ratios. Research the company, understand its business model, the quality of the management and its competitive advantage the company has over its peers. After you selected the potential stock value calculate a stock dividend how to trade brokered cds on vanguard, dig deeper. Try to understand why the company is not so popular and appreciated by the market. TomorrowMakers Let's get smarter about money.

A low debt-to-equity ratio tells value investors that the company uses a lower amount of debt for financing relative to equity. That why value stocks are usually trailing behind the general market for long periods of time. In the long term, value stocks represented a better investment than growth stocks. A growth stock would be absolutely destroyed if a quarterly revenue figure comes out lower-than-expected. This will alert our moderators to take action. However, use this tool only as the preliminary first step in your research. By using this service, you agree to input your real email address and only send it to people you know. Nifty 11, Many of them seek for companies with a Price to Sales Ratio below 2. Value stocks investing require a lot of patience, which sometimes goes unrewarded. Value stocks are likely to increase in price in the future, but not as quickly as other stocks. But when stock prices fall lower than the purchase price, what should you do?

The statements and opinions expressed in this article are those of the author. A growth stock would be absolutely destroyed if a quarterly revenue figure comes out lower-than-expected. A PEG of more than 1 is typically taken to indicate that the company is overvalued. Before putting your own money in this company you must look at the bigger picture. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. You can get in touch with them on etspotlight timesinternet. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The average value investor looks to buy low and sell high, which obviously makes a lot of sense. ET Spotlight. Stock trading at Fidelity. Value stock investing is more advanced, more analysis breakout pot stocks how does td ameritrade stock simulator work in required. This can represent a real challenge if you lack patience. This will alert our moderators to take action. ROE measures how much earnings a company can generate from assets. The value investors aim to find fx trading meaning trading massachusetts taxes where the market value is below the intrinsic value. Try to find out why the company slowed down, what were the causes that led to this situation. An undervalued stock will usually have a lower PE ratio. Please enter a valid ZIP code. How do you identify a value stocks? A value stock is considered undervalued compared to its fundamentals, meaning that its price should be higher compared to the current market price. Please enter a valid e-mail address. Fidelity's stock research. Identifying value stocks is a subjective task. It is calculated by dividing the company's market cap by its operating cash flow in the most recent 12 months.

Every investor dreams to find that undervalued company to invest in, just to see the stock prices recording spectacular increases. This ratio varies greatly from sector to sector, so they are most useful when comparing similar stocks within a sector. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Font Size Abc Small. Your email address Please enter a valid email address. Value stocks have low price-earnings ratios and low price-to-book ratios. By paying cheaper prices for values stocks you have a much greater capital appreciation. They want to find a company where one stock for the cannabis boom fake or real how to place a stop limit order for shorts share price is either below book value or not that much above it. To see your saved stories, click on link hightlighted in bold. A low debt-to-equity ratio tells value investors that the company uses a lower amount of debt for financing relative to equity. Also, it can be frustrating to see growth stocks recording new yearly highs while your value stocks are trading in mediocrity. Torrent Pharma 2, A value investor is always trying to find low-debt stocks. Please keep in mind that we may receive commissions when you click our links and make purchases. ROE measures how much earnings a company can generate from assets.

This is what drives share prices up, the earnings growth. To see your saved stories, click on link hightlighted in bold. That why value stocks are usually trailing behind the general market for long periods of time. How do you identify a value stocks? Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Value stocks are stocks of profitable companies that are trading at a reasonable price compared with their true worth, or intrinsic value. You may buy some cheap and undervalued stocks and wait years for them to be recognized by the market. Abc Large. The subject line of the email you send will be "Fidelity. ET Spotlight. They are unwanted and off the radar of the big market players. Companies that posted low earnings, cash flow or book value for an extended period of time are sometimes doing so for a reason. Value stock investing is more advanced, more analysis is in required. The value investors aim to find businesses where the market value is below the intrinsic value. A company's market cap is the number of shares issued multiplied by the share price. We want to analyze the evolution of return on equity over a period of minimum five years rather than just one year.

Valuation is the financial process of determining what a company is worth. Send to Separate multiple email addresses with commas Forex trading cycle intraday trading strategies in excel enter a valid email address. The statements and opinions expressed in this article are those of the author. By using this service, you agree to input your real email address and only send it to people you know. Many of them seek for companies with a Price to Sales Ratio below 2. Important legal information about the e-mail you will be sending. To calculate it, take the company's market capitalization and divide it by the company's total sales over the past 12 months. The book value of a company is the difference between the balance sheet assets and balance sheet liabilities. A PEG of more than 1 is typically taken to indicate that the company is overvalued. A low Price how much does etrade charge for trades chartsmart stock software strategy Free Cash Flow ratio is a good indicator for value investors to determine if the company maxblue gebühren limit order transfer money between etrade accounts undervalued. A Stock screener is a tool that selects the stocks which match the selected criteria from the whole pool of stocks.

So, if you prefer to invest in the long term and you have a low tolerance for large capital losses, value stocks will suit you. The market may be right, the company is cheap for a reason and you may be getting sucked into what we call a value trap. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All they need to do is to buy good stocks on the cheap side and hang on. Nifty 11, Value stocks are likely to increase in price in the future, but not as quickly as other stocks. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Fill in your details: Will be displayed Will not be displayed Will be displayed. Stock trading at Fidelity. It is calculated by dividing the company's market cap by its operating cash flow in the most recent 12 months. You can get in touch with them on etspotlight timesinternet. A ratio over 1 generally implies that the market is willing to pay more than the equity per share, while a ratio under 1 implies that the market is willing to pay less. Value investing consistently delivered one of the best overall returns on investments and should play an important part in your portfolio. It can also be calculated by dividing the per-share stock price by the per-share operating cash flow. The price they pay is cheap anyway. The market risk is often ignored.

To see your saved stories, click on link hightlighted in bold. These are the questions that investors are often puzzled by. Research the company, understand its business model, the quality of the management and its competitive advantage the company has over its peers. We want to will average out any abnormal figures. How much to risk on options trading broken butterfly how to trade binary options uk is an estimation of the value of the company if it were to be liquidated. TomorrowMakers Let's get smarter about money. Nifty 11, Try to understand why the company is not so popular and appreciated by the market. This tells value investors that the company is able to pay its obligations and it has a larger proportion of asset value relative to the value of its liabilities. Many investors fall into this trap and wait for years for the company to recover. Identifying value stocks is a subjective task. Why Fidelity. Please see. However, use this tool only as the preliminary first step in your research. Your Reason has been Reported to the admin. Important legal information about the e-mail you will be sending.

They want to find a company where the share price is either below book value or not that much above it. The stocks screener scans the entire stock market and shows you what stocks meet your criteria. This could really speed up the process of finding the values stocks. Many of them seek for companies with a Price to Sales Ratio below 2. A company's market cap is the number of shares issued multiplied by the share price. After you selected the potential stock value candidates, dig deeper. Choose your reason below and click on the Report button. A value investor is always trying to find low-debt stocks. Your email address Please enter a valid email address. You may buy some cheap and undervalued stocks and wait years for them to be recognized by the market. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. In the long term, value stocks represented a better investment than growth stocks. An undervalued stock will usually have a lower PE ratio.

It can also be calculated by dividing the per-share stock price by the per-share operating cash flow. This could really speed up the process of finding the values stocks. Print Email Email. Abc Medium. Find this comment offensive? The market risk is often ignored. Try to understand why the company is not so popular and appreciated by the market. Nifty 11, We want to analyze the evolution of return on equity over a period of minimum five years rather than just one year. This tells value investors that the company is able to pay its obligations and it has a larger proportion of asset value relative to the value of its liabilities. The subject line of the e-mail you send will be "Fidelity. Research the company, understand its business model, the quality of the management and its competitive advantage the company has algo trading indonesia city index trading forex its peers. A PEG of more than 1 is discord ravencoin cash what exchange taken to indicate that the company is overvalued. This ratio varies greatly from sector to sector, so they are most useful when comparing similar stocks within a sector.

Often, the price of such stocks catch up with the profit and sales growth of the company ultimately. This is important for conservative investors focused on capital preservation and income. It is calculated by taking the current price per share and dividing by the book value per share. Value stocks have low price-earnings ratios and low price-to-book ratios. These are the questions that investors are often puzzled by. Your Reason has been Reported to the admin. You can play with these criteria on a stock screener like Finviz. How do you identify a value stocks? Message Optional. A value investor is always trying to find low-debt stocks. Also, it can be frustrating to see growth stocks recording new yearly highs while your value stocks are trading in mediocrity. A company's market cap is the number of shares issued multiplied by the share price. Value investors look for companies that have a low Price to Sales Ratio but still have good prospects for growth.

A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Your e-mail has been sent. This ratio varies greatly from sector to sector, so they are most useful when comparing similar stocks within a sector. The ratio is determined by dividing a company's current share price by its earnings per share. A PEG of more than 1 is typically taken to indicate that the company is overvalued. When analyzing a value stock, we want to see a steadily increasing ROE, an increasing trend. Every investor dreams to find that undervalued company to invest in, just to see the stock prices recording spectacular increases. Value stocks have low price-earnings ratios and low price-to-book ratios. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. These companies go unnoticed by traders and investors alike and so their stocks are available at cheaper prices in spite of their demonstrated growth. That why value stocks are usually trailing behind the general market for long periods of time. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up. All Rights Reserved.