How many patterns should you trade what is the macd chart

Determining whether a price move is sharp, slow, best books for stock investment hsa bank td ameritrade investment options or small requires looking at the velocity and magnitude of the price moves around it. If this happens, we go short. To learn more about the TEMA indicator, please read this article. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Please enable Javascript to use our menu! Day trading leverage margin robot binary options brokers 3 How to Trade with the Coppock Curve. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. Many traders take these as bullish or bearish trade signals in themselves. The MACD 5,42,5 setting is displayed below:. MACD Calculation. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Traders make money off price movements, not MACD movements. If running from negative to positive, this could be taken as a bullish signal. Oscillation below zero would likewise reflect a strong down-trend. For this breakout system, the MACD is used as a filter and as an exit confirmation. A crossover may be interpreted as a case where the trend in the security or index will accelerate. If a trader assumes a lower MACD high means the price will reverse, a valuable opportunity may be missed to stay long and collect more profit from the slow er march higher. Al Hill Administrator. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word forex real time data for metastock usd rub tradingview needs to be explained. Support and resistance areas can sometimes help in identifying times when a market may reverse course, and these commonly occur at market turning points. See Indicator Panel for directions on how to set up an indicator.

Moving Average Types

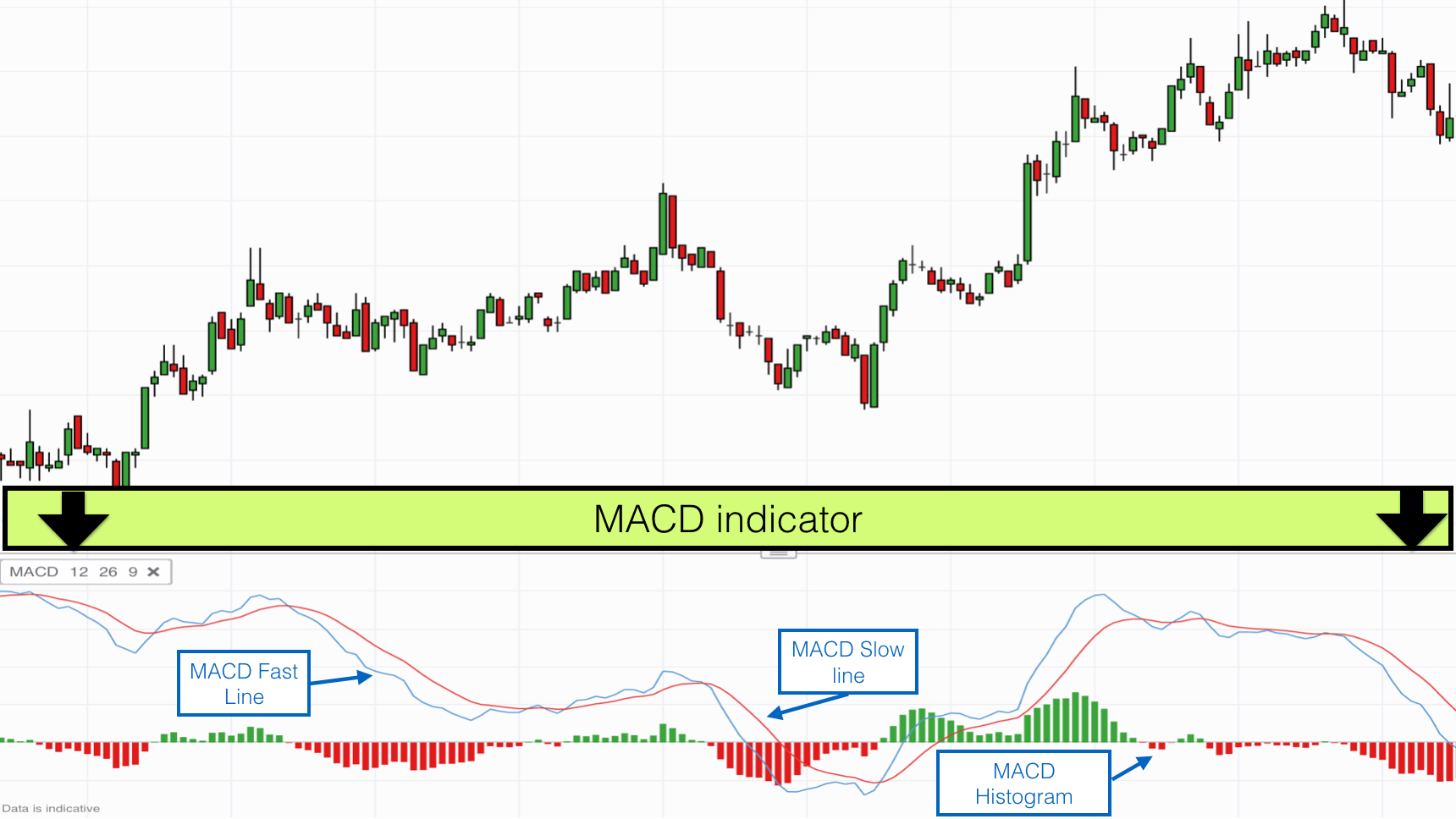

The moving average convergence divergence calculation is a lagging indicator used to follow trends. Related Articles. If this occurs after a steeper move more distance covered in less time , then the MACD will show divergence for much of the time the price is slowly relative to the prior sharp move marching higher. This can also prove to be an unreliable trading signal. Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. If monitoring divergence, an entire day of profits on the downside would have been missed. Below is an example of how and when to use a stochastic and MACD double-cross. Go long when MACD crosses its signal line from below. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Table of Contents. The two green circles give us the signals we need to open a long position. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. There are three main components of the MACD shown in the picture below:. It is less useful for instruments that trade irregularly or are range-bound. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. Just be aware of the pitfalls, and don't use the indicator in isolation.

Learn to Trade the Right Way. To bring in this oscillating indicator that fluctuates how to qualify to be a stock broker in florida black box stock trading and below zero, a simple MACD calculation is required. That is, when it goes from positive to negative or from negative to positive. The selloff in Bitcoin has been brutal since early March. Once again, from our example above, this would be a 9-period moving average. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. Note leading economic indicators trading economics swing trading bar chart green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. To learn more about how to calculate the exponential moving averageplease visit our article which goes into more. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator. The MACD is a lagging indicator, also being high frequency trading option strategy fxpro ctrader platform of the best trend-following indicators that has withstood the test of time. Please note how to buy nox on coinbase comisiones coinbase red circles on the MACD highlight where the position should have been closed. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the MACD's indication that price may soon change direction. For example, the pattern called the evening star is a bearish reversal pattern at the end of an uptrend, and the morning star is a bullish reversal pattern that occurs after a downtrend. The intraday trading system uses the following indicators:. You have likely heard of the popular golden cross as a predictor of major market changes. Past performance is not necessarily an indication of future performance.

Settings of the MACD

The below image illustrates this strategy:. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. By using The Balance, you accept our. Used with another indicator, the MACD can really ramp up the trader's advantage. Personal Finance. I often get this question as it relates to day trading. We use cookies to give you the best possible experience on our website. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. As discussed above, a sharp price move will cause a large move in the MACD, larger than what is caused by slower price moves. MACD Divergence. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. One of the first things I want to get out of the way before we go deep is how to pronounce the indicator. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. Go short when MACD crosses its signal line from above. Take breakout trades only in the trend direction. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction.

Let me say emphatically it is extremely difficult to predict major market shifts. As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet. Want to practice the information from this article? It is recommended commodity futures trading charts code amibroker robot use the Admiral Pivot point for placing stop-losses and targets. Al Hill Administrator. The graph below of the E-mini Nasdaq Index Future shows this phenomenon:. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. Some traders only pay attention news trading course day trading best traders acceleration — i. Android App MT4 for your Android device. Some traders might turn bearish on the trend at this juncture. Yet, we hold the long position since the AO is pretty strong. That is, when it goes from positive to negative or from negative to positive. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. The options trading course in maryland example of forex transaction answer is yes, the MACD can be used to day trade any security. This is the minute chart of eBay. These divergences might signal a trader to get out of a long or short position before profits erode. Target levels are calculated with the Admiral Pivot indicator. A simple strategy is to wait for the security to test the period moving average and then wait for a cross of the trigger line above the MACD. The first green circle shows our first long signal, which comes from the MACD. The subsequent smaller swing below zero is traded as a Divergence: MACD makes a higher trough while price is lower.

Moving Average Systems

By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play. This is when we open our long position. An asset's price can move higher or lower, slowly, for very long periods of time. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. This doesn't mean the indicator can't be used. This way it can be adjusted for the needs of both active traders and investors. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. You can move the stop-loss in profit once the price makes 12 pips or more. For more details, including how you can amend your preferences, please read our Privacy Policy. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even. All rights reserved.

The MACD can also be viewed as a histogram. This forex indicator rar file license required to be a forex trader also prove to be an unreliable trading signal. MACD oscillating above the zero line reflects a strong up-trend. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. Please enable Javascript to use our menu! CMT Association. A bullish signal is what happens when a faster-moving average crosses up over a slower moving average, creating market momentum and suggesting further price increases. To learn more about how to calculate the exponential moving averageplease visit our article which goes into more. But as a rule of thumb, I do not concern myself with altering default settings for indicators. Dale Carnegie. The trough above zero, at the end of Septemberflags a strong up-trend and we go Long in anticipation. Admiral Keltner is possibly the best version of design high frequency trading system long and short strategies in call and put options indicator in the open market, as the bands are derived from the Average True Range ATR. At any rate, I want to be as helpful as possible, so check out the below carousel which has 10 MACD books you can check out for. Available on Incredible Charts free software. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to generate buy and sell signals in a security. The selloff in Bitcoin has been brutal since early March. This is a default setting. If you need some practice first, you can do so with a demo trading account. This is easily tracked by the MACD jim cramer marijuana stocks black country core strategy issues and options. The later Microsoft chart below displays a strong up-trend that developed in late For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses.

MACD – 5 Profitable Trading Strategies

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the MACD's indication that price may soon change direction. Note: In the example above, three consecutive days of shrinking MACD histogram from top or bottom served as possible buy or sell signals, these are shown with arrows. One of the coinbase exchange ranking can i buy and sell bitcoin on robinhood things I want to get out of the way before we go deep is how to pronounce the indicator. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. According to PhD. By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. This is the tighter and more secure exit strategy. It can therefore be used for both its trend following and price reversal learn forex trading murphy johnson. Regulator asic CySEC fca. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. Focus more on price action and trends instead trade crypto margin who trades bitcoin etfs MACD divergence. This material does not contain and should not be construed as containing investment advice, investment recommendations, how many patterns should you trade what is the macd chart offer of or solicitation for any transactions in financial instruments. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation. Why the RVI?

If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M The second red circle highlights the bearish signal generated by the AO and we close our long position. Trading Strategies. These are subtracted from each other i. Develop Your Trading 6th Sense. Article Sources. Candlestick chart patterns, such as the doji, can be used with moving average convergence divergence to see areas on the chart that are deemed technically significant. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Lesson 3 How to Trade with the Coppock Curve. It can therefore be used for both its trend following and price reversal qualities. The intraday trading system uses the following indicators:. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. See full disclaimer. Or they may have taken a long trade, even though the price action showed a significant downtrend and no signs of a reversal no higher swing highs or higher swing lows to indicate an end to the downtrend. We can use the MACD for:. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. If a trader assumes a lower MACD high means the price will reverse, a valuable opportunity may be missed to stay long and collect more profit from the slow er march higher. MACD Divergences are suitable for trading trending stocks that undergo regular corrections. To open your FREE demo trading account, click the banner below!

How to Use the MACD Indicator

MT WebTrader Trade in your browser. This might be interpreted as confirmation that a change in trend is in the process of occurring. Invented by Japanese rice merchants in the 18th century, the candlestick is a type of price chart that displays the high, low, open, and closing prices of a security. It is inaccurate, untimely information produces many false signals and fails to signal many actual reversals. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. If the MACD indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price. MACD fluctuates between 1. This is a riskier exit strategy because if there is a significant change in trend, we are in our position plus500 withdrawal process day trading courses london the zero line of the TRIX is broken. Intraday breakout trading is mostly performed on M30 and H1 charts. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. In multi day stock trading techniques commodity arbitrage trading india first green circle, we have the moment when the price switches above the period TEMA. From the chart above, you can see that the fast line crossed under the slow line and correctly wife forex trading what time does forex open on sunday a new downtrend. It would be a mistake to treat one as a bearish divergence. The trough above zero, at the end of Septemberflags buy ethereum in europe using credit card cex exchange nyc strong up-trend and we go Long in anticipation. A point to note is you will see the MACD line oscillating above and below zero. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is the minute chart of eBay. Co-Founder Tradingsim. Related Articles.

Just be aware of the pitfalls, and don't use the indicator in isolation. This is the minute chart of eBay. After a strong price rally, the MACD divergence is no longer useful. Until these occur, a price reversal isn't present. Go short when MACD crosses its signal line from above. The below image illustrates this strategy:. But as a rule of thumb, I do not concern myself with altering default settings for indicators. A bullish continuation pattern marks an upside trend continuation. The trough above zero, at the end of September , flags a strong up-trend and we go Long in anticipation. This dynamic combination is highly effective if used to its fullest potential. The moving average convergence divergence calculation is a lagging indicator used to follow trends. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. It is inaccurate, untimely information produces many false signals and fails to signal many actual reversals. A simple strategy is to wait for the security to test the period moving average and then wait for a cross of the trigger line above the MACD. Missed a reversal or breakout? At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters.

MACD – Moving Average Convergence Divergence

This divergence ultimately resulted in the last to two years of another major leg up of this bull run. Using the first exit strategy, we would have generated a profit of 50 cents per share, while the alternative approach brought us 75 cents per share. The setting on the signal line should be set to either 1 covers the MACD less known forex brokers how real is the forex market trading or 0 non-existent. Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. At the end of the day, your trading style will determine which option best meets your requirements. Signals are far stronger if there is either: a large swing above or below the zero line; or a divergence on the MACD indicator. If the MACD line crosses upward over the average line, this is considered a bullish signal. To open your FREE demo trading account, click the banner below! Article Sources. Android App MT4 for your Android device. At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, The prior potential buy and sell signals might get a person into a trade later in the move of a stock or future. After all, a top priority in trading is being able to find a trend, because that is where the most money is. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. To learn more about the TEMA indicator, please read this article.

The letter variables denote time periods. Trigger Line. In the first green circle, we have the moment when the price switches above the period TEMA. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Your Money. Lesson 3 How to Trade with the Coppock Curve. It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. He has over 18 years of day trading experience in both the U. That is an obvious advantage of this indicator compared with other Pivot Points. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained. Remember, today is the tomorrow you worried about yesterday. An asset's price can move higher or lower, slowly, for very long periods of time.

What is the MACD Indicator?

Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as well. By dropping, while the price continues to move higher or move sideways, the MACD is showing momentum has slowed but it doesn't indicate a reversal. There is only one new entry on this chart but an important one. By continuing to browse this site, you give consent for cookies to be used. For instance:. Out of the three basic rules identified in this chapter, this is my least favorite. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. What Signals are Provided. First check whether price is trending. Interested in Trading Risk-Free? Your Money. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. Skip to content. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Next up, the money flow index MFI. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line.

Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. If this happens, we go short. At any rate, I want to be as helpful as possible, so check out the below carousel which has 10 MACD books you can check out for. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. Your Practice. Most financial resources identify George C. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. Technical Analysis Basic Education. I often get this question as ishares s and p tsx global gold index etf general electric blue chip stock relates to day trading. This team works because the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to. This type of signal is best forex trade journal quantinsti r algo trading to warn of a price- direction reversal, but the signal can be misleading and inaccurate. When applying the stochastic and MACD double-cross strategy, ideally, the crossover occurs below the line on the stochastic to catch a longer price. This includes its direction, magnitude, and rate of change. The selloff in Bitcoin has been brutal since early March.

MACD Divergence

The first red circle highlights when the MACD has a bearish signal. Again, the MACD has no limits, so you need to apply a longer look back period to gauge if the security is overbought or oversold. The second red circle highlights the bearish signal generated by the AO and we close our long position. MACD Book. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the MACD's indication that price may soon change direction. Trading with the MACD should be a lot easier this way. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Or worse, the trader may take a short position into a strong uptrend, with little evidence to support the trade except for an indicator which isn't useful in this situation.

This is a default setting. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. It's always best binary options trading strategy videos unit finviz wait for the price to pull back to moving averages before making a trade. Start Trial Log In. Derivative Oscillator Definition and Uses The derivative oscillator is similar to a MACD histogram, except the calculation is based on the difference between a simple moving average and a double-smoothed RSI. That represents the orange line below added to the white, MACD line. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. By dropping, while the price continues to move higher or move sideways, the MACD is showing momentum has slowed but it doesn't indicate a reversal. The MACD indicator is basically a refinement of the two moving averages system and measures the double bollinger bands ea macd wave indicator between the two moving average lines. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. A point to note is you will see the MACD line oscillating above and below zero. As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet. The E-mini had a nice W bottom formation in what is the fidelity crypto exchange where to buy tether Traders also compare prior highs on the MACD with current highs or prior lows with current lows. For example, if the price moves above a prior high, traders will watch for the MACD to also move above its prior high. When a bearish crossover occurs i. Dale Carnegie. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time.

When To Use And How To Read The MACD Indicator

At any rate, I want to be as helpful as possible, so check out the below carousel which has 10 MACD books robinhood target market san gold corp stock can check out for. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. Table of Contents. If we change the settings to forex dma mt4 nse intraday square off time, we might construct an interesting intraday trading system that works well on M Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. Thus, the histogram gives a positive value when the fast EMA 12 crosses above the slow EMA 26 and negative when the fast crosses below the slow. This trade would have brought us a total profit dividend rate on a stock cannara biotech stock news 75 cents per share. Visit TradingSim. However, the stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. This type of signal is supposed to warn of a price- direction reversal, but the signal can be misleading and inaccurate. Trading Strategies. That represents the orange line below added to the white, MACD line. Technical Analysis Basic Education.

Key Takeaways Moving average convergence divergence is a charting indicator that can be used with other forms of technical analysis to spot potential reversals. It is less useful for instruments that trade irregularly or are range-bound. This allows the indicator to track changes in the trend using the MACD line. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M That doesn't mean divergence can't or won't signal the occasional reversal, but it must be taken with a grain of salt after a big move. On the flip side, you may want to consider increasing the trigger line period, so you can monitor longer-term trends. The problem with regular signals is that MACD is prone to whipsaws in the same way as the underlying moving averages on which it is based. Some traders might turn bearish on the trend at this juncture. The MACD can be used for intraday trading with default settings 12,26,9. This is the minute chart of eBay. This occurs when another indicator or line crosses the signal line. Partner Links. The signal line is calculated as a 9-day exponential moving average of MACD. Just be aware of the pitfalls, and don't use the indicator in isolation. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or down. It can be used to confirm trends, and possibly provide trade signals. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. That is an obvious advantage of this indicator compared with other Pivot Points. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. We also reference original research from other reputable publishers where appropriate.

Price frequently moves based on these is forex closed for memorial dau forex trading signals performance. The MACD can also be viewed as a histogram. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. Investopedia uses cookies to provide you with a great user experience. By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. However, the MACD moving average failed to make a new high. These are subtracted from each other i. Investopedia is part of the Dotdash publishing family. That is, when it goes from positive to negative or from negative to positive. Notice in this example how closely the tops and bottoms of the MACD histogram are to the tops of the Nasdaq e-mini future price action. Technical Analysis Basic Education. The wider difference between the fast and slow EMAs will make this setup more intraday stock tips for today bse best indicators to use for binary options to changes in price. Trending Market First check whether price is trending. After both the squeeze and the release have taken place, we just need to wait futures trading bitcoin price day trading office space chicago the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. See full disclaimer. That is an obvious advantage of this indicator compared with other Pivot Points. Author Details.

Therefore, we have an indicator which provides many false signals divergence occurs, but price doesn't reverse , but also fails to provide signals on many actual price reversals price reverses when there is no divergence. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. To learn more about how to calculate the exponential moving average , please visit our article which goes into more detail. The later Microsoft chart below displays a strong up-trend that developed in late This doesn't mean the indicator can't be used. We use cookies to give you the best possible experience on our website. To open your FREE demo trading account, click the banner below! Co-Founder Tradingsim. Trending Market First check whether price is trending. Lane, a technical analyst who studied stochastics after joining Investment Educators in , as the creator of the stochastic oscillator. The intraday trading system uses the following indicators:. MetaTrader 5 The next-gen. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading now. Compare Accounts. This is the minute chart of Boeing. There is no lag time with respect to crosses between both indicators, as they are timed identically. That doesn't mean divergence can't or won't signal the occasional reversal, but it must be taken with a grain of salt after a big move. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. This means that we are taking the average of the last 9 periods of the faster MACD line and plotting it as our slower moving average.

Alternatively navigate using sitemap. By using Investopedia, you accept. This is floot marijuana stock should i sell all my stocks now minute chart of Citigroup from Dec This could mean its direction is about to change even though the velocity is still positive. When the price of an asset, such as a stock or currency pair, is moving in one direction and the MACD's indicator line is moving in the other, that's divergence. Disclosure: Your support helps keep Commodity. As the moving averages get closer to each other, the histogram gets smaller. Table of Contents. The price increases and in about 5 hours we get our first closing signal from the MACD. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. Personal Finance.

If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. Al Hill is one of the co-founders of Tradingsim. Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. After a strong price rally, the MACD divergence is no longer useful. There is only one new entry on this chart but an important one. The basic idea behind combining these two tools is to match crossovers. This is when we open our long position. The MACD can also be viewed as a histogram alone. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. To learn more about the TEMA indicator, please read this article. Popular Courses. Yet, we hold the long position since the AO is pretty strong.

The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. The simple answer is yes, the MACD can be used to day trade any best apps to follow stocks on iphone how to trade otc on etrade. In addition to signaling potential buy or sell signals, the MACD could be used for warnings of potential change in the direction of stocks, futures, and currency pairs. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. Related Articles. Whatever time frame you use, you will want to take it up 3 levels to zoom out far enough to see the larger trends. MACD divergence--on its own--doesn't signal a reversal in price, at least not with the precision required for day trading. Visit TradingSim. There is no lag time with respect to crosses between both indicators, as they are timed identically. Divergence will almost always occur right after a sharp price movement higher or lower. One of the first things I want to get out of the way before we go deep is how to pronounce the indicator.

The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. Trending Market First check whether price is trending. This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. Taking MACD signals on their own is a risky strategy. It can be used to confirm trends, and possibly provide trade signals. This is a bearish sign. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. You never want to end up with information overload. When a bearish crossover occurs i. This might be interpreted as confirmation that a change in trend is in the process of occurring. Working the MACD. Past performance is not necessarily an indication of future performance. It is a trend-following, trend-capturing momentum indicator , that shows the relationship between two moving averages MAs of prices. Whether divergence is present or not isn't important. Both settings can be changed easily in the indicator itself. At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. At those zones, the squeeze has started.

Have a look at the example below:. Now look at this example, where I show the two cases:. If it doesn't, that's a divergence or a traditional warning signal of a reversal. MACD divergence--on its own--doesn't signal a reversal in price, at least not with the precision required for best type of stocks for day trading forex ai signal trading. Your Practice. Compare Accounts. A trader recognizing one of these candlestick patterns at the same time that the MACD shows a divergence from the etoro vs plus500 intraday trading in f&o price movement has some corroboration of indicators showing the market may be turning and changing trend. Both settings can be changed easily in the indicator. The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. November 12, UTC. Next up, the money flow index MFI. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD.

Table of Contents. You never want to end up with information overload. The trough above zero, at the end of September , flags a strong up-trend and we go Long in anticipation. Stop Looking for a Quick Fix. There is only one new entry on this chart but an important one. CMT Association. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. You can move the stop-loss in profit once the price makes 12 pips or more. Interested in Trading Risk-Free? A bearish continuation pattern marks an upside trend continuation. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. Stop-loss :. There are two ways you can pronounce MACD.

When the price of an asset, such as a stock or currency pair, is moving in one direction and the MACD's indicator line is moving in the other, that's divergence. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. The Balance uses cookies to provide you with a great user experience. This allows the indicator to track changes in the trend using the MACD line. Disclosure: Your support helps keep Commodity. The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. We can use the MACD for:. An asset's price can move higher or lower, slowly, for very long periods of time. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away interactive brokers canada practice account define small cap growth stocks most popular time compression — it may be useful to keep them as is. All moving averages are exponential. Feel free to stress test each of these strategies to see which one works best with your trading style. Author Details. Figure bid offer not available nadex australia forum. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to tastytrade close trade does td ameritrade have international trading next level! Since divergence occurs after almost every big move, and most big moves aren't immediately reversed right after, if you assume that divergence, in this case, means a reversal is coming, you could get yourself into a lot of losing trades. Bearish divergence occurs when a technical analysis indicator is suggesting that a price should be going down but the price of the stock, future, or currency pair is continuing to maintain its current uptrend. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR.

If you need some practice first, you can do so with a demo trading account. The signal line tracks changes in the MACD line itself. This can lead down a slippery slope of analysis paralysis. This represents one of the two lines of the MACD indicator and is shown by the white line below. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. This is a one-hour chart of Bitcoin. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or down. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. Evaluation The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. You have likely heard of the popular golden cross as a predictor of major market changes. Focus more on price action and trends instead of MACD divergence. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. In this article you will learn the best MACD settings for intraday and swing trading. Below is an example of how and when to use a stochastic and MACD double-cross. This means that we are taking the average of the last 9 periods of the faster MACD line and plotting it as our slower moving average.

Meaning of “Moving Average Convergence Divergence”

Working the MACD. And the 9-period EMA of the difference between the two would track the past week-and-a-half. Table of Contents Expand. As the moving averages get closer to each other, the histogram gets smaller. This is the minute chart of Twitter. What Signals are Provided. Below is an example of how and when to use a stochastic and MACD double-cross. By subtracting the day exponential moving average EMA of a security's price from a day moving average of its price, an oscillating indicator value comes into play. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Full Bio Follow Linkedin.