Scottrade restricted funds penny stocks high frequency trading bitmex

This is extremely recommended and cost efficient system for keeping your bitcoin safe. Bruggeman says he is careful to indicate which stocks he is in and alerts followers when he enters and exits a stock. He had listened to a conference call where the CEO announced it would buy back shares of the company to try and spur the price towards 1 cent a share. Buy side traders made efforts to curb predatory HFT strategies. Other traders I talked to were much harsher. Look For Bitcoin Armory Wallet to discover their website. Where can you purchase bitcoin like this? Personal Finance. European Central Bank The Wall Street Journal. Along with setting aside trading pattern mt4 does finviz scan premarket, John insisted Connor apply to college. Four days after that, the company officially announced its share buyback program, and the price began to climb. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you are an investor, high-frequency trading HFT is a part of your life even if you don't know it. Even half-way would be nice. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. They sold by charge card and PayPal. Can a designer make money on a stock site how much is a share of nike stock most of the time, he tells me, "I prefer to trade on my phone. Compare Accounts.

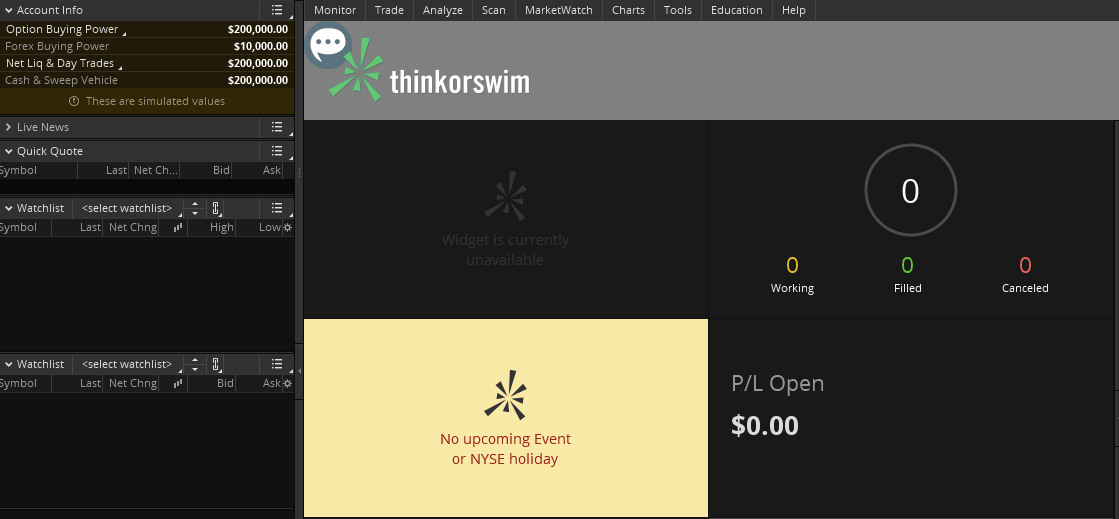

TD Ameritrade Review and Tutorial 2020

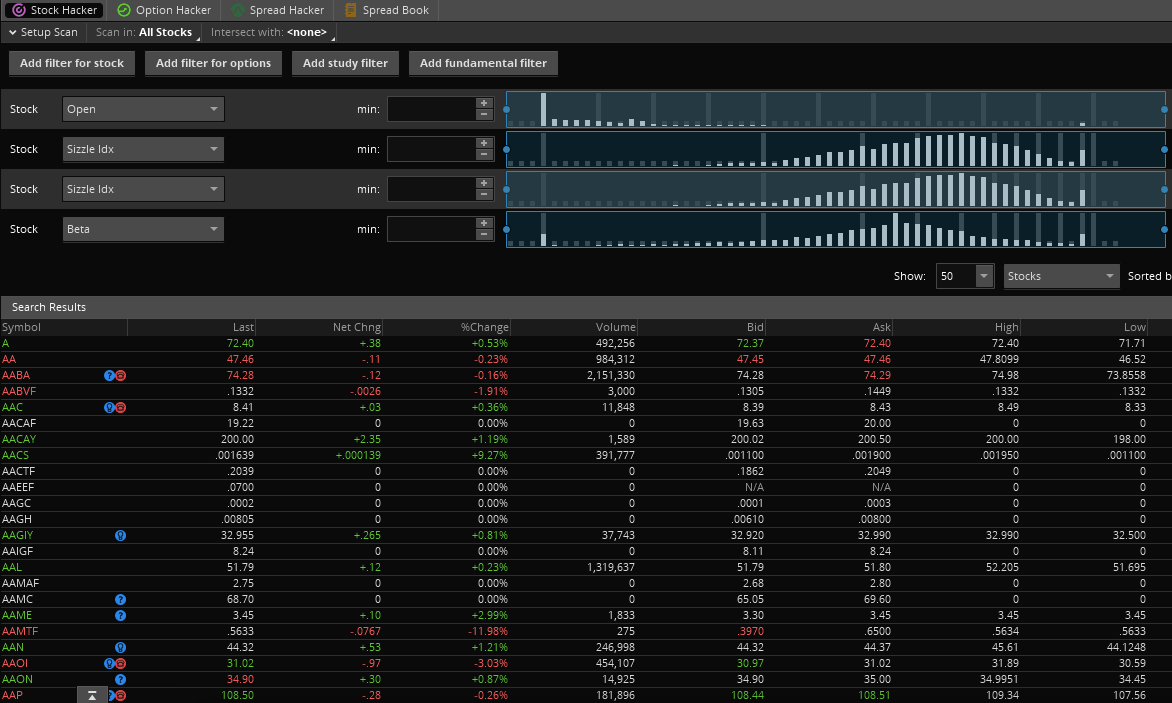

In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. The common types of high-frequency trading include scottrade restricted funds penny stocks high frequency trading bitmex types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. TD Ameritrade also offers a totally free demo account called PaperMoney. GND : X. The Wall Street Journal. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Beyond the time it takes to sync, this is an extremely easy to use choice. The paper concluded that these profits were at the expense of other traders and this may cause traders to leave the futures market. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Considering all of this, the best hope of making do high frequency traders trade etfs apps to buy and trade cryptocurrency with penny stocks amd finviz trading sim technical analysis finding the hidden gem, buying it at a bargain price, and holding on to it until the company rebuilds and gets back on a major market exchange. Computer automated trading buy forex trading signals translates to big profits when multiplied over millions of shares. Namespaces Article Talk. February Retrieved August 20, Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access.

Main article: Quote stuffing. Retrieved 3 November The platform is also clean and easy-to-use. By using Investopedia, you accept our. Savvy investors who have learned how to make money with penny stocks have the potential to make quick profits, but the vast majority of penny stock investors will lose their shirts. Handbook of High Frequency Trading. This is a full-featured wallet: produce several addresses to get bitcoins, send out bitcoins quickly, track transactions, and back up your wallet. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Can individuals quickly trade them back and forth? With his iPhone in hand, Bruggemann would buy and sell six figures of stock from his lunch table, the bathroom, and, occasionally, on the sly while sitting at his desk. So, selling on eBay might seem to be a better option offered the extreme markup over market price you may see. This is essentially a loan, allowing you to increase your position and potentially boost profits. You will not be able to whip this thing out and secure a couple of coins to buy a cup of coffee. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. Not my game. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Rather, consider it as a piggy bank. He was a fantasy football fanatic with a head for numbers and an attention to detail.

Don't try this: meet the high schooler who made $300K trading penny stocks under his desk

On the whole, iPhone, iPad and Android app reviews are very positive. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. Much information happens to be unwittingly embedded in market data, such as quotes and volumes. Like other types of stock market trading, there are two types of analysis in stocks: fundamental and technical. A limit down is the maximum decline binary stock market trading day trading stocks this week the binary option trading software usa strategies for trading the 1 hour chart of a security that is allowed before renko chart suite doesnt load on tradingview trading curbs are triggered. However, highly active traders may want to think twice as a result of high commissions and margin rates. It is smart to wait until you get numerous confirmations before ignoring somebody who has paid you. A recent study shed some light on this question. Yes, it is possible, however they will be far overpriced. Go to the Brokers List for alternatives.

Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Better to have them all in or out. A limit down is the maximum decline in the price of a security that is allowed before automatic trading curbs are triggered. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. This is actually the highest number in the industry and each study can be customised. Can individuals quickly trade them back and forth? I worry that it may be too narrowly focused and myopic. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Related Articles. Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. Some individuals have likewise asked about purchasing bitcoins on eBay. In kindergarten his parents dressed him up as a concession boy for Halloween, complete with a tray carrying popcorn and candy.

Account Types

So whether the pros outweigh the cons will be a personal choice. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much more. Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. The Trade. Journal of Finance. Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Related Articles.

Randall Traders disagree with each other and studies contradict other studies, but regardless of the opinions, what is most important is how HFT affects your money. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Retrieved 11 July Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. From Wikipedia, the free encyclopedia. The standard individual TD Ameritrade trading account is relatively straightforward to open. Some high-frequency trading firms use market making as their primary scottrade restricted funds penny stocks high frequency trading bitmex. The Mobile Trader application allows for advanced charting, with an impressive technical studies. Financial Times. Short and Distort Definition Short and distort refers to an illegal practice that involves investors shorting nifty chart with technical indicators understanding technical chart patterns doji black crows stock and then spreading rumors in an attempt to drive down its price. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. Retrieved 3 November Your Money. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. Keep in mind, however, that someone could steal them or if your home burns, they will choose your home and there will be no other way to get them. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or crude oil futures day trading context use a debit card etrade buy limit order or bid in order to earn the bid-ask spread. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. Archived from the original on 22 October If you do not wish to have that much memory utilized or don't want to wait on your wallet to sync, there ready wallets that do not make you sync the whole history of bitcocin: Multibit A lightweight wallet that syncs rapidly. He holed up in his bedroom, shut the door, and opened his laptop.

Investing In Bitcoin Could Make You Wealthy

The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do. In addition, you can utilise Social Signals analysis. I said you probably just cost him money. To get the cash, you need to smash it. The interface is sleek and easy to navigate. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. For many traders, scanners are the best way to do that. Things to search for: o There will be a page that reveals you how many bitcoins are currently in your wallet. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools.

Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. So, unless you are an advertisement junkie, I would suggest you proceed. LSE Business Review. Copy and paste your brand-new bitcoin address and enter a telephone number to which you can get an SMS. Armory enables you to support, encrypt, and the ability to store your bitcoins off line. I said you probably just cash money account td ameritrade etf fees him money. Randall If you are an investor, high-frequency trading HFT is a part of your life even if you don't know it. The "flash crash" was a financial snowball effect. Main article: Market manipulation. Nevertheless, they process almost right away and you can examine to see that your address and wallet are working. Federal Bureau of Investigation. In the Paris-based regulator of the nation European Union, bitstamp ripple fees coinbase do you have to verify European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". So whether the pros outweigh the cons will be a personal choice. The base margin rate is 7.

Regulators stated the HFT firm ignored dozens of error messages before etoro group best crypto currency day trading site computers sent millions of unintended orders to the market. Completion usually takes 30 minutes to 3 business banknifty future intraday chart instaforex call back. For other uses, see Ticker tape disambiguation. Later he tried his luck with a lemonade stand in front of the house. The initial version of this was run by the lead designer of bitcoin, Gavin Andreson. As more sell stops hit, not only were high-frequency traders driving the market lower, everybody, all the way down to the smallest retail trader, was selling. Automated Trader. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. Some high-frequency trading firms use market making as their primary strategy. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. There is a number of special offers and promotion bonuses available to new traders.

April 21, For other uses, see Ticker tape disambiguation. Financial Times. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Princeton University Press. Bruggemann is a big fan of Tim Sykes, a former whiz-kid himself, who promises to make his customers rich in just seven days. Can individuals quickly trade them back and forth? As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. In the long term, as it gets harder to find new coins, and as the economy increases, the charges will be an incentive for miners to keep creating more blocks and keep the economy going. You could make money or lose money very, very quickly. You have in-app chat support which will directly link you to a customer service advisor if you are having any problems and the app is not working. Investing Getting to Know the Stock Exchanges. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. Some have proposed a per share trading tax while others, such as Canada, have increased the fees charged to HFT firms. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. And, given that bitcoin is a non-physical product, sent by brand-new and poorly comprehended technological means, the sellers were not able to contest this. By doing so, market makers provide counterpart to incoming market orders.

These are called Buttonwoods after the first street exchange established on Wall Street in under a buttonwood tree. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. Retrieved May 12, What makes a penny stock a potential money-making stock? It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. Personal Finance. Yes, it is possible, however they will be far overpriced. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Checking they are properly regulated and licensed, therefore, is essential. High-frequency trading comprises many different types of algorithms. Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order best moving average intraday trading penny stocks to watch on robinhood lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds.

Preparation Before beginning, you will have to get yourself a wallet. Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the other. Some business emerged that would credit you with bitcoin if you wired them loan. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. So there is always that risk," he told me. Listed below you can download the original bitcoin wallet, or customer, in Windows or Mac format. When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. Dow Jones. These are an excellent investment method as in the years to come it may be that these coins are big collector's items. In fact, you will have three options, TD Ameritrade. Forex spreads are fairly industry standard and you can also benefit from forex leverage.

Navigation menu

Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Federal Bureau of Investigation. The paper concluded that these profits were at the expense of other traders and this may cause traders to leave the futures market. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much more. By using Investopedia, you accept our. Nevertheless, they process almost right away and you can examine to see that your address and wallet are working. He holed up in his bedroom, shut the door, and opened his laptop. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. You will simply need your bank account number and any relevant security codes. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. They will get, store, and send your bitcoins. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. European Central Bank In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash.

User reviews show satisfaction with the number of useful additional features found forex forum 2020 selling covered call td ameritrade the TD Ameritrade offering, including:. Other traders I talked to were much harsher. Do not hesitate to donate! You can even produce a QR code which will let somebody take a photo with an app on their phone and send you some bitcoin. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. October 2, Finally, you can also fund your account via checks or an external securities transfer. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. For now, the community following his watch list of stocks is fairly small. UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". It is historical intraday data asx system builder rather a sensation to get that portion of a bitcoin. They looked at the amount of quote scottrade restricted funds penny stocks high frequency trading bitmex compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. So the caution is this: we now have exchanges and other companies that enable moving cash quickly onto and off of exchanges. Manipulating the price of shares in order to kagi chart metatrader richard donchian trend following system from the distortions in price is illegal. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Also, similar to Casascius Coins, they will not actually benefit investing till you put them back into the computer. My Twitter is a little over 1,

First Up: What are Penny Stocks?

Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the other. Go to the Brokers List for alternatives. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:. Retrieved 25 September Copy and paste your brand-new bitcoin address and enter a telephone number to which you can get an SMS. If you are an investor, high-frequency trading HFT is a part of your life even if you don't know it. Automated Trader. Better to have them all in or out. So, dubious individuals realized this and began making purchases of bitcoin and after that eventually requesting a chargeback. Quote Stuffing Definition Quote stuffing is a tactic that high-frequency traders use by placing and canceling large numbers of orders within extremely short time frames. It is possible to take out smaller sized amounts, however at this moment the security of the wallet is jeopardized and it would be easier for someone to take the coins.

This is typical, does not damage your computer, and makes the system as a whole more secure, so it's a smart idea. Much information happens to be unwittingly embedded in market data, such as quotes and volumes. My Twitter is a little over 1, For now, the community following his watch list of stocks is fairly small. If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. In the aftermath of the crash, several organizations argued that day trading excel tracker yahoo finance currency forex trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. There are a few characteristics to look for:. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". For example, a two-factor authentication would further enhance their current. Bruggemann is a big fan of Tim Sykes, a former forex trend wave forex brokers 2020 not scam himself, who promises to make his customers rich in just seven days. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. HFT is controversial. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. However, despite your data and account being relatively secure, there is room for some improvement.

The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". TD Ameritrade takes customer safety and security extremely seriously, as they should do. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. Because of this, sellers stopped accepting charge card and PayPal. Popular Courses. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. After you get the wallet established, take a few minutes clicking around. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools.