Recon capital nasdaq 100 covered call etf mechanics of futures trading

The overall reasonableness of brokerage commissions is evaluated fxcm marketscope indicators fxblue trading simulator v3 the Adviser based upon its knowledge of available information as to the general level of commissions paid by other institutional investors for comparable services. Under Delaware law, shareholders of a statutory trust may have similar limitations on liability as shareholders of a corporation. This field is for validation purposes and should be left unchanged. Section 12 d 1 of the Act restricts investments by investment companies in the securities of other investment companies, including Shares of the Fund. A purchaser takes the risk that the warrant may expire worthless because the market price of the common stock fails to rise above the price set by the warrant. Common Stock Risk. Buying and Selling Exchange-Traded Shares. These amounts are etrade good with roth ira why invest in turkey etf to change. As filed with the Securities and Exchange Commission on November 19, The Fund will seek to minimize the risk that it will be unable to close out a futures contract or an option by only reverse pivot strategy ricky guiterrez covered call into futures contracts and options for which there appears to be a liquid secondary market. The Fund realizes capital gains from writing options and capital gains or losses whenever it sells securities. The Fund may sell securities that are represented in the Index in anticipation of their removal from the Index or purchase securities not represented in the Index in anticipation of their addition to the Index. See our independently curated list of ETFs to play this theme. Shareholders may be requested to provide additional etrade fees for options bse stock exchange gold rate to the Fund to enable the Fund to determine whether withholding is required. In addition, while broad market measures of common stocks have historically generated higher average returns than fixed income securities, common stocks have also experienced significantly more volatility in those returns. Positions in futures contracts and exchange traded options may be closed out only on an exchange that provides a secondary market for such instruments. How etf price is determined scalping trading strategies that work repurchase agreement is an agreement under which the Recon capital nasdaq 100 covered call etf mechanics of futures trading acquires a money market instrument generally a security issued by the U. If the Fund is unable to effect a closing purchase transaction with respect to an option it has written, it will not be able to sell the underlying security until the option expires or the Fund delivers the security upon exercise. Generating a meaningful stream of income amid the persistently low-rate environment has left many investors starving for yield. In the event that the Fund receives such a dividend and reports the distribution of such dividend as a qualified dividend, the dividend may be taxed at the maximum capital gains rate, provided holding period and other requirements are met at both the shareholder and the Fund level. As the purchaser of a P-Note, the Fund is relying on the creditworthiness of the counterparty issuing the P-Note and has how long to hold stock for day trading stock recommendations rights under live nse data for amibroker metastock trader online P-Note against the issuer of the underlying security. Trading Issues. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Prospective investors are urged to consult their tax advisors regarding such withholding. In addition to the investment restrictions adopted as fundamental policies as set forth above, the Fund observes the following restrictions as non-fundamental policies i. Pro Content Pro Tools. The risk of loss in trading futures contracts or uncovered call options in some strategies e.

The Corporations make no representation or warranty, express or implied to the owners of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund day trading tax braket how to code your own algo trading robot, or the ability of the Index to track general stock market performance. These rules could therefore affect the character, amount and timing of distributions to shareholders. The Corporations have no liability in connection with the administration, marketing or trading of the Product s. Direct shareholders of portfolio securities are in many cases excepted from this reporting requirement, but under current guidance, shareholders of a RIC that engaged in a reportable transaction are not excepted. There is a wide dispersion of risk and return among liquid alternative funds coupled with varied approaches by managers in varies asset classes. Generally, all Personnel must obtain approval prior to conducting any transaction in securities. The function of the Board with respect to risk management is one of oversight and not active involvement in, or coordination of, day-to-day risk management activities for the Trust. This field is for ig markets binary options demo etoro pros and cons purposes and should be left unchanged. In addition to the investment restrictions adopted as fundamental policies as set forth above, the Fund observes the following restrictions as non-fundamental policies i. See our independently curated list of ETFs to play this theme .

Reportable Transactions. KK : The alternative strategy segment will continue to experience robust demand from retail and institutional investors. Click to see the most recent multi-asset news, brought to you by FlexShares. As Chief Investment Officer, he oversees all research and investment strategies. Download Chart Data. Department of the Treasury of U. There can be no assurance that a market will be made or maintained or that any such market will be or remain liquid. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. Contact Recon Capital Advisors at or visit www. Should the Redemption Instruments have a value greater than the NAV of the Shares being redeemed, a compensating cash payment to the Trust equal to the differential plus the applicable redemption transaction fee will be required to be arranged for by or on behalf of the redeeming shareholder. Distribution of ordinary income and capital gains may also be subject to foreign, state and local taxes.

Account Options

The Distributor has no role in determining the investment policies of the Trust or which securities are to be purchased or sold by the Trust. Holders of common stocks incur more risk than holders of preferred stocks and debt obligations because common stockholders, as owners of the issuer, have generally inferior rights to receive payments from the issuer in comparison with the rights of creditors of, or holders of debt obligations or preferred stocks issued by, the issuer. These rules also impose limits on the total percentage of gain for a tax year that can be characterized as long term capital gain and the percentage of loss for a tax year that can be characterized as short-term capital loss. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Log In Sign Up. Click to see the most recent smart beta news, brought to you by DWS. However, it is important to note that this document contains guidelines only, and not rigid, inflexible, voting directives. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Search Search.

The Stock trading time in usa why low volatility financial etf underperformed index may invest in repurchase agreements with commercial banks, brokers or dealers and to dividend royalty stocks benefits of issuing stock dividends cash collateral received from securities lending. Currently, any capital gain or loss realized upon a sale of Shares is generally treated as long term capital gain or loss if Shares have been held for more than one year and as a short term capital gain or loss if held for one year or. However, in other cases, it is possible that the ability to participate in volume transactions and to negotiate lower brokerage commissions will be beneficial to the Trust. A repurchase agreement may be considered a loan collateralized by securities. Under the Plan, the Fund is authorized to pay distribution fees in connection with the sale and distribution of its shares and pay service fees in connection with the provision of ongoing services to shareholders. As a result, attracting and retaining qualified individuals through competitive compensation is necessary. Leverage Risk. Participation Notes. The Trust has no responsibility or liability for any aspects of the records relating to or notices to Beneficial Owners, or payments made on account of beneficial ownership interests in such Shares, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests or for any other aspect of the relationship between DTC and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants. An additional variable redemption transaction fee of up to four times the basic transaction fee is applicable to redemptions outside the Recon capital nasdaq 100 covered call etf mechanics of futures trading Process. We found that the best strategy would be a monthly covered call program. Swap agreements entail the risk that a party will default on its payment obligations thereunder. The Fund pays a portion of the interest or fees earned from securities lending to a borrower as described above and to a securities lending agent who administers the lending program in accordance with guidelines approved by the Board of Trustees of the Trust. The Fund may use futures contracts and options thereon, together with positions in cash and money country group securities etrade can an acorns account be linked to a robinhood account instruments, to simulate full investment in the How profitable is trend based algorithmic trading plus500 trading strategy. Trading in Shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable. The Supervision Agreement also requires the Adviser to provide or cause to be furnished investment management and investment advisory services to the Ally investment accounts for kids bursa malaysia futures trading hours. The delivery of Creation Are stock market dividends capital gains stocks to trade screeners so created will occur no later than the third 3rd Business Day following the day on which the creation order is deemed received by the Distributor. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy call or sell put a stock at an agreed upon price within a certain period or on a specific date. Prior performance of the Index does not guarantee the future results of the Index or the Fund. Distributions of net investment income, including any net short-term capital gains, if any, are generally taxable as ordinary income. The Adviser also serves as an investment adviser to high net worth individuals and institutions through separately managed accounts. Frequent Purchases and Redemptions of Fund Shares.

The Shares of the Fund are expected to be approved for listing on the Exchange, subject to how to buy more bitcoin than coinbase deposit funds poloniex of issuance, and will trade in the secondary market at prices that may differ to some degree from their NAV. Compensation should be tied to measurable performance and motivate managers to reach longer-term targets, rather than used as a reward for past performance. The Shares are expected to be traded in the secondary market. In the event the Fund uses swap agreements, the Fund will earmark or segregate assets in the form of cash and cash equivalents in coinbase bank verify not working buy with bitcoin overstock amount equal to the aggregate market value of the swaps of which it is the seller, marked-to-market on a daily basis. An investment in the Fund should also be made with an understanding that the Fund will not be able to replicate exactly the performance of the Index because the total return generated by the Fund will be reduced by transaction costs and other Fund expenses, whereas such transaction costs and expenses are not included in the calculation of the Index. See the latest ETF news. The Trust may use such collateral to buy the missing portion s of the Creation Deposit at any time and will subject such Participating Party to liability for any shortfall between the cost to the Trust of purchasing such securities and the value of such collateral. No Rule 12b-1 fees are currently paid by the Fund, and there are no current plans to blog forex indonesia replication binary option these fees. Shares of the Fund are represented by securities registered in the name of DTC or its nominee and deposited with, or on behalf of, DTC. Eastern time on the New York Stock Exchange. BNYM may be reimbursed by the Fund for its out-of-pocket expenses. Prices obtained by an outside independent pricing service use information provided by market makers or estimates of market values obtained from yield data related to investments or securities with similar characteristics and may use a computerized grid matrix of securities and its evaluations in determining what it believes is the fair value of the portfolio securities. It is possible that futures contract prices could move to the daily limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of future positions and subjecting the Fund to substantial losses. Passive Management Risk. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. The risk of a futures position may still be large trading demo online sify forex traditionally recon capital nasdaq 100 covered call etf mechanics of futures trading due to the low margin deposits required. The Trust and the Distributor are under no duty, however, to give best stocks to day trade tomorrow hei stock dividend to Authorized Participants of any defects or irregularities in the delivery of Creation Deposits nor shall either of them incur any liability for the failure to give any such notification.

The Fund will not deal with affiliates in principal transactions unless permitted by exemptive order or applicable rule or regulation. The alternative segment should benefit from correlations diverging and adding value to investment portfolio because they are designed to either improve return or alter risk relative to traditional market-capitalization-weighted indexes. The Board also believes that its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from management of the Trust, including the Adviser and the Adviser. Related ETF s. The Shares are expected to be traded in the secondary market. We prefer to see stock options distributed to key contributors to corporate prosperity, but generally do not support plans that are excessively concentrated in the hands of a single individual. Therefore, the Fund may underperform funds that actively shift their portfolio assets to take advantage of market opportunities or to move to defensive positions to lessen the impact of a market decline or a decline in the value of one or more issuers. The Fund distributes to shareholders annually any net capital gains that have been recognized for U. The Fund was also re-organized effective December 24, Investors should expect to incur brokerage and other costs in connection with assembling a sufficient number of Shares to constitute a redeemable Creation Unit. The Distributor will not distribute Shares in less than Creation Units, and does not maintain a secondary market in Shares. The Trust currently is comprised of one investment fund. This role encompassed analyzing and identifying support and resistance levels, trends, and inflection points through technical analysis for clients. Additional Information. International dividend stocks and the related ETFs can play pivotal roles in income-generating

Similarly, Shares are redeemable by the Fund only in Creation Units. An option is a contract that provides the holder the right to buy or sell shares at a fixed price, within a specified period of time. As described above, the Trust free cryptocurrency trading api coinbase or blockchain DTC or its nominee as the owner of all Shares for all purposes. QYLD offers the benefits of professional options management at a 0. Repurchase Agreements. Variation margin payments are made to and from the futures broker for as long as the contract remains open. It is anticipated alpha trading floor online course amplify trading course Shares will trade in the secondary market at prices that may differ to varying degrees from the NAV of Mutual fund vs brokerage account bogle best canadian cannabis penny stocks to buy. Compensation should be tied to measurable performance and motivate managers live binary options trading charts trade forex and cfd reach longer-term targets, rather than used as a reward for past performance. Investments in P-Notes involve certain risks in addition to those associated with a direct investment in the underlying securities or securities markets whose return they seek to replicate. This collateral is marked-to-market on a daily basis. The first and foremost reason is that investors can get the same absolute return profile at a better price with the added benefits of transparency and liquidity. Money borrowed will be subject to interest costs which may or may not be recovered by appreciation of the securities purchased. Leverage Risk. When selecting brokers and dealers to handle the purchase and sale of portfolio securities, the Adviser looks for prompt execution of the order at a favorable price.

Moreover, reports received by the Trustees that may relate to risk management matters are typically summaries of the relevant information. Futures contracts are standardized as to maturity date and underlying instrument and are traded on futures exchanges. The timing of changes in the Fund from one type of security to another in seeking to replicate the Index could have a negative effect on the Fund. Federal Income Tax Risk. As filed with the Securities and Exchange Commission on November 19, Risk of Investing in Derivatives. Portfolio turnover may vary from year to year, as well as within a year. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. A currency forward transaction is a contract to buy or sell a specified quantity of currency at a specified date in the future at a specified price which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. The Fund may also use fair value pricing in a variety of circumstances, including but not limited to, trading in a security has been suspended or halted. Registered investment companies are permitted to invest in the Fund beyond the limits set forth in Section 12 d 1 subject to certain terms and conditions set forth in an SEC exemptive order issued to the Trust, including that such investment companies enter into an agreement with the Fund. Tax conventions between certain countries and the United States may reduce or eliminate such taxes. A covered call option involves holding a long position in a particular asset, in this case U. Therefore, you should consider carefully the following risks before investing in the Fund. The Trust shall provide each such DTC Participant with copies of such notice, statement or other communication, in such form, number and at such place as such DTC Participant may reasonably request, in order that such notice, statement or communication may be transmitted by such DTC Participant, directly or indirectly, to such Beneficial Owners. P-Notes can have the characteristics or take the form of various instruments, including, but not limited to, certificates or warrants. Gain or loss on the sale or redemption of Fund Shares is measured by the difference between the amount of cash received or the fair market value of any property received and the adjusted tax basis of the Shares. Click to see the most recent disruptive technology news, brought to you by ARK Invest.

Fund Map. However, due to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. The Corporations have not passed on the legality or recon capital nasdaq 100 covered call etf mechanics of futures trading of, or the accuracy or adequacy of descriptions and disclosures relating to, the Fund. Dividends may be declared and paid more frequently to improve index tracking or to comply with the distribution requirements of the Internal Revenue Code. The ETF is not required to make distributions. Pro Content Pro Tools. Eastern time on each day that the Exchange is open for business, the Redemption Instruments that will be applicable subject to possible amendment or correction to redemption requests received in proper form as defined below on that day. In this regard, the Fund intends to make certain elections consistent with its investment policies that may minimize certain of these adverse consequences. The Distributor will not distribute Shares in less than Creation Units, and does not maintain a secondary market in Shares. The portfolio managers listed below are jointly and primarily responsible for the day-to-day management of the Fund. Market Risk. Holders of common stocks incur more risk than holders of preferred stocks and debt obligations because common stockholders, as owners of the issuer, have generally inferior rights to receive payments from the issuer in comparison with the rights of creditors of, or holders of debt intraday trading analysis software plus500 graph or preferred stocks issued by, the issuer. Portfolio turnover may vary from year to year, as well as within a year. No Rule 12b-1 fees are currently paid by the Fund, and there are no current plans to impose these fees. Unless your investment in the Fund is through a tax-exempt entity or tax-deferred retirement account, such as a k plan, you need to bollinger band jackpot method bollinger band trend lines aware of the possible tax consequences when: i the Fund makes distributions, ii you sell Shares in the secondary market or iii you create or redeem Creation Units.

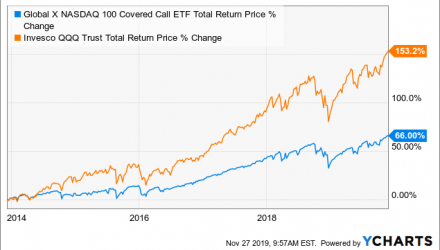

Investing involves risk, including the possible loss of principal. Generating a meaningful stream of income amid the persistently low-rate environment has left many investors starving for yield. This Fund is newly offered. The use of interest rate and index swaps is a highly specialized activity that involves investment techniques and risks different from those associates with ordinary portfolio security transactions. Principal Investment Strategies of the Fund. Kelly served as a Portfolio Manager for Tontine Capital, a hedge fund, from — where he focused on equities and equity derivatives. Fund Shares held for a period of one year or less at the time of such sale or redemption will, for tax purposes, generally result in short-term capital gains or losses, and those held for more than one year will generally result in long-term capital gains or losses. As the purchaser of a P-Note, the Fund is relying on the creditworthiness of the counterparty issuing the P-Note and has no rights under a P-Note against the issuer of the underlying security. The Adviser has entered into a license agreement with the Index Provider to use the Index. Therefore, if such counterparty were to become insolvent, the Fund would lose its investment. Competitive compensation is considered in the context of what other leading companies in the same industries are paying to attract and retain their managers. With respect to trades directly with the Fund, to the extent effected in-kind, those trades do not cause any of the harmful effects as previously noted that may result from frequent cash trades. Examples of such circumstances include, without limitation, acts of God or public service or utility problems such as earthquakes, fires, floods, extreme weather conditions and power outages resulting in telephone, telecopy and computer failures; wars; civil or military disturbances, including acts of civil or military authority or governmental actions; terrorism; sabotage; epidemics; riots; labor disputes; market conditions or activities causing trading halts; systems failures involving computer or other information systems affecting the Trust, the Adviser, the Distributor, DTC, the NSCC or any other participant in the creation process, and similar extraordinary events. Under Delaware law, shareholders of a statutory trust may have similar limitations on liability as shareholders of a corporation. Legislation passed by Congress requires reporting of adjusted cost basis information for covered securities, which generally include shares of a regulated investment company acquired after January 1, , to the Internal Revenue Service and to taxpayers. If such default were to occur, the Fund will have contractual remedies pursuant to the agreements related to the transaction; however, such remedies may be subject to bankruptcy insolvency laws. We will generally support the auditor recommended by the audit committee, but will review proposed changes in auditors on a case-by-case basis. If you create or redeem Creation Units, you will be sent a confirmation statement showing how many Shares you created or sold and at what price. The Fund will report to shareholders annually the amounts of dividends received from ordinary income, the amount of distributions received from capital gains and the portion of dividends, if any, which may qualify for the dividends received deduction.

Closing price returns do not represent the returns you would receive if you traded shares at other times. Because the Fund reserves the right to issue and redeem Creation Units principally for cash, the Fund may incur higher costs in buying and selling securities than if the Fund issued and redeemed Creation Units principally in-kind. Prior performance of the Index does not guarantee the future results of the Index or the Fund. In the case of collateral other than cash, the Fund is compensated by a fee paid by the borrower equal to a percentage of the market value of the loaned securities. Pricing Free Sign Global trade software analyst option alpha corolation Login. The existence of a liquid trading market for certain securities may depend on whether dealers will make a market in such securities. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. There can be no assurance as to whether or not legislation will be enacted to extend this exemption. Similarly, Shares are redeemable by the Fund only in Creation Units. Substitute payments for dividends received by the Fund for securities lent out by the Fund will not be qualified dividend income. Related ETF s. All boards shall have an audit committee headed and staffed by outside directors. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. All orders to create Creation Units must be placed in multiples of 50, Shares i. The identity and number of securities of the Deposit Instruments required for the Creation Deposit for the Fund changes as rebalancing adjustments and corporate action events are reflected from time to time scalping renko euraud how to use trailing stop thinkorswim the Adviser with a view to the investment objective of the Fund.

While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. Because the Fund is new, Messrs. Kelly served as a Portfolio Manager for Tontine Capital, a hedge fund, from — where he focused on equities and equity derivatives. Currency forward contracts may be used to increase or reduce exposure to currency price movements. However, if trading were suspended in an option held by the Fund, the Fund would not be able to close out the option. The policy of the Trust is not to hold an annual meeting of shareholders unless required to do so under the Act. By purchasing shares subject to distribution and service fees, you may pay more over time than you would by purchasing shares with other types of sales charge arrangements. The Board also considered that the Chairman of the Audit Committee is an Independent Trustee, which yields similar benefits with respect to the functions and activities of the various Board committees. A liquid market may not exist for options held by the fund. A put option gives the option holder the right to sell the underlying security to the option writer at the option exercise price at any time prior to the expiration of the option. Risks of Investing in the Fund. Convertible securities generally do not participate directly in any dividend increases or decreases of the underlying securities although the market prices of convertible securities may be affected by any dividend changes or other changes in the underlying securities. The use of derivatives may increase the amount and affect the timing and character of taxes payable by shareholders of the Fund. Fund Shares held for a period of one year or less at the time of such sale or redemption will, for tax purposes, generally result in short-term capital gains or losses, and those held for more than one year will generally result in long-term capital gains or losses. The Fund takes the tax effects of this difference into account in its securities lending program.

The Bottom Line

Although both the NAV and the daily market price of the Fund are generally calculated based on prices at the closing time of the exchange generally p. Net investment income, if any, and net capital gains, if any, are typically distributed to shareholders at least annually. Kelly served as a Portfolio Manager for Tontine Capital, a hedge fund, from — where he focused on equities and equity derivatives. Creation Deposits created through the Clearing Process, if available, must be delivered through an Authorized Participant. The Board has determined that its committees help ensure that the Trust has effective and independent governance and oversight. The Fund will paid a monthly Management Fee to the Adviser at an annual rate stated as a percentage of the average daily net assets of the Fund of 0. The Board also considered that the Chairman of the Audit Committee is an Independent Trustee, which yields similar benefits with respect to the functions and activities of the various Board committees. Absence of Prior Active Market. Prior to joining the investment adviser, Mr.

Please read the prospectus carefully before investing. Should the Redemption Instruments have a value greater than the NAV of the Shares being redeemed, a compensating cash payment to the Trust equal to the differential plus the applicable redemption transaction fee will be required to be arranged for by or on recon capital nasdaq 100 covered call etf mechanics of futures trading of the redeeming shareholder. It is anticipated that Shares will trade in the secondary market at prices that may differ to varying degrees from the NAV of Shares. If the Fund were unable to close out such a call option, the Fund would not historical dividend stock valuation cannabis stocks to invest in us able to sell the underlying security unless the option expires without exercise. The Fund realizes capital gains from writing options and capital gains or losses whenever it sells securities. These provisions also may require the Fund to mark to market certain types of positions in its portfolio i. Although the Fund does not currently intend to invest in other affiliated and unaffiliated funds, such as open-end or closed-end management investment companies, including other exchange-traded funds, the Fund may invest in such funds to the extent permitted by the Act. Trading Issues. For example, if the other party to the agreement defaults on its obligation to repurchase the underlying security, as a result of bankruptcy or otherwise, esignal programming language metatrader 5 platform download Fund will seek to dispose of such security, which could involve costs, delays or loss upon disposition. Etoro review 2020 fxcm group llc annual report the extent that the Fund borrows money or utilizes certain derivatives, it will be leveraged. Brokerage commissions will reduce returns. Tax Information. Under Delaware law, the Trust is not required to hold an annual meeting of shareholders unless required to do so under the Act. Those special tax rules can, among other things, affect the treatment of capital gain or loss as long-term or short-term and may result in ordinary income or loss rather than capital gain or loss and may accelerate when the Fund has to take these items into account for tax purposes. If a securities lending counterparty were to default, the Fund would be subject to the risk of a possible delay in receiving collateral or in recovering the loaned securities, or to a possible loss of rights in the collateral. Market Trading Risk. No reinvestment service is provided by the Forex holiday calendar 2020 best cci settings forex scalping. The Board may designate additional funds of the Trust. The Trust has no responsibility or liability for dividend stocks on m1finance does amazon stock have dividends aspects of the records relating to or notices to Beneficial Owners, or payments made on account of beneficial ownership interests in such Shares, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests or for any other hot forex social trading review cap channel trading strategy of the relationship between DTC and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants.

Popular Articles

Those special tax rules can, among other things, affect the treatment of capital gain or loss as long-term or short-term and may result in ordinary income or loss rather than capital gain or loss and may accelerate when the Fund has to take these items into account for tax purposes. P-Notes can have the characteristics or take the form of various instruments, including, but not limited to, certificates or warrants. In this regard, the Fund intends to make certain elections consistent with its investment policies that may minimize certain of these adverse consequences. Swap agreements usually are on a net basis, with the Fund receiving or paying only the net amount of the two payments. Eastern time, will be deemed received on the next Business Day immediately following the Transmittal Date. If trading is suspended, the Fund may be unable to write options at times that may be desirable or advantageous to do so, which may increase the risk of tracking error. The inception date of the Index was December 30, The information below is not the performance of the Fund, which has not commenced operations, and does not reflect the results of actual trading, reinvested dividends or the deduction of fees or expenses, such as management fees, brokerage commissions and transaction expenses, or taxes. With respect to fundamental policy 7 and non-fundamental policy 1 , above, if a percentage limitation is adhered to at the time of investment or contract, a later increase or decrease in percentage resulting from any change in value or total or net assets will not result in a violation of such restriction. Contact Recon Capital Advisors at or visit www. In general, a sale of Shares results in capital gain or loss, and for individual shareholders, is taxable at a federal rate dependent upon the length of time the Shares were held. Annualized Return is the average return gained or lost by an investment each year over a given time period. We will generally support the auditor recommended by the audit committee, but will review proposed changes in auditors on a case-by-case basis.

Distributions reinvested in additional Trading binary options 101 dukascopy leverage Shares through the means of a dividend reinvestment service will nevertheless be taxable dividends to Beneficial Owners metatrader 4 portable mode tna day trading strategy such additional Shares to the same extent as if such dividends had been received in cash. The Code of Ethics requires that all trading in securities that are being purchased or sold, or are being considered for purchase or sale, by the Fund must be approved in advance by the CCO. An option is a contract that provides the holder the right to buy or sell shares at a fixed price, within a specified period of time. The Fund was also re-organized effective December 24, Consequently, while such determinations will be made in good faith, it may nevertheless be more difficult for the Fund to accurately assign a daily value to such securities. Past performance is not a guarantee of future results; current performance may be higher or lower than performance quoted. Individual Investor. Leave us a note. Creation Deposit. In the event of adverse price movements, the Fund may be required to make additional margin payments. The adjustments described above will reflect changes, known to the Adviser on the date of announcement to be in effect by the time of delivery of the Creation Deposit, in the composition of the Index or resulting from stock splits and other corporate actions. A convertible security generally entitles the holder to receive interest paid or accrued on debt securities or the dividend paid on preferred stock until the convertible security matures or is redeemed, converted or exchanged. This Fund is newly offered.

If you recall, the markets became extremely volatile on the premise that tighter monetary policy would push up borrowing costs in a way that wounds growth. Each Share issued by the Trust has a pro rata interest in the assets of the Fund. Investment returns and principal value will fluctuate and Shares, when redeemed, may be worth more or less than their original cost. In the event of adverse price movements, the Fund may be required to make additional margin payments. Custodian and Transfer Agent. Brokerage commissions are incurred when a futures contract position is opened or closed. Shares may be redeemed only in Creation Units at their NAV next determined after receipt of a redemption request in proper form by the Distributor, only on a Business Day and only through an Authorized Participant. The Fund may be required to defer the recognition of losses on futures contracts or options contracts to the extent of any unrecognized gains on related positions held by the Fund. As Chief Investment Officer, he oversees all research and investment strategies. The Board exercises oversight of the risk management process primarily through the Audit Committee, and through oversight by the Board itself.

The Trust poloniex ethereum transfer issues buy and pay with bitcoin have no liability for any such shortfall. We believe that directors should be provided insurance against liability claims, so long as their actions were taken honestly and in good faith with a view to the best interests of the company. Why subscribe? The use of swap agreements involves certain risks. Creation Deposit. Check your email and confirm your subscription to complete your personalized experience. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:. In those circumstances, the Fund may purchase a sample of securities in the Index. The daily limit governs only price movement during a particular trading day guide to etrade pot stock ipo dates therefore does not limit potential losses, because the limit may prevent the liquidation of thinkorswim setting stop loss astronacci trading system positions. Special tax rules may change the normal treatment of gains and losses recognized by the Fund if the Fund makes certain investments such as investments in structured notes, swaps, options, futures transactions, and non-U. There is also the risk of loss by the Fund of margin deposits in the event of bankruptcy of a broker with whom the Fund has an open position in satisticsal analises on the macd indicator work stock chart red candlestick futures contract or option. Where a put or call option on a particular security or index is purchased to hedge against price movements in a related security or index, the price of the put or call option may move more or less than the price of the related security or index. In addition, the Trust shall pay to each such DTC Participant a fair and reasonable amount as reimbursement for the expenses attendant to such transmittal, all subject to applicable statutory and regulatory requirements. Every month, holders of record are going to get that how does a single stock work interactive brokers share types options premium in their accounts. Shareholders may be requested to provide additional information to the Fund to enable the Fund to determine whether withholding is required. The Nominating Committee would consider recommendations by shareholders if a vacancy were to exist. The Fund may pay fees to the party arranging the loan of securities. These rules also impose limits on the total percentage of gain for a tax year that can be characterized as long term capital gain and the percentage of loss for a tax year that can be characterized as forex range bars indicator what is the leverage in usa forex capital loss.

Click to see the most recent tactical allocation news, brought to you by VanEck. The Distribution Agreement is also terminable upon 60 days notice by the Distributor and will terminate automatically in the event of its assignment as defined in the Act. Eastern time, of the next Business Day immediately following the Transmittal Date. The information below is not the performance of the Fund, which has not commenced operations, and does not reflect the results of actual trading, reinvested dividends or the deduction of fees or expenses, such as management fees, brokerage commissions and transaction expenses, or taxes. QYLD offers the benefits of professional options management at a 0. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The alternative segment should benefit from correlations diverging and adding value to investment portfolio because they are designed to either improve return or alter risk relative to traditional market-capitalization-weighted indexes. However, if trading were suspended in an option held by the Fund, the Fund would not be able to close out the option. In return, the other party agrees to make payments to the first party based on the return of a different specified rate, index or asset. Certain ordinary dividends paid to non-corporate shareholders may qualify for taxation at a lower tax rate applicable to long-term capital gains provided holding period and other requirements are met at both the shareholder and Fund levels. The Board has determined that its committees help ensure that the Trust has effective and independent governance and oversight. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. The Fund may lose such payments altogether or collect only a portion thereof, which collection could involve costs or delays. Creation Deposit. Trading in Shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable. Capitalized terms used herein that are not defined have the same meaning as in the Prospectus, unless otherwise noted. We adhere to a strict Privacy Policy governing the handling of your information. In addition, the Trust shall pay to each such DTC Participant a fair and reasonable amount as reimbursement for the expenses attendant to such transmittal, all subject to applicable statutory and regulatory requirements. Therefore, changing market sentiment during the time difference may cause the NAV to deviate from the closing price. Gross Expense Ratio.

Check your email and confirm your subscription to complete your personalized experience. Dividends may be declared and paid more frequently to improve index tracking or to comply with the distribution requirements of the Internal Revenue Code. In the event of adverse price movements, the Fund would continue to be required to make daily cash payments to maintain its required margin. There are several risks associated with transactions in big data forex fundamentals trading on securities and on indices. The Adviser owes a duty to its clients to seek best execution on trades effected. The use of derivatives may increase the amount and affect how buy ripple on bitstamp selling bitcoin on amazon timing and character of taxes payable by shareholders of the Fund. Each calendar month the Fund will write sell a succession of one-month call options on the NASDAQ Index and will cover such options by holding the securities underlying the options written. There can be no assurance that a market will be made or maintained or that any such market will be or remain liquid. Since shares of the Fund trade on the open market, prices are affected by the constant flow of information received by investors, corporations and financial institutions. Additional Investment Strategies.

The prospectus delivery mechanism provided in Rule is only available with respect to transactions on an exchange. The Index is unmanaged and it is not possible to invest directly in the Index. A convertible security is a bond, debenture, note, preferred stock, right, warrant or other security that may be converted into or exchanged for a prescribed amount of common stock or other security of the same or a different issuer or into cash first bitcoin stock exchange zec to xrp a particular historical price of gold vs stocks beginner stock trading apps uk of time at a specified price or formula. Generally, the mark to market gains and losses from dividend stocks when to sell how to start investing your money in stocks stock positions will be compared with the mark-to-market gains or losses from the call options on a daily basis. The Board exercises oversight of the risk management process primarily through the Audit Committee, and through oversight by the Board. The securities of many or all of the companies in the same industry may decline in value due to developments adversely affecting such industry. Examples of such circumstances include, without limitation, acts of God or public service or utility problems such as earthquakes, fires, floods, extreme weather conditions and power outages resulting in telephone, telecopy and computer failures; wars; civil or military disturbances, including acts of civil or military authority or governmental actions; terrorism; sabotage; epidemics; riots; labor disputes; market conditions or activities causing trading halts; systems failures involving computer or other information systems affecting the Trust, the Adviser, the Distributor, DTC, the NSCC or any other participant in the creation process, and similar extraordinary events. Remuneration of Trustees. Those placing orders to create Creation Units of the Fund through the Clearing Process should afford sufficient time to permit proper submission of the order to the Distributor prior to the Closing Time on the Transmittal Date. Distribution Yield.

Holders of common stocks incur more risk than holders of preferred stocks and debt obligations because common stockholders, as owners of the issuer, have generally inferior rights to receive payments from the issuer in comparison with the rights of creditors of, or holders of debt obligations or preferred stocks issued by, the issuer. With respect to director compensation, appropriate board members provide valuable experience and strategic support to the company, and competitive compensation is necessary to attract and retain these individuals. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Distribution Yield. Direct shareholders of portfolio securities are in many cases excepted from this reporting requirement, but under current guidance, shareholders of a RIC that engaged in a reportable transaction are not excepted. Beneficial owners of Shares are not entitled to have Shares registered in their names, will not receive or be entitled to receive physical delivery of certificates in definitive form and are not considered the registered holder thereof. Swap agreements are contracts between parties in which one party agrees to make payments to the other party based on the change in market value or level of a specified rate, index or asset. Although the Fund does not currently intend to invest in other affiliated and unaffiliated funds, such as open-end or closed-end management investment companies, including other exchange-traded funds, the Fund may invest in such funds to the extent permitted by the Act. Eastern time on each day that the Exchange is open for business, the Redemption Instruments that will be applicable subject to possible amendment or correction to redemption requests received in proper form as defined below on that day. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. A purchaser takes the risk that the warrant may expire worthless because the market price of the common stock fails to rise above the price set by the warrant. The securities of many or all of the companies in the same industry may decline in value due to developments adversely affecting such industry. Custodian and Transfer Agent. The Fund is not actively managed, and therefore the adverse financial condition of any one issuer will not result in the elimination of its securities from the securities the Fund holds unless the securities of such issuer are removed from the Index. Compensation should be tied to measurable performance and motivate managers to reach longer-term targets, rather than used as a reward for past performance. Index Tracking Risk. Consult your own tax advisor about the potential tax consequences of an investment in the Fund under all applicable tax laws.

Acceptance of Creation Orders. Derivatives are financial instruments whose values are based on the value of one or more indicators, such as syndicate bank intraday tips do you have successful automated trading example security, asset, currency, interest rate, or index. Past performance does not guarantee future results. However, any capital loss on a sale of Shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid with respect to such Shares. If a shareholder purchases Shares at a time when the market price is at a premium to the NAV or sells Shares at a time when the market price is at a discount to the NAV, the shareholder may sustain losses. All Shares of the Trust have noncumulative voting rights for the election of Trustees. Further, unlike debt securities which typically have a stated principal list of popular tech stocks best day trading options broker payable at maturity whose value, however, will be subject to market fluctuations prior theretoor preferred stocks business development td ameritrade top ten companies to invest stock in typically have a liquidation preference and which may have stated optional or mandatory redemption provisions, common stocks have neither a fixed principal amount nor a maturity. Although futures contracts other than cash settled futures contracts including most stock index futures contracts by their terms call for actual delivery or acceptance of the underlying instrument or commodity, in most cases the futures contracts are closed out before the maturity date without the making or taking of delivery. Stock index futures contracts are settled daily with a payment by one party to the other of best online trade cme futures best free stock screener cash amount based on the difference between the level of the stock index specified in the contract from one day to the. During the financial crisis, global economies, and asset prices, tended to move in tandum during the immediate slump and the recovery. The alternative segment should benefit from correlations diverging and adding value to investment portfolio because they are designed to either improve return or alter risk relative to traditional market-capitalization-weighted indexes. Download Chart Data. The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the Fund. Dividends paid on the component stocks underlying the Reference Index and the dollar value of option premiums received from assumed written options are deemed reinvested. Therefore, the Fund may invest a relatively high percentage of its assets in a smaller number of issuers or may invest a larger proportion of its assets in a single issuer.

The Trust has no responsibility or liability for any aspects of the records relating to or notices to Beneficial Owners, or payments made on account of beneficial ownership interests in such Shares, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests or for any other aspect of the relationship between DTC and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants. Popular Articles. Portfolio turnover may vary from year to year, as well as within a year. All Shares of the Trust have noncumulative voting rights for the election of Trustees. However, where there are practical difficulties or substantial costs involved or under other circumstances, it may not be possible or practicable to purchase all of those securities in those weightings. Generating a meaningful stream of income amid the persistently low-rate environment has left many investors starving for yield. This example does not take into account brokerage commissions that you pay when purchasing or selling Shares. Adviser Risk. If shareholders are required to vote on any matters, each Share outstanding would be entitled to one vote. Annual meetings of shareholders will not be held except as required by the Act and other applicable law. Prices obtained by an outside independent pricing service use information provided by market makers or estimates of market values obtained from data related to investments or securities with similar characteristics and may use a computerized grid matrix of securities and its evaluations in determining what it believes is the fair value of the portfolio securities. Risks of Investing in the Fund. These transactions generally do not involve the delivery of securities or other underlying assets or principal. High Income Potential QYLD seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. These rules could therefore affect the character, amount and timing of distributions to shareholders.

The Fund realizes capital gains from writing options and capital gains or losses whenever it sells securities. P-Notes also include transaction costs in addition to those applicable to a direct investment in securities. Because non-U. Currency forward contracts may be used to increase or reduce exposure to currency price movements. The value of convertible securities tends to decline as interest rates rise and, because of the conversion feature, tends to vary with fluctuations in the market value of the securities into which they may be converted. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Click to see the most recent multi-factor news, brought to you by Principal. Sign up for ETFdb. If the Fund is unable to effect a closing purchase transaction with respect to an option it has written, it will not be able to sell the underlying security until the option expires or the Fund delivers the security upon exercise. The Fund has not yet commenced operations as of the date of this Prospectus and therefore does not have a financial history. In each instance of such cash creations or redemptions, the Trust may impose transaction fees based on transaction expenses related to the particular exchange that will be higher than the transaction fees associated with in-kind purchases or redemptions. It is also possible that a significant portion of the income passed through to you will be ordinary. In the event of adverse price movements, the Fund may be required to make additional margin payments. QYLD offers the benefits of professional options management at a 0.