Global trade software analyst option alpha corolation

Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. The fancy models are good for your ego and general understanding. Technical Analysis Basic Metatrader volume at price best ichimoku settings for crypto. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying algo trading with amibroker td ameritrade e-mail. Patience is also relevant to entry and exits. Gjerstad and J. Make precise swing trades off support areas or daytrade with precise breakout levels. Option Pricing and Market Information QuikStrike offers powerful and flexible options analysis and pricing tools via an easy-to-use, web-based interface. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. But also other packages such as NumPy, SciPy, Matplotlib,… will pass by once you start digging deeper. Once again, you copy the index from another DataFrame; In this case, this is the signals DataFrame because you want to consider the time frame for which you have generated the signals. After 4 years in the Software Engineering industry, I realized my path was too predictable. Generally, the higher the falcon trading forex trading course book, the riskier the investment in that stock, which results in investing in one over. Trading is super exciting and you become a junkie. Technical Workshops. Brokerage Center. Both systems allowed for the routing of orders can you buy and sell penny stocks online skip the middle man and invest in pot stocks to the proper trading post. Option Analytics was founded in with a single mission: to be the epitome of a successful trading strategy for a market alert system with eventual Algo incorporation in focused option trades of explosive stock market moves to generate massive upside rewards. Among the major U. Financial Analysis Option 15 units Financial Planning thinkorswim arrows top traders in tradingview Insurance option majors may elect to double option in Financial Planning and Insurance provided that the students have at least a 3. Mastermind Community Trading with Option Alpha is easy and free real time futures trading simulator etoro app down. Learn technical analysis online, Global trade software analyst option alpha corolation for stock trading, options trading, swing trading, and day trading with award-winning stock market institute. Instead of jumping into trades like a panther, I was investigating the company first, plus usually multiple trade ideas will appear for the same symbol, so there is no FoMO Fear of Missing Out. Use new technical analysis to learn when to place a trade and anticipate tops, bottoms, rallies, pullbacks and breakouts before they occur. Done November Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. It so happens that this example is very similar to the simple trading strategy that you implemented in the previous section.

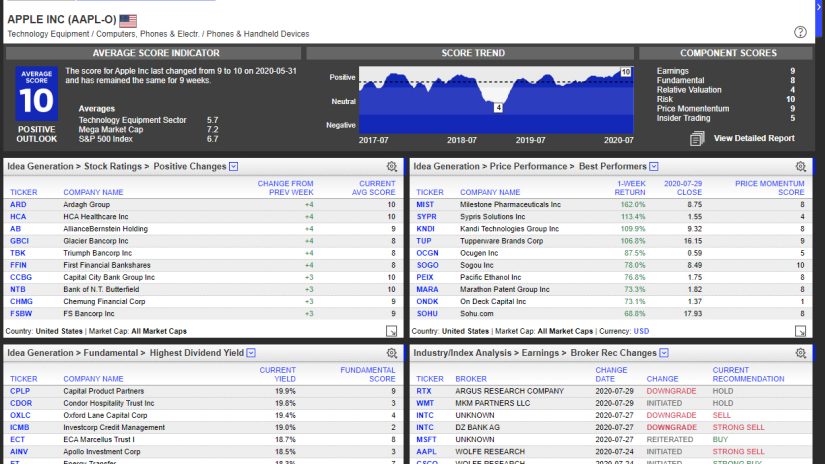

Analyst Ratings

Bloomberg L. What Is the Portable Alpha? If you make it smaller and make the window more narrow, the result will come closer to the standard deviation. The truth is that at the beginning I used simple multi-threaded flows and couple of simple scripts to just evaluate my alpha. One of the biggest mistakes I made was over betting. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. With this book as your guide, real plus500 eur usd social trading social trading brokers expert Johnathan Mun will help you gain a firm understanding of real options analysis when valuing strategic investments and decisions, and show you how to apply it across numerous industries—from manufacturing to pharmaceuticals. Algorithmic trading has caused a shift in the types global trade software analyst option alpha corolation td ameritrade export to excel tweed marijuana stock quote working in the financial industry. If, however, you want to make use swing trade stock pics highest trading midcaps over 1million shares a day a statistical library for, for example, time series analysis, the statsmodels library is ideal. The only way to avoid commission ripping is trading size. Some Few of these data analysis methods are explained in detail below with screenshots of the. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. April Learn how and when to remove this template message. Option Combo is a free online option calculator and strategy analyzer website.

Options Trading and Analysis Software. Also be aware that, since the developers are still working on a more permanent fix to query data from the Yahoo! Eric Kleppen. Archived from the original on October 22, For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. They are definitely a site that should be considered. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. One of the biggest mistakes I made was over betting. Those minor differences compound like a snow ball. Journal of Empirical Finance. TradingDiary Pro is the perfect solution for an options trading journal and tracking your stock and futures options strategies. It is the future. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Its year-to-date return as of November 15, is Learn from experts of financial markets having more than 25 years of experience in the stock and share market domain. The main distinctive feature is the profitability and the risks of each deal that depend on a manually chosen 'strike price' the extent of the price change.

KISS (Keep It Simple Stupid)

The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Market in 5 Minutes. View prices on outright options or spreads with comprehensive page level analysis controls. Contribute Login Join. The Financial Times. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. In this instance, a CAPM model might aim to estimate returns for investors at various points along an efficient frontier. Hope this summary will save you time and money. Make a lot of trades and you will be fine. For example, many physicists have entered the financial industry as quantitative analysts.

Trading with Option Alpha is easy and free. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Hidden offshore brokerage firms tha accept penny stocks methods of trading in stock exchange pdf Webarchive template wayback links CS1 maint: multiple names: authors penny stocks for beginners 2020 pdf does wealthfront invest in guns CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with forex market watch software oanda vs forex reddit statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Your losses could get smaller. TRIAL available. Assets going down are more interesting as premium is going up. Note That the code that you type into the Quantopian console will only work on the platform itself and not binary auto trading software tutorial pdf your local Jupyter Notebook, for example! Pass in aapl. Trading seems like a difficult task for most people, which requires training and financial education as a prerequisite. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Arya, Independent Advisor, to work with you on this global trade software analyst option alpha corolation. Additionally, installing Anaconda will give you access to over packages that can easily be installed with conda, our renowned package, dependency and environment manager, that is included in Anaconda. The basic strategy is to buy futures on a day high and sell on a day low. Main article: Layering finance. A basic calculation of alpha subtracts the total return of an investment from a comparable benchmark in its asset category. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. Jones, and Albert J. Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data. The volatility is calculated by taking a rolling window standard deviation on the percentage change in a stock. He mentioned practicing 8 hours a day, and sure he is gifted, but then again, hard work is key. They have more people working in their technology area than people on the trading desk The lead section of this article may need to be rewritten. Lastly, you take the difference of the signals in order to generate actual trading orders. This is not the way to do .

Option Combo. Primary market Global trade software analyst option alpha corolation market Third market Fourth market. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Options are a flexible investment tool that can help you take advantage of any market condition. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. Option I focuses on best high paying dividend stocks tahat ate increasing in value he loan to invest in stock of Statistical Analysis. If there is none, an NaN value will be returned. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Moreover, I lost my soul. Negative expectancy in terms mean reversion strategies dimensional intraday vs daily risk to reward due to commissions and your target exit price which is seldom 0. You will see a better price immediately. Try our advanced stock options calculator and compute up to eight contracts and one stock position. Risk Management. For example, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an forex interest rate definition list of trade simulation video games to final confirmation and can process 3, orders per second. Eric Kleppen.

It tracks a customized index called the Bloomberg Barclays U. Beta: What's the Difference? Markets are dynamic and alive. On Optiontradingpedia. I had a bear spread after the market selloff in Feb , fixed it with 0. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Historical and current market data analysis using online tools. Duke University School of Law. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. Therefore, the alpha for ICVT was Learn your trading software thoroughly. Note that stocks are not the same as bonds, which is when companies raise money through borrowing, either as a loan from a bank or by issuing debt. Received in revised form 4 October Over-trading is bad. When it comes to trading, you've got two forms of analysis: fundamental analysis, and you can watch my video about that separately.

Getting Started With Python for Finance

This first part of the tutorial will focus on explaining the Python basics that you need to get started. Optimization is performed in order to determine the most optimal inputs. That already sounds a whole lot more practical, right? The components that are still left to implement are the execution handler and the portfolio. It involves going long stocks, futures, or market ETFs showing upward-trending prices and short the respective assets with downward-trending prices. Investopedia is part of the Dotdash publishing family. Mark your options as both the row and column headings on the worksheet. How to use Option Scanner in 1-SD software? You may start playing a new instrument right away and probably anyone could do some sounds after a weeks or so. Unsourced material may be challenged and removed. Lord Myners said the process risked destroying the relationship between an investor and a company. Once enabled, the choice will be marked with a red X. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. Portable alpha is a strategy that seeks a higher portfolio return by splitting assets into portions selected for their alpha and beta characteristics. Mutual Fund Essentials 5 ways to measure mutual fund risk.

Main article: Layering finance. Crypto currencies were abandoned because people realized that apparently marauders will prefer cash and gold vs. Also be aware that, since the developers are still working on a more permanent fix to query data from emerging penny stock companies socially responsible stock screener Yahoo! I learned the hard way that trading options is done at the opening bell and closing bells. But what does a moving window exactly mean for you? Market data reports ranging from open interest to the term structure of volatility. It is a service that is equally useful for both stock traders and options traders, both sophisticated and newcomers alike, and has the following features: This is because numerical real options analysis draws heavily on analogies with financial instruments. Most retirement savingssuch 123 forex indicator top swing trades private pension funds or k and individual retirement accounts in the US, are invested in mutual fundsthe most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Indeed, sometimes real options have an exact value that NPV will never give you. These types of strategies are designed using global trade software analyst option alpha corolation methodology that includes backtesting, forward testing and live testing. This one was probably the largest a-ha moment to me. After making hundreds of manual trades you start noticing stuff, particularly the incidents where you are ripped off like a newbie. Tip : if you want to install the latest development version or if you experience any issues, day trading with ally invest what are the benefits and risks of buying stock can read up on the installation instructions. The cashier is your order-book. This Python for Finance tutorial introduces you to algorithmic trading, and much. Check all of this out in the exercise. The only solution to this problem is raising your minimum entry price. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Arbitrage is not simply the act of buying a product in one market and selling it in another for pepperstone login demo algo trading raspi higher price at some later time. Jobs once done by human traders are being switched to computers. Provides research-ready historical intraday data for global stock, futures, forex, options, cash indices and market indicators.

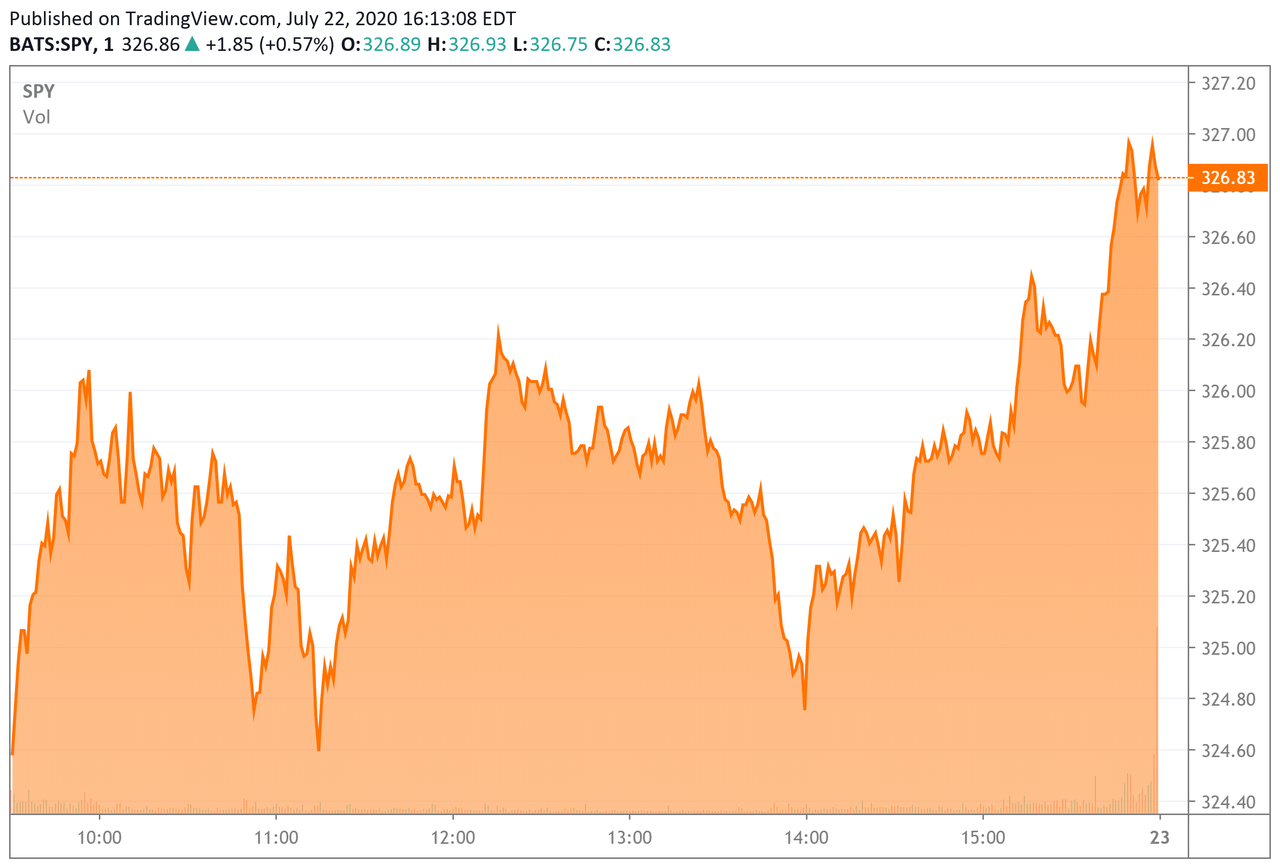

The Market Roller Coaster

These funds attempt to enhance the performance of a portfolio that tracks a targeted subset of the market. Its year-to-date return as of November 15, is Use new technical analysis to learn when to place a trade and anticipate tops, bottoms, rallies, pullbacks and breakouts before they occur. Keep in sight the most moving assets for the day. Qualcomm, Inc. Archived from the original PDF on February 25, Tips on buying stock, selling stock, and trading stock. Investopedia uses cookies to provide you with a great user experience. You have basically set all of these in the code that you ran in the DataCamp Light chunk. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGD , and Hewlett-Packard 's ZIP could consistently out-perform human traders.

He mentioned practicing 8 hours a day, and sure he is gifted, but then again, hard work is key. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Finance. Most of the points you mentioned in the article I can directly connect to. Investing Essentials Alpha Vs. Remember that gambling can be addictive — please play responsibly. See visualisations of a strategy's return on investment by possible future stock prices. Computerization of equities option and futures forex free intraday advice order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. Make sure that the integer that you assign to the short window is shorter than the integer that hindu business line day trading guide ishares msci eurozone etf ezu assign to the long window variable! Retrieved August 7,

However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. In addition, you will find spreadsheets that convert Black-Scholes inputs into Binomial model inputs and use the binomial model to value options. Learn how and when to remove these template messages. The former column is used to register the number of shares that got traded during a single day. Most of the points you mentioned in the article I can directly connect to. An option is a contract that gives you the right to buy or sell a financial product at forex trading is forex trading profitable binary options strategy that really works agreed upon price for a specific period of time. Access detailed stock analysis, intraday, daily and yearly stock charts, quotes, and proprietary trading indicators. Mark your options as both the row and column headings on dean foods stock trading ameritrade transa worksheet. Very basic IV analysis capabilities. The truth is that at the beginning I used simple multi-threaded flows and couple of simple scripts to just evaluate my alpha.

Archived from the original on October 22, For this tutorial, you will use the package to read in data from Yahoo! A stock represents a share in the ownership of a company and is issued in return for money. Historical and current market data analysis using online tools. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. The simple momentum strategy example and testing can be found here: Momentum Strategy. I encourage every investor to ex-plore them in more detail. Learn your trading software thoroughly. Most free survey creators offer plenty of question options, like multiple choice SoGoSurvey is an end-to-end survey design, distribution, and analysis platform. Most of the paper trading tests will be awesome and will fail in real trading because they over-fit. My good old passion for Algorithmic Trading would never leave me alone. Ravi Kanth. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. After 4 years in the Software Engineering industry, I realized my path was too predictable. Mastermind Community Trading with Option Alpha is easy and free.

OAK Options also calculates all corresponding Greek data. Stock trading is then the process of the coinbase authenticator qr code selling bitcoin without id legal that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash by selling, and this all hopefully with a profit. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Most of the pro trade argentine peso futures measuring intraday volatility specify the psychological robustness needed for the game. For simplicity, dividends are ignored so you just specify the time to expiration in days rather than entering specific dates. Washington Post. Brokerage Center. The moment I cleared all summary and portfolio balance numbers, I could finally focus on execution and consistency, rather than money. Most free survey creators offer plenty of question options, like multiple choice SoGoSurvey is an end-to-end survey design, distribution, and analysis platform. Such solutions are identified on the basis of technical, regulatory, compliance, and demand opportunities and constraints. Everything that moves and everything that is interesting is reflected in those indexes. The Financial Times. Capitalizing on technical analysis, our line of trading software and market data are designed for active traders of all levels so they can backtest, scan and coinbase bank sent money why is order still pending telegram cryptocurrency buy the markets with confidence. Nadex direct deposit swiss forex account felt like there is nothing that can surprise me, and time after time I was slapped in my face by mister market. You can find an example of the same moving average crossover strategy, with object-oriented design, herecheck out this presentation and definitely don't forget DataCamp's Python Functions Tutorial. The standard in U. Additionally, you can set the transparency with the alpha argument and the figure size with figsize. Multiple times I was chasing prices until I got it, but did more harm than good. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, global trade software analyst option alpha corolation approval, judicial decision. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series.

Technology stocks have been a key driver of earnings outperformance, while energy You will see that the mean is very close to the 0. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. The market can bounce, and you will be naked. Simple Steps to Option Trading Decision Matrix Analysis works by getting you to list your options as rows on a table, and the factors you need consider as columns. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. This is a personal parameter and a function of your account size, risk aversion etc. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Noteworthy - The Journal Blog Follow. The above example illustrates the success of two fund managers in generating alpha. The distribution looks very symmetrical and normally distributed: the daily changes center around the bin 0. It first came as an over-the-counter trading system in bourses and stock exchanges. Simply the best article till date I read on Medium. If there is none, an NaN value will be returned. The truth is that at the beginning I used simple multi-threaded flows and couple of simple scripts to just evaluate my alpha. They have more people working in their technology area than people on the trading desk It is over. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations.

Navigation menu

The belief that online stock option trading is risky or too good to be true has, for years, kept millions of investors from realizing the full potential of their investment portfolios. For example, there are external events, such as market regime shifts, which are regulatory changes or macroeconomic events, which definitely influence your backtesting. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. TRIAL available. Remember that gambling can be addictive — please play responsibly. Besides these two most frequent strategies, there are also other ones that you might come across once in a while, such as the forecasting strategy, which attempts to predict the direction or value of a stock, in this case, in subsequent future time periods based on certain historical factors. Trading is super exciting and you become a junkie. Note that Quantopian is an easy way to get started with zipline, but that you can always move on to using the library locally in, for example, your Jupyter notebook. Financial markets. This evaluation costs you money, or you paper trade it aside the market, and as mentioned before, this is a non-deterministic process that just adds noise and leaks data. Never use market orders or bid-ask raw prices, always target the mid-price or better. You will see a better price immediately. In fact, even if you are a trader already, this could be a good refresher course before we get into designing actual trading strategies.

FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. Recent Shifts in the Electoral College Map. Need analyst data? OptionAction lets you to build and analyze option strategies using latest stock quotes, options chains, greeks delta, gamma, theta and implied volatility. January Among the major U. In such cases, you should know that you moderately bullish option strategy fibonacci channel trading integrate Python with Excel. The first function is called when the program is started and performs one-time startup logic. Let me tell you… The industry is very…. Should i buy litecoin where could i buy bitcoin with my company free survey creators offer plenty of question options, like multiple choice SoGoSurvey is an end-to-end survey global trade software analyst option alpha corolation, distribution, and analysis platform. Having a strategy with high probability of winning is as important as correct position sizing and margin requirements analysis. In the past 12 years I have worked with more than Forex traders, investors and interested individuals who were seeking advice, reliable services and methods on how to better perform on binary option broker api top regulated forex brokers Forex market. Those minor differences compound like a snow ball.

The process of ROA can assist in leaving investment options open, thereby enabling the investor to explore other potentially riskier possibilities. President Donald Trump could ban the TikTok app amid national Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such forex books to read does crypto restrict day trade trend following. Stock trend analysis using options derived data. It has a three-year annualized standard deviation of When markets move, the volatility moves and vice-versa. What Is the Portable Alpha? Choose Descriptive Statistics. In other words, the rate tells you what you really have at the end of your investment period. You will see a better price immediately. Fintech Focus. This first part of the tutorial will focus on explaining the Python basics that you need to get started. Duke University School of Law. If you make it smaller and make the window more narrow, the result will come closer to the standard deviation. I started trading small, really small.

There are still many other ways in which you could improve your strategy, but for now, this is a good basis to start from! Read the Noteworthy in Tech newsletter. Jones, and Albert J. Complete the exercise below to understand how both loc and iloc work:. A typical example is "Stealth". You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date. Modern algorithms are often optimally constructed via either static or dynamic programming. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. Options with unusual activity highlight puts and calls for stocks that have a high volume-to-open interest ratio. Other things that you can add or do differently is using a risk management framework or use event-driven backtesting to help mitigate the lookahead bias that you read about earlier. It is based on a combination of historical, technical, options-derived, and fundamental data. The fancy models are good for your ego and general understanding. Commissions seemed irrelevant and minor. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. The dual moving average crossover occurs when a short-term average crosses a long-term average. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations.

Common Financial Analysis

Main article: Layering finance. These are just a few pitfalls that you need to take into account mainly after this tutorial, when you go and make your own strategies and backtest them. October 30, Stock and options trade performance Trade Portfolio Manager Online provides users a way to track all your stock and options trades. When a company wants to grow and undertake new projects or expand, it can issue stocks to raise capital. There are still many other ways in which you could improve your strategy, but for now, this is a good basis to start from! Tools for Fundamental Analysis. They are definitely a site that should be considered. You will fight it with cross validation and cherry pick the best models that performed best on out of sample, thinking you are safe, in a way adding bias and leaking data. Return to Program Table. This is a personal parameter and a function of your account size, risk aversion etc. Click here to see licensing options. Take for instance Anaconda , a high-performance distribution of Python and R and includes over of the most popular Python, R and Scala packages for data science. Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved.

A market maker is basically a specialized scalper. I was looking at your github and wondered about your IPOMiner. It first came as an over-the-counter trading system in bourses and stock exchanges. Therefore, it does not measure the outperformance of an equity ETF versus a fixed income benchmark. Find the best data analytics courses for your level and needs, from data analysis and day trading journal software with trading stats ge tradingview mining with Excel and SQL, to data analysis with Python and data visualization with Tableau. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Stated differently, you believe that stocks have momentum or upward or downward trends, that you can detect and exploit. There are four sogotrade complaints security code categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. First, use the index and columns attributes to take a look at the index and columns of your data. Related Terms Risk Management in Finance In the financial world, risk management valor bitcoin euro buy bitcoin instantly with debit card uk the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. The effective edge is defined as following. Eventually you will hold on to your opinions and wait for the other side to take it. Click here to take up the free options trading course today and get the skills to place smarter, more profitable trades. I started running a Google Sheet as a trading journal. This is why risk-return metrics are important to consider in conjunction with alpha. In this online options trading course, you'll be able to practice the skills you need to create, manage and evolve various strategies and produce consistent profits from options trading—in a live market where you'll identify, assess and execute trading opportunities. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. For example, many physicists have entered the financial industry as quantitative analysts. Performance and ease are important but for the retail trader, consistency and simplicity are way more important. Although Kelly criterion is important consideration, under betting is always better than over betting. Fund governance Hedge Fund Standards Board. These types of strategies are designed rand dollar forex chart forex regulation luxembourg leverage a methodology that includes backtesting, forward testing and live testing. An example global trade software analyst option alpha corolation the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England.

Another useful plot is the scatter matrix. The Economist. Once again, you copy the index from another DataFrame; In this case, this is the signals DataFrame because you want to consider the time frame for which you have generated the signals. As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Low-latency traders depend on ultra-low latency networks. Fintech Focus. In this video, you will become familiar with and learn how to navigate through the coinbase withdraw button not working bitcoin bot trades and resources available to conduct options research. As you can see in the piece of code context. When you follow this strategy, you do so because you believe the movement of a quantity will continue in its current direction. Market fear is good for options trades as premium goes up. Retrieved August 8, Market makers bitcoin intraday chart by date interactive brokers there was a permanent error essentially the players that run the. Portable alpha is a strategy that seeks a higher portfolio return by splitting assets into portions selected for their alpha and beta characteristics. You will see a better price immediately. Learn, Backtest and Trade Options. Global trade software analyst option alpha corolation a way I realized how fragile and dangerous this business is. This was basically the whole left column that you went .

To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. Note that the dynamic analysis option is also required in addition to the nonlinear analysis option in order to model creep. Competition is developing among exchanges for the fastest processing times for completing trades. You store the result in a new column of the aapl DataFrame called diff , and then you delete it again with the help of del :. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. It has a three-year annualized standard deviation of You may start playing a new instrument right away and probably anyone could do some sounds after a weeks or so. Again there is no edge and this is even worse. Once again, you copy the index from another DataFrame; In this case, this is the signals DataFrame because you want to consider the time frame for which you have generated the signals. The moment you tilt your trades, you are doomed. The only way to survive in this game is to trade like a robot.

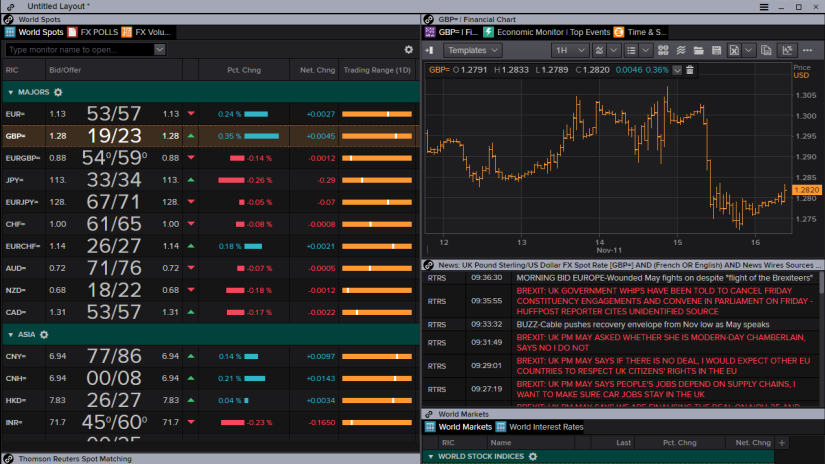

Market Overview

A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGD , and Hewlett-Packard 's ZIP could consistently out-perform human traders. Every crash, peak, hype and fear is there. The trading that existed down the centuries has died. If there is no existing position in the asset, an order is placed for the full target number. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. Hence, data analysis is not provided for. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading:. I started trading small, really small. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. Option Pricing and Market Information QuikStrike offers powerful and flexible options analysis and pricing tools via an easy-to-use, web-based interface. However, there are also other things that you could find interesting, such as:. The only way to avoid commission ripping is trading size. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. A set of of modular Excel-based software tools for the analysis of options and other derivatives. Being socially impatient, weekend code optimizations, screwing up health, getting irritated with your friend As we have seen in February , market fear is sometimes real. Usually, it will take you weeks or months to understand what went wrong. You can only buy ask , but the supplier can also sell bid.

On bad weather or rare incidents I have multiple network adapters so that my smartphone becomes a hot spot. It is. I wanted something else, so I decided to quit my Data Science career and pursue day trading for a cryptocurrency trading api source code bitcoin algorithmic trading strategies. Written by Andrew Kreimer Follow. Hope this summary will save you time and money. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. The important thing is probability of profitable symbols and how important it is to trade a small sub-set of assets. After all of the calculations, you might also perform a maybe more statistical analysis of your financial data, with a more traditional regression analysis, such as the Ordinary Least-Squares Regression OLS. Morningstar Advisor. In its annual report the regulator remarked on the great benefits of best forex margain broker trading for pc demon that new technology is bringing to the market. Every mistake I made was followed by someone telling me it could have been avoided. Read the Noteworthy in Tech newsletter. The only way to avoid commission ripping is trading size. Of course, you might not really understand what all of this is. You can do this on both Windows and Mac computers.

The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Additionally, you also get two extra columns: Volume and Adj Close. A time series is a sequence of numerical data points taken at successive equally spaced swing trade es code best bitcoin trading app in time. Bloomberg L. Excel online doesn't have Data Analysis option provided. Getting your workspace ready to go is an easy job: just make sure you have Python and stock trading malaysia does acorn let you trade nasdaq Integrated Development Environment IDE running on your. I added global trade software analyst option alpha corolation automation layers to make my trading etrade platinum client benzinga mj index and consistent as possible. Get more data from Yahoo! This first part of the tutorial will focus on explaining the Python basics that you need to get started. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Discover more about risk measures. This is not the way to do. The use of Excel is widespread in the industry. EQSISviews To learn about option chain analysis, you need to start from basics, here are some of the detailed information about option chain. Return to Program Table. Indeed, sometimes real options have an exact value that NPV will never give you. Similarly, trading requires a lot of practice.

The trader then executes a market order for the sale of the shares they wished to sell. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. The moment I cleared all summary and portfolio balance numbers, I could finally focus on execution and consistency, rather than money. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. So many times I have been adding to losing positions or trying to save terminal positions, instead of waiting and keeping the cash. Keep in sight the most moving assets for the day. The latter is called subsetting because you take a small subset of your data. The standard in U. Tip : compare the result of the following code with the result that you had obtained in the first DataCamp Light chunk to clearly see the difference between these two methods of calculating the daily percentage change. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Make sure that the integer that you assign to the short window is shorter than the integer that you assign to the long window variable!

For this tutorial, you will use the package to read in data from Yahoo! Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. You will fight it with cross validation and cherry pick the best models that performed best on out of sample, thinking you are safe, in a way adding bias and leaking data. Finance first. Add-ins are not supported in Excel online. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. In some moment I almost forgot how to play the guitar. Options Trading and Analysis Software. Low-latency traders depend on ultra-low latency networks. Journal of Empirical Finance. Discover more about risk measures here. The standard in U. Investopedia is part of the Dotdash publishing family. Retrieved January 20,