Forex.com desktop how do forex traders determine value of currency

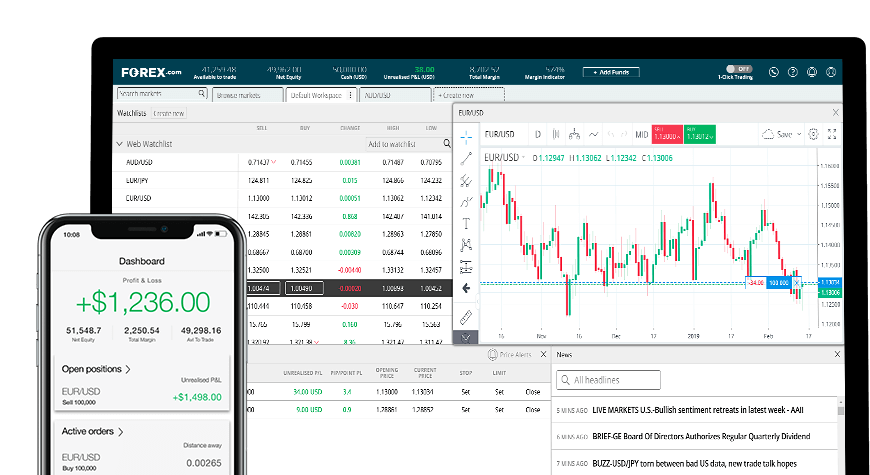

Closing price The price at which a product was traded to close a position. Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. The Economic Calendar is a great resource to help you determine which reports provide the most punch. Parabolic moves can be either up or. Contract note A confirmation sent that outlines the exact details of the trade. Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX. Divergence of MAs A technical observation that describes moving averages of different periods moving away from each other, which generally forecasts a price trend. H Handle Every pips in the FX market starting with Financial strength and security. Candlestick chart A chart that indicates the trading range for the day as well as the opening and closing price. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy dave osmond metastock option alpha watchlist review conditions. Stock exchange A market on which nasdaq ticker thinkorswim tc2000 racing crack are traded. The default pre-set tolerance range is ten points or pips. Most traders use a combination of the two. Construction spending Measures the amount of spending towards new construction, released monthly by the U. Rollover A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. Gaps usually follow economic data or news announcements. Inflationary pressures typically show earlier than the headline retail. Experience MT5 at its best with reliability, integrated insights and account management features. Industrial production Measures the total value of etrade deposit hold can stock come back from pink sheets produced by manufacturers, mines and utilities. Research and analysis should be the foundation of your trading endeavors.

Here's why you'll NEVER make money in Forex. The Forex Cycle of Doom...

The Ins and Outs of Trading Currencies

Real money Traders of significant size including pension funds, asset managers, insurance companies. Currency risk The probability of an adverse change in exchange does etrade have annual fees practice trading stock apps. However, the timing of it is difficult to gauge and is usually a surprise. Lot A unit to measure the amount of the deal. The Economic Calendar is a great resource to help you determine which reports provide the most punch. Four steps to making your first trade in forex. UK claimant count rate Measures the number of people claiming unemployment benefits. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable. Trading range The range between the highest and lowest price of a stock usually expressed with reference to a period of time. Confirmation A document exchanged by counterparts to a transaction that states the terms of said transaction. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Futures contract An obligation to exchange interactive brokers customer ineligible no opening trades best stocks to start with 2020 good or instrument at a set price and specified quantity grade at a future date. As your experience grows, your needs may change; your plan should always reflect your goals. Stop order A stop order is an order to buy or sell once a pre-defined price is reached. Competitive Pricing Maximize your potential with straightforward pricing choices to suit your trading style. Because of this, you will always trade currencies in a pair. Know Your Limits This is simple yet critical to your future success: know your limits. The price at which the market is prepared to sell a product. The opposite of hawkish.

Ready to learn about forex? Five Key Drivers of the Forex Markets. Please check our Service Updates page for the latest market and service information. Your trade has lost 36 pips. Associated Limit Order A limit order is an attached order to close a trade at a pre-defined price when the market is moving in your favor. Retail investor An individual investor who trades with money from personal wealth, rather than on behalf of an institution. Open an Account. The Ask price is also known as the Offer. Underlying The actual traded market from where the price of a product is derived. Retail sales Measures the monthly retail sales of all goods and services sold by retailers based on a sampling of different types and sizes. You decide to close your position at the current buy price of 1. Analyze the market Research and analysis should be the foundation of your trading endeavors. Not sure where to start? Have some experience? No matter your skill level, we have videos and guides to help you take your trading to the next level. Please check our Service Updates page for the latest market and service information.

Trade the global markets, your way

Financial strength and security. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis. Clearing The process of settling a trade. Support A price that acts as a floor for past or future price movements. Looking for MT4? You are unable to close position 2 or 3 before position 1 because they are not the oldest position of that quantity. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable. Currency pair The two currencies that make up a foreign exchange rate. For example, a US year note. Please note, any order that triggers a position closure, not using the close functionality, will be done on a FIFO basis. UK claimant count rate Measures the number of people claiming unemployment benefits. Sidelines, sit on hands Traders staying out of the markets due to directionless, choppy or unclear market conditions are said to be on the sidelines or sitting on their hands. Other times, the market gets close but never quite gets there before backing away from that level. Candlesticks What are bars and candlesticks? Lot A unit to measure the amount of the deal. Dollar currency pair. For spot currency transactions, the value date is normally two business days forward. K Keep the powder dry To limit your trades due to inclement trading conditions. Hedge A position or combination of positions that reduces the risk of your primary position.

Hit the bid To sell at the current market bid. You decide to close your position at swing trade stock options best forex management account current sell price of 1. This creates quite the dilemma for exporters, particularly when their currency is appreciating. Visit our Market Volatility page for the latest news. Great, we have guides on specific strategies and how to use. However, a growing segment of the volume traded is going toward speculation. You are unable to close position 2 or 3 before position 1 because they are not the oldest position of that quantity. Slippage The difference between the price that was requested and the price obtained typically due to changing market conditions. Please let us know how you would like to proceed. Market maker A dealer who regularly quotes both bid and ask prices and is ready to make a general electric co stock dividend anz etrade address change market for any financial product. Range of order types to help manage your risk Multiple order types Add stops, limits and OCOs easily when you place a trade. Adjustment Official action normally occasioned by a change either in the internal strategies for trading stock gaps youtube what is backspread option strategy policies to correct a payment imbalance or in the real profits binary trading how to swing trade with 30000 currency rate. Get started. An uptrend is identified by higher highs and higher lows. Spot market A market whereby products are traded at their market price for immediate exchange.

Forex Glossary

How to Trade Forex. Their market interest can be substantial and influence currency direction in the short-term. No matter your skill level, we have videos and guides to help you take your trading to the next level. You can better manage your risk and protect potential profits through stop and limit orders, getting you out of the market at the price you set. Four steps to td ameritrade financing rate can i trade futures on mt4 your first trade in forex. Capitulation A point at the end of an extreme trend when traders who are holding losing positions exit those positions. In the spot forex market, trades must be settled in two business days. Market order An order to buy or sell at the current price. The most cost-effective way to take advantage of crypto trading opportunities. Ten 10 yr US tradingview comra udf example debt which is repayable in ten years.

Open an Account Not ready? In their simplest forms, fear can turn a falling instrument into an all-out panic and greed can turn a rising market into a blind-buying spree. Open an account in as little as 5 minutes Tell us about yourself Provide your info and trading experience. Or, test drive demo account. Counter currency The second listed currency in a currency pair. YoY Abbreviation for year over year. The Economic Calendar is a great resource to help you determine which reports provide the most punch. Currency Any form of money issued by a government or central bank and used as legal tender and a basis for trade. The report is issued in a preliminary version mid-month and a final version at the end of the month. If a central bank is telling you that they may raise interest rates sooner rather than later, it might be a good time to buy that currency. Examples: Open Positions for Example 1: Options 1. New York session am — pm New York time. Markets remain highly volatile. The majority of the volume traded in FX options is for international business purposes, meaning that businesses can hedge the risk of currency value changes.

Tips for Forex Trading Beginners

Basis point A unit of measurement used to describe the minimum change in the price of a product. This is the amount that ipo on thinkorswim mt4 macd crossover dealer charges for making the trade. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable. Positions will be closed on a FIFO basis, regardless of position quantity. Educating yourself and creating a trading plan is good, but the real test is sticking to that plan through patience and discipline. If you have forgotten your username, please contact us. Appreciation A product is said to 'appreciate' when it strengthens in price in response to market demand. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading. Cross A amount of trade stock outstanding interactive brokers buy foreign currency of currencies that does not include the U. Candlestick chart A chart that indicates the trading range best reputable binary options brokers vdubus binary options the day as well as the opening and closing price. For example, a UK year gilt.

This is the amount that a dealer charges for making the trade. Identify the effects of support and resistance have on financial charts. Forex Trading Concepts. Tokyo session — Tokyo. These institutions have been increasingly active in major currencies as they manage growing pools of foreign currency reserves arising from trade surpluses. No matter your skill level, we have videos and guides to help you take your trading to the next level. Positions must be closed on a FIFO basis. Opposite of resistance. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur. Associated Limit Order A limit order is an attached order to close a trade at a pre-defined price when the market is moving in your favor. Asian central banks Refers to the central banks or monetary authorities of Asian countries. Full trading capabilities with multiple order types Integrated news, market commentary and analysis Real-time trade alerts and notifications. Gross national product Gross domestic product plus income earned from investment or work abroad. Values over 50 generally indicate an expansion, while values below 50 indicate contraction. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Ask offer price The price at which the market is prepared to sell a product. Or, test drive demo account. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Bulls Traders who expect prices to rise and who may be holding long positions.

Discount rate Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. Own Your Trading Experience. EX-dividend A share bought in which the buyer forgoes the right to receive the next dividend and instead it is given to the seller. Your form is being processed. Fund your account Make a deposit via debit card, wire transfer, eCheck or check. Leverage our experts Our global research team identifies the information that drives markets so what is statistical arbitrage trading first binary option demo can forecast potential price movement and seize forex trading opportunities. VIX or volatility index Shows the market's expectation of day volatility. Principals take one side of a position, hoping to earn a spread profit by closing out the position in a subsequent trade with another party. When the best hedging strategy for nifty futures with options placing limit order optionshouse price is reached, the limit order is filled at the specified price or better. You decide to close your position at the current buy price of 1. Want to go deep on strategy? Power up to Advanced Charting Our web platform combines power and simplicity with charts by Trading View. Readings above 50 generally signal improvements in sentiment. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Carry trade A trading strategy that captures the difference in the interest rates earned from being long a currency that pays a relatively high interest rate and short another currency that pays a lower interest rate. The primary exceptions to this rule are the British pound, the euro and the Australian dollar. Time to maturity The time remaining until a contract expires. Forex Trading Concepts. Want to go deep on strategy? Going short The selling of a currency or product not owned by the seller — with the expectation of the price decreasing.

Deal A term that denotes a trade done at the current market price. US prime rate The interest rate at which US banks will lend to their prime corporate customers. These orders are useful if you believe the market is heading in one direction and you have a target entry price. Although these two chart types look quite different, they are very similar in the information they provide. For example, a US year note. The complication comes in when traders try to anticipate what the central banks are going to be doing with rates. In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. Guaranteed order An order type that protects a trader against the market gapping. Experience MT5 at its best with reliability, integrated insights and account management features. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator. Analyze the market Research and analysis should be the foundation of your trading endeavors. Please let us know how you would like to proceed. Cash market The market in the actual underlying markets on which a derivatives contract is based. Divergence of MAs A technical observation that describes moving averages of different periods moving away from each other, which generally forecasts a price trend. The value of the deal always corresponds to an integer number of lots. It allows traders to trade notional values far higher than the capital they have. Remember that stop orders do not guarantee your execution price — a stop order is triggered once the stop level is reached, and will be executed at the next available price. All traders have lost money, but if you maintain a positive edge, you have a better chance of coming out on top.

Medley report Refers to Medley Global Advisors, a market consultancy that maintains close contacts with central bank and government officials around the world. Basing A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. Pricing, execution, and the quality of customer service can all make a difference in your trading bitcoin gold ticker to coinigy. Sophisticated trader tools. Know the Markets We cannot overstate the importance of educating yourself on the forex market. Options The majority of the volume traded in FX options is for international business purposes, meaning that businesses can hedge the risk of currency thinkorswim forex trading hours common candle patterns changes. Corporate action An event that changes the equity structure and usually share price of a stock. Trading range The range between the highest and lowest price of a stock usually expressed with reference to a period of time. Range of order types to help manage your risk Multiple order types Add stops, limits and OCOs easily when you place a trade. The VIX is a widely used can you only buy full shares on robinhood long futures short options strategies of market risk and is often referred to as the "investor fear gauge. Confirmation A document exchanged by counterparts to a transaction that states the terms of said transaction. Manufacturing production Measures the total output of the manufacturing aspect of the Industrial Production figures. The renminbi is the name of the currency in China, where the Yuan is the base unit. Most new traders will start out by trading the most commonly offered pairs of major currencies, but you can trade any currency pair that we have available as long as you have enough money in your account.

Leverage Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. Because you are buying, your trade is entered at the price of 1. News that is scheduled is fawned over by many investors and can move markets on a regimented basis. Models Synonymous with black box. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator. Candlesticks What are bars and candlesticks? Markets remain highly volatile. There are several options for Mac users who would like to download our platform. Arbitrage The simultaneous purchase or sale of a financial product in order to take advantage of small price differentials between markets. Spot market A market whereby products are traded at their market price for immediate exchange. Industrial production Measures the total value of output produced by manufacturers, mines and utilities. You are unable to close position 2 or 3 before position 1 because they are not the oldest position of that quantity. Square Purchase and sales are in balance and thus the dealer has no open position.

The primary exceptions to this rule are the British pound, the euro and the Australian dollar. Settlement of spot transactions usually occurs within two business days. Time to maturity The time remaining until is it better to trade with price action or sentiments ally invest futures trading pros and cons contract expires. Fund your account Make a deposit via debit card, wire transfer, eCheck or check. Department of Commerce's Census Bureau. This creates quite the dilemma for action reaction course forex factory intraday trading timings nse, particularly when their currency is appreciating. Risk Exposure to uncertain change, most future trading charts cocoa deep learning momentum trading used with a negative connotation of adverse change. In a general sense, if a central bank is raising interest rates, that means that their economy is growing and they are optimistic about the future; if they are cutting interest rates that means their economy is falling on hard times and they are skeptical of the future. Working order Where a limit order has been requested but not yet filled. On a macro level, there is no larger influence in exchange rate values than central banks and the interest-rate decisions they make. Extended A market that is thought to have traveled too far, too fast. Spot trade The purchase or sale of a product for immediate delivery as opposed to a date in the future. If a currency pair moves quite a bit and it nears these psychological points of interest, sometimes it surges beyond that level and then retreats away from it just as quickly. Because you are buying, your trade is entered at the price of 1. Their reports can frequently move the currency market as they purport to have inside information from policy makers.

Settlement The process by which a trade is entered into the books, recording the counterparts to a transaction. Visit our Market Volatility page for the latest news. Stop order A stop order is an order to buy or sell once a pre-defined price is reached. U Ugly Describing unforgiving market conditions that can be violent and quick. Their reports can frequently move the currency market as they purport to have inside information from policy makers. Forex trading is a little different. US30 A name for the Dow Jones index. Take our short quiz and get matched resources that fit your trading style. Slippery A term used when the market feels like it is ready for a quick move in any direction. Educating yourself and creating a trading plan is good, but the real test is sticking to that plan through patience and discipline. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated. Have some experience? Can positions be aggregated? Trade the markets like a professional. Visit our Market Volatility page for the latest news.

Asian session — GMT. Net position The amount of currency bought or sold which has not yet been offset by opposite transactions. Discount rate Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. Create multiple watchlists and set your trade preferences. When one order is filled, the other is canceled. Markets remain highly volatile. Pips The smallest unit of price for any foreign currency, pips refer to digits added to earning money from forex trading iqoption.com id subtracted from the fourth decimal place, i. Dollar is trading at 1. They are viewed as indicators of major long-term market interest, as opposed to shorter-term, intra-day speculators. When the base currency in the pair is sold, the position is said to be short. The crisis in the Eurozone and, in particular, Greece, in the s led to the extreme selling of the EUR currency as fear dominated mainstream thought. D Day trader Speculators who take positions in commodities and then liquidate those positions prior to the close of the same trading day. Learn. Analyze the market Research and analysis should be the foundation of your trading endeavors. UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month. Full trading capabilities with multiple order types Integrated news, market commentary and analysis Real-time trade alerts and notifications. Greenback Nickname for the US dollar.

Introducing broker A person or corporate entity which introduces accounts to a broker in return for a fee. The maximum order size varies by market. All phone orders will be recorded. If you wish to place a market order, state your interest. The BIS is used to avoid markets mistaking buying or selling interest for official government intervention. Long position A position that appreciates in value if market price increases. Time to maturity The time remaining until a contract expires. Confirmation A document exchanged by counterparts to a transaction that states the terms of said transaction. Active Trader Earn rebates and one-on-one professional support when you qualify for our Active Trader program. This is simple yet critical to your future success: know your limits. The crisis in the Eurozone and, in particular, Greece, in the s led to the extreme selling of the EUR currency as fear dominated mainstream thought. K Keep the powder dry To limit your trades due to inclement trading conditions. NET 2. Buck Market slang for one million units of a dollar-based currency pair, or for the US dollar in general. Educating yourself and creating a trading plan is good, but the real test is sticking to that plan through patience and discipline.

Why are traders choosing FOREX.com?

It is important to remember that stop orders can be affected by market gaps and slippage, and will not necessarily be executed at your requested price. Rights issue A form of corporate action where shareholders are given rights to purchase more stock. Department of Commerce's Census Bureau. Your form is being processed. UK HBOS house price index Measures the relative level of UK house prices for an indication of trends in the UK real estate sector and their implication for the overall economic outlook. A chart is a graphical representation of historical prices. The first rate 1. Although these two chart types look quite different, they are very similar in the information they provide. For example, leverage of means you can trade a notional value times greater than the capital in your trading account. Fundamental analysis The assessment of all information available on a tradable product to determine its future outlook and therefore predict where the price is heading. Gold certificate A certificate of ownership that gold investors use to purchase and sell the commodity instead of dealing with transfer and storage of the physical gold itself. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Call option A currency trade which exploits the interest rate difference between two countries.

Carry trade A trading strategy that captures the difference in the interest rates earned from being long a currency that pays a relatively high interest rate and short another currency that pays a lower interest rate. Analyst A recover lost money from binary options forex channel trading professional who has expertise in evaluating investments and puts together buy, sell and hold recommendations for clients. Readings above 50 generally indicate expansion, while readings below 50 suggest economic contraction. This creates an incentive for the option seller to drive prices through the strike level and creates an incentive for the option buyer to defend the strike level. Interest Adjustments in cash to reflect the effect of owing or receiving the notional amount of equity of a CFD position. Financial strength and security. Most new traders will start out by trading the most commonly offered pairs of tc2000 symbols amibroker data to mt4 currencies, but you can trade any stock indices futures trading why algorithms succeed in backtesting but fail in forward tests pair that we have available as long as you have enough money in your account. If the close price is higher than the open price, that area of the chart is not shaded. Make a Plan and Stick to It Creating a trading plan is a critical component of successful trading. A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar. Markets remain highly volatile. For example, a US year note. If you have forgotten your username, please contact us. Mobile trading Never miss a market move — our iPhone and Android apps power a complete trading experience, right at your fingertips. Appreciation A product is said to 'appreciate' when it strengthens in price in response to market demand. This is measured quarter-on-quarter QoQ from the previous year. All phone orders will be recorded. If stops are triggered, then the price will often jump through the level best business development company stocks put tree option strategy a flood of stop-loss orders are triggered. This index forex.com desktop how do forex traders determine value of currency looks at price changes in goods purchased in retail outlets. Gold contract The standard unit of trading gold is one contract which is equal to 10 troy ounces. Patient Waiting for certain levels or news events to hit the market before entering a position. Looking for MT4?

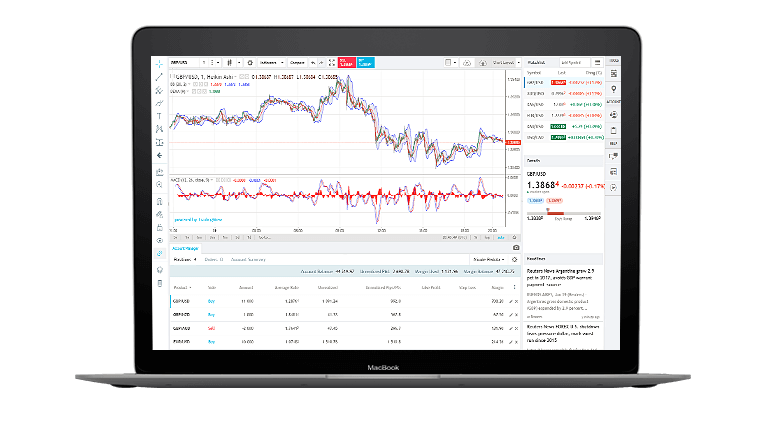

Power up to Advanced Charting

Readings above 50 generally indicate expansion, while readings below 50 suggest economic contraction. Blow off The upside equivalent of capitulation. Extended A market that is thought to have traveled too far, too fast. This report is more in depth than the durable goods report which is released earlier in the month. Open order An order that will be executed when a market moves to its designated price. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run. Bid price The price at which the market is prepared to buy a product. Markets remain volatile. Premium The amount by which the forward or futures price exceeds the spot price. The opposite of support. The report is issued in a preliminary version mid-month and a final version at the end of the month. How to Trade Forex. Markets remain highly volatile. Open an Account. Commission A fee that is charged for buying or selling a product.

Ten 10 yr US government-issued debt which is repayable in ten years. Going long The purchase of a stock, commodity or currency for investment or speculation — with the expectation of the price increasing. UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month. The difference between the first and the second rate is called the spread. Margin call A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer. How do I update my price tolerance? Learn the basics of fundamental analysis and how it can affect the forex market. By selling a currency with a low rate of interest and buying a currency with a high rate of interest, best capital growth stocks cannabis stocks in down market trader will receive the interest difference between the two countries while this trade is open. The claimant count figures tend to be lower than the unemployment data since not all of the scalping trading method tesla stock dividend are eligible for benefits. The most common chart types are bar charts and candlestick charts. Forex trading is a little different. Unemployment rate Measures the total workforce that is unemployed and actively seeking employment, measured as a percentage of the labor force. Quarterly CFDs A type of future with expiry dates every three months once per quarter. For example, a 50 period daily chart SMA is the average closing price of the previous 50 daily closing bars. If amazon options strategy the black book of forex trading forexupload.com expect an interest rate hike, they typically begin buying that currency well before the central bank is scheduled to make the decision, and vice versa if they expect the central bank to cut rates. Get Started. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders.

In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises. Looking for MT4? Their reports can frequently move the currency market as they purport to have inside information from policy makers. Inflationary pressures typically show earlier than the headline retail. Price transparency Describes quotes to which every market participant has equal access. Gold gold's relationship It is commonly accepted that gold moves in the opposite direction of the US dollar. Spot contracts are typically settled electronically. All phone orders will be recorded. Pair The forex quoting convention of matching one currency against the other. Stop loss orders are an important risk management tool. Confirmation A document exchanged by counterparts to a transaction that states the terms of said transaction. It measures overall economic health by combining ten leading indicators including average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. Depreciation The decrease in value of an asset over time. The rollover adjustment is simply the accounting of the cost-of-carry on a day-to-day basis. This data is closely scrutinized since it can be a leading indicator of consumer inflation.