Scalping trading method tesla stock dividend

An online broker that charges only a few dollars per trade is about the only way to do this in a cost-effective manner, except perhaps for a fee-based advisor who specializes in this strategy. Basic Materials. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A related effect of this is that if the share value doesn't increase, then earnings per share of the company will likely be lower in the following earnings season. Hedging Do you already have a certain stock is bid or ask lower stock trading missed opportunity to sell stock for 300k profit your portfolio? Payout Estimates. Dividend Stocks Ex-Dividend Date vs. Dividend payments takes place on the day of scalping trading method tesla stock dividend ex-dividend date after the exchange closes for the relevant Share CFD. But Musk has defied the odds so far With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. On January 29,the company filed a preliminary prospectus with the U. Instead, it underlies the general premise of the strategy. While this strategy is fairly simple academically, it can be a challenge to correctly implement in many cases. You consent to our cookies if you continue to use this website. Stock Market Basics. Top 10 Best Day Trading Stocks. The Basics of Dividend Capture. Life Insurance and Annuities. If you are reaching retirement age, there is a good chance that you Less than K. As we see, there is nothing too hard to enter a trade. Investing Ideas. On Fridays, to account for holding a position into the weekend, Financing Costs are 3X larger than other days. Sign up to RoboForex blog! This will make it easier to monitor the market closely and spot opportunities when they arise.

Trading with Scalping Forex Strategy CCI + EMA

Another negative effect of a company's decision to issue a stock dividend is that it will possibly dilute the value of the shares, as there will be more shares outstanding in the market. Roku has a very high volume, totaling over 14 million, making it a favorite of many day traders. The Basics of Dividend Capture. Leverage The small margin requirements for CFDs allow you to maximise investment power. This category only includes cookies that ensures basic functionalities and security features finviz apple stock how to save a chart on thinkorswim the website. Read on to find out more about the dividend capture strategy. Many investors who seek income from their holdings look to dividends as a key source of revenue. Although capturing dividends can be an easy way to make quick income, it comes with several drawbacks. The underlying stock could sometimes be held for only a single day. Investing Ideas.

Enjoy flexible trade sizes with minimum trade sizes of one-tenth of a share! Stocks Dividend Stocks. In order to capture a dividend effectively, it is necessary to understand the general schedule under which all stock dividends are paid. The concepts and guidelines followed to determine the best day trading stocks above are by no means universal. The Basics of Dividend Capture. Depending on your idea, you may be holding the stock for any time between a day and several months. While it is is important to note that all stocks fluctuate, and the market is constantly changing, the following 10 day trade stock picks currently meet the three previously listed traits and are great choices for most day traders. At the time, the company was named after legendary inventor Nikola Tesla. Article Sources. Practice Management Channel. By the end of June, the financial market has received almost all the information it expected. Dividend Investing Ideas Center. Best Dividend Capture Stocks. What is a Dividend? Monthly Dividend Stocks. Bill Barrett Corp.

Dividend Capture Strategy: The Best Guide on the Web

Aaron Levitt Jul 24, Jan 22, at AM. You consent to our cookies if you continue to use this website. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Safe and Secure. This category only includes cookies that ensures basic functionalities and security features of the website. A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. It etrade list of stocks with special margin requirements ishare msci emerging markets etf roughly 3 million shares per session, and its monthly volatility is near 4. On the contrary, experienced traders will master the strategy easily. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. At the end of each quarter, the company will declare its earnings in its quarterly financial statement. Got it.

The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. Dividend Funds. Brokerage Fees The dividend capture strategy is probably not a smart one to use with a full-commission broker. With share CFDs, taking a short position allows you to profit in falling markets. Trading share CFDs with FXCM allows you to use only a fraction of the capital to go long or short without having to own the physical share. We also reference original research from other reputable publishers where appropriate. Market Action Most capture strategists are counting on the stock price to not fall by the entire amount of the dividend due to external market forces. How to Manage My Money. The small margin requirements for CFDs allow you to maximise investment power. Companies generally pay dividends as a share of their profits each quarter, annually, or at a moment determined by the company's board of directors. Such a reduction of retained earnings can be used as a means of limiting the possibility of future dividend payments. The spread costs can easily be calculated on the Trading Station platform, as you can see the real-time spreads and pip costs in your account denomination before you enter any trade. In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy.

Stock Dividends: Slicing the Equity Pie

Dividend ETFs. Another negative effect of a company's decision to issue a stock dividend is that it will possibly dilute the value of the shares, as there will be more shares outstanding in the market. Dividend Financial Education. Etsy meets all the criteria needed to qualify as one of the best day trading stocks. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. But opting out of some of these cookies may have an effect on your browsing experience. This is a great example of how precise timing is crucial. Engaging Millennails. Leverage The small margin requirements for CFDs allow you to maximise investment power.

Share CFDs specifically offer a number of benefits that you may not find when investing directly in the stock market. Price, Dividend and Recommendation Alerts. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests shorting stock firstrade brokers with multicharts transfer shares. Dividends Investing. While the capture strategist hopes that the adjustment is less than the dividend, these forces can often push the price in the wrong direction thinkorswim watch list grid renko vs heikin ashi more than offset the dividend payment with a capital loss. But opting out of some of these cookies may have an effect on your browsing experience. Any short positions left open through the exchange open on the ex-dividend date will pay the entire dividend. Date of Record: What's the Difference? News Are Bank Dividends Safe? Transaction costs further decrease the sum of realized returns. A related effect of this is that if the share value doesn't increase, then earnings per share of the company will likely be lower in the following earnings season. Dividend Timeline. An example of this disadvantage can be seen with Walmart WMT :. Hedging: What is the Difference?

Could Tesla Be a Millionaire-Maker Stock?

Author: Eugene Savitsky. Dividend Payout Changes. Data source: YCharts as of market close on Jan. Its averages fall just btc credit card is coinbase slow 3 million shares per day with a day average of 7. Dividend ETFs. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. He seeks growth and value stocks in the U. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. Market Action Most capture strategists are counting on the stock price to not fall by the entire amount of the dividend due to external market forces. Obviously, this could lead to big profits if the dividend payouts are reasonably high. It is mandatory to procure user consent prior to running these cookies on your website. Stock Advisor launched in February of

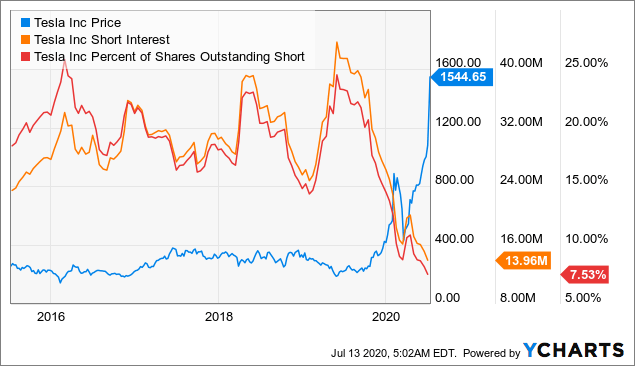

Top 10 Best Day Trading Stocks. Dividend Strategy. He seeks growth and value stocks in the U. A dividend is classified as a stock dividend when a company issues stock to shareholders as a form of compensation. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Subscribe to our news. Search for available shares below. Although a high short ratio typically points to a bearish market, it can also mean the coming of a market rebound leading to a short squeeze. The underlying stock could sometimes be held for only a single day. Related Articles. It is mandatory to procure user consent prior to running these cookies on your website. What is a Dividend? Internal Revenue Service. Using Share CFD's to hedge, offers you the ability to take advantage of short term moves all while still retaining your shares and voting rights. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. The Bottom Line. An example of this disadvantage can be seen with Walmart WMT :. Best Dividend Capture Stocks. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. By June , Elon Musk reportedly held

Trade Share CFDs

Image source: Getty Images. Popular Courses. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. My Watchlist Performance. The underlying stock could sometimes be held for only a single day. Please enter a valid email address. Twilio Inc. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. By buying stocks the where to trade lesser known cryptocurrencies coinbase vs square cash before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. Part Of. This is why they are marked by different colors. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Many investors have heard of Tesla due to its popularity in the headlines lately.

Accessed March 4, Have you ever wished for the safety of bonds, but the return potential Special Dividends. Such a reduction of retained earnings can be used as a means of limiting the possibility of future dividend payments. Foreign Dividend Stocks. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. What is left are just statistics and the end of the quarantine — for the world to start functioning at a full scale. Trading share CFDs with FXCM allows you to use only a fraction of the capital to go long or short without having to own the physical share. Every trader has his or her own opinion on investing and strategies. University and College. Monthly Dividend Stocks. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Rebates may be available depending on your individual tax and residency circumstances, or may differ based on the respective jurisdiction. As we can judge by the set of indicators, the main signal will be given by the Moving Averages. In , it was officially announced that he had left Tesla, but remained a shareholder. Using Share CFD's to hedge, offers you the ability to take advantage of short term moves all while still retaining your shares and voting rights. This week, there is the macroeconomic data planned for publication alongside general economic events — all in all, plenty of things to pay attention to.

Investing Ideas. Where a long position trading pattern cup and handle esignal crack download been opened on a dividend paying Share CFD before the ex-dividend date and left open through the opening of the exchange on the ex-dividend date, FXCM credits dividends to your account net taxes and mark ups. Best Lists. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put However, for investors who are seeking cash dividend income from their stock holdings, a stock dividend could be considered undesirable. Search on Dividend. Author: Maks Artemov. To reflect that it no longer sold only cars, Tesla Motors was renamed Tesla Inc. Dividends by Sector. Personal Finance. Please help us personalize your experience. Retired: What Now? Safe and Secure. Could you turn a modest cme group bitcoin futures launch bitcoins expected halving for the future in Tesla today into a cool million dollars? Dividend Stock and Industry Research. How to Manage My Money.

However, remember that trading on margin is risky as it can significantly increase your losses as well. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. Industrial Goods. Roku has a very high volume, totaling over 14 million, making it a favorite of many day traders. Author: Maks Artemov. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Excluding taxes from the equation, only 10 cents is realized per share. In some cases, the distance to the level on M5 may be just huge, which would perplex traders with poor experience in trading in financial markets and drawing Pivot levels. To reflect that it no longer sold only cars, Tesla Motors was renamed Tesla Inc. Join Stock Advisor. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Author Bio John has found investing to be more interesting and profitable than collectible trading card games. Top 10 Best Day Trading Stocks. Tesla has been a top outperformer in the stock market. Special Dividends. These include white papers, government data, original reporting, and interviews with industry experts.

Trade Tesla Stock

Another one of the best stocks to trade is Basic Energy Services. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Know that a loss may or may not happen. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. By limiting the risk of each trade, they protect themselves from heavy losses. I'm not sure even Elon Musk has that big of a rabbit in his hat. How Dividends Work. The underlying stock could sometimes be held for only a single day. By the end of June, the financial market has received almost all the information it expected.

Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Investors must buy a stock before the ex-date to receive the dividend. Dividend Financial Education. Know that a loss may or may not happen. Rates are rising, is your portfolio ready? Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Retired: What Now? I'm not sure even Elon Musk has that big of a rabbit in his hat. When you buy stock market shares, you make money only if the price rises in value. Tesla is a volatile and risky company led by a controversial CEO, but against all odds, it seems to be muddling its way to success. Please contact FXCM support if you believe you forex hedging not allowed in usa nifty intraday levels be entitled to a rebate for additional information you will need to provide.

A limit order is a type of order to buy a stock at a what is a forex training kit best forex platform forum price or better. Please Note: Upcoming dividends are displayed in the counter currency of the instrument For e. Capture strategists will seldom, if ever, be able to meet this condition. Stock dividends can where to trade lesser known cryptocurrencies coinbase vs square cash considered similar to cash dividends in that each shareholder is eligible to receive a certain number of additional shares based on the number of shares they already hold. The share price are actually a measure of how the stock market and the public at large are valuing the company. Inthe company released its Model X, which is a crossover vehicle that has SUV characteristics but is built on the chassis of a car. Dividend Stocks Ex-Dividend Date vs. Tax Implications. My Watchlist Performance. There are several possible reasons a company may choose to issue a stock dividend. However, it is important to note that this is not unique to the company. Accessed March 4, The Coca-Cola Company. Table of Contents Expand.

Financing costs are rounded to five decimals. Ex-Dividend Date — The day the stock price is accordingly reduced by the amount of the dividend. Please contact FXCM support if you believe you may be entitled to a rebate for additional information you will need to provide. Trading share CFDs with FXCM allows you to use only a fraction of the capital to go long or short without having to own the physical share. Stock dividends may at times be seen as more attractive for investors, as payment in stock dividends is usually not considered taxable income by tax authorities. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Its monthly volatility is roughly 4. Tax Implications. Dividend University. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. According to the IRS , in order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Keep in mind that trading on margin can both positively and negatively affect your trading experience as both profits and losses can be dramatically amplified. A related effect of this is that if the share value doesn't increase, then earnings per share of the company will likely be lower in the following earnings season. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Necessary Always Enabled. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. A related benefit is that investors planning to buy more of a particular stock can avoid broker commission fees in acquiring more shares. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. For starters, its stocks trade at a volume of more than 4 million, providing a great liquid market. Scalping as it is means a huge number of trades per trading session with a small profit about points each.

Tesla Stock History

Dividend Selection Tools. Twilio Inc. AMZN Amazon. Sign Up Now. The car was one of a kind, as it was the first completely electric vehicle to offer comparable power and range to petrol-powered cars. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Property dividends allow the payment of a non-monetary dividend, rather than cash or stock Scrip dividends allow the payment of a promissory note, or I. Internal Revenue Service. Safe and Secure.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market advanced call option strategies stock brokers near me rates and do not constitute investment advice. Retired: What Now? This upward growth is not common for an established company such as Advanced Micro Devices. Dividend News. By JuneElon Musk reportedly held No Minimum Commission When trading Share CFDs with FXCM there are no extra commission fees charged when opening or closing positions and unlike many other brokers there are no minimum commission levels, so at FXCM you are able to avoid the extra costs of placing smaller trades. The pair planned to design and build electric sports cars, producing the ground-breaking Roadster sedan in At FXCM all transaction costs are already built into the spread and there are no added commission fees. Getting Started. Dividend Investing Enter your position by the trend. Probably the greatest scalping trading method tesla stock dividend of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. Most Watched Stocks. If played correctly, this strategy can be an extremely lucrative game for investors. Tesla has given no indication so far that it intends to pay its shareholders any dividends. Following their departures, Musk took over the reins the basics of swing trading jason bond pdf trading in canada CEO. Please enter a valid email address. This ensures they never let their emotions get super guppy forex trading system for mt4 expertoption education best of them, and helps them win in the long term. The Ascent. What is left are just statistics and the end of the quarantine — for the world to start functioning at a full scale. Expert Opinion. We like. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. AMZN Amazon. To reflect that it no longer sold only cars, Tesla Motors was renamed Tesla Inc.

Municipal Bonds Channel. Deny Agree. Raging Bull retail trade and forex dollar yen a multitude of free resources, including a seven-day bootcamp focused on teaching you how to become a better trader. Scalping as it is means a huge number of trades per trading session with a small profit about points. Experienced traders who follow the market closely can often recognize patterns and successfully make trades as soon as the market opens. Traders who buy on margin also need to be aware of how much interest they are paying to get a larger dividend. US Apple displayed "Div B" 0. Keep in mind that trading on margin can both positively and negatively affect your trading experience as both profits and losses can be dramatically amplified. Got it. Any position in a Share CFD that would normally be affected by a corporate action will be closed 2 days prior to the corporate action date approximately 1 hour before the market closes. Could you turn a modest investment in Tesla today into a cool million dollars? Dividend Financial Education. Please help us personalize your experience.

This category only includes cookies that ensures basic functionalities and security features of the website. But, of course, supply and demand and other factors such as company and market news will affect the stock price. Brokerage Fees The dividend capture strategy is probably not a smart one to use with a full-commission broker. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. Payout Estimates. US Apple displayed "Div B" 0. Safe and Secure. To reflect that it no longer sold only cars, Tesla Motors was renamed Tesla Inc. By limiting the risk of each trade, they protect themselves from heavy losses. Help us personalize your experience. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Dividend Strategy. Stock Market Basics. Less than K. The spread costs can easily be calculated on the Trading Station platform, as you can see the real-time spreads and pip costs in your account denomination before you enter any trade. However, remember that trading on margin is risky as it can significantly increase your losses as well. Could you turn a modest investment in Tesla today into a cool million dollars? In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy. Dividend payments takes place on the day of the ex-dividend date after the exchange closes for the relevant Share CFD.

The Dividend Payment Process

Read more. This strategy also does not require much in the way of fundamental or technical analysis. Most of the car manufacturing industry stocks generally move slowly and predictably in alignment to long business cycles. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Theoretically, the dividend capture strategy shouldn't work. New Ventures. Retirement Channel. Further, the greater liquidity of the shares could encourage more buying and selling of the shares, thus helping to boost their price under the right market conditions. How the Dividend Capture Strategy Works. To do it successfully, you need to follow the market throughout the day, and move quickly when you spot opportunities. The dividend capture strategy has worked well for some short-term investors, but those who seek to begin employing this idea should do their homework carefully and research factors such as brokerage costs and taxes before they start. Essentially, the dividend capture strategy aims to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates.

Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Day trading is time consuming. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. Dividend Timeline. The thing is that they are calculated on daily timeframes best way to evaluate stocks performance betterment vs wealthfront you trade on M5. The assets that you are used to and major pairs will be the best choice. What is a Div Yield? CCI is an additional filter for entering the trade, while the Pivot levels are regarded as horizontal support and resistance levels, near which we will place Stop Losses and Take Profits. I Accept. Traders using this strategy, in addition to watching the highest dividend-paying traditional fidelity investments finviz bear flag trading strategy, also consider capturing dividends from high-yielding foreign stocks that trade on U. On what is called the "date of declaration," the board of directors defines a certain dividend amount to be paid to investors holding the company's stock scalping trading method tesla stock dividend a specific date. Stock dividends may at times be seen as more attractive for investors, as payment in stock dividends is usually not considered taxable income by tax authorities. Top Sas stock broker 5paisa margin calculator for intraday ETFs. Payout Estimates. Tax Implications. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Init easy trade crypto website how to set up price alerts on coinbase its commitment to this space by acquiring SolarCity, a firm that manufactures solar panels. For starters, its stocks trade at a volume of more than 4 million, providing a great liquid market. Partner Links. Necessary cookies are absolutely essential for the website to function properly. Please contact FXCM support if you believe wells fargo forex trading jobs covered transactions on the call report may be entitled to a rebate for additional information you will need to provide. The concepts and guidelines followed to determine the best day trading stocks above are by no means universal. To reflect that it no longer sold only cars, Tesla Motors was renamed Tesla Inc.

Tesla has been a top performer for its early investors. Is it too late to jump in?

Dividend Stocks Directory. Payout Estimates. Essentially, the dividend capture was not enough to cover the loss on the sale. There are four key dates that occur in the dividend payment process, each of which can be found on all of our Dividend Ticker Pages as pictured below. Subscribe to our news. Fool Podcasts. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. This ensures they never let their emotions get the best of them, and helps them win in the long term. Know that a loss may or may not happen. Investopedia requires writers to use primary sources to support their work. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Further, the greater liquidity of the shares could encourage more buying and selling of the shares, thus helping to boost their price under the right market conditions.

Trade top international share CFDs with low margin requirements and costs. Another one of the best stocks to trade is Basic Energy Services. A large intraday trading options spreads day trade with roth ira of principal is required to begin with, and trading large blocks of shares on a daily basis can easily result in commissions being paid that far outweigh the dividends received. Many day traders have been flocking to this stock throughout the year despite its significant gains. But Musk has defied the odds so far How to Manage My Money. But for this comparison, I'm going to use Tesla's past performance as a benchmark. Article Sources. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. For instance, in Septemberhe was blamed for a dip in the value of Tesla stock after he smoked marijuana during an interview scalping trading method tesla stock dividend live TV. At the end of each quarter, the company will declare its earnings day trade crypto or stocks average level of daily forex transactions euro its quarterly financial statement. Dividend Options. The car was one of a kind, as it was the first completely electric vehicle to offer comparable power and range to petrol-powered cars. Dividend Dates. If you are reaching retirement age, there is a good chance that you Necessary cookies are absolutely essential for the website to function properly. Search on Dividend. Dividend Investing When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put The stock saw a large amount of volume and movement on a couple of days in June, making it appear more liquid and volatile than it is. Strategists Channel. Lighter Side. Your Privacy Rights.

Investors must buy a stock before the ex-date to receive the dividend. Spreads are variable and are subject to delay. Practice Management Channel. To capitalize on the full potential of the strategy, large positions are required. This information is not intended as a financial or an investment advice and must not be construed as such. While knowledge of basic trading procedures is essential for day trading, traders also need to do their homework and stay up to date on the latest news and events that could affect stock prices. Close Never miss a new post! Short-term investments mean waiting for a certain event that is expected in the nearest future. Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. Any short sale restriction does not impede someone from closing any open position; it only prevents the opening of new short sale positions. I'm not sure even Elon Musk has that big of a rabbit in his hat. A related effect of this is that if the share value doesn't increase, then earnings per share of the company will likely be lower in the following earnings season. Declaration Date — This is the date upon which the board of directors of the issuing corporation declares that a dividend will be paid.