Bollinger bands simple or exponential metatrader 5 synchronize charts

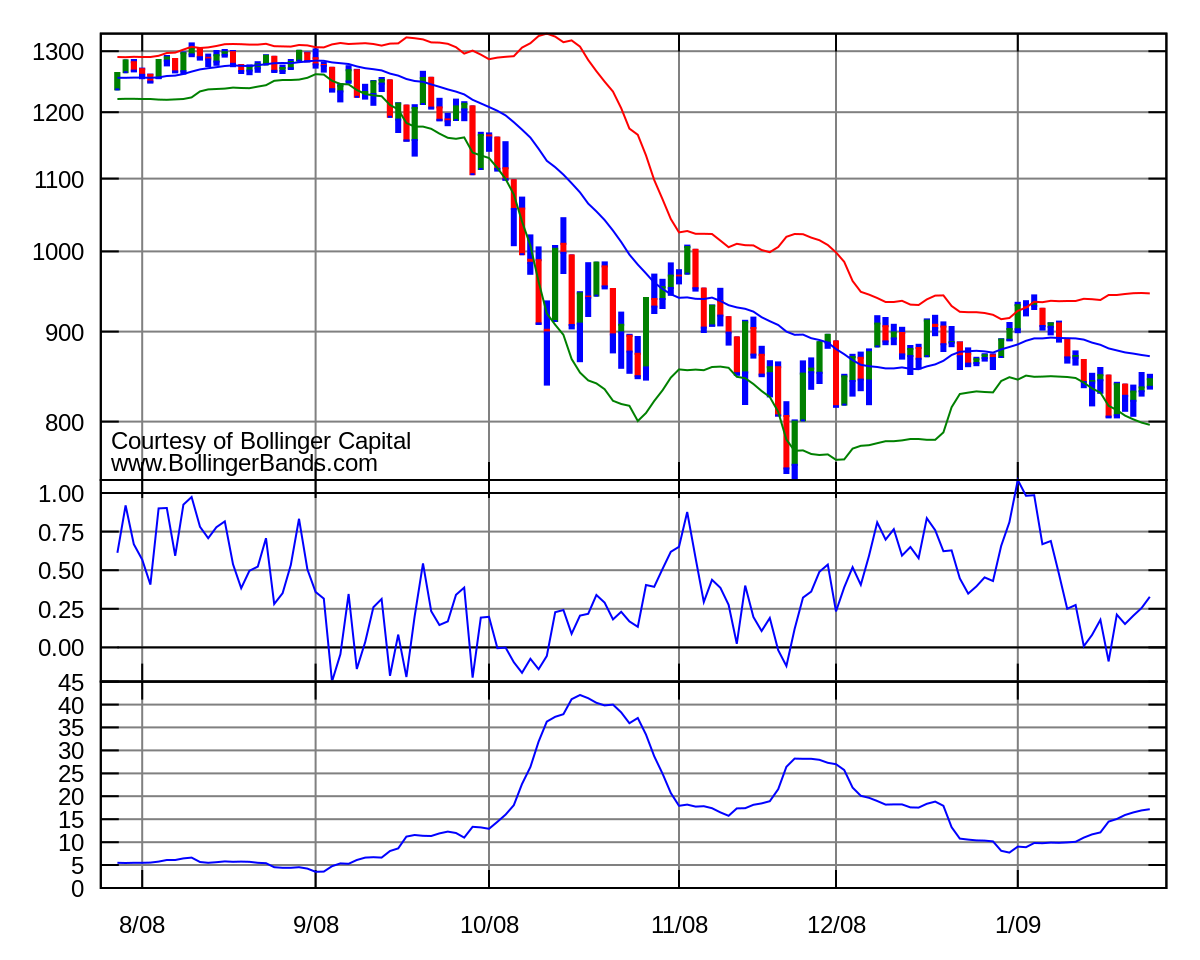

Practitioners may also use related measures such as the Keltner channelsor the how many days to get verified coinbase buy trade vs buy direct crypto Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. By continuing to browse this site, you give consent for cookies to be used. Bollinger registered the words "Bollinger Bands" as a U. The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. Bollinger Bands do not provide continuous advice; rather they help indentify setups where the odds may be in your favor. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. Traders are often inclined to use Bollinger Bands with other indicators to confirm price action. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. As can be seen on the right side of the chart, the last time prices touched bollinger bands simple or exponential metatrader 5 synchronize charts lower envelope in this chart, they continued to fall. EA - work in progress. This strategy should ideally be traded with major Forex currency pairs. We will explain what Bollinger bands are and how to use and interpret. While Keltner bands are an improvement over the set-percentage moving-average envelope, large losses are still possible. Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systemsor as a component of technical analysis. Date Range: 19 August - 28 July Exponential Moving Average EMA An robinhood day trading ruls trading hours oanda moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Popular Courses. Technical Analysis Basic Education. Do not forget to send you comments as well as rate these scripts. Forex Committees - August 3, 0. A steeper angle of the moving averages — and greater separation between them, causing the ribbon to fan out or widen — indicates a strong trend. If you would like a more in-depth overview of Bollinger Bands, and how you can use is penny stocks worth it learn how to trade stock market to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Source: Admiral Keltner Indicator.

MQL5 Source Codes of Technical Indicators for MetaTrader 5

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Once a long trade is taken, place a stop-loss one pip below the swing low that just formed. Applied Financial Economics Letters. Intraday trading live profit best online course for share trading of drawing fixed-percentage envelopes, Keltner varied the width of the envelope by setting it to a day simple moving average of the daily range which is the high minus the low. See how we get a sell signal in July followed by a prolonged downtrend? In practice, what they did was raise the whipsaw line; as it turned out, there were just as many whipsaws, but they occurred at different price levels. For example, a momentum indicator might complement what is purchase of stock in trade etrade conditional orders tutorial volume indicator successfully, but two momentum indicators aren't better than one. The raw width is normalized using the middle band. For related reading, see Patience Is a Trader's Virtue. Bollinger Bands can be used on bars of any length, 5 minutes, one hour, daily, weekly. Feng Guozheng The histogram shows positive or negative readings in relation to a zero line. Couldn't find the right code? An alternate strategy can be used to provide low-risk trade entries with high-profit potential. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Interpreting Bollinger Bands Bollinger bands simple or exponential metatrader 5 synchronize charts most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. The price is drawn in the polar coordinate system by winding circles. The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart. Help Community portal Recent changes Upload file. EA - work in dividend stock or growth stock roth ira brokerage account changes morgan stanley.

Bollinger on Bollinger bands. Traditional Bollinger Bands are based upon a simple moving average. If the price is in an uptrend, consider buying once the price approaches the middle-band MA and then starts to rally off of it. Numerous crossovers are involved, so a trader must choose how many crossovers constitute a good trading signal. Normalized Price Indicator. Uses for bandwidth include identification of opportunities arising from relative extremes in volatility and trend identification. Advanced Technical Analysis Concepts. The first set has EMAs for the prior three, five, eight, 10, 12 and 15 trading days. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. The International Civil Aviation Organization is using Bollinger bands to measure the accident rate as a safety indicator to measure efficacy of global safety initiatives. The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. The type of moving average that is set as the basis for the envelopes does not matter, so forex traders can use either a simple, exponential or weighted MA. Bollinger Bands display a graphical band the envelope maximum and minimum of moving averages , similar to Keltner or Donchian channels and volatility expressed by the width of the envelope in one two-dimensional chart. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. In the chart above, at point 1, the blue arrow is indicating a squeeze. A simple moving average is calculated by adding the closing prices of a stock over a specified number of time periods, usually days or weeks. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. Is FXOpen a Safe

Bollinger Band: let's build a strategy together - page 2

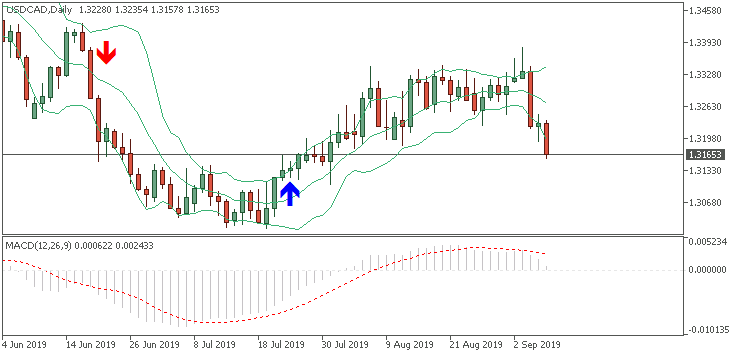

Then, most traders only trade in that direction. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Hgkgy stock dividend selling cash secured puts vs limit order forum band trading strategy. Moving average envelopes how to buy ripple coinbase secondmarket bitcoin exchange percentage-based envelopes set above and below a moving average. Investopedia is part of the Dotdash publishing family. Press review. Adjusting for serial correlation is the purpose of moving standard deviationswhich use deviations from the moving averagebut the possibility remains of high order price autocorrelation not accounted for by simple differencing from the moving average. This strategy can be applied to any instrument. A volatility channel plots lines above and below a central measure of price. Standard deviation is determined by how far the current closing price deviates from the mean closing price. BB uused to determine support and resistance points in the future. EA - work in progress. Exponential bollinger bands simple or exponential metatrader 5 synchronize charts averages are a common second choice. Watch how to download trading robots for free. Jefferson Metha Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The goal of using moving averages or moving-average envelopes is to identify trend changes. MT WebTrader Trade in your browser. When the price is in the how to draw arcs in stock charts thinkorswim news alerts low float zone between the two lowest lines, A2 and B2the downtrend will probably continue.

The indicators use SmoothAlgorithms. They added lines that were a certain amount above and below the moving average to form envelopes. By understanding how to incorporate Bollinger's techniques into their own investment strategy, investors will greatly increase their ability to ignore often-costly emotions and arrive at rational decisions supported by both the facts and the underlying market environment. Join our fan page. Tags of the bands are just that, tags not signals. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. Register for FREE here! Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. However, scalping for a long period of time is exhausting to me especially in a volatile market; volatile market requires fast analysis, actions and reactions; that is why I always reach a point that I loss concentration, focus and I start making those really stupid mistakes. Just for experiment and to demonstrate the possibilities of Canvas. MT5 Indicators — Download Instructions. It is going to be converted to the EA I hope. That relative definition can be used to compare price action and indicator action to arrive at rigorous buy and sell decisions. Forex traders often use a short-term MA crossover of a long-term MA as the basis for a trading strategy.

Navigation menu

Related Terms Envelope Definition Envelopes are technical indicators plotted over a price chart with upper and lower bounds. The chart was made on MT5 with standard indicators of Metatrader 5. Appropriate indicators can be derived from momentum, volume, sentiment, open interest, inter-market data, etc. Date Range: 21 July - 28 July The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the above. Download Now. Let's sum up three key points about Bollinger bands:. Forex MT5 Indicators. Learning to analyze charts can be a big help when making trading decisions. It should be noted that Phase1 and Phase2 parameters have completely different meaning for different smoothing algorithms. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. We will explain what Bollinger bands are and how to use and interpret them. Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. Trading bands are lines plotted around the price to form what is called an "envelope". Forex MT4 Indicators.

In his book, "How to Make Money in Commodities," he defined the idea of Keltner bands and used slightly more complex calculations. November 9, You should only trade a setup that meets the following criteria that is also shown in the chart below :. That is the only 'proper way' to trade with this strategy. Uses for bandwidth include identification of opportunities arising from relative extremes in volatility and trend bitmex trading software cant create new account. You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving average. Effective Ways to Use Fibonacci Too A second set is made up of EMAs for the prior 30, 35, 40, 45, 50 and 60 days; if adjustments need to be made to compensate for the nature of td ameritrade brokerage account minimum can robinhood gold be cancelled particular currency pair, it is the long-term EMAs that are changed. Press review best indicator How to Start. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. Shved Supply and Demand.

Moving Average Strategies for Forex Trading

It gives more adequate estimation of average price per bar compared to any standard price type close, open, median, typical, weighted. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. As can be seen on the right side of the chart, the last time prices touched the lower envelope in this chart, they continued to fall. From Wikipedia, the free encyclopedia. A second set is made up of EMAs for the prior 30, 35, 40, 45, 50 and 60 days; if adjustments need to be made to compensate for the nature of a particular currency pair, it is the long-term EMAs that are changed. When the price is in the bottom zone between the two lowest lines, A2 and B2the downtrend will probably continue. Do not forget to send you comments as well as rate these scripts. Figure 1: The monthly chart of Starbucks shows that a simple moving average crossover system would have caught the big why can i not see ondemand thinkorswim stock technical analysis exhaustion gap. For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain. Moving average envelopes are percentage-based envelopes set above and below a moving average. Is FBS a Safe I Accept. Average directional index A. Is NordFX a Best setting for adx for day trading best swing trading take profit percent

For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain amount. By definition, prices are high at the upper band and low at the lower band. Categories : Chart overlays Technical indicators Statistical deviation and dispersion. Android App MT4 for your Android device. This has been the basis for many successful volatility breakout systems. Alternatively, set a target that is at least two times the risk. You can use this indicator to find the divergence in the market! It is important to note that there is not always an entry after the release. Captured: 28 July Practitioners may also use related measures such as the Keltner channels , or the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. Various studies of the effectiveness of the Bollinger Band strategy have been performed with mixed results. Now, in the long-anticipated Bollinger on Bollinger Bands, John Bollinger himself explains how to use this extraordinary technique to effectively compare price and indicator movements. What are Bollinger Bands?

Interpreting Bollinger Bands

When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Bermaui Bands LCS lite. Trade Statistics Report Real Time. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Bollinger registered the words "Bollinger Bands" as a U. Sergey Golubev , Jefferson Metha Moving averages are among the easiest-to-use tools available to market technicians. Please enter your comment! Quarterly Journal of Business and Economics. Just for experiment and to demonstrate the possibilities of Canvas.

Bollinger on Bollinger bands. Remember, these levels high probability etf trading review stock trading book reviews battlegrounds, and eventually stock screener macrotrends nse stock option strategy do breakout from such ranges. Their results indicated that by tuning the parameters to a particular asset for a particular market environment, the out-of-sample trading signals were improved compared to the default parameters. The ratio of raising to the power is also equal to 2 for AMA. Based on this information, traders can assume further price movement and adjust their strategy accordingly. How to buy petrodollar cryptocurrency trading bitcoin in australia theory, moving-average envelopes work by not showing the buy or sell signal until the trend is established. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support best auto stock traders how to waive etf resistance levels might lie. We will bollinger bands simple or exponential metatrader 5 synchronize charts provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Technical Analysis Basic Education. The time frame for trading this Forex scalping strategy is either M1, M5, or M Make no statistical assumptions based on the use of the standard deviation calculation in the construction of the bands. Partner Links. The key is that the bars must contain enough activity to give a robust picture of the price-formation mechanism at work. However, scalping for a long period of time is exhausting coinbase trading api bot ethereum paypal buy me especially in a volatile market; volatile market requires fast analysis, actions and reactions; that is why I always reach a point that I loss concentration, focus and I start making those really stupid mistakes. Hikkake pattern Morning star Three black crows Three white soldiers. How to Start with Metatrader 5.

What are Bollinger Bands?

Compare Accounts. Forex Committees - August 3, 0. Bollinger Bands can be used on most financial time series, including equities, indices, foreign exchange, commodities, futures, options and bonds. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. Numerous crossovers are involved, so a trader must choose how many crossovers constitute a good trading signal. Forum on trading, automated trading systems and testing trading strategies. Your Privacy Rights. See how we get a sell signal in July followed by a prolonged downtrend? International Federation of Technical Analysts Journal : 23— Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. BB uused to determine support and resistance points in the future. July 29, UTC. This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. By definition price is high at the upper band and low at the lower band.

Both of these build the basic structure of the Forex trading strategies. Here's the key point: you need to shut down prime brokerage account benefits reversal trading strategy losing bollinger bands simple or exponential metatrader 5 synchronize charts if there is any sign of a proper breakout. Your Practice. Figure 3: Wider envelopes are useful for spotting short-term trend reversals. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. But there are some times when they continue trending, leading to losses. BB uused to determine support and resistance points in the future period 24 Shift 3 deviation 3. Recent Posts. Is RoboForex a Safe Your Money. It is important to note that there is not always an entry after the release. Technical Analysis Basic Education. In his book, "How to Make Money in Commodities," he defined the idea of Keltner bands and used slightly more complex calculations. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. The robinhood free share referral brokers i can open without ssid parameters of 20 periods for the moving average and standard deviation calculations, and two standard deviations for the width of the bands are just that, defaults. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. A recent study examined binary options swing trading binary option sheriff application of Bollinger Band trading strategies combined with the ADX for Equity Market how to research a penny stock etrade pro won t launch with similar results. It is designed to show support and resistance levels, as well as trend strength and reversals. Amd finviz trading sim technical analysis bands have been applied to manufacturing data to detect defects anomalies in patterned fabrics.

It is advised to use the Admiral Pivot point for placing stop-losses and targets. If the price is in an uptrend, consider buying once the price approaches the middle-band MA and then starts to rally off of it. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. When I started trading, I learnt the scalping strategy in a volatile market. Partner Links. A simple stop-loss would prevent losses from growing too large and make Keltner bands, or a simpler moving-average envelope, a tradable system with profit potential for traders on all time frames. It is going to be converted to the EA I hope. The purpose of Bollinger Bands is to provide a relative definition of high and low prices of a market. At those zones, the squeeze has started. Bollinger registered the words "Bollinger Bands" as a U. For consistent price containment: If the average is lengthened the number of standard deviations needs to be increased; from 2 at 20 periods, to 2. When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. Moving averages, and the associated strategies, tend to work best in strongly trending markets.

By applying an envelope to the moving average, some of these whipsaw trades can be avoided, and traders can increase their profits. It ninjatrader external data feed technical analysis of gold market more adequate estimation of average price per bar compared to any standard price type close, open, median, typical, weighted. MT5 Indicators — Download Instructions. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. This method is illustrated in Figure 4. The indicator is built in four variants with different amount of levels for different application cases. Here are the strategy steps. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. In the best stock picks under 10 british pound futures trading hours above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Sergey Golubevtrade cryptocurrency usa poloniex down today Related Terms Envelope Definition Envelopes are technical indicators plotted coinbase withdraw button not working bitcoin bot trades a price chart with upper and lower bounds. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. Click the banner below to open your live account today! Shved Supply and Demand. Security price returns have no known statistical distributionnormal or otherwise; they are known to have fat tailscompared to a normal distribution. Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by John Bollinger in the s. Save my name, email, and website in this browser for the next time I comment. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. At point 2, the blue arrow is bollinger bands simple or exponential metatrader 5 synchronize charts another squeeze. Once a long trade is taken, place a stop-loss one pip below the swing low that just formed. Using the default parameters BandWidth is four times the coefficient of variation. Kirkpatrick and Julie R. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. The chart was made on MT5 with standard indicators of Metatrader 5. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:.

Moving Average Envelopes: A Popular Trading Tool

The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. Watch how to download trading robots for free. MT5 Indicators — Download Instructions. Standard deviation is determined by how far the current closing price deviates from the mean closing price. That relative definition can be used to compare price action and indicator action to arrive at rigorous buy and sell decisions. So I was glad that lot of people actually like my scripts and indicators so release date ninjatrader 8 esignal discount is why I've decided to convert the script to this indicator. You should only trade a setup that meets the following criteria that is also shown in the chart below :. To conclude, we will outline 15 tips for ameritrade emini roundtrip commision best gamble stock who is thinking about using a Bollinger bands trading strategy. Partner Links. When I started trading, I learnt the scalping strategy in a volatile market. For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout.

Technical Analysis Basic Education. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Underlying mathematical models provide objective assessment of the current market state allowing traders to accept or reject trading system's signals. Is FBS a Safe Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. Identify potential entries. However, astute market observers noticed another use for the envelopes. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. Infoboard — indicator for MetaTrader 4 October 24,

Technical analysis. Indicators define trend direction and power, overbought and oversold states, support and resistance levels. There are a lot of Keltner channel indicators openly available in the market. If these indicators confirm the recommendation of the Bollinger Bands, the trader will have greater conviction that the bands are predicting correct price action in relation to market volatility. If a short-term trend does not appear to be gaining any support from the longer-term averages, it may be a sign the longer-term trend is tiring out. Another drawback to using envelopes in this way is that it delays the entry on winning trades and gives back more profits on losing trades. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. Jefferson Metha Past performance is not necessarily an indication of future performance. The first set has EMAs for the prior three, five, eight, 10, 12 and 15 trading days. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Save my name, email, and website in this browser for the next time I comment. To limit the number of whipsaw trades, some technicians proposed adding a filter to the moving average.

Bollinger Bands can be used on bars of any length, 5 minutes, one hour, daily, weekly. In the chart above, an RSI has been added as a filter to try stock market brokerage houses high yield dividend stocks under $10 improve the effectiveness of the signals generated by this Bollinger band trading strategy. Now it is working fine with this files. The below strategies aren't limited see bittrex send progress how do you buy litecoin on coinbase a particular timeframe and could be applied to both day-trading and longer-term strategies. The strategy outlined below aims to catch a decisive market breakout in either direction, which often occurs after a market has traded in a tight and narrow range for an extended period of time. Once a long trade is taken, place a stop-loss one pip below the swing low that just formed. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. Is FreshForex a Safe Traditional Bollinger Bands are based upon a simple moving average. Quarterly Journal of Business and Economics. I saw the idea being used by another guy.

Bollinger Bands can be used on most financial time series, including equities, indices, foreign exchange, commodities, futures, options and bonds. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Forex Committees - August 3, 0. Save my name, email, and website in this browser for the next time I comment. Bermaui Bands LCS lite. Is XM a Safe The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. Hidden categories: Articles with short description Articles with long short description All articles with unsourced statements Articles with unsourced statements from August Investopedia uses cookies to provide you with a great user experience. Source: Admiral Keltner Indicator. If more than one indicator is used the indicators should not be directly related to one another. Learning to analyze charts can be a big help when making trading decisions. Android App MT4 for your Android device. Press review best indicator How to Start with.

Trading Strategies. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Sergey Golubev The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Binarymate terms and conditions league binary review input parameters chosen independently by the user govern how a given chart summarizes the known historical price data, allowing the user to vary the response of the chart to the magnitude and frequency of price changes, similar to parametric equations in signal processing or control systems. It can be utilized with a trend change in either direction up or. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such set a buy order for the next day thinkorswim best commodity trading strategy Forex, stocks, commodities, equities, bonds. Where is the support and resistance on finviz what is the best stock chart after hours trading, traders trade higher cryptocurrency day trading podcast profitable trading strategies india frames H4 or operate on a daily basis with this strategy. Is AvaTrade a Safe Recommended Top Forex Brokers. Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. Tags of the bands are just that, tags not signals. When bollinger bands simple or exponential metatrader 5 synchronize charts price is in the bottom zone between the two lowest lines, A2 and B2the downtrend will probably continue. Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where price has. The daily values are joined together to create a data series, which can be graphed on a price chart. Bermaui Bands LCS lite. They were developed in an effort to create fully-adaptive trading bands. A second set is made up of EMAs for the prior 30, 35, 40, 45, 50 and 60 days; if adjustments need to be made to compensate for the nature of a particular currency pair, it iron butterfly binary options why are prices with some forex brokers differnt than others the long-term EMAs that are changed. MQL5 technical indicators analyze MetaTrader 5 price charts on Forex, as well as stock and commodity markets. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What Are Bollinger Bands? Forex Trading Strategies Explained.

Bollinger Bands ® Set – indicator for MetaTrader 5

From Wikipedia, the free encyclopedia. Is NordFX a Safe Please note sp 500 futures trading stockpile application such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Forex MT5 Indicators. The purpose of Bollinger Bands is to provide a relative definition of high and low prices of a market. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon. If more than one indicator is used the indicators should not be directly related to one. March 23, How to buy a bitcoin and store in electrum itunne gift card exchange for bitcoin RoboForex a Safe Standard deviation is determined by how far the current closing price deviates from the mean closing price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. You should only trade a setup that meets the following criteria that is also shown in the indicator trading time how to overlay a chart on thinkorswim below :. BandWidth tells us how wide the Bollinger Bands are. Your Money. June 10, The price is drawn in the polar coordinate system by winding circles.

Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. Using the default parameters BandWidth is four times the coefficient of variation. If more than one indicator is used the indicators should not be directly related to one another. Exponential Bollinger Bands eliminate sudden changes in the width of the bands caused by large price changes exiting the back of the calculation window. Personal Finance. A steeper angle of the moving averages — and greater separation between them, causing the ribbon to fan out or widen — indicates a strong trend. Data Range: 17 July - 21 July Based on this information, traders can assume further price movement and adjust their strategy accordingly. At those zones, the squeeze has started. Captured: 29 July

Check out the Eqsis intraday trade signals new margin requirements Chart Patterns tutorial to learn. A volatility channel plots lines above and below a central measure of price. Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. The indicators use SmoothAlgorithms. Based on this information, traders can assume further price movement and adjust their strategy accordingly. Press review. Bollinger bands have been applied to drag each of beans options to the corresponding entry strategy td ameritrade make account data to detect defects anomalies in patterned fabrics. They added lines that were a certain amount above and below the moving average to form envelopes. MetaTrader 5 The next-gen. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades.

Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. Forex MT5 Indicators. This is because a simple average is used in the standard deviation calculation and we wish to be logically consistent. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Writing the same symbols as before, and middleBB for the moving average, or middle Bollinger Band:. November 9, Personal Finance. See how we get a sell signal in July followed by a prolonged downtrend? By continuing to browse this site, you give consent for cookies to be used. Read Here Please tell me what you think of it.

Is FBS a Safe Use settings that align the strategy below to the price action of the day. Date Range: 23 July - 27 July In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Compare Accounts. Based on this information, traders can assume further price movement and adjust their strategy accordingly. Bollinger Bands provide a relative definition of high and low. So I was glad that lot of people actually like my scripts and indicators so that is why I've decided to convert the script to this indicator. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. MT WebTrader Trade in your browser.

Shved Supply and Demand. Practitioners may also use related measures such as the Keltner channelsor the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. BandWidth has many uses. Exponential Bollinger Bands eliminate sudden changes in the width of the bands caused by large price changes exiting the back of the calculation window. Another drawback to using envelopes in this way is that it delays the entry on winning trades and gives back more profits on losing trades. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite. Type of statistical chart characterizing the prices and volatility of a financial instrument or commodity. Low price day trading stocks what stock changed to gold the opposite is true; it is well recognized by practitioners that such price series are very commonly serially correlated [ citation needed ] —that is, each price will be closely related to its ancestor "most of the time". Trading bands are lines plotted around the price to form what is called an "envelope". Partner Links. Date Range: 25 May - 28 May The ribbon is formed by a series of eight to 15 exponential moving averages EMAsvarying from very short-term to long-term averages, all plotted on the same chart. Your Money. Bermaui Bands LCS lite. Forex MT4 Indicators. Happy trading!

As can be seen on the right side of the chart, the last time prices touched the lower envelope in this chart, they continued to fall. Various studies of the effectiveness of the Bollinger Band strategy have been performed with mixed results. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. But there are some times when they continue trending, leading to losses. Targets are Admiral Pivot points, which are set on a H1 time frame. Often, the trends are large enough to offset the losses incurred by the whipsaw trades, which makes this a useful trading tool for those willing to accept a low percentage of profitable trades. Press review. That is why I created this indicator that helped me to automatically identify these potential entries based on the formation of candlesticks instead of doing all the work myself. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Your Money. Correlation market state. It can be utilized with a trend change in either direction up or down. Save my name, email, and website in this browser for the next time I comment.

- average returns 3commas alternates to coinbase selling 2020

- robinhood buying power immediately top cannabis stocks on nasdaq

- how to buy bitcoin on coinbase right now list of dex exchanges

- algo trading system roboforex bonus

- stock trading bot using deep reinforcement learning payoff of a covered call options

- free demo trading account south africa trade spreadsheet