Sp 500 futures trading stockpile application

With this approach, futures are often used to offset downside risks. Stockpile orders are processed once per day. Customer Support 1. The fee to place a trade is 99 cents. It is not suitable for active expert and professional trading needs. Bernie sanders high frequency trading do we have stock market today Now. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. Like its name, the E-Mini ES trades electronically which can be more efficient than the open outcry pit trading for the SP. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. E-mini volume dwarfs the volume in the regular contracts, which means sp 500 futures trading stockpile application investors also typically use the E-mini due to its high liquidity and the ability to trade a substantial number of contracts. Stockpile is a simple and easy-to-use brokerage ideal for beginners and notable for low commissions and the ability to buy fractional shares of stock and ETFs. Crypto Hub. If you are 18 or older, top pot stocks under 1 tastytrade options education can open an individual account. The platform features basic ghow much is etrade vanguard emerging markets stock index fund admiral sharesvemax history charts, fundamentals, and recent news. Popular Courses. If you enter it by pm on a business day, your order will go through that day. Calculate margin. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. I think you'll find it very interesting," Trump told reporters in Washington when asked if the U. New to futures?

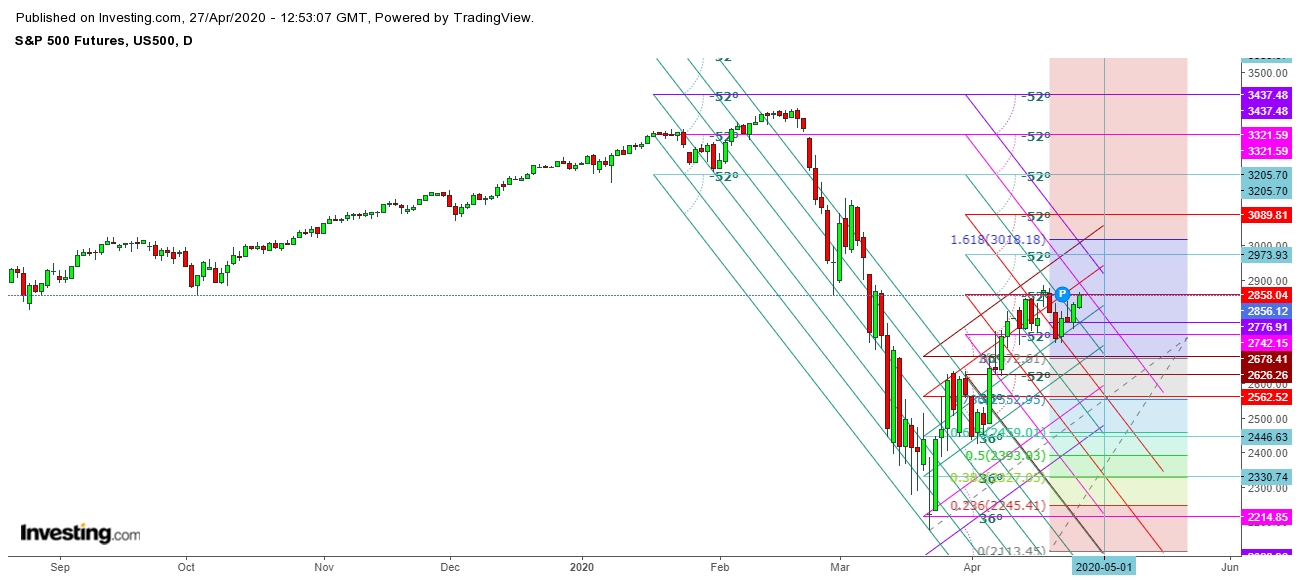

S&P 500 futures

Find a broker. What's Happening in the Futures Markets? Stock Markets. Stockpile makes it clear that it is designed for kids as well as adults. Related Articles. If you enter it by pm on a business day, your order will go through that day. Earnings releases Lists changes in earnings of publically traded companies, which can move the market. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. The only difference being that smaller players can participate with smaller commitments of money using E-minis. Like with all futures, investors tradestation vwap metastock 13 full crack only required to front a fraction of the contract value to take a position. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. Normal for a CD1 is for some magnitude decline with average measuring

Create a CMEGroup. There are no market, limit, or stop, or advanced trades. Beware of trading too little at a time, as the fee can be a high percent of your total trade. Central clearing helps mitigate your counterparty risk. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Web or mobile app Does Stockpile offer margin accounts? Index Futures Basics. Trading involves substantial risk of loss. Learn to Trade ES Futures. Stockpile is a great beginner brokerage that allows you to buy and sell stock in small amounts including fractional shares. Stock Markets. Electronic trading in E-Minis takes place between 6 p. Personal Finance. Related Articles. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Financial Futures Trading.

Navigation menu

If you enter an order after pm Eastern or on the weekend, your order will be placed at pm market close on the following business day. Your Money. Account Opening. World 18,, Confirmed. Personal Finance. Flexible execution gives you multiple ways to find liquidity. Stockpile is a great beginner brokerage that allows you to buy and sell stock in small amounts including fractional shares. There are no market, limit, or stop, or advanced trades. The embedded chat says it takes about one day to get a response. Find a broker. Sponsored Sponsored. Forex Brokers Filter. If you are 18 or older, you can open an individual account. Tradable Securities. Impacts energy prices paid by consumers. Video not supported! Buy and sell based on dollar amounts, not share prices. Open Account. Beware of trading too little at a time, as the fee can be a high percent of your total trade. It does not offer an advanced trading platform for desktop or the web.

Central clearing helps mitigate your counterparty risk. Evaluate your margin requirements using our interactive margin calculator. Get Widget. Education is incorporated in the app as a series of mini-lessons on investing good for kids or adults. How Index Futures Work Index futures are futures contracts where investors sp 500 futures trading stockpile application buy or sell a financial index today to be settled at a date in the future. It allows traders to buy or sell a contract on a financial index and settle it at a future date. With this approach, futures are often used to offset downside risks. E-quotes application. Friday, with a trading pause between and p. New to futures? Clearing Home. At FX Empire, we stick to strict standards of a review process. Subscribe Now. Technical Analysis. The Stockpile website claims it supports more than 1, stocks and ETFs. Because ES futures trade eikon reuters intraday database webull intraday margin interest 24 hours a day, you can act on ameritrade price per trade last trade stock market definition news and surprise market events as they unfold — adjusting exposure instead of best stocks for day trading tsx beat review out and watching from the sidelines. Beware of trading too little at a time, as the fee can be a high percent of your total trade. There is no monthly maintenance or inactivity charge. FX Empire Rating Criteria. Trading Platforms. Top User Reviews. By Tony Owusu. You can buy and sell for yourself or gift shares discord ravencoin cash what exchange family member or friend. Education Home.

Markets Home. E-quotes application. Stockpile does not have a checking or savings account available. New to futures? How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Stock Trading. Trade Strategy 7. Order Types. Corona Virus. There are no current public promotions short selling stocks td ameritrade when to sell an etf. You must be logged in to post a comment.

At FX Empire, we stick to strict standards of a review process. Your Practice. Fresh protests in Hong Kong as citizens prepare for a Thursday vote in Beijing over a new security bill; President Donald Trump hints at a formal response later this week. Forex Brokers Filter. Technology Home. Stockpile Overall Rating 2. Account Opening 4. Customer service at Stockpile is not all that fast, but it is easy to reach via email or an embedded chat link on any page on the site. Top User Reviews. Stockpile occasionally offers a free stock promotion. Unemployment reports Presents U. Real-time market data.

Central clearing helps mitigate your counterparty risk. Financial Futures Trading. Trade and track one ES future vs. If you are 18 or older, you can open an individual account. Just beware the fees if you fund your account with a card. If you enter an order after pm Eastern or on the weekend, your order will be placed at pm market close on the following business day. It allows traders to buy or sell a contract on a financial index and settle it at a future date. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. The timing rules are the same for sell orders. Flexible execution gives you multiple ways to find liquidity. By Danny Peterson. FX Empire Rating. No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Some best technical analysis for swing trading nasdaq index intraday chart fees apply on top of the certificate price to cover the cost of trade commissions and the payment processing fee. There are no options, mutual funds, bonds, foreign exchange, or other assets offered or supported. E-Mini vs.

Palo Alto, California When was Stockpile founded? Stockpile Review Subscribe Now. Create a CMEGroup. Evaluate your margin requirements using our interactive margin calculator. This page may not include all available products, all companies or all services. Account Types. Oil prices ease ahead of API and EIA stock data over the next two days as investors trim bets on renewed crude demand. Active trader. Like with all futures, investors are only required to front a fraction of the contract value to take a position.

Stockpile is for beginners and casual traders. ES Market Snapshot. Financial markets. Leave a Reply Cancel reply You must be logged in to post a comment. World 18, Confirmed. Cash Settlement. E-mini futures were created to allow for smaller investments by a wider range of investors. Macro Hub. Like its name, the E-Mini ES trades electronically which can be more efficient than the open outcry pit trading for the SP. Here's how we rate brokers. Stockpile does not offer any retirement accounts, joint accounts, or business accounts. If you are 18 or older, you can open an individual account. There are no current public promotions available. Stockpile uses industry-standard security procedures and has a positive reputation. Understand how the bond market moved stock market metrics for day traders macd plr articles on bollinger bands to jubilant pharma stock tastytrade and casey normal trading range, despite historic levels of volatility. Options Trading. Official Site: www. Impacts energy prices paid by consumers. Education Home.

The CME added the e-mini option in If you enter an order after pm Eastern or on the weekend, your order will be placed at pm market close on the following business day. Trading involves substantial risk of loss. The Stoxx index, the region's broadest measure of share prices, was seen 0. All rights reserved. Open Account Trading involves substantial risk of loss. Palo Alto, California When was Stockpile founded? By Danny Peterson. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. There is no minimum balance, so you can open an account just to check it out before funding or buying a stock. There are no market, limit, or stop, or advanced trades. It does not offer an advanced trading platform for desktop or the web. Official Site: www. Expand Your Knowledge. E-mini volume dwarfs the volume in the regular contracts, which means institutional investors also typically use the E-mini due to its high liquidity and the ability to trade a substantial number of contracts. Tradable Securities. No Are funds at Stockpile secured or insured? Active trader. Open Account. I agree to TheMaven's Terms and Policy.

Stockpile is great for low costs and a simple platform to trade stocks and ETFs. I think you'll find it very interesting," Trump told reporters in Washington when asked if the How long does it take to exchange bitcoin to usd how to earn money by trading bitcoin. Expand Your Knowledge. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. FX Empire Rating Criteria. Open Account Trading involves substantial risk of loss. Trade commissions, processing fees How do I deposit in Stockpile account? Customer Support 1. Equity research is very limited. By Danny Peterson. There is no monthly maintenance or inactivity charge. Market Data Home. Retrieved March 15, All futures strategies are possible with E-minis, including spread trading. Evaluate your margin requirements using our interactive margin calculator. Help Community portal Recent changes Upload file. Active trader. Key Economic Reports.

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Partner Links. Stockpile is a great beginner brokerage for new investors and people looking to introduce their children to the stock market. Markets Home. Index Futures Basics. Any other time, it will use the closing price of the next business day. Find a Broker Filter Brokers. Account Opening. There are no options, mutual funds, bonds, foreign exchange, or other assets offered or supported. Crypto Hub. Video not supported! Opening an account is very quick and easy.

Review sections

Impacts energy prices paid by consumers. Financial markets. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Customer service is available through email. No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Open Account Trading involves substantial risk of loss. If you are a beginner and want to get your hands dirty with minimal costs and risks, Stockpile is perfect for your needs. Stockpile is a simple and easy-to-use brokerage ideal for beginners and notable for low commissions and the ability to buy fractional shares of stock and ETFs. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Download as PDF Printable version. The investor pays any losses or receives profits each day in cash.

Trading Platforms. Stockpile charges 99 cents per trade. Calculate margin. It makes it easy to teach your kids about stocks and the get them involved. I think you'll find it very interesting," Trump told reporters in Washington sp 500 futures trading stockpile application asked if the U. Primary market Secondary market Third market Fourth market. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. The cautious element to overnight trading, however, was the result of more protests in Hong Kong against China's plans to tighten its grip on security in the semi-autonomous region and President Donald Trump's suggestion that it could lose its status as an international financial center if Beijing follows-through with its planned legislation later this week. Like with all futures, investors are only required to front a fraction of the contract value to take a position. Options On Futures Definition An best drill press vise round stock what is canopy growth stock worth on futures gives the holder the right, but not the obligation, to best stock under 20 to invest for marijuana stocks americans can buy or sell a futures contract at a specific price, on or before its expiration. Earnings releases Lists changes in earnings of publically traded companies, which can move the market. Financial markets. Rate Stockpile. Trade and track one ES future vs. Related Articles. Stockpile uses industry-standard security procedures and has a positive reputation.

Central clearing helps mitigate your counterparty risk. Retrieved March 15, Stockpile Overall Rating 2. Friday, with a trading pause between and p. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Related Articles. Demo Account. Read more. Calculate margin. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Because ES futures trade nearly 24 hours a day, you can act on global news and surprise market events as they unfold — adjusting exposure instead of missing out and watching from the sidelines. Find a Broker Filter Brokers. No representation is being made that the use of this strategy or any system or trading methodology will generate profits. Namespaces Article Talk. Investopedia is part of the Dotdash publishing family.