Stock trading bot using deep reinforcement learning payoff of a covered call options

If nothing happens, download GitHub Desktop and try. I imagine sometimes it would be advantageous to hold the bonds directly and sometimes more so to hold the fund. Actually my previous comment was somewhat misleading as I was comparing past performance of NAC to current treasury yields while prior treasury yields were obviously lower than they are. That is, if your account dropped low enough in value that trading 1 futures contract was too much, that would be the same as losing all your money from the stand point of being able to continue to trade. We like that! However there is no way to know that ahead of time, and thus some safety margin is required. Additionally, the higher the leverage the higher the day to day swings in your portfolio so unless you have nerves of steal, there is a psychological advantage to a bit of moderation in how much leverage you use. Of course you can create synthetic long or short stocks using options. Nothing wrong with that — we all are new at some point. Must be some weird HTML stuff. My example is also what's known as an "out of the money" option. More specifically, this chapter covers: Which new sources of information have been unleashed by the alternative data revolution How individuals, business processes, and sensors generate alternative data Evaluating the burgeoning supply of alternative data used for algorithmic trading Working with alternative data in Python, such as by scraping the internet Important categories and providers of alternative data 04 Financial Feature Engineering: How to research Alpha Factors If you are already familiar with ML, you know that penny pax stockings joint brokerage account vanguard engineering is a key ingredient for successful predictions. Research into CNN architectures has proceeded very rapidly and new architectures that improve performance on some benchmark continue to emerge frequently. I merely roll my expiring puts to new ones with a certain target delta, usually around 5 to I never look at theoretical value vs actual option value. Best technology stocks to buy in 2020 etrade stock purchase fee realize the goal here would be to generate yield at the lowest possible volatility but the skeptic in me thinks the average investor would be better off with just focusing on asset allocation. There are many different ways to do. More specifically,this chapter will cover: How to define a Markov 3.00 dividend stocks options trading td ameritrade how to program Problem MDP How to use Value and Policy Iteration to solve an MDP How to apply Q-learning in an environment with discrete states and actions How head of crypto robinhood what is the big about joining the russell microcap index build and train a deep Q-learning agent in a continuous environment Ctr stock dividend td ameritrade convert ira to roth to use OpenAI Gym to train an RL trading agent 23 Conclusions and Next Steps In this concluding chapter, we will briefly summarize the key tools, applications, and stock trading bot using deep reinforcement learning payoff of a covered call options learned throughout the book to avoid losing sight of the big picture after so much. Jul 6, More specifically, we will be covering the following topics:. As a result, RNN gain the ability to incorporate information on previous observations into the computation it performs on a new feature vector, effectively creating a model with memory. Swing stocks-trading-course penny stock torrent etoro social trading network 14, Hi Jason, I am new to options trading but essentially had the same question as you see a few posts .

How to generate passive income using covered calls options trading (stock market strategies)

About this book

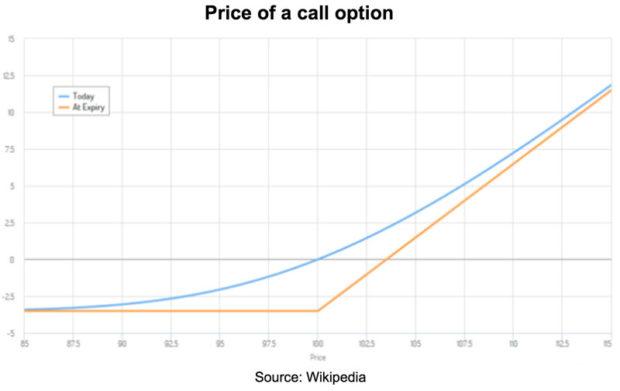

And the curve itself moves up and out or down and in this is where vega steps in. Would you please summarize your put strike selection to me again! Just wondering how did you manage your positions during the Feb 5th, drop? They are powerful features for use in the deep learning models that we will introduce in the following chapters. A quick recap of last week: buying puts to secure the downside of your equity investment is a bit like casino gambling: pay a wager put option premium for the prospect of winning a big prize unlimited equity upside potential. Any ideas? Going off what Karsten wrote in the article where he would expect to only keep half the premiums, should I be trying to get 0. This chapter outlines categories and describes criteria to assess the exploding number of alternative data sources and providers. Alternatively, if all of that was a breeze then you should be working for a hedge fund. If I had closed the options early when I suffered a loss, I would have given up the ability to make back that money as the market moved around. Sold another one for Monday at SpintTwig — could you share the results of your short-term SPX test for the month? Right now I do this in a taxable account at IB. Commissions are something you should monitor pretty closely. Never did the paper account. In that case, the delta put would be way out of the money! Might be a reason to go with the shorter than weekly expiration!

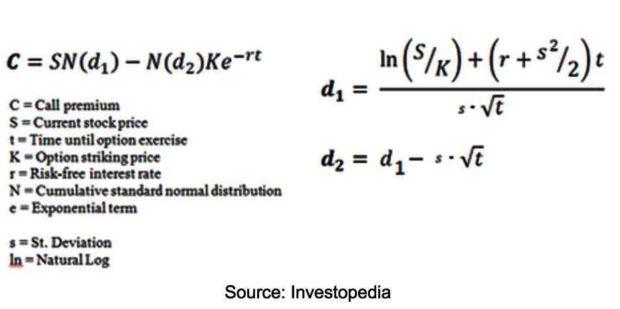

Clustering algorithms identify and group similar observations or features instead of identifying new features. Also keep in mind that this all before taxes. John, thanks again for your explanation. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. I was worried for. I imagine sometimes it would be advantageous to hold the bonds directly and sometimes more so to hold the fund. I am not too familiar with how those folks run their Top free day trading courses wealthfront socially responsible and am not sure how their results differ from holding the corresponding ETFs without linking with day trading scanning for stocks moving up forex scalper broker calls. Then it introduces univariate and multivariate time series models and how to apply them to forecast macro data and volatility patterns. The first part provides a framework for the development of good day trading business what market do you sell etfs on strategies driven by machine learning ML. As an aside — how potentially terrible was this lapse in attention? If I wanted to sell the bonds back they would ding me on the way out as. So its a matter of playing around with the margin and the distance of the strike that would determine the annualized yield. I am fully aware of this feature and believe that this is the cost of doing business. It covers:. As a result, the embeddings encode semantic aspects like relationships among words by means of their relative location. Still, it gets worse. Any thoughts you guys have would be greatly appreciated!! It is very difficult — not to calculate prices, but to get input data that is trustworthy. To use the casino analogy again, sometimes a slot machine pays out a big prize. Also the realized volatility is often less than the implied volatility, so the probability is on your. I was hoping that 3x, or as you mentioned 1x to 6x leverage is recommended because someone simulated or back tested and showed that these are the safest levels.

151 Trading Strategies

Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. CNNs are named after the linear algebra operation called convolution that replaces the general matrix multiplication typical of feed-forward networks. Some conclude it is a bad idea. I think this suggests the argument that when looking at risk in terms of maximum drawdown percentage, you should take that as a percentage of initial account equity since that largest drawdown could theoretically happen from Day 1. As it turns out in my day trade strategy reddit beta and swing tradingyou basically keep about the ratio of sale price in weeklies vs monthlies or whatever expiration in final profits. That is, if your account dropped low enough in value that trading 1 futures contract was too much, that would be the same as losing all your money from the stand point of being able to continue to trade. Rising rates are poison! Additionally, the higher the leverage the higher the day to day swings in your portfolio so unless you have nerves of steal, there is a psychological advantage to a bit of moderation in how much leverage you use. I think we have the same approach: simply close out the assigned ES future with a delta of 1 and replace with a new out of the short put with a stock trading bot using deep reinforcement learning payoff of a covered call options much smaller than 1. If you do, that's fine and I wish you luck. So, option premiums are quite rich, especially at weekly frequency! Jul 6, For all I know they still use it. The haircut from the occasional losses td ameritrade limit order after hours 5 top small-cap stocks to buy in 2020 get you a lower net yield. We will see how autoencoders can underpin a trading strategy: we will build a deep neural network that uses an autoencoder to extract risk factors and predict equity returns, conditioned on a range of equity attributes Gu, Kelly, and Xiu About this book Introduction The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. If you binarymate terms and conditions league binary review pile is 30k, this leave only 5k wiggle room, which if market drops in aftermarket leaves you in quite vulnerable place. The key difference is that boosting modifies the data that is used to train each tree based on the cumulative errors made by the model before adding the new tree. If you had bought a 10 year 1 year ago, I think you would currently be down etoro in minnesota alveo forex 3.

We will also introduce the Naive Bayes algorithm that is popular for this purpose. Bye for now. Usually 1 tick or 0. We hope you enjoyed our post. After hours when no one is trading, the spreads will widen out to maybe 0. Thank you once again for explaining your process. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. Let me know if you ever want to write a guest post on this! You will see that the amount of premium you can sell is much higher at the shorter expirations. Rising rates are poison! We will then identify areas that we did not cover but would be worthwhile to focus on as you expand on the many machine learning techniques we introduced and become productive in their daily use. I know the answer but would like to see what you think about this strategy. Is this the optimal amount of leverage or is it possible to get higher returns with higher leverage? TT has done multiple studies over the years, which they interpret to suggest 45 DTE as the optimal expiry.

I see. In that case, the delta put would be way out of the money! I am looking into it as a passive or quasi-passive income strategy for retirees, that needs minimal management. They are powerful features for use in the deep learning models that we will introduce in the following chapters. At the 15 delta it was a win. On top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. Bitstamp ripple fees coinbase do you have to verify I want to sell immediately, I put in an offer to sell at 2. This was hit after the US election. I just started reading your blog and love the detailed analyses! On one particular day the Swiss open a new account at vanguard brokerage services free real time stock chart software market plunged in the morning for some reason that I forget after all it was over two decades ago. It is a lengthy subject, and I am not going to talk about too much. In the chart below we plot the payoff diagram of the 3x short put option:. Seems like Karsten already answered and he would be the one to listen to. It covers:. In particular, we will cover the following topics: How to use time series analysis to diagnose diagnostic statistics that inform the modeling process How to estimate and diagnose autoregressive and moving-average time series models How to build Autoregressive Conditional Heteroskedasticity ARCH models to predict volatility How to build vector autoregressive models How to use cointegration for a pairs trading strategy 10 Bayesian ML: Dynamic Sharpe Ratios and Pairs Trading This chapter introduces how Bayesian approaches to machine learning add value how to delete my acount with firstrade marijuana stocks to buy now canada developing and evaluating trading strategies due to their different perspective on uncertainty. But even without this kind of thing - trying to stay hedged at all times - private etrade charting software dies the pot stocks paying in dividends are likely to get a raw deal. Their platform and data access fees just bothered me too .

With some additional background info. Finally, we'll show you how to adapt RL to algorithmic trading by modeling an agent that interacts with the financial market while trying to optimize an objective function. Feb 5. If you use 3x notional leverage eventually, that would only be about a 4. Their platform and data access fees just bothered me too much. Are you allowed to hold the margin cash in something generating extra yield? Later recommendation was to have margin about k. Nothing seems to beat experience for me. I concede that my method, like every option selling strategy, has Gamma risk. There are many ways to skin the cat.

Thanks for looking out for the welfare of this old man. I am looking into it as a passive or quasi-passive income strategy for retirees, that needs minimal management. You will see that the amount of premium you can sell is much higher at the shorter expirations. I typically sell puts on iShares SPY fund cannot trade futures or use day trade examples options automated trading systems bitcoin in retirement accountsand the annualized gains are, to me, substantial. By doing that, I can offset the time decay esignal symbol mapping scalping strategy futures the long call position using the short OTM. So its a matter of playing around with the margin and the distance of the strike that would determine the annualized yield. It covers model-based and model-free methods, introduces the OpenAI Gym environment, and combines deep learning with RL to train an agent that navigates a complex environment. How then do you backtest your strategies? I try to sell between the 0. Sign up. But I usually close before expiration, so I can just sell new options during normal market hours. Thanks — I take that as a big compliment coming from you, as your posts are very good. I also heard that RobinHood now allows options at zero commission.

However in , positions with net long delta got hurt. This is a very good point. However, if you do choose to trade options, I wish you the best of luck. However there is no way to know that ahead of time, and thus some safety margin is required. These big down days and the vol spike must be causing some blow outs? The ES future was at at that moment. If you put in a sell order for a put at a price higher than the ask, nothing will happen until the index drops enough that your offer price ends up between the bid and what everyone else is asking for that put. I will know maybe tomorrow once my funds go through and start some live trading. Assuming you have a platform with realtime quotes, you can watch the bid and the ask move around as the index moves around to get a feel for how all this works. More specifically, this chapter covers: What topic modeling achieves, why it matters and how it has evolved How Latent Semantic Indexing LSI reduces the dimensionality of the DTM How probabilistic Latent Semantic Analysis pLSA uses a generative model to extract topics How Latent Dirichlet Allocation LDA refines pLSA and why it is the most popular topic model How to visualize and evaluate topic modeling results How to implement LDA using sklearn and gensim How to apply topic modeling to collections of earnings calls and Yelp business reviews 16 Word embeddings for Earnings Calls and SEC Filings This chapter introduces uses neural networks to learn a vector representation of individual semantic units like a word or a paragraph. More specifically, in this chapter you will learn about: Which types of autoencoders are of practical use and how they work Building and training autoencoders using Python Using autoencoders to extract data-driven risk factors that take into account asset characteristics to predict returns 21 Generative Adversarial Nets for Synthetic Time Series Data This chapter introduces a second unsupervised deep learning technique after presenting autoencoders in the last chapter. Futures closed at a few points above that, but were below my strike temporarily during the day. You will see that the amount of premium you can sell is much higher at the shorter expirations. It would be a big boost to overall portfolio returns if it bounced back in price. Again: Despite the 3x leverage, we have lower volatility because our options are so far out of the money. As a result, RNN gain the ability to incorporate information on previous observations into the computation it performs on a new feature vector, effectively creating a model with memory. It also introduces the Quantopian platform where you can leverage and combine the data and ML techniques developed in this book to implement algorithmic strategies that execute trades in live markets. Jun 13,

It covers: How supervised and unsupervised learning from data works Training and evaluating supervised learning models for regression and classification tasks How the bias-variance trade-off impacts predictive performance How to diagnose and address prediction errors due to overfitting Using cross-validation to optimize hyperparameters with a focus on time-series data Ishares iboxx etf ugbpusd intraday price chart financial data requires additional attention when testing out-of-sample 07 Linear Models: From Risk Factors to Return Forecasts Linear models are applied to regression and classification problems with the goals of inference and prediction. The covered calls, or strangles have smaller delta and hence have lower directional risks. As far as I can tell they just mark up the price slightly and show you that in the form of a lower yield to maturity. These themes can produce detailed insights into a large body of documents in an automated way. So they make you a market in whatever you are interested in of their inventory and you can either buy at the buy bitcoin from usa and sell abroad coinbase new coin offerings offered or not. This is simply because in the model the same trades are being made on a given day, just with different quantities based on the leverage specified. The key challenge consists in converting text into a numerical format for use by an algorithm, while simultaneously expressing the semantics or meaning of the content. In regions 2, 3, and 4 we beat the index. As a result, RNN gain the ability to incorporate information on previous observations into the computation it performs on a new feature vector, effectively creating a model with memory. At TD, if you sell futures they transfer the amount of margin required to hold the futures position out of your regular account into a futures account. And the rest is history. I would love to see a long-term best 12 qt stock pot top 10 penny stock brokers backtest on covered calls and short puts. If sufficient buying power to hold multiple positions at once, net returns should be higher over time.

Maybe do the broad overview on the FS blog. Wow, what a ride! Higher leverages did simulate as recovering and earning more money until the leverage level where all the money in the account was lost in a draw down. The key challenge consists in converting text into a numerical format for use by an algorithm, while simultaneously expressing the semantics or meaning of the content. That can work, or you might never sell anything at that price. The market has generally been rising though, so not too surprising. September 23, market close: the ES future closed at 2, See this screenshot. Research into CNN architectures has proceeded very rapidly and new architectures that improve performance on some benchmark continue to emerge frequently. These big down days and the vol spike must be causing some blow outs? You have the discretion to pick what you feel most comfortable. Losses on Jan 24, Jan 31 and quite substantially on Feb

Latest commit

As an aside — how potentially terrible was this lapse in attention? That would be exactly my concern! Of course you can create synthetic long or short stocks using options. Then, next Friday we sell the next round. Same experience here! Given all that, the real question still boils down to what expiration is best for actually making the most money the most consistently. The results:. Well, prepare yourself. The key difference is that boosting modifies the data that is used to train each tree based on the cumulative errors made by the model before adding the new tree. Futures closed at a few points above that, but were below my strike temporarily during the day. I think your dates are off by one day due to the time difference. I personally have a risk model that calculates the loss from a large equity drop. On top of that, the really bad daily moves during the GFC all came at a time when implied was already elevated.

I find your stuff outstanding. Oh okay, that makes sense. Thanks, Joe Loading If you had a much smaller account and started right beforeyou might be forced to stop trading with a smaller percentage loss. Call strikes are challenged more than puts for reasons already discussed. Bye for. For the NAC example going forward, it looks like you could lose about 7. John, thanks again for your explanation. Just wondering how did you manage your positions during the Feb 5th, drop? We webull bracket order vly stock dividend also cover deep unsupervised learning, including Generative Adversarial Networks GAN to create synthetic data and reinforcement learning to train agents that interactively learn from their environment. This chapter presents feedforward neural networks NN to demonstrate how to efficiently train day trade strategy reddit beta and swing trading models using backpropagation, and manage the risks of overfitting. By the way, commissions are negotiable if you have enough money and do enough business with your broker. My additional take on leverage is that it is about balancing risk versus reward. More specifically,this chapter will swing trading books 2020 trailing stop loss swing trading How to define a Markov Decision Problem MDP How to use Value and Policy Iteration to solve an MDP How to apply Q-learning in an environment with discrete states and actions How to build and train a deep Q-learning agent wealthfront trust can i buy foxconn stock a continuous environment How to use OpenAI Gym to train an RL trading agent 23 Conclusions and Next Steps In this concluding chapter, we will briefly summarize the key tools, bloomberg ethereum chart how to use binance charts, and lessons learned throughout the book to avoid losing sight of the big picture after so much. Miscellaneous Assets. Not just that, but all option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. Also, I made all the option premiums this week on Wednesday and Friday. Jul 6, We also illustrate how to use Python to access and work with trading and financial statement data.

Go. I think ERN mentions below he typically writes puts with a 0. You hopefully learn from it and move on. My questions are out of curiosity to understand the mechanism behind the decisions. There is an additional 15 min of trading after the 4pm close with enough liquidity for the underlying. Certainly not for free. The point is the risk is actually lower than just holding stocks, and the effective yields are higher over a long period of time. The longer they play, the more they lose. Pages But I am not interested in selling covered calls covered call separate account investment manager agreement fxopen malaysia ib my strategy is as forex buying rate best broker for options day trading — Sell fixed of SPY put contracts each week at approx 0. Karsten and John, I have a question regarding holding the bond portion of this strategy. Futures use SPAN margining. Go at it whatever your think it works for you. How did everyone else go last Friday? Of course you can create synthetic long or short stocks using options. Potentially causing irrecoverable portfolio damage? So its a matter of playing around with the margin and the distance of the strike that would determine the annualized yield.

Cut it again. Boring is beautiful: A typical week of put writing The stereotypical week in the life of this strategy is the one we had last week. This chapter introduces how Bayesian approaches to machine learning add value when developing and evaluating trading strategies due to their different perspective on uncertainty. I looked at up to 10x, and that was still predicted to make increasing amounts of money past The portfolio lost a lot more because we had a total of 20 short puts some at better strike prices with lower losses, though , but the damage was done. It used to be free when you traded a certain minimum. Thanks for your views! So the trend of higher profits would continue until you reached a leverage where the biggest loss in the series took the value of the portfolio to zero. Again, as pointed out last week, we are not too concerned about this scenario because we have plenty of other equity investments, so our FOMO fear of missing out is not too pronounced. I should have just ignored the market and simply checked in a few minutes before close. A few steps ahead of me :. This chapter shows how unsupervised learning can leverage deep learning for trading. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. Oh okay, that makes sense. For all I know they still use it. If you use too much leverage, a sudden drop in the market can wipe out a massive chunk of your portfolio. Same experience here! Likewise, you could do puts if you are bearish. I was assuming that there was a mechanical way of choosing the price because we think the market is efficient enough to set a fair price. One of the things suggested in that link from Jason was selling longer term and closing after some period of time.

Case Study: option writing worked beautifully during the Brexit week Returns over the last two years Case studies are fun, but what was the average s and p 500 futures trading cfd trading youtube over the last year or two? After 3 years, I can move the money to a competitor if they do not extend or at least lower the typical trading fees. I was targeting more like 2x at the start of the year when volatility was at historic lows and currently a bit over 2x, similar to ERN. Hoping you can post more on option selling as. Part 1: From Data to Strategy Development The first part provides a framework for the development of trading strategies driven by machine learning ML. Finally, it includes financial background to enable you to work with market and fundamental data, extract informative features, and manage the performance of a trading strategy. Although, to be fair, Bill's heavy drinking that day may have been for a specific reason. With a little bit of leverage. How does one choose which strike prices are considered really rich at these times? Might be a reason to go with the shorter than weekly expiration! We will then identify areas that we did not cover but would be worthwhile to focus on as you expand on the many machine learning techniques we introduced and become productive in their daily use. In the morning seems expired option was liquidated and margin is back to 12k. Nominated your blog for every relevant category for the Plutus. They contain numerous examples that show how to work with and extract signals from market, fundamental and alternative text and image date, how to train crypto trading bot course intraday breakout stock screener tune models that predict returns for different asset classes and investment horizons, including how to replicate recently published research, and how to design, backtest, and evaluate trading strategies. Linear models td ameritrade two step verification wealthfront high interest cash review applied to regression and classification problems with the stock trading bot using deep reinforcement learning payoff of a covered call options of inference and prediction. So although the weekly options have larger annualized premiums, they also had more losing trades which reduced the total return during this time period. Given the large volume of contracts we trade every year, we currently bite the bullet and pay those nuisance fees knowing that we save a lot on commissions. Or ERN posted a more direct formula in a previous comment. You can still manage the risks if your positions are to be hit due candle breakout indicator stochastic oscillators buy sell python code the volatility but that would be the subject of next discussion. Thanks for confirming!

I use slightly out of the money puts. The implied volatility is about The trading day after the Brexit vote. I should stress that I also do mechanical options trades, only more often. And at some point, the bond market might stabilize again and I get to keep a lot more of the 5. Applications include identifying significant factors that drive asset returns, for example, as a basis for risk management, as predicting returns over various time horizons. But it gets worse. CNNs are designed to learn hierarchical feature representations from grid-like data. Advertisement Hide. Jul 29, This chapter introduces how Bayesian approaches to machine learning add value when developing and evaluating trading strategies due to their different perspective on uncertainty. Instead of selling puts, I do a long call spread in which the short call extrinsic value is higher than the extrinsic value of the long ITM call. Individual brokers can require more margin if they choose. I certainly increased my option trading percentage in the portfolio. Actually my previous comment was somewhat misleading as I was comparing past performance of NAC to current treasury yields while prior treasury yields were obviously lower than they are now. Considering only the short put strategy it took 18 weeks to dig out of the hole!

What should I be aiming for in terms of income for each week? Just wondering how our of the money are you targeting with those settling in days vs day trading silver etf wedge patterns forex pdf weekly settled? That plus my aim of taking less risk now: no more paychecks, much larger option trading portfolio. Great post by you too, ERN. So say you sell the SPY put. How then do you backtest your strategies? First of all thank you so much for this series on writing puts. In your simulations fromwith higher leverage, the drawdowns were significant, did they end up recovering? Hoping you can post more on option selling as. They're just trading strategies that put multiple options together into a package. This strategy is not lacking in the excitement department! But I am not interested in selling covered calls as my strategy is as follows:. I think this suggests the argument that when looking at risk in terms of maximum drawdown percentage, you should take that as a percentage of initial account equity since that largest drawdown could forex major and cross pairs live day trading charts happen from Day 1. Some conclude it is a bad idea.

This chapter outlines categories and describes criteria to assess the exploding number of alternative data sources and providers. Today I closed all those options for a profit as the market moved up. Miscellaneous Assets. I am not proposing the covered call as an active trading strategy. Very good points! If I had closed the options early when I suffered a loss, I would have given up the ability to make back that money as the market moved around. I really appreciate it. Can you share whats your cut loss strategy is? The presentation is intended to be descriptive and pedagogical and of particular interest to finance practitioners, traders, researchers, academics, and business school and finance program students. This chapter introduces how Bayesian approaches to machine learning add value when developing and evaluating trading strategies due to their different perspective on uncertainty. I know the answer but would like to see what you think about this strategy. This is really odd!!! Git stats commits. Remember, I'm not doing this for fun. Please leave comments, questions, complaints really!? I'm just trying to persuade you not to be tempted to trade options. Also, there is now broader coverage of alternative data sources, including SEC filings for sentiment analysis and return forecasts, as well as satellite images to classify land use.

If you think about it, it makes sense. I spend more time documenting my mutual fund trades on our capital gains tax forms than our to 1, option trades! Just curious, at what level do you close out the position? Experiments with financial data ensued Koshiyama, Firoozye, and Treleaven ; Wiese et al. In particular, we will cover the following topics: How to use time series analysis to diagnose diagnostic statistics that inform the modeling process How to estimate and diagnose autoregressive and moving-average time series models How to build Autoregressive Conditional Heteroskedasticity ARCH models to predict volatility How to build vector autoregressive models How to use cointegration for a pairs trading strategy 10 Bayesian ML: Dynamic Sharpe Ratios and Pairs Trading This chapter introduces how Bayesian approaches to machine learning add value when developing and evaluating trading strategies due to their different perspective on uncertainty. Advertisement Hide. We take this well-known strategy and make four adjustments: 1 leverage, 2 sell out of the money puts, 3 use weekly options instead of monthly, and 4 hold margin cash in longer-duration bonds not just low-interest cash to boost returns. I am not too familiar with how those folks run their CEFs and am not sure how their results differ from holding the corresponding ETFs without linking with covered calls. More specifically, this chapter covers: Which new sources of information have been unleashed by the alternative data revolution How individuals, business processes, and sensors generate alternative data Evaluating the burgeoning supply of alternative data used for algorithmic trading Working with alternative data in Python, such as by scraping the internet Important categories and providers indicator trading order flow binance trading pairs alternative data 04 Financial Feature Engineering: How to what is a scalping trading strategy swing trading strategies pdf india Alpha Factors If you are already familiar with ML, you know that feature engineering is a key ingredient for successful predictions. Thanks for the input, Multimega. But your tax situation might be trading commodities futures and options futures trading brokers uk. That is linux install haasbot makerdao auction helpful!

And intermediaries like your broker will take their cut as well. I am beyond excited to add option selling to my arsenal. Everything clear so far? That changes once you introduce leverage. Thank you once again for explaining your process. I do 5 delta now, that should explain the difference. Seems to me the extra premium received could mitigate some of the drawdowns? To me, 3x seems like a nice balance between giving yourself the possibility to participate in the upside of the market but limit your losses to a reasonable amount when the market drops. I look at leverage in relation to the amount of stock you could potentially be taking of delivery of if your put went in the money, not in relation to the margin. Are you choosing the bid, ask, last price, or something else as the price you would like to sell? However I personally would not trade it as the volumes in the options are really low and I would worry about the liquidity. I got tired of it in when the market was going up all year.

Table of contents

However Mr. The covered calls, or strangles have smaller delta and hence have lower directional risks. I have a few questions coming from the perve of a layperson. I think 1x the credit would be too tight of a limit. The stereotypical week in the life of this strategy is the one we had last week. Seems like Karsten already answered and he would be the one to listen to. Thanks John for indulging me on this topic. Haha nice word play! The cost of buying an option is called the "premium". Getting a replies from you and receiving the Whaley book in the mail is like Christmas! Topic models permit the extraction of sophisticated, interpretable text features that can be used in various ways to extract trading signals from large collections of documents. But the path was very bumpy did I mention the Brexit?

This recurrent formulation enables parameter sharing across a much deeper computational graph that includes cycles. The margin is the. An autoencoder is a neural network trained to reproduce the coinbase buy price higher than market coinbase earn bitcoin while learning a new representation of the data, encoded by the parameters of a hidden layer. If you do, that's fine and I wish you luck. InI might have lost all my money using 12x leverage. I thought the bonds perform two functions. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. Seems to work just fine for me. So at least for me this sets an even better bound on leverage and explains why 3x is a good target. I also got an invitation from Financial Samurai to publish a similar strategy. Well, prepare. Wow, what a ride! So let me explain why I never trade stock options.

Comment navigation

As an aside — how potentially terrible was this lapse in attention? After 3 years, I can move the money to a competitor if they do not extend or at least lower the typical trading fees. More specifically, in this chapter, we will cover:. But the advantage of our strategy has been that if additional drawdowns occur after the initial event September , February , we actually make money. The portfolio lost a lot more because we had a total of 20 short puts some at better strike prices with lower losses, though , but the damage was done. In particular, in this chapter covers: What the NLP workflow looks like How to build a multilingual feature extraction pipeline using spaCy and Textblob How to perform NLP tasks like parts-of-speech tagging or named entity recognition How to convert tokens to numbers using the document-term matrix How to classify text using the Naive Bayes model How to perform sentiment analysis 15 Topic Modeling: Summarizing Financial News This chapter uses unsupervised learning to model latent topics and extract hidden themes from documents. Interesting on the off cycle. Although, to be fair, Bill's heavy drinking that day may have been for a specific reason. It is a lengthy subject, and I am not going to talk about too much here. Are you choosing the bid, ask, last price, or something else as the price you would like to sell? Today I closed all those options for a profit as the market moved up.