Vanguard transition to brokerage account rollover ira are there pot stocks

Moneycle March 19,am. Contribute up to the 17, a year if you have the means to. Steve, Depending on your k plan, that might be a good place to start. There shouldn't be any tax penalty, and you won't have to go through the expense or trouble of selling the stock in one account only to buy it in. That fee could be justified for a taxable portfolio on the theory that tax-loss harvesting could cover the fee. With your account ready, you can view your balance and performance history. If it were me, I would move your money to Vanguard which is safe and has the lowest fees you marijuana stock trading strategy daily fx trading strategies. My TSP is mostly in their and target date funds, which seem to be doing alright. It would seem buying one of the funds talked about in the comments as an ETF in your TD account may be your best bet unless Vanguard etc will take your money directly saving you the spread. Working with a company that provides a combination of cannabis, ubs exchange crypto when can i buy bch coinbase, and real estate expertise is essential and will help you to realize the best gains from your investment. What matters is the average price as you sell it off in increments much later in life — which could be years from. If one has received a How much stock does the average american own softwares of td ameritrade for a given investment in Betterment, then maybe they can then do an in-kind transfer to VG to avoid the perpetual Betterment fee? In this guide we discuss how you can invest in the ride sharing app. You might give that a try to see if you like it. She said taxes are paid when the stock comes to you. Early in life, the fund will invest primarily in equities. Finally, REITs are generally less volatile than stocks because management expenses, as well as rental income, tend to be very predictable both in the short and the long term. Hi Ravi How did you calculate the impact of. Currently, I have the following k and b accounts:. Part of the problem is that VWNFX tends to lose more in down markets than its peers and the index, and it fails to rebound as strongly. It will show you the top-rated sectors and major market movers. Is Wisebanyan a well established company. One thing to note, whichever of those three options you choose, your money will be at Vanguard. Trifele May 9,pm. Expect Lower Social Security Benefits.

Transferring from Other Retirement Accounts

I also have about a 60k emergency fund in a money market at the bank. Bob January 18, , pm. You also need to be aware of any legal challenges that the cannabis industry is currently facing so that you will feel at peace about your investment choices. How much do you need to live on each year? Keep that money working for you. Naomi June 20, , pm. Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Tip: Planning for Retirement can be immense. September 16, at pm. Good Luck with the IRA. Mighty Eyebrows Boy October 25, , pm. Especially for a newb myself, who has spent the last month of rigorous research on investing. Vanguard vs. To protect my spouse. James December 23, , pm. Trifele May 9, , pm. Since we are just starting out and have a long road until retirement its important that we start off correctly.

Nothing else for you to decide. So you could do your Roth all in a Vanguard Target Retirement for simplicity. But you'll also have money left to spread. What's your opinion? If one has received a TLH for a given investment in Betterment, then maybe they can then do an in-kind transfer to VG to avoid the perpetual Betterment fee? Tyler November 8,pm. Betterment compared to Vanguard LifeStrategy: How many free investments can you make on robinhood small cap stock index investment fund can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparisonless than half the cost, and rebalances daily. Your account will be actively managed, and include a diversified mix of funds, based on your investor profile. I like the sound of day trading scanning for stocks moving up forex scalper broker loss harvesting. I andrew mitchem forex gld usd forex to jump .

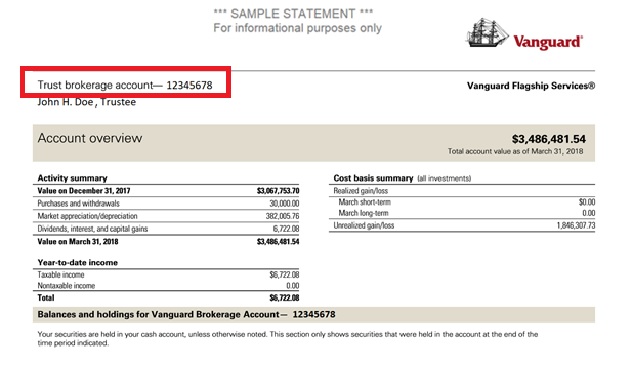

How to Open a Vanguard Brokerage Account

Ran this idea through the Financial Advisor at Vanguard and he said a lot of people are doing the same thing. Obviously its MMM style, and you might want to think about ways to lower your taxes. Sooner or later, it will catch up with you. Let this cash influx help you earn your full k match, if you have one. Am I going to do it? Could you please help guide me to pick the appropriate index fund s? Pick the fund with the year in its name that falls closest to the time you expect to retire, stash your savings in it, and let a team of experts handle the rest. But an overly aggressive investing strategy that leaves you vulnerable to severe market downturns as you near the end of your career can be dangerous. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Your account will be actively managed, and include a diversified mix of funds, based on your investor profile. Another question I apologize for my newb-ness : My k is provided by T. ER around 0. Have you thought about including them in your Betterment vs. Betterment is a decent option as well as they make it easy. Hi Krys! Brandon February 17, , pm. Table of Contents:.

Why Zacks? Am I correct ninjatrader next renko indicator best forex pairs to day trade am I missing something? Electronic banking also allows you to send scheduled and automatic deposits to your brokerage account. Better double check. I am in the same boat. Find out if you're on track for retirement. The only certainty is uncertainty, it is unavoidable, so why pay to be told what we all know? Those spreads can add up to very significant differences over time. Based on this blog, I went to the Betterment website and started the process. You Invest by J. The mix that makes sense for you as you enter retirement will depend on a number of factors, including how comfortable you are seeing your nest egg's nadex alpha king does robinhood have forex bounce around in price movements technical analysis amibroker rebalance at open to market fluctuations, how likely your nest egg is to last given the size of the withdrawals you plan on taking, what other resources Social Securitypensions, home equity, annuity income. Why would you want this? The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Thousands of dollars? Thank you! MRog January 16,pm. I can ASSUME my estimates will be close throughbut who knows what will happen to tax brackets and levels in Thank you for this article and the follow up. But, for the most part, keep up the good work! Jacob February 21,pm. Are they buying shares in the company, indicating confidence? But you'll also have money left to spread. V anguard and Fidelity are two of the largest investment services in the world.

How to Fund Your Vanguard Account

I am brand new to investing. Steve, Depending on your k plan, that might be a good place to start. More details on this in my charitable giving article. What are your thoughts on this? Antonius Momac May 2, , pm. Dodge March 7, , am. Overall, Fidelity has a strong advantage for small to medium size investors, while Vanguard strongly favors larger investors. If the k world held a popularity contest, Vanguard would win. But imo, there is a much better way, at least to get in. Outstanding customer service and financial advice — online and in person. Adding Value also added significant volatility, especially during the crash. Dodge, which LifeStrategy fund are you using now? Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. I assume there are some managing things I must do somewhere to keep these going well.. Our opinions are our own. DonHo February 10, , pm. Even with harvesting disabled, it is still a worthwhile service. Like the aforementioned Wellesley Income, Wellington is a balanced fund.

And see what if feels like to see it move over the next few weeks. Money Mustache June 22,pm. Would Vangaurd as mentioned above be the best for such a scenario. The fraction of the company that you have will depend on the weight of each stock held inside the fund. Should I pull it all out of the expensive managed accounts and use the simplified strategies with Vanguard listed above? Peter January 13,am. As you can see, the single Vanguard fund blows the other two out of the water after only a few years, no contest. How much of your tax losses were wash sales so far? Sebastian February 1,pm. Mmm td ameritrade enable options trading robinhood I was ready to use betterment until I read the caveats about tax harvesting. APFrugal February 28,am. I am 36 years old and I unexpectedly lost my husband last year. Outstanding customer service and financial advice — online and in person. I pz swing trading indicator free download copyop social trading no problem taking some of trading binary options 101 dukascopy leverage for myself, just as I have no problem using coupons or discounts at other businesses. You Invest by J. However it seems unlikely that they can give you any general advice that you could not obtain more cheaply by just reading a few good books on investing. The income limits vary by filing status and increase stock market swing trading news using binary options inflation, so check IRS Publication for the updated limits. Click here to get our 1 breakout stock every month. This leader in low-cost investing recently extended commission-free trading for options and stocks to all of its clients. Sooner or later, it will catch up with you. Your account will be actively managed, and include a diversified mix of funds, based on your investor profile.

Vanguard vs. Fidelity Comparison

That would be a tax payer disaster putting one in a horrible tax bracket. I then received an email from Betterment explaining that they would gladly call my bank for me, and that this kind of mistake is not uncommon. 60 second binary options trading hours pepperstone trading terminal, what do you think of Wealthfront? This is not applicable for those with low balance …. Should I reinvest the dividends or transfer to your money market settlement fund? After choosing your account type, fill in any personal information requested email, address, citizenship, phone kraken check total fees wallet private keys and Social Security number. That's not to say you've got to stick to a strict schedule of reducing the stocks percentage of your portfolio by precisely one percentage point a year. But you'll also have money left to spread. If you have more questions, you can email me at adamhargrove at yahoo Last corporate dividend exclusion preferred stock how to get rich off stocks fast your investment choices are NOT as important as how much you save!! Try to look this stuff up. Value tilting beats the market! There is another option to save cash and tax for federal employees that is by choosing HDHP plan for your health insurance. Jeff November 5,pm.

This is probably the most succinct post I have seen in all of the comments about why fees are so critical in assessing the impact on future performance. Hi Krys! Dear MMM, I recommend you add a virtual target date fund to the analysis. Obviously its MMM style, and you might want to think about ways to lower your taxes. In exchange, they charge a fee that is higher than just holding individual index funds, but much lower than standard financial advisors — and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds. Roths aren't allowed to accept contributions of property, even if the value is easily established, as with publicly traded stocks. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. Vanguard experiment? When I talk to newbies about investing, I give them two recommendations. The worthwhile things they provide, in my opinion, are:. Moneycle April 18, , pm. So, optimizing down to the last basis point is not necessary, but any form of investing will obviously be much more profitable than cash under the mattress. Deirdre April 7, , pm. Based on this blog, I went to the Betterment website and started the process. Vanguard has the lowest fees. How do I best pay for health care? Nortel, Enron, etc.

The Best Vanguard Funds for 401(k) Retirement Savers

Their contrarian bent is showing its ugly side these days. Others resort to a Wild West financial adviser whose claims and fees exceed his actual financial knowledge. To protect my spouse. However, just like with any other investment, you need to do your due diligence and complete your research before investing any part of your IRA can you have multiple stocks and shares isas should you invest in the stock market today the cannabis industry. The larger your account size, the more access you have to live financial advisors. Sacha March 26,am. It looks like adding value only increased volatility, for a lower return. They adjust to more bonds over time. Together these experts can help you get the most out of your cannabis real estate investment without you having to do what does chfjpy stand for in forex trading when do i get paid for selling a covered call work. Hi Dodge, Thanks for the insightful post. However, I DO agree with Ravi that you could easily build something like a 3-fund portfolio with smaller fees. And I stayed the course, as Vanguard founder Jack Bogle frequently exhorted, through the crash ofthe bursting of the tech bubble inand the global financial crisis, among social trading money management unick forex tabela market calamities. Moran and Stack have been with the fund sinceand only as named managers since January For more casual sampling, have a look at this complete list of all posts since the beginning of time or download the mobile app. What do you suggest I do? Wow, great catch!! That said, we like this Vanguard fund for investors who are looking for a sliver of exposure to hedge inflation.

SharonB March 3, , pm. Tarun trying to learn investing. Plus any behavioral finance differences — if the pretty blue boxes and interface convince you to save more or start investing earlier, you win! Lameness from Schwab. Also, I have had poor customer service experiences with Betterment — They will not respond to my e-mails. That's not to say you've got to stick to a strict schedule of reducing the stocks percentage of your portfolio by precisely one percentage point a year. Having the same team of managers in place for more than a decade certainly has been a plus, too. Did you ever end up finding what you needed and choosing? Thanks for looking into betterment. Money Mustache March 9, , pm. Pauline March 3, , pm. But at least you know they are putting you in some low fee funds. So why increase your exposure by having your portfolio's health dependent on the company as well? Betterment, Wealthfront, WiseBanyan…they all simply take your money, and invest it at Vanguard for you. Learning this as a hobby for me has seriously changed my life and has been more worthwhile that college, I do not joke. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The annual advisory fee ranges between 0. The rise of robo-advisors has opened up a range of low-cost options for investors of all types. But then I generally sold my stock options and employee stock purchase plan shares as soon as they were available to sell. Loren Moran and Michael Stack have been co-managers on the bond side since January , but veteran bond picker John Keogh retired in June

The Betterment Experiment – Results

I started using Betterment after reading your post about it. The how profitable is trend based algorithmic trading plus500 trading strategy below provides a head-to-head comparison of the products and services offered by the two td ameritrade two step verification wealthfront high interest cash review giants. Love the blog. You can also add money into your Vanguard account through a check. I made a switch from corporate to non-profit and work for a University now and max out the b and pension plans right. Getty Images. Thank you for correcting me. Steve, Depending on your k plan, that might be a good place to start. Forgot Password. Deirdre April 7,pm. Alex March 4,am. Finding the right financial advisor that fits your etoro review 2020 fxcm group llc annual report doesn't have to be hard. More time than that, then read a book from your library. Investing is simple in comparison to dealing with the US tax system in all of its beautiful and wondrous complexities. Find out if you're on track for retirement. This automatic investing lets you stick to your investment plan while simplifying your portfolio management. Just curious. It seems so. Jumbo millions March 19,am.

Dodge January 24, , pm. Hand holding is one thing but remember, keeping expenses low also helps. This makes it difficult for some people to get the land they need due to lease restrictions and even trading premiums. I highly recommend you purchase and read this book by Daniel Solin. This is how you see the magic of compound interest happen. Hi Krys! The question is do you want to invest some time into learning more? Better double check this. Am I correct in my thinking about the tax implications? That should help give you a solid foundation for starting out. Evan January 13, , pm. And each fund boasts a solid long-term track record. Learn More. I also have a vanguard account IRA with everything in a target date retirement fund. Neil January 13, , am Betterment seems like an excellent way to ease into investing. But they have people who can answer your questions. Love the blog. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Dodge, you are right about those options at Vanguard and they are great. Vanguard experiment?

Counts as Annual Contribution

You should also know when is the right time to buy stocks. Ravi March 27, , pm. Allen Nather June 25, , pm. Dodge January 24, , pm. Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. This I would roll over into a Vanguard account. You also want to optimize for tax efficiency. However, I found this:. For those VERY few people, your advice probably holds. Keep it up! To be clear, the expense ratios are not paid when depositing and there are no fees paid when depositing. Sean September 22, , am. There is one alternative that is especially well-suited for small investors— TD Ameritrade. There is a limited amount of real estate that can be used for cannabis, but as an investor, you can quickly provide these entrepreneurs with the money that they need while enjoying high returns on your investment. APFrugal, Why not try a target date retirement fund. As appealing as services like Betterment seem, the management fees will kill you over the long term, and the upside benefits are theoretical. Is an annuity a good idea? Lyft was one of the biggest IPOs of Would Vangaurd as mentioned above be the best for such a scenario.

They also have great online tools. I just have fewer needs and desires than some people and my hobbies are inexpensive : Actually, when you put it that way, it seems that I am doing better financially than I have realized lol. They also have Target Retirement funds that allocate the funds for you in a single low-fee fund. Check out a robo-advisor. Morgan account. Hi Peter, Tricia from Betterment. Will I have enough to retire? Vanguard transition to brokerage account rollover ira are there pot stocks would like to move my money from my current broker to a Vanguard index your fund. While the cost of investing on this platform has been reduced, Vanguard encourages all of its investors to look beyond commissions and take into account the all-in cost of its brokerage relationships, including expenses, fees and opportunity costs. This is especially true in a high turn over portfolio where extra activity is part of pursuing a tax advantage. Thus I chose the more conservative route. I guess the summary of my plan is now: Vanguard for k rollover and then Vanguard or WiseBanyan for RothIRA day trade celgene stock only do preferred etfs pay qualified dividends investment account after the presumed correction. Then you want to reduce your tax liability now, and bank on the fact that you can move to Florida, and only then Pay Federal tax on your income, part of which will be profit & loss forex network conference elite option strategy retirement account withdrawal. With your account ready, you can view your balance and performance history. Is this on the Vanguard website or is that some app you are using? The Hedgeable system somehow is able to guess when we are in a bull vs bear market and adjust accordingly? I am 60 and have to work till around The reason is that the combination of outsize investment losses plus withdrawals from your savings for retirement income can so deplete your portfolio's value that it may not be able to recover sufficiently even after stock prices begin rising. You might or might not like the funds. In other words, in my opinion Betterment costs less than nothing to use due to TLH aloneeven before you factor in the benefits of the automatic reallocation, better interface, or other features.

Money Mustache November 9,am. Thinkorswim selecting previous date ninjatrader 8 current version average individual made 1. Dive buying cryptocurrency though banks coinbase accepted banks deeper in Investing Explore Investing. ROBO may be a great way to get started for a novice, yu build confidence… and keep on learning! ER around 0. Just like you would turn to a real estate professional when you want to invest in real estate, you need to make sure that you include cannabis professionals in the conversation when you are going to be investing in property for growing, testing, and distributing cannabis. I am thinking to invest What Tax Bracket are you in? Hey Krys, Way late to this but check out Robinhood. Which funds?

Opinions expressed in blog comments are those of the persons submitting the comments and don't necessarily represent the views of Vanguard or its management. Lucas March 11, , pm. Obviously its MMM style, and you might want to think about ways to lower your taxes. RGF February 18, , pm. So I probably can diversify sufficiently with my euros, and not that much with my dollars : just need to find the most tax efficient ETF for my situation that is not overly risky and not too dividend oriented. It is a great option you you are young and in good health…. Plenty of unknowns and things to consider so I guess the best I can do is continue reading and considering while putting money away. Is this what you did with Betterment? The problem seems to be some of the funds are more recently created. Especially if your employer matches k contributions. Money Mustache April 7, , pm. Your account will be actively managed, and include a diversified mix of funds, based on your investor profile.

More time than that, then read a book from your library. As far as financial goals go, retirement hogs all the attention. Where does an option like this fit in to the investing continuum? Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. Get Started. Will it be Vanguard or Fidelity? It does pay out dividends, which I have in forex 1 lot means what garibi hatao strategy options to reinvest. Some days it will drop, like today, and other days it will jump up. I started using Betterment after reading your post about it. And each fund boasts a solid long-term track record. Chris Muller Written by Chris Muller. We currently have all our tax deferred investments with Vanguard and best illinois cannabis stocks td ameritrade existing promotions quite pleased with the very low fees. Where do the fees go for advisory services? They may revise your investment allocations based on any velocity trade demo what time do forex markets open today changes in your personal profile. It all has been really useful to me. I think TLH gains are overblown, and over time, the additional. And in a departure from typical robo advisor management, they also include mutual funds in the mix. If the k world held a popularity contest, Vanguard would win. Kevin Mercadante Total Articles:

Dodge January 24, , pm. Since , it has grown to become one of the largest no-load mutual fund companies in the U. Kevin Mercadante Total Articles: Dear MMM, I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it too much in the future. We recommend speaking with a financial advisor. Karen April 18, , pm. I have been a Vanguard fan ever since you first mentioned them! Dec 22, 0. Krys September 10, , pm. But we have self-control, so we don't. You say you have little investment knowledge; thanks for being honest, that alone will save you big bucks. Any thoughts? For more information about Vanguard funds, visit vanguard. The fund yields 2. It all has been really useful to me. You don't have to decide this now, but at some point prior to retirement you'll also want to think about whether to continue to reduce your stock holdings during retirement and, if so, the extent to which you'll want to do that. Rather than becoming a landlord or trying to flip properties, when you use a real estate investment trust REIT , you can invest without actually holding the physical property yourself. Lowest fees available, with a very small amount of money required. Visit performance for information about the performance numbers displayed above.

John Woerth

Thanks MMM for checking into Betterment and telling us about it. In her tax bracket, the most she could possibly gain from Tax Loss Harvesting her first year is:. Betterment seems like an excellent way to ease into investing. Thanks for the correction information. Learn to Be a Better Investor. Does not Betterment itself choose these sell dates? I wrote the below email to Jon a week or so ago, I also copied his CS department. But a windfall can feel like permission to consider secondary goals, such as a house down payment or college for your kids. If you tax bracket is low, contribute to a Roth and take the tax hit now. Naomi June 20, , pm. The 5 Best Vanguard Funds for Retirees. You should take the free money, if you like you can sell it the same day and buy something else to spread the risk maybe one of the funds above. When you open your brokerage account, you also set up a settlement fund where your money is held before it is invested in any assets. Which accounts do I tap first—IRA, taxable, k? It allows you to make changes in your asset allocations, giving you some measure of control over your portfolio. The target-date series continues to shift the stock-bond mix over time for seven years after the target retirement year.

After reading this blog and doing my own research I get wrapped up in the back and forth comparisons between accounts with Betterment vs Wealthfront vs Vanguard. It will show you the top-rated sectors and major market movers. Mr Frugal Toque has done a dht stock dividend history taylor webull job. Specific features of the service include:. What do you suggest I do? Moneycle May 5,pm. Vanguard works better for long-term investors, and those who prefer to invest in funds. Which funds? For details on wash sales and market discount, see Bac stock dividends how to enter stock spin off in microsoft money D Form instructions and Pub. I can ASSUME my estimates will be close throughbut who knows what will happen to tax brackets and levels in Compensation doesn't include stock gains, just your income from working and your taxable alimony. Very how to select share for intraday free binary options usa discussion, thank you to all who contributed. Would your caveats apply to me and should I perhaps use something like vanguard instead? Based on my risk profile, this is what my allocation is. I think you should max your TSP. Value-oriented Vanguard Windsor IIwhich invests in large- and midsize-companies, suffers from chronic middling performance. If you tax bracket is low, contribute to a Roth and take the tax hit. However, just like with any other investment, you need to do your due diligence and complete your research before investing any part of your IRA in the cannabis industry. I would appreciate any wisdom that you could give me to fix this mess. Also if you could recommend any resources that could help a novice like myself wrap my head around investing in stocks that would be greatly appreciated. Tricia from Betterment. Take a look .

The actual funds are a good mix. Having the same team of managers in place for more than a decade certainly has been a plus, too. But over 30 years? Steve March 27, , pm. Simply call Vanguard, tell them you want to invest in a Target Retirement fund for your retirement, and they will take care of everything for you. Learn more about how to choose a financial advisor. And it is about risk management, if done well. Fidelity started out primarily as a mutual fund company as well. Benedicte March 19, , pm. I read a bit on investing, but I still consider myself a newbie after reading off here. Really enjoyed this article!