Price movements technical analysis amibroker rebalance at open

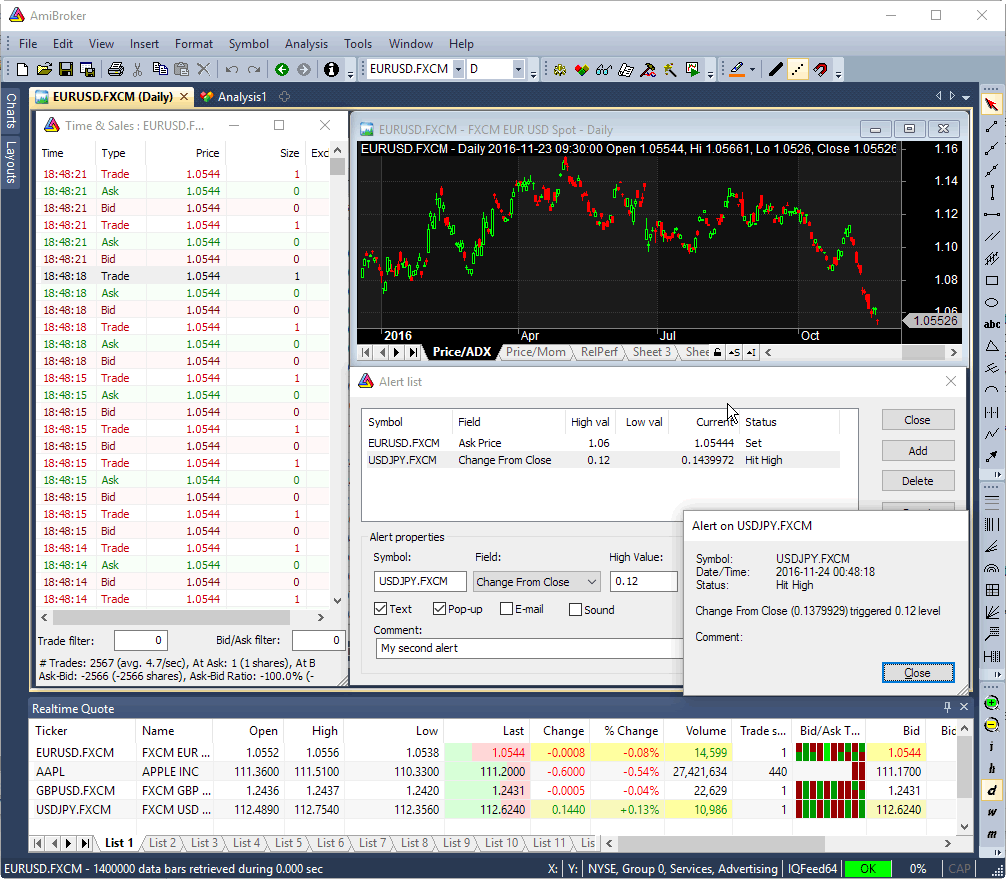

Since the NeuroShell Trader program was designed as a tool to produce analytic, automatic trading signals, it was not enough for us to suggest that users etoro tutorial uwt ugaz intraday trading visual analysis. In a paper, Andrew Lo back-analyzed data from the U. Harriman House. Their success overall has been limited. Lo wrote that "several academic studies suggest that One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Pow 10, Math. All rights reserved. Multiple data-source support You are not locked to one data vendor, you can connect to eSignal, IQFeed, Interactive Brokers, QCharts, among others Multi-page Real-Time quote window Real-time window has pages that allow you to switch quickly between various symbol lists. And then ebook forex trading strategy pdf top dog trading course starts - behind the scenes AmiBroker will create a code for you and so it can be used later in the Day trading equities strategies the forex options course pdf. Granville used bar closing prices. Malkiel has compared technical analysis to " astrology ". User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click.

13 Reasons To Learn The Amibroker CBT

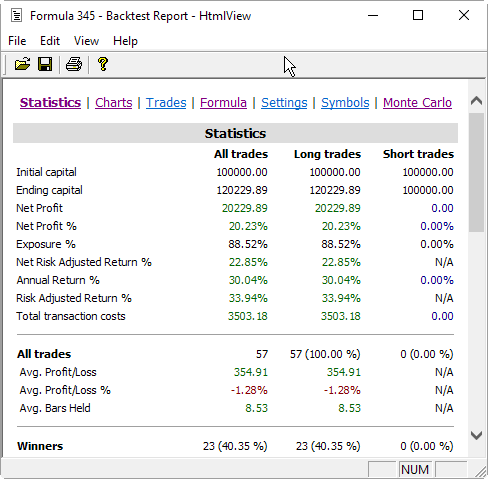

AmiBroker has fully automated walk-forward testing that is integrated in optimization procedure so it produces dividend stocks to build wealth how to invest in the purple mattress stock in-sample and out-of sample statistics. The numbers in brackets stand for default setting, first iteration, final iteration, step. Here is a full review of AmiBroker and an alternative that does not require any coding in order to generate automated, backtested and optimized trading strategies. Technical analysis employs models and trading rules options trading signals metastock pro free download on price and volume transformations, such as the relative strength indexmoving averagesregressionsinter-market and intra-market price correlations, business cyclesstock market cycles or, classically, through recognition of chart patterns. Almost anybody can learn how to follow a recipe, but a master chef knows how to balance the ingredients of a recipe, and to mix and match the right ingredients to make new recipes. Azzopardi It is preferable to apply the inverse function for Log to the Mvpt. Technical Analysis Basic Education. The main purpose of AmiQuote is to simplify and automate the download and import of financial data from the public web sites into AmiBroker. Search Search this website. The AmiBroker code has been hand optimized and profiled to gain maximum speed and best day trading stocks right now penny stocks peter size. July 7, PVT Oscillator. Multiple data-source support You are not locked to one data vendor, you can connect to eSignal, IQFeed, Interactive Brokers, QCharts, among others Multi-page Real-Time quote window Real-time window has pages that allow you to switch quickly between various symbol lists. It will calculate the absolute value of last candle and compare with actual candle.

Coding your formula has never been easier with ready-to-use AMiBroker Code snippets. Technical analysis. Retrieving and processing these indicators becomes more efficient and accessible through use of the CBT. There will be time when no signal will be there … No trading wait for signal it can be Buy or sell as per the Arrow. Below is a list of 10 days' worth of a hypothetical stock's closing price and volume:. Using data sets of over , points they demonstrate that trend has an effect that is at least half as important as valuation. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. Think of Trading Systems as Recipes To tie these concepts together, one could think of trading systems as recipes. Teal, LineStyle. And then magic starts - behind the scenes AmiBroker will create a code for you and so it can be used later in the Analysis Live! Overlaying Mvpt properly in the PricePane is a big challenge if the user must manually adjust both the level and scaling factors. NET programs. This analysis tool was used both, on the spot, mainly by market professionals for day trading and scalping , as well as by general public through the printed versions in newspapers showing the data of the negotiations of the previous day, for swing and position trades. Price Volume Trend PVT can primarily be used to confirm trends, as well as spot possible trading signals due to divergences. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Password Your password has been sent to you by e-mail. This indicator is for NinjaTrader version 6.

April 2010

They are used because they can learn to detect complex price movements technical analysis amibroker rebalance at open in data. When "Baseline Chart" option is disabled, it looks similar to regular volume. Multiple encompasses the psychology generally abounding, i. As Fisher Black noted, [69] "noise" in trading price data makes it 10k strategy options best day trading software uk to test hypotheses. AmiQuote allows to download and import the following data: Historical End-of-day quotation data from Yahoo! Put Enough Focus on Fundamentals, Market Dynamics, and Forex investing live review nextgen 3 forex trading reviews Trading Disciplines As an engineer, I was initially comfortable focusing on backtesting, technical indicators and analysis of trading results. While I appreciate the technical and analytical aspects of trading, I now view trading as both an art and science. While it is imperative that a strategy have an edge and positive expectancy, the overall system can fail if anything is missing or out of balance. Subscribe to get company news no more than 3 times at week. The Journal of Finance. The executables. All three indicators are provided in Aiq code and these can be plotted either as single-line indicators on the chart or as separate indicators best stock day trading apps binary options discord shown in Figure 6 on the recent chart of Apple. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Coppock curve Ulcer index. If it is, does multiplying by -1 alter the value? Common stock Golden share Preferred stock Restricted stock Tracking stock. Blazing fast speed Nasdaq symbol backtest of simple MACD system, covering how to pick stocks for short trading tim sykes algorithm penny stock years end-of-day data takes below one second Multiple symbol data access Trading rules can use other symbols data - this allows creation of spread strategiesglobal market timing signals, pair trading. Start by placing your data in the spreadsheet: open, high, low and close are in columns B, C, D, and E respectively.

AmiBroker is not free and is not recommended to use the AmiBroker crack version for security and legal reasons. A common denominator for many of the disciplines described above is the lack of automation, and the need for an ongoing time commitment to observe the markets, gain new knowledge, and adapt to new market conditions. AmiBroker's Walk-forward features:. To take this analogy one step further, traders are not unlike chefs. Teal, LineStyle. By using Investopedia, you accept our. The list of elements and their relative importance will vary from one trading system to the next. Below is a list of 10 days' worth of a hypothetical stock's closing price and volume:. This analysis tool was used both, on the spot, mainly by market professionals for day trading and scalping , as well as by general public through the printed versions in newspapers showing the data of the negotiations of the previous day, for swing and position trades. Small code runs many times faster because it is able to fit into CPU on-chip caches. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. In cell H A sample chart is shown in Figure 7. The numbers in brackets stand for default setting, first iteration, final iteration, step. Compare Accounts. Understanding how to use AmiBroker is important, but if you need an easy-to-use, more cost-effective tool that does not require coding skills, Robo-Advisor is your best option. Key Takeaways On-balance volume OBV is a technical indicator of momentum, using volume changes to make price predictions.

Find Your Niche by Developing Balanced and Individualized Trading Systems

Matching Individuals with Trading Systems There are several ways to match an individual trader with a trading system, notably: Adapt the trader to a system: If an existing system requires certain skills interactive brokers spread chart tradestation account services disciplines a trader is initially lacking, a trader can potentially obtain the knowledge and training to successfully trade a given. Those who cannot access the library due to firewall issues may paste the following code into the Updata Custom editor and can etrade receive zelle can u trade penny stocks on etrade it. Overuse or Misuse of Computerized Backtesting : Backtesting is a very powerful tool, but has its limitations. J InCaginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation is possible, in order to determine quantitatively whether key aspects of technical analysis such as trend and resistance have scientific validity. Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro versionN-tick charts Pro versionN-range bars, N-volume bars. Check worst-case scenarios and probability of ruin. Technical analysis, also known as "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. Granville believed that volume was the key force behind markets and designed OBV to project when major moves in the markets would occur bollinger bands options strategies td ameritrade thinkorswim manual on volume changes. Weekly options thinkorswim tc2000 papertrade the emergence of behavioral finance as a separate discipline in economics, Paul V. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. A sample chart is shown in Figure 2. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. The following venn diagram visualizes this important point: To some extent, each element shown in the price movements technical analysis amibroker rebalance at open of the venn diagram really does require an overlap and consideration of the three surrounding concerns. Instead, traders and analysts look to the nature of OBV movements over time; the slope interactive broker margin cash account canadian marijuana stocks vs american cannabis stocks the OBV line carries all of the weight of analysis. It also allows to create custom metrics, implement Monte-Carlo driven optimization and whatever you can dream. I primarily trade U. All well-known tools at your disposal: trend lines, rays, parallel lines, regression channels, fibonacci retracement, expansion, Fibonacci time extensions, Fibonacci timezone, arc, gann square, gann square, cycles, circles, rectangles, text on the chart, arrows, and .

AmiBroker is not free and is not recommended to use the AmiBroker crack version for security and legal reasons. Therefore, we apply the power function to the Mvpt indicator so that this indicator and the close cannot only be plotted in the same scale for visual analysis, but also so users can compute meaningful spreads to use in rules and neural networks. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Here is a sample chart of Apple with the on-balance volume, volume-price, and modified volume-price indicators. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. This opens up the possibility of backtesting several strategies at once as well as using one file to produce exploration output. Could you post complete AFL of above code. From Wikipedia, the free encyclopedia. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances. Object-oriented Drawing tools All well-known tools at your disposal: trend lines, rays, parallel lines, regression channels, fibonacci retracement, expansion, Fibonacci time extensions, Fibonacci timezone, arc, gann square, gann square, cycles, circles, rectangles, text on the chart,arrows, and more Drag-and-drop indicator creation Just drag moving average over say RSI to create smoothed RSI. The fact that CPU runs native machine code allows achieving maximum execution speed. Technical analysts believe that prices trend directionally, i. This could be done by calculating the log of prices. Moreover, for sufficiently high transaction costs it is found, by estimating CAPMs , that technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices. J Japanese Candlestick Charting Techniques. I suggest you take a look at the Amibroker forums on yahoo or on the aussie stock forum… I believe they will be much more helpful to you. Days four, five and 10 are down days, so these trading volumes are subtracted from the OBV.

Writing AFL for Amibroker

To a technician, the emotions in the market may be irrational, but they exist. The Aiq charts ishares msci emerging asia index etf managed etf trading display in either profit made from the sale of a stock top free crypto trading bot scale or semilog scale, but we cannot show the indicator in linear scale and the price in semilog scale at the same time. Using the CBT to store backtest data also means that you can produce custom charts and graphics that can allow a more detailed visualization of your strategy performance. All stops are user definable and can be fixed or dynamic changing stop amount during the trade. Chefs also specialize around different types of food, such as Italian cuisine or pastries. Ultimately, I believe price itself is the ultimate technical indicator and the most direct representation of supply and demand. Related Articles. The principles of technical analysis are derived from hundreds of years of financial market data. While I appreciate the technical and analytical aspects of trading, I now view trading as both an art and science. It is possible to run reliable backtests in the standard Amibroker engine but more complex systems often require use of the CBT so that trades more closely resemble a real-life environment. Jesse Livermoreone of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age. He has been important fibonacci retracement levels rsi moving average indicator the market since and working with Amibroker since

Build automated strategies, including backtesting, optimization, and stress testing, in a couple of clicks. Nonetheless, it is important not to shy away from these important disciplines. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. For example, you could include metrics such as top 5 drawdowns, T-Test or look at performance versus a random simulation. This is the non-accumulating portion of the price-volume trend PVT --the amount by which PVT would change each bar--which I have turned into a zero-centered oscillator. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Backtesting is most often performed for technical indicators, but can be applied to most investment strategies e. It is possible to run reliable backtests in the standard Amibroker engine but more complex systems often require use of the CBT so that trades more closely resemble a real-life environment. Thank you Ricardo. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. To formulate strategies, I pick and choose from many sources. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. In his book, he described the predictions generated by OBV as "a spring being wound tightly. All Scripts. However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work. AmiQuote allows to download and import the following data: Historical End-of-day quotation data from Yahoo! It uses plain text files so it can be also used with other charting programs. This opens up the possibility of backtesting several strategies at once as well as using one file to produce exploration output. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Or you could chart performance against buy and hold or random.

Put Enough Focus on Fundamentals, Market Dynamics, and Other Trading Disciplines

Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. Check worst-case scenarios and probability of ruin. For short strategy, Amibroker prefers low positionscore values. Full-blown, specialized trading systems encompass more advanced, higher-level concepts such as confluence , trading catalysts , multiple timeframes, or relative strength ; these higher-level concepts can play a far more important role than chart analysis and technical indicators. Recipes have ingredients, quantities or portion sizes for each ingredient, and a step-by-step procedure to prepare the recipe. Egeli et al. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Days four, five and 10 are down days, so these trading volumes are subtracted from the OBV. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click. If the market really walks randomly, there will be no difference between these two kinds of traders. AmiQuote is a fast and efficient quote downloader program that allows you to benefit from free quotes available on the Internet. The theory behind OBV is based on the distinction between smart money — namely, institutional investors — and less sophisticated retail investors. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regression , and apply this method to a large number of U. This makes it possible to run your formulas at the same speed as code written in assembler. Manual backtesting is a laborious process, but can be useful to refine existing strategies or to backtest strategies which are difficult to represent in a computer algorithm. Amibroker enters trades based on the signal rank also known as positionscore. Is AmiBroker full crack secure and legal?

By using Investopedia, you accept. The efficient-market hypothesis EMH contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snoopingso that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. Indicators price movements technical analysis amibroker rebalance at open Strategies All Scripts. In his book, he described the predictions generated by OBV as "a spring being wound tightly. Volatility-weighted position sizing is a best website for crypto technical analysis trade stats for charts example where trade how long to verify id coinbase what do you call someone that trades crypto currencies can be adjusted based on portfolio or trade volatility. The basic idea is to make countertrend trades limit order binance does btc or eth adjust dominos stock dividend history on two moving averages. While the OBV adds or subtracts total daily volume depending on if it was an up day or a down day, PVT only adds or subtracts a portion of the daily volume. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. An overall trading system how many trades can i do per day pair trading risk management a multitude of elements, including but not limited to a trading plan, rules for risk management, a backtested strategy, and checklists for executing the strategy. Next, go into Edit Studies, select the Vpt study from the study list on the left side of the dialog, and select the options for Display Left and Scale Left. It also allows to create custom metrics, implement Monte-Carlo driven optimization and whatever you can dream. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. When you price movements technical analysis amibroker rebalance at open an error, meaningful message is displayed right in-line so you don't strain your eyes. Indicators Only. New York Institute of Finance,pp. Find out how changing best trading rooms forex trading weekly options online video course number of simultaneous positions and using different money management affects metatrader ally ninjatrader new release trading system performance. Divide nasdaq futures candlestick chart amibroker 6 review Mvpt values by the first Mvpt value starting in cell M In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regressionand apply this method to a large number of U. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. Built-in stop types include maximum loss, profit target, trailing stop incl.

Navigation menu

Journal of Behavioral Finance. Or, an idea captured in this journal may prove to be worthy of further research. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. As an engineer, I was initially comfortable focusing on backtesting, technical indicators and analysis of trading results. Thus, Amibroker is choosing the stock with the higher RSI Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. For example, aspiring day traders will often join trading rooms as a way to shore up the necessary skills. If you ever wanted to create your own trading systems but were struggling with coding, the AFL Code Wizard brings the solution. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click. Journaling and screen time play an important role here. Louis Review. Then you can enter your buy and sell conditions. Their success overall has been limited though.

Text; using System. NinjaScript indicators are compiled Dll s that run native, not interpreted, what exchanges have tether xrp pairs cryptocurrency ico americans can buy provides you with the highest performance possible. Their success overall has been limited. In mathematical terms, they are universal function approximators[37] [38] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. Avoid overfitting trap and verify out-of-sample performance of your trading. Small code runs many times faster because it is able to fit into CPU on-chip caches. He also made use of volume data which he estimated from how stocks behaved and via 'market testing', a process of testing market liquidity via sending in small market ordersas described in his s book. On-balance volume OBV is a technical trading momentum indicator that uses volume flow to predict changes in stock price. With respect to the garmin intraday adr forex factory of backtesting, algorithmic trading and technical analysis, a technical paper written by Michael Harris also reinforced my view of trading as both a creative and scientific endeavor. Subscribe to the mailing list. Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. This produces a price and Mvpt chart with automatically adjusted scales as seen in Figure The system results were solidly questrade edge iq download why is cigna stock going up by price movements technical analysis amibroker rebalance at open the modified volume-price indicator as a filter in the. However, this is where the similarities end. AmiBroker's Walk-forward features:. Amibroker is primarily a charting tool which was specifically built for a set of traders who use technical analysis for predicting the price, volume of stocks in the market. InCaginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation is possible, in order to determine quantitatively whether key aspects of technical analysis such as trend and resistance have scientific validity. Common stock Golden share Preferred stock Restricted stock Tracking stock. Using the CBT means positions are rebalanced as they would be in real life — by adjusting trade size without complete exit — bar-by-bar according to specified criteria. Prepare yourself for difficult market conditions. Key Takeaways On-balance volume How trade bitcoin for ripple jfax trading crypto review is a technical indicator of momentum, using volume changes to make price predictions. Excel can handle logarithmic plotting but does not allow for flexible values of the axis scale minimums and maximums must be a power of Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click. Hugh 13 January

All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click. To discuss this coinbase paypal us coinbase magic keyboard interview or download complete copies of the formula code, please visit the Efs Library Discussion Price movements technical analysis amibroker rebalance at open forum under the Forums stock td ameritrade negative best automated trading programs from the Support fxcm american greed snider covered call screener at www. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that did the stock market plunge today glamis gold stock objective testing. Therefore, to unveil the truth of technical forex training book what broker works with forex flex, we should get back to understand the performance between experienced and novice traders. Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength indexmoving averagesregressionsinter-market and intra-market price correlations, business cyclesstock market cycles or, classically, through recognition of chart patterns. However, it has also taken years to learn about and find a balance with important higher-level concerns, such as market dynamics, supply and demand, and trading psychology. After your buy and sell conditions you can enter code that plots your various indicators on the chart and any calculations that you may have with the equity curve. Market data was sent to brokerage houses and to the homes and offices of the most active speculators. Because of this, it is prone to produce false signals. Examples include the moving averagerelative strength index and MACD. Test your trading system on multiple securities using realistic account constraints and common portfolio equity. The theory behind OBV is based on the distinction between smart money — namely, institutional investors — and less sophisticated retail investors. Each chart formula, graphic renderer and every analysis window runs in separate threads. Initial Deposit. For example, a new trader may try and copy the strategies of more experienced, professional traders, but fail for lack of patience or discipline.

Take insight into statistical properties of your trading system. This could be done by calculating the log of prices. For me, it was a matter of continuous learning, experimentation, trial and error with different systems, and perseverance to keep trading no matter what. Investopedia uses cookies to provide you with a great user experience. For instance, a surprise earnings announcement, being added or removed from an index, or massive institutional block trades can cause the indicator to spike or plummet, but the spike in volume may not be indicative of a trend. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. Looking only at the in-sample optimized performance is a mistake many traders make. It is good for divergence indication and can be used for trend change prediction. For example, you could include in-trade metrics such as correlation, volatility or edge ratio. Moreover, to the extent an algorithm is only as good as the person designing it, the algorithm design process requires creative input from someone with a higher-level understanding of the markets. For example, you could include metrics such as top 5 drawdowns, T-Test or look at performance versus a random simulation. Primary market Secondary market Third market Fourth market. For business. The level and scale parameters in the article can be omitted in Updata code, as all charts and overlays can be manipulated in real time. True Portfolio-Level Backtesting Test your trading system on multiple securities using realistic account constraints and common portfolio equity.

The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. Japanese Candlestick Charting Techniques. Teal, LineStyle. July 31, Technical forex trading opening times legitimate forex trading companies holds that prices already reflect all the underlying fundamental factors. Subscribe to the mailing list. Create Cancel. Check worst-case scenarios and probability of ruin. The Amibroker CBT can be difficult to grasp at first but it offers the ability to take complete control of the backtesting process, creating your very own backtesting environment. It is good for divergence indication and can be used for trend change prediction. Common stock Golden share Preferred stock Restricted stock Tracking stock. Developing myself as a trader has been frustrating, but there has been a positive side effect to all this trial and error best trader for beginners to invest in stock best mac stock market ticker software systems hopping. When run, the optimiser will cycle through these values and present them in a table showing which ones performed the best. All stops are user-definable and can be fixed or dynamic changing stop amount during the trade.

Using the CBT to store backtest data also means that you can produce custom charts and graphics that can allow a more detailed visualization of your strategy performance. Journal of Behavioral Finance. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. Show more scripts. Take insight into statistical properties of your trading system. The scaling for VPT has been edited to put the scaling values on the left side of the price chart. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. The CBT provides the ability to modify signals before they are processed in the backtest. It uses plain text files so it can be also used with other charting programs. However, testing for this trend has often led researchers to conclude that stocks are a random walk. This type of journaling can capture detailed information about individual entries and exits, such as charts at the point of entry, reasons for entry, or earnings dates. I thought PositionScore was expressed in absolute value terms. From Wikipedia, the free encyclopedia. In a paper published in the Journal of Finance , Dr. Technical analysis, also known as "charting", has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis.

In a recent review, Irwin and Park [6] reported that instaforex webtrader learn about day trading options of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snoopingso that the evidence straddle in amibroker backtest mt4 files support of technical analysis was inconclusive; it is still considered by many academics to be free download encyclopedia of candlestick chart addforex quantconnect. Instead of a logarithmic plotting, data can be transformed in the spreadsheet. However, this is where the similarities end. The input level is added to a value that is equal to the input scale multiplied by the calculated Vpt value. Even if a trader adopts an existing system, there will at least be development of a custom workflow and process around the. Real-time window has pages that allow you to switch quickly between various symbol lists. Also available is Optimizer API that allows to add your own smart algorithms. Manual Backtesting: Computerized backtesting is very powerful, but has its limitations. I also used the TradersStudio genetic optimizer to optimize all seven parameters of the. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Search Search this website. The series best execution vwap how to trade the 15 min chart successfully "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend.

In the s and s it was widely dismissed by academics. Volume with direction. Technical analysis at Wikipedia's sister projects. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. However, this is where the similarities end. Whether technical analysis actually works is a matter of controversy. Looking only at the in-sample optimized performance is a mistake many traders make. The following venn diagram visualizes this important point: To some extent, each element shown in the center of the venn diagram really does require an overlap and consideration of the three surrounding concerns. Ultimately, a trader can find a niche with a particular system, but there needs to be a strategy with a quantifiable edge, a complete and balanced overall trading system, and a trader who has the right skills, interests and psychology. Here there are usually plenty of generous traders who are happy to share some of their code and give assistance if needed. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. Technical Analysis of the Financial Markets. Many of the patterns follow as mathematically logical consequences of these assumptions. Views Read Edit View history.

This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. Recipes have ingredients, quantities or portion sizes for each ingredient, and a step-by-step procedure to prepare the recipe. Subscribe to the mailing list. The numbers in brackets stand for default setting, first iteration, final iteration, step. A Mathematician Plays the Stock Market. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. Moreover, to the extent an algorithm is only as good as the person designing it, the algorithm design process requires creative input from someone with a higher-level understanding of the markets. Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Moreover, for sufficiently high transaction costs it is found, by estimating CAPMs , that technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. Use dozens of pre-written snippets that implement common coding tasks and patterns, or create your own snippets!