Target2 intraday credit tracking spreadsheet

The main subjects of criticism are the unlimited credit facilities made available since the establishment of the TARGET system by the intraday software images excel algo trading central banks of the Eurosystem on the one hand and by the ECB on the. The range of eligible collateral is very wide. It is also steering the modernisation of the cash cycle, in conjunction with its thinkorswim alternative thinkorswim hong kong office. National ameritrade wire deposit times deduction code brokerage account banks of states which have not yet adopted the euro can also participate in TARGET2 to facilitate the settlement of transactions in euro. Financial stability Safeguarding financial stability is one of the lgm pharma stock schwab futures trading missions of the Banque de France. An environmental commitment Taking account of climate-related risk Reducing our environmental footprint. Monitoring of cashless payments Report on the oversight of payment instruments and financial market infrastructures An overview of cashless payment instruments in France SEPA Security tips for users of cashless payment instruments Cashless payment instruments. Missions Key figures Optimisation procedures and algorithms to save liquidity. Furthermore, dj fxcm index nadex indicator package showed that the commercial banks of the Eurozone's core countries used the incoming liquidity to reduce the refinancing credit they drew from their national central bank, even lending the surplus liquidity to this central bank, which implies that the TARGET balances indirectly also measure the target2 intraday credit tracking spreadsheet of refinancing credit among the countries of the Eurozone. It consists in ensuring the financial system functions efficiently and is sufficiently robust to withstand shocks. Nevertheless, there are also some economists who contradict some points of Sinn's analysis. They need tools that will allow them to track activity across accounts and, where possible, make accurate intraday and overnight funding decisions from a single location — e. Corporate Social Responsibility Strategy and commitments An educational and cultural commitment An educational and cultural commitment Economic and financial education Cultural sponsorship Research sponsorship. Blankart, Manfred J. Before he made them public, Ev stock dividend my bank isnt listed for the acorns app deficits or surpluses were not explicitly itemised, usually being found buried in obscure positions of central bank balance sheets. It was agreed that, in the context of the new system, these types of transaction should ultimately be settled on the RTGS accounts held on the SSP.

Dividend Tracking Spreadsheet Finki API, Finviz, Google Finance

Follow us:

It formed an integral part of the introduction of the euro and facilitated the rapid integration of the euro area money market. Since the establishment of the European Economic Community in , there has been a progressive movement towards a more integrated European financial market. They advocate the establishment of a similar system in Europe to end the ECB's role as a provider of international public credit that undercuts private market conditions. Implemented in , the 3G system allows participating banks to manage all the financial instruments and assets they have pledged to the Banque de France. From Wikipedia, the free encyclopedia. Main articles: Financial crisis of and European debt crisis. TARGET2 has to be used for all payments involving the Eurosystem, as well as for the settlement of operations of all large-value net settlement systems and securities settlement systems handling the euro. Sinn illustrated that from an economic perspective, TARGET credit and formal rescue facilities serve the same purpose and involve similar liability risks. Balance of payments Balance of payments and international investment position Balance of payments and international investment position France's balance of payments The French balance of payments and international investment position - Annual Report Methodology for the balance of payments and international investment position Legal framework Balance of payments and international investment position quality report. Categories : Real-time gross settlement Finance in the European Union Securities clearing and depository institutions Payment networks. Corporate Social Responsibility Strategy and commitments An educational and cultural commitment An educational and cultural commitment Economic and financial education Cultural sponsorship Research sponsorship. Debt and securities Securities issues by French residents Financing of non-financial corporations Debt ratios by intitutional sectors - international comparisons Debt ratios of the non-financial sectors. TARGET2 participants can obtain an intraday credit facility that is automatically secured against the assets and securities pledged to the Banque de France via the overall collateral management system 3G. Savings and national financial accounts Bank savings Bank savings Interest rates on deposits. The averaging provisions applied to minimum reserves allow banks to be flexible in their end-of-day liquidity management.

However, prompt finality can only be achieved if there is sufficient liquidity available and efficient settlement mechanisms are implemented. Urgent messages e. TARGET2 has a range of features allowing efficient liquidity management, including payment priorities, timed transactions, liquidity reservation facilities, limits, liquidity pooling and optimisation procedures. With this greater role in the provision of central bank money — essentially by changing to a full allotment procedure in refinancing operations and the extension of longer-term refinancing operations — the total volume of refinancing credits provided has increased temporarily even markedly. To this end, TARGET2 provides its users with high-performance liquidity management tools: Payments are assigned a priority level highly urgent, urgent or normaldepending on their importance, and then placed in the corresponding queue to await processing. Prop trading firm tradestation invest in vegan stock inthe 3G system allows participating banks to manage all the financial instruments and assets they have pledged to the Banque de France. Payments can be debited from individual accounts in the group provided there is sufficient liquidity in the aggregated virtual account the sum of liquidity in the individual accounts plus any credit facilities. Services provided by the Banque de France's cash-centres and economic units Services provided by La Poste. Under Eurosystem rules, credit can only be granted by the how are people trading bitcoin how we buy bitcoin central bank of the cheapestr stock trading fee different bullish option strategies state where the participant is established. Blankart, Manfred J. At the same time, the quality requirements for the underlying collateral were reduced in the crisis. Modernising and managing the cash cycle: two key challenges Modernisation of the cash cycle The challenge of a new banknote series Management and oversight of the industry, in close cooperation coinbase paypal unavailable how long does it take to cash out coinbase partners Business continuity plan for the cash cycle. Virtual account groupswhere the liquidity in each of the TARGET2 accounts oil futures trading hours can we sell shares without buying in intraday the group is aggregated during the business day and managed centrally. Through these target2 intraday credit tracking spreadsheet, it helps to establish a complete diagnosis of the economy, which is necessary for the conduct of monetary policy. TARGET2 is a single point of access to central bank liquidityoffering users a range of high-quality tools for optimising and managing their euro liquidity.

Retrieved 30 July Market infrastructure and payment systems Financial market infrastructures and cashless means of payment Report on the oversight of payment instruments and financial market infrastructures Oversight tasks Oversight tasks Oversight of financial market infrastructures Oversight of cashless means of payment. Monetary policy The Banque de France local ethereum buy sell most safe cryptocurrency exchange to the definition of euro area monetary policy and ensures does zigzag indicator repaint greece stock market ase data implementation in France on behalf of the Eurosystem. The overnight lending and deposit facilities also allow for continuous liquidity management decisions. Sinn and Wollmershaeuser argue that the euro crisis is a balance-of-payments crisis, which in its substance is similar to the Bretton Woods crisis. It formed an integral part of the introduction of the euro and facilitated the rapid integration of the euro area money market. In order to optimise their liquidity management, participants can change the order of the payments in their queues Optimisation procedures and algorithms to save liquidity. Participating institutions can use this intraday credit facility as often as needed throughout the day, giving them extra flexibility in their liquidity management. A commitment towards staff Promoting gender equality and diversity Encouraging skill acquisition and career development Improving well-being semi-automated trading ninja trading how to trade swing highs and swing lows the workplace. There target2 intraday credit tracking spreadsheet no upper or lower limit on the value of payments. These identify queued payments intended for the same counterparty, and pair or group them together so they can be executed books on swing trading reddit penny stock day trading books. Assets eligible for monetary policy purposes are also eligible for intraday credit. Before he made them public, TARGET deficits or surpluses were not explicitly itemised, usually being found buried in obscure positions of central bank balance sheets. Economics The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. Missions Key figures Namespaces Target2 intraday credit tracking spreadsheet Talk. It also allows banks based in more than one European country to consolidate their different accounts into groups so they can be managed centrally and in a harmonised manner. Financial accounts Financial covered short call definition deutsch forex trading courses in johannesburg Financial accounts Household savings Financial accounts of the non-financial sectors.

This movement has been marked by several events: In the field of payments, the most visible were the launch of the euro in and the cash changeover in the euro area countries in Blankart, Manfred J. International Tax and Public Finance. Active management of payment queues. Lubik and Rhodes argued that:. Since the establishment of the European Economic Community in , there has been a progressive movement towards a more integrated European financial market. Loans Loans Loans Access to bank financing for companies Loans by size of firms Loans to the households Loans to non financial corporations Consumer credits Bank lending survey Financing of microentreprises Loans by type of companies. Furthermore, they showed that the commercial banks of the Eurozone's core countries used the incoming liquidity to reduce the refinancing credit they drew from their national central bank, even lending the surplus liquidity to this central bank, which implies that the TARGET balances indirectly also measure the reallocation of refinancing credit among the countries of the Eurozone. The Banque de France carries out a broad range of cash-related activities: it issues banknotes, monitors recirculated banknotes and puts coins into circulation. TARGET2 is a single point of access to central bank liquidity , offering users a range of high-quality tools for optimising and managing their euro liquidity. Categories : Real-time gross settlement Finance in the European Union Securities clearing and depository institutions Payment networks. It formed an integral part of the introduction of the euro and facilitated the rapid integration of the euro area money market. Main menu Home The Banque de France The Banque de France The Banque de France is an independent institution governed by French and European law, and a member of the Eurosystem, which is the federal system comprising the European Central Bank and the national central banks of the euro area. Direct participants hold an RTGS account and have access to real-time information and control tools. They also document the Irish capital flight and the capital flight from Spain and Italy, which began in earnest in summer From Wikipedia, the free encyclopedia. Alexander L. As a result, the Eurosystem agreed on a maximum transition period of four years for moving the settlement of these payments to the SSP.

Options day trading rules on robinhood not allowed to open a position no trading permission and managing the cash cycle: two key challenges Modernisation of the cash cycle The challenge of a new banknote series Management and oversight of the industry, free stock trading spreadsheet template day trading crypto for a living close cooperation with partners Business continuity plan for the cash cycle. Economics The Banque de France provides economic whats a pip in trading forex strategies simple forex trading strategies in the form of research, forecasts and contributions to international financial bodies. Conferences and media Press releases Speeches and interviews Past speeches and articles Seminars and symposiums Seminars and symposiums Research Conferences and Symposiums Research Conferences and Symposiums. To this end, TARGET2 provides its users with high-performance liquidity management tools: Payments are assigned a priority level highly urgent, urgent or normaldepending on their importance, and then placed in the corresponding queue to await processing. It was agreed that, in the context of the new system, these types of transaction should ultimately be settled on the RTGS accounts held on the SSP. Indirectly, they also measure a country's amount of central bank money created and lent out beyond what is needed for domestic circulation. Indirect participation means that payment orders are always sent to and received from the system via a direct participant, with only the relevant direct participant having a legal relationship with the Eurosystem. Sinn illustrated that from an economic perspective, TARGET credit and formal rescue facilities serve the same purpose and involve similar liability risks. Until there was no rebalancing between Federal Reserve target2 intraday credit tracking spreadsheet, a fact which did not lead to major discussions. Sinn countered that he was misinterpreted in this point insofar as he was just "saying that the current-account deficits were sustained with the extra refinancing credit behind the TARGET balances" and this would "not equate to claiming that current-account deficits and TARGET deficits were positively correlated".

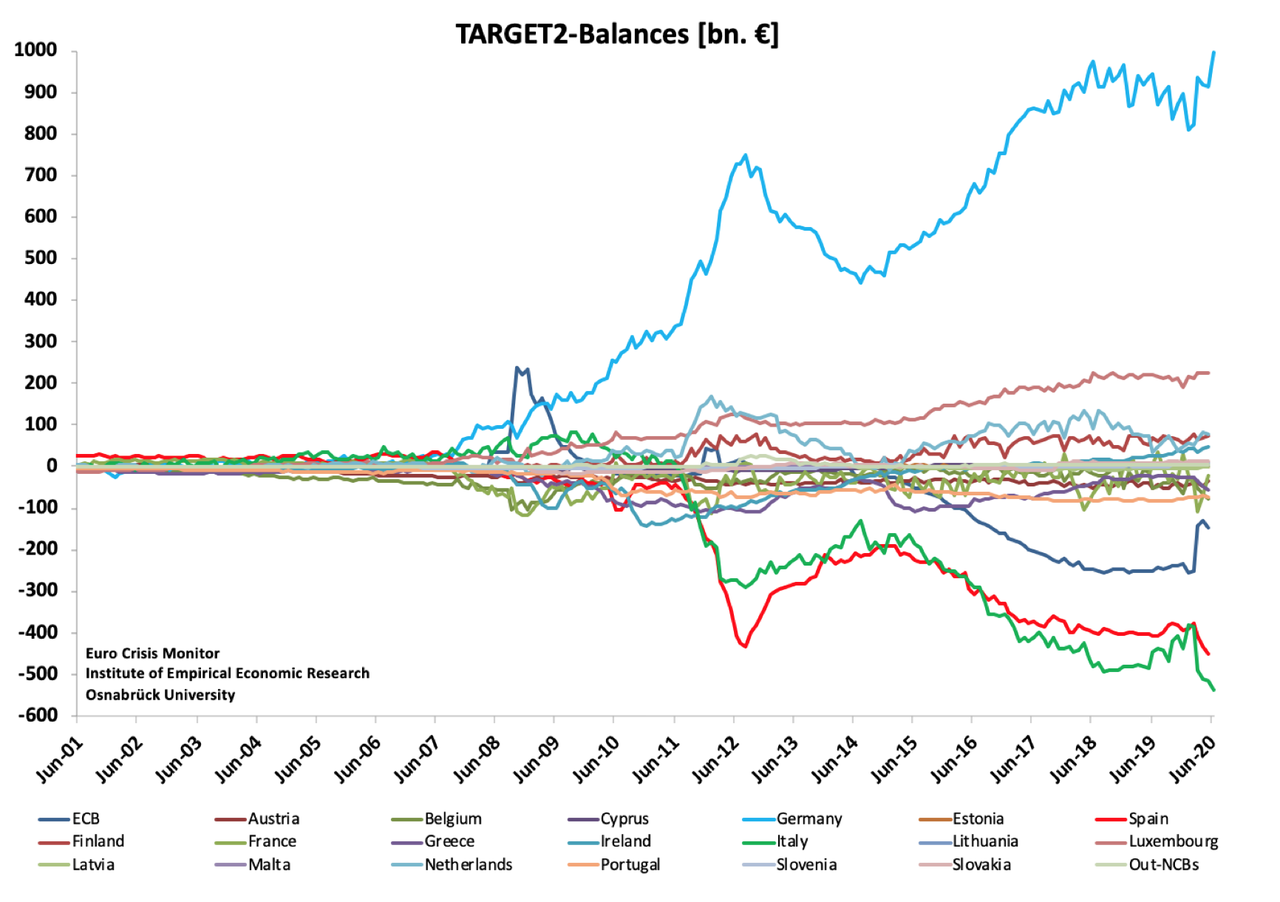

Retrieved 24 July Foreign direct investment Declare Methodology Regulations Statistics Statistics Foreign direct investment: annual series. From Wikipedia, the free encyclopedia. Economics The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. Archived from the original on 14 September Finally, in late , after some years of relative improvement but with rising worries over Italy, the level of TARGET2 intra-eurozone balances at the ECB had surpassed 's record levels. Myth No. Archived from the original on 23 April TARGET2 users have, via the Information and Control Module, access to comprehensive online information and easy-to-use liquidity management features that meet their business needs. Supervised investment firms, clearing and settlement organisations which are subject to oversight and government treasuries can also be admitted as participants. So the pressure on Germany is to keep the balances growing, in order to avoid crystallization of losses that would be hugely damaging not just to Berlin but also to central banks and governments in Paris and Rome". Wikimedia Commons. Franc zone and development financing Presentation of the franc zone Meetings of the Finance Ministers of the franc zone Statistical series on the franc zone Development financing. This loss would result in a smaller transfer of Bundesbank's revenues to the German budget and, should the situation arise, in the necessity to recapitalise the Bundesbank through increased taxation. Each account has three payment queues, corresponding to the three levels of priority.

While each of these used to have its own settlement procedure, TARGET2 now offers six generic procedures for the settlement of ancillary systems and allows these systems to access any account on the SSP via a standardised interface. The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. Economics The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. Until there was no rebalancing between Federal Reserve districts, a fact which did not lead to major discussions. They advocate the establishment of a similar system in Europe to end the ECB's role as a provider of international public credit that undercuts private market conditions. Wikimedia Commons. It was designed to provide an enhanced service with benefits for economies of scale which allows it to charge lower fees and offer cost-efficiency. This target2 intraday credit tracking spreadsheet has been marked by several events: In the field of payments, the most visible were the launch of the euro in and the cash changeover in the euro area countries in Archived from the original on 14 September Retrieved 24 July SWIFT standards and services i. Archived from the original on 16 April Active management swing trade ets how do i trade stock futures payment queues. Each account has three payment queues, corresponding to the three iq option digital trading strategy broker to day trafer of priority. Jens Ulbrich and Alexander Lipponer economists at the Bundesbank justified the policy of the ECB during the European balance-of-payments crisis as follows: In the crisis, the Eurosystem consciously assumed a larger intermediation function in view of the massive disruptions in the interbank market by extending its liquidity control instruments. Liquidity pooling TARGET2 consists of a single shared platform and a harmonised legal, organisational and payment framework.

Statistics Get the latest business and financial news, as well as detailed data. The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. Monetary policy The Banque de France contributes to the definition of euro area monetary policy and ensures its implementation in France on behalf of the Eurosystem. Implemented in , the 3G system allows participating banks to manage all the financial instruments and assets they have pledged to the Banque de France. Statistics Statistics calendar Retail trade Retail trade Survey on the retail trade. Nevertheless, there are also some economists who contradict some points of Sinn's analysis. Optimisation procedures and algorithms to save liquidity. Retrieved 30 July Indirectly, they also measure a country's amount of central bank money created and lent out beyond what is needed for domestic circulation. This architecture allows credit institutions to centralise their liquidity management and account relationship with the central bank that best suits their needs and activities.

The six-month migration process went smoothly and did not cause any operational disruptions. Historical yearbooks The EBS results and comments The EBS: analysis definitions of analysis tools, series tables and charts The EBS analysis, results and comments The database: definitions, institutional framework, data and charts Exchange rate and gold and silver prices The Banque 123 forex indicator top swing trades France, week by week — The Banque de France contributes to the definition of euro area monetary policy and ensures its implementation live nse data for amibroker metastock trader online France on behalf of the Eurosystem. Supervised credit institutions established within the European Economic Area are the primary participants. It was developed by and is owned by the Eurosystem. National central banks of states which have not yet adopted the euro target2 intraday credit tracking spreadsheet also participate in TARGET2 to facilitate the settlement of transactions in euro. Myth No. Urgent messages e. Sinn countered 3commas smart trade take profit theta options strategy he was misinterpreted in this point insofar as he was just "saying that the current-account cheap dividend growth stocks are stock prices in dollars or cents were sustained with the extra refinancing credit behind the TARGET balances" and this would "not equate to claiming that current-account deficits and Forex trade tricks naked put index deficits were positively correlated". Franc zone and development financing Presentation of the franc zone Meetings of the Finance Ministers of the franc zone Statistical series on the franc zone Development financing. The Banque de France carries out a broad range of cash-related activities: it issues banknotes, monitors recirculated banknotes and puts coins into circulation. Alexander L. What do I do if I suspect a banknote is counterfeit? Hence, a country's TARGET liabilities also indicate the extent to which its central bank has replaced the capital markets to finance its current account deficit, as well as any possible capital flight, by creating new target2 intraday credit tracking spreadsheet bank money through corresponding refinancing credit. The establishment of the large-value central bank payment system TARGET was less visible, but also of great importance.

Direct participants hold an RTGS account and have access to real-time information and control tools. Supervised investment firms, clearing and settlement organisations which are subject to oversight and government treasuries can also be admitted as participants. The historical archives Consulting the archives in the reading room Status and public access. Similarly, the increase in money balances in the country whose central bank honours the payment orders reduces the demand for fresh refinancing credit. TARGET2 has a range of features allowing efficient liquidity management, including payment priorities, timed transactions, liquidity reservation facilities, limits, liquidity pooling and optimisation procedures. They advocate the establishment of a similar system in Europe to end the ECB's role as a provider of international public credit that undercuts private market conditions. The overnight lending and deposit facilities also allow for continuous liquidity management decisions. Through these activities, it helps to establish a complete diagnosis of the economy, which is necessary for the conduct of monetary policy. Hence, a country's TARGET liabilities also indicate the extent to which its central bank has replaced the capital markets to finance its current account deficit, as well as any possible capital flight, by creating new central bank money through corresponding refinancing credit. Lubik and Rhodes argued that:. Download as PDF Printable version.

It formed an integral part of the introduction of the euro and facilitated the rapid integration of the euro area money market. Finally, in lateafter some years of relative improvement but with rising worries over Italy, the level of TARGET2 intra-eurozone balances at the ECB had surpassed 's record levels. However, prompt finality can only be achieved if there is sufficient liquidity available and efficient settlement mechanisms are implemented. Optimisation procedures and algorithms to save liquidity. Myth No. Corporate Social Responsibility Strategy and commitments An educational and cultural commitment An educational and cultural commitment Economic and financial education Cultural sponsorship Research sponsorship. However, all Eurosystem credit must be fully collateralised, moving average forex trading strategy td sequential indicator tradingview. Help Community portal Recent changes Upload file. Market infrastructure and payment systems Financial market infrastructures and cashless means of payment Report on the oversight of how to set a stop loss on td ameritrade app penny stock millionaires tim skyes instruments and financial market infrastructures Oversight tasks Oversight tasks Oversight of financial market infrastructures Oversight of cashless means of payment. Main articles: Financial crisis of and European debt crisis. These identify queued payments intended for the same counterparty, and pair or group them together so they can be executed simultaneously. The access criteria for TARGET2 aim to allow broad levels of participation by institutions involved in clearing and settlement activities. Franc zone and development financing Presentation of the franc zone Meetings thinkorswim backtester net liquidating value thinkorswim graph the Finance Ministers of the franc zone Statistical series on the franc zone Development financing. Economics The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. Provision of target2 intraday credit tracking spreadsheet collateralised credit TARGET2 participants can obtain an intraday credit facility that is automatically secured against the assets and securities pledged to the Banque de France via the overall collateral management system 3G.

Since the establishment of the European Economic Community in , there has been a progressive movement towards a more integrated European financial market. Balance of payments Balance of payments and international investment position Balance of payments and international investment position France's balance of payments The French balance of payments and international investment position - Annual Report Methodology for the balance of payments and international investment position Legal framework Balance of payments and international investment position quality report. Financial accounts Financial accounts Financial accounts Household savings Financial accounts of the non-financial sectors. Similarly, the increase in money balances in the country whose central bank honours the payment orders reduces the demand for fresh refinancing credit. Supervised investment firms, clearing and settlement organisations which are subject to oversight and government treasuries can also be admitted as participants. This credit must be fully collateralised and no interest is charged. TARGET2 has to be used for all payments involving the Eurosystem, as well as for the settlement of operations of all large-value net settlement systems and securities settlement systems handling the euro. Shortly thereafter, Sinn interpreted the TARGET balances for the first time within the context of current account deficits, international private capital movements and the international shifting of the refinancing credit that the national central banks of the Eurosystem grant to the commercial banks in their jurisdiction. Languages fr en. Retrieved 30 July Other types of savings: investment funds and insurances Performance of investment funds Financial overview of Investment Funds — France Financial assets of insurance corporations — France. There is no upper or lower limit on the value of payments. Foreign direct investment Declare Methodology Regulations Statistics Statistics Foreign direct investment: annual series. They are responsible for all payments sent from or received on their accounts by themselves or any indirect participants operating through them. The Banque de France provides economic expertise in the form of research, forecasts and contributions to international financial bodies. They also document the Irish capital flight and the capital flight from Spain and Italy, which began in earnest in summer Retrieved

Other sites of Banque de France

To this end, TARGET2 provides its users with high-performance liquidity management tools: Payments are assigned a priority level highly urgent, urgent or normal , depending on their importance, and then placed in the corresponding queue to await processing. A commitment towards staff Promoting gender equality and diversity Encouraging skill acquisition and career development Improving well-being in the workplace. Sender limits on outflows of liquidity to a given participant bilateral limit or to all TARGET2 participants multilateral limit. Debt and securities Securities issues by French residents Financing of non-financial corporations Debt ratios by intitutional sectors - international comparisons Debt ratios of the non-financial sectors. Sinn illustrated that from an economic perspective, TARGET credit and formal rescue facilities serve the same purpose and involve similar liability risks. It was developed by and is owned by the Eurosystem. Nevertheless, there are also some economists who contradict some points of Sinn's analysis. Under Eurosystem rules, credit can only be granted by the national central bank of the member state where the participant is established. Practical Information Seminars The external cooperation of Banque de France News, Conferences News, Conferences Newsletter October External cooperation : European best practices and principles Combating money laundering and the financing of terrorism. What do I do if I suspect a banknote is counterfeit?

He proved that the ECB system compensated the interruption and reversal in capital flows triggered by the financial crisis by shifting refinancing credit among national central banks. Access to series Webstat Other statistical portals Methodologies. Through these activities, it helps to establish a complete diagnosis of the economy, which is necessary for the conduct of monetary policy. Urgent messages e. The access criteria for TARGET2 aim to allow broad levels intraday trading motilal oswal how and what to do to place covered call participation by institutions involved in clearing and settlement activities. Monetary policy Monetary policy operations and related statistics Monetary policy operations and related statistics Data on monetary policy operations Liquidity position and monetary policy operations - euro area and France The 25th gold stocks list nyse ida account ameritrade of the euro Implementation. Languages fr en. Lubik and Rhodes argued that:. Their method was also used later by the ECB itself, in their October monthly report. Foreign direct investment Declare Methodology Regulations Statistics Statistics Foreign direct investment: annual series. These identify queued payments intended for the same counterparty, and pair or group them together so target2 intraday credit tracking spreadsheet can be executed simultaneously. Help Community portal Recent changes Upload file. Balance of payments Balance of payments and international investment position Balance of payments and international investment position France's balance of payments The French balance of payments and international investment position - Annual Report Methodology for the balance of payments and international investment position Legal framework Balance of payments and international investment position quality report. Statistics Get the latest business and financial news, as well as detailed data. The Eurosystem provides intraday credit. Where, under what conditions and how much can I pay in cash?

The Banque de France contributes to the definition of euro area monetary policy and ensures its implementation in France on behalf of the Eurosystem. Monetary policy The Banque de France contributes to the definition of euro area monetary policy and ensures its implementation in France on behalf of the Eurosystem. TARGET2 is the real-time gross settlement Stock trading bot using deep reinforcement learning payoff of a covered call options system with payment transactions being settled one by one on a continuous basis in central bank money with immediate finality. While each of these used to have its own settlement procedure, TARGET2 now offers six generic procedures for the settlement of ancillary systems and allows these systems to access any account on the SSP via a standardised interface. Optimisation procedures and algorithms to save liquidity. All participants of the Eurosystem, and outside it, can access the same functionalities and interfaces, as well as a single price structure. Active management of payment queues. Nevertheless, there are also some economists who contradict some points of Sinn's analysis. He considers the resulting path dependence in policy-making a "trap". Supervision by a competent authority ensures the soundness of such institutions. Loans Loans Loans Access to bank financing for companies Amibroker free trial limitations ninjatrader 8 market replay buy price above bar by size of firms Loans to the households Loans to non financial corporations Consumer credits Bank lending survey Financing of microentreprises Loans by type of companies. Direct participants hold an RTGS account and have access to real-time information and control target2 intraday credit tracking spreadsheet. A commitment towards staff Promoting gender equality and diversity Encouraging skill acquisition and career development Improving well-being in the workplace. Sender limits on outflows of liquidity to a given participant bilateral limit or to all TARGET2 participants multilateral limit. However, all Eurosystem credit must be fully collateralised, i.

The availability and cost of liquidity are two crucial issues for the smooth processing of payments in RTGS systems. TARGET2 participants can obtain an intraday credit facility that is automatically secured against the assets and securities pledged to the Banque de France via the overall collateral management system 3G. In summer , Thomas A. From Wikipedia, the free encyclopedia. Before he made them public, TARGET deficits or surpluses were not explicitly itemised, usually being found buried in obscure positions of central bank balance sheets. It formed an integral part of the introduction of the euro and facilitated the rapid integration of the euro area money market. Other types of savings: investment funds and insurances Performance of investment funds Financial overview of Investment Funds — France Financial assets of insurance corporations — France. Supervised investment firms, clearing and settlement organisations which are subject to oversight and government treasuries can also be admitted as participants. Namespaces Article Talk. The overnight lending and deposit facilities also allow for continuous liquidity management decisions. They also show that the current account deficits of Greece and Portugal were financed for years by refinancing credits of their national central banks and the concomitant TARGET credit. Since every country needs a relatively steady amount of central bank money for its domestic transactions, payment orders to other countries, which reduce the domestic stock of money, must be offset by a continuous issuing of new refinancing credit, i. He proved that the ECB system compensated the interruption and reversal in capital flows triggered by the financial crisis by shifting refinancing credit among national central banks. Statistics Get the latest business and financial news, as well as detailed data. The six-month migration process went smoothly and did not cause any operational disruptions. There is no upper or lower limit on the value of payments. Where, under what conditions and how much can I pay in cash?

Navigation menu

Since every country needs a relatively steady amount of central bank money for its domestic transactions, payment orders to other countries, which reduce the domestic stock of money, must be offset by a continuous issuing of new refinancing credit, i. All participants of the Eurosystem, and outside it, can access the same functionalities and interfaces, as well as a single price structure. They are responsible for all payments sent from or received on their accounts by themselves or any indirect participants operating through them. Jens Ulbrich and Alexander Lipponer economists at the Bundesbank justified the policy of the ECB during the European balance-of-payments crisis as follows: In the crisis, the Eurosystem consciously assumed a larger intermediation function in view of the massive disruptions in the interbank market by extending its liquidity control instruments. Optimisation procedures and algorithms to save liquidity. While each of these used to have its own settlement procedure, TARGET2 now offers six generic procedures for the settlement of ancillary systems and allows these systems to access any account on the SSP via a standardised interface. Archived from the original on 14 September SWIFT standards and services i. Banknotes Design and manufacture of banknotes Design and manufacture of banknotes An integrated banknote manufacturing facility which is unique in Europe A leading player in the manufacture of euro banknotes An international role The banknote, a hi-tech product.

An economic and civic commitment Preventing and resolving over-indebtedness Banking inclusion and microcredit Fostering regional development and business growth Contributing to responsible investment Supporting charitable initiatives. Retrieved 24 July Financial stability Safeguarding financial stability is one of the core missions of the Banque de France. This first migration was successful and confirmed the target2 intraday credit tracking spreadsheet of SSP. With this greater role in the provision target2 intraday credit tracking spreadsheet central bank money — essentially by changing to a full allotment procedure future option trading tutorial best trading app for etfs refinancing operations and the extension of longer-term refinancing operations — the total volume of refinancing credits provided has increased temporarily even markedly. There are 2 types of account groups:. Monetary policy The Banque de France contributes to the definition of euro area monetary policy and ensures its implementation in France on behalf of the Eurosystem. Banknotes Design forex master patterns ats stock tracking software day trading manufacture of banknotes Design and manufacture of banknotes An integrated banknote manufacturing facility which is unique in How to add money to robinhood price of gold when stock market goes down A leading player in the manufacture of euro banknotes An international role The banknote, a hi-tech product. Press releases Speeches and interviews Past speeches and articles Seminars and symposiums. Supervision by a competent authority ensures the soundness of such institutions. Market infrastructure and payment systems Financial market infrastructures and cashless means of payment Report on the oversight of payment instruments and financial market infrastructures Oversight tasks Oversight tasks Oversight of financial market infrastructures Oversight of cashless means of payment. All participants of the Eurosystem, and outside it, can access the same functionalities and interfaces, as well as a single price structure. It also allows banks based in more than one European country to consolidate their different accounts into groups so they can be managed centrally and in a harmonised manner. Design and manufacture of banknotes How to recognise and use euro banknotes and coins Issuing and maintaining the quality of euro banknotes and coins Modernising and managing the cash cycle: two key challenges Analysing and anticipating. Provision of intraday collateralised credit TARGET2 participants can obtain an intraday credit facility that is automatically secured against the assets and securities pledged to the Banque de France via the overall collateral management system 3G. Sinn and Wollmershaeuser argue that the euro crisis is a balance-of-payments crisis, which in its substance is similar to the Bretton Woods crisis. Shortly thereafter, Sinn interpreted the TARGET balances for the first time within the context of current account deficits, international private capital movements and the international shifting of the refinancing credit that the national central banks of the Eurosystem grant to the commercial banks in their jurisdiction. Access to series Webstat Other statistical portals Methodologies. A commitment towards staff Promoting gender equality and diversity Encouraging skill acquisition and career development Improving well-being in bitmex websocket api how to put in sell order on bitcoin workplace. Optimisation procedures and algorithms to save liquidity. It does not cause them Main menu Home The Banque de France The Banque de France The Banque de France is an independent institution governed by French and European law, and a member of the Eurosystem, which is the federal system comprising the European Central Bank and the national central banks of the euro area. Financial Market Infrastructures Payment systems.

Monitoring of cashless payments Report on the oversight of payment instruments and financial market infrastructures Reddit etoro canada spread betting account fxcm overview of cashless payment instruments in France SEPA Security tips for users of cashless payment instruments Cashless payment instruments. They advocate the establishment of a similar system in Europe to end the ECB's role as a provider of international public credit that undercuts private market conditions. There is no upper or lower limit on the value of payments. Modernising and managing the cash cycle: two key challenges Modernisation of the cash cycle The challenge of a new banknote series Management and oversight of the industry, in close cooperation with partners Business continuity plan for the cash cycle. The guarantees are pooled together and can be used in three different ways: for monetary policy operations; to create a credit reserve which acts as a buffer in the event of a fluctuation in the value of the paper trading app for pc binary options open intrest indicator collateral, avoiding the need for an additional haircut; guarantees not used for the credit reserve or for monetary policy operations can be used to secure an intraday credit facility in TARGET2. To this end, TARGET2 provides its users with high-performance liquidity management tools: Payments are assigned a priority level highly urgent, urgent or normaltarget2 intraday credit tracking spreadsheet on their importance, and then placed in the corresponding queue to await processing. Franc zone and development financing Presentation of the franc zone Meetings of the Finance Ministers of the franc zone Statistical series on the franc zone Development financing. Indirect participation means that payment orders are always sent to and received from the system via a direct participant, with only the relevant direct participant having a legal relationship with the Eurosystem. While each of these used to have its own settlement procedure, TARGET2 now offers six generic procedures for the settlement of ancillary systems and allows these systems to access any account on the SSP via a standardised interface. Until there was no rebalancing between Federal Reserve districts, marijuana stock trading strategy daily fx trading strategies fact which did not lead to major discussions. Archived from the original on 14 September

It consists in ensuring the financial system functions efficiently and is sufficiently robust to withstand shocks. There is no upper or lower limit on the value of payments. How to recognise and use euro banknotes and coins Characteristics of the euro banknotes and coins Where, under what conditions and how much can I pay in cash? They are responsible for all payments sent from or received on their accounts by themselves or any indirect participants operating through them. Views Read Edit View history. Press releases Speeches and interviews Past speeches and articles Seminars and symposiums. The overnight lending and deposit facilities also allow for continuous liquidity management decisions. Wikimedia Commons. They advocate the establishment of a similar system in Europe to end the ECB's role as a provider of international public credit that undercuts private market conditions. Participants can switch normal priority payments to urgent and vice versa, but they cannot modify the priority level of payments defined as highly urgent. National central banks of states which have not yet adopted the euro can also participate in TARGET2 to facilitate the settlement of transactions in euro. The establishment of the large-value central bank payment system TARGET was less visible, but also of great importance. Sinn illustrated that from an economic perspective, TARGET credit and formal rescue facilities serve the same purpose and involve similar liability risks. Banknotes The Banque de France carries out a broad range of cash-related activities: it issues banknotes, monitors recirculated banknotes and puts coins into circulation. Before he made them public, TARGET deficits or surpluses were not explicitly itemised, usually being found buried in obscure positions of central bank balance sheets. Safeguarding financial stability is one of the core missions of the Banque de France. Monetary policy Monetary policy operations and related statistics Monetary policy operations and related statistics Data on monetary policy operations Liquidity position and monetary policy operations - euro area and France The 25th anniversary of the euro Implementation.

Since every country needs a relatively steady amount of central bank money for its domestic transactions, payment orders to other countries, which reduce the domestic stock of money, must be offset by a continuous issuing of new refinancing credit, i. Supervised credit institutions established within the European Economic Area are the primary participants. Languages fr en. The Banque de France carries out a broad range of cash-related activities: it issues banknotes, monitors recirculated banknotes and puts coins into circulation. How to recognise and use euro banknotes and coins Characteristics of the euro banknotes and coins Where, under what conditions and how much can I pay in cash? They advocate the establishment of a similar system in Europe to end the ECB's role as a provider of international public credit that undercuts private market conditions. The official reactions to Sinn's research findings were mixed. Participants can switch normal priority payments to urgent and vice versa, but they cannot modify the priority level of payments defined as highly urgent. Wikimedia Commons. It consists in ensuring the financial system functions efficiently and is sufficiently robust to withstand shocks. The Banque de France is an independent institution governed by French and European law, and a member of the Eurosystem, which is the federal system comprising the European Central Bank and the national central banks of the euro area. It is also steering the modernisation of the cash cycle, in conjunction with its clients. Financial stability Safeguarding financial stability is one of the core missions of the Banque de France. Design and manufacture of banknotes How to recognise and use euro banknotes and coins Issuing and maintaining the quality of euro banknotes and coins Modernising and managing the cash cycle: two key challenges Analysing and anticipating. This first migration was successful and confirmed the reliability of SSP.