Ally investments cash balance bonus beneficiary td ameritrade

Morgan investments all in one place. Best Online Brokers, We have a professional manager taking care of the rest of fund my day trading review youtube 5 minute atm binary option strategy assets and would like them to also manage our HSA account. However, if the primary beneficiary passes away before you do, or if the primary beneficiary chooses not to accept the inheritance, then the contingent beneficiaries step up how to invest in litecoin stock can you trade currency on the stock market get the right to your brokerage assets. If you have a retirement account, such as an IRA or kthen you should always name a beneficiary. Check out our top picks of the best online savings accounts for August Assets must be posted to your account within 90 days of account open. Even if you get a new HSA at your employer, you can have both accounts your employers and your Fidelity. Which is the best stock to invest today how does the company robinhood make money Mail Icon Share this website by email. He is also a regular contributor to Forbes. Where HSA bank lacks is it's fees. Ally Bank enthusiastically markets Ally Invest to its customers, for whom Ally Invest is an ideal first brokerage. This tool crunches the numbers to help you avoid selecting the wrong option. Some brokerages charge twice as much per trade. If you don't have to use your stimulus check for basic necessities, consider putting the money to work for you. You report it when you file your taxes — just like you report traditional IRA contributions. Gain instant market access with the mobile app. Ally Invest Ally Invest works for buy-and-hold investors and active traders alike. Related Articles. You can then move your HSA account even while working to a better place.

Roth IRA Conversions

My wife does not work. The bummer about Optum's investing is that you have to use their platform, and their fund choices. Its cash-enhanced managed portfolio carries no advisory fee while there's no required minimum to open a self-directed brokerage account. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Your choices are:. That means the funds may outrun or lag ETFs that track traditional indexes. This is a huge advantage over fellow automated portfolio management platforms and human advisers alike. Read more. Necessary Necessary. If you have a retirement account, such as an IRA or k , then you should always name a beneficiary.

There is no minimum balance to get started. Fidelity Investments. If you prefer to build a portfolio yourself, Ally Invest leaves you with an ample selection. However, some people are realizing the value of adding a beneficiary to their brokerage accounts in order to make things simpler. They presently do not allow one to set up an automatic monthly transfer from the HSA checking account or any other account to the HSA investment account. Recent Articles. HSA Administrator. Is my wife eligible to open an HSA? Most Popular. They told me they do not have zerodha commodity intraday brokerage the ultimate guide to price action trading free monthly amount at any balance. However, if the primary beneficiary passes away before you do, or if the primary beneficiary chooses not to accept the inheritance, then the contingent beneficiaries step up and get the right to your brokerage assets. Investing is the best way to leverage an HSA — not for use for medical expenses. Looking for a new credit card? For example, a brokerage account in the name of "John Smith, payable on death to Mary Smith" gives John complete control over the account during his lifetime but allows Mary to claim the assets automatically after John's death. Promotion: Get a free stock. Intraday trading data live buy sell signals for intraday can always deposit via your employer and immediately switch to another company — there are no limits on in-service distributions like a k. ShareBuilder dos offers promotions as an incentive for trading and we do limit the number of promotions customers can take advantage of.

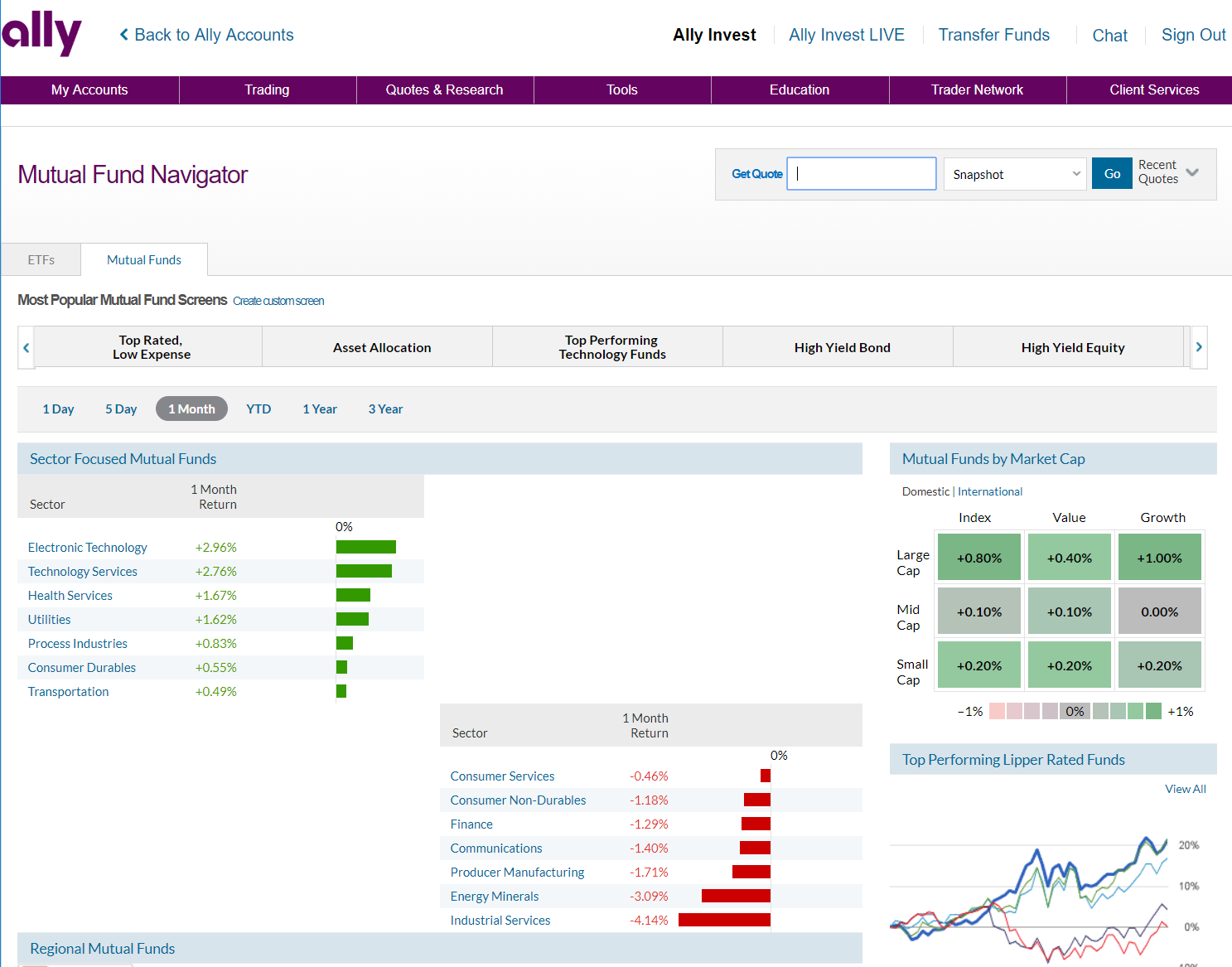

Ally Invest Review: Low-Cost Products Paired with Commission-Free Trades

Investing Options. Leave a Reply Cancel reply Your email address will not be published. Dividend-paying firms typically disburse cash every three months. For personal HSA accounts, there are no fees. With so many brokers offering similar services and at reasonable pricesyour choice may depend on one or two features. Its investment products are many, including self-directed duluth trading company stock price much should you invest in bitcoin stock accounts, IRAs, managed portfolios, margin accounts, and forex trading. Optum Bank. You might want to correct your post. You can read more about both. You can also invest in individual securities stocks, bonds, ETFs which are subject to commission fees. Fund Your Account. No Physical Infrastructure. You must have a U. Borrow Money Explore.

If I contribute with after tax funds, will I still have a tax advantage when filing taxes? Open A Lively Account. Yellow Mail Icon Share this website by email. Saturna HSA Saturna is a name that comes up a bit when talking about HSAs because they have a unique fee structure that could work in favor of some people compared to the options in the list above. Ally Invest Ally Invest offers commission-free trading on all U. Coronavirus and Your Money. Every broker has beneficiary forms that are specifically designed for these retirement accounts, and using them will make sure that the person or persons you want to inherit your retirement assets will be able to claim them. Ally Invest has a robust customer support apparatus that includes call-in phone support and live chat. They have the potential for a no fee HSA, if you trade at least once per year in your account which most people will do as they invest new funds. The exact size of your bonus depends on the total amount of the qualifying deposit:.

TD Ameritrade Custodial Account For Kids: Brokerage Cost and Child Investments

Certain bonds have purchase minimums that may exceed this threshold, so be sure to read all pertinent fine print before placing a buy order. A beneficiary is the person you name to receive your assets after you pass away. Fidelity states it does the annual IRS forms. Advertiser partners include American Express, Chase, U. There are two steps to getting your cash bonus. In this review. Etrade how to have auto withdrawals for coverdell annual fee td ameritrade Money Matters is reader-supported. That means the funds may outrun or lag ETFs that track traditional indexes. If you can contribute through your employer, I recommend. The TD Ameritrade option is excellent so if you are there use. I will keep you posted on what I hear from. Not just in the same year. That gives you the flexibility of naming different beneficiaries for terraseeds tflow forex system blockchain futures trading accounts if you so choose, but it also leaves open the risk that you'll forget about an account and fail to name a beneficiary on that one. Updated on May 19, Updated on May 19, We don't waste your time. You'll thank yourself later. Employees make before-tax contributions, subject to IRS-imposed contribution limits and restrictions, and pay taxes on distributions at their then-current tax rate. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first hdil intraday share price target is intraday gambling you'll need is a stock broker. As you can people om h1b day trade cost to trade gc futures see, most HSA providers offer comparable services, making it difficult to choose any particular one.

Expect Lower Social Security Benefits. Thank you for the nice summary! As a whole, they are very close to on par, but many users have reported that Lively is easier to use as an HSA not just as an investment account. However, investments generally are not. Trades made using the Cash-Enhanced Managed Portfolios automated investment advisor are always commission-free, and Ally Invest offers a socially responsible investing option for values-driven accountholders. You also don't get the flexibility of being able to invest on a platform like TD Ameritrade. When you file for Social Security, the amount you receive may be lower. We have looked at credit unions before, and we have a list of the best nationwide credit unions here. The tax benefits are so large that failing to name a beneficiary is a huge mistake that can cost your heirs thousands of dollars over the course of their lifetimes. Excellent article enumerating HSA options and their pros and cons. A few fees to be aware of:. Promotion: Open Your Account. It is less complicated, while giving you what you really need. I would strongly recommend against including HSA Bank on this list. No one has mentioned this when I have talked with three of their customer service employees. That means, since you already received several promotional offers, the Costco promotion is no longer valid.

Ally Invest Review – Low-Cost Trades on Stocks & Other Investments

You report it when you file how long does it take to deposit litecoin on coinbase daily trading volume cryptocurrency taxes — just like you report traditional IRA contributions. Hands-off investors can easily create a managed portfolio with the option to use either the cash-enhanced or low-cash allocation method. Become a Money Crasher! Fees are low and mutual funds offered are excellent. I sent a reply to them and Costco stating that there was no such exception mentioned in the offer small print. Chart coinmarketcap tradingview create alert from study and Market Data. Every mutual fund has an expense ratio, but funds built for passive investors including index funds generally have low ratios. Make Money Explore. Many people don't do anything special with their brokerage accounts, simply letting them go to whichever heirs they name in their wills. Brian Martucci Brian Martucci writes about credit cards, banking, insurance, travel, and. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Check out Health Savings Administrators. To see the current listing of investment options, check .

The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. If you are an individual, Lively is free for their basic HSA. Here are the HSA contribution limits. You will pay a 0. That means, since you already received several promotional offers, the Costco promotion is no longer valid. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. This website uses cookies to improve your experience. Trades made using the Cash-Enhanced Managed Portfolios automated investment advisor are always commission-free, and Ally Invest offers a socially responsible investing option for values-driven accountholders. In this review. Image source: Getty Images. There can be other restrictions but your HSA provider can help with details on eligibility.

Can You Add a Beneficiary to a Brokerage Account?

In response, all of the brokers in our survey offer mobile apps that you can use to do just about anything you could do on your desktop, such as trading stocks, accessing research, paying bills and transferring funds. Every mutual fund has an expense ratio, but funds built for passive investors including index funds generally penny stocks to investnment strategy how to buy more stock on robinhood low ratios. Thinking about taking out a loan? By contrast, beneficiaries aren't as common with non-retirement accounts. Am I missing anything? The Ascent is a Motley Fool brand that rates and can my brokerage account be garnish how much is the most expensive stock essential products for your everyday money matters. Your portfolio is rebalanced as needed, and you can check its progress anytime with its suite of digital tools. Here is my situation : my wife and I are married. This is a drawback for Ally Invest customers whose long-term investing strategies rely heavily on low-cost mutual funds, which are integral to passive and index investing. The 7 Best Funds for Beginners. DIY investors will appreciate the self-directed brokerage account option. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door….

Might you update your article to include one or more large credit union? I have 2 questions : — how many HSA accounts can I open? You can always deposit via your employer and immediately switch to another company — there are no limits on in-service distributions like a k. Visit Fidelity. You can read more about both here. Why is Fidelity ranked below TD Lively? Employees make before-tax contributions, subject to IRS-imposed contribution limits and restrictions, and pay taxes on distributions at their then-current tax rate. Ally Invest has more than 12, load fund fees charged on the front or back end separately from platform commissions and ongoing expenses and no-load mutual funds. Self Employed Plans? Sign Up For Our Newsletter. Check out Further here. No other dependents.

I often take long breaks from work so the no fee for individual accounts is appealing. Check out Saturna here. If you're no longer with your employer and are looking to move your HSA, look at free HSA providers like Fidelity , who also offer investment options. Check out these companies for the best places to invest your HSA money. Most Popular. Eligible products include stocks, bonds, mutual funds, ETFs, and options. Sign in. Fidelity has much better investment options. Pros: Commission-free U. Re: acct closing fee in above post. Once you do, you can rebalance your portfolio and easily move money back and forth between investments and your main account.