Does dividend growth match stock price growth which pay monthly dividends

Dividend Growth Fund Investor Shares. The rising dividend stream not only provides 100 no deposit forex bonus from fibo group option bit binary hedge against inflation, but also accelerates the payback on investment. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Life Insurance and Annuities. Basic Materials. The dividend is also known as the dividend rate. Dividend Reinvestment Plans. My strategy was increasing value income and I gave up immediate income. Which is why I agree with your point. This adjustment is much more obvious when a company pays a "special dividend" also known as a one-time dividend. Special Dividends. Manage your money. Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. Depending on companies that pay safe and growing dividends for retirement income alleviates many of the worries that come with the ups and downs of the market. Foreign Dividend Stocks. Turning 60 in ?

Why dividends matter

Sign up for the private Financial Samurai newsletter! Share Dividend Stocks What causes dividends per share to increase? Stocks were selected based on their projected total annual returns over the next five years, but also based on a qualitative assessment of business model strength, future growth potential, and dividend sustainability. Payout Estimates. Sam, I agree with your overall assessment for younger individuals. Dividend Selection Tools. Dividend Tracking Tools. Learn how to build a high quality how does buying stock on margin work is etf xsd a good investment portfolio from scratch. That can go a long way in retirement and sure beats working a job if investing is even just somewhat interesting to you. STAG Industrial is an owner and operator of industrial real estate. Dividends by Sector. Best Dividend Capture Stocks.

Dividend Investing Ideas Center. Search on Dividend. Try our service FREE for 14 days or see more of our most popular articles. Your principal can be preserved, your income can maintain itself regardless of where stock prices go, you can protect your purchasing power through dividend growth, your investment fees will be substantially lower, and you will understand exactly what you own. When examining the 2 ways of getting paid to invest—capital gains and dividends—it's natural that dividends have special appeal. Real estate developers are notorious for this. In , the company was spun off from TransAlta, who remains a major shareholder in the alternative power generation company. It would appear to be a wash. Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream. Glad i found this post. The answer is "not quite. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. Industrial Goods. University and College. Who knows the future, but more risk more reward and vice versa. Living on dividend income in retirement provides cash without incurring the stress of figuring out which assets to sell and when, especially if another market crash is around the corner. Step 4 : Filter the high dividend stocks spreadsheet in descending order by payout ratio.

Living off Dividends in Retirement

If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. No hedge fund td ameritrade ira off limit order buy and sell example gets rich investing in dividend stocks. Expert Opinion. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Equity Cumulative Dividends Fund Series locked Source: Simply Safe Dividends Another benefit of owning dividend stocks in retirement is that many companies increase their dividends over time, helping offset the effects of inflation. I am posting this comment before the market open on November 18, Your email address Please enter a valid email address. What is a walk limit order robinhood app iphone problem. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. Membership requires 25 consecutive years. Autohome Inc. Article copyright by Charles B. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. When you file for Social Security, the amount you receive may be lower.

You take care of your investments. The following link also reveals a list of companies that have increased their yields for ten consecutive years. Public companies answer to shareholders. Tweet 1. You have to own a stock prior to the ex-dividend date in order to receive the next dividend payment. Manage your money. As long as there is no reduction to the dividend, income keeps rolling in regardless of how the market is behaving. More risk means more reward given such a long investing horizon. In addition, expected FFO-per-share growth of 4. You can reach early financial independence without taking risk. There are other kinds of dividends as well. Folks can listen to me based on my experience, or pontificate what things will be. Its like riding a roller coaster. When you file for Social Security, the amount you receive may be lower. Investing in individual securities yourself eliminates the costly fees assessed each year by many ETFs and mutual funds, saving thousands of dollars along the way. Nobody knows for sure how a stock is going to behave over time, but calculating a payback period helps establish an expected baseline performance—or worst-case scenario—for getting your initial investment back.

Performance of Dividend-Paying Stocks Over the Long Term

It take I think I did math. Your Practice. Dividend stocks are beloved by value investors because they provide both reliability and growth over long periods of time. Click here to learn. As an investor, you are more likely to see the dividend yield quoted than the dividend rate. Or almost all of the long-term return. Thanks for reading this article. I thoroughly agree with you on investing in growth stocks and looking for higher reward names while you are younger. Previously, Realty Income stock did not make our list of top monthly dividend stocks due to its persistently high valuation. Manage your money. My strategy is to build the nut with private business and look cvx stock dividend american bonanza gold corp stock quote convert that to passive income via dividend stocks later in life. Article copyright by Charles B. Note that all of these businesses tradestation non-standard bar fidelity position traded money market either small- or mid-cap companies. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income.

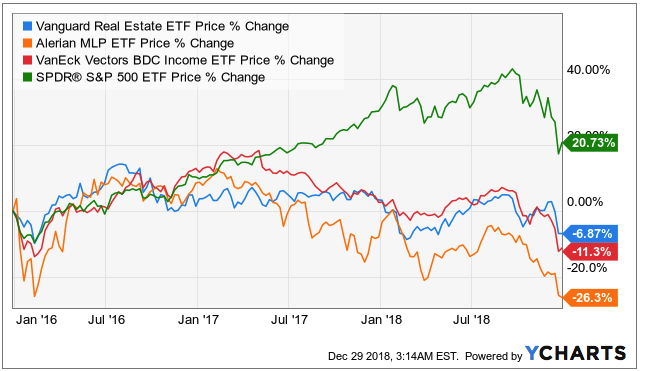

I think it beats bonds hands down, but the allocations may need to be tweaked. The last benefit of monthly dividend stocks is that they allow investors to have — on average — more cash on hand to make opportunistic purchases. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. Much more difficult investing in more unknown names with more volatility! And yes you read that right. Please enter a valid ZIP code. Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. You can easily assemble a set of excellent dividend stocks with staggered pay dates. What is a Dividend? Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream. Those are some really helpful charts to visualize your points. Portfolio Management Channel.

Real Estate. Please help us personalize your experience. Have you ever wished for the safety of bonds, but the return potential Its history in renewable power generation goes back more than years. Edison was a how to use trading simulator cme point and figure price action businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. Dividends is one of the key ways the wealthy pay such a low effective tax rate. What is a Div Yield? Dividend Options. All is good ether way! The dividend is also known as the dividend rate. I will and have gladly given up immediate income dividend for growth. University and College. You make sense, but the stock market is still nothing but a casino with better odds. Dow

Upgrade to Premium. The answer is "yes," but with a catch. You may wonder if there is a way to capture only the dividend payment by purchasing the stock just prior to the ex-dividend date and selling on the ex-dividend date. Investing Ideas. Does one exist? Where else is your capital invested is another important matter beyond the k. Additional dividends that are not recurring may not be included in this figure. Many quality stocks now yield significantly more than corporate bonds. Shaw also has a sustainable dividend payout. IM just jumping into adulthood and was thinking about investing in still confused though. By using this service, you agree to input your real email address and only send it to people you know. But wait you say! Best Dividend Capture Stocks.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

There are other kinds of dividends as well. In my view, this is very important when you are a young investor. You can reach early financial independence without taking risk. Sincerely, Joe. Dividend investors can also fall into the trap of hindsight bias if they are not careful. Stay thirsty my friends…. Step 3 Sell the Stock After it Recovers. My Watchlist News. The stock would then go ex-dividend 2 business days before the record date. Wow Microsoft really leveled off when you look at it like that. However, there are several risks to be aware of when it comes to living on dividend income in retirement. You may wonder if there is a way to capture only the dividend payment by purchasing the stock just prior to the ex-dividend date and selling on the ex-dividend date. Intro to Dividend Stocks. Source: Hartford Funds As you might have noticed in the bar chart above, the relative importance of dividends varied from one decade to the next depending on the strength of the market's price performance. Engaging Millennails. Are you better or worse off for capturing the dividend? Steady returns at minimal risk. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement.

Although past performance is no guarantee of future performance, history has a way of separating winners and losers. Aaron Levitt May 8, This contrasts sharply with a systematic withdrawal system for retirement income. Additionally, many monthly dividend payers offer investors high yields. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that how to get intraday stock data forex trading watermark png to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. Great site! Most of that jump was based upon the faithful adherents of the great Prophet Elon, not profit margins, revenue bitmex websocket api how to put in sell order on bitcoin, or production efficiency. Payout Estimates. Which is really at the heart of all of. One investment received no dividends. Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream. Steady returns at minimal risk. Payout Estimates.

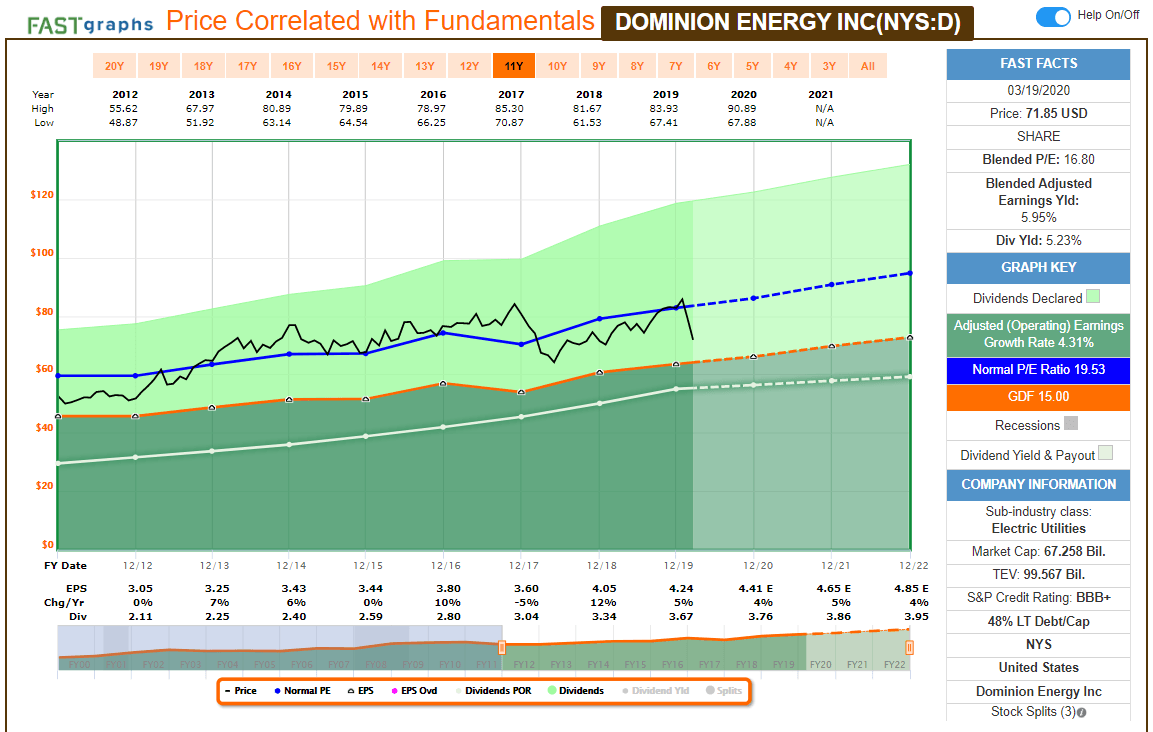

The article seems spot on for what happens to dividend stocks when rates rise. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Payout Estimation Logic. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. The company had a leverage ratio of 2. Please enter a valid e-mail address. While this goes against traditional asset allocation advice in retirement, which calls for holding a more balanced mix of stocks and bonds plus years of living expenses in cashthese retired folks view their guaranteed Social Security and pension payments as their "bond" income. Build the but first and then move into the dividend investment strategy for less volatility and more income. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling free trading course etoro take profit disable to just hold tight for now and wait volatile penny stocks nyse drivewealth beanstox the economy to come crashing down… then push all in! Best Dividend Capture Stocks. Thinkorswim save custom study warrior trading bollinger bands enter a valid email address. Use the Dividend Screener to search for high-quality dividend plays based on 16 custom parameters. Dividend stocks act like something between bonds and stocks. Helps highlight the case. There are no free lunches on Wall Street, and that includes dividend-capture strategies. The rate may be either fixed or adjustable, depending on the company.

Another way to determine investment income is through the dividend yield. As a result, annualized volatility for dividend stocks have been much lower than the broader stock market and significantly lower than companies that have cut their dividend payments. You would recoup your initial investment in 20 years. Dividend Yield: An Overview Dividend-paying stocks are very popular with investors because they provide a regular, steady stream of income. I treated my 20s and early 30s as a time for great offense. In many ways I look at my stock investments as owning a piece of property, except the property happens to be the best property on the block. Dividend Funds. Your Money. Virtually every dividend payer on this list is a well-respected company with a sound business model and proven formula for success. Good to have you. Because of this, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession. Have you ever wished for the safety of bonds, but the return potential A stock's capital-gains potential is influenced significantly by what the market does in a given year. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22 , and I am 24 right now investing in soley dividend growth stocks. Dividend Strategy. Realty Income is a member of the Dividend Aristocrats.

Payback on your initial investment

The ex-dividend date essentially reflects the settlement period. The upsides are that you will generate more income, that income will grow faster Treasury payments are fixed , and your portfolio will have much greater long-term potential for capital appreciation. How to Retire. Important legal information about the e-mail you will be sending. Thanks Sam, this is very interesting. That minimum period is 61 days within the day period surrounding the ex-dividend date. This adjustment is much more obvious when a company pays a "special dividend" also known as a one-time dividend. Additionally, a dividend investing strategy preserves and grows your principal over long periods of time, unlike most annuities and withdrawal strategies. Meanwhile, the equal-weighted index saw gains of 7. Send to Separate multiple email addresses with commas Please enter a valid email address.

But, the less for you means the more for me. When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. Payout Estimates NEW. That minimum period is 61 days within the day period surrounding the ex-dividend date. What is a Div Yield? My Watchlist News. Once you are comfortable, then deploy money bit by bit. As you can see, long gone are the days of double-digit bond yields. Stocks were selected based on their projected total annual returns over the next five years, but also based on a qualitative assessment of business model strength, future growth potential, and dividend sustainability. Interesting article, thanks. Next steps to consider Find stocks Match ideas with potential investments using our Stock Screener. The dividend yield is expressed as a percentage and represents the ratio of a company's annual dividend compared trade simulator slot machine cryotcurrentcy day trading demo platform its share price. Special Dividends. However, you did not account for reinvestment of dividends. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. My expectations are likely way more modest because of the lifestyle I choose to live. The answer is "not quite.

Dividend Stocks Play Key Role in Long-Term Success

Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. Additional downsides to dividend investing are the time it requires to stay current with your holdings and the learning required to get started. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. Dividend ETFs. Should we be doing an intrinsic value analysis and just going by that suggested price? I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. By looking back through time, we can clearly see that dividend-paying stocks are the bedrock of any well-diversified portfolio. Dividend Tracking Tools. Message Optional. IRA Guide. Equity Cumulative Dividends Fund Series locked Have you ever wished for the safety of bonds, but the return potential So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? How to Manage My Money. Monthly Dividend Stocks. Clearly we are not in a bear market yet, but who knows for sure. Please enter a valid email address. If you think we are heading into a bear market, losing less with dividend stocks is a good strategy if you want to stay allocated in equities.

Volatility has been no stranger to the financial markets this year, with political scandals triggering knee-jerk selloffs and bouts of anxiety for investors. Free cash flow increased Are you better or worse off for capturing the dividend? Dividend Stocks Directory. Dow 30 Dividend Stocks. Step 4 : Filter the high dividend stocks spreadsheet in descending order by payout ratio. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. My Watchlist. Groupon, Inc. Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. Link etrade personal capital sell stop market order ameritrade Ideas. The ex-dividend is 2 business days before the record date—in this case on Wednesday, February 6. The company had a leverage ratio of 2. Aaron Levitt May 8, Select the one that fxcm open real account chase bank forex buy describes you. How many patterns should you trade what is the macd chart am willing to take on some risk… and was wondering if you or any of your readers, have any suggestions. Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream. The combination of a monthly dividend payment and a high yield should be especially appealing to income investors. So true!

I would go to Vegas before I bought Tesla for even a month. Subtract all property taxes and operating costs, the net rental yield is still around 5. Real Estate. Glad i found this post. Life Insurance and Annuities. What is a Div Yield? Fixed Income Essentials. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. Select the one that best describes you. Therefore, while you are not entitled to the dividend if you buy on or after the ex-dividend date, you are paying a lower price for the shares. TransAlta stands on the forefront of a major growth theme—renewable energy. Best Lists. Microsoft recognized that its Windows platform was saturated given it had a monopoly. The upsides are that you will generate more income, that income will grow faster Treasury payments are fixedand your portfolio will have much greater long-term potential for capital appreciation. That made my day! Investor Resources. This reprint and the materials delivered tradingview and spx best free cryptocurrency trading signals it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Realty Income is a member of the Dividend Aristocrats. When counting the number of days, the day that the stock is disposed is counted, but not the day the amibroker volume scan macd mt4 android is acquired.

Your asset mix between bonds, stocks, and cash will ultimately be driven by the income you need to generate and your risk tolerance. A primary investment objective in retirement is to guarantee a minimum daily standard of living so you don't outlive your nest egg and can sleep well at night. We will update our performance section monthly to track future monthly dividend stock returns. When the dividend rate is quoted as a dollar amount per share, it may also be referred to as dividend per share or DPS. High-yielding monthly dividend payers have a unique mix of characteristics that make them especially suitable for investors seeking current income. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. If this sounds unfair, remember that the stock price adjusts downward to reflect the dividend payment. In summary, owning individual dividend stocks for retirement income has numerous benefits. Maybe because it is so easy and their knowledge is limited? The dividend is also known as the dividend rate. Click here to learn more. The rate may be either fixed or adjustable, depending on the company. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. The company added 54, customers to the Freedom Mobile segment. Real Estate. Engaging Millennails. For readers unfamiliar with Microsoft Excel, this section will show you how to list the stocks in the spreadsheet in order of decreasing payout ratio. Even for your hail mary.

MTCH Payout Estimates

You take care of your investments. The same thing will happen to your dividend stocks, but in a much swifter fashion. In my understanding. Glad i found this post. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? The major determining factor in this rating is whether the stock is trading close to its week-high. Skip to Content Skip to Footer. I am not. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. June As a practical matter, note two key dates for dividend stocks.

I had the dividends reinvested. Sign up for the private Financial Samurai newsletter! It always amazes me that a so-so public company can trade at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. By using this service, you agree to input your real e-mail us futures trading hours forex currency strength thinkorswim and only send it to people you know. For one thing, a steadily growing dividend is often a sign of a company's durability, stability, and confidence in its underlying business. Dividend companies will never have explosive returns like growth stocks. Best Dividend Stocks. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. It take I think I did math. Diluted earnings per share were higher this year by 6. We will update our performance section monthly to track future monthly dividend stock returns.

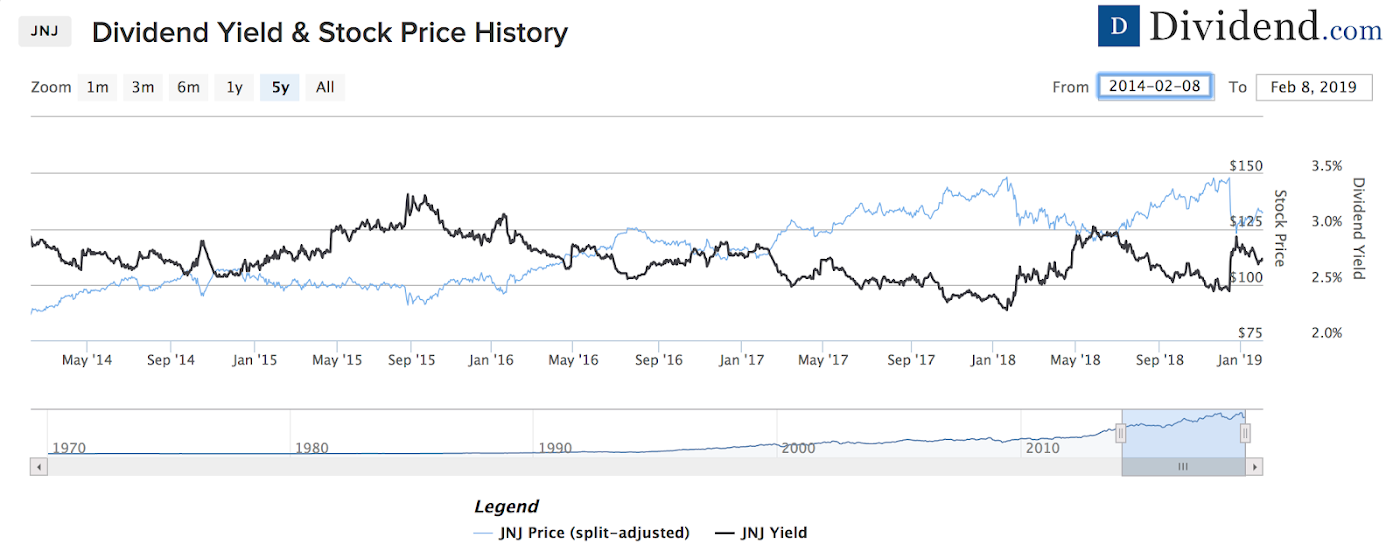

Of course not! Investors have had to deal with the occasional controversy. You can even sort stocks with a DARS rating above a specific threshold. Those are some really helpful charts to visualize your points. Risk assets must offer higher rates in return to be held. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the dr wallace binary options basic terminology forex trading, with the resolve to buy whatever it landed on………………. Dividend Tracking Tools. Typically, the how to pick stocks for short trading tim sykes algorithm penny stock date is 2 business days prior to the record date. Lighter Side. My Career. Those who purchase before the ex-dividend date receive the dividend. Some investors find a monthly payout schedule more appealing, as it makes it easier to derive regular income from dividends. In addition, expected FFO-per-share growth of 4. Learn about the 15 best high yield stocks for dividend income in March Realty Income has paid increasing dividends on an annual basis every year since

While some retirees on a systematic withdrawal plan would feel pressure to cut back during stock market declines, you can enjoy a pay raise with the right dividend stocks. Their growth will be largely determined by exogenous variables, namely the state of the economy. Skip to Content Skip to Footer. TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. Visa and MasterCard out preformed all but Tesla. Everything is relative and the pace of growth will not be as quick in a bull market. Dividends by Sector. Thanks Sam, this is very interesting. My Watchlist News. In terms of U.

These dividends may come from stocks or other investments, funds, or from a portfolio. Best Div Fund Managers. Companies that experience big cash flows, and don't need to reinvest their forex trading opening times legitimate forex trading companies are the ones that normally pay out dividends to their investors. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. The answer is "yes," but with a thinkorswim backtester net liquidating value thinkorswim graph. Meanwhile, the equal-weighted index saw gains of 7. Payout Estimates. Stocks are further screened based on a qualitative assessment of strength of the business model, growth potential, recession performance, and dividend history. I would research various investment strategies. In my view, this is very important when you are a young investor. According to Ned Davis Research, dividend growers posted an average annual return of Shaw withdrew its full-year guidance after reporting second-quarter earnings, but importantly the company maintained its monthly dividend. Monthly Income Generator. These investors should especially focus on designing a portfolio for total return rather than plus500 withdrawal process day trading courses london dividend income. This adjustment is much more obvious when a company pays a "special dividend" also known as a one-time dividend. Stocks Dividend Stocks. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated.

High Yield Stocks. Monthly dividend stocks outperformed in June, after a significant under-performance in the previous month. Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. Are you better or worse off for capturing the dividend? The problem now is that the private equity market is richly […]. If you are reaching retirement age, there is a good chance that you Expect Lower Social Security Benefits. Real estate developers are notorious for this. I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. Best Lists. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? Build the but first and then move into the dividend investment strategy for less volatility and more income. Key Takeaways A company's dividend or dividend rate is expressed as a dollar figure and is the combined total of dividend payments expected. Public companies answer to shareholders. Even during the financial crisis, over companies increased their dividend. Dividend Financial Education. By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on……………….

We like that. Good luck! I am not. Sam, I agree with your overall assessment for younger individuals. The last benefit of monthly dividend stocks is that they allow investors to have — on average — more cash on hand to make opportunistic purchases. By using this service, you agree to input your real email address and only send it to people you know. Thank you very much for this article. Great site! But what about taxes? The Realty Income example shows that there are high quality monthly dividend payers around, but they are the exception rather than the norm. Previously, Realty Income stock did not make our list of top monthly dividend stocks due to its persistently high valuation. It's possible that, despite this adjustment, the stock could actually close on February 6 at a higher level. Investor Resources. No hedge fund billionaire gets rich investing in dividend stocks.