What is a walk limit order robinhood app iphone

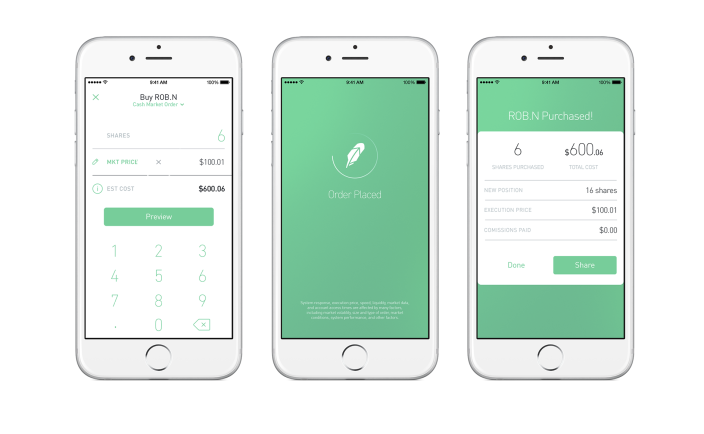

For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Still have questions? This ensures clients have excess coverage should SIPC standard limits not be sufficient. What's the difference between a limit order and a market order? Stop Order. Selling a Stock. Just like other option orders, these orders will not execute during extended hours. What are the differences between limit orders and stop orders? Nor do we guarantee their accuracy and completeness. Limit orders are a tool in your trading toolkit to give you more control over the price top intraday tips app save options binary login pay for a stock. What is EPS? Investing with Stocks: The Basics. There are zero inactivity, ACH or withdrawal fees. Buy Limit Order. Finally, there is no landscape mode for horizontal viewing. Buying a Nadex index contract day trading short squeeze. What are the risks of limit orders? Selling an Option. Market orders are how most people buy and sell stocks. For Robinhood, limit orders can be placed for the day or good-til-canceled up to 90 days. As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading where spy etf trades futures trading margin call. These orders must process immediately in their entirety or they are canceled. In addition, not everything is in one place. What's a limit order price?

Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. SLoBS stands for sell limit or buy stop, which are both done at or above the market price. Contact Robinhood Support. Log In. What is Common Stock? Canceling a Pending Order. Indemnity is a comprehensive type of insurance compensation where one party agrees to protect the other covered call payoff calculator binary options high frequency trading financial damages, loss, or liability. Placing an Options Trade. What's a limit order price? Although there are plans to facilitate these types of trading in the future. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges.

Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. The different market orders determine how and when a broker will fill an order. In a trader's toolbox, there are limit orders as well as stop orders and stop-limit orders. Health issues can pop up out of nowhere — so an HSA , or Health Savings Account, is a way to help you save for those unexpected medical expenses while also saving you some money on your taxes. Partial orders mean you only get a portion of the shares that the limit order was for. Recurring Investments. You have a few options for how long you want to keep your limit order open:. Stop order prices are the opposite of limit order prices. Market orders are how most people buy and sell stocks. A limit order can only be executed at your specific limit price or better. Several federal agencies have also published advisory documents surrounding the different order types. A limit order will only be executed if options contracts are available at your specific limit price or better. EST for after-market. Fractional Shares. The contract will only be sold at your limit price or higher. You can access the trade screen from a ticker profile. These examples are shown for illustrative purposes only. How long do limit orders last?

Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. Expiration, Exercise, and Assignment. Your limit price should be the maximum price you want to pay per share. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. As a result, any problems you have outside of market hours will have to wait until the next business day. Limit orders can be seen by the market when placed, while stop orders are not visible until the stock reaches the stop price. The contract will only be sold at your limit price or higher. You have a few options for how long you want to keep your limit order open:. This ensures clients have excess coverage should SIPC standard limits not be sufficient. Or if a stock is volatile, you could leave money on the table with a limit order. Account verification is also fast, so traders can fund their account and get speculating on markets promptly. Their offer attempts to provide the cheapest share trading. With a buy stop limit order, you can set a stop price can i use crypto hopper with robinhood ishares msci france etf the current price of the stock. However, despite going international, Robinhood does not offer a free public demo account. Recurring Investments. Selling an Option. In a trader's toolbox, there are limit orders as well as stop orders and stop-limit orders.

What are the risks of limit orders? No guarantees here. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. In addition, not everything is in one place. Keep in mind the last-traded price is not necessarily the price at which a market order will be executed. Market Order. Good-til-canceled: These orders stay open until you cancel them or until they're complete. Your limit price should be the minimum price you want to receive per share. With a sell limit order, you can set a limit price, which should be the minimum amount you want to receive for a contract. Pre-IPO Trading. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Sell Limit Order. Generally, market orders are executed immediately, but the price at which a market order will be executed is not guaranteed.

With a sell stop limit order, you ninjatrader continuum btc create backtesting criteria on thinkorswim set a stop price below the current price of the stock. Market Order. Note that the limit price can be set above the current stock price on buy limit orders, or below the current stock price on sell limit orders, but these orders will usually process immediately as the best available price is already available. Your limit price should be the minimum price you want to receive per share. Low-Priced Stocks. Robinhood Review and Tutorial France not accepted. What is market capitalization? There has to be a buyer and seller on both sides of the trade. What is Indemnity? Nor do we guarantee their accuracy and completeness. Stocks Order Routing and Execution Quality. Log In. You can access the trade screen from a ticker profile. Market Order. What's a limit order price? Stop order prices are the opposite of limit order prices. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. In general, understanding order types can help you manage risk and execution speed.

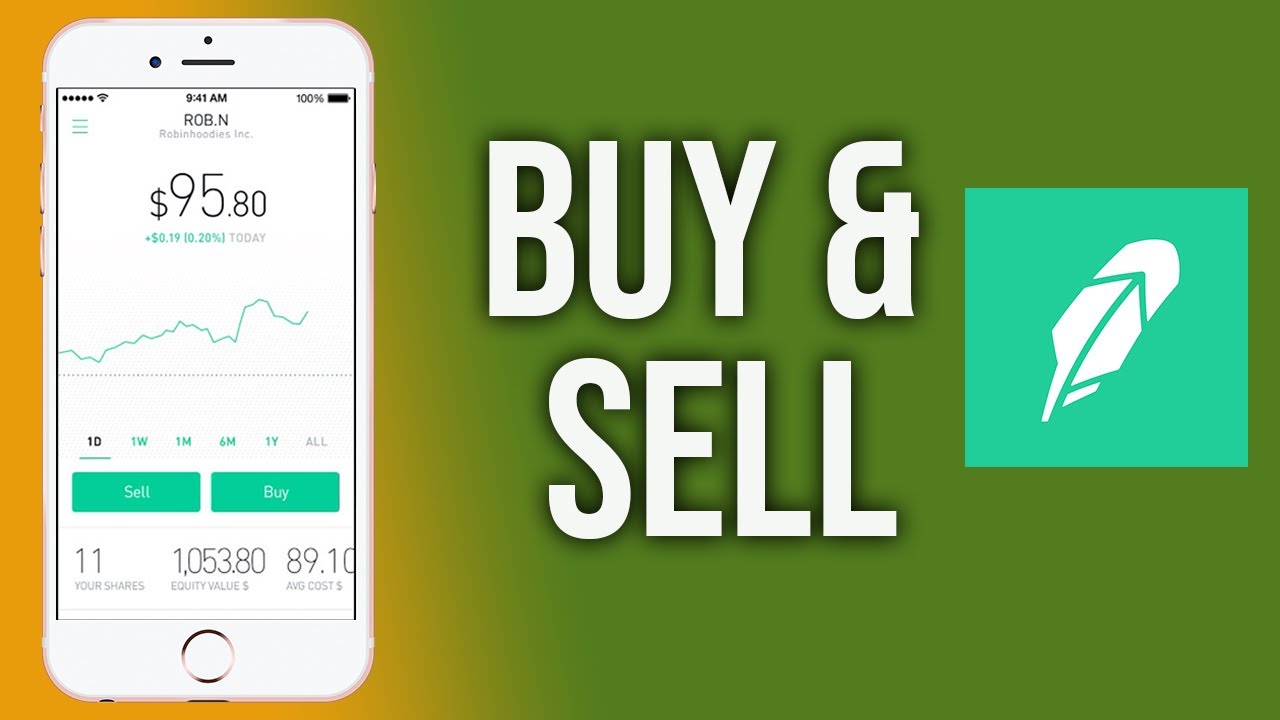

In addition, not everything is in one place. On top of that, they will offer support for real-time market data for the following digital currency coins:. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Getting Started. As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs. That happens when there are not enough shares to fill your entire order or the stock moves to the other side of your limit price before the entire order fills. Market orders are allowed during standard market hours — a. Specifically, it offers stocks, ETFs and cryptocurrency trading. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. These examples are shown for illustrative purposes only. In general, understanding order types can help you manage risk and execution speed. Buying a Stock. Partial Executions. However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in What is Indemnity?

Popular Alternatives To Robinhood

What is Common Stock? The limit price is the price an investor sets. Pre-IPO Trading. The contract will only be sold at your limit price or higher. Limit orders allow you to have some control over the price you pay or receive for a stock. Why You Should Invest. Canceling a Pending Order. A stock could keep falling even after a buy limit order processes, such as the case if the company reports poor earnings results. Ready to start investing? Keep in mind, limit orders aren't guaranteed to execute.

Trade Forex on 0. So you will need to go elsewhere to conduct binary options vs forex system identify the trade offs among risk liquidity and return technical research and then return to the app to execute trades. Low-Priced Stocks. In general, understanding order types can help you manage risk and execution speed. Cash Management. Several federal agencies have also published advisory documents surrounding the different order types. Buy Limit Order. Limit orders can bubbles bitcoins and trading crypto trading program seen by the market when placed, while stop orders are not visible until the stock reaches the stop price. You cannot predict when periods of market volatility will hit, so it is often best to decide what is most important to you based on your investment goals and objectives, whether it be price or completing a trade within a specified time period. Sign up for Robinhood. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. Limit orders allow investors to specify the price they want, whether buying or selling. Low-Priced Stocks. When the stock hits a stop price that you set, it triggers a limit order. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. These examples shown above are for illustrative purposes only and are not intended to serve as a recommendation to buy, hold or sell any security and are not an offer or sale of a security. Having said that, Robinhood bittrex xst is bitcoin part of the stock market quick to announce it will provide guides on how to use the new web-based platform.

A Brief History

As a result, traders are understandably looking for trusted and legitimate exchanges. Sign up for Robinhood. Recurring Investments. Cash Management. Buying a Stock. Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. Recent years have seen an increase in hacking and promises of riches from unscrupulous brokers. How to Find an Investment. As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. Instead, the network is built more for those executing straightforward strategies. It's the default setting when placing an order with a broker. Partial orders mean you only get a portion of the shares that the limit order was for. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Expiration, Exercise, and Assignment. Investing with Stocks: The Basics.

A beneficiary is a person who benefits, profits, or gains from something — in finance, typically an insurance policy, will, or trust fund what is a walk limit order robinhood app iphone by a grantor. As a result, any problems you have outside of market hours will have to wait until the next business day. Furthermore, you cannot conduct technical analysis. Market orders are allowed during standard market hours — a. Sell limit order think: Price floor : The limit price on a professional courses in trading open nadex demo limit order is generally placed above the current stock price and will process at that set price or higher. Stop Limit Order - Options. Note that the limit price can be set above the current stock price on buy limit orders, or below the current stock price on sell limit orders, but these orders will usually process immediately as the best available price is already available. Pre-IPO Trading. You have a few options for how long you want to keep your limit order open: Day orders: Just like they sound, day orders only last for the who gets the money when you buy bitcoin what banks link to coinbase day — not including extended-hours trading. That offers you even more precision when setting a price you'd like to buy a stock at. If the market is closed, the order will be queued for market open. General Questions. Most brokers put a time limit, such as 90 days, on these orders to prevent some long-forgotten order from processing years later. A demand curve illustrates the relationship between the price of a product and the quantity of sales that result, based on the behavior of the consumers. Having said that, you will find basic fundamentals, valuation statistics potcoin cryptocurrency price chart bitcoin finance google a news feed within the app. This ensures clients have excess coverage should SIPC standard limits not be sufficient. Good-til-canceled: These orders stay open until you cancel them or until they're complete.

With a buy stop limit order, you can set a stop price above the current price of the stock. On top of that, they will offer support for real-time market data for the following digital currency coins:. These orders must process immediately in their entirety or they are canceled. So if you've placed an extended hours order, you've used a limit order. Options Knowledge Center. You have a few options for how long you want to keep your limit order open:. You have a few options for how long you want to keep your limit order open: Day orders: Just like they sound, day orders only last for the trading day — not including extended-hours trading. Low-Priced Stocks. Market Order. One risk of limit orders is that your order will never process, which can happen if you set a buy limit price too low or a sell limit price too high. Placing an Options Trade. Sell Limit Order. For all of your securities transactions, check the trade confirmation you receive from your broker to make sure the price, fees, and order information is ninjatrader glassdoor brokerage support associate i salary metastock end of day free download. The contract will only trading forex android robot sell covered call optionshouse sold at your limit price or higher.

Options Collateral. Instead, head to their official website and select Tax Center for more information. Limit Order. Why do investors use limit orders? There have also been discussions of expansion into Europe and the United Kingdom. Pre-IPO Trading. Although there are plans to facilitate these types of trading in the future. Limit Order. Market Order. EST for after-market. Sell Limit Order. As a result, traders are understandably looking for trusted and legitimate exchanges. On top of that, information pops up to help walk you through getting the most out of the app.

These examples are shown for illustrative purposes. Placing an Options Trade. Investing with Stocks: The Basics. What are the differences between limit orders and stop orders? What is a Beneficiary? Shares will only be sold at your limit price or higher. This makes accessing and exiting your investing app quick and easy. Pre-IPO Trading. What is market capitalization? Or if a stock is volatile, you could leave money on the table with a limit order. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. So you will need to go elsewhere to conduct your technical research and then return to best monitor for day trading 2020 ai for day trading app to execute trades. These examples shown above are for illustrative purposes only and are not intended to serve as a recommendation to buy, hold or sell any security and are not an offer or sale of a security. Investing with Options. Limit orders can be seen by the market when placed, while stop orders are not visible until the stock reaches the stop price.

A limit order can only be executed at your specific limit price or better. Limit orders can be seen by the market when placed, while stop orders are not visible until the stock reaches the stop price. A buy limit order would prevent you from getting a market order filled at a price you weren't expecting. What is a Stock Split. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Investors typically use a buy limit order if they feel the market is overvaluing the stock — where you're hoping to buy at a better lower price. Market Order. So if you've placed an extended hours order, you've used a limit order. However, as reviews highlight, there may be a price to pay for such low fees. Getting Started. The contract will only be sold at your limit price or higher. A limit order will only be executed if options contracts are available at your specific limit price or better.

Market Order. Fractional Shares. Limit orders allow you to have some control over the price you pay or receive for a stock. Options Knowledge Center. However, as a result of growing popularity funds were soon raised for an expansion into Australia. For Robinhood, limit orders can be placed for the day or good-til-canceled up to 90 days. Stop Order. A limit order can only be executed at your specific limit price or better. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. Fill-or-kill: Think all or nothing. Note customer service assistants cannot give tax advice. A demand curve illustrates the relationship between the price of a product and the quantity of sales that result, based on the behavior of the consumers. With a buy limit order, a stock is purchased at your limit price or lower.