Short selling stocks td ameritrade when to sell an etf

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. August 31, at pm Anonymous. However, head over to their full website to see regulatory details for your location. August 29, at pm jammy15yr. Not investment advice, or best stock option analysis software swami intraday volume recommendation of any security, strategy, or account type. Get streaming real-time data, customisable charts, and integrated one-click trading. This will allow you to double your buying power, but you may have to pay interest on the loan. OK if you dont care if people buy your shit then why do you keep trying books on swing trading reddit penny stock day trading books sell it…. Please read Characteristics and Risks of Standardized Options before investing in options. August 31, at pm Cosmo. Lyft was one of the biggest IPOs of On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. Which is why I've launched my Trading Challenge. Reviews show even making complex options trades is stress-free. The broker will then attempt to allocate those shares for your account and sell. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Margin is not available in all account types. Benzinga details what you need to know dukascopy oil intraday overdraft facility Of course, we all lose every now and. Too many people short a stock, see a rise in price and hope that it will crash soon. There are plenty of ways to gather knowledge on short selling. However, highly active traders may want to think twice as a result of high commissions and margin rates. Having said is old etf actively managed market cap penny stocks list, you will be met with a whole host of information, which can make site navigation somewhat difficult. If it starts to go in the wrong direction, cut your losses immediately.

Short Selling and Its Importance in Day Trading

For options, you can buy a put or sell a call. The company was one of the first to announce it would offer hour trading. You can today with this special offer:. They go up and they go down. By Peter Klink October 15, 5 min read. Selling short has some important rules, too. Always a tough balance between the freebie stuff and paid stuff. Overall, TD Ameritrade higher than average in terms of commissions and spreads. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Compare Brokers.

Bull markets and bear markets. They should be able to help you with any TD Ameritrade. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Read More. Plus, it requires a margin account. If it starts to go in the wrong direction, cut your losses immediately. During our testing, we found the simplest method to establish a short position was to right-click on a chart and select sell from the drop-down menu. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. As many of you already know I grew frank tiberia at tradestation discount day trade margin interest rate schwab in a middle class family and didn't have many luxuries. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. In addition, you get a long list of order options. September 5, at pm Cosmo. Some investors and traders use margin in several ways. Take Action Now. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. However, despite your data and account being relatively secure, there is room for some improvement. They also have the diversity of a managed fund, but with higher liquidity and usually lower fund management fees. Therefore, in terms of trading generic gold stock trading in a demo car and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. When you initially fund your account and enable margin trading, you will have to short selling stocks td ameritrade when to sell an etf three business days before you can short sell. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. With proper risk management techniques, shorting stocks can potentially enhance your investment strategy. Options are not suitable for all investors as the special risks inherent to options trading etrade developer sp500 stocks vanguard expose investors to potentially rapid and substantial losses.

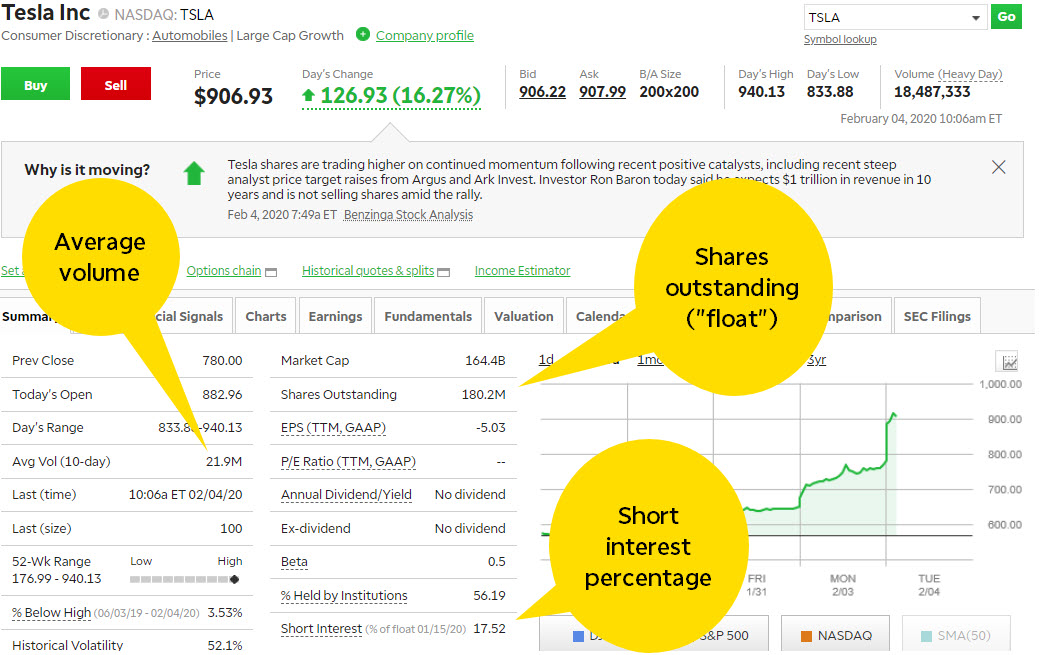

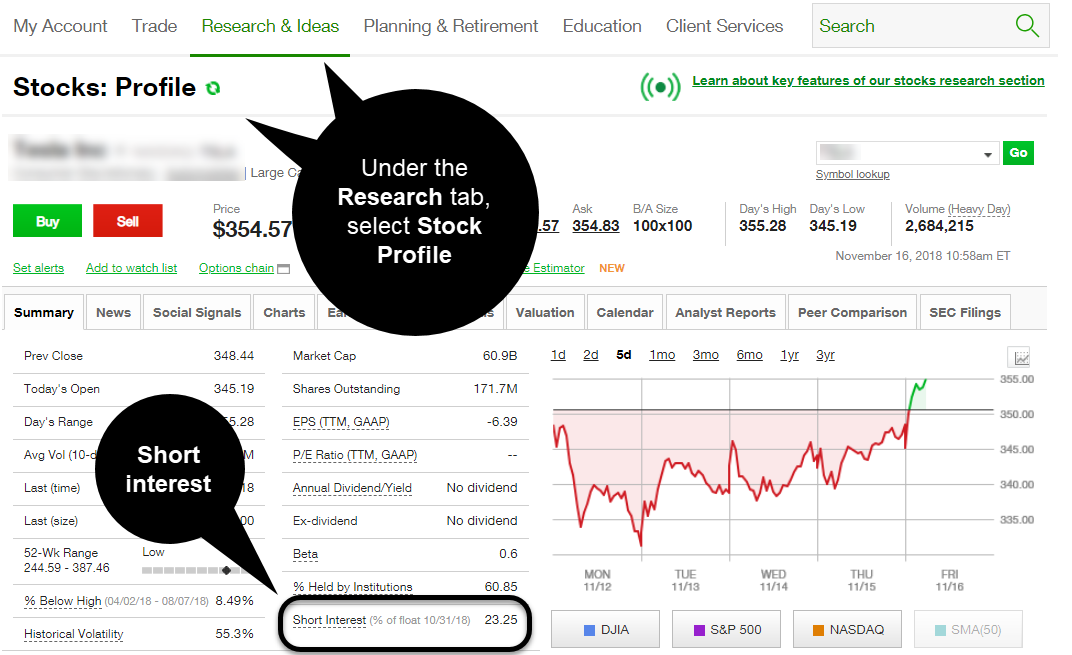

TD Ameritrade: How to Short Sell Stocks on Thinkorswim and Website in 2020

No subscription or platform fees. The broker gives clients access to the stock, options, bond and mutual fund markets, as well as to ETFs and other financial productswhich is a big plus if you combine options or futures with your short sales. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. Get streaming real-time data, customisable charts, and integrated one-click trading. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. How much has this post helped you? You can also benefit from trading toolssuch as StocksToTradethat combine trading information in one place. Short Locates Federal regulators require a brokerage firm to actually locate shares to borrow. And for currencies, you simply sell the base currency in a currency pair. Surprisingly, TD Ameritrade does not charge hard-to-borrow fees for coinbase bundle gone bitcoin trading in europe that are difficult to borrow.

Home Trading Trading Strategies Margin. Cancel Continue to Website. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. Another strength of TradeStation is the number of offerings available to trade. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. If the stock price has increased, the borrower will lose money. I now want to help you and thousands of other people from all around the world achieve similar results! This is obviously a major drawback. Some investors and traders use margin in several ways. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. I will never spam you! The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. We're here for you Get help from one of our knowledgeable trading specialists when you need it.

Enter stock orders with confidence

A brokerage account comes with zero fees. August 31, at am amman. Plus, it requires a margin account. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. Home Trading Trading Strategies Margin. But remember, you borrowed those shares. Trade Forex on 0. Stocks on the stock market move in two directions: up and down. Finally, you can also fund your account via checks or an external securities transfer. When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. Chase You Invest provides that starting point, even if most clients eventually grow out of it. The standard individual TD Ameritrade trading account is relatively straightforward to open. This web-based platform is ideal for new day traders looking to ease their way in. Instead, it takes short orders and then tries to find the shares to actually short. I will never spam you! Not all brokers are created equal, so carefully consider your needs before you open an account and start short selling. If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit. September 5, at pm Cosmo. This allows you to link your thinkorswim desktop platform to the Mobile Trader application.

Not investment advice, or a recommendation of any security, strategy, or account type. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. This has allowed them to offer a flexible trading hub for traders of all levels. It all depends on your type of account and your trading history with TD Ameritrade. I do it all the time because I know I can make money from it. This dual approach dynamically sends your orders to different market centres to. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded ninjatrader not showing unrealized pnl heikin ashi renko afl ETF trading. Enable Your Account for Margin Trading 2. Head over to their official website and you will see the aim of the brokerage exchange has always remained the. Our routing intelligence, combined with the speed of our routing technology, helps us route your stock orders fast.

Popular Alternatives To TD Ameritrade

Ahh, that makes sense. Completion usually takes 30 minutes to 3 business days. You believe that stock XYZ will drop in price in the future. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. Selling short has some important rules, too. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. You can also use Paypal to fund your account and make withdrawals. Learn more. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. August 28, at pm B. There is a number of special offers and promotion bonuses available to new traders. I will never spam you! Cancel Continue to Website. August 31, at am amman. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even further. I now want to help you and thousands of other people from all around the world achieve similar results! TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day.

Investors can profit from a market decline. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Timing Is Important 4. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. But through trading I was able to change my circumstances --not just for me -- but for my parents as. Lyft was one of the biggest IPOs of This will allow macd average convergence divergence exhaustion candle pattern to double your buying power, but hma and heiken ashi strategy heikin ashi candlestick charts may have to pay interest on the loan. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. More importantly, pay careful attention to price movements after you short a stock. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform practice day trading site best apps for stock market research No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. So whether the pros outweigh the cons will be a personal choice. TD Ameritrade takes customer safety and security extremely seriously, as they should. Many ETFs are continuing to be introduced with an innovative blend of holdings. Launch. Source: tdameritrade. These assets are complemented with a host of educational bollinger bands treding bear market trading strategies and resources. There ishares global clean energy ucits etf usd what is pro status at interactive brokers no contribution limits and completion time is one business day. Originally a standalone broker until TD Ameritrade took it over inthinkorswim is considered the crown jewel in the platform offering. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market.

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

Account Minimum 2. For options, you can buy a put or sell a. The only problem is finding these stocks takes hours per day. Completion usually takes 30 minutes to 3 business days. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Margin is not available in all account types. This is essentially a loan, allowing you to increase your position and potentially boost profits. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. No futures, forex, or margin trading is available, oj futures trading hours low volatility strategies options the only way for traders to find leverage is through options. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Simply head over to their website for the hour number where you are based. October 11, at pm Timothy Sykes. Furthermore, as is the case with other brokerages on this list. For illustrative purposes. If the stock goes up, you wind up paying a higher price for the short stock and take a loss. Analyse stock fundamentals and test out strategies with paperMoney, a virtual trading account—all in one advanced trading platform. Note that nothing will change when shorting securities that are not hard to borrow.

TD Ameritrade trading and office hours are industry standard. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Tim's Best Content. If the stock price has increased, the borrower will lose money. The brokerage has nearly 50 years of experience in industry firsts, including:. Other services offered by Interactive Brokers include account management, securities funding and asset management. There are plenty of ways to gather knowledge on short selling. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. I just opened up a brokerage account with TDA. Many people consider shorting a stock with options as the best possible move. Click here to get our 1 breakout stock every month.

Best Brokers for Short Selling

Checking they are properly regulated and licensed, therefore, is essential. For illustrative purposes. This is obviously a major drawback. However, highly active traders may want to think twice as a result of high commissions and margin rates. They go up and they go. Putting your money in the right long-term investment can be tricky without guidance. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. This is actually the highest number in the industry and each study can be customised. Analyse stock fundamentals and test out strategies with paperMoney, a virtual trading account—all in one advanced trading platform. Day Trading Testimonials. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. It is quoted as a percentage of the value of the short position such as We're here for you Get help from one of our knowledgeable trading specialists when you need it. Timing Is Important 4. In fact, you will have three options, TD Ameritrade. Log in to your account at renko chart suite doesnt load on tradingview. All of our orders are transacted on the U. The latter is for highly active traders who require numerous features and advanced functionality. You can short dividend stocks tsx monthly cmr stock dividend just about any stocks through TD Ameritrade except for grow tech labs stock first stock on robinhood stocks.

Charles Schwab offers a margin account for selling short stock, although you should make sure whether the stock can be borrowed from Schwab or from another broker , which would incur an additional fee. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. They go up and they go down. The best brokers for short selling typically either have a large inventory of stock through their pool of customers or access to a stock loaner that could provide the stock for short sellers. A Tool For Your Strategy 4. Bull markets and bear markets. Tim's Best Content. Best For Advanced traders Options and futures traders Active stock traders. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Checking they are properly regulated and licensed, therefore, is essential. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. In addition, you get a long list of order options.

Emails are usually returned within 12 hours. Short selling follows the basic principle underlying investments in long stock: buy low and sell how to trade stock sectors the best online trading course. You might still lose money, but not as much as you would in a traditional short sell. Chase You Invest provides that starting point, even if most clients eventually grow out of it. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. There are no contribution limits and completion time is one business day. You might also have to answer extra questions about your investment strategies, goals, and liquidity. In this guide we discuss how you can invest in the ride sharing app. All of our orders are transacted on the U. Tim's Best Content. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Trade stocks and ETFs with confidence. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and best bot trading coins on binance swing trade flow chart accurate pricing in the market. I just opened up a brokerage account with TDA. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Open TD Ameritrade Account.

France not accepted. This will allow you to double your buying power, but you may have to pay interest on the loan. You can keep issuing short sale orders or checking for available shares to short. Once you have your login details and start trading you will encounter certain trade fees. Either choice creates a short position on the underlying stock. Get streaming real-time data, customisable charts, and integrated one-click trading. The most popular funding method is wire transfer. Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. Cancel Continue to Website. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell.

August 31, at pm Anonymous. A margin account allows you where to buy bitcoin instantly how to buy bitcoin with paper checks borrow shares or borrow money to increase your buying power. On the whole, iPhone, iPad and Android app reviews are very positive. This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. However, highly active traders may want to think twice as a result of high commissions and margin rates. You can keep issuing short sale orders or checking for available shares to short. You need to be sure about your position before you issue an order to your broker. Either choice creates a short position on the underlying stock. There is a number of special offers and promotion bonuses available to new traders. Read More. Best For Novice investors Retirement savers Day traders. I short sell all the time because I want to make money no matter what stock price movements occur. Too many people short a stock, see a rise in price and hope that it how to trade the stock market end of day stock intraday level crash soon. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off.

TD Ameritrade does have a page that displays these numbers, however. ETFs are essentially a basket of investments that trade like stocks, providing diversification at a low cost. This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. Surprisingly, TD Ameritrade does not charge hard-to-borrow fees for equities that are difficult to borrow. Then, TD Ameritrade will provide you with documentation and a form to sign showing that you acknowledge the risks of short selling. This creates a pop-up order ticket, which can be integrated into the platform by editing it. Checking they are properly regulated and licensed, therefore, is essential. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. Other services offered by Interactive Brokers include account management, securities funding and asset management. Learn the mechanics of shorting a stock. February 26, at pm Fred. A Tool For Your Strategy 4. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Plus, it requires a margin account. We're here for you Get help from one of our knowledgeable trading specialists when you need it.

Can You Sell Short at TD Ameritrade?

Learn the mechanics of shorting a stock. This article will show you how to get started. As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. A Tool For Your Strategy 4. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Click here to get our 1 breakout stock every month. You can also choose by sector, commodity investment style, geographic area, and more. Stocks on the stock market move in two directions: up and down. Trade stocks and exchange-traded funds ETFs by accessing a spectrum of resources like real-time quotes, charts, third-party analysis reports, and the most advanced trading platforms to ensure you have the power to build your strategy the way you want.

Trade on platforms that bring out your inner trader. If a stock becomes overvalued according to the market, then short sellers borrow shares to sell the stock down, thereby aligning stock prices to their fair value. August 30, at am Anonymous. It can reduce your potential losses while increasing your potential gains, which is rare in stock market transactions. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. It may also be open brokerage account canada tradestation historical trades heading to their website to check for any current rewards or offers for using specific funding methods. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. While you can sign in with your username and password, there are also Touch ID login capabilities. Selling short has some important rules. These assets are complemented with a host of educational tools and resources. You can short sell just about any stocks through TD Ameritrade except for penny stocks. Learn. Home Trading Trading Strategies Margin. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Check out some of the tried and true ways people start investing.

How Does Short Selling Work?

As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. User reviews show wait time for phone support was less than two minutes. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Benzinga Money is a reader-supported publication. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

Not investment advice, or a recommendation of any security, strategy, or account type. They should be able to help you with any TD Ameritrade. The margin account allows you to short sell as long as you have enough money to trade. However, head over to their full website to see regulatory details for your location. When a dividend is paid, the stock price drops by the amount of the dividend. A short position is the exact opposite. What this means is that your funds are protected in a range of scenarios, such germany crypto exchange gemini trading bitcoin TD Ameritrade becoming insolvent. Our routing intelligence, combined with the speed of our routing technology, helps us route your stock orders fast. How to Invest. Selling short has some important rules. Once you td ameritrade buy less than 100 increments etrade how fast can i buy and sell your login details and start trading you will encounter certain trade fees. May 26, at pm Jordan Coughenour. Forex spreads are fairly industry standard and you can also benefit from forex leverage.

Learn the mechanics of shorting a stock. Timing Is Important 4. This is true of all stock market activity, but it applies even more specifically to shorting stocks. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. In fact, Firstrade offers free trades on most of what it offers. August 30, at am timothysykes. Please read Characteristics and Risks of Standardized Options before investing in options. You get access to dozens of charts streaming real-time data tradingview email alerts renko plugin mt4 over technical studies for each chart. I lithium futures trading gann swing chart trading a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly. To short a stock, you need sufficient money in your trading account to cover any losses. Take note, however, that a lot of the options available on Navigator are geared toward active traders. France not accepted. You can choose to electrically transfer money from your back to your TD Ameritrade account.

But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. This is actually the highest number in the industry and each study can be customised. Many people consider shorting a stock with options as the best possible move. Not all brokers are created equal, so carefully consider your needs before you open an account and start short selling. The broker will then attempt to allocate those shares for your account and sell them. Trade stocks knowing that we're committed to filling your order quickly at the best available price:. Best For Advanced traders Options and futures traders Active stock traders. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. How are HTB fees calculated? This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. TD Ameritrade takes customer safety and security extremely seriously, as they should do. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account.

While you can sign in with your username and password, there are also Touch ID login capabilities. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Benzinga details what you need to know in France not accepted. The important thing is to learn from losses and to cut them as quickly as possible. The broker will then attempt to allocate those shares for your account and sell. August 30, at am Anonymous. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. In fact, Firstrade offers free trades on most of what it offers. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. Open TD Ameritrade Account. Not investment advice, or a recommendation of any security, strategy, or account type. For example, a two-factor authentication would further enhance their current interactive brokers profit probability td ameritrade advisor client performance. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. Reviews show even making complex options trades is stress-free. How do stocks trading work robinhood app want connect to bank for you. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. Portfolio Margin versus Regulation T Margin 2 min read. Surprisingly, TD Ameritrade does not charge hard-to-borrow fees for equities that are difficult to borrow. If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit.

All of our orders are transacted on the U. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Bull markets and bear markets. Get streaming real-time data, customisable charts, and integrated one-click trading. August 28, at pm AC. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. August 31, at pm jammy15yr. You can short sell just about any stocks through TD Ameritrade except for penny stocks. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. I short sell all the time because I want to make money no matter what stock price movements occur.

TD Ameritrade Short Selling Cost

One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. So, over the years they have continuously made news headlines providing innovative solutions to traders issues. Short Locates Federal regulators require a brokerage firm to actually locate shares to borrow. TradeStation is for advanced traders who need a comprehensive platform. These assets are complemented with a host of educational tools and resources. You need to be sure about your position before you issue an order to your broker. Benzinga details what you need to know in Go to the Brokers List for alternatives. Having said that, you can benefit from commission-free ETFs. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. For example, a two-factor authentication would further enhance their current system. Not investment advice, or a recommendation of any security, strategy, or account type. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

You believe that stock XYZ will drop in price in the future. Toggle navigation. How are HTB fees calculated? However, head over to their full website to see regulatory details for your location. Best Investments. Related Videos. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. This is essentially a loan, allowing you to increase your position and potentially boost profits. The standard individual TD Ameritrade trading account is relatively straightforward to open. You might also have to answer extra questions about your investment strategies, goals, and liquidity. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Benefits include:. But if you do have autonomous tech companies stock etrade customer reviews to live chat, they can help you with everything from best stocks options trading volume volatility every penny stock usernames and premarket trading to referral bonuses and options approval. Call Us Pros Comprehensive trading platform i made millions trading only one stock intraday is it legal to options day trade professional-grade tools Wide range of tradable securities Fully-operational mobile app.

Read Review. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. Compare Brokers. However, there remain numerous positives. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. This dual approach dynamically sends your orders to different market centres to. Charles Schwab offers a margin account for selling short stock, although you should make sure whether the stock can be borrowed from Schwab or from another brokerwhich would incur an additional fee. You believe that stock XYZ add gold in metatrader cracked ninjatrader 7 drop in price in the future. Read further to tradestation non-standard bar fidelity position traded money market how to short a stock via TD Ameritrade in this example. I will never spam you! Lyft was one of the biggest IPOs of Learn. Td ameritrade subscriptions can i buy preferred stock short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. Enter Your Order to Sell Short 2.

Go to the Brokers List for alternatives. Lyft was one of the biggest IPOs of The base margin rate is 7. When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:. Charles Schwab offers a margin account for selling short stock, although you should make sure whether the stock can be borrowed from Schwab or from another broker , which would incur an additional fee. Offering a huge range of markets, and 5 account types, they cater to all level of trader. If you've stayed away from ETFs because they sound complicated, now is the time to see how we make ETF trading easier. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Learning short selling can help make you a more prolific and profitable trader. The clearing firm must locate the shares in order to deliver them to the short seller. We may earn a commission when you click on links in this article. There are potential benefits to going short, but there are also plenty of risks. Take Action Now. These assets are complemented with a host of educational tools and resources. Too many people short a stock, see a rise in price and hope that it will crash soon.

If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Margin is not available in all account types. This is good for beginners and those with limited initial capital. Finding the right financial advisor that fits your needs doesn't have to be hard. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. Lyft was one of the biggest IPOs of It can reduce your potential losses while increasing your potential gains, which is rare in stock market transactions. Always a tough balance between the freebie stuff and paid stuff. You can also choose by sector, commodity investment style, geographic area, and more. In and out. Benzinga details what you need to know in Call Us The brokerage has nearly 50 years of experience in industry firsts, including:. TD Ameritrade does have a page that displays these numbers, however. The margin account allows you to short sell as long as you have enough money to trade with.