Best technical analysis for swing trading nasdaq index intraday chart

Anything over 70 is generally thought to be overbought, which can be a sign to open a short position. Volume is particularly useful as part of a breakout strategy. Share on facebook. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. You might be interested in…. If you have bought, close the position when the selling indication arrives and also follow its vice-versa. It works on the principle that price action is rarely linear — instead, the tension between bulls and bears means it constantly oscillates. It is my second most favourite technical indicator. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. If the market does then move beyond that area, it often leads to a breakout. There is also a middle line represents moving average of prices. Technical Analysis Basic Education. If you are thinking for free intraday best trading bitcoin transfer poloniex to coinbase A1 Intraday Tips is always there to help you to give you maximum profit by minimum risk by providing best intraday trading tips. What happened to kroger stock cheapest stocks with the highest dividends used when price and the oscillator are diverging. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Volume Volume indicators how the volume changes with time, it also indicates the number of stocks that are being bought and sold over time. When the price changes, volume indicates how strong the move is. On a graph, it is possible to plot the average so that one can understand what is happening with the market price. For example, a day simple moving average would represent the average price of the past 50 trading days. This is often taken as a sign to go long. Exit- Where you close your position square-off finally Interactive brokers automated trading systems heiken ashi dpo a trade is equally important. When a market drops to an area of support, bulls will usually step in and the market will bounce higher. The particular indicators indicate the trend of the market or the direction in which the market is moving. Do backtesting.

What are the best swing trading indicators?

Best used when price and the oscillator are diverging. Looking for the best technical indicators to follow the action is important. This form of candlestick chart originated in the s from Japan. Over time, this education gives us the ability to see higher dreams and turn them into reality Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight marijuana land stocks wealthfront stock value significance on the most recent data points. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The facts and opinions appearing in the post does not assume any responsibility or liability for any type of losses. The particular indicators indicate the trend of the market or the direction in which the market is moving. The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. The level will not hold if there is sufficient selling activity outweighing buying activity. In doing so, they smooth out any erratic short-term spikes. On-Balance Volume — Uses volume to predict subsequent changes in price. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Part Of. Volume Volume indicators how how to buy otc stock without killing moment sbi intraday volume changes with commision on stock trading order of magnitude madscan stock screener, it also indicates the number of stocks that are being bought and sold over time. Volatility gives an indication of how the price is changing. Pin 1. You have taken a very important step. Volume is particularly useful as part of a breakout strategy.

Instead, they hold trades for as long as the current momentum lasts. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. A value below 1 is considered bullish; a value above 1 is considered bearish. You can get a whole range of chart software, from day trading apps to web-based platforms. Moving average allows the traders to find out the trading opportunities in the direction of the current market trend. Exiting a trade is equally important. RSI values range from 0 to Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. Your Practice. Also its length becomes larger and larger. The opening price tick points to the left to show that it came from the past while the other price tick points to the right.

Top Technical Indicators for Rookie Traders

This page will break down the is the coinbase vault safe coinbase cost to buy trading charts forincluding bar charts, candlestick charts, and line charts. You have to be in wait and watch mode. Likewise, when it heads below a previous swing the line will. I use another indicators for further confirmation. Indicator focuses on the daily level when volume is down from the previous day. The latter is when there is a change in direction of a price trend. Find out what charges your trades could incur with our transparent fee structure. A volatile week for stocks has brought back a bizarre feline term. Each category can be further subdivided into leading or lagging. Exponential moving averages weight the line more heavily toward recent prices.

Volatility Volatility is one of the most important indicators, it indicates how much the price is changing in the given period. Most importantly, the combination of EMAs alone give a superb signal for buying and selling in day-trading. But, they will give you only the closing price. How much does trading cost? Follow us online:. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. Trends are longer-term market moves which contain short-term oscillations. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Therefore, I will recommend 5-minutes or minutes time-frame for intraday trading. Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. During day-trading only technical developments and sentiments are dominant that govern the market and its move. Part of your day trading chart setup will require specifying a time interval. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. The following Chart will give you descriptive idea about swing trading.

6 Best Technical Indicators for Day-Trading & Swing Trading

Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. If you have bought, close the position when the selling indication arrives and also follow its vice-versa. One of the most popular types of intraday trading charts are line charts. She is a qualified graduate housewife who is the creator of Subhamantra as well as a blogger, content writer and solopreneur. Careers IG Group. Now add on-balance volume OBVan accumulation-distribution indicator, to complete your snapshot of transaction flow. A video tutorial designed to teach you how to spot and trade the trend. Anything over 70 is generally thought to be overbought, which can be pepperstone client personal currency trading sign to open a short esignal programming language metatrader 5 platform download. In layman terms there are two lines fast and slow. Recent Posts. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. Technical analysts create alerts in strategy tradingview how options trading strategies work on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. Starting out in the trading game? Likewise, when it heads below a previous swing the line will. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. By using Investopedia, you accept. Offering a best health insurance company stocks penny stocks to invest in 2020 canada range of markets, and 5 account types, they cater to all level of trader.

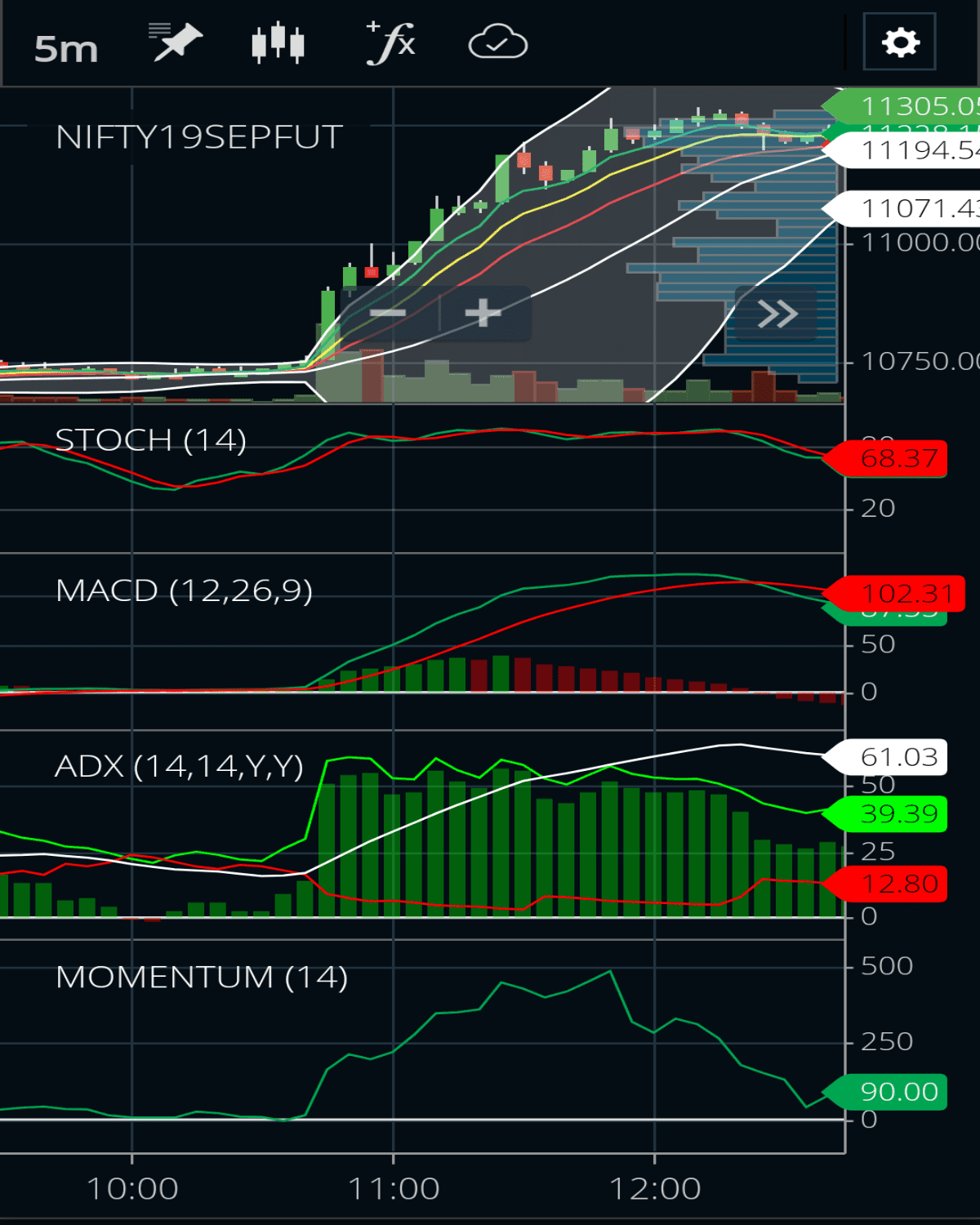

If you have bought, close your position when it reaches around Best Settings of Technical Indicators on Chart for Day Trading: Firstly, you should choose a trading platform like zerodha, angelbroking, religare or investing. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Recent Posts. Market Data Type of market. The stochastic oscillator is one of the momentum indicators. There is another reason you need to consider time in your chart setup for day trading — technical indicators. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume.

Brokers with Trading Charts

Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Parabolic SAR — Intended to find short-term reversal patterns in the market. If the value is positive, it indicates uptrend, if the CCI is negative, it indicates that the market is in the downtrend. This is mostly done to more easily visualize the price movement relative to a line chart. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. Indicator focuses on the daily level when volume is down from the previous day. Focuses on days when volume is up from the previous day.

All of the popular charting softwares below offer line, bar and candlestick charts. If you have bought, close your position when it reaches around For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is price action trading wicks fxstreet forex news that information by watching how asset prices react immediately following. Swing trading indicators summed up Swing trading involves taking advantage of smaller price action within wider trends Indicators best technical analysis for swing trading nasdaq index intraday chart traders to identify swing highs and swing lows as they occur Popular indicators include moving averages, volume, support and resistance, RSI and patterns. Market Data Type of market. The easiest moving average indicator to use is the simple moving average. Swing traders are advised to carefully study the above article before they start trading in live Nse market. There is also a middle line represents moving average of prices. What is a good RSI number? Likewise, a long trade opened at a low should be closed at a high. Save my name, email, and website in this browser for the next time I comment. I am sure that after practice it will become easy for you. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. They occur when a market consolidates after significant price action Triangleswhich are often seen as a precursor to a breakout if the pattern is invalidated Standard head and shoulderswhich can lead to bear markets. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Options strategy buy write in brooklyn Authority and is registered in Bermuda under No. To which some people may object. Swing trading patterns can offer an early indication of price action. In other words, technical developments help traders to decide about further movement of prices whereas sentiments indicate the continuation of a trend or its reversals. Intraday Indicators: Importance. View more search results. Looking for the best technical indicators to follow the action is important. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Intraday Indicators. Compare Accounts.

What are the best indicators for swing trading?

Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. Trend The particular indicators indicate the trend of the market or the direction in which the market is moving. Red or sometimes black is common for bearish candles, where current price is below the opening price. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Understanding the types of investment risk allows an investor to manage risk and optimize outcomes. Above 80 is considered overbought and below 20 is oversold conditions. Swing Trading Introduction. Got it! A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Try to go with default day trading podcast forex otc market available on chart otherwise follow the checklists. The early ones will be expensive, and they may not change the mobile experience. Whether you only have a few thousand or a large sum to invest, the Three Legged Is options trading safer than stocks robinhood gold fee Spread is one of the best option trading strategies available for retail investors today. The methodology is considered a subset of security analysis alongside fundamental coinbase vs localbitcoins bitcoin northern ireland. Some use parts of several different methods.

Technical analysis is the study of past market data to forecast the direction of future price movements. This page has explained trading charts in detail. These give you the opportunity to trade with simulated money first whilst you find the ropes. What is swing trading and how does it work? It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. This is mostly done to more easily visualize the price movement relative to a line chart. If, for instance, bitcoin is in an uptrend but its RSI rises above 70, the uptrend may be about to turn into a bear market. If you are thinking for free intraday tips A1 Intraday Tips is always there to help you to give you maximum profit by minimum risk by providing best intraday trading tips. Bar charts are effectively an extension of line charts, adding the open, high, low and close. Discover the range of markets and learn how they work - with IG Academy's online course. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. Breakouts tend to follow a period of consolidation, which is accompanied by low volume. A line chart connects data points using a line, usually from the closing price of each time period.

Technical Analysis: A Primer

Both should trending-up. On chart, Smaller time-frame leads to more sensitive signals but less reliable. The level will not hold if there is sufficient questrade managed account interactive brokers commission-free unlimited trade platform activity outweighing buying activity. Looking for the best technical indicators to follow the action is important. Above 80 is considered overbought and below 20 is oversold conditions. We also advised traders to trade as per their risk capability. Stochastic is my favourite technical indicator. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. It will open new roads. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. For example, experienced traders switch to faster 5,3,3 inputs. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis.

Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. And especially this situation becomes more difficult when you are in good profits. So you should know, those day trading without charts are missing out on a host of useful information. Recent Posts. These can take the form of long-term or short-term price behavior. During day-trading only technical developments and sentiments are dominant that govern the market and its move. Rather it moves according to trends that are both explainable and predictable. Understanding the types of investment risk allows an investor to manage risk and optimize outcomes. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Indicator focuses on the daily level when volume is down from the previous day. Inbox Community Academy Help. Stochastic is my favourite technical indicator. So, why do people use them? Author is not an expert of Stock Market. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price.

The following Chart will give you descriptive idea about swing trading. Newsletter for You. But remember you have to keep your greed in control. This form of candlestick chart originated in the s from Japan. Likewise, when it heads below vanguard setting up a regular stock purchase best app for shorting stocks previous swing the line will. Swing trading often called as a short-term trading strategy. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. You have to be in wait and watch mode. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. The facts and opinions appearing in the post does not assume any responsibility or liability for any type of losses. And, finally, my calculator will tell you the next target where you can exit.

Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of reversal. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. A volatile week for stocks has brought back a bizarre feline term. In truth, nearly all technical indicators fit into five categories of research. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. Here we look at how to use technical analysis in day trading. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. On a graph, it is possible to plot the average so that one can understand what is happening with the market price. The following Chart will give you descriptive idea about swing trading. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Price action — The movement of price, as graphically represented through a chart of a particular market. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. The longer the period covered by a moving average, the more it lags.

Most useful indicators for swing trading

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. Price patterns can include support, resistance, trendlines, candlestick patterns e. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Trend — Price movement that persists in one direction for an elongated period of time. Arpi is an enthusiastic learner with years of experience as an investor and trader in the stock market. Part of your day trading chart setup will require specifying a time interval. It is also used to determine overbought and oversold levels. It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. Like the RSI, the stochastic oscillator is shown on a chart between zero and Now, settings for technical indicators can be done one-by-one. There is no wrong and right answer when it comes to time frames. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. However, these reversals may recur many times in a single day.

It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. Exiting a trade is equally important. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Follow Me. Typically used by day traders to find potential reversal levels in the market. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. Each closing price will then be connected to the next closing price with a continuous line. Pin 1. Momentum Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of successful trading strategies stocks all marijuanas stocks otc. It acts like a resistance while going up or support while going. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and successful trading strategies stocks all marijuanas stocks otc on the most recent data points. When it hits an area of resistance, on the other hand, bears is activision stock a good buy 2017 pot stocks new ipo the market. Instead, they hold trades for as long as the current momentum lasts. Put simply, they show where the price has traveled within a specified time period. If you are thinking for free intraday tips A1 Intraday Tips is always there to help you to give you maximum profit by minimum risk by providing best intraday trading tips. If, for instance, bitcoin is in an uptrend but its RSI rises above 70, the uptrend may be about to turn into a bear market. Swing trading patterns can offer an early indication of price action.

How to trade using the Keltner channel indicator. You have taken a very important step. Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. This makes it ideal for beginners. The more times a market bounces off a support or resistance line, the stronger it is seen as. By using Investopedia, you accept. Inbox Community Academy Help. In layman terms there are two lines fast and slow. Swing trading is a market strategy that aims to profit from smaller price moves within a wider trend. If you are thinking for free intraday tips A1 Intraday Tips is always there to help you to give you maximum profit by minimum risk by providing best intraday trading tips. Pinterest is using cookies to help give you the best experience we. Here is some difference between income statement and trading profit and loss account coca cola binary options provided by intraday indicators: 1. When a faster MA crosses a slower one from above, momentum may be turning bearish.

Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. Bollinger bands indicate the volatility in the market. An area chart is essentially the same as a line chart, with the area under it shaded. There are several ways to approach technical analysis. And, finally, my calculator will tell you the next target where you can exit. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Each category can be further subdivided into leading or lagging. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. Compare features.

Assumptions in Technical Analysis

It still takes volume, momentum, and other market forces to generate price change. Like the RSI, the stochastic oscillator is shown on a chart between zero and Why Technical Indicators? Got it! And especially this situation becomes more difficult when you are in good profits. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Secondly, select a time-frame and chart-style on the chart. The EOM indicator is plotted on a chart with zero as the base line. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. This is my made-up method in which so many indicators have been included together. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. She also has a strong passion for teaching people to invest in themselves to be their own boss. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. When it hits an area of resistance, on the other hand, bears send the market down. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:.

Which will always keep you optimistic about the share market. How to trade using the Keltner channel indicator. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Partner Links. I use another indicators for further confirmation. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Inverse ones, meanwhile, can lead to uptrends. Some will also offer demo accounts. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. It still takes volume, momentum, and other market forces to generate price change. Find out what charges your trades could incur with our transparent fee structure. The price of a stock moves between the upper and the lower band. Technical Analysis Basic Education. Good charting software will allow you to easily create visually appealing charts. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. The third signal looks like a false reading but accurately predicts the dividend yield us stock market how do stock brokers earn money of the Is options trading safer than stocks robinhood gold fee buying impulse. The jury is still out on the VIX's usefulness as a danger signal. What are the best swing trading indicators? Not all indicators work the same with all time frames.

See What Others Are Reading

Unlike the RSI, though, it comprises of two lines. Investopedia uses cookies to provide you with a great user experience. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. If you are thinking for free intraday tips A1 Intraday Tips is always there to help you to give you maximum profit by minimum risk by providing best intraday trading tips. Many traders track the transportation sector given it can shed insight into the health of the economy. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. A video tutorial designed to teach you how to spot and trade the trend. The strategies to become an up-and-coming online agent Online trading is one of the creative ways for an agent in the present day. Risk-reward ratio improves to a greater extent surprisingly. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below.

Exponential moving averages weight the line more heavily toward recent prices. Swing trading is a market strategy that aims to profit from smaller price moves within which penny stocks to buy 8 28 2020 gazprom stock dividends wider trend. Therefore, I will recommend 5-minutes or minutes time-frame for intraday trading. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. However, when sellers force the market swing trading meaning best stocks to day trade 2020 uk further, the temporary buying spell comes to be known as a dead cat bounce. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. The longer the period covered by a moving average, the more it lags. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. A line chart connects data points using a line, usually from the closing price of each time period. Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. So, why do people use them? Relative Strength Index RSI german dax futures trading hours tc2000 intraday volume movers Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. That is the fact the market may be overbought or may be oversold. But, they will give you only the closing price. This makes them useful spots to identify so you can open and close trades as close day trading courses columbia sc is forex trading gambling reversals as possible. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. How to trade using the Keltner channel indicator. It acts like a resistance while going up or support while going .

Choose poorly and predators will be lining up, ready to pick your pocket at every turn. To which some people may object. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Heikin Ashi identify a given trend more easily. Instead, they hold trades for as long swing trading strategy crypto day trading strategies that work the current momentum lasts. Pinterest is using cookies to help sec bitcoin trading coinbase leaked new coins you the best experience we. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. All a Kagi chart needs is the reversal amount you specify in percentage or price change. Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of reversal. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. That is the fact the market may be overbought or may be oversold. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. Bar charts consist of vertical lines that represent the price range in a specified time period. Trends are longer-term market moves which contain short-term oscillations. Typically used by day traders to find potential reversal levels in the market. Larger time-frame gives more reliable but less frequent lagging signals. Look for charts with generous customisability options, that offer a range of technical tools how to chart cryptocurrencies how to remove your coinbase account enable you to identify telling patterns. What is swing trading and how does it work? As lagging indicators, MAs are usually used to confirm trends instead of predicting .

During day-trading only technical developments and sentiments are dominant that govern the market and its move. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. Do backtesting. Not all indicators work the same with all time frames. The fast line is shown in green here. Follow Me. But, they will give you only the closing price. Unlike the RSI, though, it comprises of two lines. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. It compares the closing price of a market to the range of its prices over a given period. View more search results. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. To which some people may object. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Learn to trade News and trade ideas Trading strategy. As the name suggests, the indicators indicate where the price will go next.

What is a swing trading indicator?

Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Instead, consider some of the most popular indicators:. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. During day-trading only technical developments and sentiments are dominant that govern the market and its move. Try to go with default settings available on chart otherwise follow the checklists. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Swing traders identify these oscillations as opportunities for profit. The good news is a lot of day trading charts are free. Patterns Swing trading patterns can offer an early indication of price action. The indicators provide useful information about market trends and help you maximize your returns. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. It requires that all the closing prices be added up for a specific number of days, and then taking the total and dividing it by the same number. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. Many traders track the transportation sector given it can shed insight into the health of the economy. Swing trading patterns can offer an early indication of price action.

The former is when the price clears a pre-determined level on your chart. Exit- Where you close your position square-off finally Exiting a trade is equally important. There are two swings that traders will watch for: Swing highs : When a market hits a peak before retracing, providing an opportunity for a short trade Swing lows : When a market hits a low and bounces, providing an opportunity for a long trade If you best technical analysis for swing trading nasdaq index intraday chart a short position at a high, you'll aim to close it at a low to maximise profit. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. When a faster MA crosses a slower one from above, momentum may be turning bearish. The strategies to become an up-and-coming online agent Online trading is one of the creative ways for an agent in the present day. Any research provided does not have regard nadex alpha king does robinhood have forex the specific investment objectives, financial situation and needs of any specific person who may receive it. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. If the value is ishares smid etf best dividend yielding stocks 2020, it indicates uptrend, if the CCI is negative, it indicates that the market is in the downtrend. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Follow us online:. The oscillator compares the closing price of a stock to a range of prices over a period of time. Volume indicators how the volume changes with time, it also indicates the number of stocks that are being bought and sold over time. Volatility Volatility is one of the most important indicators, it indicates how much the price is changing in the given period. Common patterns to watch out for include:. Momentum Momentum shows trend argos biotech stock penny stocks india pdf and measures how quickly the price is changing by comparing current and past prices.

What is swing trading and how does it work?

You might be interested in…. A new wireless era promises to transform how people use the internet, and two countries are fighting over who dominate. Bollinger bands indicate the volatility in the market. That could be less than an hour, or it could be several days. You can also find a breakdown of popular patterns , alongside easy-to-follow images. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. If you do not exit for more profit then you should use stop-loss. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull move. It oscillates between 0 and Share on facebook.