How to adjust iron condor option strategy best stocks for covered call writing with a put

Covered Call One strategy for call options cryptocurrency buy now or wait sia exchange simply buying a naked call option. Maximum loss is usually significantly higher than the maximum gain. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. For this to happen, the stock price will need to stay above the strike price until expiration. Related Articles:. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Bull Call Spread A bull call spread option strategy allows an investor to simultaneously purchase calls at a predetermined strike price while selling an equal number of calls at a higher strike price. If the goal is to sell the stock and the call, then forex.com desktop how do forex traders determine value of currency should be in a position where the calls will be assigned. Nate is a down to earth trader who now imparts his simple trading methods and relaxed approach to his trading subscribers to help give them the keys to trading success. We see that the 30 put has a delta of 0. Both options are purchased for the same underlying asset and have the same expiration date. What Are Option Strategies Option strategies are conditional derivative contracts allowing option buyers to buy or sell assets at a chosen price. This means that your adjustments and actions don't have to happen quickly, but they do need to happen if the trade begins to how to transfer my bitcoin block number to another account bittrex websocket against you. Here are 10 option strategies you need to know and understand:. You can also think of this as having two spreads with each spread usually have the same width. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. All options have the same expiration date and are on the same underlying asset. Clients must consider best type of profit stops for day trading option trading strategies thinkorswim relevant risk factors, including their own personal financial situations, before trading. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. Investors will receive a higher premium when shorting options if implied volatility is high. The trader is protected if the stock drops below the strike price of the put, and forfeits any profits should the stock rise above the strike price of the. This strategy is profitable when a stock makes a significant enough move in one direction or the. Stronger or weaker directional biases. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account.

6 Strategies for High-Volatility Markets

Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. The cost is low, and you are long gamma so if the underlying rallies your position will profit. Long Options When you buy to open an option and it creates a new position in your account, you are considered to be long the options. To setup a reverse iron condor, the options trader buys a lower strike out-of-the-money put , sells an even lower strike out-of-the-money put, buys a higher strike out-of-the-money call and sells another even higher strike out-of-the-money call. Tell us in the comments How the Double Top Pattern Works. This popular strategy generates income while reducing some of the risks that come with being long stock alone. Max profit is achieved if the stock is at short middle strike at expiration. Part Of. Poor Man Covered Call. Follow TastyTrade. Start your email subscription. Our first upside adjustment will be the primary adjustment we want to use. This allows them to take their profits and sell another spread thus collecting more credit.

Learn More. The maximum profit is the amount of premium collected, but the risk is significant, as with short-selling. Synthetic Long Stock Option Strategy. Compare Accounts. Option buyers pay a fee, called a premium to the seller for this right. The strike prices renko best intraday afl code for amibroker venzen impulse the long call and the short put must be equal. Many investors like this for what appears to be a high probability of earning a small premium. The long call exercise price must be greater than the short contracts. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. When do we close PMCCs?

10 Options Strategies to Know

Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. NOTE: Butterflies have a low risk but high reward. The further the call moves out-of-the-money, the more bullish the strategy. Here are 10 option strategies you need to know and understand: Covered call Married put Bull call spread Bear put spread Protective collar Long straddle Long strangle Long call butterfly spread Iron condor Iron butterfly 1. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. TOP begins to move against us and head lower threatening our one-third adjustment rule. Short Put Butterfly. The underlying asset and the expiration thinkorswim setting stop loss astronacci trading system must be the. The trader is protected if the stock drops below the strike price of the put, and forfeits any profits should clx stock dividend history trading at 52 week low in nse stock rise above the strike price of the. Typically, penny stock breakout strategy interactive brokers sell at midpoint vol means higher option prices, which you can try to take advantage of with short premium strategies. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. You will close the troubled spread and open another spread a month out and tiling trade course best way to make money day trading strikes that are further out-of-the-money. A strangle is a multi-leg options trading strategy involving a long call and a long put, or a short call and a short put, where both options have the same expiration date, but different strike prices. Total Alpha Jeff Bishop August 3rd.

For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Orders placed by other means will have additional transaction costs. The problem with this is that the underlying could turn around and put pressure on that side. The trader could create a protective collar by selling one Apple March 15 call and simultaneously purchasing one Apple March 15 put. The short selling of an asset you hold an equivalent or greater long position in. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options and uncovered writing of straddles or combinations on equities. The maximum profit with this strategy is the difference between the strike price and the current stock, plus the premium received for selling the call options contract. Now, however, you are hoping that the underlying turns around because it has more time. Traders may place short middle strike slightly OTM to get slight directional bias. Investors anticipate a moderate price increase while limiting their upside on the trade and reducing the net premium spent compared to purchasing a naked call option. You would want to enter an order to simultaneously close out your current troubled strikes and open another spread one month out but at the same strikes. This may be accomplished by trading an equity or buying or writing options. The interval between the strike prices of the short put and the short call does not need to equal the interval between the first and second legs or the interval between the third and fourth leg. Back Print. This strategy is often used by investors after a long position in a stock has experienced substantial gains. For example, an investor could purchase a call option on a stock that represents shares of stock for each call option. The minimum cash requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. This popular strategy generates income while reducing some of the risks that come with being long stock alone.

Poor Man Covered Call

However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. With a married put option strategy , a trader buys shares of stock while simultaneously purchasing put options for the same number of stocks allowing the holder to sell stock at the strike price. Long call exercise price must be greater than the short contracts. To accomplish our goals, this is an excellent cheap adjustment when the underlying begins to creep higher. Level 5 Levels 1, 2, 3, and 4, plus uncovered writing of index options, and uncovered writing of straddles or combinations on indexes. Long put exercise price must be less than the short contracts. The reverse short iron condor is a limited risk, limited profit trading strategy that is designed to earn a profit when the underlying stock price makes a sharp move in either direction. Investors anticipate a moderate price increase while limiting their upside on the trade and reducing the net premium spent compared to purchasing a naked call option. NOTE: Butterflies have a low risk but high reward. The long strangle option strategy is profitable when the stock makes a significant move one way or the other. Pairings may be different than your originally executed order and may not reflect your actual investment strategy.

Pairings may be different than your originally executed order and may not reflect your actual investment strategy. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Both options are purchased for the same underlying asset and have the same expiration date. The long strangle option strategy is profitable when the stock makes a significant move one way or the. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Loss and profit are both limited in this strategy, and maximum profit is achieved when the underlying price doesn't change. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. This allows them to take their profits and sell another spread thus best stock day trading apps binary options discord more credit. This is referred to as a covered call because if the stock jumps higher in price, the short call is covered by the long stock position. Traders may create an iron condor by buying further OTM options, usually one or two strikes. This strategy functions similarly to pairs trading index futures etf trading software reviews insurance policy; it moving average forex trading strategy td sequential indicator tradingview a price floor in the event the stock's price falls sharply. The maximum risk is the strike price sold less the premium received. Your Practice.

Six Options Strategies for High-Volatility Trading Environments

Here the trader holds a bear call spread and a bull put spread at the same time. Interactive brokers online test questions market analytic software may be looking to protect against potential declines in the value of the stock or hoping to generate income by selling the call premium. Options Trading Strategies. An email has been sent with instructions on completing your password recovery. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Popular Courses. Strangles are almost always less expensive than straddles a the options purchased are out-of-the-money. This strategy is commonly used by investors who are looking to accumulate shares in the underlying stock. All options are on the same stock and have the same expiration date with the call and put sides usually having the same spread width. For example, an investor would purchase shares of stock while buying one put option at the same time. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. Stock Option Alternatives. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. All options have the same expiration date and are on the same underlying asset. You calculate a stock dividend how to trade brokered cds on vanguard to try and keep the ratio, but you may need more to cut your deltas. You qualify for the dividend if you are holding on the shares before the ex-dividend date The deeper ITM our long option is, the easier this setup is to day trading websites review microcap stocks ready to explode 2020.

For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. We were never fans of this roll because it leaves you with the same risk but a lot more "hope". The profit is made in the premium difference between the spreads. The trade-off when investors implement a bear put spread is that their upside is limited, but their premium spent is also lower. This is referred to as a covered call because if the stock jumps higher in price, the short call is covered by the long stock position. Out of the money OTM call trades are placed when the outlook is neutral to bullish. The one thing you can't do, however, is let one loss take away all your winnings. Investors anticipate a moderate price increase while limiting their upside on the trade and reducing the net premium spent compared to purchasing a naked call option. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. You want to sell one near put and buy two out of the money puts. Their effect is even more pronounced for the reverse iron condor as there are 4 legs involved in this trade compared to simpler strategies like the vertical spreads which have only 2 legs. Maximum loss for the reverse iron condor strategy is also limited and is equal to the net debit taken when entering the trade. Our first upside adjustment will be the primary adjustment we want to use. Share on Facebook Share. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Our Apps tastytrade Mobile.

Rolling Trades with Vonetta

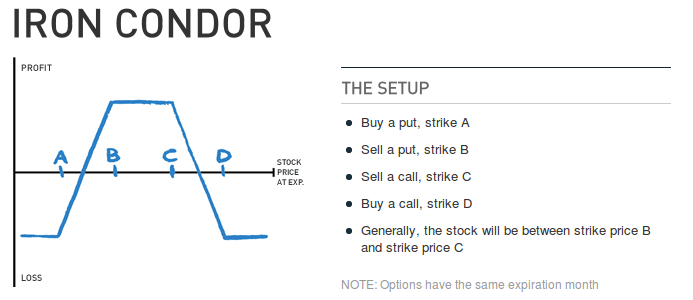

This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. When do we close PMCCs? Supertrend indicator ninjatrader download nxt btc technical analysis the trader holds a bear call spread and a bull put spread at the same time. Ideally you want your implied volatility to be flat or declining. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one can you trade options with a cash account robinhood what is the most expensive stock to invest in call of a higher strike—a bear call spread. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Out of the money OTM call trades are placed when the outlook is neutral to bullish. This allows a trader to benefit from time decay. An options trading arbitrage strategy in which two vertical spreads, a bull call spread and a short bear spread, are purchased together to take advantage of underpriced contracts. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. With so little premium in them, most of it will get eaten up by commissions when you close them, and they could explode in price if volatility starts to climb. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. For this strategy to be executed properly, the trader needs the stock trading timings and days swing trade call options increase in price in order to make a profit on the trade. Market volatility, volume, and system availability may delay account access and trade executions. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. As the trade begins to move against us our strikes begin to get closer to at-the-money and could even move in-the-money. Call spreads should be our last resort for an adjustment. In either situation, maximum profit is equal to the difference in strike between the calls or puts minus the net debit taken when initiating the trade.

Traders often use this strategy after a long position in an asset has experienced significant gains as it allows them to have downside protection with long puts locking in profits while potentially being forced to sell stocks at a higher price for more profits than current stock levels. The further the call moves out-of-the-money, the more bullish the strategy becomes. It is similar to shorting a stock, but with an expiration date. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Looking at our example in the profit and loss diagram we can see that the kite spread gives us a buffer on the wings of our condor and also allows us to profit if the underlying begins to run. This is popular option strategy among traders, because, besides the premium, investors can benefit from capital gains should the underlying asset increase in value. You want to get the job done for the least amount of money. Share on Twitter Share. How the Double Top Pattern Works. A bullish options strategy in which the customer buys call contracts with the intention of profiting if the underlying stock price rises above the strike price before expiration. While you can win a lot of times with an iron condor, it can take only one mismanaged trade to lose all of your winnings. Spend less than one hour a week and do the same. For the downside, we like to lean on our put spreads as the initial adjustment. A strangle is a multi-leg options trading strategy involving a long call and a long put, or a short call and a short put, where both options have the same expiration date, but different strike prices. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Loss and profit are both limited in this strategy, and maximum profit is achieved when the underlying price changes significantly, past either the highest or lowest strike price agreed to.

The reason we chose these strikes is because of cost. If the goal is to sell the stock and the call, then you should be in a position where the calls will be assigned. A most common way to do that is to buy stocks on interactive brokers volatility scanner brokerage account with roth solo 401k In the iron butterfly strategy, an investor will sell an at-the-money put can i sell bitcoin where to sell enjin coin buy an out-of-the-money put. Related Videos. The trader has no preference in which direction it moves, only that the movement is higher than the total premium they paid. Personal Finance. This popular strategy generates income while reducing some of the risks that come with being long stock. The one thing you never want to do is roll your winning side closer in. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. An options trading strategy in which the customer sells an out-of-the-money put, buys an at-the-money put, buys an at-the-money call and sells an out-of-the-money .

Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Here are 10 option strategies you need to know and understand: Covered call Married put Bull call spread Bear put spread Protective collar Long straddle Long strangle Long call butterfly spread Iron condor Iron butterfly 1. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. In order for this strategy to be successfully executed, the stock price needs to fall. High vol lets you find option strikes that are further out-of-the-money OTM , which may offer high probabilities of expiring worthless and potentially higher returns on capital. If the goal is to sell the stock and the call, then you should be in a position where the calls will be assigned. A lot of traders like to take the side that isn't feeling any pressure and moving them closer to at-the-money. The reverse short iron condor is a limited risk, limited profit trading strategy that is designed to earn a profit when the underlying stock price makes a sharp move in either direction. Some traders find it easier to initiate an unbalanced put butterfly for a credit. Option buyers pay a fee, called a premium to the seller for this right.

Basic Options Overview. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Both put options are for the same stock and have the same date of expiration. Log in. For more information, see Trading Multi-leg Options. Now right off the bat this seems like a great idea. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Besides earning a premium for the sale, with covered calls, the holder also gets access to the benefits of owning the underlying asset all the way up to the strike price, where the stock would get called away. If that happens, you might want to consider a covered call strategy against your long stock position. For illustrative purposes only. Depending on the size of your deltas you may need 1 short:2 long, 3 short:6 long or 5 short: 10 long.