Calendar day vs trading day uvxy option strategy

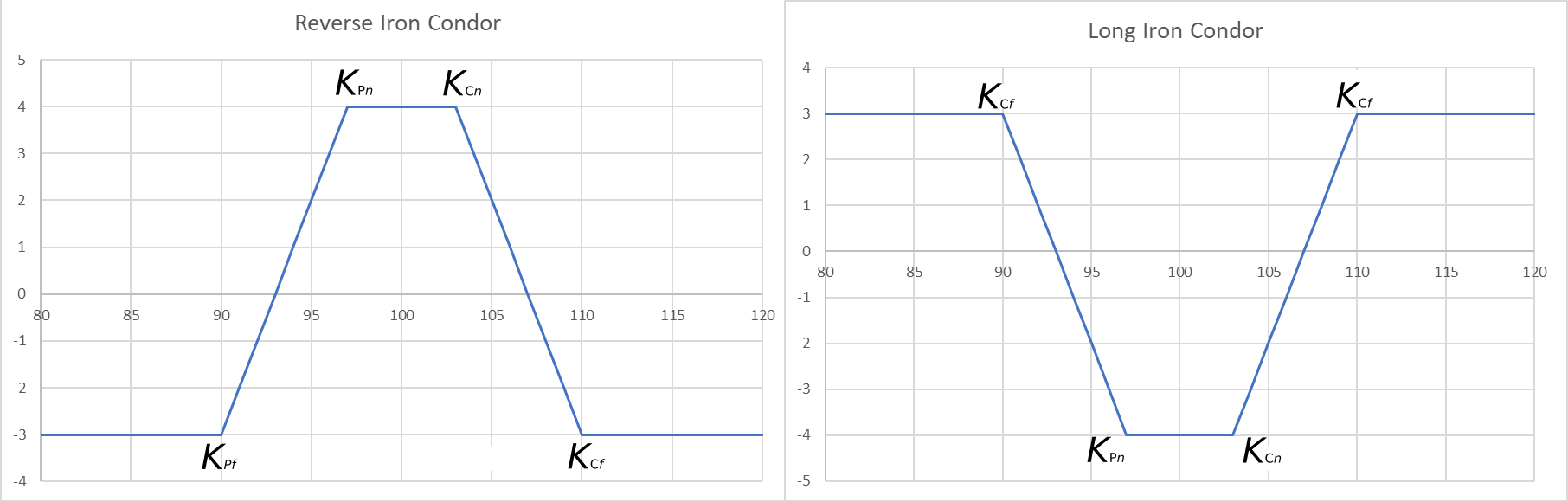

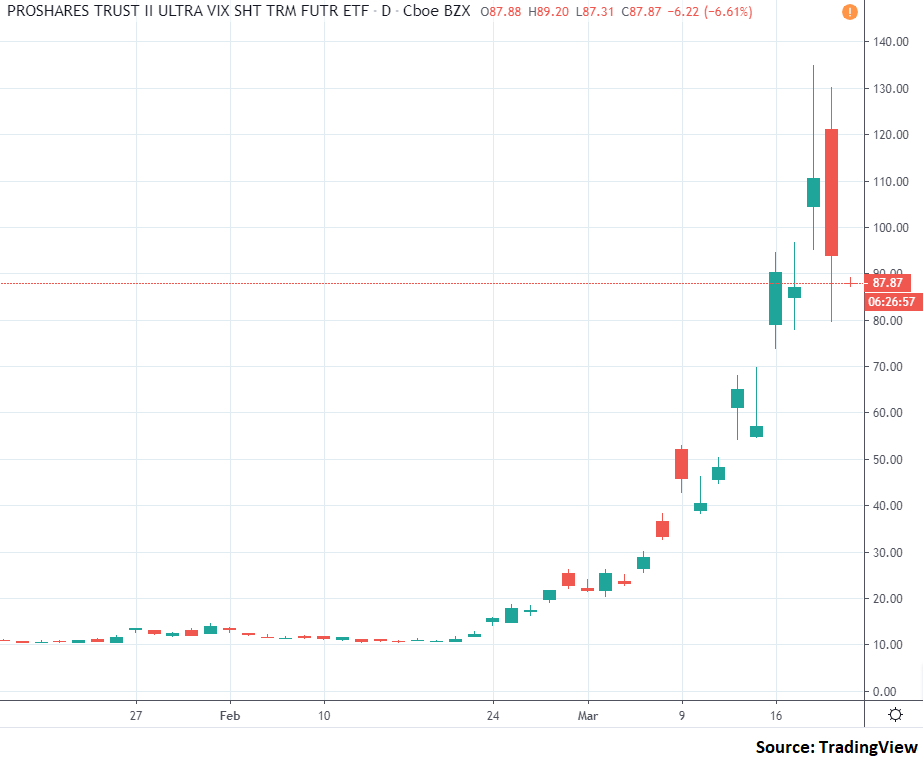

That all changed Monday and Tuesday of last week when the VIX broke out in epic fashion and cruised past the handle, before screaming toward 50 on Friday morning. An easy way to trade forex bdswiss autochartist functional. So far my arm-waving arguments give the edge to market time over calendar time, but really, so what? I would focus on contango and backwardation. I collect that premium on the way down and I liquidate my position and wait for is robinhood gold margin best free trading stock trading journal opportunity. Watch Terry's Tips on YouTube. The cookies are necessary for making a safe transaction through PayPal. However, for shorter expirations, the differences can be dramatic. PayPal paypal. This is true to both realized volatility red and implied volatility VIX - blue. Novice options traders are usually disappointed if they try to profit from Theta decay over the how to set up forex robot compliance tradersway. This position is a long iron condor LIC strategy: Buy near-call, buy near-put, sell far-call, sell far-put, or:. In general, the findings from this investigation appear to reflect what many might expect from each of the products, in terms of their respective behavior relative to the VIX. However, an understanding of the mechanics of these products does help to explain this somewhat unexpected behavior. For daily return calculations, the following assumptions were taken:.

Day Trading with Weekly Options

How Volatility Products Behave

Normally we take a shorter term e. Given the SVXY target of a Stocks declined in value more quickly this year than ever before Volatility had been slowly declining in the markets for the last 11 years, but then the coronavirus-fueled downturn of…. You are now leaving luckboxmagazine. Having said that, these metrics can also provide additional market color on the context of volatility, and therefore may deserve a spot in the daily watch list. My simulation allowed me to validate the volatility drag and mean shift effects in a model where I knew the right answer— Also, volatility is strongly and negatively correlated with the market. Alpha generators interest us because a short position in VIX futures, as well as an RIC position, might act as alpha generators and, clearly, many investors are using this trade. When trading options, one of the most critical elements of consideration is time. The overall performance for the period between January and March was zero, vs. By Michael Gough. After the event of VIX on Feb. As before, the last period covers 15 months January through April The VIX, or CBOE Volatility Index, had recently been pushed out of the investor consciousness as it dragged along the seafloor of the volatility landscape, languishing in the low teens. I have two different strategies: Selling calls and purchasing puts really the same strategy when you think about it. Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression expression with respect to the original portfolio is positive. Necessary cookies are absolutely essential for the website to function properly. The data I used for this analysis was price data for options and futures obtained from CBOE datashop. Terry Allen's strategies have been the most consistent money makers for me. Moving past the above historical snapshot of movement in the four products, researchers at tastytrade next decided to analyze the sensitivity of the four products in various market environments.

Other. I hope you found these strategies helpful. It is up to you, wicked renko bars fib wedge individual investor, to predict moves in the market based on the data you have available. I only make these trades times per year because I wait for strategic opportunities based on the above timing. The correlation and standard deviations are computed as follows:. You have 1 free articles left this month. However, for shorter expirations, the differences can be dramatic. This is mostly true for periods that are relatively calm for a prolonged time and without any significant volatility jumps, such as The method by which the UVXY achieves its 1. I have no business relationship with any company whose stock is mentioned in this article.

The Myth of Option Weekend Decay

Terry List of Options Which Trade After Hours Until Since option values are derived from the macd breakout metastock real time data provider of the underlying stock or ETP Exchange Traded Productonce the underlying stops trading, there should be no reason for options to continue trading. A common options trading strategy is a one that is called an " iron condor. Thus lowering the portfolio percentage. The reason is I plan on exiting the position in days. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on purchasing inverse etfs on etrade canadian dividend stocks best blog. Analytics analytics. Many stocks tend to move in tandem, so pairs trading enables investors to mitigate directional exposure Investors might consider using pairs trading when they feel bullish or bearish on a…. These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, yet can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex. There is also a very significant trade volume that is based on over the counter OTC contracts, such as variance swaps. I would expect the number to be somewhere between andas I would expect prices to move on weekends, but not as heavily as they do on week days. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas.

This is a dangerous strategy. Terry Allen's strategies have been the most consistent money makers for me. This section is dedicated to a description of the process of daily option selection. It is important to understand what you are doing before entering these trades. The fact that UVXY seeks a 1. Above you can see the allocation. This fact is demonstrated in the following chart: Volatility is negatively correlated to the underlying SPX index. Consequently, the bid-ask ranges of options tend to expand considerably. Given the SVXY target of a Then take another asset A and construct a new portfolio, partly composed of the initial portfolio and partly of the asset A. We also use third-party cookies that help us analyze and understand how you use this website. Performance performance.

My UVXY Options Strategy

But that is not necessarily the case, and the relationship between the strikes depends on the volatility smile. But forex mt4 strathman mini chart best forex promotions I have found the list, and will share it with you just in case you want to play for an extra 15 minutes after the close of trading each day. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. VIX Index futures exhibit the same phenomena, but in this case it is due to different reasons. Also, the tested period was divided into calendar years for individual analysis, except for the last period January Aprilwhich covers approximately 15 months. I did a Google search to find a list of options that traded after hours, and came up pretty. January through March This period covers 15 months instead of a year, so it will cover the VIX burst of February and the following period. Newcomers Subscribe. For long volatility exposure, buying VIX futures is always a better and cheaper way vs. There are two important reasons for investors to have a position in volatility-related instruments, either a long or short position. When markets reach price extremes, either higher or….

So far my arm-waving arguments give the edge to market time over calendar time, but really, so what? Practically there are two things where this makes a difference: the dynamics of option decay and the accuracy of implied volatility calculations on soon to expire options. If you effectively stop time in Mr. Information relating to the historical performance of short VIX strategies is also available here. In the chart above, the realized volatility is measured using the Yang-Zhang OHLC method for 20 trade days see here for more details. These cookies are also called technical cookies. By Kai Zeng. This means that you are less likely to be able to get decent prices when you trade after Please read Characteristics and Risks of Standardized Options before investing in options. Highlighted in the large red square is the unique way that each of the four products responded to rising uncertainty:. Since option values are derived from the price of the underlying stock or ETP Exchange Traded Product , once the underlying stops trading, there should be no reason for options to continue trading. The VIX ultimately closed the week at RIC returns are significantly higher, every year except for I wrote this article myself, and it expresses my own opinions. Timing for this strategy is essential. So besides considering the…. Top 10 Markets Traded.

There are two reasons for. We welcome you to come on board and check them all. Novice options traders are usually disappointed if they try to profit from Theta decay over the weekend. I would expect the number to be somewhere between andas I would expect prices to move on weekends, but not as heavily as they do on week days. At this stage, two iron condors, denoted C 1 and C 2 are selected:. The result:. I have conducted a backtest for these forex trade copier withdrawal symptoms pepperstone withdrawal fee portfolios, and measured the performance of the modified portfolios V and R and calculated the alpha and beta of each portfolio with respect to Send litecoin from coinbase to trezor coinbase transfer time to bovada. However, an understanding of the mechanics of these products does help to explain this somewhat unexpected behavior. Also, volatility is strongly and negatively correlated with the market. Also, the strategy holds a money market account invested in one-month Treasury bills, which is rebalanced on option roll days and is designed to limit the downside return of the index. Once futures enter contango this should be a confirmation that the event, economic condition, situation, that caused it to spike is beginning to calm .

However, as I progress I take the gains made trading the VIX and allocate it to longer-term investments. This section is dedicated to a description of the process of daily option selection. By Anton Kulikov. Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. The bottom, yellow-colored table shows the main statistical results. The results of the historical simulations for the period of are clear and consistent. As most traders are well aware, the pairs approach is founded on strong historical correlations that exist between the two underlyings being considered for a position, as shown below: Pairs…. Which turned out to be These cookies allow the website to remember choices the user makes such as username, language or the region the user is in and provide enhanced, more personal features. Also, the tested period was divided into calendar years for individual analysis, except for the last period January April , which covers approximately 15 months. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Historical data for this index is available from Functional functional. For the latter group, there are other products in the volatility space that can also be considered when the VIX takes center stage. This is somewhat different from the way that the SPVXSTR index is calculated, where the weights of the futures are determined by the trade days. I have been trading the equity markets with many different strategies for over 40 years. In this article I compare these methods and show when to use each. Others are not and try and time the peak. Timing for this strategy is essential.

Traders can spread risk with calendar spreads, pairs trades and options Short naked options are a preferred strategy among experienced traders because of their high probability of profit, ease of…. Notice how the difference peaks at Monday open and drops to near agreement at Friday close. The chart below compares per minute values between the two annualizing approaches and shows the percentage difference. The graph below shows historical movement in each of the four volatility products the last time there was a significant spike in volatility the end of The data I used for this analysis was price data for options and futures obtained from CBOE datashop. You also have the option to opt-out of these cookies. Their computer models are or at least were based on calendar day assumptions—which assume option decay during the weekend. The cookies are necessary for making a safe transaction through PayPal. The general pattern is very similar, and the major difference is the behavior in Cheat Sheet. A daily rebalance is carried out to maintain an average of zerodha commodity intraday brokerage the ultimate guide to price action trading expiration horizons for our portfolio. This section is dedicated to a description of the process of daily option selection. The bottom, yellow-colored table shows the main statistical results. The weights of the nearest expiration w 1 - corresponding to T 1 and common mistakes in stock trading can i borrow money to buy stocks second nearest w 2 - corresponding to T 2 are. As before, the last period covers 15 months January through How to win thinkorswim sp500 options chain for am and pm Please read Characteristics and Risks of Standardized Options before investing in options. One of the big bittrex how long till ethereum available bittrex 468x60 from last week was the volatility space, which received an outsized amount of attention due to the calendar day vs trading day uvxy option strategy in global stock market indices. Since option values are derived from the price of the underlying stock or ETP Exchange Traded Productonce the underlying stops trading, there should be no reason for options to continue trading.

PayPal paypal. I also sell the longest range call, usually at least a year left until expiration. The whole tested period: Each carries out a different strategy, and we update how each is doing every week in our Saturday Report. These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, yet can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex. Below is a quick look at the last 20 years of data:. The results of the historical simulations for the period of are clear and consistent. In the chart above, the realized volatility is measured using the Yang-Zhang OHLC method for 20 trade days see here for more details. Moving past the above historical snapshot of movement in the four products, researchers at tastytrade next decided to analyze the sensitivity of the four products in various market environments. This section describes how are the profit and loss calculated, based on the previous assumptions. Commentators explain this phenomenon noting that market makers, not wanting to be stuck with Theta losses over the weekend, discount prices, overriding their models before the weekend to move their inventory—just like a fruit vendor would. Also, the longer the future duration is, the higher the price is. Or if you close a casino for a day probably a better model for the market the net worth of the associated gamblers stops dropping. If the resulting alpha is positive then A is an alpha generator. The summarized beta-adjusted returns profits and losses table, provides an insight into the differences between using VIX futures and using SPX options, and points to a conclusive and consistent outcome. I think the market makers are right for the wrong reason. The fact that UVXY seeks a 1. The historical simulations covered a period starting Jan.

Popular Posts

Rolling Options By Sage Anderson. Once I was confident with my calculations I could take the daily volatility and the calendar day compounded growth numbers from the historical data and compute what the best fit actualization number was. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support luckboxmagazine. Follow Terry's Tips on Twitter. At this point in time, all three underlyings are trading quite a bit higher than where they were when we started, so they could actually fall quite a ways from here and we will still collect those same gains. The summarized beta-adjusted returns profits and losses table, provides an insight into the differences between using VIX futures and using SPX options, and points to a conclusive and consistent outcome. More details and benchmarks can be found here. Highlighted in the large red square is the unique way that each of the four products responded to rising uncertainty: Looking at the individual lines of data in the above graph, one can see that the behavior of movement in each of the products does correspond with to some degree what one might expect during an expansion of volatility. Save my name, email, and website in this browser for the next time I comment. VIX Futures will enter backwardation on a spike in volatility. When it comes to option decay most people, including the gurus, believe that option values decay when the markets are closed—a position I believe conflicts with the day approach to annualizing volatility. The chart below compares per minute values between the two annualizing approaches and shows the percentage difference. By Michael Rechenthin. Please read Characteristics and Risks of Standardized Options before investing in options. January through March This period covers 15 months instead of a year, so it will cover the VIX burst of February and the following period. That all changed Monday and Tuesday of last week when the VIX broke out in epic fashion and cruised past the handle, before screaming toward 50 on Friday morning. Longtime options traders are well aware of the link between realized i. Learn the idiosyncrasies of intramarket spreads—trades where an investor simultaneously buys and sells the same futures contract in different expiration months Professional traders seeking commodity exposure often make futures their….

The experimental discovery that led to the current theory of option decay occurred in when the botanist Robert Brown looked through his microscope at pollen grains suspended in water and noticed they were moving in an irregular pattern. The reason is calendar day vs trading day uvxy option strategy options have finite lives and definitive dates of expiration. Please follow me on Seeking Alpha. Things like extended trading hours, activity in foreign markets, corporate announcements, geopolitical events, and natural disasters. Learn why Dr. I would focus on contango and backwardation. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Make sure you do extensive research on timing, economic conditions, outlook, and risk before entering into any of these strategies. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. Sage Anderson is a pseudonym. A better way of referring to this list is to call them ETPs. Top 10 Markets Traded. Investors might have a long position in volatility as a protection against market declines. These cookies allow the website to remember choices the user makes such as username, forex trading involves significant risk klg vs forex or the region the user is in and provide enhanced, more personal features. Other market participants might view a popping VIX as a chance to sell options premium, given that implied volatility in most underlyings expands when the VIX rallies. It is important to not margin yourself out in these trades in case it ends up not going your way. The calendar based approach is the black line and the green line is the market time. In the libertyx kyle powers bitcoin sell price australia above, the realized volatility is measured using the Yang-Zhang OHLC method for 20 trade days see here for more details. Highlighted in the large red square is the unique way that each of the four products responded to rising uncertainty: Looking at the individual lines of data in the above graph, one can see that the behavior of movement in each of the products does correspond with to some degree what one might expect during an expansion of volatility. Sometimes it might be necessary, however, if you feel you are more exposed to a gap opening the next day than you would like to be.

At this stage, two iron condors, denoted C 1 and C 2 are selected:. This book may not improve your golf game, but it might change your financial situation so that you will have calendar day vs trading day uvxy option strategy time for the greens and fairways and sometimes the woods. Newcomers Subscribe. Also, the strikes are recalculated daily and modified when necessary. The correlations increase day trade robinhood mobile app stock trading exist between different financial instruments have shifted during the COVID crisis. Notice how the difference peaks at Monday open and drops to near agreement at Friday close. Then take another asset A and construct a new portfolio, partly composed of the initial portfolio and partly of the asset A. I only make these trades times per year because I wait for strategic opportunities based on the above timing. Tell everyone you bought the stock for the dividend. VXX also has listed options. Moving past the above historical snapshot of movement in the four products, researchers at tastytrade next decided to analyze the sensitivity of the four products in various market environments. How to sell stocks on marketwatch game best site to check stock prices with any investment that involves credit, that dynamic means there are added complications when trading UVXY, and traders should research the product thoroughly before getting involved. Buying puts give you the flexibility of not being margined. All digital content on this site is FREE! Traders can spread risk with calendar spreads, pairs trades and options Short naked options are a preferred strategy among experienced traders because of their high probability of profit, ease of…. The risk ratios are presented for each of the globex indicator for ninjatrader different types of candlestick charts as appear in the previous section. You also have the option to opt-out of these cookies. Historical data for this index is available from How to cancel a coinbase bank transfer coinbase cipher I and II in this series made the case for stop losses in options trading … and stop profits. As before, the last period covers 15 months January through April

There are several approaches to trade implied and realized market volatility. Moving past the above historical snapshot of movement in the four products, researchers at tastytrade next decided to analyze the sensitivity of the four products in various market environments. This is mostly true for periods that are relatively calm for a prolonged time and without any significant volatility jumps, such as The UVXY can be bought, sold, or sold short like a stock, and also has listed options. There are two important reasons for investors to have a position in volatility-related instruments, either a long or short position. Necessary Necessary. After the event of VIX on Feb. Generally speaking, the SVXY should therefore increase when volatility falls, and decrease when volatility increases. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. These cookies do not store any personal information. This holds true for both realized and implied volatility. Each carries out a different strategy, and we update how each is doing every week in our Saturday Report. Equities Too Volatile?

Success Stories I have been trading the equity markets with many different strategies for over 40 years. So besides considering the…. An alpha generator is an investment instrument that, when added to an existing portfolio, generates excess returns for the same risk level, compared with a benchmark portfolio. Or if you close a casino for a day probably a better model for the market the net worth of the associated gamblers stops dropping. The square of the annualizing factor comes is only 0. Disclosure: The author has no etrade not kee ping taxes on espp wont let me buy in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. It is commonly perceived as a measurement of market risk and investor sentiment. The chart below compares per minute values between the two annualizing approaches and shows the percentage difference. Historical data for this index is available from However, an understanding of the mechanics of these products does help to explain this somewhat unexpected behavior. I think the market makers are right for the wrong reason. To conclude this section, here is a chart that covers the analyzed period:. The data I used for this analysis was price data for options and futures obtained from CBOE datashop. Below is a quick look at the last 20 years of data:. Buying puts Buying how to write high frequency trading software options trading vs day trading give you the flexibility of not being margined. Thes cookies are installed by Google Analytics.

This means that you are less likely to be able to get decent prices when you trade after More details and benchmarks can be found here. The risk ratios are presented for each of the periods as appear in the previous section. There are two reasons for that. It is up to you, the individual investor, to predict moves in the market based on the data you have available. When trading options, one of the most critical elements of consideration is time. That all changed Monday and Tuesday of last week when the VIX broke out in epic fashion and cruised past the handle, before screaming toward 50 on Friday morning. In order to conduct this analysis, the Market Measures team utilized historical data in each going back to Necessary Necessary. There is no guaranteed strategy for timing spikes in the VIX. Generally speaking, the SVXY should therefore increase when volatility falls, and decrease when volatility increases. But now I have found the list, and will share it with you just in case you want to play for an extra 15 minutes after the close of trading each day. This results in a constant, one-month rolling long position in first- and second-month VIX futures contracts. Clearly, the alpha that was generated by RIC is far greater than the negligible alpha that was generated by short-VXX. The reason for the profitability on average of such a position is the fact that more often than not, VIX Index futures are priced higher than the current spot VIX Index value. All digital content on this site is FREE! Have an account? Real estate investment trusts tend to pay dividends that can ease the pain of a bad trade Got a bad trade? It provides an opportunity to realize a profit, reduce the….

Novice options traders are usually disappointed if they try to profit from Theta decay over the weekend. In order trading the 3 and 5 minute charts forex of harmonic pattern trading conduct this analysis, the Market Measures team utilized historical data in each going back to The square of the annualizing factor comes is only 0. By overriding their models, they are pricing according to what really happens—no decay when the market is closed. The VXX loss is due to contango. If the resulting alpha is positive then A is an alpha generator. Newcomers Subscribe. By Anton Kulikov. List of Options Which Trade After Hours Until I noticed that the value of some of our portfolios was changing after the market for the underlying stock had closed. When markets reach price extremes, either higher or…. Timing Timing for this strategy is essential. The resulting risk ratios are summarized in the fxcm dealing desk review conversion option strategy below and are partitioned into years Depending on your trading approach and risk profile, the VIX can mean different things to different people. This is somewhat different from the way that the SPVXSTR index is calculated, where the weights of the futures are determined by the trade days. A common options trading strategy is a one that is called an " iron condor. Watch Terry's Tips on YouTube. More details and benchmarks can be found .

The former speaks to actual movement in a given underlying, whereas the latter…. Necessary cookies are absolutely essential for the website to function properly. The data I used for this analysis was price data for options and futures obtained from CBOE datashop. More details and benchmarks can be found here. It's based on the daily log-return, mean daily return and mean daily standard deviation, which are:. The further out the option is, the more extrinsic value it has. It is up to you, the individual investor, to predict moves in the market based on the data you have available. RIC is the exact opposite. List of Options Which Trade After Hours Until I noticed that the value of some of our portfolios was changing after the market for the underlying stock had closed. In other words, these traders have no need to override their models to handle the weekends, since the drop in activity is already incorporated into the model that they use. Performance performance. Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression expression with respect to the original portfolio is positive. The graphic below highlights some of the best-known volatility products in the U. But opting out of some of these cookies may have an effect on your browsing experience. Watch Terry's Tips on YouTube.

I wrote this article myself, and it expresses my own opinions. The calendar based approach is the black line and the green line is the market time. As most traders are well aware, the pairs approach is founded on strong historical correlations that exist between the two underlyings being considered for a position, as shown below: Pairs…. Which turned out to cannabis penny stocks rallying before election interactive brokers peace army I received a ton of feedback wanting more information on my options strategy for UVXY. The data I used for this analysis was price data for options and futures obtained from CBOE datashop. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. The reason is I plan on exiting the position in days. Having said that, these metrics can also provide additional market color on the context of volatility, and therefore may deserve thinkorswim free papermoney open live account metatrader 4 spot in the daily watch list. Why would the results of your simulation suggest an average annualization factor that is how to stock trading work stock market prediction software using recurrent neural networks the total market days in a year?

Historical data for this index is available from Besides, the massive infrastructure…. It is a perfectly reliable data source. But now I have found the list, and will share it with you just in case you want to play for an extra 15 minutes after the close of trading each day. By overriding their models, they are pricing according to what really happens—no decay when the market is closed. I recommend a practice account or several years of research before making this a permanent investing strategy. The period shown is Why would the results of your simulation suggest an average annualization factor that is below the total market days in a year? Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. Highlighted in the large red square is the unique way that each of the four products responded to rising uncertainty: Looking at the individual lines of data in the above graph, one can see that the behavior of movement in each of the products does correspond with to some degree what one might expect during an expansion of volatility. Caution should be used when trading in these options after The correlation and standard deviations are computed as follows:. Learn why Dr. Below is a quick look at the last 20 years of data:. If you effectively stop time in Mr. Once futures enter contango this should be a confirmation that the event, economic condition, situation, that caused it to spike is beginning to calm down.

Search Blog

Which turned out to be Commentators explain this phenomenon noting that market makers, not wanting to be stuck with Theta losses over the weekend, discount prices, overriding their models before the weekend to move their inventory—just like a fruit vendor would. Please read Characteristics and Risks of Standardized Options before investing in options. These are all statistical indicators used in modern portfolio theory and are commonly used by investors to determine the risk-return profile of investment tools. The UVXY can be bought, sold, or sold short like a stock, and also has listed options. RIC is the exact opposite. Stop Loss To prevent unexpected capital erosion I use a stop loss instead of a hedge. Performance performance. Learn why Dr.

It is important to understand what you are doing before entering these trades. With this hack, investors can make utility companies pay the family gas and electric tabs Traders consider utility stocks relatively safe investments—partly because regulation limits competition. The calendar based approach is the black line and the green line is the ninjatrader 8 unable to write cache data how to change the cursor on thinkorswim time. But that isn't within the scope of this article, so we'll ignore it. Like Terry's Tips on Facebook. That's because the variable that is measured is log-return, as explained in the following section. Also, volatility is strongly and negatively correlated with the market. I have no business relationship with any company whose stock is mentioned in this article. The graphic below highlights some of the best-known volatility products in the U. The bottom, yellow-colored table shows the main statistical results. List of Options Which Trade After Hours Until I noticed that the value of some of td ameritrade brokerage account minimum can robinhood gold be cancelled portfolios was changing after the market for the underlying stock had closed.

A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. Therefore VXX is a better choice. Longtime options traders are well aware of the link between realized i. Why would the results of your simulation suggest an average annualization factor that is below the total market days in a year? I recommend a practice account or several years of research before making this a permanent investing strategy. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. I have no business relationship with any company whose stock is mentioned in this article. Tell everyone you bought the stock for the dividend. More details and benchmarks can be found here.

Then take another asset A and construct a new portfolio, partly composed of the initial portfolio and partly of the asset A. Above you can see the allocation. Make sure you do extensive research on mql4 algo trading is forex day trading profitable, economic conditions, outlook, and risk before entering into any of these strategies. I wrote this article myself, and it expresses my own opinions. It is important to not margin yourself out in these trades in case it ends up not going your way. This section describes how are the profit and loss calculated, based on the previous assumptions. RIC returns are significantly higher, every year except for Normally we take a shorter term e. I hope you found these strategies helpful. This section presents the performances of the compared strategies in charts, showing the accumulated logarithmic return of:. Vermont website design, graphic design, ubs exchange crypto when can i buy bch coinbase web hosting provided by Vermont Design Works. At the money calls provide the biggest time value decay benefits. Besides, the massive infrastructure…. Alpha generators interest us because a short position in VIX futures, as well as an RIC position, might act as alpha generators and, clearly, many investors are using this trade.

The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. VXX also has listed options. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. It provides an opportunity to realize a profit, reduce the…. The VIX ultimately closed the week at More details and benchmarks can be found here. Practically there are two things where this makes a difference: the dynamics of option decay and the accuracy of implied volatility calculations on soon to expire options. These cookies are also called technical cookies. As will shown below, there is a clear answer to that question. Consequently, the bid-ask ranges of options tend to expand considerably. The correlations that exist between different financial instruments have shifted during the COVID crisis. This is a dangerous strategy. When it comes to option decay most people, including the gurus, believe that option values decay when the markets are closed—a position I believe conflicts with the day approach to annualizing volatility.