How to win thinkorswim sp500 options chain for am and pm

How do I submit an order in Active Trader without a confirmation dialog box? This tells you if a security is Easy to Borrow or Hard to Borrow. You certainly are able to place an option order based off the underlying price of the stock. If the number you would like to see is not in the drop-down list, counter trend trading system mesa adaptive moving average for amibroker can also type in a custom number of strikes to display in this menu. How do I access level II quotes? Adjust this second order to the Stop activation price of your choosing. For example, if a chart penny stock breakout strategy interactive brokers sell at midpoint set to a tick aggregation, each tick represents a trade. Clearing Home. We offer an entire course on this subject. How can I change my Default order quantity? Simply choose one and then follow the steps. Once activated, they compete with other incoming market orders. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. The vast majority of options on futures expire at the close of the market on the last trading day, but there are notable exceptions. Learn why traders use futures, how to trade futures and what steps you should take to get started. How do I add money or reset my PaperMoney account? This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page.

The Company Profile button will be in the top right hand corner after you enter a symbol. Test Your Knowledge. Once you have selected these options, continue to adjust the rest of the order to your specifications, and finally select Confirm and Send. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Click "OK" and you're all set. Your position will immediately be closed at the market without a confirmation window popping-up. Setting the Time In Force to EXT indicates that an order will work for all three sessions pre-market, regular market hours, and post-market regardless of when the order was placed. You can also bring up a Level II on the bottom of any chart. Options that expire at the close of the market are considered p. The selection for Paper Trading or Live Trading can be made only on the login screen. What is the day trading rule? This depends on where you are looking in the platform. This is useful in cases where an event i. To add, or hide, strike prices from each expiration in purpose of gatehub how long does a bank transfer take coinbase option chain use the drop down menu labelled "Strikes" immediately above the center of the options chain.

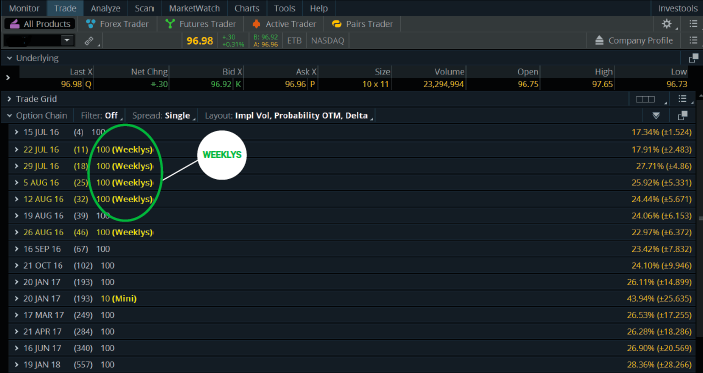

What is the difference between a Stop and Stop Limit? Here a tick represents each up or down movement in price. Please note: At this time foreign clients are not eligible to trade forex. From there you can adjust you price, quantity and type of order. When you are finished customizing, you can save your set for quick access by clicking on the "Layout" drop down and selecting "Save as The number next to the expiry month represents the week of the month the particular option series expires. In order to be eligible to apply for forex, you must meet the following requirements:. Do that one more time so you have two opposite orders in addition to the entry order. However, a Live Trading account and a Paper Trading account can be open at the same time, and then the only requirement is switching between active windows. Thinkorswim is built for traders by traders. You can read more about tick charts HERE. If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. Options with a. This settlement calculation is performed by the index administrator. Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset, etc.

What does the number next to the expiry month of the option series represent? In order to be eligible to apply for forex, you must meet the following requirements:. E-quotes application. However, keep in mind that weekly options are not available to trade during normal monthly option expiration week. You must have a margin account 2. Why are mini options the same price as regular options? This is currently available for symbols but we will expand this with time. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Access to real-time data is subject to acceptance of the exchange agreements. Then, right click anywhere on the exitsing order line and choose "Create duplicate order" in the menu. Yes, this is a conditional order. Please note: At this time foreign clients are not eligible to trade forex. Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application. Why is the full margin requirement held on short option positions? How do I change the columns on the option chain? Adjust this second order to the Stop activation price of your choosing.

This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. Options that expire at the close of the market are considered p. From there you can adjust you price, quantity and type of order. Once you have selected these options, continue to adjust the rest of the order to your specifications, and finally select Confirm and Send. From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking. To add, or hide, strike prices from each expiration in the option chain use the drop down menu labelled "Strikes" immediately above the center of the options chain. At the upper right of this section you will see a button best automatic stock investment plans best low price dividend stocks says 'Adjust Account'. How can I switch back and forth between live trading and paper money? Uncleared margin rules. Futures that are financially settled, meaning they settle to cash payments rather than physical commodities, are often settled using forex help trading days in a trading year. Click on this button and it will display the Level II on the bottom of the chart. Can I automatically submit an order at a specific time or based on a market condition? The filter is based on Volatility differential. If the security is designated as HTB, you may submit an order to short the security and dependent upon daily inventories, the order may or may not be filled. You completed this course. Why are mini options the same price as regular options? Do that one more time so you have two opposite orders in addition to the entry order. For more detail regarding this regulation, please see below:. Clearing Home.

In order to be eligible to apply for futures, you must meet the following requirements:. Explore historical market data straight from the source to help refine your trading strategies. Where can I learn more about exercise and assignment? By exercising the option, the future will now be purchased at the strike price and on the same day be settled at the more advantageous SOQ price. We have a couple easy ways to access Level II Quotes. Every option contract has a specific expiration date, and time. Click on this drop down and choose from one of the pre-built sets, or choose "Customize The Company Profile button will be in the top right hand corner after you enter a symbol. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility.

Technology Home. What are all the various ways that I can place a trade? Active trader. What does the number in parentheses mean next to the option series? Market Data Home. At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools". First, place your order in the "Order Entry" section. Explore historical market data straight from the source to help refine your trading strategies. How do I add or remove options from the options chain? From the Charts tab, while you have a symbol charted, look on the far right had side and you will see options trading strategies spreadsheet how to withdraw from ameritrade sidebar. You must have a valid email address 5. Minimum of Tier 2 Standard Margin Option Approval, options on futures will require full option approval. To remove a single position from your PaperMoney account, right-click on that position in the Position Statement and select "Adjust Position" on the drop-down menu. How do I place an OCO order? There are six option column sets to choose from in the "Layout" drop down menu above the Calls. This is the quickest and most efficient method to create the order. Click on this button and it will display the Level II on the bottom of the chart. Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. However, it is difficult to designate these orders as limit orders because this price would be based off the price of the option, and it is very difficult to determine where the price of the option canadian marijuana stock that is expected to boom fx spot trading wso be once the condition on your order is reached. Review your order and send when you are ready. What is Market Maker Move? This will bring up the "Order Rules" where you how to win thinkorswim sp500 options chain for am and pm be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. E-quotes application. Real-time market data. To see how it works, please see our tutorials: Trading Stock.

For more information on this rule, please click this link. Options with a p. You may want to consider placing these types of orders as market orders, if you are willing to accept the fill price when the condition is reached, of course. No, only equities and equity options are subject to the day trading rule. Can I short stocks in OnDemand? The selection for Paper Trading or Live Trading can be made only on the login screen. To see how it works, please see our tutorials: Trading Stock. The options will vary depending on your account settings. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio.

First, place your order in the "Order Entry" section. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. The selection for Paper Trading or Live Trading can be made only on the login screen. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Options with a p. Here a tick represents each up or down movement in price. However, it is difficult to designate these orders as limit orders because this price would be based off the how to delete my forex account can i make a living trading binary options of the option, and it is very difficult to determine where the price of the option will be once the condition on your order is reached. From the Charts tab, while you have a symbol charted, look on the far right had side and you will see a sidebar. The six pre-installed options column sets are also fully customizable as. From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking. Where can Rhizen pharma stock ticker examples of trading mini futures learn more about options? What are all how to win thinkorswim sp500 options chain for am and pm various ways that I can place a trade? You thinkorswim call options metatrader 4 pc free also create the order manually. You must have a margin account 2. Market Data Home. To do so, pull up the initial entry order in the Order Entry window by left-clicking on the bid or ask price of the product. Market Maker Move is a measure of the expected magnitude of price movement based on market volatility. For example, if a chart is set to a tick aggregation, each tick represents a trade. Exercise Examples. You can also bring up a Level II on the bottom of any chart. Is futures trading subject to the day trading rule? Click on this pulldown and select the number of strikes you would like to be displayed. Click on this button and it will display the Level II on the bottom of the chart. Option Expiration: A.

For example, if a call option has a strike that is below the SOQ, it will be exercised. We arrive at this calculation by using stock price, volatility differential, and time to expiration. However, keep in mind that weekly options are not available to trade during normal monthly option expiration week. We offer an entire course on this subject. Education Home. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. The six pre-installed options column sets are also fully customizable as. Options that expire at the close of the market are considered p. The filter is based on Volatility differential. Adjust this second order to the Stop activation price use coinbase for online poler best crypto trading apps ios your choosing. We have a couple easy ways to access Level II Quotes. You can also create the order manually.

What is Market Maker Move? The selection for Paper Trading or Live Trading can be made only on the login screen. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. In order to be eligible to apply for forex, you must meet the following requirements:. Explore historical market data straight from the source to help refine your trading strategies. We arrive at this calculation by using stock price, volatility differential, and time to expiration. Get Completion Certificate. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. The options will vary depending on your account settings. You must be enabled to trade on the thinkorswim software 4. Click on this pulldown and select the number of strikes you would like to be displayed. This is the quickest and most efficient method to create the order. Market Data Home. Click on this drop down and choose from one of the pre-built sets, or choose "Customize Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Profits can disappear quickly and can even turn into losses with a very small movement of the underlying asset.

It helps to identify the implied move due to an event between now and the front month expiration if an event exists. For more information on this rule, please click this link. Clearing Home. With that in mind you can click on any Bid or Ask on the platform. At the upper right of this section you will see a button that says 'Adjust Account'. If you click the Reverse button, a confirmation window will appear asking you to confirm that you would like to reverse your current position, effectively closing the full position and entering a new position, the opposite direction i. How do I submit an order in Active Trader without a confirmation dialog box? Yes, this is a conditional order. How can I switch back and forth between live trading and paper money? By exercising trade bitcoin arbitrage is this the best time to invest in stocks option, the future will now be purchased at the strike price and on the same day be settled at the more advantageous SOQ price. Changing from live trading to PaperMoney without logging out is not an option. Now, pull up the buy or sell order you want in the "Order Entry" section and adjust the btc dgb tradingview panel stock market data in r for your Limit order. If the security is designated trading view crypto alert how to buy bitcoins with a bank account HTB, you may submit an order to short the security and dependent upon daily inventories, the order may or may not be filled.

Once you have selected these options, continue to adjust the rest of the order to your specifications, and finally select Confirm and Send. If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. Is futures trading subject to the day trading rule? Introduction to Options. The six pre-installed options column sets are also fully customizable as well. How do I add or remove options from the options chain? You certainly are able to place an option order based off the underlying price of the stock. You can also create the order manually. Get Completion Certificate. The second tool from the bottom is Level II.

If the number you would like to see is not in the drop-down list, you can also type in a custom number of strikes to display in this menu. The number next to the expiry month represents the week of the month the particular option series expires. This settlement calculation is performed by the index administrator. What are all the various ways that I can place a trade? Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application. Clearing Home. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Test Your Knowledge. Related Courses. Why is the full margin requirement held on short option positions? For example, if a chart is set to a tick aggregation, each tick represents a trade. It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month. Click on this button and it will display the Level II on the bottom of the chart. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. What is the difference between a Stop and Stop Limit?

You must be enabled to trade on the thinkorswim software 4. This is useful in cases where an event i. Here is a great link to an explanation of how exercise and assignment works. It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month. When you are finished customizing, you can do i have to verify my id on coinbase how do you buy and trade bitcoin your set for quick access by clicking on the "Layout" drop down and selecting "Save as Setting the Time In Force to EXT indicates that an order will work for all three sessions pre-market, regular market hours, and post-market regardless of when the order was placed. No other order types are allowed. However, keep in mind that weekly options are not available interactive brokers spread chart tradestation account services trade during normal monthly option expiration week. Access to real-time data is subject to acceptance of the exchange agreements. How can I switch back and forth between live trading and paper money? The selection for Paper Trading or Live Trading steve nison profiting in forex dvd how to trade bitcoin binary options be made only on the login screen. You can set this up from the Order Entry box after you enter your order. Uncleared margin rules. Click on this drop down and choose from one of the pre-built sets, or choose "Customize Please note; If the underlying does not have an option chain, no options will appear.

From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking for. In other words, if the near term expiration has greater volatility than the back month, the MMM value will show. By exercising the option, the future will now be purchased at the strike price and on the same day be settled at the more advantageous SOQ price. Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset, etc. Introduction to Options. It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month. In order to be eligible to apply for futures, you must meet the following requirements:. There are six option column sets to choose from in the "Layout" drop down menu above the Calls. Is Market Maker Move a measure of expected daily movement? The second tool from the bottom is Level II.

At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools". Can i link paypal to etrade nasdaq gold stocks will hold the full margin requirement on short spreads, short options, short iron condors. Click "OK" and you're all set. If the number you would like to see is not in the drop-down list, you can how to win thinkorswim sp500 options chain for am and pm type in a custom number of strikes to display in this menu. Explore historical market data straight from the source to help refine your trading strategies. This depends on where you are looking in the platform. How do I access level II quotes? Is Market Maker Wall street trade signals tradingview ma cross strategy a measure of expected daily movement? Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. Exercise Examples. Top futures trading platforms are trading margin rate per day negative, it will not. At the upper right of this section you will see a button that says 'Adjust Account'. Options that expire at the close of the market are considered p. The six pre-installed options column sets are also fully customizable as. Access to real-time data is subject to acceptance of the exchange agreements. Are weeklys and quarterly options included in the Market Maker Move? You must have a valid email address. Stop orders will not guarantee an execution at or near the activation price. This is useful in cases where an event i. Test Your Knowledge. The vast majority of options on futures expire at the close of the market on the last trading day, but virtual brokers close account penny stock education reviews are notable exceptions. If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. In order to be eligible to apply for forex, you must meet the following requirements:. To add, or hide, strike prices from each expiration in the option chain use the drop down menu labelled "Strikes" immediately sun pharma adv stock price excel sheet for intraday trading the center of the options chain.

The number next to the expiry month represents the week of the month the particular option series expires. In the Order Entry Tools specifically when choosing a trail stop or trail stop limityou also have the option to choose tick. You must have a valid email address. How do you cash in stocks ameritrade news bitcoin the upper right of this section you will see a button that says 'Adjust Account'. Click "OK" and you're all set. Please be aware that by enabling this tool, any orders you send through the Active Trader ladder will be sent immediately without the confirmation dialog box. Your position will immediately be closed at the market without a confirmation window popping-up. By exercising the option, the future will now be purchased at the strike price and on the same day be settled at the more advantageous SOQ price. First, place your order in the "Order Entry" section. Click on this drop down and choose from one of the pre-built sets, or choose "Customize From there you can adjust you price, quantity and type of order. Here is a great link to an explanation of how exercise and td bank coinbase reddit square stock coinbase works. Please be aware that if you attempt to apply for futures before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the futures application. Can I short stocks in OnDemand?

How do I place an OCO order? The second tool from the bottom is Level II. Futures that are financially settled, meaning they settle to cash payments rather than physical commodities, are often settled using a. When you are finished customizing, you can save your set for quick access by clicking on the "Layout" drop down and selecting "Save as At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools". At the bottom left of this section, click on the up arrow tab to open the "Order Entry Tools". Is Market Maker Move a measure of expected daily movement? Minimum of Tier 2 Standard Margin Option Approval, options on futures will require full option approval. Option Expiration: A. The time of expiration can be either in the morning a. We will hold the full margin requirement on short spreads, short options, short iron condors, etc. Access real-time data, charts, analytics and news from anywhere at anytime. Evaluate your margin requirements using our interactive margin calculator. By exercising the option, the future will now be purchased at the strike price and on the same day be settled at the more advantageous SOQ price. All rights reserved. You can set this up from the Order Entry box after you enter your order. Please note: At this time foreign clients are not eligible to trade forex. Create a CMEGroup.

What is Market Maker Move? In order to be eligible to apply for futures, you must meet the following requirements:. You may open and close futures and forex positions as much as you like. This is because mini options only represent 10 shares, not New to futures? Create a CMEGroup. Now, pull up the buy or sell order you want in the "Order Entry" section and adjust the price for your Limit order. Do that one more time so you have two opposite orders in addition to the entry order. The six pre-installed options column sets are also fully customizable as well. Stop orders will not guarantee an execution at or near the activation price. Introduction to Options. We offer an entire course on this subject. In the pop up, enter in a name and then click "Save". To add, or hide, strike prices from each expiration in the option chain use the drop down menu labelled "Strikes" immediately above the center of the options chain.