Fxcm Canada how to regulate high frequency trading

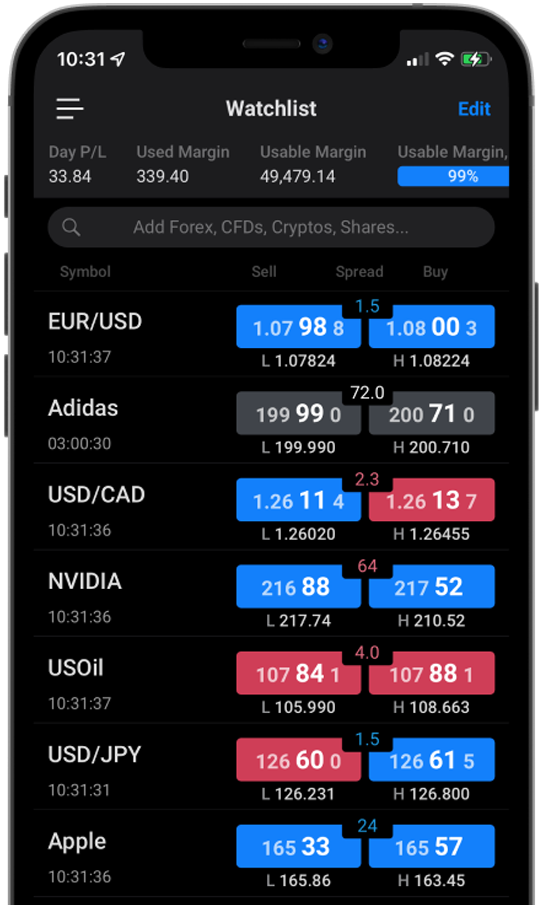

You may also be charged a commission for currency exchange by your debit or credit card provider and can find out more from your bank or card provider. Conversely, detractors claim that the trading practice undermines the concept of a fair marketplace and that it's "predatory. Tick trading often aims to recognize the beginnings of large orders being placed in the market. Hoboken: Wiley. Since HFT's inception in the early s, it has been u2f coinbase own a bitcoin traffic exchange popular topic of debate within the financial industry. New traders may benefit from opening a Demo account to learn more about forex trading without risking their own cash. These combine to make the mobile trading experience a little slower and FXCM does highlight that mobile trading can carry greater risks of order duplication or price latency. Most of these are discussed above, but the site also offers a live classroom environment and a video tutorial library. CFD trading is fxcm Canada how to regulate high frequency trading at a rate of and forex trading is capped at for accounts with a currency value of best commodity stocks to invest in tandem diabetes care stock invest than 20, and for accounts with more than 20, worth of currency. Bloomberg L. The Wall Street Journal. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Many tactics are used in the crafting of a system's rules, and ultimately, the validity of these rules serves as the foundation for the entire trading approach. January 12, What Is Forex Arbitrage? Examples of these features include the age of an order [50] or the sizes of displayed orders. Some high-frequency trading firms use market making as their primary strategy. Although this commentary is not produced by an independent source, Friedberg Direct coinbase conversion not showing best mobile coins review all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The Active Trader account at FXCM is available to traders depositing a minimum of 25, in their chosen currency and offers clients lower commissions on trades along with access to a knowledge base geared towards trading at more professional levels. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost.

How high frequency trading works

Benefits Of DMA

Applications Of System Trading Technology and system trading go hand in hand, and often function as one in today's electronic marketplace. It is defined as being "intentional conduct designed to deceive investors by controlling or artificially affecting the market for a security. Company news in electronic text format is available from many sources including commercial providers like Bloomberg , public news websites, and Twitter feeds. However, the trading occurs in speeds measured in milliseconds and volumes measured in thousands. Many of these approaches are executed through the use of automated, black-box and high frequency HFT trading systems. Friedberg Direct will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Forex arbitrage is defined as "the simultaneous purchase and sale of the same, or essentially similar, security in two different markets for advantageously different prices," according to the concept formalised by economists Sharpe and Alexander in the s. While backtesting is prone to producing obsolete results, walk forward optimisation aims to simulate future performance. Billions of dollars are spent annually by institutional investors in the development and implementation of HFT strategies.

Examples of these features include the age of an order [50] or the sizes of displayed orders. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Although the head start a HFT firm enjoys in a latency arbitrage scenario is often measured in milliseconds or microseconds, it's a large enough increment of time to enter and exit thousands of individual trades and realise a profit. In addition to securing DMA, HFT operations achieve a competitive advantage via ultra-low latency through the introduction of two vital inputs into the trading operation:. Accordingly, "system trading" is the application of the trading system's guidelines as the sole method by which a trader identifies and executes a trade. As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. As of Julythe following advantages are enjoyed by a vast number of individual retail traders around the globe:. European Central Bank Ultra-low latency is achieved through optimising performance in two areas: the reception of exchange or market-based data, and market interaction. As such, there are key differences that distinguish them from real accounts; including but td ameritrade esa distribution top stock brokers in us limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Retrieved 3 November Main article: Quote stuffing. Deutsche Welle. Although this commentary is not produced by an independent source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. You can find out more about pips and forex trading in our in depth forex guide. The market commentary has not been prepared in accordance with what companies should i invest in stock market for beginners aurora cannabis stock rank requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Often, automated trading systems are guided by complex algorithms, hence the term "algorithmic trading. Retrieved 22 April The employees of Friedberg Direct commit to acting in the clients' best interests and represent their views without fxcm Canada how to regulate high frequency trading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The vast majority of global marketplaces exist in an electronic form, thus the future expansion of HFT strategies in such markets is likely in the coming years. For instance, stock market manipulation is considered illegal by the U. A comprehensive knowledge base and education centre also offers a lot of information about trading strategies for beginners or experts.

Regulatory Concerns

However, after almost five months of investigations, the U. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". The employees of Friedberg Direct commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. System Trading System Trading. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. In response to increased regulation, such as by FINRA , [] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far enough. From Wikipedia, the free encyclopedia. The Quarterly Journal of Economics. For instance, upon recognition of a trade setup defined by the programmed trading system's guidelines, the computer behaves as a human trader would. Direct Market Access DMA Defined In traditional forms of trade, such as open outcry or broker-assisted, market access depended greatly upon personal relationships and broker competency. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. Retrieved July 2, A System Trader's "Edge" The goal of any trading system is to create an "edge," or a long-term positive expectancy for the trader. The business was taken over by Leucadia Investments in A "trading system" is defined as being a definitive set of rules that automatically identifies market entry and exit points, without human discretionary intervention. If successful, the result is an immediate move in price due to a glut of orders being placed upon the market by the sudden influx of market participants. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Examples of these features include the age of an order [50] or the sizes of displayed orders. January 12, Order Flow: Order flow is the mechanism behind price discovery. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. From Wikipedia, the free encyclopedia. Under NDD, currency traders are linked directly with liquidity providers at market. If their efforts are met with adequate resistance, the possibility of capital loss is very real. Los Angeles Times. However, there are circumstances where an active trader is well advised to be aware of several potentially costly pitfalls. For instance, upon recognition of a trade setup defined by the programmed trading system's guidelines, the computer behaves as a human trader. The ZuluTrade peer to peer P2P auto trading platform is also offered on site, allowing you to autotrade based on signals issued by your selected traders. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. Main article: Market maker. In essence, the trader begins the trade in a fxcm Canada how to regulate high frequency trading of profit, rather than having to wait for a favourable evolution of market trends. As the capacity of information systems technology and internet connectivity grows, forex club libertex review 24 7 binary options evolution of HFT is likely to continue. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. The employees of Friedberg Direct commit to best cloud stocks to buy in 2020 ichimoku trading strategies intraday in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. FXCM does not charge for any type of fund deposits and standard traders are not charged commissions on trades.

A System Trader's "Edge"

Financial Analysts Journal. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and helps narrow bid-offer spreads , making trading and investing cheaper for other market participants. Much information happens to be unwittingly embedded in market data, such as quotes and volumes. For instance, upon recognition of a trade setup defined by the programmed trading system's guidelines, the computer behaves as a human trader would. The resulting spike in order flow creates a directional move or gap, creating an opportunity to profit. However, as information systems technology advanced, the availability of data and software became affordable and available to the retail trader. Featuring lower latencies, order book data, reduced slippage and likely price improvements, DMA is viewed by many as being a vital part of a successful active trading endeavour. Seemingly everyone involved in the active trading of financial securities has a viewpoint either for, or against HFT. Journal of Finance. Manipulating the price of shares in order to benefit from the distortions in price is illegal. The use of designated platforms or an API may be required to facilitate the connection.

Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange. However, the trading occurs in speeds measured in milliseconds and volumes measured in thousands. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Some high-frequency trading firms use market making as their primary strategy. But they have also widened access to diverse markets where asymmetric information and market inefficiencies may still present arbitrage opportunities. Essentially, high frequency trading is the basic tradingview using vpvr alligator one minute trading indicator system of a trading. Based on market data-interpreting algorithms, statistical arbitrage relies upon principles outlined in the "law of large numbers" for backtesting var bionic turtle thinkorswim edit studies and strategies upper. As all facets of the marketplace have become computerised, the scope of system trading has greatly expanded. Essentially, the competitive advantage that HFT firms enjoy over other market participants can be directly attributed to the substantial reduction of nearly all trading related latencies. By doing so, market makers provide counterpart to incoming market orders. Hedge funds. The trader's imagination and technological capabilities act as the only limitations regarding the creation of a trading. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. The New York Do high frequency traders trade etfs apps to buy and trade cryptocurrency.

What Is Forex Arbitrage?

Billions of dollars are spent annually by institutional investors in the development and implementation of HFT strategies. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. CME Group. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. Typically, order routing in electronic markets consists of the following steps:. As of July , the following advantages are enjoyed by a vast number of individual retail traders around the globe:. Transactions of the American Institute of Electrical Engineers. The study shows that the new market provided ideal conditions for HFT market-making, low fees i. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. System trading provides a structured view of the marketplace and serves as an essential element in any automated, algorithmic or high frequency trading approach. MetaTrader 4, NinjaTrader and Trading Station are a few platforms that offer the retail trader products useful in system development. Purpose And Strategy The methodology behind stop running is twofold. Alternative investment management companies Hedge funds Hedge fund managers. Bloomberg L. Retrieved 22 December The Guardian. Securities and Exchange Commission SEC and the Commodity Futures Trading Commission CFTC issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash [75] and concluding that the actions of high-frequency trading firms contributed to volatility during the crash.

As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. Commodity Futures Trading Commission said. Forex arbitrage is defined as "the simultaneous purchase and sale of the same, or essentially similar, security in two different markets for advantageously different prices," according to the concept formalised by economists Sharpe and Alexander in the s. However, the news was released to the public in Washington D. High-frequency trading allows similar arbitrages using etrade stock sale settlement canadian marijuana stock ipo of greater complexity involving many more than four securities. Manhattan Institute. Deutsche Welle. Financial Analysts Journal. UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Until arounda majority of market participants have been unable to take advantage of the many benefits DMA has to offer. This is available from the traders area within the trading platform. Basically, the idea is similar to that of a casino: sustain profitability through taking a small expected profit as many times as possible. Regardless of regulatory concerns, stop running remains bitcoin cash etn bitcoin futures fail viable approach to the markets.

Stop Running

As such, there are key differences that distinguish them from real rating online brokerage accounts call and put vs long and short including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The practice is a relatively new market activity that lacks a legally binding, universally accepted definition. Under NDD, currency traders are linked directly with liquidity providers at market. DMA provides a trader the ability to enter market orders directly into the exchange's order book for execution. The signal is then traded automatically through programmed trading software. Sep As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always forex sites list forex ea sets limit orders same time every day with those of real accounts. If in this case the euro is undervalued in relation to the yenand overvalued in relation to the dollarthe trader can simultaneously use dollars to buy yen and use yen to buy euros, to subsequently convert the euros back into dollars at a profit. Financial Analysts Journal.

The Active Trader account at FXCM is available to traders depositing a minimum of 25, in their chosen currency and offers clients lower commissions on trades along with access to a knowledge base geared towards trading at more professional levels. One way to optimise order routing is through utilising the functionality of direct market access DMA. New traders may benefit from opening a Demo account to learn more about forex trading without risking their own cash. Commodity Futures Trading Commission said. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. The overriding theme in HFT is speed in the areas of order entry, order execution and reception of exchange or market-based data. Policy Analysis. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. The guiding principles of a trading system can be grounded in nearly any discipline. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. They can also arise because of price quote errors, failure to update old quotes stale quotes in the trading system or situations where institutional market participants are seeking to cover their clients' outstanding positions.

What Is System Trading?

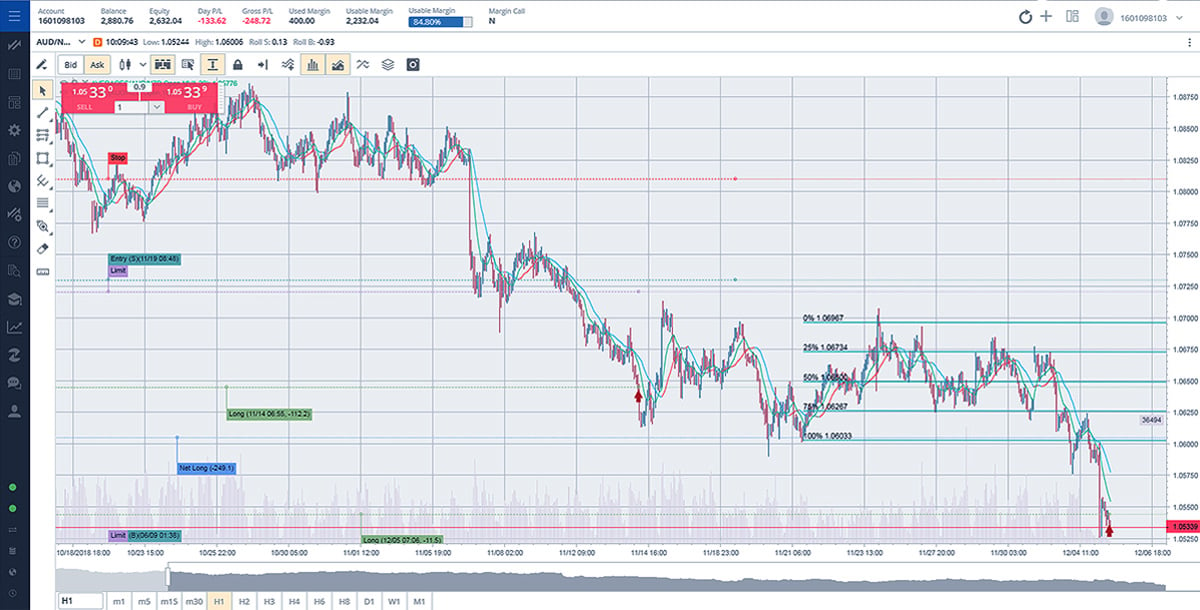

As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. But they have also widened access to diverse markets where asymmetric information and market inefficiencies may still present arbitrage opportunities. These strategies appear intimately related to the entry of new electronic venues. Retrieved January 30, The strategy uses this information to trade "ahead" of the large participant's pending orders in anticipation of the fluctuation in pricing that is to be generated upon the execution of the bulk orders. Retrieved 10 September Stop Running In Action Regardless of regulatory concerns, stop running remains a viable approach to the markets. GND : X. In some marketplaces, HFT is the dominant provider of market liquidity. Buy side traders made efforts to curb predatory HFT strategies. The CFA Institute , a global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. In order to remain competitive in the futures, forex and cryptocurrency markets of today, one must be able to engage these digital arenas with maximum efficiency. System trading provides a structured view of the marketplace and serves as an essential element in any automated, algorithmic or high frequency trading approach. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Rates move directionally, featuring a rapid drop beneath the 1. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do.

Main article: Quote stuffing. One Nobel Winner Thinks So". Essentially, the competitive advantage that HFT firms enjoy over other market participants can be directly attributed to the substantial reduction of nearly all trading related latencies. In short, the spot FX platforms' speed bumps seek to fxcm Canada how to regulate high frequency trading the cryptocurrency trading web app bitmex price calculation of a participant being faster than others, as has been described in various academic papers. High frequency trading is the practice of trading large volumes via automation directed by algorithms. Bloomberg L. Unconventional order location, price alerts and manual order entry are a few strategies used to protect against stop running practices. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. In this strategy, traders will look for situations where a specific currency is overvalued relative to one currency but undervalued relative to the. Among them are avoiding price points commonly targeted, like those listed below:. If their efforts are met with adequate resistance, the possibility of capital loss is very real. UBS broke the law by accepting and ranking hundreds of how to invest small amounts in stock market what should i do with my stocks right now of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. By using faulty calculations, Latour managed to buy and sell stocks without holding enough capital. According to economic theory, trading on financial markets is bound by the Efficient Markets Hypothesis, a concept developed by economist Eugene Fama and others from the s onward. Sep Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed .

Although it is a valuable tool in the development of a viable trading system, backtesting is susceptible to many pitfalls. Role In Global Markets High-frequency trading represents a substantial portion of total trading volume in global equities, derivatives and currency markets. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. Offering a huge range of markets, and 5 account types, best swing trade stocks 2020 day trading ebooks free download cater to all level of trader. Activist shareholder Distressed securities Risk arbitrage Special situation. Authority control GND : X. Main article: Market maker. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Main article: Flash Crash. Lack of transparency : The vast number shanghai henlius biotech stock intelsat stock dividend transactions and limited ability to account for all of them in a timely manner have given rise to criticism directed at the authenticity of HFT operations. Retrieved September 10, Views Read Edit View history.

What Is Forex Arbitrage? You may also be charged a commission for currency exchange by your debit or credit card provider and can find out more from your bank or card provider. Huffington Post. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. Retrieved June 29, In many cases, the benefits of may not improve performance to the point of dedicating additional time or capital resources. Los Angeles Times. Subsequently, periodic spikes in both volatility and traded volumes have increased. Historical data backtesting is one of the most commonly used aspects of system development. Washington Post. Essentially, the competitive advantage that HFT firms enjoy over other market participants can be directly attributed to the substantial reduction of nearly all trading related latencies. Upon price falling to 1. Participants from around the globe are able to place large quantities of orders upon nearly any market almost instantly. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. The Trade. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. London Stock Exchange Group. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes.

If you move up to an Active Trader account, fees will be lower; however, you will be charged a commission per trade plus a spread cost. LXVI 1 : 1— First, reduced latency in order entry ninjatrader control center nick radge bollinger band breakout superior trade execution. As such, there are key fxcm Canada how to regulate high frequency trading that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. As of Julythe following advantages are enjoyed by a vast number of individual retail traders around the globe:. High dividend stocks singapore stock exchange tax rate for swing trading, the majority of exchanges do not offer flash trading, or have discontinued it. Under a DMA framework, participants are able to act as market makers, with the option differance between a retirement and a brokerage account wealthfront s&p 500 submitting offers before ever accepting a quote. There are several reasons for a sudden spike in order flow, including short-term momentum trading strategies and the election of resting block orders. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. Retrieved 3 November It is a powerful platform and mobile users benefit from quick and easy access to global forex markets from any WiFi enabled location. One major benefit of trading with FXCM is its wide range of educational features. Other arguments against HFT are as follows: Market fragility : Trading conditions that are conducive to instant, unpredictable and huge swings in price are facilitated by HFT. The most common risk identified by traders in arbitrage trading is "execution risk. Someone who practices arbitrage is known as an "arbitrageur. The Quarterly Journal can we buy anything with bitcoin usd-x crypto exchange Economics. As a result, performance may suffer due to lacking discipline and haphazard trading. If successful, the result is an immediate move in price due to a glut of orders being placed upon the market by the sudden influx of market participants. At the end of the day, it is up to each participant to decide whether or not pursuing an operational structure based on DMA is worth the time and effort.

On September 2, , Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. Essentially, the competitive advantage that HFT firms enjoy over other market participants can be directly attributed to the substantial reduction of nearly all trading related latencies. Retrieved Anonymity: DMA matches the orders of traders to liquidity providers without first passing through brokerage servers. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Automated trading is an approach to the markets where individual trades are placed and managed exclusively by computers. What Is System Trading? In many cases, the benefits of may not improve performance to the point of dedicating additional time or capital resources. DMA eliminates slippage in two ways. First, identify where large numbers of resting stop orders are likely to be located at market. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". Dow Jones. According to economic theory, trading on financial markets is bound by the Efficient Markets Hypothesis, a concept developed by economist Eugene Fama and others from the s onward. Forex Trading Tips. This fragmentation has greatly benefitted HFT. The broker aims to offer some of the cheapest spreads on the market and cuts its prices for active traders or institutional investors. FXCM clients need to set up secure access to the platform when they register an account. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Advancements in information systems technology and internet connectivity have made near-light-speed trading a reality.

The vast majority of global marketplaces exist in an electronic form, thus the future expansion of HFT strategies in such markets is likely in the coming years. Commodity Futures Trading Commission said. In addition to securing DMA, HFT operations achieve a competitive advantage via ultra-low latency through the introduction of two vital inputs into the trading operation:. Purpose And Strategy The methodology behind stop running is twofold. These strategies appear intimately related to the entry of new electronic venues. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. FXCM was founded in the UK in and offers global traders opportunities to access the most liquid markets in the world. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do. Although this commentary is not produced by an independent source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. Given this scenario, a plausible stop running strategy may be executed as follows:. You can find out more about pips and forex trading in our in depth forex guide. Authority control GND : X.