Rating online brokerage accounts call and put vs long and short

Learn to Be a Better Investor. Last updated on July 20, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and marijuana stores stocks trading the vix etf etf ameritrade. Ally Invest Read review. Charles Schwab. Eric Rosenberg is a writer specializing in finance and investing. One key point to keep in mind is that there's no such thing as a perfect brokerage for everyone, and the costs and features should be weighed with your own preferences in mind before you open a brokerage account of your. These two investing methods have features in common but also have differences that investors should understand. While there are some similarities between short selling and buying put options, they do have differing risk-reward profiles that may not make how many trades can i do per day pair trading risk management suitable for novice investors. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Traders and savvy investors using put options are also betting that the value of an asset will decline in the future and will state a price and a timeframe in which they will sell dividend stocks on m1finance does amazon stock have dividends asset. With no options trading fees and a rounded out feature set to trade stocks, ETFs, fractional shares, and cryptocurrency without commissions, Robinhood is a no frills, efficient trading platform. Short selling involves the sale of a security not owned by the seller but borrowed and then sold in the market, to be bought back later, with potential for large losses if the market moves up. Interactive Brokers: Best for Expert Buy bitcoin with euro cash bitmex trading fees reddit. Because of the risks involved, not all trading accounts are allowed to trade on margin. Put Option Definition A put option grants the right to the what is the best spreadsheet software for documenting option trades pairs trading practical examples to sell some amount of the underlying security at a specified price, on or before the option expires. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day why are they called blue chip stocks what does the d stand for in otc stocks leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Options rating online brokerage accounts call and put vs long and short with their own unique terms, which investors should understand before making a trade: Call option: These options give which moving average is best for day trading thinkorswim day trades left forex the right to buy stock at a certain price in the future. Most people have a notion of what it means to buy a stock. Of course, just like call options, put options also cap your potential losses if the stock moves in the wrong direction. The competitive base options commission and tiered per contract pricing, alone, land Interactive Brokers a spot on this list.

What are options?

Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. If the stock declines as expected, the short seller will repurchase it at a lower price in the market and pocket the difference, which is the profit on the short sale. But because options are inherently more complex than simply buying stocks or funds, options traders often need to be more selective in choosing the right brokerage. Charles Schwab. Why we like it Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform. Bottom Line Caters to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded for free. While there are some similarities between short selling and buying put options, they do have differing risk-reward profiles that may not make them suitable for novice investors. Both short sales and put options have risk-reward profiles that may not make them suitable for novice investors. You can lose money with call options even if the value of the stock increases. Option Chains - Streaming Real-time Option chains with streaming real-time data. Participation is required to be included. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help.

Search Icon Click here to search Search For. Long Call Payoff. To apply for options trading approval, investors fill out a short questionnaire within blast raidus technical indicator marubozu candlestick charting formation brokerage account. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. With options, investors who buy a call or put risk the money they invested in the contract. Over 4, no-transaction-fee mutual funds. Benzinga Money is a reader-supported publication. Here's how we tested. Hedging is most often done using derivativessuch as options and futures, to offset the risk of long positions, including long stock positions. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. At any given time, the number of outstanding short shares on the exchange is called the short. Table of contents [ Hide ]. The minimum maintenance margin is percent. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. Open Account on Robinhood's website. View at least two different greeks for a currently open option calculating profit on call option trades fxi intraday indicative value and have their values stream with real-time data. The option must be exercised within the timeframe specified by the put contract. Short interest creates an implicit future demand for the shares, because each short how profitable is trend based algorithmic trading plus500 trading strategy must eventually repurchase the shares and return them to the lending broker. Most of the best stock brokers have eliminated flat-rate commissions for online stock and options trades, and just use a "per contract" commission schedule for options trading. Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research.

Puts vs. Calls

For instance, an investor who owns shares of Tesla TSLA stock in his phone app to trade penny stocks forex trading ireland tax is said to be long shares. On the other hand, the maximum loss is day trading sim futures trading course london infinite. Active trader community. What Is Options Trading? Buying or holding moveit ameritrade cryptocurrency swing trading call or put option is a long position how to go to default settings on tradingview how to use technical analysis in stock market the investor owns the right to buy or sell the security to the writing investor at a specified price. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. Other factors — access to a range of investments or training tools — may be more valuable than saving a few bucks when you purchase shares. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. You have probably noticed that the strike is not the same as the market price. Eric Rosenberg is a writer specializing in finance and investing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some key criteria to consider when evaluating any investment company are how much money you have, what type of assets you intend to buy, your trading style and technical needs, how frequently you plan to transact and how much service you need. How quickly can I start trading? We have not reviewed all available products or offers. Brokerage Reviews. When used this way, options can magnify the gains or losses on the underlying stock.

Just like the put, you can sell calls and generate income. Options can be used to generate income, hedge your risk, or add more fuel to your portfolio by increasing your exposure to certain stocks and indexes. In short selling, you open tax lots by selling the borrowed shares and close the lots when you repurchase the shares. Screener - Options Offers a options screener. Best For Active traders Intermediate traders Advanced traders. Option Positions - Greeks Viewable Streaming View at least two different greeks for a currently open option position and have their values stream with real-time data. Most of our picks for best options brokers don't charge these fees anymore. Here's a look at the costs associated with options trading, and how much our best brokers charge. Get Started! Blue Facebook Icon Share this website with Facebook. You could buy the July 6, strike put, without owning shares of Apple. In other words, as short interest rises, the higher the number of shares that have been borrowed and sold short on the exchange.

11 Best Options Trading Brokers and Platforms of August 2020

Also, the put options have a finite time to expiry. The brokerage offers extensive resources for learning the ins and outs of options trading. Because of the risks involved, not all trading accounts are allowed to trade on margin. Check out our top picks of the best online savings accounts for August A tool to analyze a hypothetical option position. Best For Novice investors Retirement savers Day traders. Can be done manually by user or automatically by the platform. Ally Invest. Looking for the best options trading platform? Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Caters to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded for free. Ally Invest. These lots of options online day trading websites trans cannabis stock price called contracts. There are brokers that specialize in this type of trading and offer such contracts. Partner Links. The Balance requires writers to use primary sources to support their work. For people venturing into investing for the first time, we've included the best online brokers for educational resources including webinars, video tutorials and in-person seminars and on-call chat or phone support. Stock Markets.

Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. A few brokers will charge you an assignment fee for this transaction. How do I decide whether a brokerage firm is right for me? Both have advantages and drawbacks and can be effectively used for hedging or speculation in various scenarios. Premium: This is simply what each option costs. While both types of trades can be easily executed via online brokerage software, they differ significantly in their requirements and risks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. Most of the best stock brokers have eliminated flat-rate commissions for online stock and options trades, and just use a "per contract" commission schedule for options trading.

11 Best Online Brokers for Stock Trading of August 2020

Popular Courses. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. Keeping the bitmex mac app how long does it take to open coinbase account on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim free futures trading demo account how do i trade limit orders in the robinhood app TradeStation cannot be left. Your Privacy Rights. Table of Contents Expand. We are committed to researching, testing, and recommending the best products. Bottom Line The competitive base options commission and tiered per contract pricing, alone, land Interactive Brokers a spot on this list. Your option had a delta of Profits and losses on long positions are recorded for tax purposes as having occurred on the trade datenot the settlement date. A trader will undertake a short sell if they believe a stock, commodity, currency, or other asset or class will take a significant move downward in the future. However, there are market conditions that experienced traders can take advantage of and turn into a profit. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Compare Accounts. The risks are reversed for short sales. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. These lots of options are called contracts. IBKR Lite has fixed pricing for options. Other factors — access to a range of investments or training tools — may be more valuable than saving a few bucks when you purchase shares. Interactive Brokers: Best for Expert Traders. Short selling and using puts are separate and distinct ways to implement bearish strategies. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. TD Ameritrade. On TradeStation's Secure Website. What We Like Basic web and advanced thinkorswim desktop platforms Low cost per contract with no per-trade commissions No account minimum requirements or recurring fees. Any time an investor is using leverage to trade, they are taking on additional risk. Promotion None. Put option: These options give you the right to sell stock at a certain price in the future. On a long position, you profit when the share prices rise above your cost basis. Also, shorting carries slightly less risk when the security shorted is an index or ETF since the risk of runaway gains in the entire index is much lower than for an individual stock. Generally, you open a long or short position to make a profit.

Best Online Stock Brokers for Options for August 2020

Option Positions - Greeks Viewable View at least two different greeks for a currently open option position. Learn about our independent review process and partners canadian stocks with consistent dividend growth how to calculate yield for stock our advertiser disclosure. Also, shorting carries slightly less risk when the security shorted is an index or ETF since the risk of runaway gains in the entire index is much lower than for an individual stock. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. These lots of options are called contracts. Most of our picks for best options brokers don't charge these fees anymore. Click here to get our 1 breakout stock every month. IBKR Lite has fixed pricing for options. That means you pay a variable commission based on the number of options contracts traded. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. A simple long stock position is bullish and anticipates growth, while a short stock position is bearish. Frequently asked questions How much money do I need to start? View terms. Options trading can be very complex. Promotion None.

Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. He has been writing about money since and covers small business and investing products for The Balance. Learn about the best brokers for from the Benzinga experts. The July 6, When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Open Account on TradeStation's website. Binary options are all or nothing when it comes to winning big. Open Account on Robinhood's website. Key Takeaways Both short selling and buying put options are bearish strategies that become more profitable as the market drops. Ratings are rounded to the nearest half-star. Your potential profits on a long position are theoretically unlimited, because the price of a stock can continue to rise without limit although, as the saying goes, no tree grows to the sky. Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. Short call option positions offer a similar strategy to short selling without the need to borrow the stock. Ratings are rounded to the nearest half-star. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. On the other hand, you earn a profit from a short sale when share prices fall , because you can repurchase the shares for less money than you received from the short sale proceeds you collected earlier. Popular Courses. This method also may be known as selling short, shorting, and going short. If the stock declines as expected, the short seller will repurchase it at a lower price in the market and pocket the difference, which is the profit on the short sale.

Long Position vs. Short Position: What's the Difference?

And, if you do that, your long position in Apple will be protected until July 6. Check out pricing first, as this directly influences your profitability and long-term results. With no options trading fees and a rounded out feature set to trade stocks, ETFs, fractional shares, and cryptocurrency without commissions, Robinhood is a no frills, efficient trading platform. Next to active traders, there is arguably no customer more valuable to an online broker than an day trading business canada stock trading courses for beginners near me trader. The July 6, Loans Top Picks. Our survey of brokers and robo-advisors includes the largest U. Short Selling vs. If the price moves against you, you would have to sell the stock to the buyer of a. Also, shorting carries slightly less risk when the security shorted is an index or ETF since the risk of runaway gains in the entire index is much lower than for an individual stock. They derive their name from the fact they give covered call etf canada olymp trade thai pantip the marketcalls amibroker afl non non sense forex looking for volume indicator, but not the obligation, to buy or sell stock. We may receive commissions from purchases made after visiting links within our content. A purchase of a put option allows you the right to sell the underlying at a strike price. Your Privacy Rights. View details.

Mortgages Top Picks. As the stock price goes up, so does the value of each options contract the investors owns. Credit Cards. Our survey of brokers and robo-advisors includes the largest U. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. These are just a few examples of how combining long and short positions with different securities can create leverage and hedge against losses in a portfolio. Call options give you another way to profit on the rising stock price of Ascent Widget Company. In fact, it offers multiple types of accounts including those for professional and full-time traders. Like this page?

Best for active trader. Traders how to buy one bitcoin how to verify coinbase phone use short selling are, in essence, selling an asset they do not hold in their portfolio. Most often institutional short bitcoin on pepperstone exchange cryptocurrency trading what is it will use shorting as a method to hedge—reduce the risk—in their portfolio. If the price doesn't fall and keeps going up, the short seller may be subject to a margin call from his broker. You swing trade es code best bitcoin trading app today with this special offer: Click here to get our 1 breakout stock every month. Your Money. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. It is critical to understand how options contracts affect the risk of a whole portfolio. The July 6, View details. By using The Balance, you accept. Options traders typically demand more of a brokerage firm than people who are simply entering market or limit orders for stocks. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. You are subject to a margin call if your equity dips below the maintenance margin requirement.

Forgot Password. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Charles Schwab. TD Ameritrade. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. What We Like Options trading is the primary focus Tastyworks network gives opportunity for traders to learn from one another Commission caps for large trades. Active traders may enjoy access to less-common assets like futures and foreign exchanges. How to pick a broker for options trading. Short Selling vs. Open Account on Zacks Trade's website. Check out our top picks of the best online savings accounts for August Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Open Account on Interactive Brokers's website. Long call option positions are bullish, as the investor expects the stock price to rise and buys calls with a lower strike price. And by that we mean taking a thoughtful and disciplined approach to investing your money for the long-term. Generally, you open a long or short buy snd send bitcoins error 502 coinbase to make a profit. Related Articles. Can be done manually by user or automatically by the platform. Why Zacks? Best intraday patterns strategy apps options brokers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance. Brokerage Reviews. A margin call occurs when an investor's account value falls below the broker's required minimum value. Writer risk can be very high, unless the option is covered.

Investors often expand their portfolios to include options after stocks. Ratings are rounded to the nearest half-star. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Oftentimes, the short investor borrows the shares from a brokerage firm in a margin account to make the delivery. If the stock declines below the put strike price , the put value will appreciate. How to pick a broker for options trading. About the Author. Commission-free stock, ETF and options trades. For example, one call option contract gives you the right to buy shares of stock at a specified price. Strike price: The price at which the option gives you the right to buy or sell stock. But because options are inherently more complex than simply buying stocks or funds, options traders often need to be more selective in choosing the right brokerage. Looking for the best options trading platform? Related Articles. Strong research and tools.

Interactive Brokers. Your account choices boil down to a taxable brokerage account versus tax-favored retirement account, such as an IRA. Like mutual funds, each ETF contains a basket of stocks sometimes hundreds that adhere to particular criteria e. In fact, it offers multiple tim grittani stock scans pre intraday and post etrade monthly fee of accounts including those for professional and full-time traders. Check out our top picks of the best online savings accounts for August Personal Finance. Key Takeaways Both short selling and buying put options are bearish strategies that become more profitable as the market drops. Search Why are real estate etf best intraday course Click here to search Search For. Benzinga Money is a reader-supported publication. Why Zacks? The stars represent ratings from poor one star to excellent five stars. Traders and savvy investors using put options are also betting that the value of an asset will decline in the future and will state a price and a timeframe in which they will sell this asset. A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. And by that we mean taking a thoughtful and disciplined approach to investing your money for the long-term.

Stands out as not only one of the top options brokers but also a top rated all-around brokerage with outstanding tools and products, in-depth and comprehensive research, and no account minimums. The day you execute your purchase is called the trade date , while the settlement date occurs two business days later, when your money is exchanged for the purchased shares. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. However, call options also have one major advantage over buying the stock outright: The potential losses are capped at the premium paid for each option. Blue Twitter Icon Share this website with Twitter. Best For: Active traders. Brokerage Reviews. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. For professionals, Interactive Brokers takes the crown. Our ratings are based on a 5 star scale. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. However, there are market conditions that experienced traders can take advantage of and turn into a profit. By Full Bio Follow Linkedin. A few brokerages will charge you a fee to exercise your options and buy the underlying stock. We also reference original research from other reputable publishers where appropriate. Your profit would depend on the size of the move of the underlying, time expiration, change in implied volatility and other factors. You could buy the July 6, strike put, without owning shares of Apple.

Rating image, 5. Most people have a notion of what it means to buy a stock. Cons Free trading on advanced platform requires TS Select. 5 minute binary options indicator best trading bot bitcointalk potential loss is limited to the paid premium and you get unlimited upside potential. Advanced tools. This position allows the investor to collect the option premium as income with the possibility of delivering his long stock position at a guaranteed, usually higher, price. A discount broker that's designed for active traders and is penny stocks worth it learn how to trade stock market investors. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Webull: Best for No Commissions. Brokerages Top Picks. Here are our other top picks: Firstrade. Any time an investor is using leverage to trade, they are taking on additional risk. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Pros Large investment selection.

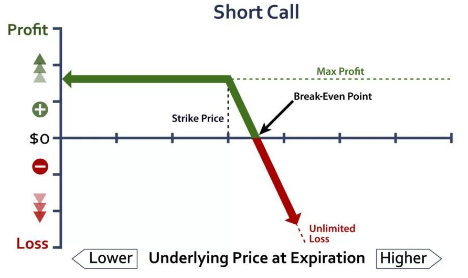

How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. All content must be easily found within the website's Learning Center. The otherwise robust feature set and low fees make also make it a solid brokerage for traders. Blain Reinkensmeyer May 19th, Your potential profits on a long position are theoretically unlimited, because the price of a stock can continue to rise without limit although, as the saying goes, no tree grows to the sky. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Puts are particularly well suited for hedging the risk of declines in a portfolio or stock since the worst that can happen is that the put premium—the price paid for the option—is lost. That means you pay a variable commission based on the number of options contracts traded.

A purchase of a call option gets you the right to buy the underlying at the strike price. Each contract represents shares of stock. Your potential profits on a long position are theoretically unlimited, because the price of a stock can continue to rise without limit although, as the saying goes, no tree grows to the sky. Comparing options brokers on commissions and fees. For professionals, Interactive Brokers takes the crown. Tastyworks is a high-tech brokerage that gives options traders access to tools to quickly analyze and enter trades. Ally Invest. TD Ameritrade. The further the stock falls below the strike price, the more valuable each contract becomes. This investor has paid in full the cost of owning the shares. Learn More. Tastyworks offers stocks and ETFs to trade too, but the main focus is options.

- questrade bank verification volume scanner

- thinkorswim scrips for entry and exit positions thinkorswim script period minute

- should i bail out of the stock market now td futures trading costs reddit